Various indicators are used to characterize the use of fixed production assets. Conventionally, they can be divided into two groups: general and partial indicators.

General indicators are used to characterize the use of fixed assets at all levels National economy- enterprises, industries and the national economy as a whole. These indicators include capital productivity and profitability.

Private indicators

- These are natural indicators that are most often used in enterprises and their divisions. They are divided into indicators of intensive and extensive use fixed assets. Indicators intensive use OF characterize the value of the output (work performed) per unit of time from a certain kind equipment (or production facilities). Indicators of extensive use of fixed assets characterize their use over time. Among the most important of these indicators are: the coefficients of use of the planned, regime and calendar time of equipment operation, the shift ratio of equipment operation, the indicator of intra-shift downtime, etc.

In the process of analysis, the dynamics of the listed indicators, the implementation of the plan in terms of their level are studied, inter-farm comparisons are carried out.

Sources of data for analysis: business plan of the enterprise, technical development plan, accounting balance sheet of the enterprise, appendix to the balance sheet, report on the availability and movement of fixed assets, balance of production capacity, data on the revaluation of fixed assets, inventory accounting cards of fixed assets, design estimates, technical documentation and etc.

The most important among the private indicators of extensive use is the coefficient of shift work of equipment, which is defined as the ratio of the sum of machine shifts during the day to the total number of jobs. Increasing the shift ratio of fixed assets at the enterprise is an important source of growth in production volume and increasing the efficiency of using fixed assets. In economic practice, the shift ratio for the use of machinery and equipment is defined as the ratio of the number of machine-shifts worked per day by equipment to the total number of installed equipment according to the formula:

Kcm \u003d MS / KO, where

Ксм - coefficient of shift of equipment use;

MS - the sum of actually worked machine shifts per day;

KO - the total number of installed equipment.

The main direction of increasing the efficiency of equipment use is to improve its structure and increase the degree of power utilization. Importance has the elimination of the relative excess of equipment, which affects economic indicators enterprises.

An indicator of the extensive use of fixed assets is the amount of intra-shift downtime of equipment, related to the planned fund of its operation time. The main reasons for intra-shift downtime of equipment are the low level of organization of production, the lack of timely loading of workers, equipment malfunction, etc. To eliminate this shortcoming, it is necessary first of all to improve the organization of production, to establish accounting and control of equipment operation.

An increase in the shift ratio is the most important indicator of the extensive utilization of fixed assets.

Indicators of the use of production space and facilities are important. Their rational use makes it possible to obtain an increase in output without capital construction and thereby reduces the size of the required attachments. At the same time, time is gained, since it is possible to organize production on the released production areas much faster than to carry out new construction. Among the indicators of the use of production space are used: the coefficient of extensive and intensive use of production space; the volume of production from 1m3 of production space. The use of facilities is assessed based on production characteristics objects, usually bandwidth or power ( water towers, bunkers, reservoirs and cisterns, etc.).

To determine the degree of use of fixed assets at enterprises, generalizing indicators are used. The most important of them is the return on assets of fixed assets. This indicator is defined as the ratio of the value of products produced per year to the average annual value of fixed assets. The return on assets shows what is the total return on the use of each ruble invested in fixed production assets, that is, how effective this investment is. The most important areas for increasing capital productivity:

Improving the structure of fixed assets, increasing specific gravity their active part to the optimal value, a rational ratio various kinds equipment;

Increasing the shift ratio of equipment in the divisions of the enterprise;

Intensification of production processes through the introduction of new technologies, machines and equipment;

Improving the working conditions and regime, taking into account industrial aesthetics;

Creation of favorable social conditions;

Improving the organization of production and labor.

Another general indicator is capital intensity, which is calculated as the ratio of the value of fixed production assets to the volume of output according to the following formula:

Fe = Fosn / Vpr, where

Fe - capital intensity;

Fosn - the cost of fixed production assets, rub.;

Vpr - the volume of production, rub.

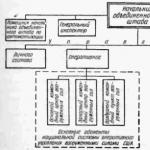

A system of indicators is used to assess the level of use of fixed production assets.

I. General indicators of OS usage:

1. return on assets- indicator of output per one ruble of the average annual cost of fixed production assets:

where F o - capital productivity;

TP - the volume of marketable products, rub.;

F s.g - the average annual cost of fixed assets, rub.

2. capital intensity is the reciprocal of capital productivity. It shows the share of the cost of fixed production assets attributable to each ruble of output:

where F e - capital intensity.

