AT modern world such a huge number of professions have appeared that it is sometimes even difficult to imagine what a specialist in a particular field does. And since the most important industry is finance, working with them attracts a large number of university students and their graduates. Thus, the profession of "financial analyst" raises many questions about its essence and tasks.

Young but very promising profession

On the modern market labor financial analyst is a new specialist, but very necessary. Of course, many unenlightened people are lost at the mention of this profession and do not know if there are differences between an analyst and a trader. It is worth noting that with a certain similarity, there are still differences in the content of the activity. From the name itself, you can roughly define the main occupations and responsibilities of a financial analyst. It is obvious that he works in the field of finance and analyzes them. When working with finances, a certain clarity and care is required. The analysis of the situation should be qualitative. But finance is a very broad field with many subsections, so it is not surprising that a particular section requires the services of a specific specialist. So, a financial analyst can work with the securities market, monitor the performance of a financial company or a certain sector of the economy. It is also possible that the analyst works with the entire economy as a whole. Thus, the work of each specialist is evaluated according to individual system and is determined by the specifics of the enterprise where he works. Today, the main areas of work remain the stock, currency and commodity markets.

Feet feed the wolf. But finances will not be superfluous ...

In general, analysis is a complex process that cannot be carried out in one step. It is best to divide it into parts. First of all, you need to collect all relevant information, implement it. Next, you will have to systematize all the data and identify the main trends. The information obtained allows you to get a general picture of events and identify important changes. A detailed and qualitative analysis of the situation in the financial market is able to predict the further course of events with the issuance of recommendations regarding behavior and further strategies in the market. Therefore, we can summarize and say that the purpose of the work of a financial analyst is to make a forecast, as well as issue recommendations. If a financial analyst fulfills his duties clearly, then, following the algorithm of actions prescribed by him, one can expect profit.

An important gear in the global machine

Each specialist in a company, both young and developing, and in a stable and growing one, should take its place justifiably. The financial analyst is the engine of the company. His responsibilities include monitoring the situation in the financial markets, analyzing the work of the company and competitors, regularly advising on financial matters, as well as the preparation of daily analytical reviews and reports. A financial analyst is the person who foretells the "weather" in the market and gives his forecasts as to where the wind is blowing and how to insure in case of "rain". Also, an analyst can develop an investment portfolio for his clients with economic recommendations for trading, in addition, create information materials for publication in the media.

What is analytics and how to deal with it?

From the outside it may seem that there is no particular difficulty in this work, but such a point of view is superficial! A financial analyst must perform his duties perfectly, otherwise he does not benefit his company and cannot take his place. Progress in work is demonstrated by the dividends received from his recommendations and forecasts. Working as a financial analyst is primarily associated with certain financial risks that can be avoided if you have the appropriate skills and knowledge.

What should a specialist in the financial industry know?

A financial analyst should be distinguished by extensive knowledge of economics and an interest in deepening his knowledge and regular professional development. Also, a specialist must constantly analyze existing changes in the stock and financial markets, having the skills to draw up appropriate financial statements. In addition, it will be useful to be able to consider the economic activity of a particular enterprise and the market in general.

Each company forms its own list of minimum requirements that a financial analyst must meet. The minimum program assumes higher education in the specialty, work experience of at least one year, as well as knowledge of the main financial analysis tools and computer skills at the level of an experienced user. Since the main value of an analyst lies in the accuracy of forecasts, an important component will be the presence of analytical and a certain financial insight.

A document fixing the tasks, functions and responsibilities of a specialist

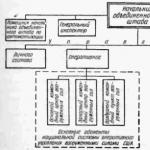

Each company has a job description for a financial analyst, which a hired specialist must adhere to. So, according to this document, the analyst belongs to the category of specialists who are appointed and removed from their positions by order of the general director of the enterprise. The order must indicate a potential substitute in case of absence of a financial analyst. The analyst must be familiar with legal and regulatory legal acts which regulate production, economic and financial and economic activities, tax, civil, banking and administrative legislation, as well as laws on advertising, accounting and the securities market. In his work, he is guided by the law of the Russian Federation and the charter of the company, as well as orders from the management and job description.

The workflow of a financial analyst

Functional responsibilities analytics are based on an analysis of the organization's activities, its economic side and the work of competitors. The expediency of concluding contracts, the adequacy of financial statements and the available indicators depend on what the final forecast of financial analysts is. The forecast they made makes it possible to assess the level financial risk, to give timely recommendations on the timing of investment and purchase and sale transactions. In their work, financial analysts use statistical methods of valuation, search for and systematize the necessary information, and resolve operational issues of production activities with third-party institutions and organizations.

What is a financial professional responsible for?

In his competence - the implementation qualitative analysis available information in compliance with current instructions, orders and instructions. If, in the process of work, financial analytics assumes its own problems and solutions in the field of administrative, criminal and civil legislation of the Russian Federation, then an appropriate level of responsibility is also possible. Causing material damage by a financial analyst is punishable within the limits determined by the labor and civil legislation of the Russian Federation.

Dream profession, or Why is working with finance so attractive

A financial analyst is a professional expert with an economic education and specialization in a particular market sector. As a professional, he must be attentive, responsible, competent in the matter under consideration, have a high reaction rate and analytical thinking. The duties of the analyst include the study of companies issuing shares with the preparation of recommendations for all transactions with securities. His job is not endless seminars reading newspapers and writing reports. If you are thinking about how to become a financial analyst, then it is better to be aware of the state of affairs in advance. Probably, in the first years you will have to work in the database in Excel, summarize the data and systematize them for different periods. You will have to go on business trips and perform routine tasks. In practice, it can be seen that many young professionals cannot withstand the monotony and monotony of tasks, so they move to another job.

What is work?

The popularity of this profession is determined by the proximity to the financial sector and the high social status of a financial analyst when working in a reputable company. The ability to work with large amounts of data, scrupulousness and accuracy allow you to work as efficiently as possible and quickly gain respect in the team. With the proper level of knowledge and experience, a financial analyst becomes the most prominent figure in the company, as he turns into an oracle, each word of which entails an immediate reaction from others and, if events are successful, implies an increase in the rating of a specialist.

What are the job prospects of a specialist?

