Today we will learn how to make payments from buyers through payment cards (Visa, MasterCard and others).

In another way, such operations are also called acquiring:

Acquiring (from the English acquiring - acquisition) - acceptance of payment cards for payment as a means of payment for goods, works, services.

Attention, this is a lesson - you can repeat all my actions in your database (only the organization and the period will be different for you).

Situation. We are a retail store with a sales area. On January 1, revenue from payment cards amounted to 100,000 rubles. On January 2, our acquiring bank transferred this amount to our current account. For acquiring services, the bank took 1% of the amount.

Let's go to the section "Bank and cash desk" and select the item "Payment by payment cards":

In the journal that opens, click the "Create" button:

The type of operation we naturally have is "Retail revenue":

Fill in the date and the warehouse field (with the manual outlet type):

Create a new payment type:

- Payment type: Payment card

- Name: for example, Visa

- Counterparty: our acquiring bank VTB

- Contract: Acquiring contract (you can also specify the number and date)

Do not forget to also indicate the percentage of the bank's commission for acquiring services (1%).

It will turn out like this:

Specify the amount of payment and post the document:

Let's see the wiring (DtKt button):

That's right:

62.R (retail buyer) 90.01.1 (revenue) 100,000 (revenue reflected)

57.03 (transfers on the way) 62.R (retail buyer) 100,000 (revenue on the way, transfer from the acquiring bank to our current account is expected)

According to the statement dated January 2, the money (except for the commission) was transferred to our current account.

To reflect the receipt of money, let's go to the newly created document "Payment by payment cards" and create on its basis "Receipt to the current account":

Please note that the program automatically allocated a bank commission (in this case, 1,000 rubles):

And she attributed it to other expenses (account 91.02):

Let's check the document and see the postings (DtKt button):

That's right:

51 (our current account) 57.03 (transfers in transit) 99,000 (payment minus commission credited to our account)

91.02 (other expenses) 57.03 (transfers in transit) 1,000 (expenses for paying commission for acquiring)

By the way, if the revenue was not retail (62.P), but the usual payment from the buyer (a specific counterparty) - we just had to select "Payment from the buyer" as the type of operation, and then instead of 62.P, 62.01 would appear everywhere, indicating the selected by us of the buyer (contractor).

Progress in the field of commodity-money relations has led to the emergence of one of the incredibly convenient inventions - bank cards. At the very beginning, they were intended to receive funds that are stored in the bank, but over time, the functionality of the cards has been expanded for the convenience of servicing at retail outlets - acquiring has appeared.

Acquiring is a payment for goods and services provided by an organization using payment cards. This is a very convenient, modern and simple payment method, which has gained great popularity, and therefore the installation of acquiring through systems based on the 1C: Enterprise 8.3 platform has become a matter of time.

Connecting acquiring to 1C is not the only action. In order to carry out acquiring operations in your organization, it is necessary to conclude an appropriate agreement with a servicing bank that will provide equipment for accepting payments on the terms specified in the agreement - this can be rent or free use.

The most common equipment is USB-connected equipment. They interact at the level of installation on the operating system. That is, if you do not install the driver itself into the system, then the trading equipment driver will not work.

As soon as the buyer presents the card to pay for the purchase to the seller, a certain number of transactions occur. After receiving data about the buyer, the terminal contacts the bank's system and transmits data about the amount and the buyer. Common information is the pin code of the card. Next, a response comes to the device in the form of a payment payment or refusal, in case of an incorrect password entry.

The operation of terminals is fundamentally different from the operation of any other commercial equipment. If the drivers or the system itself is configured incorrectly, this can lead to a failure in the operation of all transmitting systems.

To get started, there are a few important steps you need to take:

- Conclude an agreement with the bank for the provision of acquiring services;

- Obtain a POS terminal from the bank;

- Discuss the terms of cooperation and get advice on installing and configuring equipment;

- Obtain appropriate drivers for POS-terminals from the bank.

During the consultation, the bank employee will definitely explain how and where to register and copy the files. Next, you need to connect the terminal and the reader for entering the pin code via the USB port.

Loading library parameters is easiest done by running the dedicated program provided with the equipment.

Fig.1

In the opened window, select "Acquiring equipment".

Fig.2

If all the drivers are loaded correctly, the system of the bank we need will appear in the drop-down list, if it is not there, you need to download the file manually.

