The participation of the authorized capital in the activities of the company has a lot of features and functions. Without understanding this indicator, it is difficult to draw conclusions about the state of affairs of the enterprise. The authorized capital is one of the most important sources of funds participating in the activities of the enterprise. Therefore, its features and functions should be analyzed in detail.

What is authorized capital

By definition, capital is the amount of funds, the property of the enterprise, which is used to make a profit.

The authorized capital is the initial contribution of the founders of the company, invested to ensure a minimum profit, and also to satisfy the interests of creditors. Its main purpose is to insure the investments of creditors, which they directed to generate income for the company.

Therefore, the authorized capital has a fixed value. This value is specified in the documents when creating a company.

Authorized capital enterprises in the form of ownership refers to their own funds. At the foundation legal entity its authorized capital is equal to its own. The company's property, which it owns, when converted into cash equivalent, is the considered type of own funds.

With a positive result of the enterprise's activity, own funds increase by directing retained earnings back into circulation. In this case, the authorized capital will become less than the legal entity's own funds.

Performing the most important functions in the activities of the enterprise, the formation of these funds is clearly regulated by the legislation of the Russian Federation.

Formation of the authorized capital

Depending on the organizational and legal form of the enterprise, its initial equity. The contribution to the charter capital of the partnership is the funds contributed by the founders to the activities of the company, guaranteeing each of them a share ownership of the enterprise.

For a joint-stock company, a contribution to the authorized capital is a fund formed by selling shares. Number of owners for of this type organizations are quite large. Therefore, the composition of the owners is easily changed. This does not apply to closed joint stock companies.

Partnerships are convenient as a form of organizing small enterprises. Joint stock companies are more suitable for large enterprises.

Less popular are such forms of organization as cooperatives and municipal companies. The authorized capital of municipal organizations is formed from the funds of the state or local budgets. Cooperatives form this fund from the shares of their owners.

Authorized capital functions

The authorized capital is a means that performs a number of functions in the company's activities.

One of the main functions that this fund performs is the start of activities. This reflects the rights of owners to start their production activities. Regardless of the results of the work, the authorized capital of the enterprise is the most stable liability item.

The next function is warranty properties. It is the authorized capital that provides the minimum that is necessary for insurance in case of need for settlement with creditors.

Another property of the authorized capital is the distribution function. It indicates what voting rights the investor has in the management of the organization. The value of each share in authorized capital determines the value of the property of the organization.

Minimum authorized capital

The minimum amount of the authorized capital is constant and is established at the time of the organization's creation.

In the future, no one has the right to force a legal entity to increase this fund. The increase in the minimum wage (minimum wage) affects only newly organized enterprises. Minimum size authorized capital is:

- for LLC - 10 thousand rubles;

- for CJSC - 1000 minimum wages;

- for OJSC - 1000 minimum wages;

- for state enterprises - 5,000 minimum wages;

- for municipal enterprise- 1000 minimum wage.

For implementation state registration at least half of the size of the authorized capital must be paid. A joint-stock company, according to the law, must be registered without an initial payment. 50% of the authorized capital of the company is redeemed in the first 3 months of its operation. And after a year of operation, the entire fund is paid.

The authorized capital of the company is cash, material assets, property, securities.

The composition of the authorized capital

The authorized capital of the organization is the source that forms the assets of the enterprise. The creation of a fund is carried out from the property of its founders - legal or individuals. Contributions may be in the form of cash, property, or rights such as leases. Restrictions exist only for special types of organizations. Thus, banking institutions cannot form their statutory fund from securities.

The founder is obliged to contribute property to this fund in without fail. Under no circumstances can he be released from his duty.

Formation process

The charter of the organization regulates the process of transferring property from the founders to a legal entity. For limited and additional liability companies, these actions are also stipulated in memorandum of association. The documents establish the responsibility of the founders for the untimely contribution of their parts to the general fund.

Authorized capital is property valued by making a decision on its value at general meeting founders. This is done by an independent appraiser and is entered into the documentation after the general agreement.