A specialist with no work experience, but with a prestigious diploma and additional courses in accounting, can qualify for an initial career salary of $ 800. If you have up to three years of work experience, the salary increases to $ 1,000. More serious experience and additional education add another $500 to your salary. Analysts of the extra class receive about 2,000 USD. e. Thus, a higher education is not the last step for the growth of a financial analyst. The bonus will be the received specialized education, master's degree and MBA program. The price of a specialist in Russia is significantly increased by education received abroad, or an internship completed there. But the experience gained in other countries may not be enough if you want to work in Russia. Therefore, before starting your career, it is better to complete an internship at the enterprise. In addition, for any specialist in this field of activity, an extremely important condition for career growth will be the presence of eloquence. Making money investments for most people is too serious a step, involving parting with a significant part of their own savings, so not everyone can convince a potential investor to decide on it. And the rating of trust in the company depends entirely on the analyst. A client who is convinced of the capabilities and power of this specialist will definitely come back to him again, therefore, many enterprises hold seminars and master classes where financial consultants share their knowledge and demonstrate opportunities in practice.

If we talk about who a financial analyst is and who can be put in such a position, then everything is simple: the most important thing is to find a highly qualified specialist with a higher education.

We will understand what the job description of a financial analyst is in this article.

Basic requirements for the position of financial analyst

What should a financial analyst do and know? The first thing to mention is the presence of a special higher education. It is necessary to have an engineering and economic education in order to be hired. Unqualified people are not hired for such positions.

If we talk about what category a financial analyst belongs to, then everything is simple - to the category of specialists. If someone can appoint a person to this position, then only the head of a particular company. No other unauthorized persons are authorized to do these actions.

The work of an analyst includes knowledge of documents such as:

- Orders.

- Directions.

- Instructions.

- Orders.

In a word, this includes everything that directly regulates the work of such a specialist. The presence of knowledge of the law is also one of the integral factors, thanks to which it is possible to decide whether to hire a person or not. Without knowledge of banking and tax regulations, a person has nothing to do as a financial analyst, because without such knowledge the work will be inefficient and there will be 0 benefit from the employee.

Responsibilities of a Financial Analyst

The first thing an employee is obliged to do is to analyze the entire financial side of the company. That is, if the company had any actions where finances were involved, the analyst is obliged to analyze all documents confirming such actions. In order for the profession not to seem too useless to the boss, the analyst must analyze and study all kinds of information about the prices of goods and services.

This is done in order to find the moment when it will be profitable and profitable to invest funds. The financial analyst of any company is the heart of the entire budget. This person is obliged to perform all kinds of analyzes and, based on the conclusions, accompany the development of the company's economy. All matters related to finance are the business of analysts. Who, if not they, are responsible for the well-being of the company in the financial industry? Where and how it is better to buy, where it is better to invest, where you can save money - all these are the tasks of analysts.

They should already deal with it and bring good answers to such questions. Financial Analyst is a very important position. That is why only highly qualified and educated people who never stand still are taken there.

Below is a standard form and a sample job description for a financial analyst, a version of which can be downloaded for free.

With the development of business in our country, many owners and managers of companies are thinking about the need for professional employees who could competently optimize the use of financial assets.

Therefore, the profession of "Financial Analyst" has become in demand.

What does this specialist do and what is his role in the success of the organization.

Financial analytics is hard and responsible work that requires profound knowledge and skills in the field of economics, accounting and financial reporting, the ability to analyze and predict both the fundamental movements of the market as a whole and the internal processes of the company itself.

So working in high stress environments constant voltage and the burden of responsibility requires a person also considerable emotional and mental stability.

Read more about the profession in the article.

Who is a financial analyst, what does he do

In a narrow sense, an analyst is a specialist, an employee of a company, a bank, who owns the methodology of economic analysis and conducts such an analysis.

Or a slightly different definition: an analyst is a specialist trained at the level of international requirements for systematic analytical work on assessing and forecasting the financial position of an organization, the state of the stock market, and analyzing socio-economic and demographic phenomena at the municipal, regional and federal levels.

Also in the field of economics, a financial analyst (or a trader - a specialist in securities) is distinguished. A financial analyst is a specialist in a specific market sector whose duties include researching issuer companies and making recommendations for buying, selling or holding shares.

But what can an analyst do? There is no need to build illusions that the newly minted analyst will be entrusted with making forecasts and will be allowed to travel to seminars at the company's expense. Most likely, for the first few years you will be sitting with an Excel database, making summaries, consolidating data for different periods, check calculations, your own and others, etc.

It is possible that you will often have to go on business trips and perform all sorts of boring, but necessary routine tasks, but this is experience, practice, and development of skills. The real analytics and forecasting starts in the next step. Practice shows that a fairly large percentage of young professionals after the first two years go to another job.

An analyst must possess a number of qualities:

- accuracy

- scrupulousness

- ability to work with large datasets

- leadership skills

- learnability

- analytic mind

To begin with, only a higher education is enough for an analyst, but then it is desirable to complete a master's program, and ideally an MBA program, and finally, it will be necessary to regularly attend seminars, trainings and advanced training courses. As for work, an analyst can work in various large companies in different sectors of the economy.

Source: "humeur.ru"

Getting Started as a Financial Analyst

The vacancy "financial analyst" appeared on the Russian labor market relatively recently. In this connection, not everyone clearly understands what the meaning of this profession is. Quite often, financial analysts become traders and, conversely, traders move into the “camp” of financial analysts.

In this article, we will consider the main components of the work of an analyst of global financial markets, and also find out what knowledge and professional skills you need to have in order to qualify for the title of financial analyst.

Financial analyst by definition

To begin with, let's deal with the very concept of "financial analyst". It should be noted that in this article the phrases "financial analyst" and "analyst of global financial markets" will be used as synonymous. To date, a single and clear definition of this profession has not yet developed, not only in Russia, but also in countries with developed market economies.

The definition given by David Damant, ex-president of the European Federation of Financial Analyst Societies (EFFAS) is the most widespread: “The name of the profession includes the word “analyst”, to which various definitions are added: “financial”, “investment”, “securities market analyst” and etc.

However, all definitions come from the fact that a specialist of this kind analyzes securities and the activities of companies issuing them.

