A practical instrument of protectionist policy is the customs regulation of foreign trade. Exist two main groups of methods of protectionism: customs-tariff and non-tariff. Customs tariff methods involve the establishment and collection of various customs duties for foreign trade activities. Non-tariff methods, which number up to 50, are associated with the establishment of various prohibitions, quotas, licenses and restrictions in the field of foreign trade. In fact, the foreign trade policy of any country is based on a combination of these two groups of methods.

Customs tariff methods of regulation

The most common and traditional way is the customs duty.

customs duty- this is an indirect tax that is levied on goods imported or exported from the customs territory, and which cannot be changed depending on two factors: the general level of taxation and the cost of services provided by customs.

Since the customs duty is an indirect tax, it affects the price of the goods. In customs practice, only movable tangible property is called a commodity.

Customs territory- this is the territory in which the control over exports and imports is carried out by a single customs institution. The boundaries of the customs territory may not coincide with the border of the state. For example, with customs unions of several states. Or when, due to geographical conditions, the establishment of customs control is not possible or convenient. The borders of the customs territory are established by the government of each country.

Customs duty has two essential features. Firstly, it can only be withdrawn by the state. And so it goes to the state (federal), and not the local budget. Secondly, import duty applies to goods of foreign origin. And export (albeit an atypical type of duty) - to domestically produced goods. In this regard, an important problem in customs practice is the correct and precise definition country of origin of the goods. The schematic diagram of the customs tariff is as follows:

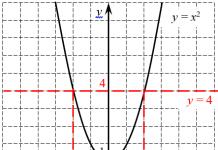

The product code is determined according to the harmonized system of description and coding of goods (HS) generally accepted in the world. According to the method of calculating duties, they can be: 1) ad valorem; 2) specific; 3) combined.

Ad valorem duties are set as a percentage of the customs value of the goods. Specific - depending on the units of measurement of goods (for 1 ton, for 1 piece, for 1 cm 3, etc.). Combined combines ad valorem and specific accruals. Customs duty rates are associated with various regimes of foreign trade activity. The minimum rate (called the base rate) is set for goods originating from countries with which there is an agreement on the most favored nation in trade (MFN). Maximum - for countries with which no MFN agreement has been concluded. The preferential, or preferential, rate is the lowest and is set on goods originating from a number of developing countries. In addition, according to world foreign trade rules, there is a group of the poorest countries whose agricultural products and raw materials are not subject to customs duties at all.

The higher the tariff level, the more reliably it protects national firms. But in order to understand who is personally protected by the tariff, it is necessary to consider the structure of production.

A tariff on a product of any industry is protection, but only in relation to the firm that produces it in the country. It also protects the income of workers and employees employed in these firms and creating "added value". In addition, the tariff protects the income of industries that supply this industry with raw materials and materials.

Thus, the tariff on goods (for example, refrigerators) supports not only firms that produce them, but also working firms, suppliers of parts. This makes it difficult to measure the effect of a tariff on the firms that produce the good. The position of firms that produce goods is also affected by tariffs on imported goods, which represent cost elements for them (firms), for example, imported components.

Therefore, a complete model of the interaction of supply and demand, simultaneously covering several industry markets, is required. To simplify the model, another measurement method is used. This method quantifies the impact of the entire tariff system on the value added of a unit of output produced by a given industry. At the same time, the production of the industry and subcontractors, as well as prices, do not change.

Thus, the actual level of protective tariff (the effectiv rate of protection) in a particular industry is defined as the value (in%) by which the added value of a unit of output created in this industry increases as a result of the operation of the entire tariff system.

The actual level of the protective tariff in a particular industry may differ significantly from the amount of tariff paid by the consumer of the “nominal level of the protective tariff”.

The effective customs duty rate characterizes two main principles that underlie the overall effect of protectionism:

- industry revenues or added value will be affected by trade barriers, not only erected on the way of imports, but also acting on the market for raw materials and materials of the industry;

- however, if the final product of an industry is protected by a higher duty than its intermediate products, the actual protective tariff will exceed its nominal level.

Foreign economic relations include various international economic, political and trade relations, such as the exchange of goods, cooperation and specialization of production, the provision of technical and economic assistance, cooperation in the scientific and technical field, the creation of various forms. Such relations become possible as a result of the development of commodity production.

State regulation of foreign trade is an activity aimed at regulating and developing economic relations with other countries. The main directions of this activity are protectionism and liberalism. They are carried out not only in the field of wholesale trade, but also state regulation is carried out

Protectionism tends to protect the national market from the competition of foreign goods or even capture new foreign markets. Liberalism is a policy of opposite direction, the goal of which is to reduce barriers that hinder development externally. economic ties and creating conditions for free trade.

State regulation of foreign trade in the form of protectionism and liberalism almost never exists in its pure form. Typically, the state economic policy, choosing those methods that are necessary to solve specific problems being solved in the country at a certain stage of development.

The state regulation of Russia's foreign trade is due to a number of reasons, since it is aimed at solving economic, social and political problems on a nationwide scale. Therefore, the state, despite all the benefits, should not allow the uncontrolled flow of goods and services.

State regulation of foreign trade is necessary to control the employment of the population; protecting new industries; prevention of violations in monetary circulation; control of prices for goods of international exchange; ensuring defense capability, law and order in the country; protection of the environment, life and health of the population; ensuring the viability of international organizations.

Foreign economic relations are controlled by the highest legislative bodies of the state: national assemblies, parliaments, congresses. They determine the directions of foreign economic policy and issue laws in the field of foreign economic relations, ratify treaties and agreements at the international level.

State regulation of foreign trade is carried out by government bodies: departments and ministries. In this case, different economic and administrative methods are used.

Administrative methods include the issuance of legislative acts (customs codes, joint stock laws, etc.). Economic methods include such methods of influencing the economy that create the best conditions for the development of foreign economic relations and the balance of payments. These methods include direct financing of export-oriented production (subsidies from the budget), subsidies for research and development, indirect financing through banks, to which the state allocates special subsidies to reduce lending rates to exporters; reduction of duties paid for the purchase of raw materials; tax cuts for exporters.

In Russia, the state monopoly on foreign economic relations ensures their development under the influence not of individual business entities, but of the central government. Foreign economic activity in the Russian Federation is carried out according to the principle of unity as part of the foreign policy of the state, unity of control over its implementation, priority of economic measures, equality of participants, unity of the customs territory, protection of the state, rights and interests of all participants in foreign economic activity.

Leafing through the pages of world history, it is easy to see that international trade has never developed without state intervention. Even before our era, in Ancient Greece, Egypt and other states, trade with "overseas" countries was carried out under the close attention of the ruling circles.

It was merchants who discovered new land and sea routes opened up new markets for trade. The states expanded their political influence in parallel with the development of economic ties, or rather, trade relations were first established, and later the economically more powerful power established its political dominance over a less powerful country.

