As early as July 2017 big number economic entities, in accordance with the rule of law, must use new control equipment for cash transactions, which involves storing information on completed transactions on the Internet. Therefore, these machines are called online cash registers. Consider an online cash register from 2017 - who should switch to a new cash register.

At its core online checkout- a special device with the help of which the information on the receipt of cash proceeds is recorded on fiscal media, as well as with access to the Internet.

In order to transfer information about punched checks to a special site. Both the business entity itself, and the tax authorities, and the buyer or customer have access to it.

Therefore, enterprises and individual entrepreneurs must necessarily draw up agreements with, which on professional level is engaged in the storage of information from online cash registers, and, if necessary, transfers the information it has to the tax authorities.

Like the previous generation of cash registers, the online cash register has a serial number located on the outer case of the machine, a means for printing control receipts (except for some online cash registers designed for trading via the Internet), and a clock mechanism for fixing the time of the transaction.

The main purpose of introducing new cash registers was the establishment of continuous control of the IFTS over all receipts of taxpayers' income to verify the correctness of the calculation of mandatory payments to the budget.

The legislation requires that the online cashier's check contains a number of mandatory elements:

- First of all, they include the name of the goods (services, works).

- Quantitative measurement.

- Price and purchase amount.

- There is also a QR code with which you can check the validity of the check on the tax website.

Attention! Also, the buyer may ask for a copy of the receipt in in electronic format to him by email.

This is the main difference between online cash desks and devices of the previous generation. For these reasons, the use old KKM since the second half of 2017 is prohibited, and registration is not carried out after January 2017.

Business entities can upgrade old CCA by installing special devices for connecting to the Internet. However, it must be taken into account that not all devices can be upgraded, and its cost may not be much less than a new cash desk.

Who should use online cash registers from 2017

Since 2016, new cash registers could be used by any economic entities on a voluntary basis. The new law has determined who has been using online cash registers since 2017. The deadlines for the transition of existing companies, as well as for new companies - at or .

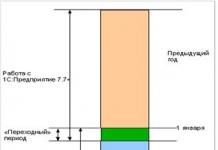

The norms established a transition period during which companies and individual entrepreneurs could switch to the new rules gradually. During this period, it was possible to use ECLZ, but it was already forbidden to register CCPs with them and renew their validity.

From the second half of the year, all taxpayers who are on the general and simplified taxation systems must use only online cash registers when accounting for cash income. This is primarily due to the fact that they keep records of actual income for tax purposes.

Attention! New changes in the legislation determined the obligation of alcohol sellers to purchase new devices from March 31, 2017. The same law first determined the obligation to install online cash desks for individual entrepreneurs on and for companies on UTII. However, in a subsequent clarification, the deadlines for exchangers and those applying were postponed.

Who should switch to the new CCP from 2018

From the 2nd half of 2018, an online cash desk will become necessary for individual entrepreneurs on a patent and entities that use the imputed taxation system. This category of business entities is currently exempt from using online cash desks, due to the fact that they are not taxed on actual income. Therefore, the regulatory authorities have given them some relief so far.

But from the 2nd half of 2018, all business entities will have to use online cash desks, not only those that are on and.

Attention, changes! On November 22, 2017, amendments were made to the law according to which the need to use cash desks for these categories of business is transferred from July 1, 2018 to July 1, 2019. Those. the obligation to install online cash desks was delayed for a year.

In what case can you not use online cash registers?

The legislation defines a list of companies and entrepreneurs who, even from the 2nd half of 2018, have the right not to use online cash desks.

The legislation defines a list of companies and entrepreneurs who, even from the 2nd half of 2018, have the right not to use online cash desks.

These include:

- Entities engaged in the sale of goods with Vehicle.

- Entities engaged in the sale of goods in unorganized and not equipped markets and fairs.

- Carrying out the sale of goods from tankers.

- Carrying out the sale of magazines and newspapers in kiosks.

- Carrying out the sale of ice cream, drinks in non-equipped kiosks.

- Subjects repairing shoes.

- Entities repairing and manufacturing keys, etc.

- Leasing premises of individual entrepreneurs owned by the right of ownership.

- Pharmacy points located in rural clinics, feldsher points.

- Companies and sole proprietorships that have economic activity carried out in remote areas and localities. The list of such territories is determined by federal legislation.

It is important to understand that if the taxpayer conducts activities only using non-cash payments, that is, he does not have cash proceeds, he does not need to use the online cash desk.

Attention! It is also allowed not to install online cash desks for credit organizations, enterprises in the securities market, engaged in catering in kindergartens, schools, other institutions and educational institutions.

New devices can be used on a voluntary basis by religious organizations, sellers of postage stamps, as well as persons selling handicrafts.

Benefits when using new cash registers

Legislative bodies are currently considering a draft act, according to which entities using UTII and PSN will be able to receive a tax deduction in the amount of 18,000 rubles if they purchase a cash register with an Internet connection and use it.

This tax reduction can be made with the purchase of each new device. It is assumed that the date of purchase of the online cash register should not be earlier than 2018.

The draft provides for the possibility of transferring the unused deduction in whole or in part to the next tax periods.

Important! There is a restriction according to which the deduction can only be used once for a given machine. Therefore, the transition from UTII to PSN and vice versa will not allow you to use this benefit a second time.

