19Apr

Hello, in this article we will discuss the removal of individual entrepreneurs from state records.

Today you will learn:

- How to withdraw individual entrepreneur from accounting in the tax;

- How to remove an individual entrepreneur (with or without employees) from the register with the Pension Fund and the Social Insurance Fund;

- How to deregister a cash register.

When an IP is deregistered

The SP may at any time own will. Sometimes this is the most correct decision of the situation, because the individual entrepreneur is responsible for all the mistakes with his budget and property.

In fact, the deregistration of an individual entrepreneur, its closure and liquidation are synonymous concepts.

By a court decision, it happens automatically; a citizen will be able to start entrepreneurial activity again only after a year.

Deregistration of IP - the only way exempt yourself from all obligatory payments. A simple suspension of activities will not save the entrepreneur from contributions to the Pension Fund, to the Social Insurance Fund, and will not even save him from taxes.

For example, with an “imputation”, which does not depend on the income of an individual entrepreneur, there is no such thing as a zero declaration, therefore deregistration is the only way out of not paying taxes and contributions.

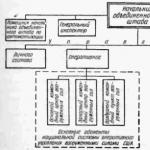

Stages of IP closing

In order to switch from an individual entrepreneur back to the status of a simple citizen, an individual entrepreneur must be deregistered in all state funds.

The closing entrepreneur will have to:

- Settlement of all debts;

- Solving personnel issues;

- Removal of IP from tax accounting;

- Deregistration in the FIU;

- Deregistration in the FSS;

- Deregistration of the cash register;

It begins with an appeal to the tax office, as the main registration authority.

Before filing an application for liquidation of an individual entrepreneur, it is necessary to submit all reports and pay debts. The tax return must be prepared for the last working period, regardless of the schedule. the main task at this stage - to convince the state that the entrepreneur does not have any debts.

Additional costs in the process of liquidation are created by the obligatory payment of the state fee. In 2018, it is equal to 160 rubles.

You can choose any convenient way payment:

- Through a teller in a branch of Sberbank;

- By bank card through the Sberbank terminal (not all terminals are equipped with a similar function);

- Transfer via internet bank.

Removal of IP from tax accounting

An individual entrepreneur leaving the register with the tax authorities will need the following documents:

- Application (form Р26001);

- Certificate of;

- The passport;

- Receipt of payment of state duty;

- Power of attorney to represent the interests of an individual entrepreneur (notarized) - in situations where he himself cannot visit the tax office.

Application submitted to paper version, can be filled out by hand (in block letters, black pen) or on a computer. An electronic form is available on the tax website, and a paper form and sample filling can be found at any branch.

In the first section of the application, the details of the individual entrepreneur are indicated (full name, OGRNIP,). Next, you need to make a choice in which way the IP wants to receive a response notification (personally, through an authorized representative or by mail).

You must sign the application strictly in the presence of a tax officer or a notary.

It is possible to submit documents to the branch that previously registered the individual entrepreneur in any of the following ways:

- Personal visit to the IFTS branch. This is the most popular and quite easy way, however, it will take a lot of time, which will be required for the road and easy in the queues.

- Contacting the tax trustee. Sometimes this function is shifted to a full-time accountant or director. In this case, in addition to the basic package of documents, the authorized person must take his passport and a notarized power of attorney.

- By mail. You can send documents to the tax office from any post office. It is safest to send by registered mail with declared value and acknowledgment of receipt. For insurance, you can make an inventory of all invested papers.

- Through the website of the tax. Here you will need a properly executed electronic signature.

The answer from the tax office should come on the sixth business day after receiving all the documents. If the deregistration is approved, then the former individual entrepreneur will receive an appropriate certificate and an extract from the USRIP. Documents can be received in person or requested to be mailed.

Withdrawal to the FIU and the FSS

Deregistration of individual entrepreneurs without employees in the FIU and the FSS occurs automatically, according to data from the tax. Even if the former individual entrepreneur has debts to funds, he can pay them off after the business is closed. But it’s not worth delaying this case either, otherwise the penalty will go through the court. All debts must be paid within 15 days.

To receive a calculation of mandatory payments, you must contact the Pension Fund with a passport and a certificate of termination entrepreneurial activity received in the tax. If there are debts, the former IP will be issued a receipt for their repayment.

The deadlines for deregistration of individual entrepreneurs in the FIU and the FSS are not established by law, but it is recommended to do this before the start of the new quarter.