In the XX century. state interference in foreign trade not only did not decrease, but, on the contrary, increased even more. Harsh circumstances pushed them to this. During the First World War, the governments of the warring countries began to regulate the consumption of raw materials by industry and food by the population, and in this regard, they began to strictly regulate the export-import operations of their subjects. economic activity. During the Great Depression 1929-1933. In order to ensure the development of their national economies, the governments of many countries, including industrialized ones, have applied a number of measures to encourage the export of domestic enterprises and restrict the import of foreign goods. After the end of World War II, countries resorted to a system of collective regulation of world trade. In 1947 they created a world organization - the General Agreement on Tariffs and Trade, which began functioning on January 1, 1948. It was supposed to regulate customs and tariff issues of foreign economic relations on a worldwide scale. However, despite the functioning of the collective organization, the individual regulation of foreign trade by individual countries did not stop, but only acquired other forms.

State regulation of international trade has different scales:

Firstly, it can be unilateral, when the government of one country, without agreement or consultation with trading partners, resorts to state regulation of foreign trade. This measure is associated with an extremely difficult economic situation, with a large state budget deficit, as well as with a negative balance of payments. Volumetrically, in response to this step, the governments of the partner countries use similar actions, which can lead to a complication of their political relations with the country - the initiator of individual state regulation of foreign trade.

Secondly, government regulation is bilateral. This occurs when two countries, on the basis of mutual agreement, agree technical requirements to packaging, labeling, agree on mutual recognition of quality certificates and other indicators of commodity production.

Thirdly, state regulation of foreign trade can be multilateral. This is exactly what it is in the case when the aforementioned General Agreement on Tariffs and Trade acts as the subject of regulation. In addition, it is multilateral within the framework of numerous integration groupings - the European Union. North American Free Trade Association and other international economic associations. It should be emphasized that the role of the state in regulating foreign economic relations is not limited to influencing individual contracts concluded by businessmen or firms, but is manifested in the implementation of a certain foreign trade policy. So, depending on the scale of intervention in international trade, the trade policy of the state is protectionist and free trade.

Protectionism is a state policy that is aimed at protecting the domestic market from the competition of foreign entrepreneurs through the use of tariff and non-tariff methods. Protectionism aims to create the most favorable conditions for the development of domestic production and the national market. Its solution is achieved by establishing a high level of customs tax on imported goods. On the other hand, protectionism involves encouraging the export of domestic goods, increasing their competitiveness in the foreign market in order to increase sales, as well as conquer new markets. The ratio of import and export aspects of protectionism varies depending on the international economic and political situation, as well as on the relationship between individual countries or groups of countries. Currently, experts distinguish several main types of protectionism in foreign economic relations:

- - selective protectionism, which is applied against certain countries or certain goods;

- - sectoral protectionism, which protects certain sectors of the national economy;

- - collective protectionism, which is a set of economic measures applied by a group of countries in relation to a country that is not part of this group;

- - Hidden protectionism, which is a set of domestic economic measures.

As for free trade (freedom of trade), it implies an insignificant level of customs duties and implies the fullest encouragement of the import of foreign goods into national market countries. Free trade is a policy of very limited state intervention in a country's foreign trade, which is carried out on the basis of the play of free market forces of supply and demand. Some authors distinguish another type of protectionism - moderate protectionism. In our opinion, such a decision is incorrect. Indeed, selective, sectoral, collective and hidden are nothing but varieties of moderate or partial protectionism. If we talk about completely complete protectionism, then it is undoubtedly identical with the foreign economic monopoly. Apparently, this is why full protectionism is not usually singled out as an independent economic category.

It should be shown that protectionism and free trade have never achieved complete dominance in the foreign economic activity of most countries of the world. It can be emphasized with sufficient certainty that between these two types or directions of foreign economic policy there was a constant "tug of war". In certain historical periods of time, foreign trade policy leaned one way or the other.

Over the past half century, experts have noted at least three periods in which one or another foreign trade policy prevailed:

- - until the 1970s, most of the world's states were moving from protectionism to free trade;

- - until the 1990s, there was a tendency to separate from each other, to create tariff barriers and other restrictive measures;

- - In the 1990s, a course was taken again to develop free trade.

And now, in 2014, it can be definitely noted that the vector of development of foreign economic relations between world powers is again changing dramatically. The planet is on the verge of a new "cold war" and a manifestation of collective protectionism directed against Russia and its allies.

At all times, the governments of countries were faced with the task in the field of foreign trade - on the one hand, this is assistance to national exporters (supporting their competitiveness in the world market), on the other hand, limiting imports. And no matter what course the government chooses - protectionism or free trade, in any case, they use the most different instruments to achieve this main objective. The instruments are divided into two main groups - tariff measures and non-tariff measures, which should be discussed in more detail.

The first group of instruments in its content refers to the economic regulators of foreign trade and is a special set of measures aimed at using the price factor of influence on the foreign trade operations of the state.

Customs tariff is a systematized list of goods passing through the border given state and subject to duties. The customs tariff includes the name of taxable goods, rates per unit of taxation, a list of duty-free throughput of goods and goods prohibited for export, import and transit through national borders of states. The customs tariff is used to protect national enterprises from foreign competition in the domestic market, to stimulate the development of certain sectors of the national economy, to strengthen the country's trade and balance of payments, to increase state budget revenues, to counteract the discriminatory policy of a foreign state, and for other purposes. The central element of the customs tariff system is duties. Customs duties are a fee collected by the customs authorities when importing or exporting goods and is a condition for the implementation of export-import operations. For several millennia, in connection with the development of foreign trade of states, customs duties have become a tool that performs the following functions:

- - fiscal function, because customs duties affect both import and export operations, while being one of the significant items of the state budget revenue;

- - protectionist function, because with the help of import duties, the state protects national entrepreneurs from foreign competitors; at the same time, the state can not only establish, but also cancel import duties if there are no or insufficient domestic analogues of goods offered by other states on the national market;

- - balancing function, because export duties are set in the amount that allows you to raise the prices of supplied goods to such a limit that they exceed the prices of domestic counterparts.

Currently, customs duties continue to act as an effective tool for protecting the national, including economic, security, defense capability and international prestige of the country. Defenders of the existence of the customs system argue their position with this factor. In addition, another argument in their favor is the fact that customs duties protect young, innovative sectors of the national economy. As a temporary measure, to protect new industries from the impact of foreign competitors, customs duties are vital. In the future, when the new industry has strengthened its position, for its further successful functioning and development, customs functions may be reduced or completely canceled.

Another major argument in favor of this system is its positive role in maintaining the level of employment within the country. The absence of customs duties or their too low level inevitably leads to the fact that the national market is occupied by goods produced by foreign competitors, which have more high quality and low cost. As a result, this will entail the bankruptcy of national enterprises, a surge in unemployment and an additional burden on the country's budget due to an increase in unemployment benefits.

Well, no less important argument in favor of the customs system is the fact that customs duties are a serious source of budget revenues. In countries where there are significant difficulties in collecting domestic taxes, and these are usually countries with an actively developing tax system, it is much easier to collect customs duties than to collect income tax. Therefore, in these states, income from customs duties is positioned, as a rule, as additional income to cover the state budget deficit.

Nevertheless, despite all the advantages of the customs system, at present there are its opponents who, in order to prove their position, give their arguments.

- 1. Customs duties lead to an aggravation of interstate relations. Indeed, the result of a reduction in imports under the influence of tariff or non-tariff restrictions on foreign trade may be a decrease in its exports in response to an economic partner, which will lead to a decrease in employment, as well as a decrease in aggregate demand. As a result, tensions between partner countries may escalate interstate relations to such an extent that serious contradictions will begin between them, which can be sewn up by trade wars, leading to deep negative consequences for both sides. 2. Tariffs slow down economic growth and increase tax time for consumers, as they are forced to buy both imported and similar local products at higher prices due to the application of tariffs. As a result, part of the income of consumers is redistributed in favor of the state, and their disposable income is reduced.