Currently, the dissatisfaction of the subjects on the simplified taxation system is growing, as they also want to receive this benefit. However, until now, the norms establishing the possibility of using benefits when purchasing online cash registers remain only projects.

The cost of switching to new cash registers

The law requires the use of devices with sending data to the Federal Tax Service. The use of old cash registers with ECLZ is now prohibited. Before the beginning of the 2nd half of 2017, all subjects were required to either buy new devices or carry out the modernization procedure.

In the second case, equipment manufacturers have released kits that allow you to convert the device from the use of ECLZ to the installation of a fiscal drive. The price of the upgrade kit, based on the cash desk model, varies from 7 to 16 thousand rubles.

The modernization process usually includes the installation of a fiscal drive, equipment for connecting to the Internet. When choosing this approach, it is necessary to analyze how many goods will be in the nomenclature, as well as what will be the number of operations.

If a significant amount of these indicators is expected, then it is more expedient to purchase a new cash desk designed to work with big list goods.

| Device brand | Scope of use | Estimated price |

| "Atol 30F" | It is better to use it in small organizations, with a small number of goods and customers. | 20200 r. |

| "Viki Print 57 F" | Recommended for small retail outlets. Can work with the EGAIS system | 20300 rub. |

| "Atol 11F" | This device is best used in small organizations with a small number of customers. Maintains communication with the EGAIS system. | 24200 r. |

| "Viki Print 80 Plus F" | Cash desk for medium and large retail outlets, has a large number of additional features- for example, it can automatically cut off checks. Supports work with the EGAIS system. | 32000 r. |

| "Atol 55F" | A cash register with many additional features - it can cut checks, it is possible to connect to a cash drawer, etc. It is recommended for use in large points with a large daily turnover. Can work with the EGAIS system. | 30700 r. |

| "Atol FPrint-22PTK" | Cash register with large quantity additional features. For medium and large stores. Supports work with EGAIS. | 32900 r. |

| "Atol 90F" | A battery can be connected to this unit, which will enable battery life up to 20 hours. The cash register can be used for delivery trade. Supports work with EGAIS. | 18000 r. |

| "Evotor ST2F" | The device is recommended for use in small shops, places Catering, hairdressing salons, etc. Equipped with a touch screen, Android system installed, inventory control software. | 28000 r. |

| "HATCH-ON-LINE" | Recommended for small stores with limited product numbers. | 22000 r. |

| "SHTRIKH-M-01F" | Recommended for large stores, has a large number of additional functions, can be connected to a trading terminal. | 30400 r. |

| "KKM Elves-MF" | Recommended for small shops. Due to the presence of a battery, it can be used for remote and distribution trade. | 19900 r. |

| "ATOL 42 FS" | Checkout for online stores without a mechanism for printing paper checks | 19000 r. |

| "ModuleKassa" | A device that supports both full integration with the online store, and the ability to break through simple checks. The device has a display, battery with work up to 24 hours, Android system. | 28500 r. |

| "Drimkas-F" | A device that can be connected to an online store, as well as used to break through simple checks. It is possible to attach a terminal for payment by cards, a scanner, a cash drawer. | 20000 r. |

Checkout service procedure

The new act on cash desks abolished the obligation to periodically check and service new devices in specialized workshops.

After acquiring an online cash register, the owner himself decides whether to call a specialist for the purpose of prevention or repair. It is expected that such functions will also be performed by service centers.

Also new law abolished the obligatory nature of the centers, when performing work on the repair or maintenance of cash desks, in without fail register with the FTS. It is planned that thanks to this, new specialists and firms will come to the industry.

Due to the abolition of mandatory maintenance, CCP owners now have the opportunity to choose:

- Make a long-term contract with the service center;

- Involve the specialists of the center only in the event of a malfunction of the cash register;

- Hire craftsmen who do not work in CCP service centers, but have everything necessary knowledge for the repair of the cash register;

- If the company has a lot of new devices, then you can include a separate specialist in your staff who will be engaged in the repair and maintenance of cash desks.

Features of cash discipline

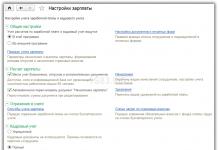

Before the introduction of online cash desks, the cashier was charged with the obligation to draw up documents for KM-1 - KM-9, including:

- return act Money to the buyer (KM-3);

- Magazine for the cashier-operator (KM-4).

Now reports similar to these are generated automatically due to the transfer of information to the Federal Tax Service. Therefore, the use of such forms is not mandatory. However, organizations and entrepreneurs can apply them according to own initiative, indicating this in internal administrative local acts.

Another key document, when using devices of the previous generation, was the Z-report. It was necessary to remove it at the end of the working day, and, based on its data, make entries in the cashier's journal.

Attention! Now the Z-report has been replaced by another document - the “Shift Closing Report”, which is generated at the end of the working day, or with the transfer of a shift from one cashier to another.

Its main feature is that, like checks, it is also automatically sent to the Federal Tax Service. At the same time, the new report includes all information about the movement of money during the day: cash, card payments, refunds for each type of payment, partial prepayment, etc.

Features of using online cash registers for online stores

The main reason for the introduction of online cash registers is the control over the functioning of online stores.

