In this article, step-by-step instructions for accounting for salaries in 1C will be considered in detail: pre-configuration, direct calculation and payment of wages in 1C 8.3 Accounting, as well as a salary project. Once you figure it out, it's pretty simple.

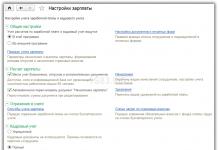

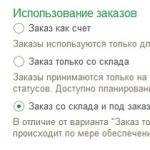

Before you make the accrual and payment of wages in the program 1C 8.3 Accounting 3.0, you need to configure it correctly. To do this, select Accounting Settings from the Administration menu.

In the window that appears, select "Salary Settings". This section allows you to set up not only wages, but also personal income tax, insurance premiums and personnel records.

Let's take a closer look at these settings step by step:

- General settings. In this example, we chose the item “In this program”, because otherwise some of the documents we need will not be available. The second setting option involves maintaining personnel and payroll records in another program, for example, in 1C ZUP. In the “Salary accounting setup” subsection, the method for reflecting salaries in accounting, the terms for paying salaries, vacation reserves, territorial conditions, etc. are indicated.

- Payroll. Here we indicate that we will take into account sick leave, vacations and executive documents. It is important to remember that this functionality will only work if the number of employees does not exceed 60 people. Also here are configured types of accruals and deductions. For convenience, we will also set the automatic recalculation of the document "Payroll".

- Account reflection. In this section, accounts are set up to reflect salaries and mandatory contributions with payroll in accounting. Let's leave the default settings.

- Personnel accounting. In this example, full accounting is selected so that the main personnel documents are available.

- Classifiers. We will leave the settings in this paragraph as default. Here you can configure the types of income and deductions used in the calculation of personal income tax and the parameters for calculating insurance premiums.

How to calculate and accrue salary in 1C

The second step is to hire the employee. In this case, we will consider an example on an employee who has a minor child. As you know, in such cases, a tax deduction applies. You can specify an application for it in the employee card by going to the "Income Tax" section. Please note that tax deductions are cumulative. If they are not applied in one month, then in the next month they will be taken into account for both periods.

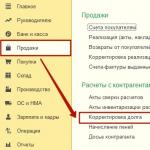

After all personnel documents are completed, you can proceed directly to payroll. To do this, select the item "All accruals" in the "Salary and personnel" menu.

In the list of documents that opens, select the "Payroll" item in the "Create" menu. Fill in the month of accrual and division in the header and click on the "Fill" button.

The program will fill in all the necessary data. Manual adjustments are allowed. It is important to remember that the 1C: Accounting program does not maintain the document "Timesheet". All absences from work (holidays, sick days) must be completed before the salary is calculated in order to correctly reflect the actual hours worked in this document.

The "Employees" tab displays a summary table for the document in the context of employees.

The next tab reflects accruals and deductions for employees and the amount of time actually worked. These data can be adjusted manually if necessary. Also on this tab, printing of the pay slip is available.

The Holds tab in this example is empty because the employee didn't have any. We will miss her.

The next tab reflects personal income tax and tax deductions. This employee has a deduction for children, which we previously introduced. The data on this tab can be corrected by setting the corresponding flag.

On the “Contributions” tab, contributions to the PFR, FSS and FFOMS are detailed. Manual adjustment is also available here.

The very last tab shows manual adjustments.

Click "Post and close" and this is where we will finish the payroll.

Bank salary statement

After the salary has been successfully accrued, it must be paid. Consider the payment through the bank, since this method is the most common in organizations.

In the menu "Salary and personnel" select the item "Statements to the bank".

Create a new document from the list form. In its header, indicate the month of accrual, division, type of payment (per month or advance). There is also a field for specifying the salary project. It will be discussed later.

See also the video instruction on advance payment:

And the calculation and payment of wages in 1C:

Salary project in 1C 8.3

In the "Salary and personnel" menu in the "References and settings" section, select the "Payroll projects" item and create a new document. It requires bank details.

The salary project for an employee is indicated in his card in the "Payments and cost accounting" section.

In the window that opens, specify the employee's personal account number, the start period, and select a payroll project.

After this setting, when choosing in the document "Statement for the payment of salaries through the bank", employees will be substituted with the numbers of their personal accounts.