- 3. Imported goods indirectly undermine domestic exports and thus complicate the problem of the country's balance of payments. According to this group of specialists, import duties reduce imports and increase the country's net exports, and contribute to an increase in the exchange rate of the national currency. And this last circumstance stimulates imports and restrains exports. The result of this situation is the deterioration of the balance of payments, which affects literally the entire economic situation in the country.

- 4. Import duties lead to a reduction in the overall level of employment in the country. While protecting jobs in sectors that produce goods that compete with imports, import duties at the same time lead to a reduction in employment in the export and other related sectors of the national economy.

Customs tariffs are, although the most important, but only one of the economic methods of regulating foreign trade operations. In addition to customs duties, such methods as subsidies, loans and dumping are also used as economic regulators of foreign trade. Export subsidies are economic benefits that are provided by the state to its exporters for the expanded export of goods abroad. By receiving state direct subsidies in the form of subsidies when an entrepreneur enters the foreign market or indirect in the form of preferential taxation or insurance, exporters can sell their goods in the foreign market at a lower price than in the domestic market or in comparison with exporters of other countries in the foreign market. Export subsidies often take the form of subsidized loans provided by state banks to domestic exporters at below-market rates. They can also act in the form of so-called linked loans, i.e. state loans to foreign importers with the obligatory purchase of goods only from firms of the country that provides such a loan. Often, such a type of export subsidies as dumping is used, i.e. delivery of goods to foreign markets at prices that are lower than prices within the country of origin of the goods. Anti-dumping duties are used to combat deliberate dumping. Among the economic methods of regulating foreign trade are international cartels - monopolistic associations of exporters that control production volumes and limit competition between sellers in order to establish favorable prices.

The foreign economic policy of the state is a purposeful activity of the state in the formation and use of foreign economic relations to strengthen its potential (political, economic, military, social, environmental, etc.) and effective participation in the world economy. The foreign economic policy of the state largely depends on the state of its balance of payments. state foreign trade

The foreign economic policy of the Russian Federation establishes and regulates the relations of the Russian Federation with foreign states in the field of foreign trade, which covers the international exchange of goods, services, information, and the results of intellectual activity. The procedure for carrying out foreign trade activities by Russian and foreign persons, their rights, duties, and responsibilities are regulated by the Law of the Russian Federation “On the Fundamentals of State Regulation of Foreign Trade Activities” (Federal Law of December 8, 2003 N 164-FZ).

Foreign trade policy includes: export and import. The export policy is aimed at selling competitive Russian goods and services on the world market and stimulating the production of these goods. To stimulate export-capable industries, government orders, budget financing, loans, R&D funding, etc. are used.

Import foreign trade policy is aimed at regulating the import of foreign goods and services into the Russian Federation. Import foreign trade policy in its actions takes into account the role of imports in the domestic economy. Import can be considered as a traditional source of state income, as well as an antimonopoly lever and a competitive element in the production of domestic goods.

Foreign investment policy is a set of measures to attract and use foreign investment in the territory of the Russian Federation and regulate the export of Russian investments abroad.

Investments are all types of property and intellectual values invested by investors in business objects in order to make a profit. Capital plays the main role in investments, i.e. money to generate income.

Capital can be directly invested in the creation of an enterprise in order to obtain rights to management and profit (direct investment), it can be invested in the purchase of securities (portfolio investment), it can be loaned at interest (loan capital).

Foreign investment policy includes the policy of import and export of Russian investments.

The policy of importing foreign investments in the Russian Federation is aimed at solving several problems:

- - increase in the volume of domestic production of goods and services at the level of international standards;

- - attraction to the Russian Federation advanced technology, experience, know-how, etc.;

- - increase in employment of the population and reduction on this basis of the level of unemployment;

- - an increase in the total social product and national income.

The Russian investment export policy is aimed at solving such problems as:

- - promotion of Russian export goods (services) to foreign markets;

- - the development of foreign production for profit and to ensure a guaranteed supply of the Russian market with imported goods (semi-finished products, spare parts, etc.);

- - strengthening the banking sector and increasing the efficiency of foreign exchange transactions.

Monetary policy is a set of economic, legal and organizational forms and methods in the field of currency relations carried out by states and international monetary organizations. At the state level, this is a policy for the purposeful use of foreign exchange funds. The scope of monetary policy is directly the foreign exchange market and the market of precious metals and stones. The task of the current monetary policy is to ensure normal functioning state system, maintaining balance of payments.

The current monetary policy is subdivided into discount and motto. Currency discount policy is a system of economic and organizational measures to use the discount rate of interest to regulate the movement of investments and balance payment obligations, oriented exchange rate adjustments. This policy is manifested in the impact on the state of money demand, the dynamics and level of prices, the volume of money supply, and the migration of short-term investments.

Monetary motto policy - a system for regulating the exchange rate by buying and selling currency with the help of foreign exchange intervention and foreign exchange restrictions. Currency intervention is a targeted operation of the Central Bank of the Russian Federation for the purchase and sale of foreign currency to limit the dynamics of the national currency exchange rate by certain limits of increase or decrease. Currency restrictions regulate operations with national and foreign currencies, gold, etc. The main methods of long-term monetary policy are interstate negotiations and agreements, primarily within the framework of the IMF.

Quotas are understood as the regulation of the volume of goods in quantitative or value terms, which is allowed for import or export from the territory of the country in a certain period of time. Quotas are used both as a tool to regulate the import of products of companies that compete with national producers, and as a punitive measure - in response to discriminatory actions of other states.

Like duties, quotas are divided into export and import. The World Trade Organization, which includes many economically developed countries of the world, determines, on the basis of international stabilization agreements adopted jointly, the share of each country participating in the process in the total export of goods. And the government of a particular country sets its internal export quota to limit the export of goods that are in short supply in the domestic market. Accordingly, import quotas are aimed at protecting the interests of national producers, to regulate supply and demand within the country. For example, the state reduces the quota of a long-term supply partner chicken meat due to the fact that it has concluded trade agreements with a new manufacturer and in order to avoid an uncontrolled increase in supply in the domestic market, it goes to a conscious redistribution of the quota - while maintaining the total number of deliveries to the country, the share of deliveries of a particular state is reduced. Or vice versa, it increases if the state refuses to supply from a third country, and it is extremely necessary to keep supply on the market.

The quota system has a number of advantages over the customs tariff, since The quota gives a firm guarantee that imports will be at a given level, because it deprives competitors of the opportunity to increase supplies to the market of a particular country by lowering prices. In addition, the quota system is a more flexible and efficient measure of foreign trade policy regulation in comparison with the customs system. One of the most important factors in favor of the use of quotas is the selectivity of the system, since when distributing quotas, the state has wide opportunities to support both specific enterprises and partner countries. This circumstance is fundamental for the formation of various economic unions between countries.

The distribution of quotas is closely connected with another type of state regulation of foreign trade - licensing. Licensing is positioned as a special document issued to market participants by special government agencies, giving them the right to export or import products. Licenses have different forms related to the specifics of foreign trade relations. There are single, general, global and automatic licenses.