Until that moment, entrepreneurs opened websites for the sale of goods, services, and accepted payment with electronic money. When deposited into Internet wallets, such income was difficult to trace and oblige taxpayers to pay tax on them.

Now the online store is obliged to use the cash register when selling any type of goods. An online checkout for an online store must send a receipt of purchase to the customer’s e-mail at the right time after receipt of payment.

Attention! There is one exception to this rule - if payment is made by receipt or invoice, and goes directly to the current account of the company or entrepreneur, it is not necessary to use a new cash register to fix this sale.

Also, the Federal Tax Service, by its order, clarified that the deferment for entrepreneurs and firms applying imputation or a patent also applies to online stores. This means that if a business entity, by law, has the right not to use a new type of cash register now, but is obliged to do so only from the 2nd quarter of 2018, this also applies to online commerce.

The obligation to use the online cash register, as well as to send a check to the e-mail, applies not only to payment bank cards, then also for all types of electronic money.

For the device, which is used in online stores, there is one feature - if payment is made electronically, then you do not need to withdraw a paper receipt, you only need to send an electronic one. Until recently, only one device of this kind was offered - ATOL 42 FS.

Now manufacturers of cash registers are moving in several directions:

- An attempt to integrate existing online cash registers with Internet sites using third-party programs. There are currently few such solutions;

- Specialized cash desks for "Bitrix" - are connected to the server hosting the online store;

- Devices that can both punch checks when accepting cash, and work with an online store only in electronic format.

Attention! The check that the checkout sends to the online buyer does not differ from a simple check and contains all the same details. If the store delivers goods by courier with cash payment, he needs to have a portable cash desk with him in order to immediately break the check. In such a situation, it is beneficial to have a device that can work with paper checks and online payment.

Features of the use of new cash registers in the sale of alcohol

With the adoption of amendments to the law on alcohol regulation, as well as the introduction of new principles for conducting cash transactions there was a conflict between the laws. It affected entrepreneurs and companies that traded in beer and similar products.

So, according to 54-FZ, entities that apply a patent or imputation are required to use online cash registers only from July 1, 2018. At the same time, the law 171-FZ determined that all business entities, regardless of the taxation system, when selling any alcohol are required to use cash registers since March 31, 2017.

On July 31, 2017, an amendment to 171-FZ came into force, which determines that subjects need to use a cash register, but in accordance with the provisions of 54-FZ.

This means that the law established the priority of the law on cash registers, which means that an online cash register for individual entrepreneurs selling beer and companies on imputation and a patent will be required only from mid-2018.

Attention! The amendment applies to those who are on PSN or UTII. If an individual entrepreneur or a company selling beer uses OSN or USN, it was necessary to switch to a new cash desk from 07/01/17.

It is important to remember that this applies specifically to low-alcohol products that do not have the necessary labeling and are not subject to fixation through the EGAIS system.

If an entrepreneur or company sells labeled alcohol, they are required to use the cash register, regardless of the tax system.

Important! When choosing a cash register, such entities need to remember that it must be able not only to send checks to the Federal Tax Service, but also to interact with the EGAIS system.

Let's see how it will change next year the procedure for applying CCPs, as well as control by the tax authorities and liability measures for non-use or incorrect use of CCPs.

On July 15, 2016, amendments ((hereinafter referred to as the Law No. 290-FZ)) to the Law on CCP (Federal Law No. 54-FZ of May 22, 2003 (hereinafter referred to as the Law on CCP)) came into force, which introduce new requirements for the order registration and use of cash registers, expand the scope of its application, as well as the rights of tax authorities to control and receive information.

In addition, amendments have been made to the Code of administrative offenses which toughen responsibility for non-use or misuse of CCPs and introduce new types of penalties.

Procedure for applying CCP: new requirements

The law on cash registers now imposes more stringent requirements on cash registers and the procedure for settlements with buyers (clients). The purpose of the changes is to ensure the possibility of transferring information on settlements (fiscal data) to the tax authorities in real time through the cash register.Recall that in 2014-2015, an experiment was conducted on the territory of a number of constituent entities of the Russian Federation on the use of online cash desks (decree of the Government of the Russian Federation dated July 14, 2014 No. 657). It was recognized as successful, and now the experience gained is being disseminated throughout the country.

Organizations and individual entrepreneurs(hereinafter - IP), which carry out cash cash settlements and (or) settlements using payment cards when selling goods, performing work or providing services (referred to in the Law on CCP as “users” (paragraph 17, article 1.1 of the Law on CCP)), will have to purchase and register cash registers under the new rules that meet the new requirements (https://www.nalog.ru/rn77/related_activities/registries/reestrkkt/), as well as conclude an agreement for the processing of fiscal data transmitted through a cash register with a fiscal data operator — specialized organization, which has the appropriate permit issued by the tax authorities (Article 4.4 of the Law on CCP). The functions of the operator include the processing, storage and transfer of information to the tax authorities. His services are paid.

The use of a CCP that does not meet the new requirements is allowed until July 1, 2017, and its registration under the old rules is until February 1, 2017 ().