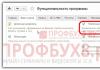

In accordance with Russian legislation, the organization CJSC "Automation" draws up a payroll in the unified form T-51 for a certain time interval. To generate such a report, we will enter the menu item "Reports" and select the sub-item "Settlement statement in the form T-51".

Figure 5.223 Interface Payroll for organization employees. Settlement sheet in the form of T-51

In the window that opens, specify the period of the statement (January 2008) and click the "Generate" button.

Figure 5.224 Formation of the printed form of the payroll

You can print the statement by clicking the "Printer" button.

We will form a set of charges

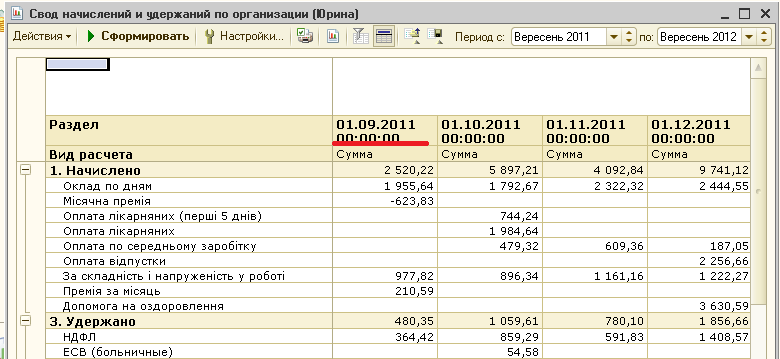

To view accruals and deductions for the organization for January, we will generate a special report "Account summary" for the organization "Automation". To do this, go to the "Reports" menu item and select the "Account summary" menu item.

Figure 5.225 Interface Payroll for employees of organizations. Summary of accruals

The blank report "Summary of accruals and deductions for the organization" will open.

Let's set the period - January 2008. Fill out the report by clicking the Generate button.

Figure 5.226 Formation of a set of accruals and deductions

If you need to print the report, click on the "Send the form to the printer" button.

The report "Summary of accruals and deductions for the organization" reflects the amounts accrued and withheld from employees in the whole organization for any specified period. Using the report settings form, you can change the grouping of the report data presentation and the list of output fields.

Check the structure of debt to employees

Let's analyze the debt of the organization CJSC "Automation" to employees for January. Let's go to the "Reports" menu item, from the submenu select "Debt to employees structure".

Figure 5.227 Interface Payroll for organization employees. The structure of debt to employees

In the window that opens, set the period - January 2008. By clicking on the "Generate" button, a table with a list of employees by departments and the amounts of the opening and closing balances of accrued and paid amounts will be displayed on the screen.

Figure 5.228 Formation of the organization's debt structure

You can print the report "Debt Structure of Organizations" by clicking on the "Print" button.

Let's pay attention to the fact that the output of information in the report is made in the context of individuals, for the same reasons as the pay slips of organizations.

The report displays the structure of the enterprise's debt to employees in the context of periods of debt occurrence, which can be convenient when analyzing the necessary payments to employees.

We will analyze the accruals to employees

To analyze accruals for a certain period, it is more convenient to use the report "Analysis of accruals to employees". Go to the menu item "Reports" and select the sub-item "Analysis of accruals to employees".

Figure 5.229 Interface Payroll for organization employees. Analysis of accruals to employees

Let's generate such a report on the organization CJSC "Automation" by clicking on the "Generate" button, indicating the period January 2008. The table with data was generated in the context of organizations and divisions. In separate columns, the amounts included in the calculation of ALL and the amounts included in the formation of transactions were displayed. As can be seen from the report, when calculating the UST and generating postings, not all data was taken into account. In the following works, we will consider what actions need to be taken in order for all calculated amounts to be taken into account in the calculation of the UST, also when displaying these amounts in accounting.

Print the report by clicking the "Print" button.

This report is convenient to use when completing the payroll for the next billing month to track whether all employee accruals are taken into account when calculating the UST and generating postings.

Figure 5.230 Formation of data for the analysis of accruals to employees

– Report on the results of accruals:

- Settlement statement in the form of T-51;

- A summary of the accrued salary;

- Pay slips;

- Employee salary analysis.

- Reports on taxes and contributions.

The command to call all payroll reports in 1C 8.3 ZUP 3.0 is located on a special reporting panel. In each section of the 1C ZUP 3.0 program there is a link to call the panel. For example:

- Section "Salary - Payroll Reports";

- Section "Payments - Reports on payments";

- Section "Taxes and contributions - Reports on taxes and contributions".

