13.03.2014

Setting up accounting entries in "1C:ZUP 8"

Setting up accounting entries in the program 1C: Salary and Human Resources 8 edition 3.0

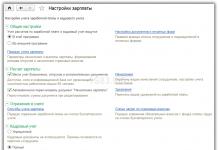

With the release of the "1C: Payroll and Human Resources Management 8" version 3.0 configuration, the procedure for setting up the generation of postings to reflect wages in regulated accounting has become much easier. The developers of the program "1C: Salary and Human Resources Management 8 ed. 3.0" separated Accounting and Payroll. Now, to set up postings, you do not need to upload the chart of accounts and cost items from the accounting program. This is immediately done in "1C: Salary and Personnel Management 8". We can still specify the Method of reflection: - for the organization as a whole, - separately for departments, - separately for employees. To begin with, we create Methods for reflecting salaries in accounting (Settings - Methods for reflecting in accounting), add a new Method for reflecting, assign a Name to it. (Fig. 1).

Rice. one

Having set the required number of Methods for reflecting wages in accounting, we make the settings:

- In general, for the organization (see Fig. 2).

Enterprise - Organizations (if there are several organizations, select the organization in which we will make the settings) - Accounting policy and other settings - Accounting and payroll - Reflection method - Select the desired reflection method.

- By analogy, it is configured by departments.

- Separately for the employee (see Fig. 3).

Enterprise - Employees - Cost accounting - Reflection method - Select the desired reflection method.

Then a document Reflection of salary in accounting is created (Salary - Reflection of salary in accounting - Create a document). See fig. 4

After all the described procedures, it is necessary to upload to the accounting program (more precisely, Data Synchronization). If synchronization has not been done yet, it is necessary to make synchronization settings (see Fig. 5).

Then, in "1C: Accounting 8" edition 3.0, we make additional adjustments to the Methods for reflecting salaries in accounting. Employees and wages - Methods for reflecting wages in accounting - Choose our Method and fill in the missing data (see Fig. 6).

1C:Accounting provides the ability to set up cost accounts and payroll analytics for employees. For this, the reference book 1C 8.3 “Methods of accounting for salaries” is used.

Starting from program version 3.0.43.162, this directory can be opened from the combined form "" (which opens in the "Salary and Personnel" - "References and Settings" section):

In earlier versions of the program, the "Payroll Accounting Methods" reference book is available directly from the "Salary and Human Resources" section (see the "Reference Books and Settings" subsection).

Setting up salaries in 1C for accounting

Methods of accounting for salaries are entered into the directory, in each they select an account for allocating costs and analytical parameters. The program has already created one element of this directory - "Reflection of accruals by default." The cost account selected here will be used for payroll accounting unless otherwise configured. Account 26 (General expenses) is indicated in the "Reflection of accruals by default", but you can specify another account if necessary.

The method of accounting for salaries must be indicated in the accrual, which is assigned to the employee in or after the transfer. If no method is specified, default reflection will be used. The “Accruals” directory is also available from the “Salary settings” form starting from program version 3.0.43.162, in previous versions - directly from the “Salary and personnel” section. Some accruals have already been created in the program, including “Payment by salary”. It does not select the method of reflecting salaries, therefore, the salary of employees who are assigned "Payment by salary" will be taken into account by default - to account 26.

Get 267 1C video lessons for free:

The user has the ability to create new ways of accounting for salaries and new accruals and assign them to employees.

Example. The organization accepted two new employees: Ivanov P.I. to the sales department as a manager and Kuznetsov S.P. to the production site as a turner. Both receive a monthly salary, while the manager's salary should be taken into account on account 26, and the turner's salary on account 20.01 (Main production).

Watch our video about payroll in 1s Accounting.

To reflect in the program "1C: Accounting 8 (rev. 2.0)" the payments or deductions accrued to employees, it is necessary to fill in the reference books "Methods of reflecting salaries in accounting", "Accruals of organizations" (types of calculation) and enter the correct information in them.

Let's look at a few examples.

Reflection of the salary of production workers

The enterprise has production, while the salary of production workers should be charged to account 20, with the appropriate analytics.

Actions in the program:

Reflection of the fine accrued to the employee

The employee was charged a fine, the amount was posted to account 73 “Calculations for compensation for material damage”.

