In order to choose a method for assessing the value of a company, it is necessary first of all to rely on the objectives of the assessment and the characteristics of the company itself. The choice of method for assessing the value of an object is very important, since different methods can give completely different results. Such deviations may be caused by market imperfections and the collection of incorrect information about the company.

Traditionally, there are three approaches to determining the valuation of a business: profitable, costly and comparative. Let's take a closer look at each of these approaches and highlight the main methods of each approach.

Income Approach: The income approach is the most common method for estimating the value of a company, as it is used when deciding whether to invest in a company. Any investor who wants to invest his money in a business hopes to receive income in the future that would pay off all his investments and make a profit.

"Income approach is a set of methods for assessing the value of the object of assessment, based on the determination of expected income from the object of assessment."

This approach is based on calculating the value of a company by projecting future earnings to the valuation date. This approach is used when the company's future earnings can be accurately predicted.

The main methods of the income approach include the income capitalization method and the discounted cash flow method.

The method of capitalization of cash income is most often used to evaluate companies that have accumulated assets, have stable production and are at the stage of maturity. This method allows "to estimate the value of the company based on the capitalization of income for the first forecast period, assuming that the amount of income will be the same in subsequent forecast years" .

In the income capitalization method, it is necessary to determine the future cash flows or future average profit that the company will receive.

This method is quite simple compared to discounting methods, since the valuation does not need to make a long-term forecast of income, but the application of this method is limited to the number of stable enterprises that are at the stage of maturity.

Thus, the main factor determining the possibility of applying this method is the presence of a stable income from the company in question. The following stages of the method of capitalization of income can be distinguished (Sharipo, 1989):

Justification of the stability of income;

It is possible to determine whether income is stable or not based on an analysis of the company's financial statements.

Determining the amount of capitalized income;

The amount of income to be capitalized can be calculated as forecast income for one year after the valuation date, or as an average of income over a number of years.

Calculation of the capitalization rate;

The capitalization rate for a company is derived from the discount rate by subtracting the expected CAGR of revenue or cash flow. That is, the capitalization rate is usually less than the discount rate.

- - capitalization of income;

- - making final corrections.

In practice, the method of capitalization of income is rarely used, due to market fluctuations and the volatility of the income of most companies.

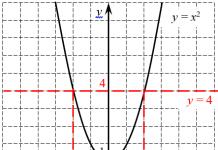

More often than not, companies use the discounted cash flow method to estimate their value. This is because this method relies on the fact that cash flows change every year. Thus, the discounted cash flow method is based on a forecast of the future flows of a given company, which are discounted at a discount rate that is a function of the risk of expected cash flows (Gordon, 1962). Calculation of the value of the company, using discounted cash flows is made according to the following formula:

where: PV - current value of the company;

CF - cash flow;

FV - value of assets in the post-forecast period;

R - discount rate;

n is the number of years of forecasting.

The discounted cash flow method is most often used for companies that are at the stage of growth or development, i.e. These are relatively young companies. In such companies, it is expected that future cash flows will vary significantly compared to the present, or the company wants to implement an investment project that will have a significant impact on future cash flows.

The stages of conducting a business valuation using discounted cash flows are as follows:

a) collecting the necessary information;

Calculating the value of a business requires information from a company's balance sheet, its income statement, cash flow statement, and other market indicators.

b) choice of cash flow model;

Cash flow is the difference between the cash inflow and outflow of a company. There are two main cash flow models - cash flow on equity and cash flow on total invested capital.

c) determination of the duration of the forecast period;

The duration of the forecast period is determined depending on the expected growth of the company's key indicators and plans for the development of the company, which are accepted by the management. Most often, the forecast period is taken as the number of years after which the company will be able to reach a constant growth rate of cash flow.

d) conducting a retrospective analysis of gross revenues and expenses, as well as their forecast;

