Russian Legislation determines that in order to register an LLC, it is necessary to contribute the authorized capital. Without this procedure, the Society will not be registered, but its minimum amount is not so large as to seem unbearable even for one person - 10 thousand rubles. It is even easier to divide it among several co-founders. Why is it necessary to enter authorized capital, how it is formed, how to bring it in, and what structure does it have?

What is the share capital of an LLC for?

The need for it is due to a number of factors:

- In view of the fact that such a norm is prescribed in the Legislation, the contribution of the authorized capital is one of the guarantees that the Company's activities will be registered in accordance with the Law.

- This contribution is a guarantee for creditors that the obligations assumed by the founders of the LLC will be fulfilled to the first ones.

- It becomes one of the bases in determining the shares of the founders in the Company and the votes that belong to them in resolving important issues related to the activities of the enterprise.

Shares of each founder in authorized capital, which is the fund of the enterprise, formed during its organization, do not have to be equal. At the same time, the share of each participant must be determined, which, first of all, is necessary for him to determine the degree of his influence within the framework of the enterprise.

Minimum authorized capital

There are a number of activities for which the amount may differ, and significantly.

First of all, this issue can be regulated by local authorities, but less 10 thousand rubles authorized capital cannot be.

In addition, the Law provides for the following minimum amounts for such areas of activity:

- the authorized capital for insurance companies operating in the field of medical insurance is 60 million rubles;

- the amount for insurance companies operating outside the field of medicine is 120 million rubles;

- for manufacturers of alcoholic beverages, the amount of the authorized capital is 80 million rubles;

- organizers of gambling must deposit an amount of 100 million rubles;

- depending on the type of license for non-banking organizations, the minimum amount of the authorized capital is determined at 90-180 million rubles;

- banking organizations need to contribute 300 million rubles.

These amounts may also be different depending on local legislation, including in the direction of reduction.

As for the maximum amount of the authorized capital, the founders of the Company determine it at their discretion and prescribe it in.

Formation of the authorized capital of LLC

As a rule, information about it is contained in the Articles of Association of the Company. Until 2014, at least half of the required amount should have been generated by the time the state registration enterprises. In 2017, amendments were made to the Legislation, according to which payment must be made within 4 months after the creation of the LLC.

The required amount is paid to the cash desk of the Tax Inspectorate or to a savings account. Upon completion of the registration of documents and their delivery to the founders of the enterprise, it is transferred to the company's current account.

If any of the founders of the organization did not contribute their share in a timely manner, they may suffer penalties, provided that such measures are determined by the Charter. The unpaid share in this case can be taken away from the defaulter by alienation and divided among other founders. One option is to sell it to third parties.

The organization can use these funds for its own purposes:

- payment wages employees;

- procurement for the activities of the enterprise;

- payment for renting a room, etc.

The procedure is carried out in strict accordance with the Law.

It can be carried out in several forms:

- money;

- through the alienation of property on account of the authorized capital;

- shares and other securities.

When it comes to depositing property, there are several things to consider. important points:

- the minimum amount of the authorized capital must be contributed in cash;

- an independent appraiser should be involved in the process, who will evaluate the property being contributed;

- as soon as it is paid, the property can immediately begin to be used in the activities of the enterprise.

The law also provides for such a method of contributing the authorized capital as the right to use any property. This option is considered not the most acceptable, since these rights are very easily contested, which entails a lot of paperwork.

The procedure for adding property to the authorized capital of an LLC is carried out according to the following algorithm:

- The appraiser evaluates the contribution.

- Next, the founders must approve the assessment. It is considered approved only in case of unanimous decision of all founders.

- Information relating to the valuation of property is entered into the Charter or the minutes of the meeting of participants. It must also be included in the agreement concluded between them, if there are more than two founders.

- The property is recognized as a contribution, transferred to the balance of the organization with the drawing up of an appropriate act of acceptance and transfer.

Depending on the method of making the authorized capital, there are such types of it:

- Share capital, which is formed at enterprises whose activities are regulated by other documents other than the Charter.

- Charter capital formed by the contributed property.

- Unit trust, which often happens in cooperatives. It is a collection of contributions from all the founders of the organization.

Lawyers advise entering all the little things, even those that may seem insignificant, into the contract and the Charter of the LLC. This will avoid many controversial issues in the future, and if they arise - without unnecessary problems allow.

As for paying the contribution in cash, this can be done in two ways:

- by transferring money to a special account;

- at the Tax Office.

The most common option of the two listed is the first one, because it is more convenient. Registering an account requires money, but you still have to complete this procedure for registering the Company, therefore it is more convenient and faster to do it in advance, and use the account already at the first stages of registration.

Each of the founders transfers money to the created account, and then a receipt about this is transferred to a special service - the Tax Inspectorate.

The second option is also quite possible to use, and it will not cause any difficulties, but it has one drawback - the amount of the commission exceeds that which is taken during a bank transfer. This option also has an advantage - using it, you do not have to worry about notifying the Tax Inspectorate about the contribution.