The name itself suggests that a one-time license allows a certain company to make one transaction related to the import or export of products for up to one year. A general license is also issued for a period of up to one year, but unlike a one-time license, it does not limit the number of transactions. The global license is focused on allowing a company to export or import products to any country in the world within a specified period without limiting the quantity and value of these products. In the event that the legislation provides for the issuance of a license immediately after the company submits an application, this species permission is called an automatic license.

Foreign economic relations are also regulated by creating all sorts of barriers in the way of entrepreneurs - we are talking about technical standards (products must comply with GOSTs adopted in the state), about appearance and the form of products, on compliance with the norms of sanitary and veterinary control. If desired, these barriers can become a serious obstacle to the free supply of certain products and can be used by the state as an effective punitive tool in relation to a particular country.

One of the measures to regulate foreign trade is the most favored nation treatment, i.e. special rule adopted within the framework of a particular trade organization(for example, the WTO). If two countries have provided each other under this treaty certain rights, benefits and privileges, then any of those countries that are also members of this trade organization should use these conditions. The most favored nation treatment is one of the most important conditions for the existence of international trade organizations and is considered as the basis for the functioning of a non-discriminatory regime in foreign trade relations.

In addition to the most favored nation treatment, it is also worth noting the national treatment, which consists in the fact that one country provides companies from other countries with a regime for operating on its territory no less favorable than the regime established for its entrepreneurs. The national regime is established between individual countries participating in international trade relations.

Another form of state restriction of foreign trade, used, as a rule, for political purposes, is an embargo. An economic embargo is a complete prohibition by a state of the import into its country or export to another country of goods, services and various values. For example, the United States in the middle of the twentieth century, after the socialist revolution of Fidel Castro, imposed an embargo against Cuba. For several decades, the young republic was deprived of free trade relations with a powerful neighbor, which could destroy it economically, if not for the support Soviet Union. The United States sought to influence Cuba's domestic and foreign policy, but the country persevered. And only in 2014, due to the aggravation of political relations between Western countries and Russia, the United States lifted the embargo against Cuba, counting on a change in the political and economic course of this country.

State regulation of foreign trade activities is carried out through:

1) customs and tariff regulation;

2) non-tariff regulation;

3) prohibitions and restrictions on foreign trade in services and intellectual property;

4) measures of an economic and administrative nature, contributing to the development of foreign trade activities.

Stages:

1) 1992 - the first half of 1994 - the stage of regulation of foreign economic relations (FEC) with the help of predominantly restrictive measures - non-tariff and tariff.

2) the second half of 1994 - August 1998 - the stage of liberalization of foreign economic activity (FEA) and the limited use of measures of state regulation of FEA, mainly economic ones.

3) since August 1998 - the stage of strengthening the regulatory functions of the state. At this stage, the introduction of administrative methods of regulation turned out to be more effective, since the use of economic instruments (increasing customs duties and taxes, introducing a system of import deposits, etc.), on the one hand, could not prevent dumping exports, and on the other On the other hand, it led to a significant increase in costs for importers with their subsequent transfer to the cost of goods when they are sold on the domestic market.

Question 26. Russia and the WTO: conditions and consequences of accession.

Obligations of Russia:1) to eliminate administrative barriers to the access of foreign goods to domestic markets and various quantitative restrictions on the import of these goods; 2) contribute to the reduction of import (up to 7.8%) and export duties on goods; 3) to complete the reform of the legislation of the Russian Federation in accordance with the requirements of the WTO; 4) contribute to increasing the access of foreign service providers to the domestic market.

After Russia's accession to the WTO, exports in the "machinery and equipment" group increased by 16%, exports of clothing and footwear grew by 26%, and food - by 5%. During the first half of 2015, the physical volume of exports of metals and metal products increased by 8.1%. The share of exports of machinery and equipment in the total structure amounted to 5.1%, the value of exports in this category increased by 23%. For the last year Russian manufacturers in the field of agriculture, exported goods worth $20 billion, an increase of 15%. Lada also strengthened its positions - the increase in deliveries in 2015 ranged from 20% to Kazakhstan to 4.5 times to Germany. Russia's accession to the WTO entailed a three-fold reduction in duties on new imported harvesters, and five times on used ones. As a result, the production of harvesters in Russia, Belarus and Kazakhstan fell by almost 15%. Duties on imported cars have been reduced from 30% to 25%.

QUESTION 27. International export of capital: causes, forms and dynamics. Regulation of the export of capital.

International capital migration- this is the movement of capital between countries, including the export, import of capital and its functioning abroad. Reasons for the export of capital: 1) the relative abundance of capital in the country; 2) the availability of the opportunity to monopolize the local market of the host country; 3) the presence in countries hosting capital of cheaper raw materials and labor; 4) stable political situation in the recipient country; 5) lower environmental standards compared to the donor country; 6) the presence of a favorable "investment climate" in the host country. Forms of capital movement: a) private and public; b) monetary and commodity; in) short term and long term; G) loan and business.

The net outflow of capital in 2015 from the Russian Federation amounted to $56.9 billion, in 2014 - $151.5 billion, in 2013 - $61 billion.

Due to the fact that the migration of capital has a significant impact on the economic development of the country, it is regulated by the state. The methods of such regulation are currency restrictions and currency control. In recent years, in most developed countries, the prevailing trend is the abolition and lifting of restrictions on the international movement of capital thanks to agreements within the framework of the World Trade Organization (WTO), the adoption of the Code of Liberalization by the Organization for Economic Cooperation and Development (OECD), the European Energy Charter.

4.1. Importance of foreign trade for the Russian economy. Formation of the country's foreign trade policy

One of the traditional forms of participation of our country in the system of international economic relations is foreign trade. Despite the relatively small scale of Russia's export-import operations (in comparison with its potential in this area), it has already accumulated the necessary experience in the development and implementation of foreign trade policy, the use of tariff and non-tariff methods of foreign trade regulation. Difficult tasks in this area are facing Russia in connection with the solution of the problems of joining the World Trade Organization.

In the post-Soviet period, the Russian economy has to simultaneously solve three major tasks that are closely related to each other. First, it is a systemic transformation, the transition from a centrally planned economy to market relations. Secondly, the restructuring of the economy in order to create and develop modern, competitive industries that correspond to Russia's advantages in terms of production factors. Thirdly, the effective inclusion of the Russian economy in world economy at the micro, macroeconomic and institutional levels.

The more important is the foreign economic complex of the country, the development of foreign trade and other forms of foreign economic activity, which ensure the flow of goods, services, information, capital between Russia and other countries of the world and thereby affect the restructuring of the economy, the stability of the national monetary system, the formation of budget revenues .

The importance of foreign trade is also emphasized by the fact that its dynamics in the 1990s, at least before the 1998 crisis, differed from the development of other industries in better side. Against the backdrop of an economic recession, which was overcome only in 2000-2004, since 1993 foreign trade has been showing steady growth, positive dynamics in foreign trade turnover, export and import volumes, and the foreign trade balance.