When forecasting a company's gross revenues and expenses, two methods can be used: coarse and detailed approaches. The aggregated approach is based on a revenue forecast, which is calculated taking into account the rate of its growth in previous years. When calculating the forecast value of expenses, this approach assumes that variable costs will increase proportionally with revenue growth. A detailed approach is based on the study of a large amount of information. So, to calculate gross proceeds, data on sales volumes of past years, current and forecast prices for products, and forecasts of specialists regarding changes in economic conditions are required. To calculate costs, this approach determines the cost of production by cost elements.

e) calculation of the amount of cash flow for each year of the forecast period;

There are two methods for calculating the amount of cash flow. The first method is an indirect method, which is carried out by analyzing the cash flow in the company's lines of business. This method is based on the preparation of the cash flow budget and the further calculation of the cash flow. The second method - the direct method, is aimed at analyzing the cash flow by item of income and expense, i.e. it is based on consideration of the company's balance sheet and further calculation of cash flow based on it.

f) determination of the discount rate;

The calculation of the discount rate takes into account the following factors: the presence of different sources of attracted capital, changes in the value of money over time, and possible risks. Based on which cash flow model has been chosen, the company determines the discount rate: for equity cash flow it is a cumulative rate building model or capital asset pricing model (CAPM), and for invested capital cash flow it is a weighted average cost of capital (WACC) model .

g) calculation of the present value of future cash flows and the value of the company in the post-forecast period, as well as their total value;

The post-forecast period is the remaining life of the company, during which an average stable growth rate of cash flows is expected. To calculate the value of the company in the post-forecast period, the cost of the reversion is calculated. Reversion - income from the possible resale of the enterprise at the end of the forecast period. There are several ways to calculate reversion, depending on what the company has prospects for development in the future. There are the following reversion calculation methods: salvage value method, net asset value method, purported sale method and Gordon model.

h) introduction of final amendments.

The discounted cash flow method allows you to get a market valuation of the company's value, which shows how promising the company is. That is why this method is the most attractive valuation method for investors who want to invest their assets in a profitable, developing and promising company.

Using the income approach to calculate the value of a company has both advantages and disadvantages. The benefits of the income approach include:

- - this approach takes into account the future changes in the income and expenses of the company. Thus, it shows the profitability of the company, which in turn satisfies the interests of owners who want to receive dividends;

- - the application of this approach helps to make decisions about investing in the company, that is, this approach takes into account the interests of potential investors;

- - this approach takes into account the prospects for the development of the company.

The main disadvantages of this approach are the following:

- - the difficulty of forecasting long-term income and expenditure flows, as the economy is unstable. As a result, the probability of an incorrect forecast increases with an increase in the forecast period;

- - the complexity of calculating capitalization and discount rates, since there are various ways to calculate them;

- - the existence of risks that may have a significant impact on the forecasted income;

- - the possibility of a discrepancy between the real income of the company and what they show in their financial statements.

As a result, we can say that the income approach has its advantages and disadvantages, but today it is widely used in practice in assessing the value of a business.

Cost approach: The cost approach is based on the calculation of the market value of all assets and the value of all liabilities of the company. Most often, this approach is used by companies that have significant tangible assets, when the company is unprofitable, when the company is liquidated, or when it is impossible to evaluate it using income or comparative approaches.

In general, the formula for calculating the value of a company using the cost approach is as follows:

Company Value = Assets - Liabilities (2)

The cost-based approach has two possible methods for calculating the value of a company - the net asset method and the salvage value method. Let's consider each of these methods in more detail.

The net asset method is based on an analysis of the market value of the company's assets and liabilities. When calculating the value of a company using this method, you must perform the following steps:

- a) calculation of the market value of all assets of the company;

- b) calculation of the company's current liabilities;

- c) calculation of the difference between the received assets and liabilities.

When calculating the value of a company's assets, the following assets should be considered:

- - intangible assets;

- - long-term financial investments;

- - buildings, structures;

- - machines, equipment;

- - reserves;

- - receivables;

- - other.