Fig.3

Fig.4

Fig.5

If the steps are strictly observed, the form "Setting the parameters of the Acquiring system" will open.

Fig.6

After installing all the drivers, we check the operability of the equipment. We select in the system "Pay by card", enter the amount and click "Payment payment". The system will immediately ask you to insert a bank card into the POS terminal. Prior to this, the terminal must be connected to the fiscal registrar.

After completing all the settings in 1C 8 (rev. 3.0), it will be possible to accept payments and make settlements with customers using the document “Payment card transactions”, which is located in the “Bank and cash desk” section.

Fig.7

Here we create a document in accordance with the type of sale - "Payment from the buyer", intended for making payments from wholesale buyers, and "Retail revenue" to reflect the revenue from a non-automated outlet.

Fig.8

"Type of payment" is filled in from the directory. It contains the necessary information to fill out an acquiring agreement and a settlement account.

Fig.9

When posting, the document generates the following postings:

Fig.10

It is important to note that the procedure for connecting such equipment is quite complicated, since some problems may arise when connecting with this type of equipment for the first time. Most of the retail equipment uses one-way communication with accounting systems and does not require additional settings. Acquiring equipment - POS-terminals, on the contrary, use communication with external software and hardware systems. For their correct setting, it is important not to forget about this nuance. Therefore, for quick and correct connection of equipment, it is better to invite specialized specialists.

You will not surprise anyone in our time with calculations made by means of bank cards (acquiring). Acquiring is widely used not only by large trade organizations, but also by small businesses and individual entrepreneurs. For information on how acquiring operations are supported in 1C: Accounting 8, edition 3.0, including for VAT accounting purposes, read the article by 1C experts.

The concept and parties to the acquiring agreement

Despite the fact that the practice of concluding an acquiring agreement today is quite extensive, there is no chapter in the Civil Code of the Russian Federation devoted to this agreement. The concept of an acquiring agreement is contained in clause 1.9 of the Regulation of the Bank of Russia dated December 24, 2004 No. 266-P "On the issue of payment cards and operations performed using them" (hereinafter - Regulation No. 266-P). The terms "acquirer" and "acquiring" are contained in the Glossary of Terms Used in Payment and Settlement Systems (Committee on Payment and Settlement Systems of the Bank for International Settlements) (Basel, Switzerland, 01.03.2003). Many dictionaries offer an alternative spelling for this term - "acquirer". According to the established practice, the spelling "acquirer" is more often used in the regulations of the Russian Federation, the same spelling is also used in the program.

An acquiring agreement is concluded between a credit institution (acquiring bank) and an organization (individual entrepreneur) selling goods (works, services). An acquiring agreement is a mixed transaction containing elements of a bank account agreement, a lease agreement, an intermediary agreement, etc.

The essence of the acquiring agreement is that the bank provides an organization or individual entrepreneur with the opportunity to accept payments from customers using payment (plastic) cards. At the same time, payment cards do not have to be issued by the same bank. To accept plastic cards for payment, a special electronic software and hardware device (POS-terminal) is required, which is provided by the bank and installed at the cashier's workplace.

Depending on certain conditions in various banks, the funds received from the buyer can be credited to the organization's account within 1 to 3 business days.

Under the acquiring agreement, funds can not only be accepted, but also issued to bank card holders. As a rule, ATMs and special terminals with the function of issuing cash are used for this.

The bank charges a fee for acquiring services. Usually, the commission is a certain percentage of the amount of payment accepted from the client. The specific amount of the commission is set by the bank individually for each organization with which the contract is concluded. When determining the amount of such a commission, the bank takes into account the turnover of the organization, its scope of activity, region and many other factors.

In some cases (as a rule, if the average turnover of funds in an organization is small), banks may require a fixed rent for the use of their equipment instead of charging interest. This amount is fixed in the acquiring agreement.

Acquiring allows you to attract more customers, since for many of them the ability to pay by card is an advantage due to its convenience. In addition, using non-cash payments, you can reduce the costs and expenses associated with the movement of cash (for example, the cost of collection).

Which merchants are required to accept payment cards

In accordance with Article 16.1 of the Law of the Russian Federation of 07.02.1992 No. 2300-1 “On Protection of Consumer Rights”, the seller (executor) at the choice of the consumer is obliged to ensure the possibility of paying for goods (works, services) both by cash and by using national payment instruments .