The development of Russia's foreign trade at the beginning of the 21st century. complicated by the same problems as the development of the Russian economy as a whole,

including the influence of the unstable conjuncture of the world

Therefore, in accordance with the changes in the economic policy of Russia, its foreign trade policy was also adjusted. In particular, since the mid-90s. there was a transition from the reckless openness of the economy, inclusion in the world economy "at any cost", to the reasonable protection of the domestic market and domestic producers.

For decades, developing economies have been characterized by two extreme models of development: 1) import substitution and 2) priority development of export industries. Based on the first model, they were created in the 50-70s. economies of India and Brazil. The second model is typical primarily for the newly industrialized countries of Southeast Asia. However, for Russia, both of these models in their pure form are unacceptable, since its economy has long gone through the process of industrialization and, despite the long-term systemic crisis and decline in production, has significant scientific, technical, production, personnel and intellectual, and not just natural, potential.

One of the main problems in the development of Russia's foreign trade relations is to ensure a rational balance between the creation of a competitive environment in the domestic market and the protection of domestic production. It is in this regard that the creation of import-substituting industries, including competitive industries for consumer and investment goods, is relevant.

Another problem is the development of export industries based on deeper processing of raw materials, effective support for the existing export potential in both the fuel and energy and military-industrial complexes, as well as in other science-intensive industries.

The third most important problem in the state foreign trade policy is to ensure Russia's equal, non-discriminatory participation in international trade. In this direction, it is important to complete the process of accession to the WTO.

4.2. Dynamics, geographical and commodity structure of Russia's foreign trade

In the period preceding 1992, Russia's foreign trade relations were carried out not independently, but within the framework of a single state - the USSR. Mutual deliveries of goods between the union republics were not considered as foreign trade activities, and Russian-made goods, entering the world market, did not stand out in any way from all-union exports.

Trends in the development of foreign trade of the USSR, its geographical and, to a lesser extent, commodity structure have undergone significant

significant changes in the late 80s - early 90s. Until 1988, foreign trade turnover was constantly increasing and the foreign trade balance, as a rule, was positive. Since 1989, under the conditions of the deepening economic crisis and the collapse of the USSR, the volume of foreign trade begins to decline, the foreign trade balance becomes negative, which is an additional reason for the growth of external debt.

1991 - the last year of the existence of the USSR - was characterized by a sharp decline in the volume of exports and imports. One of the important reasons for this decline was the transfer from the beginning of 1991 of foreign trade with the CMEA countries to world prices and freely convertible currency and the subsequent dissolution of this organization, which had functioned for more than 40 years (since 1949).

Since 1992, Russia has been an independent subject of the world economy and the volume of foreign trade is calculated in US dollars at the current exchange rate.

It does not follow from this that all foreign trade transactions are carried out only in dollars or other freely convertible currencies. Up to 20% of the volume of foreign trade are transactions in Russian rubles and non-convertible or partially convertible currencies, and barter transactions (goods for goods) are also common.

From 1992 to 1997, there was a continuous growth in Russia's foreign trade turnover (from $96.6 billion to $153.6 billion) and imports (from $43.0 billion to $66.9 billion). The monetary and financial crisis of 1998, combined with the fall in 1997-1998. oil prices - Russia's main export commodity - led to a sharp decline in foreign trade turnover, exports and imports (Table 4.1). At the same time, the change in the situation on the world oil market in 2005-2000, when the prices for this product increased significantly, made it possible to maintain the total volume of exports in these years, with a decrease in imports in 2005, and then its growth in 2000. In 2000, The positive foreign trade balance for the first time exceeded $60 billion.

Table 4.1 Dynamics of Russia's foreign trade (billion dollars)*

Indicators 1997 1993 1994 1995 1996 1997 1998 2005 2000

Turnover 96.6 103.9 118.6 142.2 149.9 153.6 133.4 115.1 148.7

Export 53.6 59.6 68.1 81.3 88.4 86.7 73.8 74.7 104.9

Import 43.0 44.3 50.5 60.9 61.5 66.9 59.6 40.4 43.8

Balance + 10.6 + 15.3 +17.6 +20.4 +26.9 +19.8 + 14.2 +34.3 61.1

trade balance

Including unorganized trade.

Despite fluctuations in the volumes of imports and exports since 1992, the balance of foreign trade has remained invariably positive, reaching its maximum value. in 2000. In the context of high external debt, capital outflow problems, and uncertainty in relations with international financial centers, a positive foreign trade balance contributes to the accumulation of foreign currency, maintaining the ruble exchange rate, servicing and repaying external debt, and, in general, Russia to pursue a more independent economic policy.

Since 1992, fundamental shifts have taken place in the geographic structure of Russia's foreign trade, which were partially outlined as early as the late 1980s.

The foreign trade of the USSR was invariably dominated by the CMEA member countries and other socialist countries, whose share exceeded 60%. In connection with the transition to trade at world prices and settlements in hard currency, as early as 1990, the foreign trade of the USSR began to reorient itself from the markets of Eastern Europe (former CMEA members) to Western markets with their higher quality goods. The decrease in the share of the former CMEA countries in the foreign trade of the USSR was also connected with the unification of Germany. Trade turnover with this group of countries as a whole decreased by 60%, with some states even more. Poland, Czechoslovakia and Bulgaria, which were previously leaders among the foreign economic partners of the USSR, receded into the background.

The predominant place in the foreign trade of the USSR in 1991 was occupied by developed countries with market economies, whose share increased from 26.2 to 57.3%. A reduction in trade turnover with this group of countries also occurred, but it was not so drastic, and trade with the United States even increased. The united Germany took first place in the foreign trade of the USSR. There has been an increase in economic ties with China.

In the statistics of Russia's foreign trade, two large political and geographical sectors are distinguished: the CIS countries, "near abroad", and countries outside the CIS, or "far abroad": The selection of these two sectors is associated with a number of differences in regulation, settlement system and pricing.

Russia's foreign trade is dominated by industrial countries. Thus, according to data for 2000, the share of 15 EU states in Russia's foreign trade turnover amounted to about 35%. If we add other industrial countries (USA, Canada, Japan, etc.) to this indicator, then the share of industrial states exceeded 50%.

The CIS countries occupy a steady second place among Russia's foreign trade partners. Their maximum share (24-25%) was reached in 1993-1994, in the second half of the 90s. it fluctuated within 18-21%.

The third group of Russia's foreign trade partners are the states of Central and Eastern Europe - the former members of the CMEA. Their share is 12-13% and tends to decrease. Russia's most important partners in this group are Poland, Hungary, the Czech Republic and Slovakia.

The share of developing countries in Russia's foreign trade is also decreasing (9-10% in 1998). The main partners here are Turkey, South Korea, India, as well as Iran, Egypt, Brazil. Trade with such countries (former CMEA members) as Cuba, Mongolia and Vietnam, as well as the DPRK, has been reduced to a minimum.

One of Russia's largest trading partners is China. However, the turnover of Russian-Chinese trade in the second half of the 90s. tended to decline despite important political and economic agreements at the highest level, which should have contributed to the dynamic growth of foreign trade between Russia and China.

In table. Table 4.2 presents a list of the ten leading foreign trade partners of Russia in 2000. Basically, this list is more or less stable, but countries at the top of the list may change places. So, if Germany almost invariably ranks first in the table, then Belarus or Ukraine are in second place. In general, Russia's ten largest partners account for more than half of its foreign trade turnover.