The new CCP registration procedure consists in the user submitting to the tax authority an application for registration on paper or in electronic form through the office cash register equipment on the website of the Federal Tax Service of Russia. The user enters the registration number of the cash register received from the tax authority, as well as information about himself and the cash register, and then submits the registration report generated in the cash register to the tax authority. We note in particular that the implementation technical support KKT for registration is no longer required.

The order of application of the BSO has changed. Now it is a primary accounting document, equated to a cash receipt, generated in electronic form and (or) printed using a cash register at the time of settlement with the buyer, containing information about the settlement, confirming the fact of its implementation (paragraph 5, article 1.1 of the Law on cash registers). From July 1, 2018, the CCP Law does not provide for the use of BSOs made by printing ().

Fundamental innovations have appeared in terms of information about calculations. Firstly, a two-dimensional bar code (QR code no less than 20 × 20 mm in size) will now be printed on a cash receipt or BSO, containing in an encoded form the details of checking a document (date and time of the calculation, the serial number of the fiscal document, the sign of the calculation, the amount of the calculation, the serial number of the fiscal accumulator, the fiscal sign of the document) (clause 1, article 4 of the Law on CCP).

Secondly, organizations and individual entrepreneurs have an obligation in the event that the buyer (client) provides until the calculation of the subscriber phone number or address Email send them information identifying the issued on paper cash receipt or BSO (registration number of the cash register, amount, date and time of settlement, fiscal attribute of the document), as well as information about the address of the Internet resource where a cash register receipt or BSO can be received free of charge. Moreover, the received document in printed form is equated to a check or BSO issued by a cash register (clauses 2, 3, article 1.2 of the Law on CCP).

Scope of application of CCP expanded

The list of activities and special circumstances in which the use of cash registers is not required (clause 3, article 2 of the Law on cash registers) has not changed. However new edition The Law on CCP does not provide for benefits that were previously provided to organizations and individual entrepreneurs providing services to the public, payers of UTII and individual entrepreneurs using patent system taxation (hereinafter - PSN).Recall that until July 15, 2016, organizations and individual entrepreneurs providing services to the population were exempted from the obligation to use CCP. Instead of a cash receipt, they could issue a BSO to the client with the details established by the Government of the Russian Federation (clauses 3, 5-6 of the Regulations on the implementation of cash settlements and (or) settlements using payment cards without the use of cash registers, approved by the decree of the Government of the Russian Federation of 06.05.2008 No. 359 (hereinafter referred to as the Regulation)). BSOs were printed or formed using an automated system. If the automated system, in terms of its functioning parameters, met the requirements for CCPs (clauses 11, 12 of the Regulations; letters of the Ministry of Finance of Russia dated November 25, 2010 No. 03-01-15 / 8-250, dated February 3, 2009 No. 03-01-15 / 1-43, dated November 26, 2008 No. 03-01-15 / 11-362, dated August 22, 2008 No. 03-01-15 / 10-303), then, in fact, organizations and individual entrepreneurs using such systems used a special type of CCT. Printed BSOs were usually filled out by hand.

As noted above, from July 1, 2018, the Law on CCP does not provide for the use of BSOs made by printing (part 8, article 7 of Law No. 290-FZ). In turn, an automated system for the formation of BSOs in accordance with the changes is a CCP used for the formation of BSOs in electronic form, as well as their printing on paper. Thus, the practical difference between the issuance of a cashier's check and the issuance of a BSO has disappeared. Therefore, an organization or individual entrepreneur providing services to the public will have to purchase and register a cash register that meets the new requirements and conclude an agreement for the processing of fiscal data with a fiscal data operator.

Similarly, individual entrepreneurs using PSN, as well as organizations and individual entrepreneurs - UTII payers, from July 1, 2018, lose the right to carry out cash settlements and settlements using payment cards without the use of cash register equipment, provided that a document (sales receipt, receipt or receipt) is issued at the request of the buyer (client). other document) confirming the acceptance of funds for the relevant goods (work, service).

The use of CCP now involves more responsibility

Legislators have significantly changed the system of punishments in the field of CCP application.Previously, the Code of Administrative Offenses provided for all violations (non-use of CCP; application of CCP that does not comply with established requirements; violation of the CCP registration procedure; non-issuance of a cash receipt to the buyer) a single measure of responsibility (part 2 of article 14.5 of the Code of Administrative Offenses of the Russian Federation in the previous version): a warning or a fine in the amount of 1,500–2,000 rubles for citizens, 3,000–4,000 rubles for officials and 30,000–40,000 rubles - for legal entities.

With the entry into force of Law No. 290-FZ, a whole set of new administrative offenses and types of fines appeared in the Code of Administrative Offenses. In addition, the amounts of fines are set not just in rubles, but in an amount that is a multiple of the amount of the payment made in violation.

So, non-use of CCP in cases established by law entails a fine (part 2 of article 14.5 of the Code of Administrative Offenses of the Russian Federation):

For officials in the amount of from 1/4 to 1/2 of the amount of the calculation carried out without the use of cash registers, but not less than 10,000 rubles;

For legal entities - from 3/4 to one amount of the amount of the settlement carried out using cash and (or) electronic means payment without the use of cash registers, but not less than 30,000 rubles.