The composition of reports on the panel and assignment to a particular section can be configured.

In the Payroll Reports section, you can find all payroll reports:

- "Full set of accruals, deductions and payments";

- “Analysis of salaries by employees” is what used to be called “Payroll in free form”:

We will form in 1C ZUP 3.0 “A complete set of accruals, deductions and payments”, where a summary is formed by types of charges:

- Everything that is accrued in the context of types of accruals,

- Everything that is retained in the context of types of retention,

- Everything Paid:

In 1C ZUP 3.0, a key difference from the previous version of 1C ZUP 2.5 is visible, which is to account for the balance. In 1C ZUP 3.0 there is a “salary balance”. If everything that is accrued for the current month is paid, then the balance is zero. That is, there is no balance in the vault, because the entire salary for the current month has been paid.

In the salary report, the payment will be for January, because the month of payment is January. In 1C ZUP 3.0, the most important thing for payment is the month of payment, it is in this month that the amount paid will be included in the reports:

How to see the salary of employees for a period in 1C ZUP 3.0

In 1C ZUP 3.0, you can use the accumulation register “Mutual settlements with employees”. In this report, you can set up custom fields by movement date:

And for the amount of movement:

This report will compare turnovers. Set the register entry period for January, from 01/01/2016 to 01/31/2016. We will also set an additional selection by the date of movement from 01/01/2016 to 01/31/2016. The turnover of account 70 is formed:

If you generate a report for the period until February 06, that is, when the salary has already been paid, then there will be no balance, since everything that has been accrued has already been paid:

How to view the “salary balance” in 1C ZUP 3.0

If, according to the results of calculations for the current month, some of the employees owe money, and someone remains indebted to us, then the “Balance according to the results of calculations for the month” appears in the salary reports. For example, in January, one employee was paid 10,000 rubles more, and another - 1,000 rubles less. This can be seen:

- In the report "Full set of accruals, deductions and payments":

- You can also see the turnover on account 70 in the Universal report:

- In the section "Payments - Reports on payments - Salary arrears:

Also, the balance can be seen in the "Payroll in any form", in 1C ZUP 3.0 the report is called "Analysis of salaries for employees." This report has:

- balance at the beginning of the month

- number of days and hours worked and not worked for each employee,

- amounts of accruals by types of accruals,

- total on accruals,

- amount of deductions by types of deductions,

- retention total,

- payments for the current month,

- balance at the end of the month:

In 1C ZUP 3.0, the balance will automatically be taken into account at the next salary payment. In our example, one employee in the next month will receive a salary of 10,000 rubles less, and the second employee will receive 1,000 rubles more.

Settlement sheet T-51 in 1C ZUP 3.0

Consider how the columns are filled in the Payroll T-51.

The payroll has fields that indicate: what is accrued, what is withheld and the amount to be paid. According to the new methodology in 1C ZUP 3.0, the amount payable is filled with the amounts actually paid. Having created a statement for payment in the 1C ZUP 3.0 program, the amount to be paid is determined. This amount goes to column 18 of the payroll and to the pay slips in the Amount payable section:

Columns 16 and 17 in the T-51 Payroll are the balance at the beginning of the month. The fact that employees were overpaid or underpaid in the current month can be seen on the T-51 Payroll for the following month:

The main request for the 1C ZUP 3.0 salary program is that the user must make sure that everything that is accrued is paid. In 1C 8.3 Accounting 3.0, it is not clear on the balance sheet whether everything has been paid, because, for example, the salary for January is paid in February and there is a balance on account 70 at the beginning of the month. Analyzing account 70, it is impossible to determine whether all employees have been paid what accrued. Therefore, for 1C ZUP 3.0, they developed a "salary balance" mechanism. And this is convenient, because in 1C ZUP 3.0 it is clear: if there is no debt, then everything is done correctly.

Pay slip in 1C ZUP 3.0

In 1C ZUP 3.0, a very convenient form of payslips is formed, as compact as possible in order to print. Details of information output to pay slips are configured using the "Settings" button:

Using the checkboxes, you can configure the composition of information for printing:

The pay slip indicates the amount of income accrued, how much was withheld, actually paid, and the amount paid in salary is indicated as the amount payable:

If you enter everything correctly in 1C ZUP 3.0 and pay wages on time, then there will be no balance. If the statement is filled in automatically, then the 1C ZUP 3.0 program offers to pay everything that has been accrued.

