An assignment is an assignment of a claim by a creditor to another person (clause 1, article 388 of the Civil Code of the Russian Federation). The creditor who assigns the claim is called the assignor, and the person acquiring the debt is called the assignee. What, under the assignment agreement, the transactions with the assignee, assignor and debtor need to be done, we will tell in our consultation.

Assignee Accounting: Postings

So, for the receivables acquired under the assignment agreement, the following conditions must be met:

- availability of documents confirming the existence of the right to receive funds or other assets;

- transfer to the assignee of financial risks associated with the acquired debt (risk of price changes, risk of insolvency of the debtor, liquidity risk, etc.);

- the ability to deliver economic benefits to the assignee in the future (for example, in the form of value appreciation).

If these conditions are met, the debt acquired by the assignee will be accounted for as part of financial investments on account 58 “Financial investments” (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Therefore, when acquiring a debt under an assignment agreement, the entry from the assignee is formed as follows:

Debit of account 58 - Credit of account 76 "Settlements with different debtors and creditors"

The acquired debt is reflected in the accounting of the assignee at the amount of actual costs for its acquisition (clauses 8, 9 PBU 19/02), which consist of the following expenses:

- amounts paid in accordance with the contract to the assignor;

- amounts paid for information and consulting services related to the acquisition of a financial investment;

- the fees that the assignee pays to the intermediary organization;

- other costs directly related to the acquisition of debt.

When the debtor repays a monetary claim acquired under an assignment agreement, the accounting entries of the assignee will be as follows:

Is it necessary, under the contract of assignment of the right to claim, to make the transaction with the assignee for the amount of VAT?

If the previously acquired debt arose from a contract for the sale of goods (works, services), then from the excess of the debt to be repaid over the costs of its acquisition, VAT will need to be charged at the estimated rate of 18/118 or 10/110 (clause 2 of article 155, clause 4 article 164 of the Tax Code of the Russian Federation).

Accordingly, in this case, upon termination of the debt or subsequent assignment of the right to claim, the postings from the assignee will be supplemented with the following:

Debit account 91 - Credit account 68 "Calculations on taxes and fees", subaccount "VAT

Assignment agreement: accounting at the assignor

And what are the entries under the assignment agreement with the assignor?

Assignment of the right to claim under an assignment agreement in the accounting records of the assignor is reflected as the sale of other assets through account 91.

Here is a book of transactions under the assignment agreement with the assignor:

Accordingly, upon assignment of the right to claim, the accounting entry for payment under the assignment agreement will be as follows:

Debit of accounts 51, etc. - Credit of account 76

Thus, the transactions with the assignor in the sale of debt are similar to the transactions in the sale of other property (except for finished products and goods).

Transactions under the assignment agreement with the debtor

What accounting entries should be made with the debtor under the assignment agreement?

Since the debtor has the amount payable reflected in the credit of the corresponding settlement account, this account must contain an analytic - to whom exactly the debt belongs. Accordingly, when a creditor is changed, the debtor in analytical accounting reflects the change in the creditor.

Let's take an example.

Entity A purchased goods from Entity B:

Debit of account 41 "Goods" - Credit of account 60 "Settlements with suppliers and contractors" / "Organization B"

Entity B ceded the debt to Entity C under an assignment agreement.

Based on the notification to the debtor-Organization A about the assignment of debt between legal entities, the accounting entry in the accounting of Organization A will be directed to clarify the analytical accounting data on account 60:

Debit account 60 / "Organization B" - Credit account 60 / "Organization C"

This means that accounting entries for the assignment of rights from the debtor will be reflected only in analytical accounting.

Consequently, the repayment of the debt for the goods will be made by Organization C, to which the right of claim has been transferred on the basis of an assignment agreement:

Debit account 60 / "Organization C" - Credit accounts 51, etc.

This article is devoted to how to reflect the contract, that is, operations under the cession agreement in 1C using the example of the BP 8.3 configuration.

An assignment agreement is an assignment of the right to claim receivables, that is, in other words, the sale of such debts to another person. Typically, the debt is sold at a discount, and the original creditor suffers a loss.

Legislatively, accounting for an assignment agreement is due to:

- Civil Code of the Russian Federation - articles 382-389 (refer to chapter 24 - Change of persons in an obligation);

- PBU 9/99 - Income of the organization;

- PBU 19/02 - Financial investments - p. 8, p. 9;

- Tax Code of the Russian Federation - art. 146, 155, 164, 268, 271, 279. When making a transaction between related parties, additional nuances are possible.

