Currently, the transition from 1C: Enterprise 7.7 to 8.3 (similarly to 8.2) has become a headache for accountants. Preferably as soon as possible and without errors. If you are a 1C: Accounting programmer and you need to produce documents from the seventh version to the eighth, then this article is for you.

Take just a few steps and your data transfer problems will be solved. Read this manual to the end, and you will discover how to do it. To begin with, you must prepare a workplace on your computer for the necessary manipulations. First, your hard drive must be at least 100 GB. This is necessary because it is multi-level. And you will need to work with several 7.7 configurations.

If you need a quick and high-quality transition from 1C Accounting 7.7 to 1C 8.3, contact! The average cost of a turnkey transition is 6,600 rubles.

Data transfer from 1C 7.7 to 1C 8.3 accounting 3.0

So, before you work with transferring data to version 1C 8.3, you need to prepare this data in version 7.7. To do this, you must do the following. Let's say you have a working database "Accounting for the enterprise" on your computer, with which your accountants work. Using Export77 processing, upload all the necessary documents to a text file and from that moment on, no longer return to the main working base. Your further manipulations will occur with other configurations.

Install the fresh Release 1C:Enterprise 7.7 into the new directory. (the package includes a standard empty (without data) and a demo version). We will work with the standard version. Now run this database and using the Import 77 processing, load data from your main database from a text file.

When converting data, some documents may not be posted. It's not scary. The trick is that you can easily fix this after the transfer, since in the standard database you work with the main standard chart of accounts. Therefore, no matter how sophisticated the sub-accounts are, in your working database it is easy to fix it in about 3 hours by going into each unposted document and changing the accounts that you have in your configuration in the account fields.

Naturally, in advance, before the transfer, you bring the chart of accounts of the standard configuration in line with the chart of accounts of your main working base. Options are purely individual, depending on the specifics of your organization. Having done this work, you get a standard configuration filled with data from your working database.

Now we need to do another data transfer. To do this, install the standard zero configuration again in a new directory. And already there transfer data from the standard configuration with your data. As a result, you will get an ideal version 7 database, ready for transfer to version 8.2.

The fact is that data is transferred directly to the eighth version exclusively from the “untouched” standard version 7.7. And you just also have such configuration now. But now it is not empty, but with your working data.

Everything! We launch 1C:Enterprise 8.2. Select "Data transfer from version 7.7." and enjoy how the program itself transfers data from your processed 7.7., transfers documents and displays a comparative table of the balance sheet of versions 7.7 and 8.3 on the screen.

Of course, 100% result will not be. But at 70-80 percent you will get compliance. And then your work will be done only in version 8.3.

Possible inaccuracies are easily corrected. It's still 3-4 hours. You go to the document journal and either adjust accounts or fields (for example, "Agreement" or "Main cash desk"). It depends on the degree of difference of your base 7.7. from standard. As a result of all these actions, your version 8.3 working configuration will be able to issue accounting data through the balance sheet in an ideal form.

After the transition, it will be useful for you to learn how to work in the new program. For this we have prepared a section.

By the way! If you need to finalize 1C programs, you can contact us!

Video on the transition from 1s 7.7 to 8:

Do I need to switch to 1C:Enterprise 8.2? If you are reading this article, it means that you have probably already answered this question in the affirmative. Therefore, now we will not talk again about the benefits of switching to a new platform, but will focus directly on the details and features of this process.

1. General algorithm

So, you have decided to switch to the "eight" and want to know how it is done, and what it "threatens" you. In its most general form, the transition scheme looks like this (Fig. 1).

Rice. 1. Algorithm for the transition from the 1C:Enterprise 7.7 platform to the 1C:Enterprise 8.2 platform

1. Upgrade. The first thing you need to do is to write an application from your organization, submit a registration form for platform 7.7 and purchase platform 8.2. In doing so, you will be provided discount in the amount of the cost of the old platform, but no more than 50%. The old platform is preserved for you, and you can continue to use it, however, it will be removed from technical support at 1C.

2. Update current configuration to the latest actual release.

3. Preparing the database for migration. It involves backing up the database, closing the current billing period, clearing the database of items marked for deletion, and correcting accounting errors (if any).

4. Data transfer. This is the main stage. Algorithms and complexity in each case are different.

5. Training of personnel to work with the new configuration. Since the configurations on the 7.7 and 8.2 platforms differ both in interface and functionality, you may need training to work in the new configuration. You can study it yourself using the relevant methodological literature, but it is still better to take a specialized 1C course.