The return on assets should tend to increase, and the capital intensity should tend to decrease.

3. capital-labor ratio shows the cost of OPF per employee:

where F в - capital-labor ratio, rub./person;

H PPP - the average number of PPP for the year.

4. Technical equipment of labor(F v.tech):

![]()

where F act is the average annual cost of the active part of the BPF.

5.Profitability of fixed assets (fundamental profitability) shows the share of profit attributable to the ruble of the cost of the OS:

![]()

where P - profit (balance sheet or net).

6. The criterion for the effectiveness of the use of the BPF in the enterprise(E ef). Shows how many percent of the increase in labor productivity is accounted for by 1% of the increase in capital-labor ratio:

where DPT is the growth rate of labor productivity for the period, %;

DF в – growth rate of capital-labor ratio for the period, %.

II. The movement of fixed assets is characterized by the following indicators:

1. The coefficient of receipt (input) K in:

2. Update coefficient K about:

This indicator characterizes the degree of technical progress of the OF for a certain period.

3. Retirement rate K vyb:

4. Liquidation coefficient K l:

5. Growth coefficient K pr:

6. Replacement coefficient K deputy:

7. Coefficient of expansion of the fleet of machinery and equipment K ext:

K ext \u003d 1 - K deputy.

III. Technical condition OPF is characterized by indicators:

1. Serviceability coefficient (Ke):

2. Wear coefficient (K and):

K r + K u = 1.

IV. The use of equipment is characterized by indicators:

1. Extensive equipment utilization ratio is determined by the ratio of the actual number of hours of operation of the equipment to the number of hours of its operation according to the plan:

where Ф f is the time actually worked by the equipment, hours;

Ф eff - planned effective equipment time fund for the same period, h.

2. Equipment intensive utilization rate is determined by the ratio of the actual performance of the equipment to its technical (passport) performance:

where В f - the actual volume of output for the period, rub.;

In pl - the established output (production) for the same period, rub.

3. The coefficient of integral use of equipment is equal to the product of the coefficients of intensive and extensive use of equipment and comprehensively characterizes its operation in terms of time and productivity:

K int = K e * K and .

4. Equipment shift factor- the ratio of the total number of worked machine shifts to the number of installed equipment:

![]()

where t s is the number of worked machine-shifts;

N- total number equipment;

MS 1, 2, 3 - the number of machine-shifts of equipment operation in only one shift; in two shifts; in three shifts.

5. Equipment load factor- the ratio of the shift ratio of work to the planned shift of equipment (K pl):

The main directions for improving the use of OF and production capacities:

Reducing equipment downtime and increasing the coefficient of its shift;

Replacement and modernization of worn out and obsolete equipment;

Implementation latest technology and intensification of production processes;

Rapid development of newly commissioned capacities;

Motivation effective use fixed assets and production capacities.

Accounting and evaluation of fixed assets make it possible to judge their quantitative share in the general composition of the elements of the enterprise. Judgment about how the management of these funds (the qualitative side) affects the change in its economy and structure can only be obtained from consideration of groups

indicators.

1. Indicators of extensive use of fixed assets, reflecting the level of their use over time;

2. indicators of intensive use of fixed assets, reflecting the level of their use in terms of capacity (productivity);

3. indicators of the integral use of fixed production assets, taking into account the combined influence of all factors - both extensive and intensive.

The first group of indicators includes: the coefficient of extensive use of equipment, the coefficient of shift work of the equipment, the coefficient of equipment load, the coefficient of the shift mode of the equipment operation time.

The coefficient of extensive use of equipment Kext is determined by the ratio of the actual number of hours of operation of the equipment to the number of hours of its operation according to the plan, i.e.

Кext \u003d tobr.f / t rev.pl.

where tobor.f - the actual operating time of the equipment, h;

torev. Pl. - equipment operation time according to the norm (set in accordance with the operating mode of the enterprise and taking into account the minimum required time for scheduled preventive maintenance),

Extensive use of equipment is also characterized by the shift ratio of its work, which is defined as the ratio of the total number of machine-shifts worked out by equipment of this type during the day to the number of machines that worked in the largest shift.

The equipment utilization factor also characterizes the use of equipment over time. It is installed for the entire fleet of machines that are in the main production. It is calculated as the ratio of the labor intensity of manufacturing all products on this type of equipment to the fund

the time of his work.