The transfer of values is carried out with the help of the transfer acceptance act. This document, together with the contributions reflected in the balance sheet of the legal entity, serve as evidence of the contribution of the authorized capital within the agreed time frame.

In case of cash repayment of its part in the enterprise fund, the proof of the contribution of the founder's share is a certificate from the bank with the account of the legal entity.

The essence of the insurance function

The concept of authorized capital as the property of an enterprise is rather conditional. In reality modern organization the work of companies and partnerships, the contributed property is assessed under an agreement between shareholders.  Prior to registration, a legal entity does not yet have an authorized fund. And after registration, the capital is sent into circulation and can increase and decrease. Therefore, this fund in the reality of the financial and economic activity of the enterprise loses its insurance function.

Prior to registration, a legal entity does not yet have an authorized fund. And after registration, the capital is sent into circulation and can increase and decrease. Therefore, this fund in the reality of the financial and economic activity of the enterprise loses its insurance function.

Due to such aspects, in some countries they refused to fix the size of the authorized capital. On the this moment 100 minimum wage cannot protect the rights of creditors, because in terms of cash, this amount is only 490 dollars. USA.

How the authorized capital is applied

Due to the inherent stability of the fund under consideration, it is directed to cover less liquid, fixed assets.

Share capital is an asset such as land, equipment and real estate. For a newly created enterprise, the most popular balance sheet items covered by the established fund are non-current assets, fixed assets. The cost of such objects is transferred to the cost of products in the form of depreciation over a certain period of time.

For financing working capital apply or short term borrowed capital or retained earnings.

Installed capital of LLC and ALC

Exist certain features creation of the statutory fund of limited and additional liability companies. He, according to part 1 of Art. 90 of the Civil Code of the Russian Federation, consists of contributions from its participants. The size and proportions are set in advance.

For such organizations, the authorized capital is funds that must be paid at least 50% at the time of registration. The second half is paid during the year of the company's operation.

If this does not happen, the enterprise announces its liquidation or a reduction in the size of the statutory fund.

If after each year of operation, net assets have a lower value than the authorized capital, it is reduced in accordance with the procedure established by law.

Authorized capital of the joint-stock company

According to paragraph 1 of Art. 99 of the Civil Code of the Russian Federation, the authorized capital consists of the net value of the shares of the company that were acquired by its shareholders. When an open joint-stock company is established, all its shares must be distributed among the founders.

The increase in the value of the authorized capital of the company occurs by increasing the nominal value of securities or issuing an additional number of shares.

In case of a decrease in the value of net assets, the same rules apply for OJSC as for LLC, ALC.

Coverage of debts upon liquidation of an enterprise

The size of the authorized capital is the insurance fund of the enterprise, from which the legal entity is settled with creditors.

However, depending on the type of organization of the company, the responsibility in the event of a reorganization varies. Large partnerships bear less responsibility than owners of cooperatives. The latter are liable to creditors on a par with the founders of companies with full responsibility.

The majority of organizations bear partial responsibility. The debt to creditors is returned from the amount of the authorized capital. As a rule, in current conditions it is completely insufficient to repay all obligations in the event of bankruptcy of the organization.

If the company's own funds are not enough to pay off the debt, its credit rating drops. Such an enterprise is unattractive for investment and cannot expect to expand in the future. production assets through loans. It is in the interest of a legal entity to maintain its credit rating at high level at the expense of a sufficient amount of own funds, in particular the authorized capital.

Cooperatives and limited liability companies cover their obligations to creditors with the personal property of all founders of the partnership, their shares in other organizations.

Fund Size Changes

The authorized capital of the enterprise is a fixed value. However, there are cases when its size changes.

An increase in the authorized capital is possible only when additional participants join the organization. The attached share of the authorized capital is one of the possible causes fund increase. The issue of shares carried out after the registration of a legal entity also affects the authorized capital.

Such changes are carried out strictly in accordance with the law and are documented. All cases of increasing the fund are registered in the relevant legal sources.