Repeated commission of the above offenses in the event that the amount of settlements amounted, including in aggregate, to one million rubles or more, entails disqualification for officials for a period of one to two years, and administrative suspension for individual entrepreneurs and legal entities activities for up to 90 days (parts 2, 3 of article 14.5 of the Code of Administrative Offenses of the Russian Federation).

Note that the liability of individuals - performers (that is, ordinary sellers) is excluded from Article 14.5 of the Code of Administrative Offenses. Only officials will be punished.

The use of a cash register that does not meet the established requirements, or the use of a cash register in violation of the procedure for its registration, the procedure, terms and conditions for its re-registration, the procedure and conditions for its application entails (part 4 of article 14.5 of the Code of Administrative Offenses of the Russian Federation):

- warning or imposition of an administrative fine on officials in the amount of 1,500 to 3,000 rubles;

- for legal entities - a warning or the imposition of an administrative fine in the amount of 5,000 to 10,000 rubles.

Liability has been introduced for failure to submit or violation of the deadlines for submitting information and documents at the request of the tax authorities: a warning or a fine of 1,500 to 3,000 rubles for officials and a warning or a fine of 5,000 to 10,000 rubles for legal entities (part 5 of article 14.5 of the Code of Administrative Offenses RF).

Responsibility has been established for failure to send to the buyer (client) a cash receipt or BSO in electronic form or failure to transfer the specified documents on paper at his request: warning or imposition of a fine on officials in the amount of 2000 rubles, on legal entities - warning or imposition of an administrative fine in the amount of 10 000 rubles (part 6 of article 14.5 of the Code of Administrative Offenses of the Russian Federation).

Amendments to the law 54-FZ "On the use of cash registers" came into force: since 2018 the introduction of cash registers affected even entrepreneurs in special regimes. In 2019, everyone should install CCP.

The transition to a new cash register is a step-by-step process. Buying new equipment is not enough. To print the names of goods on receipts, you need a cash register program. Try the free Checkout MySklad app - it supports this and all other requirements of 54-FZ.

Who should use cash registers from 2019?

Have cash registers for individual entrepreneurs been introduced since 2018? What to do IP in 2019?

- renders services to the population, making out their forms of strict accountability. More about

- applies UTII and PSN, works in retail or catering and does not have employees.

The rest were supposed to deliver a new CCP by the summer of 2018.

From July 1, 2019, no entrepreneur has the right to make payments without using new cash registers.

Cash register for individual entrepreneurs since 2018: latest news

- From January 1, 2019, the online cash desk must support fiscal data format 1.05 and a VAT rate of 20%. It won't work without updates.

- The concept of calculations has been changed. Now they include not only the movement of funds, but also the offset of the prepayment and the receipt of other things for the goods.

- After receiving an online payment, a check must be generated no later than the next business day.

- From July 1, 2019, when offsetting an advance payment, it will be necessary to punch two checks: upon receipt of money and upon transfer of goods.

- Individual entrepreneurs on an imputation or patent can return up to 18,000 rubles in the form of a tax deduction for the purchase or setup of a new cash register.

- Entrepreneurs and companies on special regimes (USN, UTII and patent) will be fined up to 10,000 rubles for using fiscal drives for 13 months. The tax authorities explained that small businesses can only apply FN for 36 months.

- Since 2017, you can register a KKM via the Internet - it's convenient and fast. More about registering a cashier >>

- If an entrepreneur does not comply with the requirements of 54-FZ, he faces a fine of up to 50% of the amount received during his work without a cash desk (but not less than 10,000 rubles). Since July 2018, individual entrepreneurs can be fined 10,000 rubles for making settlements through the CCP that actually did not take place, as well as 50,000 rubles for incorrectly marked goods indicated on the receipt. The same penalty is imposed for late transmission of fiscal data.

What can be done right now?

In 2018, almost all entrepreneurs had to register a cash register. In total, according to experts, this year they switched to new order about 1 million businessmen. The rest of the entrepreneurs must deliver the cash register by July 1, 2019. We recommend that you think about cash registers now: there may be a shortage of fiscal drives and new models. Postponing the purchase is dangerous: as the practice of last year showed, the majority of entrepreneurs are dragging to the last - and there are more than 1 million of them!

Will the new rules affect online stores and vending companies?

Yes, online stores must also install CCP. A check is always needed - even when the client pays for the purchase remotely with a card. In such a situation, you need to send the document to the buyer's email. If there is a delivery for cash, the courier issues a check.

Vending machines could work without cash registers until July 1, 2018. But if you are an individual entrepreneur without employees, you can not set up a cash register until July 1, 2019.

What cash registers can be used in 2019?

All CCP models allowed for use are in the register on the website of the Federal Tax Service. Since 2017, online cash registers must be connected to the Internet - an Ethernet port has been added, a built-in GPRS or WiFi modem has been added. The most budgetary samples use the Internet on a computer to which they are connected via a USB port. Since 2017, the new cash register should have a fiscal drive - an analogue of an electronic tape (EKLZ). EKLZ itself is a thing of the past - cash desks with it are no longer released.

How much do new cash registers cost in 2019?

Entrepreneurs have to change CCP at their own expense. Often, buying a new cash register is cheaper than refining an old one. The cost of upgrading depends on the number of vehicles and their models.