Actions in the program. Of course, you can reflect the fine by manual operation. But if such an accrual has to be done repeatedly, then it makes sense to enter information into the program to reflect it.

Reflection of sick leave accrual

The employee was on sick leave and received temporary disability benefits. The first two days of illness were paid for by the employer, the costs were charged to account 26. The subsequent days of illness were paid for by the FSS.

Actions in the program:

- To reflect benefits at the expense of the FSS, we are creating a new way to reflect salaries. Debit account: 69.01 “Social insurance settlements”, analytics: “Insurance expenses”. Credit account: 70, we do not fill in the type of accrual.

- We create a new type of calculation (accrual) for benefits at the expense of the FSS. Specify the created reflection method. Type of income for personal income tax: 2300 (Temporary disability benefits), insurance premiums: "State benefits of compulsory social insurance paid at the expense of the Social Insurance Fund." We do not indicate the type of accrual under Article 255 of the Tax Code of the Russian Federation, since benefits are not included in wage costs.

- The b / l allowance at the expense of the employer can be reflected in accounting using the “Default” method of reflecting expenses (account 26). But in order for payments to be correctly taken into account when calculating personal income tax and insurance premiums, it is necessary to create an accrual (calculation type) and indicate the corresponding types of income. We create an accrual, indicate “Reflection of accruals by default”, type of income for personal income tax: 2300 (Temporary disability benefits). The benefit is not subject to insurance premiums, so we select “Income that is wholly exempt from insurance premiums, except for benefits from the FSS ...”. We do not indicate the type of accrual under Article 255 of the Tax Code of the Russian Federation, since benefits are not included in wage costs.

- The 1C:Accounting program is not intended for payroll and other payments. Therefore, the amount of benefits is calculated outside the program. At the end of the month in the program we create the document “Payroll to employees”. We manually add lines, indicate the employee in them, the types of calculation for b / l at the expense of the employer and at the expense of the FSS, the amount of benefits. We also change the amount of the accrued salary for this employee, since the salary is not paid during the illness.

- We carry out the document "Payroll to employees." The amounts of salary and b / l at the expense of the employer are assigned to the account. 26, the amount b / l at the expense of the FSS - to the account. 69.01s subconto "Insurance expenses", according to the settings:

- In order for the payment of benefits at the expense of the Social Insurance Fund to be reflected in the accounting for insurance premiums, it is necessary to create and conduct a regulatory document “Accounting taxes (contributions) from the payroll”. It generates not only accounting entries, but also movements in the registers of accounting for taxes and contributions, in particular, in the register “Accounting for income for calculating insurance premiums”:

Let's generate the report "Card for insurance premiums":

Menu "Salary - Accounting for personal income tax and taxes (contributions) from the payroll" or the tab "Salary"

The card, in addition to the base for calculating contributions and the contributions themselves, reflects the tax-free amount of benefits at the expense of the employer, as well as the amount of accrued benefits at the expense of the Social Insurance Fund.

In this article, we will consider an example of maintaining in the program 1C: Accounting 3.0. For different categories of employees, different methods of reflection in accounting will be applied. Such a mechanism is often used in practice, and we will consider its implementation in detail.

Directory setup

You can set up payroll accounting methods, as well as other similar settings, in, which are located in the "Administration" section. Open them and follow the hyperlink of the same name, as shown in the figure below.

Please note that in the general settings it is indicated that accounting for payroll and personnel records are maintained in this program. Also, within the framework of our example, personnel records will be complete, since we will assign the type of accrual in the hiring document. This document is not available when maintaining simplified personnel records.

After you have switched to payroll accounting methods, a corresponding list of methods previously entered into the program will open. You can either edit an existing one or add a new one.

Suppose we want to allocate the wages of auxiliary production workers. Let's create a new way of accounting for wages and call it "SW of workers of auxiliary production." All such accruals will be reflected on the 23rd account with the cost item "Payment". In fact, the data we enter into this directory will later act as a subconto of payroll movements.

Payroll

Above, we created a new way of accounting for the wages of auxiliary production workers. Now you need to assign it to an existing accrual, or a new one. You can open the list of accruals from the general form of salary settings, which is located in the accounting parameters.