Additional funds can be attributed to the authorized capital after the sale of shares at a price that is higher than their nominal value. In the balance sheet, these funds are displayed in the "Additional capital" section. These funds increase the reliability rating of the company.

The authorized capital is the means by which the enterprise must form the reserve capital. This fund must be at least 15% of the authorized fund.

If the value of net acts for the period decreased and became lower than the value of the authorized capital, the company announces the reduction of its authorized capital. Such actions lead to a decrease in the credit rating and reduce the reliability of the company in the eyes of investors.

Having considered the features of the formation and management of fixed assets of an enterprise, one can understand the principle of organizing the company's funds. Without it, the activity of a legal entity is impossible. The authorized capital is a fund created during the registration of an enterprise. Its value is regulated by law and acts as a guarantee of the organization's solvency to investors. Fund changes affect the rating of the company in the eyes of creditors.

Authorized capital of a legal entity

The size of the authorized capital of an LLC in 2018 - 2019 determines the minimum amount of property that ensures the interests of its creditors (clause 1, article 14 of the Law "On Limited Liability Companies" dated February 8, 1998 No. 14-FZ). We will talk about the methods of its formation, the obligations of the participants in making a share in our article.

In accordance with what is the authorized capital of business entities determined?

The authorized capital of business companies is determined in accordance with Art. 66.2 of the Civil Code of the Russian Federation. The lower limit of the size of the authorized capital, in particular the minimum authorized capital of an LLC in 2018-2019, is established by laws on business companies. That is, when paying for it, funds are deposited not lower than the established minimum.

IMPORTANT! A part of the authorized capital in the amount of at least the established minimum is paid in cash(Decision of the Federal Tax Service of Russia dated September 27, 2016 N SA-3-9 / [email protected])

For business companies it is established minimum value in the following size:

- For credit institutions (Law No. 395-I of December 2, 1990 "On Banks and Banking Activities"), namely:

- banks with a universal license - 1 billion rubles;

- banks, central counterparties - 300,000,000 rubles;

- non-bank credit institutions - 90,000,000 rubles.

- For insurance companies (Law "On the organization of insurance business" dated November 27, 1992 No. 4015-I): 120,000,000 rubles. (base size excluding coefficients).

At the same time, many of these rules contain restrictions not only on the size, but also on the composition of capital. For example, insurance organizations are prohibited from making borrowed funds, collateral (clause 3, article 25 of law No. 4015-I).

The amount of the authorized capital of LLC from 2018 - 2019

The minimum authorized capital of an LLC in 2018-2019 is the total of the nominal value of the shares of all members of the company, is accounted for in the currency of the Russian Federation and cannot be less than 10,000 rubles. (Article 14 of Law No. 14-FZ).

The size of the participant's share is determined as a percentage or a fraction (the ratio of the par value of the share to the entire size of the authorized capital).

The real value of the share (paid to a participant, for example, who left the company) is a proportion of the value of the net assets proportional to the size of the share.

The statute may set limits:

- the maximum size of the share;

- the admissibility of changing the ratio of shares.

IMPORTANT! Such restrictions must be applied equally to all participants.

The authorized capital may be formed by:

- of money;

- of things;

- property rights;

- other rights that can be assessed.

However, there are restrictions on the types of property that cannot be transferred:

- the right to permanent use of a plot of land (clause 6, article 3 of the law “On the entry into force of the Land Code of the Russian Federation” dated October 25, 2001 No. 137-FZ);

- the right to lease a plot of the forest fund (Article 5 of the Law "On the Enactment of the RF LC" dated 04.12.2006 No. 201-FZ).

Restrictions on the types of property can be established by the participants themselves, who fix them in the charter.

When paying a share with property, it is necessary to evaluate it in monetary terms. Such an assessment is approved by the unanimous decision of the participants (clause 2, article 15 of Law No. 14-FZ) and is carried out with the obligatory involvement of an independent appraiser (clause 2, article 66.2 of the Civil Code of the Russian Federation).