The situation is much more complicated with individual entrepreneurs who had employees. They need to pay off their debts in advance. Deregistration of an individual entrepreneur with the Pension Fund occurs on the basis of an extract from the USRIP, which is sent there by the Federal Tax Service.

In practice, individual entrepreneurs often face the requirements of the FIU to submit additional documents, for example:

- Application for deregistration;

- A copy of the order on the dismissal of the last full-time employee;

- Copies work books employees with records of their dismissal.

The removal of an individual entrepreneur as an employer can occur without the termination of entrepreneurial activity. For example, if the individual entrepreneur no longer plans to hire employees, but will continue to work "for himself."

If the individual entrepreneur was registered as an employer, then he is obliged to submit to state funds reporting, even if there are no employees in the state. Therefore, in order to relieve himself of this obligation, the individual entrepreneur must apply to the FIU and the FSS with a statement and confirmation of the dismissal of the last employee.

You can also submit reports to the FSS both before deregistration and after it.

You must contact the FSS if the individual entrepreneur was registered there as an employer. In this case, it is necessary to provide a report, an application for deregistration and copies of documents confirming the termination labor relations with employees (for example, a dismissal order).

The documents are considered by the FSS and the FIU within two weeks, then a copy of the deregistration verdict is sent to the former employer by letter. Although, according to the new rules, confirmation of deregistration can also be sent in electronic format, to the specified IP mail.

You can download applications for deregistration of individual entrepreneurs in the FIU and the FSS below.

Cash register

The cash register is removed from the tax register very quickly. On average, the procedure takes one day, but it can take up to 15 minutes.

Before going to the tax office, you must fill out an application, contact the center Maintenance and call an employee of the company to remove the fiscal report.

The following documents will be required:

- Application for deregistration of CCP;

- Form KND-1110021;

- Fiscal report;

- CCP passport and registration card;

- IP passport.

Deregistration of the cash register in the tax office is free of charge.

If all documents are collected and correctly executed, tax specialists take readings from all counters and draw up an act. The cash desk is officially recognized as closed, which is noted in the CCP passport and registration card, as well as in the CCP accounting book and registration coupon.

The CCP registration card is stored in the tax office for five years after the cash desk is deregistered.

It is possible to receive a refusal to close the cash desk only if errors were made in the documents provided, and the individual entrepreneur did not correct them within 24 hours.

Download an application for deregistration in the FIU

Download an application for deregistration in the FSS

To deregister an individual entrepreneur in the FSS, you need to contact the fund with a corresponding application. Closing an individual entrepreneur is not the only reason for deregistration in the social insurance fund. An entrepreneur can continue to conduct business on his own or by attracting employees to perform one-time work under civil law contracts (in this case, you do not need to register with the FSS).

In what cases is it necessary to deregister in the FSS

Deregistration in the FSS is required after the dismissal of all employees who worked under an employment contract with an individual entrepreneur. Payments of insurance premiums to the FSS under civil law contracts are voluntary. An individual entrepreneur, at will, can include a clause on voluntary insurance of employees and the payment of contributions for them “for injuries”. If an individual entrepreneur continues to have civil law contracts with similar conditions, then he does not need to be deregistered.

This is necessary if the IP:

- made a decision to close the business;

- changed the place of residence;

- fired the last employee and will continue to work independently;

- decided to stop the voluntary payment of disability and maternity contributions.

Deregistration will allow an entrepreneur without employees to get rid of the need to submit quarterly reports on paid and accrued insurance premiums. Companies do not have this opportunity: they must have at least one employee (director), so they are required to continue to file zero statements until closing.

Back to index

The procedure for deregistration in the FSS IP as an employer

To deregister an individual entrepreneur in the FSS, the following documents must be presented simultaneously:

- deregistration applications;

- copies of the order of dismissal or termination of the employment contract (or other documents confirming the termination of the work of the last employee).

You can submit a package of documents to the territorial office in person (you need to have a passport and a seal if you have one) or by registered mail with a description of the attachment. In the latter case, notarization of the copies provided will be required.

Served in the prescribed form (can be found in the law governing the procedure for registration and deregistration in the fund). In it, you need to fill in information about the entrepreneur as an insured (legal address, contacts, subordination code, registration number, etc.).