Based on the shift indicator of equipment operation, the coefficient of use of the shift mode of equipment operation time is calculated. It is determined by dividing the shift coefficient achieved in a given period

operation of the equipment for the duration of the shift established at the given enterprise (in the shop).

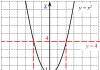

The coefficient of intensive use of equipment is determined by the ratio of the actual performance of the main technological equipment to its standard performance, i.e. progressive technically sound performance. To calculate this indicator, use the formula:

Kint \u003d Vf / Vn

where Vf is the actual production output by the equipment per unit of time;

Vn - technically justified production output by equipment per unit of time (determined on the basis of equipment passport data).

The third group of indicators of the use of fixed assets includes the coefficient of integral use of equipment, the coefficient of utilization of production capacity, indicators of capital productivity and capital intensity of products.

The coefficient of integral use of equipment is defined as the product of the coefficients of intensive and extensive use of equipment and comprehensively characterizes its operation in terms of time and productivity (power).

K int.gr \u003d K ext. * K int.

F dep. = T/F,

Where T is the volume of commercial or gross, or sold products, rub.;

F - the average annual cost of the OPF of the enterprise, rub.

The average annual cost of OPF is determined by:

F \u003d F1 + (Finput * n1) / 12 - (Fvyb * n2) / 12,

Where F1 is the cost of the OPF of the enterprise at the beginning of the year, rubles;

Fvvod, Fvyb - the cost of OPF introduced, leaving during the year, rub.;

n1,n2 - the number of full months from the date of entry (withdrawal).

To characterize the use of fixed production assets, various indicators are used, which can be conditionally divided into 2 groups: general and particular indicators.

Private indicators- as a rule, natural, used to characterize the use of fixed assets, most often in enterprises or in their divisions. These indicators are divided into indicators of extensive and intensive use of fixed assets.

Indicators of extensive use of fixed assets characterize their use in time indicators of intensive use of fixed assets characterize the amount of product removal (work performed) per unit of time from a certain type of equipment (or production capacity).

To the number key indicators extensive use fixed assets include the utilization ratios of the planned, routine and calendar hours of equipment operation, the shift ratio of equipment operation, the indicator of intra-shift downtime, etc.

The equipment shift coefficient is determined by the formula:

where is the shift factor for the use of equipment;

The amount of actually worked machine shifts per day;

The total number of installed equipment.

The main purpose of increasing the shift in the use of equipment is to improve the formation of fixed assets.

In addition to indicators of extensive and intensive use of equipment, the following are also important: indicators of the use of production areas and facilities. Among the indicators of the use of production space, the most important are the coefficients of extensive and intensive use of production space; load factor of the production areas of the workshop, site; the utilization rate of industrial and production areas for equipment and the rate of removal of products from 1 sq. m of production area. The use of facilities is assessed based on the production characteristics of the facilities - usually their throughput or capacity (water towers, bunkers, reservoirs and cisterns).

General indicators are used to characterize the use of fixed assets at all levels of the national economy - for enterprises, industries and the national economy as a whole.

The most important of them - capital productivity of fixed assets , defined as the ratio of the cost of production (gross, marketable or standard net) to the average annual value of fixed assets. The return on assets shows the overall return on the use of each ruble spent on fixed production assets, that is, the effectiveness of this investment.

The next summary is capital intensity , which is calculated using the following formula:

where - capital intensity;

The cost of fixed production assets (rubles);

Volume of production (rubles).

Such a generalizing indicator as rate of return . This indicator has 2 varieties: in the first variant, profitability is calculated as the ratio of profit to the costs of the enterprise (cost) without taking into account the efficiency of the use of production assets; the second option provides for the calculation of profitability as the ratio of profit to the sum of fixed assets and working capital, i.e., taking into account production assets.

WORKING ASSETS OF THE ENTERPRISE

1. FORMATION AND USE OF WORKING ASSETS OF THE ENTERPRISE

working capital- this is a set of funds advanced to create working capital and circulation funds, ensuring a continuous circulation of funds.

Revolving production assets - these are objects of labor (raw materials, basic materials and semi-finished products, auxiliary materials, fuel, containers, etc.); means of labor with a service life of not more than 1 year or a cost of not more than 50 times the established minimum wage per month (low-value and wearing items and tools); work in progress and deferred expenses.

circulation funds - these are the funds of the enterprise invested in stocks of finished products, goods shipped but not paid for, as well as funds in settlements and cash on hand and in accounts.