Member's share payment requirement

The decision on the amount of the authorized capital is reflected in the document on the establishment of the organization. It may also contain liability for non-payment of a share in the form of a penalty.

If the company has 1 founder, then the decision should reflect:

- the size of the authorized capital;

- procedure, terms of its payment;

- size, nominal value of the share (clauses 2, 8, article 11 of Law No. 14-FZ).

IMPORTANT! The transfer of property is not considered an independent transaction, but occurs as part of the execution of the decision to create a person (decision of the 10th Arbitration Court of Appeal dated 06/21/2016 in case No. A41-81131 / 15).

The term for making a contribution is determined by the decision on the establishment, but is limited to 4 months from the day the company was registered.

When resolving the issue of whether a person has the status of a participant, the fact of payment of a share or the full formation of the authorized capital is taken into account.

If there is no evidence of payment by the participant of a share or making a property contribution, such a person does not have the rights of a participant (CA decision Ural District dated April 21, 2016 No. Ф09-2008/16).

IMPORTANT! The founder cannot be released from the obligation to pay the share.

If the share is not paid in full within due date, its unpaid part goes to the society. The size of the authorized capital of an LLC in 2018 - 2019 in this case either decreases (when the unpaid part of the share is repaid by the company) or remains unchanged (when the unpaid part of the share is sold to another participant) according to the rules of Part 4 of Art. 24 of Law No. 14-FZ.

So, the minimum authorized capital of an LLC, which determines the value of the property, which creditors are guided by, assessing their risks when entering into legal relations with the company, is 10,000 rubles. and paid in cash only. The minimum amount of the authorized capital of an LLC may be higher if the company is engaged in special activities (for example, it is a non-bank credit or insurance organization).

Represents the amount of initially invested assets (most often cash) needed to start the business. Its size is not arbitrary, but is established in accordance with certain norms of jurisdiction. Thanks to the authorized capital, it becomes possible to form the funds that are needed for the first steps in commercial activities.

The value of the authorized capital

Of course, it is important and performs several functions at once. Here are the main ones:

- it provides creditor protection. This implies that this capital gives investors an excellent guarantee that they will receive some compensation even if the enterprise does not succeed and is completely ruined;

- impact on market positioning. It is by the authorized capital that experienced people judge how successful the company is and what awaits it in the future (although this indicator is not very informative);

- for a developing company, it is the initial capital. No initial capital commercial activity impossible, because without fixed costs and spending in it is indispensable;

- used as a means to limit entry of companies into the market. In some cases, activities will not be possible if the authorized capital of the company does not meet the requirements. All this is justified by the fact that serious business requires great responsibility.

Minimum authorized capital

Such capital must be calculated in accordance with all requirements that are established by the regulatory authorities of the jurisdiction. To date, almost all countries have established a minimum amount of funds, without which it is impossible to open any company. To register a company, you will need to go through procedures that are associated with the collection and provision of documents and writing applications and so on.

It is possible to contribute not only money, but also material assets, property rights, and even securities to the authorized capital - this is quite acceptable.

Calculations in this case occur using the minimum wage, although sometimes the amount in money is also indicated. For CJSC - this is 100 minimum wages, OJSC - 1000 minimum wages, the minimum authorized capital of LLC must be more than 100 minimum wages, municipal unitary enterprises - this is 1000 minimum wages, and state enterprises must have an authorized capital of at least 5,000 minimum wages. These data refer only to Russia.

Foundations, ANOs and others non-profit organizations can legally be created without it.

Increase the authorized capital

The size of the authorized capital of CJSC, LLC and other commercial organizations may be increased over time. Without this, the growth of the company is impossible. This is only possible if the previous share capital has been contributed. The decision to increase it is made directly at the general meeting of the members of the company or its shareholders.

The reasons that lead to its increase:

- the need to finance the growth of the company. In this case, even funding from third parties is possible;

- the need to provide employees with securities;

- the reason for its increase may be a merger with some other company.

Undoubtedly, a developing company must constantly increase its authorized capital, and information about it, as a rule, should be available to the public.