Consider an example: Organization A sold goods or provided services to organization B in the amount of 118,000 rubles, incl. VAT 18000 rub. Not having received payment by the due date, A sold this debt to organization C for 108,000 rubles.

Terminology within the framework of a transaction under an assignment agreement:

- Entity A (original creditor) – Assignor;

- Entity B (debtor) – Debtor;

- Entity C (new creditor) – Assignee.

BU at the assignor

Dt 62 (balance on B) 118000. Postings under the assignment agreement:

The loss on the operation will be 10,000 rubles.

If the assignor sold the debt for more than the original amount, then VAT should have been charged on the excess amount, entry 91.02 - 68. VAT.

Note: VAT can only be charged on the sale of debt on VATable transactions. If the subject of the transaction is a loan agreement, VAT should not be charged even if the amount of the agreement exceeds the real debt.

NU at the assignor

The loss on the operation is 10,000 rubles.

If the due date has already come, then the loss is recognized in full. If the payment deadline has not come, the loss cannot be taken into account in full in tax accounting. Here, the provisions of Art. 279 of the Tax Code of the Russian Federation and the accounting policies of the organization.

It should be noted that several lines in the income tax declaration are specially allocated for the features of reflecting losses in such a situation.

In our example, the payment deadline has come, so we will take into account the entire amount of the loss in NU.

BU at the assignee

NU at the assignee

In the event that a profit is made on the operation (it does not matter the type of obligations, loan or debt for the sale of goods), the assignee considers such amounts as income subject to income tax. At the same time, the cost of the acquired obligation, as well as other expenses directly related to this transaction, are taken into account as expenses that reduce the taxable base for profit.

BU at the debtor

The assignment agreement has no tax consequences for the debtor.

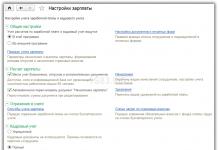

Assignment in 1C BP

There are no special documents to reflect assignment operations in the program. Sometimes in this case, the document "Operation" is used, where the user manually fills in the necessary entries. This option has many downsides. Firstly, in order to obtain correct reports and fill out regulated reporting, it is often not postings that are important, but register entries that are not generated when using the “Operations” document. Secondly, there are restrictions on the choice of printing forms.

Based on this, we will try to reflect the assignment agreement in 1C using standard documents, which is easiest to do in this situation by showing the operations of the debtor organization. Let's start with this.

Having received notification of a change of creditor, the debtor must transfer the amount of debt from one counterparty to another. For this, the “Debt Adjustment” document is used, which can be located in the “Purchases and Sales” section.

Create a new document Debt Adjustment. In document:

Operation type – Debt transfer; Transfer - Debt to the supplier.

We fill in the data on the creditor and the new supplier from the directory of counterparties.

By clicking the "Fill" button, you can automatically generate a tabular part, and if necessary, later add the necessary parameters (in our case, this is a New contract and a New invoice).

Sometimes it becomes necessary to reformat the document, but an error occurs - it is proposed to pre-approve it. Here you can use the menu option by clicking the "More" button.

Assignment agreement in 1C 8.3 at the assignor

We create a new document for the implementation of services, having a choice of two options for the input form.

More on details

We change the settlement accounts to 76, the advance payment method - Do not read out.

By type of income, we create a new position with the type of article, as in the figure, and a mark of acceptance to NU.

In this case, there is no consensus on the formation of an invoice. On the one hand, there is no object of taxation and no tax to be charged. On the other hand, if the case of a loan is directly indicated in the Tax Code as not being subject to VAT, then the sale of debt on sales with VAT under certain conditions can form the amount of tax. In our example, the midrange has been formed.

To write off the debt to expenses, we will use the “Debt Adjustment” document with the corresponding type of operation. The "Fill" button allows you to create a tabular section on the tab that reflects the buyer's debt.

For VAT, revenue is the amount of sale to the Debtor.

For profit, the assignment of a debt claim is added to the amount of revenue.

The cost of realized property rights is shown in a separate line.

Since the income between the declarations does not match, the accountant should be prepared to receive a request from the tax office to explain this difference.

Assignment agreement in 1C 8.3 with the assignee

Carrying out an assignment agreement in the configuration 1C 8.3: "Enterprise Accounting 3.0"

In other configurations, there are management ledgers in addition to accounting ledgers (postings that can be entered manually). These registers are formed by documents that are not available in a standard form for conducting operations under an assignment agreement.