The obligation to ensure the possibility of payment using national payment instruments does not apply to organizations and individual entrepreneurs whose income from entrepreneurial activities for the past year does not exceed the limit values established for micro-enterprises. Decree of the Government of the Russian Federation No. 265 dated April 4, 2016 (effective from August 1, 2016) sets the limit values for micro-enterprises in the amount of 120 million rubles.

National payment instruments are payment cards and other electronic means of payment provided to customers by participants in the national payment card system (NSPK) in accordance with the rules of this system (part 2 of article 30.1 of Federal Law No. system"). Currently, a national payment instrument is being introduced - the Mir payment card. Detailed information about the national system of payment cards can be found on the NSPK website.

As the Mir payment card spreads, the seller (if he does not fall under the exception) does not have the right to refuse his buyers to pay for goods (works, services) using this payment instrument. Refusal entails the imposition of an administrative fine on officials and individual entrepreneurs in the amount of 15 thousand rubles. up to 30 thousand rubles, for legal entities - from 30 thousand rubles. up to 50 thousand rubles. (part 4 of article 14.8 of the Code of Administrative Offenses of the Russian Federation).

Making settlements with buyers using payment cards does not relieve the seller of the obligation to use cash register equipment (CRE) (part 2, article 5 of the Federal Law of May 22, 2003 No. (or) settlements using payment cards”; letters of the Federal Tax Service of Russia dated 11.08.2014 No. AS-4-2/15738, the Ministry of Finance of Russia dated 20.11.2013 No. 03-01-15/49854). In addition to the cash receipt, the buyer needs to issue a document confirming payment using a plastic card - the so-called slip (clause 6 of Decree of the Government of the Russian Federation dated July 23, 2007 No. 470 “On approval of the Regulations on the registration and use of cash registers used by organizations and individual entrepreneurs ").

Support for acquiring operations in "1C: Accounting 8" (rev. 3.0)

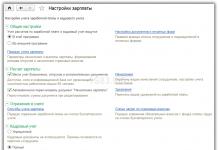

In order for the accounting of acquiring operations to become available to the user, he will need to enable the appropriate functionality of the program. The functionality is configured by the hyperlink of the same name from the section The main thing. Bookmark Bank and cash desk flag must be set Payment cards(Fig. 1).

This functionality enables customers to pay for goods and services not only with payment cards, but also with bank loans.

To enable the ability to use your own and third-party gift certificates on the tab Trade flag should be set Gift certificates.

Rice. 1. Setting up the functionality of the program

Payment by payment cards (payment with a bank loan) can be reflected in the accounting system using the following documents:

- Payment by payment card ( chapter bank and cash desk) with types of operations Payment from the buyer and Retail revenue.

- Retail sales report (Sales section).

Type of operation Payment from the buyer is intended to reflect the payment made by the representative of the counterparty using a payment card under the agreement in case of wholesale. The total amount of payment received reflected in the document Payment by payment card, can be distributed for accounting under several contracts or under several settlement documents.

Type of operation Retail revenue is designed to reflect the amounts of payments by bank cards accepted per day by a non-automated outlet (NTT). The total amount of the received payment can be distributed for reflection in accounting at different VAT rates.

Document Retail sales report should be used to reflect bank card payments at an automated retail outlet (ATT)

To reflect information about the acquiring bank and the acquiring agreement in documents Payment by payment cards and Retail sales reports serves as props Payment type, which is filled out from the directory of the same name.

Directory element form Payment type depends on the item chosen Payment method, which can take one of the following values:

- Payment card;

- Bank loan;

- Gift certificate own;

- Third party gift certificate.

If the selected method Payment card, then when creating a new element of the directory Payment type as mandatory details, you must enter the name of the new type of payment, indicate the counterparty (acquiring bank) and the acquiring agreement for servicing plastic card holders. The settlement account for payment cards is indicated automatically - 57.03 "Sales by payment cards". In the form of a reference element Payment type you can specify the commission percentage of the acquiring bank so that the remuneration is calculated automatically in the future.

Starting from version 3.0.44.102 "1C: Accounting 8" in the directory Payment types it became possible to specify the amount of the bank's commission depending on the amount of transactions (revenue) per day.