You can learn more about making and increasing the authorized capital of an LLC from this video.

Storage of authorized capital

Speaking about where it is stored, you need to understand that this is a kind of fund that is used to carry out the activities of the Society, and its existence, in fact, is only a documentary formality.

After moving these funds to the account of the organization, they are used for its needs. The legislation of the Russian Federation does not prohibit the spending of these funds by the Company at the discretion of its founders.

Change in the authorized capital of LLC

It can be carried out both in the direction of increase and in the direction of decrease - it depends on the goals pursued, and in the second option, also on how much the Law allows to do this.

The need to increase the size of the authorized capital is usually dictated by the appearance of new members, shareholders in the LLC.

The larger the authorized capital of the organization, the more confidence it inspires among potential shareholders, partners, creditors, etc.

There are reasons for that too. The main ones are:

- the company incurs losses, in fact is not profitable;

- the Company has not distributed the shares that have passed to it.

Algorithm for changes in the authorized capital regardless of whether they are plus or minus, the same:

- Preparation of a package of documents. It includes an application drawn up in accordance with the P13001 form, a document confirming the payment of the state fee, a decision of the founders of the Company to make changes to the authorized capital, a document indicating that a new shareholder (if any) has contributed his share, the amended Charter. All documents must be notarized.

- Transfer of a package of documents to the Tax Service. Be sure to get a receipt from the inspection officer confirming that he received the documentation.

- Obtaining new documents from the Tax Inspectorate.

- Notification of all persons who are interested in this about the changes made.

Each of these items in without fail must be fulfilled.

The law of the Russian Federation states that upon liquidation of an LLC, shareholders must first of all close all their debts to creditors, partners, banks and other organizations and persons. After that, profit and authorized capital can be distributed between them in shares proportional to those that each of them contributed to it.

Starting any business carries certain risks, and opening an LLC is no exception. But having correctly spelled out all the nuances, the founders can protect themselves as much as possible from disputes, including those related to the authorized capital.

The beginning of the activity of an enterprise of such forms of ownership as OJSC, CJSC, LLC provides for the creation of an authorized capital. These are all tangible and intangible assets that provide security guarantees for the shares of co-founders. If a start-up capital can be spent in full for the purpose of implementing a business project, then the authorized capital remains unchanged for two years. We will analyze the details in the article.

What is authorized capital

The authorized capital is all the resources of the organization necessary for its successful launch. This includes cash, securities, property. The management company is formed from its own and investment funds. The resources involved from outside are provided with a guarantee of return at the expense of the authorized capital. In other words, the MC shows the initial value of the assets of the enterprise.

One or more persons take part in the establishment of the authorized capital of an LLC. Co-founders make a feasible contribution with tangible and intangible values. The interest of the LLC participants is to receive dividends throughout the entire activity of the enterprise as a percentage, according to the value of the shares.

The authorized capital of an LLC is the minimum property valuation of an organization, equivalent to the nominal value of the shares of co-founders. The management of the enterprise signs an agreement with each investor. Under the terms of the agreement, the UK acts as a guarantor covering all possible losses in the future.

Meaning and functions

The authorized capital is the initial financial component of the enterprise. The total amount of resources depends on the functionality of the organization. When registering legal entity the starting amount is fixed.

The authorized capital in the modern sense is divided into two categories:

- Equity acting as a guarantor to the founders of the business. Includes all enterprise resources.

- Capital as an accounting and legal unit- this is the money and income received in the process of development of the organization. Motion financial resources reflected in the accounting entries.

The value of the authorized capital is embedded in its functions:

- Formative function. Based on Russian legislation, the minimum size of the UK and its material basis are determined. Conditions for increasing or decreasing capital are negotiated. The starting function gives an initial impetus to the beginning of the organization's activities and lays the material base for the future.

- guarantee function. If the organization's activities turn out to be unprofitable, the UK will serve as a guarantor, ensuring the repayment of debt to creditors and investors.

The authorized capital is considered enterprise asset. In the event of an unexpected termination of activity or bankruptcy of the organization, all property is put up for sale in order to return the value of the shares to the co-founders.

Minimum authorized capital

The federal law on the minimum size of the Criminal Code No. 14 FZ of February 8, 1998, as amended and supplemented for LLCs, came into force on January 1, 2017.

According to Federal Law No. 14, the smallest starting amount is 10,000 rubles. Moreover, it must be paid only in monetary terms. The remaining amount, exceeding the minimum amount, is formed at the expense of any resources.

Enterprises whose predicted profit is quite high are given an increased size of the authorized capital:

- 100 million rubles will be contributed by organizations whose activities are related to gambling: casinos, slot machines, bookmakers;

- 300 million rubles - the starting amount for banks;

- 90-180 million rubles - licensed organizations providing loans to the population;

- 60–120 million rubles will be contributed Insurance companies medical direction;

- Producers of alcoholic beverages will pay 80 million rubles.