Table 4.2 Leading foreign trade partners of Russia in 2000*

No. Country Foreign trade turnover (billion dollars) % of total foreign trade turnover

1 Germany 13.1 9.6

2 Belarus 9.3 6.8

3 Ukraine 8.6 6.3

4 Italy 8.5 6.2

5 US 7.3 5.3

6 China 6.3 4.6

7 UK 5.3 3.9

8 Poland 5.2 3.8

9 Netherlands 5.1 3.7

10 Kazakhstan 4.4 3.2

TOTAL 73.1 53.4

Excluding unorganized trade.

The commodity structure of Russia's imports and exports corresponds to the demand for Russian goods on the world market and the demand for foreign goods on the Russian domestic market. However, established in the 90s. the commodity structure of foreign trade does not correspond to the economic, intellectual, industrial and agro-climatic potentials of Russia. It is a consequence of the economic crisis and the decline in production, on the one hand, the lack of competitiveness of many Russian industries and failures in the structural transformation of the national economy, on the other. Many features of the commodity structure are inherited from the Soviet period, but a number of problems arose already in the 1990s.

In the export of Russia, as well as the USSR in the recent past, the enlarged group “Mineral Products” dominates, including energy resources, primarily crude oil, as well as natural gas and oil products (Table 4.3). Specific gravity This group traditionally exceeds 40%, and its fluctuations in the value of exports depend on world prices, while in physical terms, energy supplies are kept at about the same level (132 million tons of oil in 2000).

Table 4.3 Commodity structure of imports and exports of Russia in 2005, % of total*

Item No. Fortified commodity group Export Import

1 Machinery, equipment and vehicles 10.7 33.4

2 Mineral products 44.4 3.9

3 Metals, precious stones and articles thereof 25.5 7.4

4 Products of the chemical industry, rubber 8.5 16.3

5 Wood and pulp and paper products 5.0 3.6

6 Textiles, textile products and footwear 1.1 5.4

7 Food products and agricultural raw materials (except textiles) 2.7 26.0

8 Other goods 2.1 1.5

* Excluding unorganized trade.

In Russia's exports, the second place is occupied by metals, precious stones and products made from them. Export deliveries of metals, primarily of various grades and grades of rolled ferrous metals, seriously support the ferrous metallurgy of Russia. Problems

exports of Russian ferrous metal products is that in the USA and a number of other countries against Russian rolled products, mainly high-tech, an anti-dumping campaign is being waged, threatening Russian suppliers with prohibitively high import duties.

Compared to the Soviet period, the export of aluminum and other non-ferrous metals (copper, nickel, etc.) has increased significantly, as their domestic consumption has declined sharply. Russia is one of the four main exporters of aluminium, one of the three of nickel, and has almost a monopoly in the production and export of platinum, palladium and other platinum group metals.

As for precious stones, under an agreement with the diamond monopolist, De Beers, this corporation undertook to purchase rough diamonds from the Russian company Alrosa worth at least $550 million a year.

The group "Machinery, equipment and vehicles" occupies a very small place in Russian exports, with more than a third of exports of engineering products going to the CIS countries. It is here that the weakest point in the structure of Russian exports reflects both the uncompetitiveness of Russian engineering, and the shortcomings of the state industrial policy and the "vices" of the conversion of the military-industrial complex.

In the USSR, the share of engineering products in exports was more than 3 times higher. But we should not forget that until 1992, almost no Soviet equipment entered the markets of Western Europe, the USA and Japan. Now the markets of the countries of Central and Eastern Europe are practically lost for the Russian engineering industry, there is a struggle for the markets of investment goods and equipment of China and a number of developing countries. The same applies to the arms trade, where Russia must compete fiercely with the US, France and other countries. In the 90s. supply of arms and military equipment from Russia fluctuated within the limits of 2-3.5 billion dollars. A significant place in the engineering export of Russia is occupied by products of the electrical industry (generators, turbines) and metal-intensive equipment.

The export of chemical goods (4th place) is dominated by potash, nitrogen and phosphorus fertilizers. The situation in this group of goods is similar to metallurgy: low domestic demand, the danger of anti-dumping sanctions against goods with a higher degree of processing.

The first place in terms of imports is occupied by the commodity group "Machinery, equipment and vehicles" (33-36%), a high share of which is typical for imports from developed countries; it was about the same in the Soviet period. However, the commodity structure of this group in the 90s. changed significantly: reduced

"J Smitienko

import of industrial equipment, and the main place was occupied by those goods that were not imported in Soviet times - cars, household appliances, color televisions, electronic equipment, computers. The corresponding industries in Russia turned out to be uncompetitive and, with the exception of the automotive industry, reduced their production to a minimum, not adapting to the conditions of an open economy.

Approximately the same situation has developed with the import of goods of the group "Food products and agricultural raw materials" (2nd place, about 26%). The proportion of this group roughly corresponds to the Soviet period. In the 80s. the main import item was grain (up to a maximum of 42 million tons per year). In the 90s. centralized purchases of grain ceased, and its import as a whole was reduced to a minimum. The main place in imports was occupied by finished food products, including those in small packages, alcoholic and non-alcoholic drinks, confectionery and tobacco products.

The financial crisis of August 1998, combined with "consumer patriotism", led to a certain displacement of imported products and, to an even greater extent, to the relocation of a number of industries to Russia through foreign direct investment. This concerns, first of all, the dairy, oil and fat, confectionery, brewing, tobacco industries, the production of juices, soft drinks, etc., often under the usual Russian brands. Nevertheless, the agro-industrial complex (AIC) of Russia remains unreformed, the restoration of many animal industries requires a long time and large investments, purely trade measures, including protectionist duties, are insufficient for the development of the AIC and ensuring food security.

The Chemical Industry Products group ranks third in Russian imports (14-16%). The high share of this group is explained by the import a large number household chemicals, perfumes and cosmetics, pharmaceutical products. For the most part, these goods were not imported at all in Soviet times, and they also made strong competition for the corresponding Russian enterprises. And this group, especially household chemicals, is characterized by import substitution based on foreign direct investment and technology imports.

It should be noted that the main orientation in Russia's foreign trade towards developed countries with market economies and the raw material orientation of Russian exports are interrelated.

For the further development of Russia's trade with developed and developing countries outside the CIS, it is necessary to achieve full and unconditional recognition of Russia as a country with a market economy.

economy, the elimination of discriminatory restrictions on Russian exports of finished products, the completion of negotiations on Russia's accession to the WTO.

The diversification of Russian exports and the increase in the export of products with a high degree of processing will be associated with the restructuring of industry and the development of its competitiveness in the global production market.

4.3. Formation of the legislative, regulatory and legal framework for Russia's foreign trade

The reform of foreign trade is carried out in the general context of market reforms. However, it even preceded the radical reforms of the early 1990s. and carried out more decisively and consistently. Market relations began to develop between Russian economic entities and foreign partners earlier than with domestic ones. These relations served as a model for the domestic market.

The reform of foreign trade and foreign economic activity in general is associated, first of all, with the transition to an open economy and the abolition of the state monopoly in this area. State monopoly, i.e. the exclusive right of the state to carry out foreign economic activity in all forms, dominated our country for many decades. Its weakening took place already in the second half of the 1980s. The beginning was laid by the expansion of the rights of state foreign trade organizations, along with them, sectoral, republican and regional organizations were admitted to the foreign market. From the end of the 80s. manufacturers of export products received the right to directly enter the foreign market.

