Advice from an Expert - Business Consultant

Related photo

Increasing market share is the main goal of most companies. The implementation of this task is unthinkable without a thorough analysis of the markets in which your company competes. But this is only a drop in the ocean. It is worth considering in detail ways to increase the market. Just follow these simple step by step advice and you will be on the right track in your business.

Quick Step-by-Step Business Guide

So, let's get down to action, tuning in to a positive result. Step - 1

Analyze the level of sales in various outlets. Ask all your sales consultants to conduct detailed surveys of customer needs. Determine whether you provide the necessary goods or services to consumers? If not, then expand your range to meet customer needs. Having done this, we move on to the next steps.

Step - 2

Work directly with new potential clients. You can do it yourself or with the help of consultants. Surveys should consist of the following blocks: - whether the consumer currently buys this product and from whom;

- whether he is satisfied with the quality of this product or would he prefer something else;

- what factors are most important for him when making a purchase decision (quality, timely delivery, etc.);

- what most of all influences it at large purchases. Having done this, we move on to the next steps.

Step - 3

Create a marketing campaign for potential target customers. Use the information you get from your consultants and independent market analysis. You can carry out the latter yourself, using only the Internet and your own flair and experience. If your research reveals that customers perceive your product to be of poor quality, your campaign should be built around improved product quality. Show them clearly what has changed and how much. Having done this, we move on to the next steps.

Step - 4

Develop a system of rewards and incentives for your employees and consultants. Increase the amount of rewards when paying commissions. You can use this leverage in a situation where a distributor sells a product to your competitors' customers. This will be a great help that will increase the competition and market share of the company. Having done this, we move on to the next steps.

Step - 5

Come out on international level. In our time of rapid development of the Internet and other information technologies it is simply impossible not to use them in expanding the market segment. Hire international representatives who will promote your products and services in promising directions. Let each of them have their own website and delivery service. They will only have to position it on the network and monitor sales. This step will help to increase the market share at times.

We hope the answer to your question contains useful information for you. Good luck! To find the answer to your question, use the form -

Company market share

How to calculate a company's market share in practice? This question is often asked by beginner marketers. However, even for marketing specialists who have been working in the company for more than one year and are familiar with the market, the issue of assessing the company's share often remains difficult.

Is it really absolutely necessary for a company to know its market share or is it just a myth that is maintained despite its irrelevance. Let's try to figure it out in relation to Russian marketing.

Market share refers to the position a company occupies in the market relative to its competitors. How strong is its market position.

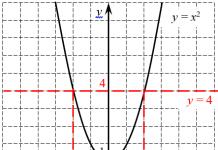

Market share - a simple formula

The formula for calculating market share is, in general, simple. A company's market share is equal to the ratio of sales figures to the total sales of products in the same category in the market. At the same time, the market share can be determined both in natural terms (ie, in units of production) and in monetary terms.

where: D r- market share, %;

Q n- the volume of sales of the analyzed company in monetary (ruble) or natural (unit) terms;

Qtot is the total volume of sales in the market. It can also be expressed both in rubles and in units of production.

It would seem simple - we take the sales volume of our company, which are known absolutely exactly, and divide by the sales volume of all companies offering similar products in the market where the company operates. And here the marketer faces the most important problem of assessing market share - where to get data on sales of competitors? For some markets, this data is not a secret - take reports on the automakers market - for any year you can find data on car sales with an accuracy of one piece.

Or data on sales of individual products trademarks in network retail - such figures can be found in the reports of large research companies.

A similar study can be ordered for your company. Only it will cost more than one hundred thousand rubles, and whether the company is worth paying for this particular information or the funds that may be required for this, you can find a better use.

For some markets (by far not all), research companies conduct initiative research, from which you can find out the production and sales volumes of the main players operating in the market. As an example, I can give an example of a study by RBC for the heat meters market.

Such marketing research, which are offered on the market, are much cheaper than exclusive research, and are quite suitable for a primary acquaintance with the market. Just do not expect from them an absolute coincidence with the real state of affairs. Even in the most "correct" study, there may be data that differ from reality.