Decrease in authorized capital

There are cases when companies reduce their authorized capital. The goals here may be different. Here are the most basic ones:

- to increase the value of the shares. The authorized capital is growing, and with it the number of shares is growing - this leads to their partial depreciation. In other words, its reduction does not allow the shares of shareholders to be diluted.

- to optimize the management of authorized capital.

The authorized capital is the totality of the founder's contributions. The law does not limit the maximum amount of capital. As for the minimum, its observance is immutable. What is the minimum amount of authorized capital in 2019?

The amount of the authorized capital in its minimum value is predetermined by the participants of the company. But below the level prescribed by law, it cannot be. What should be the minimum authorized capital in 2019?

Basic moments

Minimum value the authorized capital for LLC is predetermined as ten thousand rubles. Moreover, since 2019, this amount can only be paid in money, as stated in.

Property contributions are only allowed as an addition to a certain minimum amount. But not for all organizations, the smallest indicator of the authorized capital is the same.

It depends on the type of activity being carried out. For example, the minimum CC for:

The value of the initial capital of any organization cannot be less than the amount determined by law. The minimum value must be respected at all times and not only for initial stage activities.

If for some reason the amount decreases in comparison with the minimum indicator, then its increase is necessary.

Concepts

The authorized capital is the totality of all contributions made by the founders, regardless of the form in which the funds are contributed.

Normative base

Regulatory regulation of the provisions regarding the authorized capital is carried out.

In clause 1 of this document, the minimum amount of authorized capital for an LLC is prescribed. The size of the participant's share is determined as a percentage or a fraction of the total amount.

At the same time, in the process of determining the size of the authorized capital, it is necessary to take into account the type of activity of the organization. So the amount of the UK for banks is determined.

The minimum authorized capital of insurance organizations must comply with the requirements. Some other subjects must adhere to special requirements.

What can be the minimum amount of authorized capital in 2019

The minimum value of the authorized capital of an LLC in the law is defined as ten thousand rubles. But for individual enterprises, special features are provided.

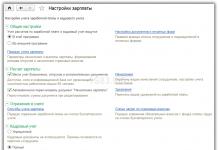

Video: the receipt of wasps in the authorized capital in 1C

For example, the minimum amount for joint-stock companies is different. Also, a larger amount is determined for banks, insurance organizations, alcohol producers, etc.

As for some of the nuances of contributing the authorized capital in 2019, they are as follows:

For LLC

The minimum amount of the authorized capital of an LLC is ten thousand rubles. an increase in this norm is allowed, a decrease is not. In this case, the minimum amount is paid exclusively in cash, more - at the discretion of the founders.

You need to know that the amount of the minimum authorized capital must be observed in the course of the entire activity of the enterprise, and not only at the initial stage.

In case of non-compliance with the requirement for the amount of capital, it must be increased. The following rule is also important - the amount of profit for the first two years of activity should not be less than the amount of the authorized capital, otherwise the amount of capital should be reduced.

If it is impossible to reduce, that is, the amount of capital is still equal to ten thousand rubles, the organization is subject to.

If, for any reason, a member of the company cannot pay his share in in full, then at the end of the period provided for making contributions, the unpaid part can be sold to other participants or third parties.

For bank

The authorized capital of the bank is made up of investments of participants, and the amount of capital guarantees the interests of creditors. Authorized capital funds are the initial resource for starting the activities of a banking institution.

The authorized capital of a bank cannot include borrowed funds. The minimum amount of capital is three hundred million rubles.

If the bank is a joint-stock company, then the authorized capital is the nominal value of the shares purchased by the shareholders.

Bank authorized capital can be increased by additional issue of shares or by increasing their value at face value.

The capital is reduced by reducing the par value of shares or by acquiring outstanding shares and redeeming them.

A bank operating as a limited liability company increases its authorized capital through partial capitalization of profits, additional contributions from the founders, and contributions from third parties.

The decrease in capital occurs when the nominal value of the shares of participants decreases or the shares owned by the bank are redeemed.