Another item of expenditure is OFD services. They cost about 3,000 rubles a year for one cash desk. It is worth considering the cost of connecting to the Internet - the law assumes that each trade point must be connected to the network. In addition, every 13 months it is necessary to change the fiscal drive. Legal entities on UTII, USN or patent - once every three years.

New cash registers also require maintenance costs. But today an entrepreneur can choose: to pay for constant service in service center Or only go there if it's broken.

How is the replacement of cash registers in 2019?

To re-register an existing cash register, you need to find out if it can be upgraded - the cash register must be able to connect to the Internet. It is also necessary to check whether it is possible to install a fiscal drive on the cash register. Find out more at your service center. If your cash register cannot be finalized, you will have to buy a new one. Then you need to conclude an agreement with the OFD and register the cash register, this can be done via the Internet.

How is fiscalization going now?

Fiscalization can be done on the Internet - an entrepreneur does not need to go to the tax office or contact the center Maintenance. This will require a qualified electronic signature (QES) - an analogue of a personal signature.

You can get a CEP at a certification center accredited by the Ministry of Communications. Addresses are published on the website of the department - pick up electronic signature need to personally.

Is it necessary to service new cash registers in the central heating service?

Not necessary. Cash registers are supported by the manufacturer, which can attract partner service centers, which now do not need to obtain permission from the tax authorities. Thus, there is nothing to worry about if, from January 1, 2017, new cash desks are not served there on a permanent basis. To register a CCP in a tax agreement with the CTO is no longer a prerequisite.

Who can not install new cash registers at all?

There are activities that 54-FZ did not touch. And it doesn’t matter whether such a business is run by an individual entrepreneur or LLC, he doesn’t need a cash register in 2019.

- gourds, vegetables and fruits waddle, as well as live fish;

- ice cream and soft drinks in kiosks and stalls;

- peddling and at retail markets and fairs (except for trade in separate covered pavilions or shops);

- milk, butter or kerosene for bottling;

- newspapers and magazines;

- products of artistic folk crafts.

Exempted from the use of cash registers and those who provide services:

- plowing gardens and sawing firewood;

- shoe repair and painting;

- Key making and minor repairs jewelry and points.

- nannies and nurses;

- porters at railway stations;

Also on the list of CCPs exempted from use are points for the collection of waste materials and glass, pharmacies and medical assistants in rural areas and other medical institutions.

How will the new rules work in hard-to-reach areas where there is no internet?

In remote villages and towns, you can work without transferring data to the tax office via the Internet. But no one canceled the replacement of cash registers in 2018 even there: all cash registers should still have a fiscal drive. The list of settlements in which you can work without an Internet connection is determined by local authorities.

An online cash register is a device that issues a cash receipt and transmits information about the sale to tax office through the Internet. Since the middle of last year, most retailers have switched to such equipment. In 2018, further changes were made to the law on the application of CCP.

CCP and tax regimes

The new procedure for applying cash registers online in 2018 for different categories of taxpayers accepting cash and card payments depends on the tax regime of the seller.

Until 2017, many entrepreneurs and organizations could work without cash registers. When paying for services to the population, instead of a check, they issued (strict reporting form). In addition, all traders on and PSN were entitled to accept payment for goods without any documents. Only in the case of the buyer's request, he was issued a sales receipt.

The reason for such concessions is that the PSN and UTII for taxation take into account:

- potential annual income for SPE;

- income that is imputed (i.e. assumed) for payers of a single tax on imputed income (UTII).

But on simplified system taxation, as well as on OSNO and UAT, indicators of actually received income are used to calculate the tax base. More was not required from old-style cash registers; information on sales volumes was recorded in the ECLZ (electronic secure control tape).

The use of cash registers for processing cash payments for UTII in 2018, as well as for individual entrepreneurs on a patent, depends on whether they have employees. If there are employees in the field of trade or catering, then new cash desks for these modes are needed from July 1, 2018. Moreover, real income on UTII and PSN will still not be taken into account when calculating taxes. New cash desks for these special regimes are being introduced in order to ensure the rights of consumers.

Although the new cash registers are now used by more businessmen, there are still situations when cash registers can not be used for cash payments. This limited list is provided in Article 2 of the Law of May 22, 2003 No. 54-FZ on the use of cash registers. Among them:

- sale of newspapers, magazines and related products in specialized kiosks;

- sale of tickets in the salon of public transport;

- trade from tanks with kvass, milk, vegetable oil, live fish, kerosene;

- waddle sale seasonal vegetables, fruits, gourds;

- peddling trade in some goods;

- sale of medicines in rural pharmacies, etc.

With regard to trading in the markets, the requirements have been tightened - both for trading places and categories of goods. Thus, the government has developed non-food items, which cannot be sold in the markets without cash desks. Regardless of the type trading place you will have to use CCP when selling clothes, leather goods, furniture, wooden products, carpets, rubber and plastic products and others (total 17 product groups).

By order of the Ministry of Telecom and Mass Communications of Russia dated December 5, 2016 No. 616, it is allowed to use old CCP models instead of online cash desks in settlements with up to 10,000 people.