A feature of payment by bank cards (as well as with the involvement of bank loans) is that the funds for the transactions performed do not come to the organization from the buyer, but from the acquiring bank (or from the bank that issued the loan), and the moment of actual receipt of funds on the settlement account of the organization, as a rule, differs from the moment of payment by the buyer. In other words, at the time of such payment, the debt of the retail or wholesale buyer is transferred to mutual settlements with the acquiring bank (the bank that issued the loan). Prior to the actual transfer to the settlement account of the organization of funds, they are recorded on the transit account 57.03.

The actual receipt of funds to the settlement account of the enterprise is documented (chapter Bank and cash desk - Bank statements) with operation type Sales proceeds from payment cards and bank loans. The acquiring bank acts as the payer, and the acquiring agreement is indicated as the contract. Directly in the form of a document in the field Amount of services you can specify the amount of remuneration held by the acquiring bank, and the account and bank service cost analytics are set by default.

In accordance with the data specified in the directory Payment types, props Amount of services will be filled in automatically if the document Receipt to the current account:

- loaded from the "Bank Client" (through the service 1C: DirectBank *);

- entered on the basis of the document Payment by payment card.

Note:

* About DirectBank technology - a direct exchange with a servicing bank from the 1C program online - read in the article " New features of 1C:Enterprise 8: DirectBank technology - online exchange with the bank". Also about the 1C: DirectBank service and how to work with the bank directly from "1C: Accounting 8" - see the video of the lecture "New features of "1C: Accounting 8" (rev. 3.0) for effective accounting", which took place in 1C: Lectures 12/22/2016.

When manually entering a document Receipt to the current account bank commission will have to be calculated and specified manually.

Accounting for acquiring transactions under the general taxation system

Accounting for income and expenses under the general taxation system (OSNO) in "1C: Accounting 8" is supported only on an accrual basis, so the fact and method of receiving payment from the buyer does not matter much in itself. At the same time, if the buyer pays for goods (works, services) in advance with a bank card, then the receipt of the advance payment is reflected in the accounting, which entails the calculation of VAT.

Consider an example in which a wholesale buyer pays with a seller organization with a bank card.

Example 1

|

The organization Andromeda LLC applies the general taxation system (OSNO), is a VAT payer, does not apply the provisions of PBU18/02. In October 2016, Andromeda LLC entered into an agreement with a wholesale buyer for the supply of goods for a total amount of RUB 16,000.00. (including VAT 18% - 2,440.68 rubles) on the terms of 50% prepayment. On November 1, 2016, the buyer made an advance payment by bank card. The prepayment amount, minus the bank commission, is credited to the organization's settlement account the next day. The goods were shipped to the supplier on 11/14/2016. The buyer made the final payment by bank card on 11/15/2016. The amount of the final payment for the sold goods, minus the bank commission, is credited to the organization's settlement account the next day. The remuneration of the acquiring bank depends on the amount of the transaction and is 1% of the amount of revenue received per day, if it does not exceed 250,000.00 rubles. |

Document Payment by payment card can be generated from a document Buyer invoice(button Create based on). In this case, you only need to manually fill in the field Payment type and adjust the payment amount, all other details, including the tabular part, will be filled in automatically (Fig. 2).

Create in directory Payment types Payment card and indicate the name of the new type of payment, the name of the acquiring bank and the agreement with it (Fig. 3).

Pay attention that the contract with the acquiring bank has the form Other.

In accordance with the acquiring agreement, we will indicate differentiated interest rates for the bank's commission, which, according to the conditions of our example, depends on the amount of transactions per day.

Rice. 3. Type of payment

In the future, when choosing a specific type of payment from the directory Payment type requisites Acquirer, Acquiring Agreement and Settlement account in document movements Payment by payment card on accounting registers will be filled in automatically. They can be changed by clicking on the hyperlink located to the right of the payment type selection field (see Fig. 2).

After the document Payment by payment card the following accounting entry will be generated:

Debit 57.03 Credit 62.02 - for the amount of the prepayment made with a bank card (8,000.00 rubles).

For income tax purposes Amount NU Dt and Amount NU CT.

So, the buyer made an advance payment, although the money has not yet been received to the organization's current account. What day is considered the day of payment? In the letter of the Federal Tax Service of Russia dated February 28, 2006 No. MM-6-03 / [email protected] clarifies that for the purposes of applying subparagraph 2 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation, payment (partial payment) against the forthcoming supply of goods (performance of work, provision of services), transfer of property rights is recognized as the receipt of funds by the seller or the termination of obligations in another way that does not contradict the law. In this case, the buyer has fulfilled its obligations, and the acquiring bank only acts as an intermediary, so the moment of determining the tax base for VAT with the seller occurs when the buyer makes an advance payment using a payment card, and not when the funds are credited by the acquiring bank to the settlement account of the organization.