Basic concepts and participants of the assignment agreement:

- Assignment agreement - assignment of the debtor's claims (receivables)

- Assignor - primary creditor

- Assignee - new creditor

Consider the postings that an accountant must generate to reflect the operation.

Manual reflection of postings for the execution of an assignment agreement in 1C 8.3 Accounting

Manual postings in this configuration are entered using the "Manually entered transactions" documents, which are located in the "Transactions" menu:

Assignment of the debtor's claims in 1C it is reflected in the following postings:

1. First posting:

- Dt: 76.09 "Settlements with debtors - creditors". Analytics is conducted by counterparty, or rather by "Assignee"

- Ct: Loan 91.01 “Other income”

- Posting amount - the debt of the new creditor (assignee) under the assignment agreement

2. Second wiring:

- Dt: 91.02 "Other expenses"

- Kt: 62.01 "Settlements with buyers"

- Amount of accounts receivable as recorded by the assignor

What postings need to be made under the assignment agreement with the assignee:

1. First posting:

- Dt: 58.05 "Provision of financial investments"

- Kt: 76.09 "Settlements with debtors - creditors", analytics also for the counterparty

- Posting amount - costs actually attributed to the acquisition of remote sensing

In the account of the assignee debt repayment by the debtor occurs as follows:

- Dt: 76 "Settlements with debtors - creditors", subaccount - "Settlements with the debtor"

- Ref: 91.01 "Other income"

- Amount of debt to be recovered from the debtor

- Dt: 91.02 "Other expenses"

- Loan 58.05 "Provision of financial investments"

- Amount - actually received costs

- Debit 51 "Settlement account"

- Credit 76.09 "Settlements with debtors - creditors", subaccount - counterparty

- Amount - actually received cash

Accounting for an assignment agreement using a debt adjustment

As I have already said, entering only transactions manually, in most other configurations, a full reflection of the cession agreement cannot be done.

Most often, accountants use the document "Debt Adjustment". It allows you to generate the necessary postings and, at the same time, correctly reflect the amounts in the reporting, for example, in a profit declaration.

Here is an example of such a transaction:

1. Buying debt. It is drawn up by the document "Adjustment of the dog" - operation: mutual settlements:

- Dt: 58.05 - Debtor

- K: 91.01

- Amount: 16,000 rubles.

2. Sale of debt. Document "Implementation of services":

- Dt: 79.09 - Creditor Ct. 91.01 = 22000 rub.

- Dt: 91.02, Ct. \u003d ((22000-16000) / 118 * 18 rubles.

3. The next posting for 16,000 rubles. you can also issue through the "adjustment" (operation - debt write-off):

- Dt. 91.02

- ct. 58.05 - Debtor

- Amount: 1600 rub.

Source: programmer1s.ru

Assignment agreement - transactions with the assignor, assignee and debtor are different. Consider the main entries that need to be generated by each of the parties to the agreement, and the documents with which these accounting records must be supported by the parties to the agreement.

Assignment agreement: postings at the assignee

The assignee accounts for the receivables acquired under the assignment agreement as a financial investment.

In the amount of actual costs incurred when buying a receivable, and therefore in the initial cost of such an investment, one can take into account not only the amount of the debt itself, but also the following expenses (clauses 8, 9 PBU 19/02, approved by order of the Ministry of Finance dated 10.12.2002 No. 126n):

- information, intermediary services;

- any other costs incurred in the acquisition of assets (financial investments).

Continuation of the example

The assignee reflects the transaction as follows:

|

Accounting entries under the assignment agreement with the assignee |

Sum |

the name of the operation |

|

Dt 58 Kt 60 (76) |

Purchase of receivables |

|

|

Dt 58 Kt 60 (76) |

Costs for auditors included |

|

|

Dt 60 (76) Kt 51 |

Transferred funds to the assignor |

|

|

Dt 51 Kt 91.1 |

The debtor transferred money to the assignee |

|

|

Dt 91.2 Kt 58 |

All expenses under the assignment agreement are reflected |

|

|

Dt 91.2 Kt 68.2 |

2 666,67 |

VAT charged on income (118 125-102 125) × 20 / 120 |

|

Dt 91.9 Ct 99 |

13 559,32 |

Profit from the assignment agreement |

Transactions under the assignment agreement with the debtor

What should be the accounting entries under the assignment agreement for the assignee and the assignor, we figured it out. And what about the debtor?

We found out that the debtor does not even participate in the discussion and signing of the assignment agreement. The amount of his debt does not change. Only the name of the lender changes.