The size of the UK is primarily influenced by the type of activity. The constituent documents of an LLC stipulate the minimum starting amount and the conditions under which its size is reduced or increased.

The size of the UK may be affected by legislation at the regional level. Local authorities have the right to establish restrictions on the Criminal Code on separate categories manufactured products and services.

What affects the size of the authorized capital

In the course of the activity of the enterprise, the funds of the authorized capital are allowed to be spent on their own needs: the purchase of equipment, raw materials, the payment of wages, the payment of rent for premises. At the end of the second reporting year, the amount of the authorized capital should not be lower than the pledged initial cost.

The size of the starting amount and its change significantly affect the change in the value of the shares of depositors.

During the operation of the enterprise, a voluntary decrease in the initial capital is possible. If the board of directors deems it appropriate to reduce the starting amount, then appropriate adjustments are made to the company's Charter. For example, entered manufacture building not used for its intended purpose. It is returned to the co-founder in the property.

The percentage of depositors' shares will remain unchanged, and the monetary indicator will decrease in accordance with the decrease in the size of the authorized capital.

Consider an example:

Established initial capital in the amount of 2,000,000 rubles. The LLC has three founders.

The share of Sergeev I.V. - 60% = 1,200,000 rubles.

The share of Yakovlev S.K. - 25% = 500,000 rubles.

The share of Chernova E.S. - 15% = 300,000 rubles.

By agreement of the parties, the size of the Criminal Code was reduced to 1,200,000 rubles. Thus, the equity participation of co-founders will change only in monetary terms:

Sergeev I.V. - 60% = 720,000 rubles.

Yakovlev S.K. - 25% = 300,000 rubles.

Chernova E. S. - 15% = 180,000 rubles.

It is allowed to reduce the starting amount of capital to its limit value - 10,000 rubles. If its size is below the minimum level, the enterprise is subject to liquidation.

At the meeting of co-founders, a decision may be made to increase the size of the Criminal Code, drawn up by an additional document to the Charter of the organization. The percentage of investors' shares will not change, but the amount of dividends will increase.

The increase in the value of shares is calculated by analogy with the example discussed above.

How is the authorized capital of an LLC formed?

At the stage of formation of the LLC, the Charter is drawn up, which specifies the size of the UK. Both one and several co-founders take part in the creation of the company. It is clear that it makes no sense to start activities with 10,000 rubles. In practice, the initial starting amount is much higher. Additionally, what is more profitable to open an individual entrepreneur or LLC.

Registration of an LLC provides for the filing of constituent documents, which spell out the estimated value of the enterprise. A checking account is opened. Within four months after the official registration of the company, the authorized amount is fully paid by the co-founders.

Application methods:

- the amount of money in Russian rubles is sent to the settlement account of the LLC;

- money in the form of securities: shares, financial certificates, bills of exchange, checks, etc. are provided with an extract from the LLC register;

- real estate, equipment, transport, technical equipment, equivalent to a monetary unit;

- ownership, trademarks and other.

The introduction of intangible assets provides for preliminary assessment value, if the nominal amount of property is more than 20,000 rubles. An independent appraiser is appointed. When registering an LLC, the tax service is provided with a document on the ownership of the object, which acts as a share of the UK, an act of transferring property to the LLC and a report on its assessment.

An interesting moment! If one of the founders made a contribution to the management company, for example, in the form of promissory notes, then they become the property of the LLC. If, for some reason, the company transfers the rights to the securities back to the investor, then for the latter it is taxable income. It turns out that for their own bills, the investor will pay income tax.

Structure

The financial component of the starting amount of an LLC is divided into five elements:

- , expressed in the initial cost of the shares of the organization. The indicator characterizes the basis and property base, which determines the future activities of the LLC.

- Extra capital. It is formed due to changes in the value of the enterprise on the basis of revaluation, revaluation, gratuitous transfer to third parties, profit from the sale of securities. The difference between the initial cost of assets and the proceeds from their sale is taken into account.

- Reserve capital- the emergency reserve of the enterprise, formed from the means of profit. It is used to pay off losses and eliminate force majeure situations. The size of the AC is not less than 15% of the UK LLC.

- Undestributed profits- This is a profit margin. The indicator characterizes financial stability enterprises. NP is a key source of financing for LLCs. It can be directed to the authorized capital, current operations of the organization, increase in liquid assets.

- trust funds, raising funds from unallocated or net profit OOO. The funds are directed to technical equipment, equipment modernization, social development of the enterprise, research, purchase of raw materials to increase production. social development involves maintaining a favorable atmosphere in the team.

Kinds

Depending on the organizational and legal form, the Criminal Code is divided into four types:

- Share capital provided for in organizations that do not have a Charter. These include general partnerships and fellowship of faith. The financial component of the share capital is formed from the shares and contributions of the co-founders in monetary and property terms.

- Authorized fund- these are all intangible values of the enterprise necessary for the implementation of the organization's activities. UV is laid in state and municipal enterprises.