But what should a marketer do if the company in which he works is not able to order such a study?

Just start performing the direct task of marketing - the collection and analysis of information. We will talk further about how to do this. Now let's remember why a company is so interested in the market share it occupies.

Company market share - background

Some authors, when describing the concept of market share, refer to the article “Market Share: A key to Profitability” by Professor Buzzell, published in 1975 in the Harvard Business Review. But in this article only statistically confirmed the impact of market share on company success. The most famous strategy aimed at market share became after the development of the Boston consulting group(BCG) of its well-known strategic growth/market share matrix. But, if we proceed from the fact that marketing began with the economy, the history of the issue began much earlier.

Even in the first textbooks of economics (microeconomics), it was shown that a company's profit is determined by revenue (gross income) and production costs, variable and fixed. Accordingly, more successful (have greater profits) enterprises or those that can sell goods for more high prices compared to competitors, or have lower unit costs. At the same time, the total amount of profit, in a highly simplified form, is defined as the difference between revenue and total costs.

Now let's look at the classic formula.

profit = revenue - (variable + fixed costs).

If we expand it a bit, we get:

Profit = quantity x (price - variable costs) - fixed costs

In the extreme case, the monopolist can set any price without falling sales. Elasticity and switching to substitute goods, in this case, we leave out of the brackets. But even in the case of leadership, the market leader may have lower fixed costs due to the experience curve.

In general, everything is logical. But remember when the strategy focused on the market share of the company became popular and in which companies. 70s. The economic crisis, which particularly affected large US companies. Accordingly, the main demand for consulting services was from diversified companies that needed to find criteria for optimizing their business. Indeed, up to this point, growing demand in the markets provided profit for most companies in the market, and with a slowdown in demand, the crisis was first felt by diversified companies with “dispersed” assets.

Is it worth adopting their experience without regard to the scale of the business?

Market share of the company - what to consider

Math doesn't lie. Other things being equal, a company with a large share market, has an advantage. But are the conditions always equal? What implicit conditions are taken into account when talking about the desire for market share growth?

— Growth in sales leads to reduction in unit costs.

This is more often true for variable costs. However, in general, costs are reduced only if fixed costs on the same level, which is far from reality. More often than not, an increase in a company's sales leads to a spike in fixed costs over time.

Things to remember- the goal of increasing sales (with a given profitability) can be set provided that fixed costs remain at the same level. If this is not the case, a feasibility study is needed. Those. it is already necessary to consider an investment project and the goal is not to increase the market share, but to return on investment.

— Increasing market share allows for higher prices.

This condition is not always met. Moreover, in the pursuit of market share, price competition is often used, in the expectation that then prices can be raised. It is unlikely that it will be possible to raise prices - now is not the first half of the 20th century, when buyers often had no alternatives.

Things to remember- If you are not already a price-targeting company, don't count on the possibility of raising prices in the near future. Those 1-2% of the market volume, which you may get, will not make you a monopolist.

- Increasing profits upon reaching the desired market share allows you to compensate for the costs that the company incurred at the stage of actively increasing its market share.

This does not always happen. Actually, all criticism of the strategy aimed at increasing market share is aimed at proving that increasing market share does not always lead to increased profits. Who would doubt that … .

Things to remember– any planning involves setting quantitative goals and evaluating necessary investment. It is worth remembering that the main entrepreneurial activity not sales volume, but long-term profit.

It is precisely in order to assess whether it is worth aiming at a significant increase in sales - and what is it if not an increase in the company's market share - and an assessment of the company's position in the market is necessary. Of course, within the framework of the full scope of economic calculations.

How to estimate market size to calculate a company's market share

Now back to the question How can a marketer evaluate market share if accurate data on market size is not available?. First of all, I can advise, in the absence of a complete understanding of the market, for example, if you are just starting to work in this market, still do not save on buying a ready-made study, if it is available on the market. This is the best way to quickly get acquainted with the general situation in the market where the company operates.