Document Invoice issued in advance You can register in two ways:

- based on document Payment by payment card(button Create based on);

- processing Registration of advance invoices(chapter Bank and cash desk - Invoices for advance payment).

Document Invoice issued for advance payment filled in automatically according to the data of the base document. After posting the document, an accounting entry will be generated:

Debit 76.AB Credit 68.02 - for the amount of VAT calculated from the buyer's prepayment (1,220.34 rubles).

Document Invoice issued for advance payment in addition to accounting movements, it also generates entries in special registers for VAT accounting purposes.

Pay attention that document date Invoice issued for advance payment will match the date of the document Payment by payment card.

Document Receipt to the current account can also be created from a document Payment by payment card- then all the main details will be filled in automatically, including the remuneration of the acquiring bank (Fig. 4).

Rice. 4. Receipt to the current account from the acquiring bank

After the document Receipt to the current account

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (7,920.00 rubles); Debit 91.02 Credit 57.03 - for the amount of remuneration withheld by the acquiring bank (80.00 rubles).

Corresponding amounts are also recorded in resources Amount NU Dt and Amount NU CT

The sale of goods to a wholesale buyer is recorded using a standard document of the accounting system Implementation (act, invoice) with type of operation Products(chapter Sales). The document can be generated based on the document Buyer invoice. After the document Implementation (act, invoice) the following accounting entries will be generated:

Debit 90.02.1 Credit 41.01 - for the cost of goods sold (6,440.00 rubles); Debit 62.02 Credit 62.01 - for the offset amount of the advance from the buyer (8,000.00 rubles); Debit 62.01 Credit 90.01.1 - for the amount of proceeds from the sale of goods (16,000.00 rubles); Debit 90.03 Credit 68.02 - for the amount of VAT (2,440.68 rubles);

Corresponding amounts are also recorded in resources Amount NU Dt and Amount NU CT for accounts with a sign of tax accounting (NU). Entries are also formed in special registers for the purposes of VAT accounting.

Document Invoice issued for sale automatically generated by button Issue an invoice located at the bottom of the document Implementation (act, invoice). At the same time, a hyperlink to the created invoice appears in the form of the basis document.

To reflect the VAT deduction from the prepayment, you need to create a document Formation of purchase book entries(chapter Operations - Regulatory VAT operations). As a rule, this document is created on the last day of the month. The document is filled in automatically (button Complete the document). After posting the document, entries will be generated in special registers for the purposes of VAT accounting, as well as an entry in the accounting register:

Debit 68.02 Credit 76.AB - for the amount of VAT deduction (1,220.34 rubles).

The subsequent payment of the buyer is registered in the program by a document Payment by payment card, after which the buyer's debt is transferred to mutual settlements with the acquiring bank. Well, after the actual receipt of funds to the settlement account of the seller, registered by the document Receipt to the current account, the debt of the acquiring bank is repaid, as evidenced by the zero balance on account 57.03.

Thus, the procedure for accounting for acquiring transactions with OSNO in 1C: Accounting 8 (rev. 3.0) is a fairly simple sequence of actions. For the purposes of calculating VAT, settlements with buyers made by means of payment cards also do not cause any additional difficulties in accounting.

Accounting for payment by departments on account 57.03 in "1C: Accounting 8 CORP" (rev. 3.0)

Organizations that have separate divisions and use the program "1C: Accounting 8 CORP" (rev. 3.0) can keep records of business transactions, including accounting for retail sales and payment by bank cards, in the context of departments.

Consider an example in which an organization carries out retail sales through the head office and through a separate division of the organization and accepts payment by bank cards under one acquiring agreement.