Reports on taxes and contributions in 1C ZUP 3.0

Reports on taxes and contributions in 1C ZUP 3.0 are generated in the Section "Taxes and contributions - Reports on taxes and contributions":

Time sheet in 1C 8.3 ZUP 3.0 - settings, filling procedure, discussed in the article.

What I love about 1s is that it provides several ways to solve the same problem. Looking through the catalog of developments, I came across a Code of accruals and deductions for a monthly period (Summary of wages for a month within one year for 1C8.2 ZUP) for 500 rubles, according to screenshots, the processing is not bad, but almost the same result can be obtained by setting up the report “Summary of accrued salaries" (attention to the configuration "Salary and Human Resources Management for Ukraine (basic)", edition 2.1. (2.1.25.3)) but I think that for the Russian configuration the differences will be minimal.

By default, the report displays summary information on accrued and paid wages for the specified period.

But we will try to reconfigure the cat report in order to get information about the accrued and withheld salary in an arbitrary period of time.

First, let's go to "Settings" and delete everything that is configured there as standard.

Add a new table to the report structure.

In the rows we will add the grouping "Section" and the subordinate grouping "Type of calculation", and in the columns "Month of accrual"

Now let's select the topmost element of the report hierarchy and, on the selection setting, specify the employee for whom we want to get data, by the way, I think that the balance in the report will be superfluous, and we will exclude it using the "Does not contain" "Balance" comparison type.

Great, now we can select a custom period to view the employee's salary information.

But the presented report is not very readable, you can get information, but it would be a shame to show the director somehow. Let's first try to represent the months without days and hours in the format "February 2012", for this we will use the "Conditional formatting" tab.

Let's add a new condition with the following parameters:

All this is applied to the “Account month” field being drawn up without conditions.

Oh, I forgot, we will also set the maximum column width to 12 (we select this parameter empirically).

Let's look at the result:

Much better than it was. It remains to set the title of the report. To do this, go to the other settings tab and set the following parameters

See the final version of the report:

I think it's ok to show management.

Now the final touch, saving the settings to a file. Let's go to the settings, right-click on the report, and select "Save settings" specify the file name, the settings are restored in the same way. I will post the report settings file in the “Development” section, if anyone is too lazy to customize the report or liked the article, then 60r. ($2) A small amount for the time saved. Once again I remind you that the report for the configuration of the ZUP for Ukraine, whoever can, check it on the Russian version of the ZUP.

A sample invoice form can be downloaded from the following link:

Download sample form in MS Excel!

The BukhSoft program fills in this sample of the payroll form automatically! More about accounting automation. accounting

Payroll (Unified Form No. T-51)

An excerpt from the Decree of the State Statistics Committee of the Russian Federation of January 5, 2004 N 1 "On the approval of unified forms of primary accounting documentation for accounting for labor and its payment":

When using the payroll in the form N T-49, other settlement and payment documents in the forms N T-51 and T-53 are not drawn up.

For employees who receive wages using payment cards, only a payroll is compiled, and a payroll and payroll are not compiled.

Statements are compiled in one copy in the accounting department.

Payroll (forms N T-49 and N T-51) is made on the basis of data from primary documents for accounting for output, hours actually worked and other documents.

In the columns "Accrued" the amounts are entered by types of payments from the payroll, as well as other income in the form of various social and material benefits provided to the employee, paid at the expense of the organization's profit and subject to inclusion in the tax base. At the same time, all deductions from the amount of wages are calculated and the amount to be paid to the employee is determined.

The title page of the payroll (form N T-49) and payroll (form N T-53) indicates the total amount payable. The permission to pay wages is signed by the head of the organization or a person authorized by him. At the end of the statement, the amounts of paid and deposited wages are indicated.

In the payroll (form N T-49) and payroll (form N T-53), after the expiration of the payment period, the “Deposited” mark is made against the names of employees who have not received wages, respectively, in columns 23 and 5. If necessary, the number of the submitted document is indicated in the "Note" column of Form N T-53.

At the end of the payroll, after the last entry, a final line is drawn to enter the total amount of the payroll. For the amount of wages issued, an expenditure cash warrant is drawn up (Form N KO-2), the number and date of which are entered on the last page of the payroll.

In the payrolls compiled on computer media, the composition of the details and their location are determined depending on the adopted information processing technology. In this case, the form of the document must contain all the details of the unified form.