6. Operation. At this stage, when users start working in a new program, it is debugged and possible errors of automated data transfer are corrected.

Consider the transition process to a new platform in the context of the configuration "1c accounting".

2. Change "1C: Accounting 7.7" to "1C: Accounting 8.2"

The strategy and mechanisms for transferring data from 1C:Accounting 7.7 to 1C:Accounting 8.2 are determined by the following factors:

- start time of accounting in the new program;

- the presence and complexity of improvements in the current version of your configuration;

- the need to maintain a history of business transactions for past periods.

We advise our clients to start working in a new accounting program from January 1st of the new year . This is due to the fact that most taxes are calculated on an accrual basis. Therefore, in order not to develop means of correctly transferring the accumulated results, it is necessary to link the start of work in the program to the beginning of the reporting period for taxes. Of course, you can start work from the beginning of the quarter, and even from the beginning of the next month, but such a transition will entail more significant costs (due to significant differences in the structure of documents in 7.7 and 8.2).

Depending on the combination of the above factors, situations may be as follows.

Situation 1:

Transition from the new year, TYPICAL configuration, the correct account balances are formed in the old program

This option is simple and straightforward, but in practice it is extremely rare. Forming the correct balances in the old program immediately before starting work in the new program is possible only in a number of small companies, and then on condition that all primary documents for the past period are provided and included in the program.

If this is your case, you are in luck. You only need to update the 1C:Enterprise 7.7 configuration to the latest version and use the built-in 1C:Enterprise 8.2 processing "Data transfer from 1C:Enterprise 7.7 infobases". You can do it yourself, without the help of a specialist. You just need to strictly follow the instructions indicated in the processing.

Situation 2:

Transition from the new year, TYPICAL configuration, in the old program THERE ARE NO CORRECT BALANCES ON THE ACCOUNTS

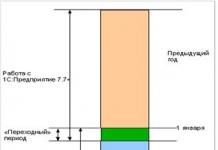

The standard practice in this case is work in the old and new program at the same time . During the “transition period” (Fig. 2), employees are closed with previous transactions in the old program and begin to enter documents for new transactions into the new system.

Rice. 2. Transition period when changing platforms

To overcome this period with the least losses, you can use the following strategies:

- transfer balances “as is” to the beginning of the year and keep records based on these data. As soon as the correct balances in the "seven" are received, it is necessary to immediately correct them retroactively in the "eight".

- refuse to transfer incorrect balances and submit primary documents for new transactions to the G8 without their subsequent execution. In this case, it does not matter whether there are balances in the program or not, unposted documents will not make any movements on the accounts. So you need to act until the moment you receive the correct balances in 1C:Enterprise 7.7. Further, the received balances are transferred to the new program at the beginning of the year. The final step is the consistent implementation of the “primary” introduced into the new program during the transition period using built-in processing "Group processing of directories and documents" .

Situation 3:

Mid-Year Transition, TYPICAL

1C:Accounting 8.2 supports a number of mechanisms important for accounting, the performance of which depends on the data entered into documents during the year. Among such mechanisms are the already mentioned calculation of taxes on an accrual basis, the algorithm for distributing indirect costs and other procedures related to the closing of the month. It is precisely because of these features that in this situation it is impossible to switch to a new program as easily as in the first two cases. To minimize the number of errors that may occur during migration, we recommend:

- start work, if not from the beginning of the year, then at least from the beginning of the quarter;

- carry forward balances to the beginning of the year;

- transfer all primary documents for the current reporting period (year) to a new system and restore accounting and tax accounting data using group processing of directories and documents.

1. Typical solution "1C: Data conversion 2.1". This software product can be used to transfer information between configurations on the 1C platform of any structure and complexity.

2. Developments of 1C franchisees. Many companies, including the company « RG-Soft" () , there are proven methods for solving this problem, which can significantly reduce the time and budget for data transfer.

Situation 4:

Transition from TYPICAL configuration WITH TRANSFER OF DOCUMENTS OF THE PAST PERIOD

Separately, we note that there are companies that have long-term (more than a year) relationships under contracts with counterparties. The management of such companies is interested in having a history of business transactions in the program. The presence in the new program of documents entered in the old program allows users to easily and quickly track the relationship on specific contracts / transactions.

It is possible to implement such a transfer using the same mechanisms as in the previous situation. The difference of this process is that there is no need to transfer all documents, you can limit yourself to transferring only a few types of documents, and the remaining account balances are entered through standard processing. In this case, additional transferred documents are usually left unposted.