Insurance companies

Insurance organizations, except for mutual insurance companies, must have a fully paid-up AC, not less than the minimum amount specified by law.

For insurers carrying out, the minimum amount of the authorized capital is sixty million rubles.

For all other insurers, the minimum is determined on the basis of a base value of one hundred and twenty million rubles and the corresponding coefficient. This is equal to a value from one to four.

The minimum authorized capital may be changed once every two years.

Moreover, a transitional period must be established. It is strictly forbidden to contribute borrowed funds or collateral to the authorized capital of an insurance company.

joint stock company

According to the current Russian legislation, the authorized capital of a joint-stock company is the nominal value of all shares of the company, which were bought out by the shareholders and are at their disposal.

It is important that each of the shares in this case has the same value. Shareholders have equal rights. But the right to vote and the amount of dividends is determined for the founder in proportion to the number of shares he has.

The authorized capital of a JSC is the minimum amount that shareholders may need to protect the interests of the company's creditors. The minimum amount of the authorized capital for a JSC is prescribed in paragraph 1 of Article 66.2 of the Civil Code of the Russian Federation. It is equal to one hundred thousand rubles.

Open joint-stock company

OAO is commercial organization, whose authorized capital is divided into a certain number of shares to certify the obligations of the shareholders of the company in relation to the JSC.

An open joint-stock company differs from an LLC in that it can issue securities (shares). Moreover, shares of OJSC can be distributed among an unlimited number of persons.

The peculiarity of this organizational and legal form is that the participants of the company bear limited liability for the debts of the OJSC in transferring the value of the number of shares they have.

Since September 1, 2014, the definition of JSC has changed somewhat. amended the provisions relating to joint-stock companies. Their division into open and closed (CJSC) has been discontinued.

Instead, public and non-public societies began to be distinguished. From that moment on, the JSC turned into a public JSC, or PJSC.

What should be the size of the authorized capital of a joint-stock company,.

That is, its shares are placed publicly. The same law classifies LLCs as non-public companies. The minimum authorized capital of a PJSC in 2019 is set at one hundred thousand rubles.

Credit organization

The value of the authorized capital in the minimum amount for credit institutions is established by Article 11 of the Federal Law No. 395-1.

The minimum amount of the UK at the time of registration is as follows:

| Three hundred million rubles | For banking organizations on the date of submission of documents on state registration and issuance of a license to perform banking operations |

| Ninety million rubles | For non-banking organizations wishing to obtain a license to perform settlements on behalf of legal entities, on their accounts |

| For a non-banking organization applying for a license for non-banking credit organizations to make transfers without opening bank accounts and performing banking operations | |

| Eighteen million rubles | For non-bank credit institutions wishing to obtain a license to perform banking operations |

Operating banking credit institutions, whose minimum capital size did not meet the norm at the time of the adoption of the law, were required to increase their capital to three hundred million rubles by at least 01/01/2015. Banks that failed to comply with this requirement were closed.

The requirements of the legislation on the minimum amount of the authorized capital must be strictly observed.

It should be noted that many entrepreneurs, when choosing a legal form, give an IP, since in this case no initial monetary contribution is required.

The size of the authorized capital of an LLC in 2018 - 2019 determines the minimum amount of property that ensures the interests of its creditors (clause 1, article 14 of the Law "On Limited Liability Companies" dated February 8, 1998 No. 14-FZ). We will talk about the methods of its formation, the obligations of the participants in making a share in our article.

In accordance with what is the authorized capital of business entities determined?

The authorized capital of business companies is determined in accordance with Art. 66.2 of the Civil Code of the Russian Federation. The lower limit of the size of the authorized capital, in particular the minimum authorized capital of an LLC in 2018-2019, is established by laws on business companies. That is, when paying for it, funds are deposited not lower than the established minimum.