When calculating current liabilities, the following items should be included:

- - long-term and short-term liabilities on loans and credits;

- - accounts payable;

- - debt on payment of dividends;

- - reserves for future expenses;

- - other.

Using the net asset method when calculating the value of a company does not always give an objective assessment of its actual value. But in reality, due to the lack of market information, companies have to resort to this method. However, this method is now less common, due to the development of companies involved in the development of new technologies, whose assets consist mostly of intangible assets, which are very difficult to evaluate.

Another method of the cost approach is the salvage value method. This method is based on "determining the difference between the total value of all assets of the enterprise and liabilities, taking into account the costs of its liquidation" . This method is used by companies that are at the stage of bankruptcy, unprofitable companies, companies that have decided to liquidate themselves.

When calculating salvage value, the following steps must be followed:

a) analyze the financial statements of the company;

This analysis is carried out in order to determine whether the company has enough funds to cover its debt.

b) form an idea of how many assets need to be assessed;

With this assessment of property, the company's assets are divided into the most liquid (current assets) and less liquid (non-current assets)

- c) calculate the amount of the company's debt;

- d) develop a calendar schedule for the liquidation of the company;

During the liquidation process, the company sells its existing assets, but it should be noted that different assets are sold at different time intervals. Thus, real estate is sold on average in one to two years, and stocks, raw materials and materials are usually sold immediately after the decision to sell them.

When calculating costs, it is necessary to distinguish between the costs of liquidation and the costs that are directly related to the ownership of assets before they are sold. Liquidation costs include the following costs: commissions from valuation and law firms, taxes and fees that will need to be paid upon sale. And the costs associated with the ownership of assets include the costs of maintaining inventories of finished products, equipment, real estate and management costs to maintain the company's work until the completion of its liquidation.

- f) evaluate the assets being sold;

- g) determine the discount rate;

The discount rate is determined depending on the period of sale of the property, and a different rate can be set for each asset, depending on its liquidity.

- h) determine the proceeds from the sale of assets (tangible and intangible), taking into account the schedule for the sale of these assets;

- i) pay off the current debt of the company, which arose during the period of liquidation, and pay off its obligations;

The company's obligations are paid to creditors in the order in accordance with Article 64 of the Civil Code of the Russian Federation.

j) estimate the salvage value;

The residual value is determined by subtracting existing liabilities from the adjusted present value of the company's assets.

The cost approach has its pros and cons. The main advantages of this approach include:

- - this approach is based on taking into account the influence of production and economic factors on the value of assets;

- - this approach takes into account the degree of depreciation of assets when assessing the level of technology development;

- - asset valuation is based on the analysis of financial and accounting documents, i.e. has an objective basis.

But there are also disadvantages to the cost approach, namely, that it:

- - does not take into account the prospects for the development of the company and the market situation as of the valuation date;

- - does not take into account possible risks;

- - does not take into account the main financial and economic indicators of the company.

Comparative Approach: Another approach to assessing the value of a company is the comparative approach, which aims to determine the value of a business based on the market price of similar companies.

This approach is possible only if there are several factors. Firstly, it is necessary to have a developed financial market, since the comparative approach is aimed at using data on completed transactions. Secondly, the market should have access to information about the financial performance of companies similar to the one being evaluated.

There are three main methods for assessing the value of a company that are related to the comparative approach - this is the method of a company-analogue (capital market method), the method of transactions and the method of industry coefficients. Let's consider each of these methods in more detail.

The analogue company method or the capital market method is based on the analysis of the real prices of shares that have formed on the open stock market. The price of one share of an open joint-stock company is taken as a basis for comparison. And this method is used to evaluate a minority stake.

The transaction method is aimed at comparing data on the sale of controlling stakes in a company or on the sale of entire companies. This method is used when the purchase of a controlling stake in a company is carried out, as well as when a closed joint-stock company is valued, which has analogues of an open type. This method also includes the analysis of multipliers.