Although documents for the past period can be transferred from the old program to the new one, such a transfer leads to a noticeable increase in the size of the database, and, consequently, the size of the processed tables. This can cause the system to slow down. Therefore, this transition option should not be used unless absolutely necessary. Documents transferred from previous periods are recommended to be left unposted so that the information contained in them does not affect the current accounting and tax reporting. Use documents from the past period only as a reference.

Situation 5:

Migration from a non-TYPICAL configuration on the 1C:Enterprise 7.7 platform

The options described above are used when switching from a typical 1C:Enterprise 7.7 configuration, but in practice one often encounters modified configurations. The organization of the transition in this situation is a special option that deserves consideration.

Depending on the nature of the changes made to the program, there are the following data transfer technologies:

If the configuration is changed slightly and in the main mechanisms is similar to the typical 1C solution, you can, as in the previous options, use the typical transition tools. You only need to adjust or slightly modify them for your program. Perhaps the most tested and reliable tool is the already mentioned "1C: Data Conversion 2.1". This tool will require certain skills from the user, however, it can be used to organize an automated transfer of objects between configurations.

· If the configuration has been radically redesigned over the years of use, then setting up typical migration tools can be more time-consuming than writing your own processing for these purposes. A similar situation arises in the case of organizing the transition from an accounting program that is not related to 1C platforms. It is also possible to make such a transition, but it will not be possible to come up with a universal exchange in advance. In each case, an individual approach to the problem is needed. Our company can offer its experience in transferring data through files of various formats, such as dbf, xls(Universal loader from Excel to 1C), xml.

Another point worth mentioning in connection with the transition from platform 7.7 to 8.2 concerns database federations.

Due to the lack of a mechanism for keeping records of several companies in one database, many enterprises had to keep several databases at the same time in 1C:Enterprise 7.7. Since this problem is solved in the eighth version, the task arises of combining several databases into one as part of a data migration project. Moreover, each of the bases of the seven can have its own characteristics.

Using the techniques given above, you will be able to establish interaction with each of the bases separately. However, there are a number of subtasks that are specific to this particular case.

1. Unification of documents related to a particular organization. This problem is easily solved using the prefix mechanism. Each organization registered in the program is assigned its own letter prefix. This prefix is added to the document number, thereby ensuring the uniqueness of the numbers.

2. Control of duplicate elements of directories. When transferring data from several information sources to a single information system, a situation may arise when the same elements of directories, for example, the same counterparty, will be repeated several times in a new directory. Therefore, after data transfer, it is necessary to perform the procedure for comparing and merging duplicate elements of directories.

3. Possible difficulties that you should be aware of

With proper planning of the process of transition to a new platform, many problems can be avoided. However, there are a number of specific features that are detected already at the stage of project implementation. We are talking about various errors that occur both due to incorrect user actions and due to the technical features of the 1C:Enterprise platform. Let's consider these points in more detail.

3.1. Errors in the original data

In the general case, an unambiguous identification of an object in the database is possible by the details of the TIN and KPP. In the seven, both of these values were stored in the same TIN/KPP variable, and there were no checks for the correctness of the data entered in this variable. It was possible to enter fewer numbers, and put the separator in the wrong place, and enter a completely abstract TIN.

A typical transfer, when forming a directory, counterparties separates the TIN and KPP by simply cutting off the required number of characters. Therefore, absolutely incorrect data can be written to the details of the new database. Thus, the correct identification of objects during transfer using such data will be very difficult.

Another problem is the lack of a single data entry format. Each user can enter the name as he likes. Imagine that in one "seven" database, the user, filling in the "Name" of the counterparty, wrote "MC Vympel", and in another "seven" database, the same counterparty is indicated as "Vympel Management Company". In such a situation, automatic processing will not be able to determine that this is the same counterparty, and will transfer it to the eight twice. It will be difficult to work further in such a database, since part of the balance will be on one element, and the second part on another.

3.2. Configuration Differences

Another group of migration errors is caused by technological differences in configurations. Some business transactions are reflected in 1C:Enterprise 7.7 by several types of documents, and in 1C:Enterprise 8 by one. For example, receipts of both materials and goods are reflected in the new program with one document, and in the old one - with two. Thus, when trying to transfer the documents "Receipt of materials No. 22" and "Receipt of goods No. 22", a uniqueness control error occurs. Since it is impossible to record two documents with the same number in a given period, it is necessary to artificially introduce differences into them, and the system for introducing these differences is agreed in advance.