IMPORTANT! A part of the authorized capital in the amount of at least the established minimum is paid in cash (Decision of the Federal Tax Service of Russia dated September 27, 2016 N SA-3-9 / [email protected])

For business entities, the minimum value is set as follows:

- For credit institutions (Law No. 395-I of December 2, 1990 "On Banks and Banking Activities"), namely:

- banks with a universal license - 1 billion rubles;

- banks, central counterparties - 300,000,000 rubles;

- non-bank credit institutions - 90,000,000 rubles.

- For insurance companies (Law "On the organization of insurance business" dated November 27, 1992 No. 4015-I): 120,000,000 rubles. (base size excluding coefficients).

At the same time, many of these rules contain restrictions not only on the size, but also on the composition of capital. For example, insurance organizations are prohibited from making borrowed funds, collateral (clause 3, article 25 of law No. 4015-I).

The amount of the authorized capital of LLC from 2018 - 2019

The minimum authorized capital of an LLC in 2018-2019 is the total of the nominal value of the shares of all members of the company, is accounted for in the currency of the Russian Federation and cannot be less than 10,000 rubles. (Article 14 of Law No. 14-FZ).

The size of the participant's share is determined as a percentage or a fraction (the ratio of the par value of the share to the entire size of the authorized capital).

The real value of the share (paid to a participant, for example, who left the company) is a proportion of the value of the net assets proportional to the size of the share.

The statute may set limits:

- the maximum size of the share;

- the admissibility of changing the ratio of shares.

IMPORTANT! Such restrictions must be applied equally to all participants.

The authorized capital may be formed by:

- of money;

- of things;

- property rights;

- other rights that can be assessed.

However, there are restrictions on the types of property that cannot be transferred:

- the right to permanent use of a plot of land (clause 6, article 3 of the law “On the entry into force of the Land Code of the Russian Federation” dated October 25, 2001 No. 137-FZ);

- the right to lease a plot of the forest fund (Article 5 of the Law "On the Enactment of the RF LC" dated 04.12.2006 No. 201-FZ).

Restrictions on the types of property can be established by the participants themselves, who fix them in the charter.

When paying a share with property, it is necessary to evaluate it in monetary terms. Such an assessment is approved by the unanimous decision of the participants (clause 2, article 15 of Law No. 14-FZ) and is carried out with the obligatory involvement of an independent appraiser (clause 2, article 66.2 of the Civil Code of the Russian Federation).

Member's share payment requirement

The decision on the amount of the authorized capital is reflected in the document on the establishment of the organization. It may also contain liability for non-payment of a share in the form of a penalty.

If the company has 1 founder, then the decision should reflect:

- the size of the authorized capital;

- procedure, terms of its payment;

- size, nominal value of the share (clauses 2, 8, article 11 of Law No. 14-FZ).

IMPORTANT! The transfer of property is not considered an independent transaction, but occurs as part of the execution of the decision to create a person (decision of the 10th Arbitration Court of Appeal dated 06/21/2016 in case No. A41-81131 / 15).

The term for making a contribution is determined by the decision on the establishment, but is limited to 4 months from the day the company was registered.

When resolving the issue of whether a person has the status of a participant, the fact of payment of a share or the full formation of the authorized capital is taken into account.

If there is no evidence of payment by the participant of a share or making a property contribution, such a person does not have the rights of a participant (Resolution of the Arbitration Court of the Ural District of April 21, 2016 No. Ф09-2008 / 16).

IMPORTANT! The founder cannot be released from the obligation to pay the share.

If the share is not paid in full within the established period, its unpaid part passes to the company. The size of the authorized capital of an LLC in 2018 - 2019 in this case either decreases (when the unpaid part of the share is repaid by the company) or remains unchanged (when the unpaid part of the share is sold to another participant) according to the rules of Part 4 of Art. 24 of Law No. 14-FZ.

So, the minimum authorized capital of an LLC, which determines the value of the property, which creditors are guided by, assessing their risks when entering into legal relations with the company, is 10,000 rubles. and paid in cash only. The minimum amount of the authorized capital of an LLC may be higher if the company is engaged in special activities (for example, it is a non-bank credit or insurance organization).