As part of these functions, a financial analyst must analyze the economy as a whole, since the macroeconomic environment has the most direct impact on the activities of companies, the state of a particular industry, and the specifics of the activities of a particular company in the market.Glossary.ru defines the concept of "financial analyst" as follows: "A financial analyst is a specialist in a particular market sector whose duties include researching issuing companies and developing recommendations for buying, selling or holding shares."

The above definitions to a greater extent limit the scope of the financial analyst to the stock market. To some extent, this is certainly justified, since the stock market is the most important component of the global financial market.

However, in addition to the stock market, the global financial market also includes the foreign exchange market, commodity markets and the money market (credits and loans).

Therefore, it is advisable to expand the considered definitions. An analyst of global financial markets is a specialist in the stock, currency and commodity markets.

A brief excursion into history

It must be said that the profession of a financial analyst is one of the youngest not only in Russia, but throughout the world. The first securities analysts began their activities in 1928 in Chicago. However, until the end of the Second World War, the profession of "financial analyst" had not yet received a clear content content and public recognition in any country, including the United States.

Financial analysts as such appeared only in the 1950s. So, in 1955, the British Society of Investment Analysts was founded, which later became the Institute of Investment Management and Research.

What is the job

So, what is the job of a modern financial analyst? The process of analytical work can be conditionally divided into several stages:

- First, a financial analyst collects all the necessary information, monitors the market, and identifies the main trends.

- Further, the collected materials are systematized. The analyst identifies the most significant economic indicators, and also monitors important events that can lead to major changes in the market.

- The most responsible moment is the preparation of forecasts. The correctness of the forecast largely depends on the quality of the work done earlier, on how complete and reliable the information collected turned out to be, and on how accurately the key aspects were identified and taken into account.

In order to get a more specific idea of what a financial analyst does, we list the following main areas of work for such a specialist. This is, first of all:

- monitoring of the macroeconomic situation in the world economy;

- analysis of financial performance of companies and assessment of the effectiveness of their management;

- tracking the main trends and sentiments emerging in the markets;

- investment consulting;

- information and analytical support;

- preparation of current analytical reviews (daily, weekly, etc.);

- drawing up forecasts and recommendations for conducting trading and managing an investment portfolio;

- publication of materials in periodicals and on the websites of news agencies.

High qualification standards

There are the following components of a qualified financial analyst:

- high level knowledge of the economy as a whole;

- knowledge of accounting and financial reporting;

- the ability to apply an integrated approach to the analysis of the object under study (both the market as a whole and a specific investment object);

- possession of fundamental and technical market analysis tools;

- understanding the mechanisms of action of a particular market.

There are international standards for assessing the professional level of financial analysts. National communities of analysts unite into international organizations and develop common standards for all member countries of these organizations.

Since 1962, the European Federation of Financial Analyst Societies (EFFAS) in European countries has been certifying analysts for the pan-European qualification Certified European Financial Analyst - CEFA, the Asian Federation of Securities Analysts (AFSA) has also developed for its member countries common standard training of investment analysts.

In 2000, an international qualification for investment and financial analysts "Certified International Investment Analyst - CIIA" was established. At the moment, the CIIA qualification is one of the most respected in the world.The aforementioned European and Asian Analysts' Federations, which together bring together specialists from 32 countries in Europe, Asia and Latin America, took part in its creation. The Association of Certified International Analysts (ACIIA) was established by its developers to carry out certification on the CIIA qualification.

Since 2001, the process of implementing this certification has spread throughout the world. CIIA came to Russia in 2002. The main task of ACIIA is to conduct examinations, and in case of their successful completion, the qualification of "Certified International Investment Analyst".

In order for a candidate to be awarded the CIIA international qualification, he must pass the general and national examinations, and the general examination consists of two levels.

In Russia, the professional community of financial analysts is represented by the Guild of Investment and Financial Analysts (GIFA).

GIFA is the sole representative of Russia in the ACIIA, as well as in the European Federation of Financial Analyst Societies (EFFAS). One of the main objectives of the GIFA is to improve the professional level of investment and financial analysts in Russia and to promote their professional certification in accordance with international standards. GIFA is authorized to administer the qualifying examinations for the CIIA degree.

Primary requirements

Having studied a number of ads posted on the websites of recruitment agencies, we came to the conclusion that the main requirements for the vacancy of a "financial analyst" are:

- higher economic or financial education;

- 1 to 3 years experience in a similar position;

- computer knowledge;

- fluency in English;

- analytical mindset and the desire for continuous professional growth.

Employers most often give preference to young active professionals aged 25 to 35, although age, of course, is not a determining factor.

Today positions in the field of financial services are the second most popular (in the first place are positions in the field of telecommunications and IT-technologies) in the Russian labor market.

Demand for this kind of specialists greatly exceeds the supply. In this connection, employers are increasingly softening the strict limits of their requirements, especially in terms of having a certain work experience.In Russia, financial analysts usually work in investment and financial companies, banking structures, consulting and brokerage houses, economic publications, as well as in large corporations and government regulatory bodies.

How to become a financial analyst

Among higher educational institutions that provide good training in the field of economics and finance, experts distinguish:

- Russian School of Economics,

- Higher School of Economics,

- economic branch Novosibirsk University,

- MGIMO,

- Financial Academy under the Government of Russia,

- Moscow University of Economics, Statistics and Informatics (MESI),

- State Institute of Management,

- Russian Academy of Economics. Plekhanov and some others.

A higher education diploma is, of course, necessary condition on the way to becoming a highly qualified specialist in the field of finance. However, a diploma of graduation from an economic university is not a guarantee that a specialist is able to engage in financial analysis at a high level.

As a rule, people receive the necessary qualifications already directly in practice, when working in banks and financial and investment companies. An additional plus is an international certificate in financial analysis.

In Russia, the international qualification of investment analysts CIIA, which we have reviewed, as well as the analytical degree of Chartered Financial Analyst (CFA), is most widely used.

In conclusion, I would like to state that in recent years Russia has seen the formation of the stock market and the development of financial institutions, and this leads to an increase in the need for financial and investment analysts. However, in our country, so far we can only talk about the emergence of financial analysis and about a very small number of specialists in this field.

In this connection, the specialty of a financial analyst in Russia is seen as very promising and requires the active involvement of young highly educated personnel who are ready for continuous improvement and raising their professional level.

Source: "rfc-spb.ru"

Description of the profession

One of the most popular professions is the financial analyst. These specialists are needed in various fields of activity, despite the fact that their profession is considered relatively young.