For example, this problem is solved by adding an additional prefix to the uploaded document number. For each feature of the document, this prefix is allocated separately. This may be a characteristic of the database from which the documents are loaded or the type of document from which the load was made. Here is an example of the formation of such a prefix. The base of the branch in Krasnoyarsk gives the prefix "KR". The type of document "Receipt of goods" from which the loading is made, gives the prefix "M". So, if the document number in the seven was 00000031, then the eight number will be as follows:

"KR" + "M" + "00000031" = "KPM00000031"

As a result, a number will be written to the database, which will be unique.

3.3. Technical problems

Data transfer errors can also occur due to the technical features of the 1C:Enterprise platform. Let's say that the standard search mechanism by name does not distinguish between large letters in the name of a directory element and small letters. There is confusion when using this mechanism. For example, in the database there are two counterparties "L-Audio" and "L-Audio". When searching for the “l-audio” counterparty, the system will find “L-Audio”. The result is an incorrectly completed document.

It is also necessary to pay attention to the chosen method of data transfer. The example described above with doubling counterparties, when transferred from the bases of the company's branches, may not actually be doubling. Companies operating in different cities may well have counterparties also operating in different cities. The branch of the L-Audio company in Nizhny Novgorod and the L-Audio company itself in Moscow can rightly be called exactly the same in the databases. To avoid such confusion, you need to choose a transfer method in advance. In our example, you can separate counterparties into different groups of the directory, depending on the source database. The choice of such a methodology will also affect the mechanisms for loading data.

The methods described above for solving emerging problems may also not be universal enough. When migrating data, it is very important to be able to combine the methods used in the migration tool. For example, we identify most elements of directories by name. At the same time, when transferring the document “Acceptance of fixed assets for accounting”, this method will give undesirable results in the case when a number of small fixed assets of the same type (stationery, furniture, etc.) are entered, differing only in the inventory number. In each document of acceptance for accounting, the same object will be indicated. And the acceptance of one object for accounting several times is impossible. Therefore, it is very important to provide the ability to customize the data migration tool used. In this case, we simply indicate that the OS must be searched for by the inventory number (code).

Conclusion

Currently, there are still quite a lot of companies working using 1C:Enterprise 7.7. This is due to factors such as a lack of understanding of the benefits of the new platform, unwillingness to learn new technologies, and fears of encountering a large number of difficulties during the transition. Using the example of 1C:Accounting, we tried to show that most of these reasons are not so significant. Throughout our activity, we help our clients to cope with any possible difficulties associated with the implementation of programs on the 1C:Enterprise 8 platform. If you are interested in the transition issue or you have any other questions regarding the 1C:Enterprise 8 platform and the configurations created on it, RG-Soft specialists are at your service!

It would not be an exaggeration to say that all users of "1C: Accounting 7.7" who decide to switch to "1C: Accounting 8" are concerned about the issue of data transfer. And not just a mechanical transfer of directories, but the transfer of all the information accumulated on the accounts of accounting and tax accounting, which would allow users to start working in the new program immediately after purchasing it. For a quick transition from "1C: Accounting 7.7" to "1C: Accounting 8", a mechanism called "Transition Assistant" was developed. More precisely, two assistants. One is for uploading data from "1C: Accounting 7.7", the second - for uploading data to "1C: Accounting 8". How to use the assistant, tell the methodologists of the company "1C".

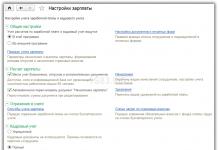

Summon Assistant to "1C: Accounting 7.7" it is possible from the menu "Service - Transition to 1C: Accounting 8" (see Fig. 1).

Rice. one

Working with the Assistant is divided into five steps. The transition from step to step is carried out using the "Next" and "Back" buttons.

The first step is getting to know each other. Here is a brief description of the purpose of the Assistant, you can view information about the benefits of "1C: Accounting 8", it is indicated where you can get additional information about the transition to "1C: Accounting 8".

The second step provides an opportunity to check and, if necessary, obtain an update of the typical configuration. It is recommended to use the latest release of the configuration, as the program is constantly updated due to changes in legislation.

If there are no updates, you can continue working.

If there is an update, you can get a new configuration release.

After receiving a new release, you should update the configuration. To do this, you will need to exit the Assistant and close the program. After updating the configuration, the Assistant will be launched automatically to continue the transition, and will prompt you to go through the next step.

The third step is to specify what information needs to be migrated. You can only transfer balances from accounting and tax accounts at the beginning of the year.

Or balances at the beginning of the year and turnover from the beginning of the year to the end of any month.