Example 2

|

Organization Intertrade LLC is engaged in wholesale and retail trade in household goods, applies OSNO, is a VAT payer. Intertrade LLC has a separate subdivision in Klin, through which retail trade is also carried out. Intertrade LLC concluded an acquiring agreement No. 32132 dated December 31, 2015 with RFT Bank. The remuneration of the acquiring bank is 2% of the amount of proceeds received. On November 23, 2016, retail goods were sold through the head office Intertrade LLC in the amount of 100,000.00 rubles. (including VAT 18% - RUB 15,254.24). On the same day, through a separate division, goods were sold at retail in the amount of 10,000.00 rubles. (including VAT 18% - RUB 1,525.42). All goods were paid for with bank cards under an acquiring agreement with RFT Bank. On November 24, 2016, the acquiring bank transferred (net of its fee) the proceeds related to the head office for the goods sold. The funds related to the separate division were received on the settlement account of the organization on 11/25/2016. |

In order to organize accounting for departments on account 57.03 in the 1C: Accounting 8 CORP program, edition 3.0, it is recommended that each department create its own payment types with its own acquiring agreement. To do this, the contract with the acquiring bank must be formally divided into two contracts, each of which is intended for accounting for a specific unit (head and separate). Enter in the directory Treaties two elements with names:

- Acquiring agreement No. 32132 (head) dated 12/31/2015;

To reflect retail sales through an automated outlet, the program uses a document Retail sales report(chapter Sales) with operation type Retail store. The document allows you to register retail sales simultaneously with the receipt of retail revenue, including those paid by payment cards, bank loans and gift certificates.

Let's create a document Retail sales report by head office. Bookmark Products we will indicate the goods and services sold to the retail buyer per day: their nomenclature composition, quantity, prices and amounts.

By default, all payments are considered cash. If during the day payments were made by payment cards, bank loans or gift certificates, then you need to fill in the tab Cashless payments(Fig. 5). Add to directory Payment types new item with payment method Payment card and specify the name of the new payment type, for example, Acquiring RFT (head office), name of the acquiring bank and name of the agreement: . Enter the created payment type in the tabular section of the tab Cashless payments and indicate the amount - 100,000.00 rubles.

Rice. 5. Non-cash payments for the head office

After the document Retail sales report For the head office, the following accounting entries will be generated:

Debit 90.02.1 Credit 41.01 - for the cost of goods (64,000.00 rubles); Debit 62.R Credit 90.01.1 - for the amount of proceeds from the sale of goods (100,000.00 rubles); Debit 57.03 Credit 62.R - for the amount of payment by payment cards (100,000.00 rubles); Debit 90.03 Credit 68.02 - for the amount of VAT on sales (15,254.24 rubles).

Amount NU Dt and Amount NU CT for accounts with a sign of tax accounting (NU). It also creates an entry in the register Sales VAT.

Retail sales report for a separate division, where to indicate the appropriate type of payment, for example, Acquiring RFT is a separate subdivision of Klin. The details of this type of payment must indicate the appropriate name of the agreement with the bank: Acquiring agreement No. 32132 (separate Klin) dated 12/31/2015.

We will register the receipt of funds from the acquiring bank, related to the head office, with a document Receipt to the current account(Fig. 6). In field Treaty choose a value: Acquiring agreement No. 32132 (head) dated 12/31/2015.

Rice. 6. Receipt to the settlement account for the head office

After the document Receipt to the current account the following accounting entries will be generated:

Debit 51 Credit 57.03 - for the amount of funds received from the acquiring bank (98,000.00 rubles); Debit 91.02 Credit 57.03

For the amount of remuneration withheld by the acquiring bank

(2,000.00 rubles).

Corresponding amounts are also recorded in resources Amount NU Dt and Amount NU CT for accounts with a sign of tax accounting (NU).

Similarly, you need to create a document Receipt to the current account in a separate subdivision, where in the field Treaty specify value: Acquiring agreement No. 32132 (separate Klin) dated 12/31/2015.

The balance sheet for account 57.03 (Fig. 7) in the context of departments and contracts shows that all mutual settlements with the acquiring bank are reflected correctly.

Rice. 7. Turnover balance sheet for account 57.03

From the video you will learn how to organize accounting by departments on account 57.03 "Payment card sales" within one acquiring agreement in the "1C: Accounting 8 CORP" version 3.0 program.

An increasing number of buyers prefer to pay for goods or services with bank cards in retail sales, therefore 1C provides the functionality of carrying out this type of payment for both automated outlets and non-automated ones.

If the point of sale is automated, then bank acquiring is quite simple. To complete the operation, you need to select the “Retail Sales Report” item in the “Sales” section. A list of sales reports will open, in this list you need to select a report to which we will link payment with a card, go to the "Non-cash payments" tab.

Do not confuse the concept of "non-cash payments" by bank cards from an individual and non-cash payments from a legal entity through a current account.