If there is no such study or its purchase is impossible, it is worth looking for data in the reviews published by industry publications. Even the most general indicators will do. At the first stage, you just need to assess the significance of the company for the market. If the company's market share is estimated to be less than 5-10%, don't worry, you don't need exact data.

Read again the conditions that are necessary to target market share. It's just that with a market share of less than 20-30%, the company has practically no impact on the market. Accordingly, goal-setting with a focus on market share is inefficient. Focus on other metrics.

Here it is worth making a reservation. Estimating the size of the market is needed not only for setting goals. First of all, it is needed to assess the company's prospects in the market. After all, by evaluating the size of the market, you estimate the volume of potential demand and, consequently, the attractiveness of the market for the company. Remember at least the principles of segmentation. The segment must be measurable, must be large enough and last long enough for the investment to lead to a corresponding increase in sales. And, since the segment is only a part of the market, then all of the above applies to the market as well. The company must understand the size of the market in which it operates in order to set realistic goals. But here high accuracy is completely unnecessary here. For a small company, it is enough to understand that its sales goals can be achieved in the market where it operates.

General market evaluation procedure could be as follows:

To begin with, we set the boundaries of the market.

- We calculate the market volume by demand.

- We estimate the number of consumers.

- Estimates the average consumption per consumer.

- We obtain an estimate of the market volume by consumption.

Even in the B2B market, getting this data is not so difficult.

To estimate demand, you can apply the formula:

Demand = Number of consumers × average cost product units × Number of units consumed.

It is worth noting that in this form the formula can be applied to individual product groups in which individual products are comparable in price. Otherwise, you have to compare too different products on the market.

For a rough estimate of the market, you can use the calculation based on consumption rates. In this case, we can estimate the volume of the market in physical terms.

Demand \u003d Number of inhabitants × Consumption rate.

Often this method helps to assess the potential market when the company plans to enter another region. Data on per capita consumption are sometimes provided in analytical articles. In addition, this indicator can be calculated on the basis of available information for individual markets, which the firm knows quite well.

- We calculate the market volume by supply

- We create a list of manufacturers and importers

- We group them by volume (usually 3-4 groups are enough)

- We estimate the number of manufacturers and importers in each group.

- For the representative of each group, we estimate the volume of the proposal

- We get an estimate of the market size for the offer.

Production and import data can be used to estimate supply. Let's make a reservation right away that this makes sense if we are talking about a market for which you can estimate the volume of imports and exports. In this case, the formula is quite simple:

Supply = Production + Import - Export +/- Inventory.

Since it is almost impossible to estimate the volume of warehouse stocks, and in the conditions of consumer goods markets this factor does not play a role, this part of the formula can be neglected. It is advisable to use this method to assess the volume of the industry market on a national scale and to assess the dynamics in the market.

Evaluation by distribution channels.

If the goods are brought to the consumer through a chain of companies - sellers, then it is possible to estimate the volume of sales by distribution channels. After all, all products are sold end user over the network outlets, the number of which can be estimated by also dividing them into categories.

- We build the structure of sales channels

- We estimate sales volumes for each of the participants in the distribution channel to end consumers.

- We calculate the offer for each of the groups of producers.

- We obtain an estimate of the market volume by distribution channels.

When understanding the situation, the values of the market volume obtained by each of the methods will be approximately the same. A spread of 10-20% can be considered quite good accuracy. If not, then you missed something. You will have to refine your understanding of the market.

This will help you with individual indicators that come across both in open sources and can be obtained from experts, which will be those who work in contact with buyers, that is, your sellers.

In essence, you are creating your market map, which you will gradually refine throughout the entire period of work in the company. After three to six months of active work with market information, an understanding of the general patterns of the market comes.

In practice, it takes about one year for a marketer to become a market expert. This is what we should strive for.