In some departments of the fund, they additionally require you to provide a notice of registration as an employer received from the FSS. But an individual entrepreneur can indicate in his application that it was lost (no penalties are due for the loss of a notice). It is enough to know your registration number as an employer.

It is not required to file an application for the closure of the IP with the FSS. This form is not provided. After all, an entrepreneur can continue to operate, but without employees.

It is not required to file an application for the closure of the IP with the FSS. This form is not provided. After all, an entrepreneur can continue to operate, but without employees.

The liquidation of the status of the employer and the IP number in the FSS is carried out within 14 working days. After that, the individual entrepreneur will receive a copy of the fund's decision. In case of refusal to deregister, the fund is obliged to indicate the reasons for such a decision.

An individual entrepreneur is obliged to submit reports to 4-FSS until the moment he is deregistered. For example, if he receives a notice about the liquidation of his registration number on February 20, he must submit a report for the 1st quarter by April 15.

It is necessary to first reconcile the calculations in the fund (order a reconciliation report). If there is a debt or overpayment, deregistration may be refused. If arrears are revealed by FSS specialists during a desk audit, it must be paid off as soon as possible. After that, with a document confirming the payment of the resulting debt, you need to submit an application to the fund.

If necessary, you need to write an application for the return of overpaid amounts to the budget. After consideration, the employees of the fund are obliged to notify him of their decision by registered mail and transfer the money to the current account of the individual entrepreneur (in his absence, to a personal account).

Late registration of an individual entrepreneur with the FSS as an employer is punishable by a fine of 5,000 rubles. up to 10,000 rubles For the cancellation of registration in the social insurance fund, the terms are not specified by law, therefore, no liability for untimely deregistration is provided. But the entrepreneur must continue to submit zero reports in the form 4-FSS. You need to do this quarterly, because. for filing the reporting form later than the established deadlines, a fine of 1000 rubles is provided. (as well as for each document not provided). Therefore, it is worth filing an application for deregistration within a reasonable time.

Late registration of an individual entrepreneur with the FSS as an employer is punishable by a fine of 5,000 rubles. up to 10,000 rubles For the cancellation of registration in the social insurance fund, the terms are not specified by law, therefore, no liability for untimely deregistration is provided. But the entrepreneur must continue to submit zero reports in the form 4-FSS. You need to do this quarterly, because. for filing the reporting form later than the established deadlines, a fine of 1000 rubles is provided. (as well as for each document not provided). Therefore, it is worth filing an application for deregistration within a reasonable time.

It is important to consider that the absence of a document confirming the liquidation of the status of the employer is not a basis for refusing to close the IP. It is not on the must-have list.

Back to index

The procedure for deregistration of a voluntarily insured entrepreneur

In the case when the entrepreneur did not involve employees, he does not need to apply to the fund for deregistration. Under standard conditions, an individual entrepreneur is not required to pay insurance premiums for disability, maternity and injury. But he can voluntarily register with the fund to receive compensation from the social insurance fund for sick leaves and child care benefits (in case of illness, going to maternity leave, the birth of a child).

If an individual entrepreneur agrees to pay insurance premiums, he receives the status of a voluntarily insured person. To remove it from the register (as well as for registration), only an application is required.

But you can not submit any documents at all and just wait for the liquidation of the volunteer status.

It should be borne in mind that if the insurance premium for himself is not paid before December 31 of the current year, the entrepreneur will be automatically deregistered as a voluntarily insured person from January 1 next year.

He will be notified of this in writing.

There are no penalties or fines for non-payment of insurance premiums on a voluntary basis. The reporting of individual entrepreneurs for themselves, which had previously been submitted in the form 4-a of the FSS, was abolished in the spring of 2016.

When a businessman ceases his activities, the question becomes relevant: how to deregister as an employer in the FIU. You need to know the nuances to avoid problems with government agencies.

Who can be an employer

AT Russian Federation not only organizations can hire employees. Any private person can use the labor of hired specialists.

There are 5 main categories of employers:

- organizations;

- private entrepreneurs;

- notaries;

- lawyers;

- individuals using wage labor.

A person can sign a contract if he has reached the age of eighteen and gives back reporttheir actions. There are cases when a person acquires legal capacity before the age of eighteen (Article 21 of the Civil Code). Then he can act as an employer earlier than the period specified by law.

In Russia, if a person is incompetent, a guardian must act on his behalf.