Using the "Add" button, create a new line, in the first column of which we create a new type of payment:Fill in the fields:

"Method of payment" - payment card;

"Name" - indicate the payment through the ATT terminal;

"Counterparty" - indicate the acquiring bank with which the organization has an agreement;

"Agreement" - filled out from the details of the counterparty;

"Settlement account" - by default it is 57.03

"Bank commission" - % that we pay to the bank for each transaction.

After creating the type of payment, the amount that was paid by cards is indicated and the document is posted. The postings that were generated as a result of the operation will look like this:

The total amount from the retail sales report is broken down into cash and card payments, which is reflected in the respective accounts.

The money has already been debited from the buyer's card, but 1C has not yet reflected the receipt to the current account. You need to reflect the receipt by downloading a bank statement. This item is located in the "Bank and cash desk" section:

We need to issue a new arrival:

Fill out the opened form:

"Type of operation" - income from sales on payment cards and bank loans;

"Payer" - a bank with which a service agreement has been concluded;

Accounts of accounting and expenses are substituted by the program by default;

"Amount" - indicate how much should be credited to our account (minus bank fees);

"Amount of services" - a trade concession in favor of the bank;

"Article DDS" - payment from buyers.

After posting the document, you can check the postings:

It can be seen that the operation was reflected correctly and the amount of payment by card, minus the bank commission, was received on the organization's account.

Now let's look at how acquiring is performed for a non-automated outlet. In the "Bank and cash desk" section, select the "Payment by payment cards" item:

When you go to the item, a list of card payments opens, in which you need to create a new payment. Click "Create", in the form that opens, fill in the fields:

"Type of operation" - retail revenue;

"Warehouse" - a non-automated outlet is indicated or created;

"Type of payment" - the already created type of payment through the terminal is used;

Acquiring is a procedure for paying for goods or services by buyers using plastic cards (Visa, MasterCard, Mir, etc.). Unlike cash payment, funds do not come directly from the buyer, but from the servicing bank. The terms of service, the size of the withheld commission and the terms for crediting funds to the organization's settlement account are indicated in the agreement with the acquiring bank.

What are the features of acquiring in 1C?

Acquiring is configured within the framework of typical configurations of one of the versions of 1C: Accounting. The peculiarity of accounting for non-cash payments is that funds are credited to the organization's current account not at the time of payment by card. The acquiring bank transfers the total daily proceeds on the next day (standard terms are from 1 to 3 business days) and minus the commission. To account for such funds in 1C: Accounting, account 57.03 “Sales by payment cards” is provided.

What to preconfigure?

Acquiring in 1C 8.3 for all editions of Accounting 8, and not just for edition 3.0, is configured as follows:

Go to the menu and select the Main item, find the Settings section and click on the Functionality subsection.

In this subsection, open the Bank and cash desk tab. And check the box next to Payment cards.

Return to the menu and select the Directory item "Types of payments for organizations", create a new element and enter the data from the agreement with the acquirer into it, specify 57.03 as the settlement account.

How to conduct acquiring in 1C?

Accounting for acquiring in 1C is carried out by creating the following documents:

The retail sales report is located in the Sales section of the main menu. Ideal for automated outlets. The data in the Non-cash payments tab allows you to generate an acquiring transaction in 1C for all operations of the reporting period at a time. Also, this method allows you to display non-cash transactions in the organization and its divisions within the framework of one agreement with the acquiring bank.

Payment by payment card is located in the Bank and cash desk section of the main menu. Available transactions are divided into Payment from the buyer and Retail revenue. The latter method is suitable for non-automated outlets, allowing you to display all transactions with cards for the day of work. Operation type Payment from the buyer allows you to create a separate posting to account 57.03 for each non-cash payment.

How to display the receipt of funds from the bank?

Acquiring operations in 1C by the bank are displayed in the document Receipt to the current account. It is possible to automatically insert data into the document form when loading a statement from a client-bank. If only one transaction with a card was previously performed, then it is more expedient to create an Receipt on the basis of a previously generated document about a payment card transaction. In other cases, the Receipt to the current account document will need to be created and filled out manually.

Are there any nuances of acquiring with "simplification"?

Acquiring with the simplified tax system in 1C requires changing the settings so that the bank's commission is taken into account in expenses if the organization falls under the principle of taxation "income minus expenses". For organizations with simplified taxation of only “income”, it will be necessary to take into account income only from transactions under the documents Receipt to the current account, and not from cash transactions.