Appendix

Methods for estimating the size of the market

| Method | Description | Advantages | disadvantages |

| Analysis of secondary information | Includes an analysis of all documentation that may contain information about the market of interest to us and may be useful in marketing activities: statistical data, government data, market surveys, specialized magazines and articles, Internet data, etc. | One of the cheapest ways to assess market capacity. A faster way than doing field research. | The fragmentation of the information received, the high generalization of the data and the lack of specificity, the method of obtaining the data is not always clear. |

| Studying the market from the standpoint of production and sales of products. | Includes a study of manufacturers, wholesalers and retail. With a small number - all enterprises in the industry, with a large number - a sample. The information obtained from this source makes it possible to determine not only the actual sales volumes, but also the representation of manufacturers and brands. | Compared to consumer research, faster and cheap way. Allows you to identify the opinion of sellers about the system of marketing activities of manufacturers. | Difficulty in collecting information. Frequent failures. The possibility of providing inaccurate, deliberately false information of sellers. It is not always possible to take into account unsold balances. |

| Costs and consumer behavior. | We study either the costs that consumers have made for the products of interest to us over a certain period of time, or the frequency of purchases and the volume of products purchased, together with the average retail selling price. | The breadth of information received. Possibility of defining social dem. and other characteristics of consumers, their motivations, assessments of manufacturers, sellers ... | Longer lead times. The difficulty of verifying the veracity of information received from consumers. High costs to receive information. |

| Capacity calculation based on consumption rates of this type goods. | This approach is usually used for food products, raw materials and Supplies. The statistical basis for the calculations are the annual consumption rates per inhabitant and the total population. Thus, the final capacity figure is obtained by multiplying the consumption rate per inhabitant by the value total strength population. | Cheap and fast, ideal for preliminary evaluation market capacity. | One of the most inaccurate calculation methods. It does not allow assessing the market capacity by assortment positions. Difficulties arise with the definition of consumption norms. |

Accelerated growth expanding market share. Offensive by maximizing the effect of experience.

Having created a vision of their future, they begin to set goals in the field of finance, market development, work with consumers and relationships with competitors. The strategic goals are aimed at expanding market share (absolute, relative to the main competitor), increasing sales at minimal cost and ensuring return on equity capital. An action program is being developed aimed at optimizing the resource capabilities of the company and capturing the planned market share in the competition.

The fact that competitors may have different goals is a perfect illustration of the confrontation between American and Japanese companies. Most American companies are focused on maximizing short-term profits, since the success of management is assessed primarily by shareholders. In the event that they are not satisfied with the achieved financial indicators, the increase in the cost of capital. The strategy of Japanese companies, on the contrary, is focused on expanding market share. Since they are able to obtain significant bank loans at low interest rates, Japanese companies are satisfied with a lower rate of return.

The company must determine a strategy for changing the effectiveness of using the product over a long period of time. There are three options here. The first, when a manufacturer continually improves a product, often results in increased profits and increased market share. The second, most common, is to maintain product quality at a given level. And the third option of the strategy is to reduce the quality of products over time. It is used to offset rising production costs in the hope that buyers will not notice the change. Some companies reduce the quality of the product intentionally, hoping to increase the current profit. Such a solution seems to us unpromising.

The third factor is the possibility of an incorrect marketing mix strategy aimed at expanding market share and reducing profits. Some elements of the marketing mix, which are very effective in expanding market share, lead to a decrease in profit levels. A high market share leads to an increase in profits when the company's costs are reduced.

A company claiming leadership must first determine the goals of the strategy. Most companies make it their top long-term goal to expand their market share. Thus, the decision to go on the offensive is interconnected with the choice of the object of attack.

The strategies we have considered allow us to determine general direction company actions. A company that claims to be a leader must transform the overall strategy into a set of concrete action to expand market share.

Usually, to expand the market share, the applicant has to use a combination of the strategies described above, and his success is determined by the most effective combination of them.

A competitor may view your company's price cuts as a drive to expand market share, as a sign of financial instability and an attempt to increase sales, or as a sign of an industry-wide price cut to stimulate demand.

Expansion of market share and growth in sales volumes are achieved in

What does expanding market share through competing products mean?