- Unit trust- used in cooperative organizations. Team work provides for the pooling of share contributions of co-owners and funds earned in the process of doing business.

- provided for in CJSC, OJSC, LLC. This is the starting financial component necessary to launch a new enterprise and ensure the safety of attracted investment funds.

What is a share in the authorized capital of an LLC

One or more members can open an LLC. In the first case, the capital is not divided. In the second, the starting amount is divided into shares as a percentage, depending on the contribution of the co-founders.

Consider an example of calculating shares:

According to the Charter of the LLC, a UK is required in the amount of 1,300,000 rubles.

Khakimov M. Yu. contributed 900,000 rubles. Its share = 70% (900,000*100/1,300,000);

Yurasova E.V. contributed 200,000 rubles. Its share = 15% (200,000*100/1,300,000);

Sergeev V.N. contributed 200,000 rubles. Its share = 15% (200,000*100/1,300,000).

The total amount of shares is 100%, which corresponds to the starting amount of 1,300,000 rubles.

The controlling stake is held by Khakimov M.Yu. It is he who will be able to exert a greater influence on the development of the enterprise.

The maximum deposit amount may be limited. There is also a change in the proportion of shares. All the nuances are stipulated in advance in the Charter of the LLC. If in the process of carrying out activities it becomes necessary to make additions regarding equity participation, the decision is made at general meeting through voting.

At the time of registration of the LLC, the management submits to tax office The charter of the organization, which contains data on the number of co-founders and the size of the shares of each participant. Within the next four months, each depositor is obliged to pay his share.

Accepted for payment:

- Russian rubles;

- securities;

- property, technical equipment, transport, etc.;

- rights to property or any property.

If the share is not paid within the appointed time, then it passes to the LLC. This part of the UK is sold to another investor or distributed among the current co-founders. Payment of the outstanding starting amount is made within one reporting year.

What is the alienation of a share in the authorized capital

LLC participants have the right to dispose of the shares at their own discretion - to sell to community investors or third parties, that is, to produce alienation. The opinion of other co-founders is not taken into account, unless otherwise stipulated in the founding documents.

The transaction is carried out in succession. The other participants of the LLC, and then third parties, have the primary right to purchase the alienated share. If the Charter of the organization contains a prohibition on the sale of shares outside the LLC, then the transaction is concluded in favor of the company.

All agreements on alienation are certified by a notary. AT short video Trifonov Alexander talks about the procedure for concluding a transaction for the sale of shares to third parties:

When organizing an LLC, you should not focus on the minimum size of the UK. The higher the initial amount pledged initially, the more confidence the organization will receive from investors. The new venture will receive sufficient assets to launch successfully. A small amount of authorized capital requires small investments. But here there is a difficulty in finding investors and creditors.

Get a lawyer's answer in 5 minutes

The capital of the enterprise can be considered from several points of view. First of all, it is useful to distinguish between capital real, those. existing in the form of means of production, and capital monetary, i.e. existing in the form of money and used to acquire the means of production, as a set of sources of funds to ensure economic activity enterprises. Consider first money capital.

Equity and debt capital

Funds that ensure the activities of the enterprise are usually divided into own and borrowed.

Equity of the enterprise is the value (monetary value) of the property of the enterprise, wholly owned by it. In accounting value equity is calculated as the difference between the value of all property on the balance sheet, or assets, including amounts not claimed from various debtors of the enterprise, and all obligations of the enterprise in this moment time.

The company's own capital is made up of various sources: authorized, or share, capital, various contributions and donations, profits that directly depend on the results of the enterprise, additional capital, targeted financing. A special role belongs to the authorized capital, which will be discussed in more detail below.

Borrowed capital is the capital that is attracted by the enterprise from the outside in the form of loans, financial assistance, amounts received on bail, and other external sources for a specific period, on certain conditions under any guarantees.

The sources of borrowed capital of the organization are:

- long-term credits and loans;

- short-term loans;

- advances from buyers and customers;

- long-term lease of fixed assets;

- etc.

Authorized capital

The capital of the enterprise is the monetary value of the property of the enterprise.

According to the sources of formation The company's capital is divided into equity and borrowed capital.

Of particular importance in the equity capital of an enterprise is the authorized capital - the basis for the creation and functioning. The authorized capital combines the right to own and dispose of property and the functions of a guarantor of shareholders' property rights.

The authorized capital plays the most important role in the functioning of the organization, since its funds are basic for the economic activity of the organization and on its basis most of the funds are formed, Money organizations.

Authorized capital represents a set of funds (contributions, contributions, shares) of the founders (participants) in the property when creating an enterprise to ensure its activities in the amounts determined by the constituent documents.

The authorized capital is the initial, initial capital for the enterprise. Its value is determined taking into account the proposed economic (production) activity and is fixed at the time of state registration of the enterprise.