An important innovation for online stores is that from July 1, 2018, cash registers will also have to be used in cases of online payment by card or through services such as Yandex Checkout. In this case, the buyer receives only an electronic check. Previously, there was no such requirement. For online fiscalization, you can use the Yandex.Checkout solution with a partner cash register or your own version, for example, sending receipts using a CMS or CRM system. Yandex.Checkout will transfer information about orders and payments to your cash register and inform the store about successful payment and receipt registration.

If you provide remote services/sell goods and have not yet connected Yandex.Checkout, we advise you to do it right now. Today it is the most adapted payment service to the new law. By leaving a request using the button below, you will receive 3 months of service at a premium rate with a minimum percentage (the connection itself is free):

When should I switch to a new CCP?

The timing of the transition to online cash desks depends on the taxation regime and the direction of activity. Recall that those who trade on the simplified tax system, OSNO and UAT have been using online cash registers since mid-2017. If you are engaged in trade or catering at UTII and PSN and at the same time have employees, you need a cash desk from July 1, 2018. If there are no employees in these modes, that is, you trade or provide catering services on your own, then the deadline for switching to cash desks is July 1, 2019.

In the same period - from July 1, 2019 - everyone who provides services to the population under any tax regime with the issuance of a strict reporting form must switch to online cash desks. For clarity, we present the features of the use of CCP in the table.

Online checkout requirements

What is an online checkout? The simplest explanation is cash register, which works in online mode, i.e. connected to the internet. Information about the purchase is transmitted to the fiscal data operator, who sends a confirmation that the information has been accepted, and the receipt is assigned a fiscal attribute.

New cash registers must comply with the requirements given in Article 4 of Law No. 54-FZ.

- have a case with a serial number;

- there must be a real time clock inside the case;

- have a device for printing fiscal documents (internal or external);

- provide the ability to install a fiscal drive inside the case;

- transfer data to a fiscal drive installed inside the case;

- ensure the formation of fiscal documents in electronic form and their transfer to the operator immediately after entering the data into the fiscal drive;

- provide printing of fiscal documents with a two-dimensional bar code (QR code no less than 20 x 20 mm in size);

- accept from the operator confirmation of data receipt or information about the absence of such confirmation.

In addition, separate requirements are established for the fiscal accumulator itself (Article 4.1 of Law No. 54-FZ), which must:

- have a housing with a serial number and a manufacturer's seal and a non-volatile timer;

- ensure information security of fiscal data and their encryption;

- generate a fiscal sign with a length of no more than 10 digits for each fiscal document;

- provide authentication of the operator of fiscal data and verification of the reliability of its confirmations;

- form records in the memory of cash registers;

- execute the information exchange protocols established by Article 4.3 of Law No. 54;

- have a document key and a message key of at least 256 bits;

- provide the ability to read fiscal data recorded and stored in memory for five years from the end of operation.

Register of cash registers, which meet the requirements of online cash desks and are allowed for use, is published on the official website of the Federal Tax Service. Before deciding on your own which CCP (cash register) you can use, be sure to make sure that the selected model is in this registry.

Expenses for online cash desks

The new CCP, as well as the implementation of changes adopted by the law on cash registers, will require certain expenses from sellers. Moreover, here it is necessary to take into account not only how much an online cash desk costs, but also the costs of the services of a fiscal data operator (OFD).

OFD is an intermediary that receives data from the online cash register via the Internet, and then transfers them to the tax office. The operator can only be a specialized commercial organization that fulfills the technical and information requirements of the Federal Tax Service. For violation of the procedure for transferring data, their safety and security, OFD can be fined for a large amount (from 500 thousand to 1 million rubles).

Naturally, the operator's services will cost money. To attract customers, most operators offer low tariffs for the first year of service - from 3,000 rubles for one device, i.e. The cost of services depends on the number of cash desks. In the future, it is expected that the service will grow to 12,000 rubles per month.

Please note: the operator of fiscal data must be selected only from the official list posted on the website of the Federal Tax Service and having permission for such activities.

As for the cost of the device itself, if you already have it, it is possible that it will be possible to upgrade it, rather than buying a new one. Find out how your cash register equipment complies mandatory requirements and the ability to install a fiscal drive instead of ECLZ, it is possible from the manufacturer or operator.

In the table, we have given the approximate cost of the cost of online cash registers and the first year of their operation.

Thus, the replacement of cash registers occurs gradually. The final transition to online cash registers is expected to be completed in mid-2019.

To pay insurance premiums, taxes and cashless payments, we recommend opening a current account. In addition, many banks provide preferential terms of service. So, for users of our website, Alfa-Bank provides 3 months of completely free service and a free connection to an online bank.

Under the new 54-FZ "On the use of cash registers" almost all retail fell: in 2018 online cash registers put the majority of businessmen. And by July 1, 2019, all entrepreneurs should use cash register equipment - even on UTII and PSN without employees.

To meet the new requirements, it is not enough just to buy the right equipment. Now the receipts must indicate the names of the goods, which means that you need a cash register program that can do this. Our free application Cashier MySklad supports this and all other requirements of 54-FZ. Download and try it right now.

Online cash desks. Latest news

- From January 1, 2019, new requirements for online cash registers are introduced. The format of fiscal data is changing: a new version FFD - 1.05. If the cash register was registered with FFD 1.0, it will have to be re-registered. The VAT rate will also be changed: from January 1, 2019 - 20%. Online cash registers will have to print checks indicating exactly this rate. Learn more about how to reconfigure the CCP >>

- The State Duma adopted amendments to 54-FZ. They say that after receiving an online payment, a check must be generated no later than the next business day.