Accordingly, the changes will affect only analytical accounting.

Continuation of the example

Results

So, we have examined what entries are formed by its participants under the assignment agreement if the enterprises are VAT payers. In conclusion, let us say that for some entrepreneurs, assignment agreements can become an interesting business, and for others, they can be a sure way to get their money. But you need to understand that the assignor after the conclusion of the contract is not responsible and does not guarantee the payment of the entire debt by the debtor.

What to look for when signing a contractwithSTS payers or individuals, readin articles:

- "Assignment agreement under the simplified tax system income minus expenses (nuances)";

- "Physicist" received execution on a loan acquired in the order of assignment. What about personal income tax?.

The founder (participant) may assign his share in the authorized capital of the organization to a third party. But provided that it is not prohibited by the charter of the company and the share has already been paid. This is stated in Article 21 of the Law of February 8, 1998 No. 14-FZ. The share of a company participant is a set of rights. With the transfer of a share, there is always a new participant who receives these rights. As a result, there is a change of persons in the obligation, that is, the assignment of the right to claim (clause 1, article 382 of the Civil Code of the Russian Federation). The assignment of a share in the authorized capital shall be formalized by an agreement on the assignment of the right to claim according to the general rules, taking into account the requirements specified in paragraph 12 of Article 21 of the Law of February 8, 1998 No. 14-FZ. Documentation The transfer of rights from the assignor to the assignee is formalized by an assignment agreement. The assignment agreement must be concluded in the same form as the original agreement (purchase and sale agreement, credit, etc.).

How to conduct an assignment agreement in 1s 8.3 - examples of postings

Postings on the assignment of the claim on 10/12/17, Smart LLC sold a batch of office supplies to Kantselaria LLC:

- selling price - 177.320 rubles, VAT 27.048 rubles;

- the cost of a batch of stationery - 104.800 rubles.

Within the prescribed period, the "Chancery" did not transfer the amount of funds to "Smart" as payment for stationery. In this regard, on November 2, 2017, Smart entered into a cession agreement with Kurs JSC, according to which:

- "Smart" transfers to "Kurs" the right to claim the debt of "Chancery";

- the cost of transferring the right to claim is 154,700 rubles.

On November 14, 2017, Kurs transferred to Smart the amount of payment under the cession agreement. Since the cost of transferring the claim (RUB 154,700) is lower than its book value (RUB 177,320), Smart does not need to charge VAT on the sale amount.

The following entries are reflected in Smart's accounting: Date Debit Credit Amount Description 12.10.17 62 90.1 177.320 rub.

Examples of postings under an assignment agreement with the assignor

Attention

Under the contract, Hermes receives money until the end of February. The right of claim passes to Alpha at the time of its occurrence. In February, upon receipt of money from Alpha, the accountant of Hermes made the following entries: Debit 51 (50) Credit 76 sub-account “Settlements under the contract for the assignment of the future right of claim” - 10,000,000 rubles.

– funding has been received on account of the assignment of a future right of claim; Debit 76 subaccount "Settlements under the contract of assignment of the future right of claim" Credit 68 subaccount "VAT settlements" - 1,525,424 rubles. (10,000,000 rubles: 118 × 18) - VAT has been charged on account of the payment received for the transfer of the future right of claim. In March, Hermes sold 70 machines at a price of 105,000 rubles. a piece. The total transaction amount was RUB 7,350,000. (70 pieces × 105,000 rubles).

Including VAT 18 percent - 1,121,186 rubles. (7,350,000 rubles: 118 × 18).

Reflection of operations on the assignment of the right to claim in accounting

VAT on the sale of goods; Debit 90-2 Credit 41– 2,310,000 rubles. - written off the cost of goods sold. When the machines were sold, Hermes acquired the right to claim. Under the cession agreement, it passes to Alfa. The Hermes accountant reflected this operation as follows: Debit 76 subaccount “Settlements under the contract of assignment of the right to claim” Credit 91-1– 3,000,000 rubles.

(30 pieces × 100,000 rubles) - the assignment of the right to claim is reflected; Debit 91-2 Credit 62– RUB 2,940,000.00 - the value of the realized receivables under the contract of assignment of the right to claim is written off. At the same time, the accountant put part of the VAT from the advance for reimbursement and, after confirming the right to it, made the following entry: Debit 68 “VAT settlements” Credit 76 subaccount “VAT settlements from advances on assignment” - 457,627 rubles. (3,000,000 rubles: 118 × 18) - reflects the obligation of the budget to refund VAT previously paid from the advance.