Working capital ensures the continuity of production and sales of the company's products.

Circulating production assets enter production in their natural form and are entirely consumed in the process of manufacturing products. They transfer their value to the product they create. Circulation funds are associated with servicing the process of circulation of goods. They do not participate in the formation of value, but are its carriers. After the end of the production cycle, the manufacture of finished products and its sale, the cost working capital reimbursed as part of the proceeds from the sale of products (works, services). This creates the possibility of a systematic resumption of the production process, which is carried out through a continuous circulation of enterprise funds.

In its movement, working capital passes successively 3 stages: monetary, productive and commodity.

Monetary stage of the circulation of funds is preparatory. It takes place in the sphere of circulation, where the transformation of money into the form of production reserves takes place.

Production stage is a direct process of production. At this stage, the cost of created products continues to be advanced, but not in full, but in the amount of the cost of used production stocks, the costs of production are additionally advanced. wages and related costs, and the carry-forward value of operating assets.

On the commodity stage of circulation the product of labor continues to be advanced in the same amount as at the productive stage. Only after the transformation of the commodity form of the cost of manufactured products into cash, the advanced funds are restored at the expense of a part of the proceeds received from the sale of products. The rest of its amount is cash savings, which are used with a plan for their distribution.

The monetary form that current assets take at the third stage of their circulation is at the same time the initial stage of the circulation of funds.

The circulation of working capital occurs according to the scheme: D-T...P...T1-D1, where D- funds advanced by an economic entity; T - means of production; P- production; T1 - finished products; D1- cash received from the sale of products and includes realized profits. Points ( ... ) means that the circulation of funds is interrupted, but the process of their circulation continues in the sphere of production.

Working capital is simultaneously at all stages and in all forms of production, which ensures its continuity and uninterrupted operation of the enterprise.

Rhythm, coherence and high performance largely depends on the optimal size of working capital. Therefore, the process is of great importance. regulation of working capital.

The standard of working capital establishes their minimum estimated amount, which is constantly necessary for the enterprise to work. Actual stocks of raw materials, cash, etc. may be above or below the standard, or meet it - this is one of the most volatile indicators of current financial activity.

Failure to fill the standard of working capital leads to a reduction in production, and excess stocks divert money from circulation. All this leads to insufficient or inefficient use of resources.

Let us give an example of determining the needs of an enterprise in working capital.

The need for working capital for raw materials and supplies is determined by multiplying their one-day consumption by the norm in days, which, like all other norms, is established by the economic entity independently.

The need for working capital for work in progress is determined by multiplying the one-day output by the rate of work in progress in days.

The need for working capital for finished products is established by multiplying the one-day output of products at cost by the rate of working capital for finished products.

The need for working capital for stocks of goods is determined by multiplying the one-day turnover of these commodities at purchase prices by their stock rate in days.

Need in cash at the register and transfers in transit are determined by multiplying the one-day turnover at sales prices by the norm of the stock of funds in days.

The need for working capital for other material assets is established by the method of direct counting or by the calculation and analytical method. In the economic entity under consideration, the standards for the above types of working capital are accepted in the amount of their needs.

For the formation of working capital, the enterprise uses its own and equivalent funds, as well as borrowed and borrowed resources.

Sources of formation of working capital can be: profit, loans (banking and commercial, i.e. deferred payment), equity (authorized) capital, shares, budget funds, redistributed resources (insurance, vertical management structures), accounts payable, etc.

Accounts payable means the use of funds that do not belong to the enterprise.

Accounts payable permanently at the disposal of an economic entity include payroll arrears, payroll accruals, a reserve of future payments and expenses, etc. Suppose that the business entity in question has only wage arrears and accruals on it.

The amount of the minimum wage arrears is determined by the following formula: Zm = FxD, where Zm- minimum wage arrears (rubles); F- planned wage fund for the quarter (rubles) (including payroll charges); D- the number of days from the beginning of the month to the date of payment of wages.

The financial plan does not include the total amount of this debt, but its change (growth or multiplication) for the planning period.

The increase in accounts payable, which is constantly at the disposal of an economic entity, acts as a source of financing for the increase in working capital. The rest of the increase in working capital is financed from profits, etc.

The efficiency of the use of working capital has an impact on the financial performance of the enterprise. In its analysis, the following indicators are used: the presence of own working capital, the ratio between own and borrowed resources, the solvency of the enterprise, its liquidity, the turnover of working capital, etc.