The method of industry coefficients is based on the use of recommended ratios between the price and certain financial parameters. Typically, industry ratios are calculated by special analytical organizations that make their calculations using long-term statistical observations of the company's sale price and other important production and financial indicators.

In Russia, the first two methods of the comparative approach are most often used, namely the capital market method and the transaction method. These methods have a similar application technology, and the difference lies in the fact that in one case we find the price of one share, which does not give any control to the owner, and in the other case we get the price of a controlling stake, which includes a premium for elements of control.

Let's consider the stages of the company valuation process, which are typical for the transaction method and the capital market method:

- a) study of the market and the industry in which the company operates.

- b) selection of peer companies that will be used for comparison;

- c) financial analysis;

- d) calculation of price multipliers;

- e) the choice of multipliers that are appropriate to apply to the company being valued;

- f) determining the final value of the company by weighing the intermediate results;

- g) introduction of final amendments for the degree of control.

When assessing the value of a company using a comparative approach, the choice of peer companies plays an important role. The selection of these companies is usually carried out in three stages. At the first stage, the maximum possible number of companies that are similar to the one being evaluated is selected. This search is carried out by identifying the main competitors. At this stage, the main criterion for comparability is the similarity of the industry. At the second stage, the list of possible analogue companies is reduced, due to the fact that some companies will be closed companies and it will be difficult to obtain information about them. Also at this stage, the criteria for comparability are the main characteristics of companies. At the third and last stage, a final list of peer companies is compiled, which includes companies that meet all comparability criteria. This list is based on a thorough analysis of additional information about the companies. Next, we consider some criteria for selecting peer companies.

One of the most important selection criteria is industry similarity of companies. Peer companies always belong to the same industry, but keep in mind that not all companies in the same industry are comparable. First, it is necessary to compare the level of diversification of the companies' production. So if a potential analogue company produces one type of product or product that dominates production and brings most of the total profit, and the company being valued is aimed at the production of various goods, and profit from one product does not bring most of the total profit, then this is about comparability. companies are not allowed to speak. The dependence of the performance of companies on the same economic factors is also subject to comparison. In some industries, such as the construction industry, performance results depend not so much on economic factors as on the location of the property (in Moscow, the price per square meter differs significantly from the price in the regions). Another comparison factor is the stage of economic development of the company being valued and its peers. If the company exists for a long time and is successfully functioning, then it will have certain advantages in the form of additional profit, stable clientele and suppliers.

An important criterion after industry similarity is company size. In order to assess the size of companies, a number of parameters are determined, such as: the degree of capitalization of the company, the number of employees, the volume of products sold, the amount of profit, the number of branches, and more.

Also, when deciding on the comparability of companies, it is necessary to determine the level financial risk companies. This risk can be assessed on the basis of the following criteria: the ratio of own and borrowed funds, the company's liquidity level and the company's creditworthiness.

Another comparison factor is management quality companies. However, the analysis of this factor is rather complicated, as it is based on indirect data, namely, on the assessment of the quality of reporting and the level of education, experience, average age, and salaries of managerial personnel.

The list of comparability criteria described above can be extended depending on the characteristics of the company being valued and the personal opinion of the appraiser on additional criteria.

After the analog companies are selected, it is necessary to calculate the price multipliers, with the help of which the company's value will be assessed. The price multiplier is the ratio between the company's price and some financial or production indicator that characterizes the results of its activities. In general, the formula looks like this:

where: M - price multiplier;

C - the price of the company-tax;

FB is a financial or production indicator.

The use of price multipliers for valuation is based on the assumption that the company being valued and its peers have a similar relationship between price and some financial indicator. Therefore, having calculated the multiplier, we can calculate the price of the company being valued by multiplying the value of the multiplier by the financial indicator of our company.