Particular attention should be paid to the fact that before making the transition, it is necessary to carry out routine procedures for closing the month in each month that is included in the unloading period.

In the fourth step, the Assistant specifies which file the uploaded data will be written to. If you do not change the default settings, then when loading data into 1C: Accounting 8, the Transition Assistant in 1C: Accounting 8 will automatically find the specified file.

And finally, the final step is uploading the data. If you check the "Generate balance sheet" checkbox, then after unloading, a balance sheet will be generated, which can be printed, and with which it will be possible to verify the result of loading into "1C: Accounting 8". Directly unloading is carried out by clicking the "Unload" button.

This completes the work of the Transition Assistant from "1C: Accounting 7.7".

Now, you need to run "1C: Accounting 8" and start loading data.

You can call the Assistant from the menu "Service - Transition from 1C: Accounting 7.7" (see Fig. 2).

Rice. 2

Just like in "1C: Accounting 7.7", working with the Assistant is divided into several steps. The transition from step to step is carried out using the "Next" and "Back" buttons.

The first step is getting to know each other. Here is a brief description of the purpose of the Assistant, it is indicated where you can get additional information about the transition to "1C: Accounting 8", there is a hint what should have been done to upload data from "1C: Accounting 7.7".

The second step provides an opportunity to check and, if necessary, obtain an update of the typical configuration. It is recommended to use the latest release of the configuration, as the program is constantly updated due to changes in legislation. After receiving a new release, you should update the configuration. To do this, you will need to exit the Assistant and close the program. After updating the configuration, the Assistant will be launched automatically to continue the transition, and will prompt you to go through the next step.

Information about the organization will have to be filled in only by users of the basic version of "1C: Accounting 8". It should be noted that the TIN and KPP must completely match the TIN and KPP entered in "1C: Accounting 7.7". In "1C: Accounting 8 PROF" the organization will be created automatically when loading data, and the Assistant will skip this step.

Before you start loading data, you need to set up inventory control. The fact is that in "1C: Accounting 7.7" only quantitative accounting in the context of warehouses is supported. In "1C: Accounting 8" the possibilities of warehouse accounting are much wider: you can keep batch accounting, you can keep quantity-sum accounting for warehouses, or you can turn off warehouse accounting. In the event that the warehouse accounting settings do not correspond to the functionality of "1C: Accounting 7.7" (warehouse accounting is disabled), the user is prompted to set warehouse accounting. If inventory control has already been enabled before, the Assistant will skip this step.

The next step is to specify from which file the data should be loaded. The Assistant automatically searches for a file with uploaded data by the name that was specified by default in the Assistant when uploading data from "1C: Accounting 7.7".

And finally, the final step is loading the data. Direct download is carried out by clicking the "Download" button.

If you select the "Generate balance sheet" checkbox, then after downloading, a balance sheet for accounting accounts and a balance sheet for tax accounts will be generated, which can be printed, with which you can verify the balance sheet generated during uploading data from "1C: Accounting 7.7".

Before you start working with the program "1C: Accounting 8", you need to set the basic accounting parameters:

- set up an accounting policy;

- set up an accounting policy for tax accounting;

- set up analytical accounting of inventories;

- set user preferences, etc.

Check the box "Open Startup Assistant" in the transition assistant from "1C: Accounting 7.7", and after loading the data, the Startup Assistant will start automatically.

This completes the transition process from "1C: Accounting 7.7" to "1C: Accounting 8".

Now users of "1C: Accounting 7.7" do not have to wait until the end of the year to switch to "1C: Accounting 8". The transition can be made at the end of any month of the tax period. The technology for transferring balances has already been tested at operating enterprises, one of which is described by specialists from Automated Accounting Systems LLC. The article contains a description of the transfer technique and general recommendations for input and output control of transferred data.

Before moving to Laima LLC (Miass, Chelyabinsk region), the program "1C: Accounting 7.7. Standard version" was used. The program is installed on a laptop. Work is done in the home office.

The release by 1C of a new methodology for transferring data and a small amount of information base made it possible to transfer data for 2006 directly at the time of installation of 1C: Accounting 8.

Data Transfer Methodology

Included in release 1.5.8.5, a new methodology for switching from "1C: Accounting 7.7" to "1C: Accounting 8" provides for the transfer of data from the "1C: Accounting 7.7" infobase, which would ensure the correct execution in "1C: Accounting 8" of the following actions:

- holding documents issued after the transition to "1C: Accounting 8";

- formation of accounting registers for the current reporting period (balance sheet, general ledger, etc.);

- formation of tax accounting registers for the current reporting period, containing indicators determined on an accrual basis from the beginning of the year;

- formation of regulated reporting for the current reporting period.