A significant change in foreign trade policy and regulation of foreign economic activity is associated with the Decree of the President of the Russian Federation "On the liberalization of foreign economic activity on the territory of the RSFSR" dated November 15, 1991. In fact, this document eliminated the state's monopoly on all types of foreign economic relations, including foreign trade and currency transactions. From that moment on, all economic entities, regardless of the form of ownership, formally received the right to engage in foreign economic activity. Formation of foreign economic policy, legislative and regulatory framework since 1992, when Russia became an independent subject of the world economy, is carried out as an integral part of the market transformation of the economy. This process is directly influenced by: the transition to freedom

new market pricing, privatization, tax and monetary policy, exchange rate for the convertibility of the ruble, formation of the foreign exchange market. Of particular importance was the introduction on July 1, 1992 of a single market exchange rate of the ruble and the transfer of settlements with most foreign partners to world prices and freely convertible currency.

The main tasks of the Russian Federation in the implementation of foreign economic (in a narrower sense - foreign trade) policy are defined by Russian legislation as follows:

Ensuring economic security, protecting economic

the interests of the state as a whole, the subjects of the Russian Federation

walkie-talkie, Russian participants in foreign economic activity

Protecting the domestic market and domestic producers in

the process of implementing foreign trade relations;

Conclusion of international agreements in the field of external eco

economic relations and participation in the activities of international economic

nomic organizations in order to create the most favorable

conditions for the economic development of the country.

In the 90s. the legal basis for foreign trade is gradually being created, and attempts are being made to form a concept and strategy for the development of foreign trade relations. The foundations of state regulation of foreign trade activities have been developed, including customs and tariff regulation, non-tariff restrictions, currency and export control, coordination of foreign trade activities of subjects Russian Federation. The priority of economic methods of regulation of foreign trade is established with the equality of its participants, regardless of the form of ownership.

The most important federal laws, which by 2010 formed the basis of Russian legislation in foreign trade, are as follows:

“On the Fundamentals of State Regulation of Foreign Trade Activity” dated December 08, 2003 No. 164-FZ;

"On measures to protect the economic interests of the Russian Federation in the implementation of foreign trade in goods" dated April 14, 1998 No. 63-FZ (as amended on December 08, 2003),

The federal law "On the Customs Tariff" contains the basics of state regulation of the domestic market in its interaction with the world market. It gives definitions of the customs tariff, customs territory and customs border, customs duty with a list of its types. Special occasions

the cases are devoted to the customs value of the goods and methods of its determination, as well as to the determination of the country of origin of the goods. The law also provides for the provision of tariff privileges (preferences) and cases of exemption from customs duties.

Import duty is calculated on the basis of the customs value of the goods, which is also used to calculate taxes on imported goods, customs fees and fines, and customs statistics are kept. The customs value is determined by the importer (declarant) and checked by the customs office that clears the goods. Customs decides on the amount of duty on the basis of the documents of the declarant or its own price information.

The customs value is determined by six methods, the main of which are calculation at the transaction price of imported goods and calculation at the transaction price of similar goods. At the same time, in addition to the price of goods under the contract, the transaction price includes transportation costs to the border crossing point and other costs of the importer that increase the value of the goods.

Taxes on imported goods include VAT (on almost all goods) and excises, which are levied only on excisable goods.

The customs tariff includes the product code, product name, customs duty rate(s).

In Russia, ad valorem import duties prevail (from 5 to 20%), combined, which increase the overall taxation, have a certain distribution. Export duties are mostly specific or combined.

The Customs Code of the Russian Federation is an extensive and detailed legislative act that contains the legal, economic and organizational foundations of the customs business. The Customs Code of the Russian Federation regulates the movement of goods across customs borders, establishes customs regimes, the procedure for customs clearance and customs control. Responsibility for violations of customs rules is also provided for by special sections of the code. The Customs Code of the Russian Federation also establishes the rules for maintaining customs statistics and the commodity nomenclature of foreign economic activity.

The Federal Law "On State Regulation of Foreign Trade Activities" formulates the main directions, principles and organizational foundations of Russia's foreign trade. Foreign trade activity is considered as entrepreneurial activity in the field of international exchange of goods, works, services, information, results of intellectual activity. A good is any movable property, and the results of intellectual activity include intellectual property.

Participants in foreign trade activities can be:

Russian legal entities;

Russian individuals registered as

stve individual entrepreneurs;

Foreign legal entities and organizations in a different form;

Foreign individuals;

The Russian Federation;

Subjects of the Russian Federation;

Municipal entities.

At the same time, foreign entities carry out their foreign trade activities in Russia in accordance with Russian legislation. direct involvement of the state and municipalities in foreign trade activity is regulated by laws and other legal acts RF and its subjects. All participants in foreign trade activities are equal and are under the protection of the state.

The composition of the participants in Russia's foreign trade actually looks like this.

1. Foreign trade firms of different forms of ownership (order

ka 650 thousand), which are the main subjects of external

trade relations and provide the main (about 80%) volume

export-import operations.

2. State foreign trade organizations - legal

successors of all-union foreign trade associations and again with

buildings with the status of federal state units

nyh enterprises. They operate in the arms trade and

military-technical cooperation in general. In addition, keeping

their role in the supply of Russian equipment^ to other investments

provisional goods under interstate agreements.

3. Participants in unorganized small-scale wholesale trade (“people

noki"). Hundreds of thousands of "shuttles" mainly supply consumers

body goods (clothing, footwear and others) to the domestic market

from Turkey, China, UAE and other countries, food products

ry (including fruits and vegetables) - from the CIS countries. Although their number

The share of foreign trade is declining, but in 2000 their share in the

whether it was more than 8%.

Legal entities and individual entrepreneurs engaged in foreign trade activities related to the movement of goods and Vehicle through the customs border of the Russian Federation are subject to registration with the customs authorities, and registration is officially voluntary.

The main methods of regulating foreign trade activities are of an economic nature. At the same time, the state monopoly on trade in certain categories of goods, restrictions and temporary bans on the import and export of goods in the interests of national security, including economic security, are not excluded.

Laws and other regulations adopted in the second half of the 90s. contributed to the strengthening of state regulation of foreign trade in the areas of export and currency control, protection of the domestic market and the national producer. More flexibly using the principles and directions of foreign trade policy generally accepted in world practice, Russia began to defend its national interests more rigorously and consistently.

4.4. Tariff regulation of foreign trade

In the state regulation of Russia's foreign trade, all methods and instruments of customs and tariff regulation and non-tariff restrictions generally accepted in world practice are used.

The Russian Federation, as an independent subject of the world economy, inherited from the Soviet Union the well-equipped state and customs borders with Norway, Finland, China, Mongolia and the DPRK. At the same time, the customs borders with the newly independent states had to be created anew. Already at the end of 1992, a customs control zone and customs posts were established on the borders with the Baltic countries, as well as with Ukraine, Azerbaijan and Georgia. A special position in this regard is occupied only by the borders with Belarus, where customs control was formally lifted in 1995, and Kazakhstan, where customs border only equipped.