The person who chooses this field of activity will be engaged in the study of issuing companies and the preparation of recommendations regarding the purchase, sale or retention of securities. In fact, they perform very important functions, since the success of the organization or the person for whom it works depends on their advice. The slightest mistake can cost a reputation or a career.

If we talk about the history of the profession of a financial analyst, then it has recently appeared not only in our country, but also abroad. For the first time, these specialists began to provide their services in Chicago. This was in 1928. Then it only began to emerge, and was not fully formed.

These specialists gained recognition only after the Second World War. Demand for the services of this specialist increased dramatically after the creation of the British Society of Analysts. We now know this organization as the Institute for Investment Management and Research.The activity of a specialist in the field of economics and finance is closely related to the analysis of certain information. His work can be divided into several stages:

- The specialist is given a clear task.

- Then he searches for information that will answer all the questions posed by the customer.

- In the course of his work, he analyzes the market, identifies trends in its development.

- The specialist systematizes all the information received, notes the most important economic indicators. The most important part of an analyst's job is making forecasts.

It is extremely important to do everything right here, because due to a mistake, customers can lose a lot of money. A good financial analyst must have a high level of knowledge of economic disciplines.

It is extremely important to have the skills to analyze development trends and changes in the market, to understand the mechanisms of a certain market niche. Also in the work can not do without knowledge of financial reporting and accounting.

Where to study and in what specialties

You can get an analyst education at the following higher educational institutions:

- National research university « graduate School economy". It offers training in the specialty "Economics".

- Russian New University (specialty "Economics").

- National Research Nuclear University "MEPhI" (specialties: "Mathematical Methods in Economics", "Finance").

- North-Eastern Federal University named after K.M. Ammosov (specialty "Economics").

You can also choose a suitable university for yourself in the sections "Economic universities in Moscow" and "Economic universities in St. Petersburg".

What has to be done

Analysts in the field of finance have quite busy work schedules. Their responsibilities include:

- monitoring trends in the global market,

- analysis of financial performance of commercial organizations or enterprises,

- analysis of the effectiveness of company management,

- investment consulting and information support,

- drawing up forecasts and recommendations.

In some cases, publication of materials in the media is required. Responsibilities are determined by the employer, taking into account the specifics of the activities of his organization. So they can be very different.

Financial analysts can work in various fields of activity. Based on this, its specialization is determined:

- Such specialists successfully work in financial and investment companies, in banking organizations.

- They are also indispensable workers in state regulatory bodies.

- They are needed in large corporations and stock exchanges.

Good financiers can be people who:

- have analytical skills

- have excellent RAM,

- are distinguished by tolerance and care.

- The work of this specialist requires perseverance and the ability to bring his work to the end.

- Deep knowledge in the field of economics, accounting is important.

- Financial analysts must be able to select and synthesize information, organize it, and convey it to the client.

So if you want to be a good specialist It is important to have all these qualities.

Demand

Above, we have already said that the profession of a financial analyst has appeared relatively recently. Of course, the specialty did not immediately receive great recognition, but it is becoming more and more relevant.

According to forecasts, in a few years the profession of an analyst in the field of economics and finance will be at the peak of popularity. So if you have the ability and desire to work in this area, you can safely associate your professional activities with it.

Analysts in the field of economics and finance are quite highly paid specialists.

But again, the wages of such workers depend on several factors:

- First, it is a regional affiliation. In large cities of Russia, the highest wages are determined - from two thousand dollars and more.

- Secondly, the level of training and knowledge of a specialist affects the salary.

If you are lucky enough to get a job in a large corporation, then you have every chance of making big money. Good financial analysts have every chance to build a successful career. There is nothing surprising in this, since the activities of these specialists are closely related to finance, capital growth. If you succeed in establishing yourself as one of the the best specialists then a successful career will be guaranteed.

In the last few years, the services of analysts in the field of finance have become increasingly relevant. Since many companies and individuals are focused on increasing their capital, these specialists will receive even more recognition. Owners and managers of companies have realized that experienced financial analysts will help to effectively increase capital, and therefore this profession will become even more in demand and highly paid.

Source: "edunews.ru"

Financial analyst

A financial analyst is a specialist in the financial field who analyzes the economic performance of an enterprise and then issues recommendations for planning financial activities and improving its efficiency.

- Salary: 40.000–60.000 rubles. (worka.yandex.ru).

- Place of work: Private and municipal enterprises, consulting companies.

Responsibilities

- A financial analyst analyzes the company's activities, studies economic indicators, financial information. The data obtained is used to make management and investment decisions.

- The specialist can influence decision-making when concluding contracts, prepares recommendations on the best time to conduct a “purchase and sale” operation.

- The analyst studies the main market trends, controls the finances of the enterprise, assesses financial risks, is engaged in research and preparation of financial reports.

Important qualities:

- perseverance,

- attentiveness,

- accuracy,

- persistence,

- patience,

- justice,

- striving to get things done,

- purposefulness,

- desire to constantly develop.

Reviews about the profession

“A financial analyst is the person who predicts the “weather” in the market and gives his forecasts as to where the wind is blowing and how to make sure in case of “rain”.

Education

To become a financial analyst, you need to get a higher economic education. In St. Petersburg, you can study at the following universities:

- St. Petersburg State University,

- Saint Petersburg University of the Ministry of Internal Affairs Russian Federation,

- St. Petersburg State Polytechnic University,

- St. Petersburg State University of Economics,

- Institute of Management.

Source: "opis.pro"

Financial Analyst

- VPO specialties: "Finance and credit" (080105), "Economics" (080100), "Accounting, analysis and audit" (080109).

- Related professions: Auditor, tax inspector, economist, financier.

- Areas of professional activity: Management, Finance, Economics.

Occupation classification

- On the subject of labor: a financial analyst works with numbers, formulas and tables, this allows us to attribute the profession to the type of "Man - Sign System".

- On the basis of purpose: exploration.

- By means of labor: manual.

- According to working conditions: work in "room" conditions.

- Profession class: creative (heuristic).

By the nature of the work, the profession of a financial analyst is associated with analysis, planning, organization and management, design, making non-standard decisions, and requires independent original thinking.

Description

A financial analyst is a specialist who analyzes the financial activities of an enterprise and gives recommendations on planning and improving its economic efficiency.