The transition from "1C: Accounting 7.7" to "1C: Accounting 8" according to this method is recommended to be performed at the beginning of a new tax period (year) or, if a new period is already open, then at the end of the next month of the current reporting period. In the process of transferring data to "1C: Accounting 8", the following information is loaded:

- balances on accounting and tax accounts at the beginning of the current reporting period (as of January 1 of the current year);

- turnovers on accounting and tax accounts for the current reporting period by consolidated monthly entries;

- temporary differences reflected in the relevant tax accounts (for organizations applying PBU 18/02);

- documents for entering initial balances for fixed assets and intangible assets;

- tax bases for personal income tax and payroll taxes for the current reporting period;

- arrears in payment of received and issued invoices at the end of the last closed month of the current reporting period;

- information about the objects of analytical accounting.

Preparatory operations in "1C: Accounting 7.7"

Data transfer from "1C: Accounting 7.7" is possible starting from release 7.70.477. Therefore, it was necessary to update the configuration to this release before the migration.

It is also necessary to make sure that regular accounting and tax accounting operations have been carried out for the last month of the year (including balance sheet reformation).

All files required for data transfer are contained in the Convert folder in the template directory of release 1.5.8.5 "1C:Accounting 8". It is better to copy the contents of this folder to the ExtForms directory of the "1C:Accounting 7.7" infobase.

The transfer technique provides for the only preparatory operation - checking reference codes, which may become non-unique when transferring data to "1C: Accounting 8". For verification, external processing ChkCode.ert is used.

However, in order to verify the correctness of accounting and tax accounting in the 1C: Accounting 7.7 database and not to transfer deliberately erroneous entries to the G8, it is useful to perform a technological analysis of accounting (Menu "Reports -> Technological analysis of accounting" ), as well as analysis of the state of tax accounting ("Tax accounting -> Analysis of the state of tax accounting").

As a rule, problems are caused by "manual" postings, which are made without control of the opening balance, quantity accounting, etc. The new methodology transfers even such postings correctly, however, incoming control allows you to immediately identify problems and issue recommendations for correcting them.

In our case, the control revealed discrepancies in accounting in terms of writing off depreciation of fixed assets for losses from previous periods, which it was decided to correct already in "1C: Accounting 8" after the transition.

Data transfer

The data transfer itself is performed using external processing V77Exp.ert (menu "File -> Open"). The processing dialog states:

- data conversion rules file - Acc77_80.xml ("Rules file name" field);

- the file to which the data will be uploaded (field "Data file name");

- start date of the current reporting period - January 1, 2006 ("Start date" field);

- end date of the last closed month in the current period ("End date" field). In our case - May 31, 2006.

After clicking the "Load exchange rules" button in the processing dialog, the list of data upload rules will be filled. The loaded list is a list of accounts, the results of which can be downloaded, and directories that can be transferred to the "Enterprise Accounting" configuration. In the table on the right, you can set filters for most data upload rules by attribute values (for example, for selective uploading of items).

Since we are transferring data from the "seven", the first time you start "1C: Accounting 8", you must abandon the initial filling of the database. After that, using the processing of data loading (menu "Service -> Data exchange -> Universal data exchange in XML format"), we load the transfer file into the eight.

Examination

The whole procedure of data transfer took no more than half an hour. It remains only to make sure that all the data was transferred correctly. Here it is best to start with the balance sheet for the data transfer period. For balance accounts, statements generated in "1C: Accounting 7.7" and "1C: Accounting 8" must match. If the turnovers for any account do not match, it is necessary to generate more detailed reports (balance sheet or card) for this account in order to determine which turnovers have not been transferred. Thus, it is possible to check all the data, with the exception of the balances of fixed assets and intangible assets, tax bases for personal income tax and payroll taxes for the current reporting period and arrears in payment of received and issued invoices at the end of the last closed month of the current reporting period.

In our case, in "1C: Accounting 7.7" the data on the fixed assets were not completely entered, and in the "eight" the documents "Entering the initial balances on the fixed assets" simply did not post, respectively, and the balance at the beginning of the period on account 01 did not arise. These documents have been manually corrected.

The VAT accounting subsystem is implemented in "1C: Accounting 8" on registers, to check the correctness of the transfer, you should use the universal report "Balances and turnovers" (Reports -> Balances and turnovers) without limiting the period for the accounting sections "VAT presented", "VAT from advances "to analyze the correctness of the transfer of accounts of the ZPK and ZPR.