In order to calculate the price multiplier, it is first necessary to determine the value of capitalization or the market value of the equity of the peer company. To calculate this, you need to multiply the number of shares traded on the stock exchange by the market price of the shares. Thus, we will get the value of the numerator in the formula. The share price is taken as of the latest date prior to the valuation date, or it is calculated as the average between the maximum and minimum price for the last month. Secondly, it is necessary to calculate the value of the denominator in the formula, that is, financial indicators, for example, such as: profit, sales proceeds, net asset value, dividend payments, cash flow and some others. These indicators are taken for the last reporting year, for the last 4 quarters or as an average for several previous years.

In valuation practice, the following multipliers are most often used:

- - "Price / Profit";

- - “Price/Cash flow”;

- - “Price/dividend payments”;

- - "Price / Sales proceeds";

- - "Price / book value";

- - "Price / Net Asset Value";

Depending on the characteristics of the company being valued, its industry and competitors, the valuation of the company can be based on the value of one multiplier, but most often on a combination of several. The choice of the multiplier value is a complex and responsible stage. Due to the fact that absolutely identical companies do not exist, the value of the multiplier for different analogue companies can vary greatly. Therefore, it is first necessary to discard the extreme values of the multiplier, and then calculate its average and median values using analogues.

In order to get the market value of the company being valued, it is necessary to choose which multiplier we will use to look for the value. But most often, in a comparative approach, several multiples are calculated, and then they are weighted to obtain the final value. The specific weights of each multiplier are determined depending on the specific conditions, the objectives of the assessment and the degree of confidence in one or another indicator.

After calculating the final value of the company, it is necessary to make adjustments depending on the specific characteristics of the company. An example of adjustments can be a discount for non-productive assets of a company, low liquidity, a premium for providing elements of control to an investor (when buying a controlling stake).

The comparative approach has its advantages and disadvantages. The following advantages of this approach can be noted:

- - if there is reliable information about peer companies, the results of the assessment will be accurate and will have an objective market basis;

- - the approach is based on the analysis of the real supply and demand for such objects, as it is based on a comparison of the company being valued with analogues that have already been purchased or whose shares are in free float;

- - the company's price reflects the results of its production and economic activities.

However, this approach also has disadvantages:

- - the basis for the analysis is only retrospective information, that is, the prospects for the development of the company are taken into account;

- - the difficulty of collecting information about peer companies due to the lack of development of the stock market or the fact that the companies are closed joint stock companies;

- - it is highly likely that peer companies will have strong differences from the company being valued, in connection with which it will be necessary to make significant adjustments.

Although the comparative approach involves laborious calculations and extensive industry analysis, it is an essential technique for determining the reasonable market value of a company.

What methods (methods) are used to assess the value of a business? How is business valuation carried out by example and what are the goals for this? What documents are needed to assess the business of an enterprise?

Hello everyone who visited our resource! In touch Denis Kuderin is an expert and one of the authors of the popular HeatherBober magazine.

In today's publication, we will talk about what a business valuation is and why it is needed. The material will be of interest to current and future entrepreneurs, directors and managers of commercial companies and all those who are close to business and financial topics.

Those who read the article to the end will receive a guaranteed bonus - an overview of the best Russian companies specializing in business valuation, plus advice on choosing a reliable and competent appraiser.

1. What is a business valuation and when is it needed?

Any business - whether it is a plastic cup manufacturing company or an automotive complex - strives to develop and expand its sphere of influence. However, it is impossible to correctly assess your prospects without a comprehensive analysis of the current state of affairs.

It is business valuation that gives owners and managers of existing commercial enterprises a real picture of the company's assets and its potential.

When does a business need an appraisal?

- sale of the entire enterprise or its shares in the form of shares;

- rent of an operating business;

- development of new investment directions in order to expand and develop the company;

- revaluation of funds;

- reorganization of the company - merger, separation of individual objects into independent structures;

- liquidation of the company as a result of bankruptcy or termination of activities;

- issue or sale of shares;

- optimization of production and business activities;

- changing the format of the company;

- leadership change;

- transfer of assets as collateral;

- transfer of shares of the enterprise to the authorized capital of a large holding;

- company insurance.