The main activity of a financial analyst is related to the analysis of financial performance indicators of enterprises, comparing performance with competitors and developing recommendations for improving performance indicators.The main duties of an employee include:

- analysis of the organization's activities;

- analysis financial information to forecast economic conditions for further use in making investment decisions, to calculate future income and expenses;

- analysis of the feasibility of concluding contracts;

- collection of economic, legal and industry information, as well as financial reports of the company;

- conducting financial research;

- assessment of the level of financial risk;

- control of the company's finances;

- preparation of recommendations on the time of investment and purchase and sale operations;

- preparation of financial statements;

- tracking the main trends in the market development.

Requirements for the individual characteristics of a specialist

A financial analyst must have such personal qualities as:

- perseverance,

- patience,

- persistence,

- a responsibility,

- "pedantry" at work,

- honesty,

- accuracy,

- emotional and mental stability,

- justice,

- purposefulness.

Professionally important qualities of a financial analyst include:

- high level of mathematical abilities;

- ability to analyze, synthesize, generalize information;

- the ability to engage in a certain type of activity for a long time;

- the ability to quickly move from one activity to another;

- good development of short-term and long-term memory;

- high noise immunity;

- personal computer skills;

- knowledge of English language at a high level.

Medical contraindications that prevent working as a financial analyst include:

- diseases of the nervous system;

- vegetovascular dystonia with severe headaches;

- hypertension;

- severe diseases of the visual system.

Professional training

The financial analyst should be familiar with:

- economic theory,

- fundamentals of macro- and microeconomics,

- legislation,

- regulating financial activities

- accounting (financial and managerial),

- financial reporting,

- business analysis,

- taxation, business and commercial law,

- quantitative economic and mathematical methods of analysis and statistics for commercial activities,

- operational management and strategy, Western Financial Reporting Standards (GAAP, IAS) and Russian standards(RAS).

The financial analyst must be able to:

- conduct research in the field of economics and finance, statistics;

- analyze the financial and economic activities of the enterprise;

- control financial performance;

- predict the market situation;

- draw up business plans, develop investment projects;

- advise the company's management and top management on financial decision-making;

- use specialized financial software products;

- conduct negotiations, conferences and seminars.

The profession of financial analyst is in demand. Specialists of this profile can work at large enterprises, banks, brokerage campaigns, economic journals.

Working conditions

A financial analyst can work independently or in a team. He spends his working day indoors, mostly sitting.

The financial analyst uses:

- hand tools (pen, pencil),

- modern technical means(stamp equipment, copying and other office equipment),

- personal computer with Internet access,

- means of performing computational operations (calculators, PC),

- means of communication (telephone, fax).

The workplace should be well lit.

Working conditions at the workplaces of specialists with disabilities must comply with the individual program for the rehabilitation of a disabled person, developed by the Bureau of Medical and Social Expertise (if there is a disability).

The design of all elements of production equipment and the organization of the workplace must comply with anthropometric, physiological and psychological characteristics and limited opportunities working disabled people.

special shape not available for financial analysts.

Professional risks

- Working posture - sitting position. Prolonged stay in this position can lead to diseases accompanied by pain in the back and neck.

- Permanent job with a computer can cause diseases of the visual system.

- In addition, work in a constant voltage, in stressful situation often causes fatigue, neurosis and depression. During the reporting period, the working day of a financial analyst is not standardized.

Required professional education

To become a financial analyst, you need to get a higher economic or financial professional education.

Secondary institutions vocational education:

- Volokolamsk College (Technical School) of Law, Economics and Security;

- Stupino Aviation and Metallurgical College named after V.I. A.T. Tumanov;

- Orekhovsky Industrial College.

Institutions of higher professional education:

- Russian economic academy named after G.V. Plekhanov;

- High School of Economics;

- Russian School of Economics;

- Moscow State University named after M.V. Lomonosov;

- Moscow State Regional Social and Humanitarian Institute;

- Moscow State Regional University;

- International University of Nature, Society and Man "Dubna";

- Moscow State University of Instrument Engineering and Informatics. Branch in Chekhov.

Career

Career growth of a financial analyst is associated with advanced training. Knowledge of a foreign language and international financial reporting standards, new versions of computer programs increase the chances of building a successful career.

The professional growth of a financial analyst involves a managerial career, when a specialist, gradually improving, can be promoted to the position of financial director of an enterprise.

Source: "my-orientation.rf"

Profession financial analyst

The financial analyst is engaged in:

- analysis of the financial activities of the organization;

- analysis of trends and changes in the economy;

- financial forecasting at the organization level;

- advising on financial matters (eg accounting, cost reduction);

- preparation of financial statements.

- Places of work: Audit companies, Banks, Commercial companies.

- Salary, entry level: 30,000 rubles. - 50,000 rubles. Advanced level: RUB 50,000+, depending on location and work experience.

Will it suit me

Required Interests:

- economics and finance;

- maths;

- jurisprudence and law (especially taxation, commercial and business law);

- English language.

Required personal qualities:

- analytical thinking;

- critical thinking;

- attention to detail;

- a responsibility;

- good communication skills;

- teamwork skills;

- stress tolerance;

- ability to learn throughout life.

Difficulties are possible if not ready:

- to a high degree of responsibility;

- work with a large amount of information;

- if necessary, to an irregular work schedule.

If you want to change something, you can become:

- investment analyst;

- an economist;

- an appraiser (it is necessary to obtain a CPO appraiser certificate);

- an auditor (it is necessary to obtain a CPO auditor certificate);

- compliance manager.

Qualification

Higher education in the field of economics and finance, financial management.

It is desirable to obtain a CFA (Chartered Financial Analyst) certification.

Terms of study:

- Specialist (5 years);

- Bachelor's degree (4 years);

- Master (2 years).

Subjects required for admission to a university for higher education economic education(Economics and finance, financial management):

- maths;

- Russian language;

- social science;

- foreign language.

Source: "intalent.pro"

What does a financial analyst do

Relatively recently, such a profession as a financial analyst has appeared. The emergence of the profession accompanied the development of various agencies and enterprises that deal with economic diagnostics, as well as forecasting. commercial enterprises.

It should also be noted that the emergence and development of the profession contributed to the fact that for almost every start-up company that wants to succeed, it is necessary to have financial statistics with it, which will allow the company to correctly allocate funds, as well as help create anti-crisis plans in advance. It is because of this that the profession of a financial analyst is widespread in our time.

However, it should also be noted that thanks to a competent specialist in this field, one can not only successfully maintain a business, but also develop it, which is very important for those who decide to open a serious enterprise. It is the responsibility of a financial analyst to consider in advance the most profitable financial solutions for the firm, as well as calculate the benefit of the contributions of a particular firm.

With the help of an analyst, you can save quite a few amounts, while not risking losing the company's earnings. All this is possible by studying the marketing strategy, as well as by studying all the weaknesses and strengths of the company.

But it should be remembered that the analyst must, first of all, work with the company's documents, calculating its profit and loss, but for this, the financial analyst must be provided with a number of documents, without which his work will be impossible. It should also be said that the analyst is engaged in personnel departments, and his main work lies in the organization of the firm by considering various options.

However, the analyst does not take any action, his main task is to collect all the necessary data and provide them to his superiors. In addition, the financial analyst acts as an advisor to the head of the business.

Source: "fc-intime.com.ua"

Profession Analyst

Within this profession, you can find various positions:

- marketing analyst,

- financial analyst,

- securities market analyst

- investment analyst,

- system analyst (business analyst) and others.

The profession of an analyst is universal, a specialist in this field can work in:

- financial and investment companies,

- banking institutions,

- consulting companies,

- brokerage houses,

- international corporations.

The analyst has the right to choose:

- he can be a full-time employee,

- or independent, working directly with the customer.

Functional and job responsibilities

The functional responsibilities of an analyst depend on the position held, in different companies they may differ from each other.

The main duty of an analyst is the collection, generalization, analysis of information, forecasting future situation and providing basic guidance on how to conduct business.

In his work, an analyst can also engage in marketing research, conduct business correspondence with clients, work with documentation, and negotiate.

Qualifications

Employers have quite strict requirements for applicants for the position of analyst. The profession of an analyst usually requires higher education in economics/finance, statistics or information technology.

The analyst must know:

- market analysis methods,

- fundamentals of statistics

- have analytical skills

- skills to work with large volumes of information.

AT international companies one of the main requirements for an analyst is knowledge of a foreign language and document international standard about confirmation of professional level.

Analyst skills include:

- attentiveness,

- perseverance,

- observation,

- structural and analytical thinking,

- good memory.

Career and salary

Analyst pay increases as professional experience and length of service increases. Also, the salary level of an analyst depends on the position held, the nature of functional duties and the amount of responsibility.

The profession of an analyst is quite promising, it has good opportunities for career growth to the head of a department or financial director.

Source: "working-papers.ru"

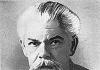

Damant David about the profession of a financial analyst

Damant David (EFFAS representative in the International Committee on Financial Reporting Standards, until 2000 - President of the European Federation of Financial Analyst Societies (EFFAS)):

The task of training highly qualified specialists in the field of market economy is very relevant.

What is the role of financial analysts in this process and what exactly do they do? The answer to these questions is by no means so simple, because the importance of these specialists is quite often misunderstood, even in countries with developed market economies.Let's start with a little historical digression. The first group of specialists who were professionally engaged in the analysis of the securities market arose in 1928 in Chicago.

However, until the end of the Second World War, the specialty "financial analyst" had not yet received a meaningful definition and official recognition in any country, including the United States. For example, the British Society of Investment Analysts (now the Institute of Investment Management and Research) was created only in 1955.

Thus, the specialty "financial analyst" is one of the youngest in the world.

The name of the profession includes the word “analyst”, to which various definitions are added: “financial”, “investment”, “securities market analyst”, etc. However, all definitions proceed from the fact that a specialist of this kind analyzes securities and the activities of companies, their issuers.

As part of these functions, a financial analyst must also analyze the economy as a whole, since the macroeconomic environment has the most direct impact on the activities of companies, the state of a particular industry, and the specifics of a company's activities in the market.

When analyzing the performance of a particular company, the financial analyst must pay attention not only to financial indicators (although they are extremely important), but also to the broader context of its activities. Thus, the work of a financial analyst includes an analysis of the main indicators: the macroeconomic climate, the effectiveness of financial and non-financial structures and company indicators, the quality of its management, etc.

You can often hear that financial analysts are "too short-sighted" - their attention is focused only on the indicators of the coming year. However, it is not. A study of the activities of this kind of specialists in many countries and the impact that their analysis has on prices in the securities market clearly shows that the role of analysts is similar to that of the top management of companies.

Thus, when planning the activities of their companies, their top management takes into account the same factors that are the object of study of analysts working outside the companies.

In a number of countries, I have heard more than once that the role of analysts is clear and understandable when it comes to corporate planning and attracting private equity (in industrial premises, equipment, real estate), but much less clear when it comes to portfolio investment, especially when valuing quoted securities.In fact, it is precisely in the capital market that the role of analysts is revealed most clearly and fully. Take as an example a well-organized exchange where liquid stocks and bonds trade freely between sellers and buyers, without the intervention of players who have any insider information.

As it turns out, only these factors are not enough for the effective functioning of the market. Sellers and buyers need to be confident that the prevailing price in the market is realistic in order to function properly.

And this can only be achieved if this confidence, as well as the behavior of the market as a whole, is based on forecasts and advice from professionals based on an analysis of both the economic situation in general and the prospects for a particular quoted security in particular.

Otherwise, transactions with securities would be carried out in the absence of an idea of their real prices, which would lead to large discounts on risks.

In other words, in the absence of recognized methods for valuing securities, their market will be at a significantly lower price level due to the fears of buyers who insure against possible adverse events.

It must be emphasized that the above circumstance, namely the availability of a qualified analysis of the development of the market situation, is extremely important for the successful development of the economy of a particular country.

It must be remembered that capital is very timid. If there is uncertainty in a country economic environment(due to poor reporting standards, lack of qualified financial analysts), then capital will always require a certain premium for its income and thus will cost more to this country.Accordingly, in relation to the companies of this country, the capital will act on the principle of "cold-hot".

Return and risk analysis

An important issue is the risks associated with uncertainty about future returns from companies in which investments have previously been made. In efficient markets, there is a clear relationship between risk and return. The assessment of this interdependence and the possibility of exchange between them is one of the most important areas of work for financial analysts.