Let's create a new accrual "Payment according to the salary of auxiliary production workers" and fill it in as standard. As a method of reflection in accounting, we will choose the method that was created earlier.

The accrual we created must be assigned to an employee. This can be done by admission, transfer to work.

In our example, Myasishchev Roman Aleksandrovich was hired as a production line operator. We appointed him payment according to the salary of auxiliary production workers in the amount of 20,000 rubles.

Let's start for the hired employee for September 2017. The program filled in all the data automatically. The figure below shows that exactly the one for which we set the reflection method on account 23 was substituted as an accrual.

After posting the payroll document, let's move on to its movements. The amount of the salary of 20,000 is reflected in the 23rd account, as indicated in the corresponding account. The payroll is listed as a subconto.

Thus, when setting up the ways of reflecting wages in detail, you can divide these costs into separate accounts, depending on the accrual.

ATTENTION: a similar article on 1C ZUP 2.5 -

✅

✅

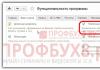

The document is designed to collect information on accruals for all employees, deductions and calculated taxes and contributions at the end of the month. The document is created for each month one, after all accruals, contributions and taxes are calculated. Thus, this document must be entered after the document is calculated for all employees.

Let me remind you that I continue to consider this issue on the basis of the information base that was formed as a result of . We had payroll for October for three employees: according to Sidorov - payment at an hourly rate and a bonus; according to Ivanov - payment according to salary and he also had a sick leave; according to Petrov - payment according to salary and work on a day off.

Let's create a document Reflection of salary in accounting(Section Salary - Reflection of salary in accounting) and click on the button Fill.

Lines are created for each employee in the tabular section. According to Ivanov: the first line is salary payment. Further, information about sick leave is broken down in two lines: separately FSS insurance costs and Costs at the expense of the employer. The accrual for employee Petrov is also divided into two lines: Salary payment and Payment for work on weekends. For employee Sidorov accrual: Payment at the hourly rate and Bonus.

I would like to draw your attention to the fact that in this tabular section the Reflection method column is not filled. It is on the basis of the information in this column that it is determined which accounts will reflect this or that accrual. This will become more clear when we begin to consider this document a little lower on the side of the accounting program.

Let's decide how to configure the program so that the Reflection Method column is filled. The most important setting is located in the information about the organization. Section Settings - Company details.

Go to the tab Accounting policy and other settings - Accounting and payroll. In more detail about all the other settings of the program, I tell in the article.

Here, for the entire organization, we can define the reflection method that will be applied to the employees of the entire organization. The choice comes from the directory of the same name Ways of reflecting wages in accounting.

In our database, a directory element called “26-70” was created, which will tell us that later on the side of the accounting program we will link account 26 to this reflection method. On the side of the payroll program, the account is not set, since the chart of accounts in 1SZUP 3.1- No. It is on the side of the accounting program. Therefore, here we should set only the name of the reflection method, but such a name by which we can understand which account, perhaps which analytics, will be tied to this method of reflection on the side of the accounting program.

We choose the way to reflect "26-70" in general for the organization. We indicate that this method of reflection will be valid from October 2016, since we keep records in the database from this month. Click Write and close.

After we have saved the change in this directory, let's go to the document Reflection of salary in accounting and refill it.

For all employees, the Method of reflection "26-70" was filled in. It is not affixed only for sick leave at the expense of the FSS. The program sees that this is an accrual at the expense of the FSS and on the side of the accounting program, the Debit account posting will be automatically entered. 69.01 Credit account 70.

In addition to accrued amounts, this document contains information about accrued contributions.

Information about insurance premiums is also taken from the document Payroll and contributions. Contributions will be treated in the same way that was determined for the accrued amount from which these contributions are calculated. Therefore, accruals and contributions are presented in one tab of the document “Reflection of wages in accounting”.

This document also has a tab Accrued personal income tax. Let's move on to it.

On this tab, the program collects personal income tax for employees per month. In the accounting program, based on the information provided, postings will be generated for the calculated personal income tax for the month. You can read more about accounting for calculated, withheld and transferred personal income tax.

Now let's talk about reflecting holds. Document Payroll and contributions we had two holds.