Most users of the 1C 7.7 program represent the transition from 1C 7.7 to 8.3 (8.2) as something complicated and subject only to programmers. If the organization does not have a configuration that has not been redone up and down, then this article is written for you and will help with the transition to 1C 8.3 or 8.2.

How to prepare a 1C 8.3 (8.2) base for subsequent data transfer from 1C 7.7 step by step

Before starting work, it is necessary to prepare the 1C 8.3 (8.2) database for subsequent data loading.

Step 1

Update the 1C database to the current release, use the latest version 8.2 or 8.3. You can check the relevance of the current release on the 1C technical support website.

How to install or update the 1C 8.3 platform, see our video tutorial:

Step 2

Carry out monthly closing procedures. Additionally, you can do an accounting check through Service - Checking data for the transition 1C Accounting 8. If there are errors, correct them.

Step 3

Step 5

Create a clean database for loading data. This is necessary to quickly cancel the download of data in case of unforeseen situations. Select the top menu of the program Administration - Upload data, enter the name of the upload file and the location to save it.

Thanks to these preparatory measures, unnecessary objects will be removed from the database, the 1C database will become smaller. There will be a recalculation of the results, a check of the logical integrity of the database. Now you can start transferring data from 1C 7.7 to 1C 8.3 (8.2).

How to add an infobase to 1C 8.3, see the following video tutorial:

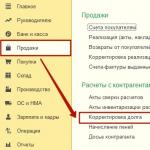

Data transfer from 1C 7.7 to 1C 8.2 Accounting 2.0

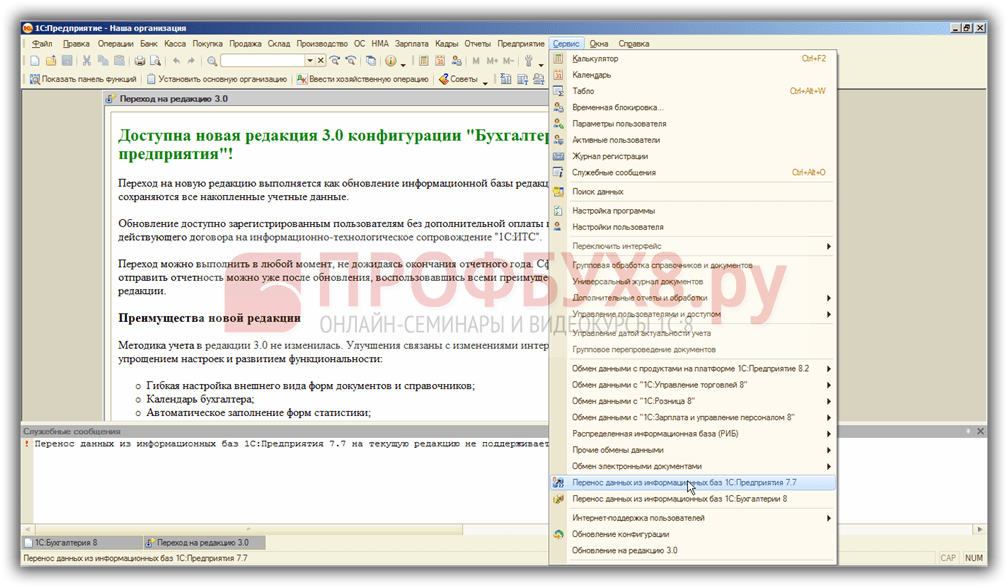

In the latest version of the release of the 1C 8.2 Accounting 2.0 program, translation from 1C 7.7 infobases is not supported. In accordance with the requirement of the company 1C, it is necessary to do. Therefore, if in the base 1C 8.2 select Service - Transferring data from infobases 1C Enterprise 7.7, then we get an error:

But what if you really need to make a transfer and it is in the version of the program 1C 8.2?

Step 1. Uploading data from 1C 7.7

You need to download files that were previously supplied by 1C for uploading to 1C 8.2 Accounting. These files must be placed in the ExtForms folder with your database. In the example, this is D:\1с\77\unp_demo\ExtForms. You can see the path to your database when loading the 1C program:

Let's run this processing: If everything is done correctly, then an inscription should appear - Uploading data for 1C Accounting 8, select it by clicking the Open button:

- Upload rules - a file named Acc77_80.xml, we copied it to the ExtForms folder;

- Start date and end date - the period during which the data will be uploaded;

- Data upload rules - objects to upload, directories and documents that need to be uploaded to a file.