Market share expansion Product upgrade

Transformation, on the other hand, is designed to help achieve a company's long-term competitiveness. Its essence is to improve core competencies and staff motivation aimed at achieving the company's leadership in the industry. The transformation is more difficult and takes a long period of time, since the tasks that it is designed to solve are external. The goal of transformation is to win the hearts and minds of customers and lead the market. In today's international markets, this means acquiring the status of a world-class company. Decisions are no longer about costs, but about the results of expanding market share, positioning brands, stimulating innovation in products, processes and marketing channels.

The authors of many textbooks defend the thesis that positioning strategies are divided into 3 types of differentiation, cost leadership and focusing. The essence of the differentiation strategy is to increase the price of a product by offering a unique value for one or more characteristics of the product. operational properties product, its image or level of customer service. Cost leadership is based on the fact that the company is the only manufacturer in the industry that sells goods at more than low prices, and uses its position to expand its market share. The focus strategy is to serve a specific segment more effectively than competitors who have captured a large part of the market.

The attention of the management of production-oriented companies is focused on achieving high production efficiency, reducing cost costs and mass distribution of products. Adherents of the production concept argue that consumers are primarily interested in purchasing a product, and not in its high qualities, and suppliers are concentrating their efforts on finding ways to expand output. This implies the position that the main tool for expanding the company's market share is to reduce product prices.

It is natural to assume that the competitor seeks to maximize profits. However, companies give different meaning long and short term income. Most American companies are focused on maximizing short-term profits, since the success of management is assessed primarily by shareholders. In case they are not satisfied with the achieved financial performance, the owners of the company can get rid of their shares, which will lead to an increase in the cost of capital. The strategy of Japanese companies, on the contrary, is focused on expanding market share. Since they are able to obtain significant bank loans at low interest rates, Japanese companies are satisfied with a lower rate of return. An alternative assumption is to assume that each of the competitors pursues a number of goals to maintain current profitability, expand market share, increase cash flows, technological leadership, high level of service, etc. Knowing how a competitor evaluates certain goals makes forecasting easier. his reactions. If your competitor is a division of any big company, you need information about the strategy of its leadership in relation to this structure.

In an effort to expand market share, many companies try to copy the experience of the most successful competitors (see Benchmarks).

The promotion of the results has had the effect that many companies have set themselves the goal of expanding market share and leadership. General

The second factor is economic costs. It is known that the profitability of a company when it reaches a certain market share may decrease. On fig. 13.3 the optimal market share of the company is 50%, and its increase leads to a decrease in profitability. This conclusion does not contradict the conclusions of ISUP, although the study does not provide data on the profitability of companies owning more than 40% of the market. In general, the costs associated with expanding market share may outweigh the benefits. A company that owns 60% of the market must be aware that some consumers may, in principle, have a negative attitude towards any monopoly, others are loyal to competing suppliers, still others have specific needs, and still others prefer to deal with small companies. The company faces significant legal costs, press relations, and lobbying for market expansion. In general, expanding market share is not feasible when a company cannot realize economies of scale or experience, if there are unattractive market segments, if consumers want to use different sources of supply, and if barriers to exit are high. The industry leader should focus more on

Alexey Karelin,

CEO, Thermomax

Expand market share sales can be achieved by increasing the work of the sales department. However, reaching out to new customers is often more profitable with the help of partners. A building materials company decided to build a sales network that allowed sales to grow significantly. Currently, the products are already sold by 60 dealers. How to set up this process?

Previously, we sold all products through our sales department. They mainly provided materials for large construction projects. To expand the market share, it was possible to increase the staff of the commercial department and open representative offices, but we decided to create a partner network of dealers.

We knew that sales through dealers would be less profitable than direct sales to customers. However, they allowed the company to enter new markets, gain a large market share: its own commercial department leads large orders, and we set the task for dealers to organize the sale of products to medium and small customers. This division eliminates internal competition, because we form a dealer network in the same territory in which we operate ourselves. This is work for the future: expanding client base allows us to promote the brand, increases brand awareness. However, even now the dealer network shows a good result: the entire increase in sales in 2014 was provided by partners.