Join

Summary payroll sheet

The payroll is called document used by the organization for settlements with employees. It shows all payments, deductions, etc. which ultimately allows you to receive exactly the amount payable, which is due to the employee. Prepare payroll. an accountant can be in the payroll, and in the settlement, and in the payroll.

Types of statements

In accounting, there are the following types of statements:

- Form t 49 - payroll

- Form t 51 - payroll

- Form t 53 - payroll

payroll sheet is compiled by the accountant of the enterprise, he also signs it .

Such a document is drawn up in a single copy, according to those primary documents that take into account the working hours of employees.

There is a statement on the form title page and table on the back. in a large organization, the form consists of several sheets. On the title page of the statement must be indicated:

- Name of the organization

- Organization code

- Amount to be paid

- Billing period, in organizations. As a rule, this is one month for which wages are calculated.

According to the current legislation, the payroll statement should be kept for five years. For verification, a turnover sheet can be drawn up, which serves to summarize the data entered in the primary document in order to check the opening balance, turnover for the billing period, and the final balance.

What is a payroll summary

Such a statement is used at agricultural enterprises in order to to control the movement of cash on wages and reporting. Such a statement is drawn up for a billing period for a period of one year, every month data on earnings, bonuses, compensations, and any other payments that are included in the payroll are entered for all categories of employees. A separate line indicates the amounts that are given in kind of wages, as well as payments that are not part of the wage fund.

Read also: Wage indexation labor code

Consolidated payroll sheet No. 58 includes :

- Section on employees who are engaged in the main activity

- Section on employees not engaged in activities that are the main in the enterprise

- Section dedicated to employees who are not included in the lists of employees of the enterprise

Without this document, it is impossible to conduct a statistical report on the use of funds from the amounts. for the payment of wages. It has two sections, one of which reflects the amount of accruals, this is section A. The second section B indicates the amounts that have been issued, transferred to accounts, and the amounts withheld.

All indicators on the movement of the amounts of wages of employees (accruals, deductions, amounts of issuance), summarized using the payroll summary sheet. where each month data is entered based on the results of settlement and payrolls.

Salary codes when checking the FSS

Hello dear forum users. Need help. From the FSS, the auditors requested payroll guidelines for the year, broken down by months, to verify the correctness of the calculated NSIPZ. We have 1C Accounting 7.7. As far as I know, in ZiK it is possible to form some kind of vaults, but in 1C Bukh. it looks like there is no such option? Maybe someone has a processing for 1C, or tell me at least how they look, these vaults!

So print out to them "payrolls for __ month", which are formed monthly, in 1C they are called "Accrued taxes with a payroll". What do you doubt?

Reports=Specialized=accrued taxes with payroll

I have, for example, in 1C so

Yes indeed, I have too. Why didn't I see him before. Thank you very much.

For the time being, I decided to take them the table I made in Ixelle, in which the lines indicate the total amounts for wages, compensation, sick leave at the expense of wed-in-la and for bills. Wed-in the FSS, vacation pay, and in the columns of the month. Those. the same OSV according to 70, but all months on one sheet. And then we'll see if they are satisfied or not.

Thank you all for your replies, they've been very helpful.

now they came to check my colleague already according to the new rules, a pensioner together with the FSS, so they also requested a set of statements.

we work in Sail, and we don’t make vaults, only statements, they ask, as I understand it, such as is derived from 1s.

And they ask for the code broken down into payments, in order to exclude probably payments that are not taxed

Tell me, on the basis of what documents, they generally work and carry out these checks, what they have the right to demand.

There is no salary code in the Instructions for Budget Accounting (and, as far as I remember, in commercial accounting too), this is not a mandatory form, but an analytical piece of paper "for myself"

And the payroll statement does not suit the inspectors, there you have to calculate everything yourself

I speak long and unconvincingly, as if talking about the friendship of peoples.

Everything I said is IMHO, if there are no references to legislation

The organization received a requirement from the FSS to provide documents for verification for 3 years. Asking for a pay slip. What is this document?