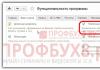

The data file in the example will be copied to the desktop, but you can choose any other folder. Click the Load Exchange Rules button. A list of objects will open that will be unloaded from 1C 7.7 and which can be edited by removing or checking the checkboxes:

Depending on the situation, you can upload data either all at once or in parts. First, we unload directories - 95% of them are unloaded without problems. With the second file, we upload balances and turnovers by accounting sections. This option is convenient to use if some data is not uploaded correctly.

Step 2. Loading into 1C 8.2 Accounting 2.0 from 1C 7.7

Choose Service - Transferring data from infobases 1C Enterprise 8, in the window that appears, select Load from file:

We select the file that was uploaded from 1C 7.7 to the desktop. After pressing the Next button, the data will be loaded from the file. If accounting in the 1C 7.7 database has been maintained for a long time, then the download may take a long time.

If errors occur during the download, only part of the data will be downloaded and therefore you will have to download again.

Data transfer from 1C 7.7 to 1C 8.3 Accounting 3.0

The algorithm for transferring a database from 1C 7.7 to 1C 8.3 is slightly different in details, but in general it is similar to the one described above for 1C 8.2 Accounting 2.0.

Step 1

After updating the 1C infobase, you need to update the data upload rules. This can be done in the following way.

Open 1C 8.3 Accounting 3.0 and select In the lower right corner, select the Save transfer rules button, select the 1C Accounting 7.7 version and save the rules by specifying the path to the ExtForms directory of the information database:

Step 2. Uploading data from 1C 7.7

The ability to upload from 1C 7.7 to 1C 8.3 is made by default, that is, there is no need to download additional files and add them to the database.

Let's start processing the upload: Service - Additional features. We find the inscription Transition to 1C 8.3 Accounting ed. 3.0 and click Open:

In the window that appears, fill in:

- Upload rules - a file named ACC_ACC8.xml, which can be found in the folder with your database (how to determine the path to the database was described above), the ExtForms folder. This is the one that was copied from 1C 8.3;

- Start date and end date - the period for which the data will be uploaded;

- Data file name - the place where we will copy the file with the uploaded data;

- Data upload rules – objects to upload, directories and documents that will be uploaded to a file:

Click the Load Exchange Rules button. A list of objects will appear that will be unloaded from 1C 7.7, which can be edited by removing or setting the checkboxes.

You can upload in parts, creating several files, or upload all the data at once. How to proceed depends on the specific situation. In the example, we unload all the data at once.

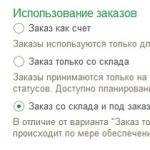

Let's open 1C Accounting 3.0 (8.3) and choose Here we will see 2 ways to load data:

- Load data from the infobase - the 1C 8.3 program will find the installed databases on its own and try to connect to this infobase by copying the data from there. Using the settings, you can specify what needs to be uploaded and click the Upload data button:

- Loading data from a file is just our option. You must specify the file that was uploaded from 1C 7.7 and click the Upload data button. If a window like below appears, it means that the download was successful. Otherwise, you need to download either in parts and fix the errors that the program will issue in 1C 7.7:

Data transfer from the modified standard configuration 1C 7.7 to 1C 8.3 (8.2)

Transferring data from changed 1C 7.7 configurations is much more complicated due to rewritten business processes that are not in the edition of the program to which we will transfer data. In most cases, such transfers should be done by a specialist with experience in data transfer or a good command of the Data Conversion configuration. There are general migration principles that you can use to migrate these configurations:

- Function transfer. In the new configuration, it is necessary to repeat the functionality that is present in 1C 7.7. Additional documents, reference books and details. Unload -CF this base.

- at the end of the year. Compare account turnovers before convolutions and after- they must be equal.

- Transferring data from a collapsed 1C 7.7 database to a standard clean database of a new edition. Check the turnover data for accounts in 1C 7.7 and 8.2 or 8.3. In case of errors, correct them.

- In a clean database, into which data was loaded from 1C 7.7, it is necessary to load the CF configuration file, in which the functionality from 1C 7.7 was repeated.

- Additional reference details can be transferred using the Data Conversion configuration.

Checking data after transferring data from 1C 7.7 to 1C 8.3 and 8.2

Using the Balance sheet report, generate a report with data on sub-accounts, types of accounting, off-balance accounts, currencies and compare with the same report from the 1C 8.3 (8.2) database into which the data was transferred: