Programs for calculating the earnings of employees, maintaining history, tracking the activity of personnel.

↓ New in the category "Personnel, salary":

Free

PSAPU-Year 04.11 is a convenient application that will help to conduct a qualimetric analysis and statistical processing of student attendance for compulsory classes. The PSAPU-Year application will automatically create lists of absent students for any school day, as well as students who missed more than a third of classes for not entirely valid reasons.

Free  PSORUD-Uniform 02.11 is an application for checking results in learning activities. The PSORUD-Uniform application will be more convenient, as it saves time when entering the initial data about the school.

PSORUD-Uniform 02.11 is an application for checking results in learning activities. The PSORUD-Uniform application will be more convenient, as it saves time when entering the initial data about the school.

Free  Time sheet 2.4.2.19 is a convenient functional application for keeping records of work time for employees, as well as printing time sheets and duty schedules.

Time sheet 2.4.2.19 is a convenient functional application for keeping records of work time for employees, as well as printing time sheets and duty schedules.

Free  Employees of the enterprise 2.6.8 is an application to facilitate record keeping by employees of the personnel department. The program has the ability to separate the possibilities by the obtained access rights and group the rights for different categories of users.

Employees of the enterprise 2.6.8 is an application to facilitate record keeping by employees of the personnel department. The program has the ability to separate the possibilities by the obtained access rights and group the rights for different categories of users.

Free  Warehouse and trade 2.155 is an organization application wholesale and retail trade and warehouse accounting. The application has a unified and highly customizable interface. The application also contains a large database with the ability to customize its subject matter for each user.

Warehouse and trade 2.155 is an organization application wholesale and retail trade and warehouse accounting. The application has a unified and highly customizable interface. The application also contains a large database with the ability to customize its subject matter for each user.

Free  Seniority Calculator 6.1.1 is a program for calculating seniority, examining records in work book. The Seniority Calculator program will good helper for accountants and personnel departments. The program also has the ability to calculate the length of service, taking into account the coefficients, calculating exact amount years, months and days that have passed between the dates of the device and work, as well as counting only the days - calendar and working.

Seniority Calculator 6.1.1 is a program for calculating seniority, examining records in work book. The Seniority Calculator program will good helper for accountants and personnel departments. The program also has the ability to calculate the length of service, taking into account the coefficients, calculating exact amount years, months and days that have passed between the dates of the device and work, as well as counting only the days - calendar and working.

Free  The calculation of experience 1.3 is a program for the number of years, months and days. The program "Calculation of experience" makes it possible to enter several periods of work, in addition, the calculation will be carried out by the number of years, months and days for each period, and the general and continuous experience.

The calculation of experience 1.3 is a program for the number of years, months and days. The program "Calculation of experience" makes it possible to enter several periods of work, in addition, the calculation will be carried out by the number of years, months and days for each period, and the general and continuous experience.

Free  Payroll in MS Excel 4.2 is a convenient electronic form of calculation wages in MS Excel, with minimal manual input. The Payroll program will be able to automatically calculate all the necessary payroll taxes, including Social Security, UST, health insurance, income tax, and the like.

Payroll in MS Excel 4.2 is a convenient electronic form of calculation wages in MS Excel, with minimal manual input. The Payroll program will be able to automatically calculate all the necessary payroll taxes, including Social Security, UST, health insurance, income tax, and the like.

Free  Human Resources 6.0 is a human resources program. The Human Resources Department program makes it possible to create a personal card for an employee, his staff list and print out all personnel orders. The program also allows you to a large number of a variety of reports and calculate the total or continuous experience for employees.

Human Resources 6.0 is a human resources program. The Human Resources Department program makes it possible to create a personal card for an employee, his staff list and print out all personnel orders. The program also allows you to a large number of a variety of reports and calculate the total or continuous experience for employees.

The payroll program is designed to calculate wages for employees of the enterprise and income of third-party individuals under civil law contracts, calculate the amounts of mandatory insurance premiums and personal income tax (hereinafter referred to as personal income tax), generate primary accounting documents for payroll: time sheets , sick leave, vacation pay, compensation for unused vacation upon dismissal. The program also allows you to generate primary documents for the calculation and payment of wages: payroll, payroll and standard accounting reports: turnover sheet, calculation of insurance premiums, summary report in the context of accrual and deduction transactions. There is a function for exporting data in xml format for submitting information on 2-personal income tax in electronic form to the Federal Tax Service and SZV-6-4 and RSV-1 to the Pension Fund, as well as several types of salary certificates for the specified employee.

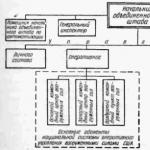

The main menu items of the program "Payroll":

1. Reference books

Enterprise employees- a directory of employees of the enterprise containing information about the employee: last name, first name, patronymic, passport details, registration address, date of birth and other data of an individual.

Organizations- a directory of counterparties of the enterprise, suppliers, buyers, debtors and creditors. Each entry contains basic information about the counterparty: name, legal address, TIN, KPP, current account number and bank details, corresponding account, bank BIC and bank name. It should be noted that when entering information into the directory, the program checks the correctness of the specified TIN and the account number of the counterparty. If you have access to the Internet, it is also possible to check the compliance of the specified TIN, name and address of the counterparty with data from the Unified State Register of Legal Entities, which is the simplest verification of the supplier for reliability. Additional fields contain reference information: contact persons, phone numbers, e-mail address, etc.

Sites (subdivisions) of the enterprise- directory of subdivisions (sections, departments) of the enterprise.

Types of work schedules- a directory of types of work schedules used at your enterprise.

Program Constants- constants used in the program "Payroll": in this paragraph, the rates of insurance premiums are indicated.

Types of accruals- a directory of types of payroll calculations.

Types of deductions- directory of types of deductions from wages.

Details of your own organization– constants of your company: abbreviated and full name, legal address, TIN, KPP, full name of the head and chief accountant, as well as bank details.

- the function of importing data into the employee directory from the information files in the FIU.

- the function of importing data into the employee directory from the files of information on income and personal income tax withheld.

2. Data

Employee balances- menu item for the initial entry of balances in the context of employees on account 70.

Calculation- this item contains three submenus: charges, retention, .

In the "Accruals" submenu, you can view all operations on the accrued salary, add them, and perform the accrual time payment. The "Deductions" submenu contains functionality for calculating personal income tax, viewing, entering and adjusting all deduction transactions, generating salary and advance payment transactions. Menu item

is designed to calculate insurance premiums and generate payment orders for their payment.

Savings base for the year- a menu item for entering 2-NDFL certificates for new employees for the correct calculation of the amount of standard deductions and personal income tax.

- adjustment production calendar for the current year.

- creation and adjustment of work schedules for employees used at your enterprise.

- creation, filling, correction and formation of the printed form T-13 of the time sheet.

Transition to a new month- Change of payroll month.

Return to the previous month- return to the previous billing month.

Import transactions (out of 71, 60)- import of amounts (Dt 70 Kt 70) subject to personal income tax from the modules "Settlements with accountable persons", "Settlements with enterprises".

- a point intended for the formation of documents: a payroll in the form of T-53 for the payment of wages through the cash desk of the enterprise, a report for the transfer of wages to bank cards and personal accounts of employees.

3. Reports

Payslip with posting dates- an item designed to generate a payslip for an employee.

Payslip- formation of a unified form No. T-51 of the payroll.

Payroll for payroll- formation of a unified form No. T-53

Account turnover sheet- formation of a standard turnover sheet for account 70.

Correspondent accounts results- a report with the results of the corresponding accounting accounts.

Tax cards- menu for the formation of a tax card and a card for recording insurance premiums.

Employee certificates - a menu containing items for generating the following forms of certificates and applications: certificate of average salary, application for standard tax deductions, certificate in form 2-NDFL, employee payslip for specified period, certificate in accordance with Appendix No. 1 to the order of the Ministry of Labor and social protection Russian Federation dated April 30, 2013 No. 182n.

Data export- a menu designed to export data in XML format to the Pension Fund and the Federal Tax Service: unloading 2-NDFL (Format 2011-2013, Version 5.02 xml), .

- the item is used to generate a regulated report on Form 4-FSS, submitted to the Social Insurance Fund.

4. Service- the menu contains the service functions Packing and Reindexing, as well as the journal of applications for the production of plastic cards. (The journal of applications for payroll projects for the issuance of plastic cards).

Calculation of contributions to the PFR, FSS and CHI

To calculate contributions to the Pension Fund, the Social Insurance Fund and compulsory medical insurance in this paragraph, click the button "Calculation for the current month". The program will calculate insurance premiums for personalized accounting in the Pension Fund of the Russian Federation, mandatory contributions to the Social Insurance Fund and Compulsory Medical Insurance, and the formation of accident insurance deductions for employees will also be made. The rates of deductions for insurance against industrial accidents can be specified in the item "Reference books", "Program constants" using the button "Accrual postings and CB rates".

The "Report" button allows you to generate a report broken down by employees on accrued insurance premiums, and the functionality of the "Summary report" button is necessary to obtain a report with summary data on cost accounts and accounting entries.

We also consider the function of generating payment orders for the payment of personal income tax and insurance premiums to be very useful for the user. Set up this function yourself by selecting already sent payment orders and in the future the process of their creation will take a minimum of your time after the payroll.

Working days calendar

This menu item is necessary to adjust the working days calendar in accordance with the current legislation. The data from the calendar will be used to calculate the number of working days and hours for a standard work schedule: 5 days 40 hours work week. The day type is adjusted by clicking the right mouse button to bring up the day type menu.

Work schedules

Specify the type of schedule from the directory (for example, “5-day schedule”) and using the “Fill” button, you will receive a standard schedule based on the working days calendar data. Similarly, you can create individual work schedules used in your company. To adjust the hours according to the schedule, you need to select the desired day of the month and correct the number of hours.

Time sheet

The time sheet is the main primary document for the calculation and payroll. The payroll program offered to your attention very flexibly allows you to form the specified primary document: for the specified period, for the entire enterprise or division. The logic of the timesheet generation algorithm also includes the differentiation of access rights. This will be relevant if the time sheet is signed and corrected by the head of the department (the priority of the user of the intangible asset program for the Payroll module must be set to less than 99), and the document is checked and payroll is performed by an accountant. In the simplest case, the program allows you to get a time sheet in the form T-13 in the shortest possible time.

To add a new document, click the " F5 New Timesheet". In the form window, specify the billing month, the period with the start and end dates inclusive, for which the time sheet will be generated within the specified month, and the person responsible for compiling this document.

Next, click the " F4 View Timesheet» and using the button « Ins Add list» Add employees to the timesheet. When selecting all employees from the list, use the "Mark all" button. When selecting employees to add to the document, it is convenient to use the filter by department: the “ F9 Filter by division". Button " F10 Select to Timesheet» completes the selection of employees and adds the marked lines to our document. When adding an employee, the date of hiring and the date of dismissal, registered sick leaves (module accounting and registration of incoming and outgoing documents), as well as orders for granting leave in the "Personnel" module are checked.

If necessary, you can make adjustments for the selected employee: using the right mouse button, specify the reasons for leaving or absenteeism by selecting the one you need from the list, and in the hours field, specify the actual hours worked. The letter code will be entered automatically depending on the selected position in the list.

To generate a printed form of the time sheet T-13 in the list, press the button "F9 Print T-13".

The form also contains additional functionality to manage the selected document:

« Close timesheet» - a button for prohibiting making corrections to the document,

« Open timesheet» - open a document for correction,

« F11 Payroll"- automatic payroll according to the timesheet, the formation of operations in the table"Payroll",

« Accrual rollback» - canceling payroll: deleting operations in the Payroll table.

Payroll Example

Consider, using a small example, how to calculate salary in the program of intangible assets "Payroll". Suppose you need to calculate the salary for September 2012 according to staffing for 5 people:

Table for our example

We believe that in our example, the time sheet has already been provided. In the employee directory, we indicate salaries and tariffs according to the staffing table. Select the item "Data", "Calculation", "Accruals", "Accumulation of time payment".

As a result of these actions, amounts will be accrued according to the salaries and tariffs specified in the employee directory based on the total hours worked according to the calendar of working days in September 2012.

Next, select the item "Data", "Calculation", "Accruals", "All payroll operations", payroll operations will appear in the list that opens.

By choosing required employee, we can adjust the hours worked, and the accrued amount for the operation will be calculated automatically depending on the salary or tariff specified in the directory for the selected employee. Next, you need to calculate the personal income tax. To do this, select the item "Data", "Calculation", "Hold", "Calculation of Income Tax (PIT)".

In the paragraph "All withholding on withholding" operations for withholding personal income tax (PIT) will be displayed.

At this stage, the payroll and tax calculation operations are completed. Next, we will generate the necessary reports.

By selecting the menu item "Reports", "Payroll" you can get payroll in the form No. T-51.

If you choose the item "Payroll for payroll", then we will be able to receive a payroll in the form No. T-53.

In the payroll generation dialog box, you can specify Extra options: division of the enterprise, period of formation of the payroll, details of the payroll.

The output form obtained when calculating the salary in our example is as follows:

As standard reports, the “Account Turnover Statement” is also used. If we pay attention to the turnover sheet, we will notice that the payment of wages has not yet been made. In accounting, the payment transaction, as a rule, occurs in the next billing month. In our example, to do this, you need to change the billing month by selecting the "Data" menu item, "Transition to a new month". After performing the specified operation, the balances at the beginning of the month will be recalculated, and the data for September 2012 will be archived. Further, let's say, on October 15, 2012, a salary was paid according to the payroll we generated. To reflect the payroll transaction in accounting, select "Data", "Calculation", "Deductions", "Payroll". According to the balances at the beginning of the billing month, salary payment operations will be formed.

Payroll journal

This menu item is used to prepare payroll documents. By selecting this item, you can create the following documents: a payroll for payment through the company's cash desk, a report for transferring salaries to bank cards. To add a new document, press the "F5 Add" button.

In the window that opens, specify the type of salary payment: through the cash desk of the enterprise or by transfer through the bank from the current account, and the month for which the salary is paid. When generating a document, you can use various filters: by division (section) of the enterprise, by the range of personnel numbers, by the sign “fired” (the date of dismissal is indicated in the employee directory). To calculate the amount payable, you can specify the payout percentage from total amount for issuance, the rules for rounding the amount: exactly to kopecks, to the ruble without kopecks, to the ruble according to the rounding rules.

After adding the document, its contents will be filled in - a list of employees with the amount of payment. When paying through the cash desk, you can print the payroll and withdraw money by check at the bank. After paying salaries through the cashier or write-off Money from the settlement account on the payment order to the cards of employees, it is necessary to reflect the issuance of accounting entries in the withholding table. Use the "F10 Postings for issuance" button for this.

Import of data about employees of their files with individual information to the Pension Fund of the Russian Federation and the Federal Tax Service in XML format

To automatically fill in data about an employee in the directory in the main menu of the program "Payroll" select the menu item "References", and then - "Import of employee data from the SZV-6-1(2) XML file to the PFR". In the form window that opens, by clicking the "Select PFR file" button, specify the file with information SZV-6-1 or SZV-6-2, already submitted to the PFR, in XML format. Then click the "Read Data to Table" button. If the file conforms to the required XML format, the table will display the data contained in the specified file. By clicking the "Import data into the employee directory" button, you can automatically receive employee cards in the directory with the fields filled in: last name, first name, patronymic, insurance number (SNILS), address for information transferred to the Pension Fund. Adding an employee who is not in the directory, generating his personnel number and filling in the address for the PF will be done by the program. If the employee has already been added to the directory, the program will identify him by his full name or insurance number and update the information in his card. Thus, it is possible to import several files for the PFR (including it will not be a mistake to specify the same XML file several times) and get a correctly completed directory.

To receive and import data about your employees from a file for the IFTS containing information on the 2-NDFL form in XML format (format version 5.02), select the menu item "Import of employee data from the 2-NDFL XML file to the IFTS". In the import form window, by clicking the "Select 2-NDFL file" button, specify the file with 2-NDFL information presented in tax office, in XML format (Format version 5.02). Then click the "Read Data to Table" button. If the file corresponds to the required information format 5.02 XML, then the table will display the data contained in the file you specified. By specifying the setting "Copy registration address to the address for the PF", the registration address of the employee according to KLADR will be checked and copied into the address fields to inform the PF. By clicking the "Import data into the employee directory" button, you can automatically receive employee cards in the directory with the fields filled in: last name, first name, patronymic, TIN, date of birth, citizenship, registration address. Adding an employee who is not in the directory, calculating and assigning a personnel number to him, as well as filling in the information fields indicated above, will be performed by the program. An employee is identified by TIN, full name and date of birth. Thus, if an employee has already been added to the directory, the program will identify him and update the information in his card.

We recommend the following import sequence from your files in XML format: first, import the 2-NFDL information, and then import the SZV-6-1 and SZV-6-2 information into the FIU, since the requirements for the address in the FIU when receiving information are more stricter than in the IFTS.

Presentation of personalized accounting information. Forms SZV-6-4, ADV-6-2 and RSV-1

To generate information on the amount of payments and other remunerations, on accrued and paid insurance premiums for compulsory pension insurance and the insurance period of the insured person (Form SZV-6-4), select the menu item "Reports", sub-item "Data export", sub-item “Data in the Pension Fund of the Russian Federation (format SZV-6-4) from 01.01.2013”.

Let's consider the main functions of the screen form "Registration log in the form SZV-6-4 from 01.01.2013" in more detail:

Remains in the FIU- a function designed to enter debt to the Pension Fund in the context of employees of the enterprise. The balance of debts by employees is necessary for the correct automatic distribution of the total amount of paid insurance premiums for the reporting period.

Add period– screen form button for adding a new reporting period. Information about balances by employees from the previous reporting period will be transferred automatically.

Information SZV 6-4– this function is used to call the view form and generate SZV-6-4 information.

If you add a new reporting period, you will see empty list. Click the button "F9 import contributions and cards", then in the dialog box "Import data on accrued insurance premiums and length of service", be sure to specify the "Type of import":

1 Import according to the directory of employees- is used if you do not use the "Personnel" module of the NMA program. The algorithm for the formation of seniority for the reporting period in this case uses the fields of the Employees directory: the date of admission and the date of dismissal. If the date of dismissal is not specified, it is considered that the employee is working to the present.

2 Import by orders of personnel records– this kind of data import better use when full control personnel records in the "Personnel" module, including the execution and registration of orders for admission, orders for granting administrative leave for own will employee, dismissal orders, as well as registration of temporary disability sheets indicating the period in the module "Accounting and registration of documents".

Next, click the "Run" button. The import algorithm will create new detail cards and populate them with the required information. Using button "F4-Card" You can view the SZV-6-4 form in full:

A function "F10 Payment Calculation" allows you to distribute the amount of paid insurance premiums among employees:

The amounts of paid insurance premiums for the reporting period will be calculated on the basis of data on the movement on the current accounts of your enterprise in the "Bank" module. If you do not use the "Bank" program, enter the correct amounts in the appropriate fields. The algorithm for distributing these amounts is as follows: at the first stage, the balance of debts at the beginning of the reporting period is closed, then at the second stage, the balance of the debt will be distributed among employees dismissed during the reporting period, and finally, at the third stage, the balance of the payment amount is distributed in proportion to the amount of accrued contributions . So, when you received the information registers filled with data using the functions described above in the form SZV-6-4, you distributed the amount of paid insurance premiums among employees. Now you can return to the “information log in the form SZV-6-4 from 01.01.2013” and start recording information SVZ-6-4, inventory ADV-6-2 in XML format and reporting RSV-1 PFR.

Write XML SZV-6-4- this function is used to record information in the SZV-6-4 form to the folder you specified. Do not forget to indicate the number of the pack from which you want to number the packs with information. The pack number for inventory ADV-6-2 and its creation will be done automatically.

Formation of RSV-1- a button designed to generate a "Calculation on accrued and paid insurance premiums for compulsory pension insurance to the Pension Fund of the Russian Federation and for compulsory health insurance to the Federal Compulsory Medical Insurance Fund by payers of insurance premiums making payments and other remunerations individuals", according to Appendix No. 1 to the order of the Ministry of Labor of Russia dated December 28, 2012 No. 639n. Please note that the data for filling in line 100 "debt at the beginning of the billing period" will be calculated based on the data synthetic accounting. The algorithm for the formation of RSV-1 PFR refers to the balances of the corresponding sub-accounts in the module for the chief accountant "Journal of Business Transactions". The indicated balances on account 69 can be entered in the module "Journal of business operations", item "Data", "Account balances". The calculation can be generated in printed form and written to the specified folder in XML format. To check the uploaded information, use one of the verification programs recommended by the FIU.

Calculation submitted to the FSS (form 4-FSS from the 2nd quarter of 2013)

To generate a regulated report according to Form 4-FSS (valid starting from the 2nd quarter of 2013), in the Payroll program, select the "Reports" item. The calculation form is filled out on the basis of data on the accrued salary and calculated insurance premiums in the "Calculation", "Calculation of contributions" paragraph and the constants specified in the "Details of your own organization" paragraph. To fill out the form on the “Title” tab, specify the period for the calculation (usually the previous quarter), the date the calculation was made and click the “Fill with data from the payroll” button.

On the this moment The following sections are automatically filled in: Title page, Table 1 , Table 2, Table 3, Tables 6 and 7. The data of the table, with the exception of Table 2, are mandatory for submitting the calculation to the FSS. To generate a printed form of the report, click the "Generate Form 4-FSS" button. The report will be generated in MS Excel format.

Copyright © 2018, site

All rights reserved. Copying of materials is permitted only with the written permission of the administration.

Description:

Recently, employers have begun to cheat with wages more and more often? You come, they say that they will pay one thing, but in fact another (does not take into account hours worked). To calculate your salary, use a special calculator. With this application, you can easily calculate your salary for a calendar month, see the amount earned per day or shift. Distinctive features:

- convenient;

- very accurate calculation;

- the ability to create shifts;

- the ability to set your% for working hours;

- free;

- accounting of worked shifts;

- does not contain ads.

Main screen:

After launch salary calculator we get on main screen. At the bottom of the screen are two buttons: add and filter. To add a new shift, click on the "Add" button, then select a date, add a shift and select a place of work. "Place of work" is useful only if you work at several jobs. To add a shift, click on the green "+" on the right side of the screen. In the shift, specify the name of the shift, the start and end time of work, salary per hour, and%. After entering all the data, click the "Save" button.

All saved shifts (days) are displayed as a list on the main screen. With the filter you can filter your salary by month. Your salary for the selected month is displayed at the bottom of the screen, which is quite convenient. It is a pity that the application does not have additional settings, for example, setting shifts two days after two, or there is no calculation of income tax and transfers to the pension fund.

In any, even a small organization, there is a staff. In order for employees to calculate wages, they must be entered in specialized program- frames. Such a program for the personnel department as 1C has gained great popularity. Of course, this application does an excellent job with the tasks, but it is paid.

Newly opened organizations sometimes cannot afford the installation of 1c frames. Therefore, it is recommended to consider other programs that are distributed free of charge, but also do their job well.

Choosing a program for personnel

On the Internet you can find more than a dozen programs that will facilitate the work of a personnel officer. Do not rush to install the first application that comes across. It is necessary to conduct a small analysis, and then compare all paid and free programs. Most often, personnel officers use the following software:

Each of the above programs is unique, while all of them are suitable for work. personnel services. It should be noted that some of the programs are free, and others are paid.

The 1C Personnel program is designed for personnel records, as well as payroll. The application works with budgetary and self-supporting financing. The program can be designed to organize the accounting of employees, register office premises, as well as to receive background information by staffing.

The main features include:

- Payroll preparation;

- Creation of a staffing table;

- Personnel accounting;

- Taxation;

- Formation of reporting;

- Possibility of accounting for hours worked;

- Work with wage funds.

The program occupies a leading position in terms of popularity. The only downside of the app is that it's paid.

A program designed for personnel accounting. Thanks to the application, the personnel officer can take into account the employees of the enterprise, as well as generate all the necessary orders. The program is paid, it can be purchased for 1500 rubles. If you do not want to pay money, it is recommended to use the free version of the product - Mini-frames. Of course, the free version is a bit truncated, but its functionality will be enough for the main work.

The main features of the program:

- Creation of an employee profile, with all the data (name, photo, education, etc.);

- Maintaining the "calendar" of the personnel officer (visits, absenteeism, sick leave);

- Making report;

- Print required documents.

The program has an intuitive interface, so even an inexperienced user can handle the work. It should be noted that the application also has a network version.

The Human Resources program occupies a leading position among free applications designed for personnel records. If you wish, you can purchase a license, the cost of which does not exceed 1000 rubles per year. In this case, you get additional functionality.

The program can keep track of data such as:

- Taxation;

- Holidays;

- sick leave;

- Employee card;

- Business trips;

- moving;

- Debts.

You can work with the Salary and Personnel program not only through a computer, but also through the Internet, that is, a mobile device can be used for these purposes.

This is a free application designed for personnel work. Unlike many programs, "Enterprise Employees" allows you to manage several organizations at once. To make it easier to work with the application, the developers have provided the ability to work with three accounts: Administrator, User and Guest. In the first case, you can create and edit entries. Concerning account"User", it only allows you to fill in the already created databases and documents. The guest can only view the finished documentation.

The main features of the program include:

- Ability to capture the camera (to get a photo of an employee);

- Work with the scanner;

- Creation of employment contracts;

- Development of new templates;

- Creation of orders;

- Ability to calculate vacation and work experience;

- Maintaining time sheets;

- Reminder of the need to undergo a medical examination;

- Uploading documents to Word and Excel;

- Sending documents for printing.

The program has network access, which means that several employees can work with it at once. The number of jobs in the program is not limited.

This is a multifunctional program that contributes to the improved work of the personnel department. It should be noted right away that the application is paid, but it can be used in test mode for 55 days. This time is enough to fully explore the functionality and understand whether the application is suitable for working in your company.

The main functions of "Personnel Plus":

- Creation of cards for each employee;

- Accounting for working hours;

- Organization structuring;

- Job classification;

- Formation of time sheets;

- Creation of all necessary orders;

- Calculation of the employee's length of service;

- Accounting for the movement of each employee;

- Creation of templates for any documents;

- Export documentation to Excel;

- Vacation calculation.

This is an incomplete list of program features. More details about the functionality can be found on the official website of the developers. It is noteworthy that the application can be installed even on weak computers running Windows XP.

The personnel department is a multifunctional program that can replace even 1C. It should be immediately noted that the application is paid. Developers provide budget and government organizations 30% discount.

The interface of the program is intuitive, so there should not be any difficulties in the work. Of course, at first there may be some misunderstandings, since the "HR Department" is equipped with large quantity functions. Over time, all the work will be done automatically.

The main functions of the application:

- Creation of a detailed employee card;

- Import/Export of data from 1C;

- Creation of personnel documents;

- Drawing up a staffing table;

- Calculation of all types of experience;

- Connection of any type of classifier;

- Accounting for vacations and business trips;

- Export of data for sending to the FIU;

- Working with standard reports;

- Organization statistics (free and occupied units).

In fact, this is not the whole list of what the program can do. You can work with the program over the network. If necessary, you can connect an additional employee, but you will have to pay for each account.

Professional application necessary for personnel work. Thanks to the "Personnel Business" program, automation is carried out personnel office work. The program is aimed at organizations that do not have an independent personnel service.

It is not difficult to manage the program, so anyone responsible for personnel work employee. Even an unprepared "personnel officer" will be able to keep a full-fledged personnel record. The version "Personnel Business" is distributed free of charge. If necessary, you can upgrade to the "Pro" version, but for a fee.

Program functionality:

- Maintaining employee records;

- Tracking of movements and appointments;

- staffing;

- Time sheet;

- Calculation of experience;

- Planning career development employees;

- Work with normative documents;

- Printing of necessary documents;

- Creation of text and graphic statistics;

- Database backup;

- Ability to maintain reference and regulatory documents.

Thanks to the ability to create queries, you can extract any information from the database. At the same time, a similar procedure can be performed by the personnel officer himself without the involvement of a system administrator.

Conclusion

Don't underestimate free software. They cope with the tasks no worse than paid products. Of course, they may have some nuances, but this does not greatly affect the work. Of the paid products, it is recommended to pay Special attention 1C Personnel and Personnel Department. As for free software, Business Personnel is an excellent solution. Need to compare software products, and then choose the one that best suits your organization.

Video review of the program

It's not only payroll program, but also a tool for maintaining personnel records in the enterprise. It calculates taxes and contributions, generates the necessary reports in the IFTS, PF, FSS, both in printed and electronic form.

Attention!

The "Salary and Personnel" program is not needed for those who use or plan to purchase our other product - "", because. it already contains the "Salary and Personnel" module.And small and big

We are proud of our salary program! After all, it suits both small organizations and entrepreneurs, as well as large holdings with an extensive network of branches. Regardless of the taxation regime: ORN, USN, ESHN, UTII and the accounting policy of the enterprise, it will suit you just in time. And if you have several enterprises, then it is possible to maintain a consolidated accounting of all of them in a single database. Payroll setup tools allow you to adapt the program to your tasks and volumes.

Getting started is easy

If you use other programs to calculate salaries, and perhaps not for the first year, then you do not need to enter everything again! "Salary and Human Resources" processes and downloads data from all existing formats approved by the pension fund and tax authorities: from information on the income of individuals, bundles of personalized records, etc., both from existing formats and outdated ones. It remains only to add data on current accruals and start counting!

It is easy to adjust it both for an enterprise with a dedicated personnel department, and for an organization in which payroll is calculated by one specialist. There are many different enterprises and accounting schemes are sometimes very different, but for each case there are settings available to the average user that allow for efficient work.

Personnel

You will be able to keep records of personnel and personal data of employees, keep a personal card, store data for the military registration and enlistment office. Personnel transfers of employees, promotions, business trips, etc. everything is taken into account in a special journal of orders with a printout of the established forms of documents. To create personnel orders, a special wizard is provided, with the help of which it is easy and clear to enter data. The Salary and Human Resources program provides for three fundamental different options integration of personnel records and payroll. The personnel department and the payers will not interfere with each other!

The personnel officer will benefit from special reports on personnel: various registers and lists; reports on birthdays, length of service, children, relatives; detailed information on admission and dismissal; holiday reports, etc.

Payroll in the program

Simplified calculation, step-by-step calculation, built-in interactive editors for data entry, group operations and already included in the standard version. By purchasing our payroll program, you get more than 70 various kinds accruals: from salary and bonuses to royalties, all types of allowances, additional payments, compensations, regional coefficients and northern allowances, prizes, gifts and various accruals for tax agents. But with the help of customizable calculation formulas, you can create your own unique accruals, which will also be calculated automatically.

Our salary program includes all possible types calculations from the average: calculation sick leave, maternity, allowances for the care of a child, a disabled person, various types of vacations and compensations, travel allowances, donor allowances, etc. Intricate legislative schemes for such calculations in Info-Enterprise become understandable and logical. It is also important that the system allows an experienced calculator to make adjustments to sick leave calculations at all stages of calculation, taking into account non-standard life situations. For you, it will not be a mysterious black box, issuing results from nowhere. Everything is visible here, everything can be configured and everything can be changed.

Access rights

Our payroll software can be configured both for close coordination of personnel services and payers, and indirect work. The differentiation of rights allows you to block access to confidential information from unauthorized persons about the amounts of accruals, prioritize the possibilities for editing and displaying individual transactions and documents. Correct installation and setting rights allows you to comply with the provisions of the law "On Personal Data".

|

|

|

Reports to the Pension Fund, Social Insurance Fund, personal income tax to the tax

The product is regularly updated both via the Internet and through the partner network. This is very important due to constant changes in legislation.

In addition to calculating salaries, the program allows you to print the necessary reports and upload them in electronic format for transfer to the tax, pension, FSS. However, today it is important not only to generate reports, but also to be sure of the correctness of their calculation. For this purpose, modules for monitoring and diagnosing the correctness of the calculation of taxes and contributions are built into all reports. In addition, it has a whole set of reports that allow you to analyze the amount of taxes and contributions and the bases for their calculation in a variety of ways.

Personalized accounting

You will be able not only to calculate the salary in the program, but also to generate reports to the Pension Fund and individual information on personalized accounting. All this is done completely automatically! Everything counts possible features length of service: temporary disability, maternity and parental leave, unpaid leave, work under civil law contracts, etc. Data on special working conditions, list position codes are automatically generated. The amounts of paid insurance premiums are automatically calculated individually for each employee. And if the result does not suit you, you can always edit the data on the packs. To do this, our payroll program provides a special log of packs, where the accountant can arbitrarily edit information, transfer employees between packs, etc.

Integration

Our payroll program is easily integrated into the company's accounting system. In addition, you can use our other product - "", which already contains the "Salary and Human Resources" module. You can also upgrade the program "Salary and Personnel" to "Accounting" at any time in order to keep all accounting in the program.

Technical support

Every year we improve the quality of users. Instantly respond to the problem, quickly understand the situation - this is our primary task. In addition to traditional services such as a hotline, Email, user suggestions tracking system, technical support forum, etc. We offer a "Remote Support" service. No matter what city you are in, with the help of it, most issues are resolved in a matter of minutes.