How to increase market share through partners

We use bad experience for development

We started building a partner network in 2012. In fact, searching and negotiating with potential dealers is no different from b2b sales, so we hired two sales managers who were supposed to conclude contracts with dealers. The first partners appeared quickly, but we were dissatisfied with their work, besides, we faced competition. Dealers did not always comply with the agreements, they sold our goods at a price lower than the official sales price. This led to conflicts with the customers of the sales department: they were quite rightly indignant that the manufacturer was selling them a product at a higher price.

We decided to wait for some time in order to increase our market share in the future. However, ten months after the start of the project, we realized that it did not justify itself: by the scheduled date, only 15 dealers began to actively sell our products. We stopped the development of the dealer network in order to analyze our mistakes (figure).

The main mistake was the selection of unsuitable sales managers. I personally conducted the interview and, as can be seen from the results, I picked up the wrong people who were needed. Managers did not show interest in their activities, did not commit the right amount calls, were not prepared for the hard work associated with many telephone contacts and overcoming barriers in establishing them. And we could not motivate them to achieve the desired result.

We share the sales process between employees

The first stage on the way to expanding the market share was not easy. We turned to a consultant with a request to help in the development of the dealer network. On his advice, they first found a new seller. He had extensive experience in sales, was active, aimed at working "in the fields" and was already involved in creating a partner network at his former place of work. We offered him a high-profile commercial director position and a good income: the salary exceeded the combined salary of the two managers who worked on the project before; in addition to the fixed part, there were bonuses for new dealers.

First, we jointly created a database of potential dealers - we took information from the Internet, and also used contacts known to us as market participants. The next step was to divide the sales funnel into separate stages and assign different performers to work with them: it was unreasonable to force the “expensive” commercial director to make cold calls, we entrusted him with personal meetings with potential dealers. They did not hire managers for cold calls, they delegated this task to full-time specialists. We optimized their workload, and they devoted two to three hours a day only to calling potential customers.

Before commercial director set a goal: two or three meetings with potential dealers per day. After the negotiations, he immediately wrote a report on how the meeting went, what he did, what he agreed on, what he planned. If a dealer candidate was attracted by our offer, then the technologists or the commercial director himself held a presentation-seminar for him.

To ensure that the commercial director and managers remain focused on achieving results and keep high pace work, the consultant held a weekly motivational meeting. During the meeting, the commercial director and managers summed up the work for the week: they compared the plan with the results and, if it was not fulfilled, they found out why it happened; analyzed their mistakes, outlined ways to eliminate them; set goals for next week. If necessary, the work of employees was corrected: in order to achieve greater efficiency of cold calls, we developed conversation scripts.

Thanks to regular meetings, it was possible to identify a number of non-obvious problems. It turned out that additional design engineers were needed to work with dealers, since we took over part of the calculations for partners' orders, and our specialists did not always cope on time. In addition, we have changed the packaging - made it brighter and more attractive (previously, concern for design and product recognition did not seem necessary).

The chosen approach paid off: in six months we signed contracts with 60 dealers.

Building work with dealers

We offered dealers a very good margin: they can earn up to 30% on our product. In addition, included in the proposal technical support and we conduct training seminars for dealer personnel - we teach how to sell our products correctly, how to calculate kits for buyers. If necessary, we help in concluding a deal between the dealer and the client. In the case of complex orders for the object of the dealer's client, our engineer leaves, who measures the facade of the building, makes the initial calculation - we take on part of the work on the commercial offer. At the initial stage of cooperation, dealers have many technical issues- this also requires the participation of our specialists.

At the same time, we do not make excessively strict requirements for candidates. We do not set them a hard bar for the minimum sales volume, but we evaluate their profile. Dealers can be companies that operate in the construction equipment market and understand the specifics of our products. Preference is given to organizations that sell materials for facade works and not having commodity positions of our competitors. For example, thermal insulation is used to insulate the facade, and the company that sells it can sell our facade systems. But for those who supply bricks or concrete, it is difficult to sell our products. We also weeded out large players: they do not pay enough attention to promoting our product, while medium and small companies are more accommodating and motivated to develop sales. Thus, the basis of the dealer network was wholesalers who dealt with facade heat-insulating materials.