The economy of any country greatly benefits if it has the opportunity for financial analysts to carry out such an assessment not only at the level of a specific transaction, but also for the market as a whole. The following main elements that make up the professional baggage of qualified financial analysts can be distinguished:

- First, it is a certain level of knowledge of the economy as a whole. The analyst must understand the mechanism of influence of macroeconomic factors and be well versed in issues of changes in interest rates and fluctuations in inflation.

- Secondly, he must have a very good knowledge of accounting and financial reporting, as well as experience in certain industries.

- Thirdly. If the analyst works with unquoted securities, then he must be able to carry out a particularly detailed study of the state of the object in which it is proposed to invest.

If he works in the market with quoted assets, then he should be familiar with the theory of markets and the changes that have taken place in it over the past 40 years.

- Fourth. He must understand how a particular market operates, what is its efficiency, the relationship between risks and profitability, and what are the possibilities of their interchange.

All these questions are very complex, but the answers to them are not built only on the basis of intuition, which is how the market itself differs from the casino. In well-organized markets, capital is able to act rationally despite the large fluctuations that occur in them.

These fluctuations, by the way, reflect the fact that the markets themselves cannot predict the future better than people. The task of analysts is precisely to understand the whole complex of problems associated with this.

Initially, most members of this new profession called themselves analysts. Recently, however, a number of organizations that bring together specialists in this profession have changed their names to reflect the fact that analysts are also involved in investment portfolio management.Thus, the US Federation of Investment Analysts became known as the Investment Management and Research Association. The British Society of Investment Analysts is now the Institute for Investment Management and Research.

In connection with the development of the practice of investment portfolio management, the corresponding theory has also been developed, which has become an integral part of professional knowledge that analysts must have.

An important element of the theory and practice of portfolio management has become its international diversification. This reflects, on the one hand, the significantly increased interconnection and interdependence of national economies, and, on the other hand, the benefits of such diversification, revealed in serious studies conducted in recent decades.

International portfolio diversification has become a very important area of professional activity.

This circumstance is of great practical importance for Russia, as international investors are beginning to consider Russian securities as an integral part of their portfolios, and not just as random one-time purchases. The arrival and then the mass exodus of foreign investors indeed gave rise, in a number of cases, to very significant fluctuations in national markets. Such incidents may recur in the future.

However, these upheavals cannot cancel the fact that there has been a real globalization of investment flows and the corresponding professional activity. Investors now have an interest in all markets, although not to the same extent.

This new situation must be taken into account in Russia and efforts should be focused on the formation of an efficient market, the creation of a favorable information environment that attracts investors, and the training of qualified specialists in the field of financial analysis and portfolio management.

Other Financial Analysis Applications

The training of specialists in the field of financial analysis in its broadest sense will have a positive effect and application in other areas. For example, in investment banking, in which financial analysts perform work very similar to that required in the formation and management of investment portfolios. There are, of course, some differences between these activities.

Thus, an investment bank is guided by the desire to raise funds for a certain project on behalf of a certain client, while a financial analyst working as part of portfolio management is guided by a more neutral view, recommending the purchase of certain shares.

However, highly qualified specialists - financial analysts are needed in both cases.

Training in financial analysis can be of great benefit to both government regulators and agencies responsible for implementing economic policy.At the same time, it is necessary to focus on really high qualification standards, and not on a limited set of knowledge and skills required for the current activities of narrow specialists (for example, a trader or investment consultant to private investors).

Qualification in the field of financial analysis should imply the presence of such a level of knowledge that allows this specialist to discuss at a high professional level a wide range of investment problems (including both direct and portfolio investments) and with various categories of interlocutors (company managers, investment consultants, representatives of public authorities). regulation).

It is possible that the considerations I have expressed seem obvious and too general. They are indeed obvious, however, despite this, many of them are ignored.

Therefore, their discussion, in my opinion, can contribute to the promotion of truly high standards of professional activity of financial analysts in all countries, including Russia. And this work needs to be done as soon as possible.

I think that the work of the GIFA, which began to create a national qualification program and organize regular qualifying examinations for obtaining a certificate of a certified financial analyst, recognized by the international professional community, has a very importance For Russia.The introduction of such a qualification will bring the discussion of professional problems in the field of investment to a new level. Investing has always been and remains a process in which it is impossible to make absolutely accurate forecasts. However, qualified professionals can and should help investors to gain a clear understanding of risks and their relationship to profitability.

APPROVE

CEO

Surname I.O. ________________

"________"_____________ ____ G.

- General provisions

1.1. The financial analyst belongs to the category of specialists.

1.2. A financial analyst is appointed to a position and dismissed from it by order.

1.3. The financial analyst reports directly to the head of the department / .

1.4. During the absence of a financial analyst, his rights and obligations are transferred to another official, which is announced in the order for the organization.

1.5. A person with a higher professional (economic or engineering) education and similar work experience is appointed to the position of a financial analyst.

1.6. The financial analyst should know:

- legislative and regulatory legal acts regulating production, economic and financial and economic activities;

- tax, civil, banking, administrative legislation, legislation on advertising, accounting, securities market;

- regulatory and teaching materials relating to the financial activities of the organization;

- prospects for the development of the organization;

- the state and prospects for the development of sales markets for products (works, services);

- distribution order financial resources, determining the effectiveness of financial investments;

- tax law.

1.7. The financial analyst is guided in his activities by:

- legislative acts RF;

- the Charter of the company, the Internal Labor Regulations, other regulatory acts of the company;

- orders and directives of the management;

- this job description.

- Functional responsibilities of a financial analyst

The Financial Analyst performs the following job responsibilities:

2.1. Analyzes the activities of the organization.

2.2. Analyzes financial information to predict economic conditions for further use in making investment decisions, to calculate future income and expenses.

2.3. Analyzes the feasibility of concluding contracts.

2.4. Collects economic, legal and industry information, as well as company financial reports and financial periodicals.

2.5. Collects data for financial reports.

2.6. Calculates financial ratios.

2.7. Performs financial research.

2.8. Assesses the level of financial risk.

2.9. Gives recommendations about the time of investment and purchase and sale transactions.

2.10. Prepares financial reports.

2.11. Uses statistical cost estimation methods.

- Rights of a financial analyst

The financial analyst has the right:

3.1. Request and receive necessary materials and documents relating to business matters.

3.2. Enter into relationships with departments of third-party institutions and organizations to resolve operational issues of production activities.