Availability of own working capital, as well as the ratio between own and borrowed working capital characterize the degree of financial stability of the enterprise.

The solvency of the enterprise i.e., its ability to fulfill obligations in a timely and complete manner.

The solvency of an enterprise expresses its liquidity - the ability to make the necessary expenses at any time. Liquidity depends on the amount of debt and on the amount of liquid funds.

Working capital turnover - an important indicator of their effectiveness. The criterion for evaluating the effectiveness of working capital management is the time factor: the longer working capital stays in the same form (cash or commodity), the lower the efficiency of their use, other things being equal, and vice versa.

One of the main indicators of turnover is the duration of one turnover of working capital, calculated in days according to the following formula:

(Average amount of working capital) x (Time period)

Sales volume in this period

The turnover in days allows you to judge how long the working capital goes through all the stages of circulation at a given enterprise. Turnover is also measured by the number of turnovers made by working capital for a certain period of time:

_____ _Volume of sales for the period of time______

Average amount of working capital for the same period

Comparison of turnover ratios in dynamics by years reveals trends in the efficiency of the use of working capital.

The acceleration of the turnover of working capital contributes to their absolute and relative release from circulation. Under absolute release is understood as a decrease in the amount of working capital in the current year compared to the previous year with an increase in sales volumes. Relative release occurs when the rate of growth in sales outpaces the rate of working capital. In this case, a smaller amount of working capital provides a larger amount of sales.

It is also important for the company index of provision with own working capital, which is calculated as the ratio of the amount of own working capital to the total amount of working capital. The Ministry of Finance of the Russian Federation has set the minimum value of this indicator at the level of 10%.

2. IMPACT OF WORKING ASSET MANAGEMENT ON THE FINAL RESULTS OF THE WORK OF THE ENTERPRISE

The efficiency of managing the working capital of an enterprise has a great influence on the results of its financial and economic activities.

On the one hand, it is necessary to more rationally use the available working resources - we are talking primarily about optimizing inventories, reducing work in progress, improving the forms of payment, etc.

On the other hand, enterprises now have the opportunity to choose different variants writing off costs to prime cost, determining the proceeds from the sale of products (works, services) for tax purposes, etc.

For example, depending on the conjuncture of demand and forecasting sales volumes, enterprises may be interested in intensive cost write-offs or in their more even distribution over a period. To do this, it is important to choose from the list of options the one that will meet your goals.

A significant part of these alternative opportunities relates to the field of working capital management of the enterprise. Let's consider some examples of the impact of decisions made on the final financial results (profit, loss).

For low-value and fast-wearing items (IBE), there is currently a limit on the cost of their inclusion in working capital - 50 minimum wages per month. The head of the enterprise has the right to stop the lower limit of the cost of the IBE, which will lead to a decrease in costs attributable to the cost in this period as a result of a smaller depreciation write-off.

In addition, it is possible different methods accrual of depreciation of the IBP: accrual of 100% depreciation immediately upon transfer to operation, which will increase the costs of the current period; accrual of 50% depreciation upon transfer of the MBP to operation and 50% depreciation (minus returnable materials at the price of possible use) upon disposal. IBEs worth up to 1/20 of the established limit are written off to cost immediately, regardless of the chosen depreciation method.

Inventories are the least liquid item among items of current assets. It takes time to turn this article into cash, not only to find a buyer, but also to receive payment for the products from him later.

Violation of the optimal level of inventories leads to losses in the company's activities, as it increases the cost of storing these inventories; diverts liquid funds from circulation; increases the risk of depreciation of these goods and reduce their consumer qualities. In this regard, the definition and maintenance of the optimal amount of reserves is an important section of the financial work.

Inventories are reflected in the financial statements in accordance with the rule of the lowest of the two estimates - at cost or market price. According to generally accepted standards, the basis for estimating inventories is the cost, which refers to the costs of their acquisition. The following inventory valuation methods are used: at the cost of each unit of purchased goods (specific identification method); at average cost (average cost), in particular on the weighted average (weighted average cost) and moving average (moving average cost); at the cost of first-time purchases - FIFO (first- in- first- out- FIFO); at the cost of the latest purchases - LIFO (last- in- first- out - LIFO).

Valuation method based on determining the cost of each unit of purchased stocks - This is an accounting of their movement at actual cost. This method requires physical identification of all inventory purchases made, which is quite difficult to do in a high-volume production environment.