Formation of the authorized capital

Certain features has the formation of the authorized capital joint-stock companies. The authorized capital consists of a certain number of shares different kind with a fixed value. The procedure for the formation and change of the authorized capital is regulated by the relevant legislative acts. When creating an enterprise, it is necessary to determine the necessary and sufficient amount of the authorized (share) capital.

Authorized capital formed at the expense of contributions (contributions) of the founders(participants at the time of the creation of the organization); it must not be less than the size established by law. The composition of the authorized capital depends on the organizational and legal form of the organization. The authorized capital is formed:

- from the contributions of participants (share capital) for business partnerships and for limited liability companies (LLC);

- par value of shares for a joint-stock company (JSC);

- property share contributions (production cooperatives or artels);

- statutory fund allocated government agency or local government.

Any changes in the size of the authorized capital (additional issue of shares, reduction of the nominal value of shares, making additional contributions, admission of a new participant, accession of part of the profit, etc.) are allowed only in cases and in the manner prescribed by the current legislation and constituent documents.

When forming the authorized capital, additional sources of funds may be formed - share premium. This source arises during the initial issue, when shares are sold at a price above par. The amounts received are credited to additional capital.

Additional and spare capitals are formed in the organization mainly as additional reserves of the organization to cover unforeseen losses and losses of the organization. So, for example, the organization's reserve fund is formed without fail by annual deductions of at least 5% of net profit and must be at least 15% of the authorized capital. Additional capital is a source of funds for the organization, which is formed as a result of the revaluation of fixed assets and other material assets. Regulations prohibit its use for consumption purposes.

Undestributed profits represents the entity's cash after incorporation trust funds and payment of all required fees. Retained earnings form a multi-purpose fund, which accumulates profit funds. Each organization independently decides on the options for the distribution and use of net profit.

Funds special purpose - these are funds that are formed for the purpose of subsequent targeted spending financial resources.

Capital structure

One of the pressing problems is the problem of choosing optimal structure capital, i.e. determining the ratio of own and long-term borrowed funds.

The ratio between own and borrowed sources of funds is one of the key analytical indicators that characterize the degree of risk of investing financial resources in a given organization.

The structure of capital provides its minimum price and, accordingly, the maximum price of the organization, the optimal level of financial leverage for the organization. Financial leverage is a potential opportunity to influence the organization's profit by changing the volume and structure of long-term liabilities. Its level is measured by the ratio of the growth rate of net profit to the growth rate of gross income (ie income before interest and taxes). The higher the leverage value, the more non-linear the relationship (sensitivity) between changes in net profit and profit before taxes and interest becomes, and, consequently, the greater the risk of not receiving it. The level of financial leverage increases with an increase in the share of borrowed capital. So the effect financial leverage is manifested in the fact that an increase in the share of long-term borrowed funds leads to an increase in the return on equity, however, at the same time, there is an increase in the degree financial risk, i.e. there is an alternative risk and expected return.

When making decisions about the capital structure, other criteria should also be taken into account, for example, the organization's ability to service and repay debts from the amount of income received, the size and stability of projected cash flows for servicing and repaying debts, and so on. The ideal capital structure maximizes the total value of the organization and minimizes total cost her capital. Decisions on the capital structure should also take into account sectoral, territorial and structural features organization, its goals and strategies, the existing capital structure and the planned growth rate. When determining the methods of financing (issue of shares, loans, etc.), the structure of debt financing should take into account the cost and risks alternatives funding strategies, market trends and their impact on future capital availability and future interest rates, etc.

The real capital of the organization reflects the totality of production resources, which, as a rule, include:

- main capital;

- working capital;

- personnel (cadres).

To fixed capital includes fixed assets, intangible assets and long-term financial investments.Working capital spent on the purchase of funds for each production cycle (raw materials, fixed and auxiliary materials etc.), as well as for wages. Fixed capital serves for a number of years, while circulating capital is completely consumed during one production cycle.

Fixed capital in most cases is identified with the fixed assets of the enterprise. However, the concept of fixed capital is broader, since in addition to fixed assets (buildings, structures, machinery and equipment), which represent a significant part of it, fixed capital also includes construction in progress and long-term investments - funds aimed at increasing capital stock.

Under the staff (personnel) understand the totality of employees employed at the enterprise and included in its payroll.

In the activities of each company, the authorized capital plays a very important role. According to its size, you can give assessment of the state of affairs of the enterprise. UC is often the main source working capital with which the organization takes its first steps in the world of business.

What it is

Authorized capital is the initial contribution of the founders of the company, which can be calculated both in cash and in property equivalent. Its main purpose is to satisfy primary needs of the enterprise.

Authorized capital is the initial contribution of the founders of the company, which can be calculated both in cash and in property equivalent. Its main purpose is to satisfy primary needs of the enterprise.

With the help of the authorized capital, the founders insure the investments of creditors that were made to develop the business and make a profit.

The capital (authorized) has a fixed amount, which is established by the Federal legislation in force on the territory of Russia. The Criminal Code is necessarily described in the statutory documentation, which is drawn up in the process of registering a business entity.