3.3. Represent the interests of the organization in third-party organizations.

3.4. Submit proposals for the management to improve the work related to the responsibilities provided for in this job description.

- Financial Analyst Responsibilities

The Financial Analyst is responsible for:

4.1. For non-performance and / or untimely, negligent performance of their official duties.

4.2. For non-compliance with current instructions, orders and orders for the preservation of trade secrets and confidential information.

4.3. For violation of the internal labor regulations, labor discipline, safety regulations and fire safety.

4.4. For offenses committed in the course of carrying out their activities - within the limits determined by the current administrative, criminal and civil legislation of the Russian Federation.

4.5. For causing material damage - within the limits determined by the current labor and civil legislation of the Russian Federation.

JOB DESCRIPTION OF A FINANCIAL ANALYST

I approve _____________________________ (Surname, initials) (name of the organization, its ________________________________ organizational - legal form) (director; other person authorized to approve the job description) 00.00.201_g. m.p. JOB INSTRUCTIONS FOR FINANCIAL ANALYST ----------------------- (name of institution) 00.00.201_g. №00 I. General provisions 1.1. This job description establishes the rights, responsibilities and duties of a financial analyst ____________________________ (hereinafter referred to as the "enterprise"). Name of institution 1.2. The financial analyst belongs to the category of specialists. 1.3. A person appointed to the position of a financial analyst must have: - higher economic or engineering economic education; - CFA (Certified Financial Analyst - certified financial analyst) certificates of the Institute of Certified Financial Analysts of the United States, or CIIA (Certified International Investment Analyst - certified international investment analyst) of the Association of International Investment Analysts ACIIA, or FRM (Financial Risk Manager - financial risk manager) of the Global Risk Association GARP; - at least _________ work experience in the specialty. 1.4. Appointment to the position of a financial analyst and dismissal from it is carried out on the basis of the order of the head of the enterprise on the proposal of ______________________________________. 1.5. The Financial Analyst reports directly to ____________________________. 1.6. The financial analyst should know: — tax, civil, banking, administrative legislation; — legislation on advertising, accounting, securities market; — regulatory and methodological materials relating to the financial activities of the company; - orders, instructions, instructions, instructions and other normative and administrative documents regulating the work of a financial analyst; — legislative and regulatory legal acts regulating industrial and economic and financial and economic activities; — macro- and microeconomics; — financial reporting and its analysis; — corporate finance; — portfolio investment management; - derivatives financial instruments, other financial market instruments; — alternative investments; — methods of analysis and evaluation equity companies; — corporate finance; — the state and prospects for the development of sales markets for products (works, services); - the procedure for the distribution of financial resources, determining the effectiveness of financial investments; — ways to evaluate and analyze fixed income securities; — assessment and management of credit risks, market risks, risks at the operational and corporate levels, legislative regulation and ethical standards risk management and investment management; — economics, organization of production, labor and management; - means of computer technology, telecommunications and communications; — basics of labor legislation; – company charter, internal labor regulations; — rules and norms of labor protection; — rules and norms of safety, industrial sanitation and fire protection; — professional ethics and standards; — Prospects for the development of the company. II. Job responsibilities The financial analyst performs the following job responsibilities: 2.1. Produces a systematic analysis of the financial information of the company's activities to calculate future income and expenses. 2.2. Analyzes the situation on the market of relevant goods (works, services). 2.3. Prepares financial reports and statistical observations of the company's activities, to illustrate which he draws up mathematical and statistical charts and graphs. 2.4. Analyzes information containing information about the company's financial activities in order to predict economic conditions for the purpose of their further use in making investment decisions. 2.5. Examines information on prices for goods (works, services) in order to determine trends in investment risks and economic events in order to determine the conditions and the moment of investment that are most favorable and beneficial for the company. 2.6. Provides advice on various financial matters. 2.7. Gives recommendations about the time of investment and transactions of purchase and sale. 2.8. Carries out the purchase of investments for the company in accordance with the policy of the company. 2.9. Selects relevant economic legal industry information, financial periodicals. 2.10. Collects and analyzes the information necessary for the subsequent preparation of the financial statements of the company and the calculation of financial indicators of its activities. 2.11. Carries out research and assessment of the level of the company's financial markets, paying attention to the current economic situation. 2.12. Analyzes the financial feasibility of concluding various civil law contracts and other transactions by the company. 2.13. Conducts financial market research of relevant goods, works or services. 2.14. Tracks modern tendencies and the most important events in various segments of the economy, the latest Scientific research in the field of economics, finance, securities market. 2.15. Keeps official and commercial secrets. 2.16. Complies with the rules of internal labor regulations, labor protection, safety, industrial sanitation and fire protection. 2.17. Contributes to the financial prosperity and well-being of the company. 2.18. Raises your professional level. III. Rights The financial analyst has the right to: 3.1. Contact the management of the enterprise: - with the requirements of assistance in the performance of their duties and rights; - with proposals for improving the work that is related to the responsibilities provided for in this instruction. 3.2. Sign and endorse documents within their competence. 3.3. Involve specialists from all (individual) structural divisions in solving the tasks assigned to him (if this is provided for by the provisions on structural divisions if not - with the permission of the head). 3.4. Get acquainted with the draft decisions of the management of the enterprise regarding its activities. 3.5. Represent the interests of the organization in third-party organizations on issues related to the production activities of the company. 3.6. Interact with employees of all departments. 3.7. Request and receive from heads of departments and other specialists information and documents necessary for the performance of their duties. IV. Responsibility The financial analyst is responsible for: 4.1. In case of causing material damage within the limits determined by the civil and labor legislation of the Russian Federation. 4.2. In the event of the commission of offenses in the course of carrying out its activities within the limits determined by the criminal, administrative and civil legislation of the Russian Federation. 4.3. In case of improper performance or non-performance of their official duties, which are provided for by this job description, within the limits determined by the labor legislation of the Russian Federation. : _____________ __________________ (signature) (surname, initials) 00.00.201_ I am familiar with the instructions, one copy received: _____________ __________________ (signature) (surname, initials) 00.00.20__