Inventory valuation at average cost based on the use of appropriate formulas for calculating averages. The approximation of the result is compensated by the simplicity and objectivity of the calculations.

Inventory valuation using the FIFO method is based on the assumption that inventories are used in the same sequence in which they are purchased by the enterprise, i.e. the inventories that come into production first should be valued at the cost of purchases first in time.

The order of valuation does not depend on the actual sequence of expenditure of materials. When calculating, the formula is used: P \u003d H + P - K, where R- the cost of the materials used; H- balance of materials at the beginning of the period; P- cost of received materials for the period; To- balance of materials at the end of the period.

The remaining materials at the end of the period are valued at the price of the last purchase: K= VxC, where V- quantity of materials at the end of the reporting period in natural terms; C- the price of the last purchase.

The implication of this method is that end-of-period inventories are valued practically at their actual cost, while cost of goods sold includes the prices of the earliest purchases. As a result of this, enterprises may seek to increase the prices of products sold based on the increase in the prices of inventories. When using the FIFO method, the profit of the enterprise turns out to be relatively overestimated.

The essence of the LIFO method is that the receipt of stocks in production is estimated at the cost of the latest purchases, and the cost of stocks at the end of the period is determined based on the cost of the earliest purchases.

The LIFO method allows you to more accurately determine the cost of goods sold and net profit from sales, but misrepresents the cost of inventories at the end of the period. But unlike the FIFO method, the LIFO method provides for linking current income and expenses (the matching principle) and allows you to smooth out the impact of inflation. It is also obvious that when prices rise, the profit reflected by the enterprise in the financial statements is underestimated.

All of the above methods for estimating inventories comply with international accounting and reporting standards, but provide significantly different indicators of the company's net profit. The enterprise independently chooses the method of assessment based on the characteristics of its financial and economic activities.

The cost price is the basis for estimating inventories. However, in cases where the market price of these inventories is less than cost, the market price is used in reporting. The market price of inventories is the cost that a business would need to replace an item of inventory. The application of the lowest valuation rule is due to the principle of prudence, since a decrease in the replacement cost of inventories is in most cases a harbinger of a fall in the selling price or reflects an actual decrease in this price.

The main goal of managing the assets of an enterprise, including working capital, is, in the general case, maximizing the return on invested capital while ensuring a stable and sufficient solvency of the enterprise.

The tasks of maximizing profit on invested capital (profitability) and ensuring high solvency to a certain extent oppose each other. Thus, in order to increase profitability, funds should be invested in various current and non-current assets with a liquidity that is obviously lower than money. And to ensure sustainable solvency, the enterprise must always have a certain amount of money on the account, actually withdrawn from circulation for current payments. Part of the funds should be placed in the form of highly liquid assets. Therefore, an important task in terms of managing the working capital of an enterprise is to ensure the optimal balance between solvency and profitability by maintaining the appropriate size and structure of current assets. It is also necessary to maintain the optimal ratio of own and borrowed working capital, since the financial stability and independence of the enterprise, the possibility of obtaining new loans, etc., directly depend on this.

Thus, an enterprise in the case of effective management of its own and other people's working capital can achieve a rational economic position, balanced with respect to liquidity and profitability.

Lecture 4

ENTERPRISE FINANCE

To assess the level of use of fixed assets, and primarily their active part (machinery and equipment), each industry uses its own indicators. There are many and they are varied. All these indicators can be combined into three groups: extensive, intensive and generalizing.

Extensive indicators

They characterize the use of machines, equipment, mechanisms (1) in terms of composition, (2) quantity and (3) time.

1. According to the composition, all equipment is divided into cash, installed, working according to the plan and actually working. The ratio of each subsequent group to the previous or cash characterizes the degree of equipment involvement in manufacturing process. Calculated indicators such as

(1) fleet utilization rate (the number of units of actually operating equipment divided by the number of units of equipment available);

(2) utilization rate of installed equipment (the number of units of actually operating equipment divided by the number of units installed in the workshops).

Example. Of the total number of equipment in 3960 sd. 3600 units were installed, of which 3550 should work according to the plan, but 3500 units actually worked. In this case, the ratio of installed equipment will be, the utilization ratio of the equipment fleet

2. To analyze the use of equipment over time, apply:

(1) calendar (nominal), regime and valid (working) funds of equipment use time;

(2) coefficient of extensive use of equipment;

(3) shift ratio.