The MC of the organization performs a number of functions:

- Reserving. In the process of forming the company's assets, the management has the opportunity to make payments on loans if they were attracted due to a lack of working capital.

- Investment. The organization has the legal right to spend the funds of the authorized capital on the acquisition of raw materials and materials necessary for the implementation of economic and production activities.

- Structural distribution. At the end of the reporting period, the company distributes net profit among the founders. In this case, income is paid to each participant as a percentage of theirs.

Thresholds

The procedure for the formation of capital (authorized) is regulated by the Federal legislation and set for each type of organization in individually . For example, the minimum size of a joint-stock company is several times higher than the limit set for a limited liability company.

OOO

In 2018, the minimum amount of capital (authorized) for an LLC is set at 10,000 rubles. When it is formed, each personally pays his share.

In 2018, the minimum amount of capital (authorized) for an LLC is set at 10,000 rubles. When it is formed, each personally pays his share.

After registering an LLC and receiving the relevant documents, its owners can increase the charter capital by contributing property, cash or other assets. It should be noted that any changes in the authorized capital are possible only with the participation of a notary.

In accordance with Article 90 of the Civil Code of the Russian Federation when forming the authorized capital of an LLC, its proportions and size are established in advance. When conducting state registration, the founders must make contributions of at least 50%. They are obliged to transfer the remaining assets to the ownership of the organization during the first year of its existence.

In the event that the founders were unable to in full to form the authorized capital, they either announce its reduction or begin the liquidation procedure.

Non-public JSC

The activities of non-public joint-stock companies are regulated by the Civil Code of Russia. Such a joint-stock company cannot have more than 50 shareholders, and there should not be anything in it that indicates its publicity.

The activities of non-public joint-stock companies are regulated by the Civil Code of Russia. Such a joint-stock company cannot have more than 50 shareholders, and there should not be anything in it that indicates its publicity.

Minimum size the authorized capital of such a company is 10,000 rubles. The nominal capital in non-public joint-stock companies is divided into a certain number of securities that cannot be placed openly.

The statutory documentation initially stipulates the share of bills that belong to each owner, as well as the number of votes given to one holder of securities.

In this situation, the minimum authorized capital of a non-public JSC must be at least 10,000 rubles.

Public JSC

The activities of public JSCs are regulated not only by the Civil Code, but also by Federal Law No. 208 "On Joint Stock Companies". The authorized capital of such organizations is formed from shares, which are acquired by the owners at the initial cost determined at the time of issue.

In the course of the activities of companies, their authorized capital can change both to a greater and lesser value, depending on the situation existing in the financial market. In accordance with the regulations of the Federal legislation, the minimum authorized capital of public joint-stock companies must be at least 100,000 rubles.

Additional information about the authorized capital is in this video.

State enterprise

While creating state enterprises their founders must be guided by the Civil Code of the Russian Federation. In accordance with its regulations, the minimum authorized capital of such companies should be 5,000 minimum wages.

Municipal unitary enterprise

For municipal enterprises Federal legislation establishes minimum value authorized capital, amounting to 10,000 minimum wages. They are created by local authorities and in the future fully supervise the activities.

Newly opened bank and credit institution

Opening process jar provides for a large number events. Its founders must comply with all requirements of Federal law in order to receive license the right to carry out banking activities.

Opening process jar provides for a large number events. Its founders must comply with all requirements of Federal law in order to receive license the right to carry out banking activities.

In process financial institution they need to form an authorized capital, the minimum amount of which should be 300,000,000 rubles.

The founders will have to place this amount on special accounts of the Central Bank of Russia.

Where to submit and how

Information on the amount of capital (authorized) of each LLC is reflected in its Charter. It is formed from the value of the share (it is reflected as a percentage of the total share capital or in the ruble equivalent) of each founder at the time the company was founded.

Until the moment when the founders of the organization are ready to apply for the state, they must place half of the authorized capital in a savings account.

After the founders receive the registration documentation in their hands, they must transfer the remaining part of the Criminal Code to (payment of funds to the cashier is allowed).

After the founders receive the registration documentation in their hands, they must transfer the remaining part of the Criminal Code to (payment of funds to the cashier is allowed).

If one of the founders has not fulfilled its obligations and has not contributed its share in the Criminal Code, then a financial penalty provided for by the Charter may be applied to it.

Contributions to the authorized capital can be made by the founders on your own, but within the framework of the current Federal legislation:

- in cash, both in cash and in the form of a bank transfer;

- securities, in particular shares, bills, etc.;

- property and other assets;

- rights to any property.

Property contribution

To contribute property to the authorized capital, the founders need to act in a certain sequence:

- Perform a property appraisal. To do this, you must contact a specialized company that has the appropriate permits.

- At the meeting of the founders approve the assessment report which should be reflected in the protocol. If the company is opened by one owner, then there must be his decision, drawn up in writing.

- Draw up an act of acceptance and transfer, on the basis of which the property is put on the balance sheet of the organization.