Since the beginning of 1993, regardless of the collection of customs duties, all goods imported into Russia or exported from Russia are subject to customs clearance. This also applies to the countries - members of the CIS. In the same way, it is mandatory to collect customs fees for clearance and storage of goods, sanitary and veterinary control, etc. Only clearance of transit shipments within the CIS (for example, from Uzbekistan to Belarus or from Ukraine to Kazakhstan) is exempt from customs fees.

The customs authorities combine fiscal (collection of customs duties and customs fees), control and law enforcement functions. In the performance of fiscal and control functions, the customs service cooperates with the tax authorities and the Ministry of Finance of the Russian Federation, which in 2000 took over the function of currency and export control.

With the current economic situation in Russia, the fiscal function has acquired particular importance. Unlike most developed countries, customs duties in Russia are one of the most important items of federal budget revenue. For example, in 2000 and 2001 the total volume of import and export

customs duties, VAT and excises on imported goods amounted to about 30% of the federal budget revenue.

The formation of the Russian customs service was completed by 1994. It includes the State Customs Committee (SCC of Russia), 7 territorial customs departments, customs and customs posts. The total length of the protected customs border is 21.2 thousand km.

The customs service controls the movement of goods, movable property and services across the customs border. When collecting duties, it is guided by the Commodity Nomenclature for Foreign Economic Activity (TN VED). The uniform classification and coding of goods in the TN VED system was introduced by the Government of the Russian Federation in 1992. The TN VED of Russia is based on the Harmonized System for the Description and Coding of Goods adopted in the European Union and coincides with the TN VED of the CIS.

TN VED includes 97 groups of goods, united in 24 sections, and has over 10 thousand commodity items, for example:

1. Live animals.

2. Meat and edible meat by-products.

10. Cereal bread.

30. Pharmaceutical products.

39. Plastics and products from them.

72. Ferrous metals and products from them.

84. Nuclear reactors, boilers, equipment and mechanical devices.

97. Works of art, collectibles and antiques.

Within commodity groups, each commodity item has a 10-digit code, which is used by the customs officer when controlling the passage of goods.

Import (import) tariff and import (import) duties. Import (import) tariff and import duties in the 90s. repeatedly changed in accordance with changes in foreign trade policy and the economic situation in Russia. For example, at the beginning of 1992, the lack of food and other consumer goods was considered a difficult problem, and for several months their import was duty-free. With the saturation of the consumer market in the context of price liberalization, another problem came to the fore - the difficulty in selling domestic products as a result of a decrease in the effective demand of the population and increased competition from foreign goods.

As a result, from 1994 until the end of 2000, there was a trend towards an increase in import duties, including the introduction of very high (protectionist) duties on many goods (cars, meat products, butter and sunflower oil, sugar, alcoholic and non-alcoholic drinks, cigarettes, some

other types of raw materials for light industry, furniture, finishing building materials, etc.).

The current customs tariff was approved by the Decree of the Government of the Russian Federation of February 22, 2000 and entered into force on April 1, 2000.

The question of fundamental changes in the customs tariff almost immediately became on the agenda. At a new stage of development, it turned out that high rates of import customs duties do not at all provide either the expected budget revenues, or the protection of national producers and the national market, and do not contribute to the development of industrial production.

Too high rates and significant differences in import duties within the TN VED groups and between close groups led to the flourishing of the so-called gray imports, in fact, smuggling, based on false customs declarations and understated customs values. Such operations are widely known when importing chicken meat under the guise of turkey, expensive furniture under the guise of chipboard, declaring flowers as greenery, and televisions as household goods or components with low import duties.

High import duties negatively affected the purchasing power of the population and the formation of a competitive environment in the Russian consumer goods market. In addition, the negotiations on Russia's accession to the WTO required a change in the rates of import duties in the direction of their reduction.

Changes in the Customs tariff since the beginning of 2001 have affected about a third of all commodity items. As a result of a general reduction in import duties, their weighted average rate was 10-11%. This is 2.5 times higher than the weighted average rate of import duties for WTO members in 2000, but significantly lower than the rate of 13-15% that prevailed in Russia by 2000.

The general reduction in import duties affected a large number of consumer goods, both industrial and agricultural, such as duties on imported televisions, video recorders, a range of raw materials and foodstuffs.

The reduction of duties (if necessary, to zero values) may in the future affect technological equipment that has no domestic analogues, a number of semi-finished products and components, which should reduce costs in the industry and revive business activity, as well as accelerate the reconstruction, modernization and new construction of industrial enterprises.

A general unification of ad valorem rates was carried out (5, 10, 15 and 20%). Maximum bet sizes are only saved as used.

The exception is for very few goods - cars (25%), sugar and tobacco products (30%).

The amount of import duty charged depends on the country of origin of the goods and, therefore, on the trade regime granted to a particular country. Since Russia has not yet achieved accession to the WTO, foreign trade regimes are established mainly on the basis of bilateral trade treaties and agreements.

The base rate of import duty applies to countries with which trade agreements and agreements have been concluded providing for the most favored nation treatment. In the 90s. this list included 126 states, as well as the EU (in fact, the MFN also extended to Taiwan).

In accordance with world practice, Russia presents preferences in the collection of duties to developing countries (reduced duties) and the least developed countries (duty-free import of goods) according to the UN lists. In 2005, there were 105 states and territories in the list of developing countries-users of the Russian Federation's scheme of preferences. Among them are China, the newly industrialized countries of Southeast Asia, Bulgaria, Romania, and the Balkan states. The list of least developed countries includes 46 countries in Asia, Africa, Oceania, and Haiti.

In contrast to the WTO settings, the amount of preferential duties is not 50, but 75% of the base. In addition, the above preferences apply only to a part of goods from developing and least developed countries, mainly food products and agricultural raw materials (tea, coffee, rice, cocoa, fruits and nuts, rubber, etc.), natural fibers (cotton , wool, silk), carpets, wood and some simple industrial products. Duty-free (with a number of exemptions) regime is also provided to CIS member countries.

Goods from countries with which there are no trade agreements are subject to double duty (in the 1990s, this applied practically only to Estonia).

Export (export) customs duties. As you know, export duties are not typical for developed countries with market economies. However, in Russia export (export) duties were used quite widely in 1992-1996. Then they were abolished and reintroduced after the monetary and financial crisis of August 1998. When collecting export duties, specific duties calculated in euros per unit of production prevail.

Export duties in Russia are associated with the following economic circumstances: firstly, it is a replenishment of the revenue side of the budget, and secondly, the protection of the domestic market, where ruble prices for many export goods are much lower than world prices in freely convertible currency.

In the early 90s. there was an acute shortage of all goods on the domestic market, and the prices of many goods were still subsidized by the state. Therefore, in 1992 - 1993. export duties covered up to 3/4 of Russian exports. They were taxed not only on raw materials and fuel, but also on food, alcohol, semi-finished industrial products, and aviation equipment. The duties were very high: specific duties reached 80 thousand ECU per ton (silver ore), ad valorem - 70% (vegetable oil, sugar).

In connection with the change in the situation in the domestic market (saturation with goods, price liberalization) in 1994-1996. there was a process, on the one hand, of reducing the rates of export duties and, on the other hand, of reducing the list of goods subject to duties. The last to be abolished (in the middle of 1996) were export duties on the main Russian export goods - oil and oil products.