Accounting with the assignor upon assignment of the right to claim at a loss

- 1 Grounds for assignment of the right to claim

- 2 Documentation

- 3 Accounting

- 4 Accounting - assignment of a future claim

- 5 Taxes

Upon assignment of the right of claim, the creditor (assignor) transfers to another person (assignee) his right to claim from the debtor the performance of his obligations. For example, the creditor has the right to transfer his rights of claim when the debtor cannot pay his accounts payable on time. Grounds for assignment of the right to claim The creditor may transfer his rights to another person:

- under an assignment agreement;

- on the basis of the law (for example, by a court decision, during the reorganization of an organization).

This is stated in paragraph 1 of Article 382, Article 387 of the Civil Code of the Russian Federation.

Situation: is it possible to formalize the change of the sole founder (participant) of an LLC by assigning the right to claim? Yes, you can.

Postings under the cession agreement in 1s 8.3

Important

An example of the reflection in accounting of the assignment of the right to claim. Accounting with the assignor CJSC Alfa on March 16 sold goods in the amount of 165,200 rubles. (including VAT - 25,200 rubles). The cost of goods sold is 120,000 rubles.

20 April "

Alfa ceded the right to claim receivables to another organization for 160,000 rubles. This amount was transferred to Alfa's account on May 17. Since the income from the assignment of the right to claim (160,000 rubles) does not exceed the amount of the claim itself (165,200 rubles), Alpha does not have a tax base for VAT. The accountant of Alpha made the following entries in the accounting.

March 16: Debit 62 Credit 90-1– 165,200 rubles. - reflected the proceeds from the sale of goods; Debit 90-3 Credit 68 subaccount "VAT settlements" - 25,200 rubles. - VAT is charged on the sale of goods; Debit 90-2 Credit 41– 120,000 rubles. - written off the cost of goods sold.

Assignment agreement - postings, examples, laws

- in writing and registered (if the transaction, the claims for which are assigned, was subject to state registration).

This is stated in article 389 of the Civil Code of the Russian Federation. The assignor must attach documents certifying the right to demand the performance of certain obligations from the debtor to the assignment agreement. These can be contracts, invoices, invoices, acts of work performed (services rendered), etc. The assignment agreement must specify:

- on the basis of which agreement this or that right arose;

- what is the obligation of the debtor;

- a list of documents and terms for the transfer of documents certifying the right to claim, which the assignor must transfer to the assignee;

- other information regarding the assigned rights.

This procedure is provided for by Articles 385, 389.1 of the Civil Code of the Russian Federation.

Moreover, so that it can be accurately identified at the time of occurrence and transition to the assignee. For the example taken, it is possible to prescribe the conditions for the assignment by the assignor of the obligations of tenants to pay him for specific areas at certain rates, the price agreed with the assignee. This may be the following text: “... The assignee receives the right to claim rent payments from an office building area of 1500 sq.

m. At a rate of 19,000 rubles. per year for 1 sq. m… The assignee receives the right to claim for 85 percent of its value…”. Choose any indicator. The main thing is that it allows you to understand exactly what rights of claim the assignor must give. By default, the assignee receives the right to claim at the time of its occurrence.

The parties to the cession have the right to agree on a later moment of transition by prescribing a special condition in the contract. All this is provided for by Article 388.1 of the Civil Code of the Russian Federation.

The settlement account of "Prom Stroy" received funds on account of payment for the assignment of the rights of claim 76 of the Agreement for the assignment of the right of claim 68 VAT 17.765.084 rubles. VAT accrued on account of the future right of claim (116.460.000 rubles / 118 * 18) In June 2017, Prom Stroy sold 85 pieces of equipment at a price of 1.080.000 rubles. (total amount of the transaction - 91.800.000 rubles, VAT 14.003.389 rubles). Upon the sale of the equipment, Prom Stroy acquired the right to claim, which was transferred to the Mekhanizator. Operations are reflected in accounting records: Debit Credit Amount Description 62 90.1 91.800.000 rub. Reflected proceeds from the sale of equipment (80 units) 90.3 68 VAT 14.003.389 rubles. Accrued VAT on the amount of sales 90.2 41 59.840.000 rubles.

The cost of sales was written off (85 units * 704.000 rubles) 76 Contracts for the assignment of the right to claim 91.1 82.492.500 rubles. The assignment of the right to claim for goods sold is reflected (85 items).