UK money

All funds contributed by the founders to the authorized capital of the LLC must be placed immediately on the accumulative account, and after receiving the registration documentation on the current account (in the future they can be spent on the needs of the company).

Statutory contributions can be made both in Russian rubles and in the currency of other states.

The founder's contribution to the current account must be documented. Usually, an announcement for a cash contribution is drawn up, consisting of several parts: receipt order, receipts and announcements.

As evidence of the deposit of funds can be considered:

- incoming cash order;

- statement from the current account;

- copies of payments and receipts;

- the provision of the company's charter, which states that the payment of the minimum amount of the authorized capital was carried out in full.

Formation example

The process of formation of the statutory fund can be considered on an example. Several founders held a meeting at which they made all the main decisions regarding the state registration of the LLC. The authorized capital of the company will be formed as follows:

- Vasiliev P.P. made a contribution of 44,000 rubles, of which cash in the amount of 24,000 rubles and refrigeration equipment in the amount of 20,000 rubles. The share (as a percentage) was 18.41%.

- Petrov E.R. made a statutory contribution in the form of a car, the cost of which is 75,000 rubles. The share (as a percentage) was 31.38%.

- Sidorov N.P. made a statutory contribution in monetary terms - 120,000 rubles, in the form of the right to use the trading premises for 1 year. In percentage terms, the share was 50.21%.

Deadline for joining an LLC

The term for the founders to contribute money to the Authorized Fund is determined by the decision of the meeting, which deals with the creation of an LLC. Boundary date, in monetary terms, should not exceed 4 months from the moment the company receives registration documents.

How the increase in the authorized capital of an LLC takes place, you will learn from this video.

An economic entity can register a business either as an entrepreneur or by creating a legal entity. In the latter case, it is necessary to follow the procedure established by law for the establishment of an organization. important place in this process is given to the formation of the initial funds of the new company, which are called the authorized capital of the LLC.

The authorized capital of an LLC represents the organization's own property, formed with the help of contributions, on the basis of the parts fixed in the company's constituent documents.

The obligation of the owners of the company to create this capital is enshrined in the provisions of regulations and without it it is impossible to register the company with the Federal Tax Service.

Thus, the authorized capital of an LLC is a part of the company's funds, which are its property, using which the company will carry out its activities in the future. The firm can also raise borrowed funds, but the law requires a mandatory share of the contributed capital.

For the owners of the organization, the authorized capital also shows the declared funds, what they risk when making business decisions, as well as the limit value of their liability for debts during the operation of the company.

The size of the authorized capital must be reflected in the charter of the economic entity, as well as, while the company exists, and in the financial statements of the enterprise. The amount of property and funds in the capital must be expressed only in rubles.

It also requires registration of the company's charter. Based on this, if there is a change in this source of funds of the company, it must be accompanied by necessary changes in the information of the subject in the Unified State Register of Legal Entities and constituent documents.

The creation of capital is carried out by the participants of the company, the source can be:

- Property objects.

- Intangible assets(NMA),

- Cash, etc.

Under certain conditions established by law, the authorized capital of an LLC must be created only in monetary amounts that must be paid by the owners either to the cashier or to opened by the company checking account. Having entered the company's accounts, these funds may not be there.

Attention! The management of the company, after registration, can dispose of these funds, since they cease to belong to the owners, but are already the property of the enterprise.

The property used as a contribution to capital is not the income of the established company, and therefore it should not be subject to income tax.

What is the time period for funds

Previously, the period during which the owners of the company must use the funds as contributions to the authorized capital was not fixed at the legislative level. This period was reflected in the constituent documents along with its full amount.

Currently regulations a period is set during which the owners must transfer their shares. It is four months from the date of registration of the company with the tax authorities.

At the same time, the formation of such capital can be carried out in stages, that is, all four months in arbitrary parts. The legislation only requires that four months after receiving the OGRN extract, the founders have no debt to the company for the creation of authorized capital.

If several persons act as the owners of the company, and by the deadline established by law, one of them has not contributed his share, other founders receive the right to sell his share of the contribution to other persons.

Also, do not forget that if 4 months after the registration of the company, the owners still have debts on contributions to capital formation, then according to the Civil Code of the Russian Federation, the company must be liquidated.

The amount of the authorized capital of LLC

When created new company, the founders determine the amount of its capital independently. There is one restriction that must be strictly observed - the minimum amount of authorized capital. The minimum amount of the authorized capital of an LLC has not changed since 2017.

When created new company, the founders determine the amount of its capital independently. There is one restriction that must be strictly observed - the minimum amount of authorized capital. The minimum amount of the authorized capital of an LLC has not changed since 2017.

It is fixed in the amount of 10,000 rubles. This size is determined for simple business entities. If the future company plans to conduct insurance, betting activities, etc., they may have their own minimum amounts of capital.

When choosing the amount of capital, owners should keep in mind that the profit for the year must be at least fixed size capital. This rule is valid for two years after the organization of the company.