Important! If a citizen hires specialists in order to make a profit, then official registration of an individual entrepreneur is required. When people are hired for their own needs and management household you don't need to register.

Registration of an employee must take place under an employment contract (Article 57 Labor Code). But often the requirement is ignored, and the contract is not signed.

Download for viewing and printing:

IP closing procedure

Deregistration of an entrepreneur in the FIU as an employer is carried out upon application. Information about the termination of the work of companies comes automatically from tax office.

To carry out the deregistration procedure, you must:

- Collect the necessary documents for applying to government agencies.

- Notify the tax authorities of the termination of business. The business termination date is the date when changes are made to the USRIP.

- Notify the Social Insurance Fund.

- Notify the pension office.

- Submit information about employee contributions to the pension department.

- Pay outstanding dues, if any. The debt must be repaid no later than fifteen days.

- Wait for certificates confirming the completion of registration actions.

Termination Notice

When deregistration, it is mandatory to indicate in the application:

- IP name;

- registration codes;

- reason for terminating the activity.

The notification form is approved by Decree No. 296 P dated October 13, 2008 Appendix No. 11 is being filled.

5 required information to provide:

- surname, patronymic and given name;

- place of official registration;

- activity codes;

- reasons for business termination;

- the name of the pension department.

Do you need on the subject? and our lawyers will contact you shortly.

Required package of documents

First, documentation is collected for the territorial Federal Tax Service.

First, documentation is collected for the territorial Federal Tax Service.

The following documents are required to apply to government agencies:

- application (form R 26001);

- receipt stating that the fee has been paid;

- the passport;

- TIN;

- registration codes;

- certificates from funds about the absence of debts.

Documentation can be submitted:

- personally;

- send by mail;

- transfer through an authorized person.

When an application is submitted by a representative, a power of attorney is required.

Necessary steps to complete the procedure

At first glance it seems that the bureaucratic procedure quite complex. In fact, you need to do several things.

At first glance it seems that the bureaucratic procedure quite complex. In fact, you need to do several things.

Algorithm of actions for passing the procedure:

- Make payment of state duty. The payment amount is one hundred and sixty rubles (subclause 7, clause 1, article 333.33 of the Tax Code).

- Fill out applications. When bankruptcy becomes the reason for closing a business, a court decision is attached to the application.

- Notify the IFTS and funds.

- Pay debts, if any.

- Close bank account.

- Report income and pay taxes.

Reports and taxes after deregistration of IP

Termination of business does not mean that all debts are removed from a person. Debts to employees, banks and the tax office will have to be repaid. If you delay paying taxes, you will have to pay penalties.

Termination of business does not mean that all debts are removed from a person. Debts to employees, banks and the tax office will have to be repaid. If you delay paying taxes, you will have to pay penalties.

Tax debts can be paid off even after the closure of the IP.

But the situation is different with the pension department. Registration will take place only after all fees have been paid.

What documents remain after the closure of the IP

After activity will be officially terminated, there will be two references:

After activity will be officially terminated, there will be two references:

- from the IFTS;

- from the FIU.

Important! You may need original certificates for the calculation of benefits and benefits. There are benefits that a businessman cannot count on. Therefore, documents confirming the termination of business activities are required.

Instead of a conclusion

If a decision is made to close the business, then the tax authorities should be the first to know this news. After that, it is time to notify other government agencies at the place of residence.

If a decision is made to close the business, then the tax authorities should be the first to know this news. After that, it is time to notify other government agencies at the place of residence.

There is no clear answer to the question: is it mandatory to notify the FIU or not.

Let's explain why.

| Arguments for sending a notice | Arguments against |

| The basis for notification is provided - the termination of the work of a private entrepreneur hiring employees. | The interaction of a private entrepreneur with the FIU is regulated by two legal acts. The procedure is approved by the Resolution of the Board No. 296 P dated October 13, 2008 G and the Law on Compulsory Pension Insurance. The law does not contain a mention that a private entrepreneur must independently send a notice. |

| Get rid of the obligation to report for employees. Some courts are of the opinion that a private entrepreneur is obliged to submit reports even if he dismissed employees. | A private entrepreneur does not have to submit a report when he does not use hired labor. Art. 14 and 16 of the Law "On Insurance Contributions" do not establish the obligation to submit fund reports for individual entrepreneurs where there are no employees. |

So, deregistration of individual entrepreneurs in the PFR department is an ambiguous issue. There are arguments for and against. The businessman solves the problem on his own.