WHAT DOCUMENTS TO PREPARE

The company must provide the inspectors with the opportunity to familiarize themselves with the documents related to the calculation and payment of insurance premiums (part 21 of article 35 of Law No. 212-FZ). *

Auditors can request almost all documents related to remuneration, constituent documents, as well as calculations for insurance premiums in the forms RSV-1 and 4-FSS of the Russian Federation. Controllers will look for violations of the law, discrepancy between the indicators reflected in the calculations for accrued and paid insurance premiums, accounting data. They will also check the completeness and correctness of the accounting transactions that affect the formation of the base for the calculation of contributions.*

The list of documents that will most likely have to be submitted is given in Table 1 below. 1 and 2. Note that the FSS of Russia requires more documents than the Pension Fund. The fact is that, in addition to general information, inspectors of the FSS of Russia also analyze documents related to the payment of benefits for compulsory social insurance.*

Table 1. List of documents required by employees of the PFR and the FSS of Russia

Constituent documents (charter and (or) memorandum of association)

The auditors will verify the name of the company, its address, preferential activities, the procedure for paying dividends

Read also: Will working pensioners receive pensions and salaries in 2019

Orders on the approval of the accounting and (or) credit policy in force in the period under review

In the accounting policy, the auditors will familiarize themselves with the list of documents maintained by the company

Licenses valid in the period under review

They serve, among other things, to understand whether companies have the right to apply reduced rates of insurance premiums

Accounting registers (including the general ledger, business transaction journals, order journals, statements, analytical cards, salary summaries, books of income and expenses and business transactions for the period under review).

Tax accounting registers*

In the requested documents, the auditors will try to find errors and inconsistencies

"1C Salary and Personnel Management" in examples!

Part 7: Printed forms 1C (Pay slips, Timesheet, Payroll, etc.). Instructions for 1s ZUP for beginners or a step-by-step description of the stages of accrual

Hello dear readers of the zup1c blog. Today I am completing a series of articles devoted to an overview of the main features of the software product. "1C: Payroll and Personnel Management". In the last publication, I noted that the formation of regulated reporting is one of the main tasks of accounting. But no less important task is the generation of reports for internal use. First of all, these reports should include:

- pay slips,

- timesheet forms,

- payroll forms,

- summary of wages.

And of course 1C ZUP provides opportunities for generating these reports. In addition, the software product has a large number of other useful reports and printables:

- analysis of accrued taxes and contributions (PFR, personal income tax, FSS),

- reflection of salary in accounting,

- printed form of the employment contract,

- forms of orders for hiring, personnel transfer and dismissal,

- leave form.

These are not all reports and forms presented in the program. It makes no sense to list all possible reports in this publication, since it is of an overview nature. However, this topic is very extensive and I will return to it more than once in my future materials.

Let me remind you that this is the seventh and final part of a series of review articles about the 1C ZUP program. Links to previous articles are provided below:

pay slips

Most medium and large organizations provide their employees with pay slips of their monthly payroll. In 1C ZUP there is a specialized report of the same name for this purpose. It can be found on the Payroll tab in the Reports section.

When generating pay slips, you can make the following selections (filters):

- Period - month of calculation. As a rule, it is required to print sheets for a certain month, so this field is filled in most cases;

- Organization - if you keep records for one organization, you can not select anything here;

- Type of payslip - 1C developers have provided different options for sheets. The “Brief” view is the least detailed and the other two views “For employee” and “Detailed” are more detailed;

- Selection by Division – it is possible to generate a report on the selected division;

- Selection by Employee - accordingly, you can select certain employees.

You can see the appearance of the pay slip in 1s zup in the figure:

The report contains information on accrued and withheld amounts with details on the types of accrual and deduction, information on personal income tax deductions, the amount of debt for the enterprise or employee, if any, and other information, this was the main one.

The program also has access to the so-called "operational" payslip. It can be opened directly in the document "Payroll for employees"(More on payroll here.) This payslip reflects the accruals and deductions of the current Payroll document, even if it has not been posted. The sheet also reflects the data of other documents on payroll for the same month of accrual, but these documents must be posted. To open the sheet, you need to click on the link in the document "Payroll" at the bottom right "Show pay slip". It is also worth noting that the data will be generated for the employee who is currently highlighted in the document form.

This sheet basically provides the same information as the first report, but is generally used for viewing rather than printing.

Time sheet templates

Unified form No. T-13 “Time sheet. Just like the previous report, this report is available on the payroll tab of the program desktop. I would like to point out right away that Do not confuse this report with the document of the same name"Time sheet". To print a time sheet based on the results of work for a month, it is enough to use these reports and not resort to using a document of the same name, which is intended for other purposes.