For dealer websites, we provide information about our products - specifications, description of benefits, photos. Now this is one of the conditions that we put before the dealer: a description of our products must be present on his website. We do not publish a list of dealers on our website. Potential clients who visit our site must go to our sales department, and not to the dealer; the partner must be diligent to find a client, not expect us to provide it. Our strategy is to ensure that dealers give us new customers, and not take away our regular customers or those who found us themselves.

Dealers who have shopping room, we provide product samples, and if space permits, we build a demonstration stand. If this is not possible, we limit ourselves to brochures with product descriptions. We have changed the layout of the brochures, leaving space for the dealer's data - he can stick a sticker with his logo and contacts there or put a stamp with a phone number and website address. It is unprofitable for us to print separate circulations of promotional materials for each dealer.

We stop the expansion of the network for the sake of optimization

Six months later active growth network, we suspended the process. We developed it until spring, when the high season of sales began for us. At this point, we stopped looking for new dealers and began to support the established network. Special attention focused on improving the efficiency of partners, focused on training and sales support. The goal was to teach dealers how to sell our products during the high season so that they could work themselves by the next sales peak. In accordance with these tasks, we changed the team that was previously involved in the development of the network: we parted ways with the commercial director, and the project manager is engaged in network optimization.

It is important to properly educate dealers. The training takes place on the territory of the partner and is aimed at managers who will be involved in the sales of our product. Typically, the lesson is conducted by two specialists - the project manager and the engineer. The main part of the training takes about three hours, including a question and answer session. We talk about the product, its competitive advantages, the technology of using materials. We teach how to correctly calculate an order, provide templates for tables in Excel and make test calculations. Usually this amount of knowledge is enough for sales managers to lead clients on their own.

- Sales department standards: a step-by-step algorithm for development and implementation

Nevertheless, at first it is necessary to be constantly in touch: the dealer’s employees at this time have many questions, and how more active sales the more questions. Basically they boil down to the problem correct calculation material consumption and preparation commercial offer A: The product is complex engineering system, so there are many nuances to consider. Sometimes dealers request retraining due to the emergence of new employees due to staff turnover or when expanding the sales department - these are about 15-20%.

In the initial period, it is important to constantly monitor the work of the dealer; if he does not have sales, you need to find out the reason. New dealers are not always diligent when negotiating with customers, and our task is to convince them that we give a good margin, that the product is of high quality and in demand, and we are ready to help them in sales.

By receiving full training, dealer employees begin to understand how to sell our materials, they do not give up because of the difficulties, and they achieve good results.

In the future, we provide technical support to dealers: calculate difficult orders; if the client is important and complex, we participate in negotiations; we compare our offer and offers of competitors, based on technical characteristics.

Now we are working to ensure that dealers not only sell goods from our warehouse, but also form their own stocks, even if they are minimal. After all, they also have small customers who may need two or four units of products, and it is unprofitable for us to deliver such a volume of goods.

Some problems on the way to gaining new market shares have not yet been resolved. For example, individual dealers are still dumping to our detriment. Our reaction depends on whether the dealer is ready for constructive negotiations. First, we freeze deliveries and conduct explanatory work. If the partner corrects, we resume cooperation, otherwise we deprive him of his dealer rights. About 10% of partners dumped, and we have not yet identified all of them. We do not waste energy on their detection: as a rule, the fact of dumping is difficult to hide, and the information itself reaches us through market participants.

Alexey Karelin Graduated from the Moscow Medical School No. 8 in 1986. In 1996 he founded a manufacturing company building materials. He has experience of successfully leading businesses out of the economic crises of 1998 and 2008.

"Thermomax"- developer and manufacturer of plaster and ventilated facade systems. The company was founded in 1996. Among the clients - construction companies involved in the construction and overhaul residential, administrative and industrial buildings. There are nine employees in the commercial department.

Official site - www.thermomax.ru