AT recent times Increasingly, there are individual entrepreneurs (IP), limited liability companies (LLC) and other types and forms of companies. Some are made up of one employee(for example, lawyers in private practice), others have several hundred people on staff.

However, regardless of the number of employees, all these persons, both individuals and legal entities, must go through the procedure of registration as an employer in Pension Fund of Russia (PFR), and in case of certain circumstances - to be removed from this account.

Who can be an employer (insurer)?

The main document regulating the registration and deregistration of individuals and legal entities as an insurer is the Federal Law of December 15, 2001 N 167-FZ. It regulates the system (OPS).

According to this document:

- Persons performing the functions of the insured who entered into legal relations under the CPT voluntarily;

- Individuals and organizations paying wages(s/n) to its employees;

- Persons who are not individual entrepreneurs, but are equated to them by the aforementioned law (notaries, lawyers, arbitration managers, etc. - engaged in private practice), paying insurance premiums only for themselves.

The procedure for registering as an employer in the FIU

The term for deregistration in the FIU as an insurer is 3 business days.

- For organizations (LLCs), neither an application nor any documents are required at all - deregistration occurs in non-declarative order, based on the data transmitted by the Federal Tax Service on the liquidation of the organization.

- If the organization is a subsidiary, it will be necessary to write an application, as well as present documents, confirming the termination of activities separate subdivision as an insurer. This may be an order or a decision to switch to centralized system contributions (when the parent company will pay insurance premiums to the FIU), or on the liquidation of a subsidiary.

- When the employer is an individual - an individual entrepreneur, notary, lawyer, etc., who pays wages to their employees, it is deregistered upon application submission to the Russian Pension Fund.

- If the policyholder pays contributions for himself, the withdrawal occurs automatically upon receipt of data from the relevant authorities. The exception to this rule are arbitration managers- they need to write a statement.

Application for deregistration in the FIU

If the termination of the employer's powers does not occur automatically, regardless of the type of insured, he (or his representative) will need to write an application for deregistration (RU).

As in the case of registration, this application contains all the information that the Pension Fund of Russia will need to remove the status of an employer from a legal entity or individual.

In the application, it is required to indicate information about the applicant (full name, TIN, PSRNIP, address and passport data), as well as the reason for removal from the RC.

There are the following types of deregistration applications, depending on the type of insured:

- for separate divisions;

- for individuals that pay salaries to their employees.

Notice of deregistration

According to the current legislation, the Pension Fund of Russia may notify of deregistration as an insurer upon written request of an individual/ legal entity. The notice for persons paying wages is placed in Appendix 11 of the Resolution of the Board of the Pension Fund of the Russian Federation of October 13, 2008 N 296p and contains the following information about the insured:

- Full name in accordance with identity documents;

- registration address;

- registration data - OGRNIP, TIN, registration number received from the Federal Tax Service;

- date of removal from RU;

- name of the FIU.

Conclusion

Deregistration as an insured is as important a process as registration. In general, the following nuances that require attention can be distinguished:

- individuals and legal entities, depending on the type of employers to which they are assigned, have various delivery procedures to the Pension Fund of Russia required documents: for someone, the withdrawal takes place without an application, someone will need to submit an application;

- the basis for deregistration may be the liquidation of the organization, the termination of activity by the entrepreneur, the transition to centralized payment of insurance premiums, the change of residence and the death of the insured.

Legal entities and individual entrepreneurs with employees registered with the regulatory authorities as employers can be deregistered in the prescribed manner. From our article you will learn how deregistration in the FIU of an individual entrepreneur and a legal entity is carried out.

general information

Upon registration with the administrative authorities, employers assume the functions of policyholders, namely:

- monthly calculation and payment of the amount of insurance premiums for each employee (both full-time and hired under a contract);

- maintaining personalized records of information about employees, updating it and submitting it to regulatory authorities in set time(read also the article on the procedure for compiling and filing);

- preparation and submission of reports on the amounts of remuneration paid to employees and the amount of transferred insurance premiums.

Individual entrepreneurs and other self-employed persons using the simplified tax system, UTII, PSN can submit reports in a simplified form. Read more about the functions of the employer-insured in the OPS system.