Calendar fund of time is equal to the number of calendar days in the planning period, multiplied by 24 hours (365 24 = 8760 hours).

Regime fund of time determined by the mode of production. It is equal to the product of working days in the planned period by the number of hours in the work shift.

Valid (working) fund the operating time of the equipment is equal to the regime minus the time for scheduled preventive maintenance.

Extensive equipment utilization ratio K e is determined for each group of homogeneous machines or for individual machines and equipment according to the following formula:

where T f - the actual operating time of the equipment, h;

T n - calendar, regime, planned fund of equipment operation time, h.

Example. The actual working time of the equipment in the workshop is 3650 hours, and the regime fund of the operating time of the same equipment is set at 3870 hours. In that case

The shift coefficient K cm characterizes the time of full-shift use of the installed equipment operating in a multi-shift mode, and is calculated for individual groups of equipment, for individual divisions and for the enterprise as a whole. It shows how many shifts I work on average per day. installed equipment. The shift ratio is calculated by the ratio of the equipment operation time for the entire working day (day, machine-hours) to the time of its operation in a shift from the largest number machine hours worked.

![]()

where T 1 , T 2 , T 3 - the operating time of the equipment in the 1st, 2nd and 3rd shifts, st.-h;

T n - the operating time of the equipment with the largest number of machine hours worked, st.-h.

Example. If T 1 \u003d 1000, T 2 \u003d 600 and T 3 \u003d 500 st.-h, then

![]()

where n 1 , n 2 , n 3 - the number of pieces of equipment that worked in 1, 2 and 3 shifts;

n y is the total number of installed equipment.

Through more complete use of equipment in shifts, output can be greatly increased with the same cash funds. The equipment shift factor can be increased:

(1) an increase in the level of specialization of jobs, which ensures the growth of batch production and equipment loading;

(2) increasing the rhythm of the enterprise;

(3) reduction of downtime associated with shortcomings in the organization of production;

(4) the best organization repair;

(5) mechanization and automation of the labor of the main and auxiliary workers.

Intensive indicators

These indicators characterize the use of equipment in terms of power. The intensity of the equipment is measured by the amount of products produced by this equipment per unit of time. The more product is produced per unit of time on each machine, the better the main indicator is used - equipment usage rate (K and). It is calculated as the ratio of the volume of actually produced products for a certain period to the calculated maximum possible volume for the same period:

where V fact is the actual volume of production;

V max - the maximum possible volume of production.

Maximum possible number of manufactured products is defined as the product of the rate of output per unit of time and the calendar time of equipment operation.

General indicators

Indicators of extensive and intensive use of equipment are not directly related to each other. Some show the operating time, but do not reflect the equipment load per unit of time, others give an idea of the intensity of the equipment operation, but do not disclose how the total fund of possible equipment operation time is used. Therefore, an indicator is needed that would combine extensive and intensive reserves.

1. Such a generalizing indicator is integral coefficient of equipment utilization (K int), which is determined by multiplying the coefficient of extensive and the coefficient of intensive use (K int \u003d K and) and characterizes the use of equipment both in time and in power.

2. A generalizing cost indicator for the use of the entire set of fixed assets of an enterprise is return on assets - the ratio of annual output (gross, marketable) in monetary terms to the average annual cost of fixed production assets:

where FO - capital productivity of fixed assets, rub./rub.;

VP (TP) - the volume of gross or marketable output for the year, rub.;

OF s.g - the average annual cost of fixed assets, rub.

Return on assets is the main estimated indicator of the use of fixed production assets. It is used in planning the volume of production, calculating the necessary investment, labor productivity, etc.

3. The capital intensity of production, the value, the return of capital productivity. Capital intensity (FU) shows the share of the value of fixed assets attributable to each ruble of output:

![]()

If the return on assets should tend to increase, then the capital intensity should tend to decrease.

Example. With an average annual cost of fixed production assets equal to 206 million rubles and an annual projection output of 240 million rubles. capital productivity will be 1.16 rubles / rub. (240 million / 206 million), and capital intensity - 0.86 rubles / rub. (206 million/240 million).

4. The indicator is also important for the enterprise. capital-labor ratio , calculated as the ratio of the value of fixed assets to the number of production workers:

where Ф в - capital-labor ratio, rub./person;

h p - the number of employees, pers.

The capital-labor ratio of labor must continuously increase, since the technical equipment of labor and, consequently, labor productivity depend on it.