We are talking about withholding under an executive document and withholding for cellular communications. These deductions are reflected in the tab Withheld salary document Reflection of salary in accounting

On this tab, there is no such thing as a reflection method. The wiring will be determined based on Type of operation. For alimony, the program automatically substituted the type of operation. The program also substituted its own type of operation for holding for cellular communication -. This happened because in the settings of the type of deduction we indicated that this deduction has the purpose "Deduction on account of settlements on other operations" and the type of operation Withholding from other transactions with employees(Section Settings - Holds, where we created the hold type "Cell Hold (over limit)").

The program saw this, and already in the document Reflection of salary in accounting substituted the desired type of operation. What kind of posting is meant by the type of operation Deduction for other transactions with employees, we will see already on the side of the accounting program.

So, we have considered all the tabs of the document Reflection of salary in accounting. Now let's complicate our example a bit.

Here we can specify the reflection method for a particular employee. We choose the reflection method 20-70. This setting will take precedence over the setting in the organization details. The program will see that the reflection method is configured in the employee card and when filling out the document Reflection of salary in accounting for this employee, the reflection method 20-70 will be selected.

For the rest of the employees, we did not make such a setting in their cards, so the reflection method that is indicated in general for the entire organization will be applied. In the next post, we will take a closer look at other similar settings and their priority, because. this is not the only place where you can customize the reflection method. The reflection method can be configured at the level of the accrual type, at the level of some documents, in the Subdivision directory and in some other sections of the program. All of these settings take precedence. But I will talk about this in a separate article.

Let's return to our topic. Let's go through our document. The document is now ready to be transferred to the accounting program.

Reflection of salary in accounting in the program 1C Accounting 3.0

✅ Seminar "Life hacks for 1C ZUP 3.1"

Analysis of 15 accounting life hacks in 1s zup 3.1:

✅ CHECK LIST for checking payroll in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll in 1C ZUP 3.1

Step by step instructions for beginners:

Let's move on to the accounting program. Document transfer Reflection of salary in accounting produced during synchronization. I will not dwell on setting up and performing synchronization in detail, since I wrote about this in detail, and. But I note that in 1C Accounting, as well as in ZUP, there is a document journal Reflection of salary in accounting. This log is synchronized with the log in ZUP and a similar document is created here. The screenshot below shows the document Reflection of salary in accounting, which was created in Accounting after synchronization.

Since we are performing the transfer for the first time, we still need to fine-tune the reflection methods used. A window will open.

We select for editing the reflection method 26-70. To do this, press the F2 button or right-click and call the context menu. Choose Change.

On the payroll side, we only set the name of this reflection method, and on the side of the accounting program, we already have the opportunity to set an accounting account, which implies this reflection method.

In this case, this method of reflection implies accounting account 26. We indicate the cost item - it will probably be Wages. We save.

We do the same for the reflection method 20-70. We put down the account of 20.01 and the cost item - Wages. We restrict ourselves to these settings.

Let's pass the document. Let's open the lines. Let's see what kind of wiring we got.

The first two lines for employee Sidorov are his salary and bonus were reflected on account 20, i.e. posting D-t 20 K-t 70.

Further, for the rest of the employees, postings D-t 26 K-t 70 were formed, i.e. this is the setting that we set for the organization as a whole (line 3 - 6). The seventh construction site, we have a posting reflecting the fact that sick leave is accrued at the expense of the FSS (Dt 69.01 Kt 70)

Lines 11 to 18 are entries related to insurance premiums. Kt 69 of the account means insurance premiums.

And the last two lines are data related to deductions. According to employee Petrov, alimony, the program sees the type of operation Alimony and other writ of execution. It is written in the program code that this type of operation corresponds to posting Dt 70 Kt 76.41 and it is automatically substituted. Concerning Deductions from other transactions with employees, then the program code states that this type of operation corresponds to posting Dt 70 Kt 73.03.

So, today we figured out why we need a document "Reflection of salary in accounting" what settings you should pay attention to before filling it out and how the postings are formed in the program 1C Accounting 3.0 based on this document, ported from 1C ZUP 3.1. In the next publication, I will talk in more detail about the various settings for reflection methods and about the priority of these settings on the side of the RAM program.