Deregistration in the Pension Fund of the Individual Entrepreneur and a legal entity: changes in 2017

Until the end of 2016, the functions of controlling the amounts of accrued and paid insurance premiums were performed by the territorial bodies of the PFR. The PFR also registered employers who acted as insurers in relation to their own employees.

Since the beginning of 2017, legislative changes have come into force, according to which the duties of administering insurance premiums have been transferred to the fiscal service. After 01/01/17, PFR bodies are still involved in accounting for employers - insurers. Organizations and individual entrepreneurs with employees are registered and deregistered as insurers in the FIU. At the same time, the payment of insurance premiums to business entities should now be submitted to the Federal Tax Service. The fiscal service also accepts quarterly RSV reports (calculation of insurance premiums). The FIU retained the functions of monitoring the completeness and reliability of the provided personalized accounting information.

The procedure for deregistration of legal entities - insurers

A company may be deregistered as an employer in the following cases:

- Legal entity liquidated(including due to bankruptcy), about which there is a corresponding entry in Rosreestr:

- The company does not have full-time and / or employees. In this situation, several options are possible:

- the company is not operating;

- the organization has terminated labor / civil law contracts with all employees, or the validity of such agreements has expired.

The procedure for removing a legal entity from registration as an employer depends on the reason for which it is carried out.

Automatic deregistration for legal entities

When a company is liquidated, it is automatically deregistered by employers. The Rosreestr body, on the basis of the corresponding entry in the Unified State Register of Legal Entities, informs the FIU of the need to deregister this employer. Based on the Rosreestr information, the PFR body makes a corresponding note in the database, after which the legal entity loses the status of the employer and the insured. After deregistration, the company is released from the obligation to pay insurance premiums and submit reports. Also, this procedure provides for exemption from the submission of personalized accounting data to the FIU.

Deregistration procedure for employers - farms is carried out in a general manner, that is, automatically, without filing an application and additional documents.

When a company submits documents for deregistration

In certain cases, the company must still independently apply to the administrative authorities for deregistration as an employer. These are the following cases:

- The company is not liquidated, but has no employees . Let's say that the company was previously operating and had full-time / hired workers, but this moment labor/civil relations with all employees terminated. In this case, the company must apply to the FIU with an application (the form can be downloaded on the website of the pension fund), after which the registration of the company as an employer is terminated. Together with the application, the organization must provide supporting documents (copies of terminated contracts and / or agreements that have ceased to be valid).

- Branch of the parent company ceased operations . Unlike general order, representative offices registered as employers are removed from the register of policyholders on the basis of a written request. The reasons for deregistration may be the complete cessation of the activities of the representative office, the termination of contracts with all employees, the transfer of the company to a centralized system, etc. In each case, deregistration is carried out on the basis of an application and supporting documents (changes in the charter, terminated labor / civil law contracts, etc.).

Deregistration term - 5 working days from the date of submission of documents. Upon deregistration, the legal entity is notified accordingly.

The current legislation does not provide for a period within which the employer is obliged to issue a deregistration as an insurer. The application and documents can be submitted at any time, while until the termination of registration, the employer is recognized as the insured and is obliged to pay insurance premiums and submit reports.

If the organization does not have employees, then it is exempt from paying contributions (since there is no tax base), but at the same time, the obligation to file reports for the company remains ("zero" reporting).

Deregistration of employers - individual entrepreneurs and individuals

Deregistration of employers of individual entrepreneurs and citizens, leading economic activity and having employees, is carried out in a declarative manner. The procedure for submitting documents for each of the categories of persons is presented in the table below.

| Policyholder | Deregistration procedure | The documents | |

|

IP with employees |

When terminating contracts with employees, the individual entrepreneur draws up an application for deregistration as an employer. A similar rule applies to individual entrepreneurs who have ceased operations. |

|

|

|

sole proprietor without employees |

An individual entrepreneur who pays insurance premiums for himself is deregistered automatically, based on information from the USRIP submitted to the Federal Tax Service and the Pension Fund of the Russian Federation. |

Not required |

|

| 3 | Individual with employees | In the event of termination of activities or termination of contracts with employees, an individual informs the administrative body of the need to deregister as an employer. |

|

In each case, deregistration is carried out within 5 days from the date of receipt of documents from the individual entrepreneur. At the expiration of the specified period, the PFR makes a note in the employers' registration database, after which the individual entrepreneur loses the status of the insured. The fact of deregistration is confirmed by a notification sent by the PFR to the individual entrepreneur.