- From July 1, 2019, it will be necessary to punch a check after payment individual through a bank.

- For non-cash payment, if the buyer's e-mail address or phone number is unknown, you need to print the receipt and give it along with the goods.

- From July 1, 2019, it will be necessary to punch checks when offsetting an advance payment: it will take two cash document- upon receipt of advance payment and upon transfer of goods.

- If the entrepreneur ceases his activity and this is recorded in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs, the cash register is deregistered automatically.

- The concept of settlements has been expanded: now they include not only any movement of money in cash and by bank transfer, but also the offset of prepayment (for example, sales with gift cards).

- The procedure for actions in the event of a breakdown of the fiscal drive has been approved. Now we need to hand over the broken FN to the manufacturer for examination. If the breakdown occurred due to a manufacturing defect, it is made free of charge. Within five working days from the date of the breakdown, you must submit an application for registration (re-registration) of the cash register with a new drive or for deregistration. If data can be read from a broken FN, they must be transferred to the tax office within 60 days.

- For individual entrepreneurs on a patent and UTII payers, the introduction of online cash desks was postponed until July 1, 2019.

- Entrepreneurs who do not have employees and prisoners received a reprieve employment contracts. If the entrepreneur hires workers, he must register a new cash desk within 30 days.

- In 2018, the tax authorities can fine an entrepreneur up to 50% of the amount received during the period of trading without an online cash desk, but not less than 10,000 rubles. Companies face a fine of up to 100%, but not less than 30,000 rubles. From July 1, sanctions will also be introduced for the use of cash registers in fictitious settlements: organizations can be punished in the amount of up to 40,000 rubles, individual entrepreneurs - up to 10,000 rubles. There will also be fines for labeled goods incorrectly indicated on the receipt: up to 100,000 rubles can be recovered from companies, and up to 50,000 rubles from an entrepreneur. The same amounts will be fined if fiscal data is not submitted to the tax office on time.

Online cash desks began to be phased in in 2016, but since then the situation has changed more than once. Below are the answers to the main questions about the application of new CCPs in 2018-2019.

Watch the recording of our seminar, where Ivan Kirillin, head of the sales department of My Warehouse, spoke about recent changes in 54-FZ: how to choose a cash desk taking into account the new requirements, which option is suitable online store, how to switch to FFD 1.05 and VAT 20%.

Who is affected by the new edition of 54-FZ

Who is required to use online cash registers in 2018-2019?

Do you need online cash desks for UTII and a patent in 2019?

Online cash desks for UTII and a patent are needed from July 1, 2019. But, if you work in catering or retail and have hired employees, you had to switch before July 1, 2018.

Are online cash desks used under the simplified tax system in 2019?

Yes. Those who trade in excisable goods in 2018 should have already used online cash desks. If you are not already doing so - Those who are employed in the catering industry and have hired employees should have registered a CCP before July 1, 2018. And those who do not have workers received

Law on online cash registers: how to apply BSO (strict reporting forms)?

Until July 1, 2019, organizations and individual entrepreneurs providing services to the public can issue BSOs in paper form. An exception is made only for public catering. After this date, you need to switch to an electronic format. BSOs are printed on a special CCP - automated system for forms of strict reporting. The requirements for checks and forms have changed - new details have been added, for example, it is necessary to indicate the serial number of the fiscal drive and the name of the OFD. All

Is it necessary to install cash registers in vending machines?

From July 1, 2018 vending machines should be equipped with CCP. You can use one checkout for all devices. If you are an individual entrepreneur without employees and trade using automatic machines, you can not use KKM until July 1, 2019.

Was it necessary to use online cash registers in catering in 2018?

About the new cash register equipment

How much will the online checkout cost?

The cost of a new CCP is, according to the Ministry of Finance, about 25,000 rubles. You can buy cheaper from us: for example, the "Economy" kit. It includes an online cash desk, a one-year contract with OFD and cash program. All prices -

Will those who purchase a new CCP receive a tax deduction?

Do I need to contact the technical service center (TSC) to register a new type of cash register? Who maintains online checkouts?

How to set up MySklad to work with a new cash register?

We provide for setting up the work of My Warehouse with new cash desk. If you still have questions, our technical support is available around the clock and will help you figure it out.

Does the point of sale in MySklad work when the Internet is disconnected?

Yes. You will be able to punch checks, all completed sales are recorded in the system and fiscal drive. After the connection is restored, the data will automatically be sent to the OFD.

Can I send a check to the buyer directly from My Warehouse? Including SMS?

Yes. To do this, the seller's interface in MySklad has fields for entering the buyer's contact information.

What to do with the return of goods in MyWarehouse under the new scheme?

MyWarehouse forwards returns to fiscal registrar. The FR automatically sends this data to the OFD, and from there they go to the tax office.

How to work with goods without a barcode in MyWarehouse, for example, with bulk goods?

Barcodes have nothing to do with the requirements of the law 54-FZ, they are used for convenient operation with goods. MySklad supports search by name and work with weight goods.