Then a comparison of net assets with equity should be made. In this case, the first cannot be less than the second. In case of violation of this provision, the FTS body can single-handedly decide on liquidation.

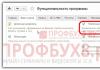

buchproffi

Important! In the case where one of the owners has a share of more than 50%, then the addition of funds from him will not be considered the income of the company, and they will not need to be taxed. So, for example, with two participants, the shares can be distributed as 49 and 51%.

Application procedure

Any property can be used to create the authorized capital. What exactly should be prescribed in the statutory documents of the organization. The Civil Code establishes one restriction on the process of creating authorized capital. So, if it is formed in the minimum amount of 10,000 rubles, then its contribution should be made only in money. At the same time, it does not matter whether they will be paid in cash or by bank transfer.

If funds are deposited non-cash, then this requires the preliminary opening of a current account in one of the banks. This can be done immediately upon registration (in this case, a temporary account is opened first, and after registration - a permanent one). Or after the procedure, you can personally contact the selected institution at any time.

The transfer of funds in this case will be carried out by crediting from the bank account of an individual or legal entity, which are the owners, to the account number of the created organization. In the payment order, in the purpose of the payment, it is written that this is a contribution of funds to the authorized capital.

Also, a citizen can contact the bank where the account is registered with the company and deposit cash directly to the current account using the cash deposit announcement. In this case, this will also be considered a non-cash deposit.

If funds are deposited into the company's cash desk, then it must be remembered that the cash limit rule is valid immediately from the date the organization was created. Therefore, if the order on the limit was not immediately accepted, then the money must be immediately transferred to the current account, otherwise this will be a violation of cash desk operations.

When depositing cash, it is drawn up, where the contribution to the authorized capital is indicated in the base column.

Attention! If the firm is organized by several persons, then the total amount of capital must be divided among them according to shares, which may be fractional. Based on the size of the shares, the owners receive votes to manage the organization.

If the LLC includes several participants, then it will be more convenient to establish the amount of the authorized capital in proportion to the number of owners. For example, three persons create an LLC with a capital of 30,000 rubles. When dividing it by 3, it turns out that everyone must contribute a share of 10,000 rubles.

Change in authorized capital

Increasing order

In the process of activity, the founders of the company may decide to increase the authorized capital.

In the process of activity, the founders of the company may decide to increase the authorized capital.

This can be done in one of the following situations:

- A new owner wants to enter the organization, and he contributes his part of the capital;

- The company wants to engage in a new direction of activity, and for this it is necessary to increase the authorized capital;

- The amount of capital must comply with the requirements of the law;

- One founder wants to have larger size its share in the capital;

- Partners (investors, creditors) require an increase in capital.

The authorized capital can be made larger by adding additional funds, or using the property available in the organization.

An increase is allowed only when the authorized capital is formed and is equal to that stated in the statutory documents, the share of each of the owners is equal to the designated one.

Entering a participant is only allowed when, in founding documents the company does not include a direct ban on adding third parties to the founders of the company. If this is not the case, then any person has the right to issue an application addressed to the director.

The document must contain a request to accept him as an owner, as well as the size of the share he wants to form, the method of depositing funds, the duration of this event.

If it is decided to carry out the capital increase by adding additional funds, this can be done by both each owner and one person. In the first case, everyone must add the same amounts so that the final ratio of shares in the capital does not change. In order to make such a decision, it is imperative to convene a general meeting of the founders.

If the only participant wants to make the share larger, he draws up a request addressed to the head, indicating the size of the final share, the method of adding new funds.

Attention! If it is decided to increase capital by adding funds or property of the company, this must be done in equal volumes so that the percentage of shares of all owners does not change. The property for increase is withdrawn from the net assets of the organization only after it has been adopted at the annual meeting financial statements for the past year.

Decreasing Order

Decrease overall size authorized capital is allowed only if the share of each participant is reduced in equal proportion. This means that the overall share ratio should not change after that. The part that will be withdrawn from the capital after the reduction must be transferred back to the founders.

It is impossible to reduce the authorized capital of an LLC in order to avoid covering the debts of the organization. Before starting the procedure, participants must provide information that each creditor of the company has been notified of the reduction. In this case, any of them may require the company to repay the debt.

The organization can carry out a decrease in the authorized capital through the issuance of cash, or by withdrawing part of the property. At the same time, in any of the chosen ways, personal income tax will need to be calculated and paid on the received share of property or funds. The Ministry of Finance takes this side in its recommendations. However, there are many available arbitrage practice when during the proceedings the court stood up both on one side and on the other.

The law provides for several cases in the event of which the organization is obliged to carry out the reduction procedure, these include:

- The size of the company's net assets fell below the size of the authorized capital;

- Within a year from the moment one of the participants left, the other founders could not divide or repay his share.

buchproffi

Important! The decision to reduce the capital must be taken at the general meeting of participants by at least 2/3 of the votes. The only member of the society makes such a decision independently.