As you can see, there are many situations in which a business needs a professional assessment. But the main goal of such a procedure is always the same - a competent analysis of the financial efficiency of the enterprise as a means of making a profit.

When initiating business valuation activities, stakeholders want to know what revenues a particular business entity is or will be generating in the future. Sometimes the task of the assessment is even more specific - to answer the questions: develop or sell the company, liquidate it or try to reorganize, whether to attract new investors?

The value of a business is an indicator of its success and efficiency. The market price of a company consists of its assets and liabilities, the value of personnel, competitive advantages, profitability indicators for the entire period of existence or a specific time period.

Small business owners and individual entrepreneurs may have a question - is it possible to evaluate the enterprise on their own? Alas, the answer is no. Business is a complex and multifaceted category. You can get a rough estimate, but it is unlikely to be objective.

And one more important nuance - independently obtained data do not have an official status. They cannot be considered as full-fledged arguments and will not be accepted, for example, in court or as.

2. What are the goals of business valuation - 5 main goals

So, let's consider the main tasks that are solved during the business valuation procedure.

Goal 1. Improving the efficiency of enterprise management

Efficient and competent enterprise management is an indispensable condition for success. The financial status of the company is characterized by indicators of stability, profitability and stability.

Such an assessment is needed mainly for internal use. The procedure identifies excess assets that slow down production and undervalued industries that can bring profit in the future. It is clear that the first must be disposed of, the second - to develop.

Example

In the course of a business assessment in a trading company, it turned out that the use of rented warehouses for storing products is 20-25% cheaper than maintaining and maintaining their own premises, which are on the balance sheet.

The company decides to sell its warehouses and continue to use only leased space. There are cost savings and optimization of production processes.

Goal 2. Purchase and sale of shares in the stock market

The management of the company decides to sell its shares on the stock market. To make an economically viable decision, you need to evaluate the property and correctly calculate the share that is invested in securities.

Selling shares is the main way to sell a business. You can sell the company as a whole or in parts. Obviously, the cost of a controlling stake will always be higher than the price of individual shares.

At the same time, valuation is important for both stockholders and buyers. It is also desirable that the appraiser not only name the market price of the package, but also analyze the prospects for the development of the business as a whole.

Goal 3. Making an investment decision

Such an assessment is carried out at the request of a specific investor who wants to invest in an existing enterprise. Investment value is the potential ability of invested funds to generate income.

The appraiser finds out the most objective market value of the project from the point of view of the investment perspective. Take into account, for example, the prospects for the development of the industry in a particular region, the direction of financial flows in this area, the general economic situation in the country.

More information - in the article "".

Goal 4. Enterprise restructuring

The main goal of the owner ordering an appraisal during the restructuring of the company is to choose the most optimal approach to the processes of changing the structure of the company.

Restructuring is usually carried out in order to improve business efficiency. There are several types of restructuring - merging, accession, separation of independent elements. Evaluation helps to carry out these procedures with minimal financial costs.

With the complete liquidation of the object, the assessment is needed mainly for making decisions on the return of debts and the sale of property at free auction.

In the process of restructuring, it is often required to carry out, the current assets and liabilities of the company, complete.

Goal 5. Development of an enterprise development plan

Development strategy development is impossible without assessing the current status of the company. Knowing the real value of assets, the level of profitability and the current balance, you will rely on objective information when drawing up a business plan.

In the table, the assessment objectives and features are presented in a visual form:

| № | Objectives of the assessment | Peculiarities |

| 1 | Improving management efficiency | Results apply for internal use |

| 2 | Purchase and sale of shares | Valuation is important for both sellers and buyers |

| 3 | Making an investment decision | The object is evaluated in terms of investment attractiveness |

| 4 | Business restructuring | Evaluation allows you to change the structure, taking into account maximum efficiency |

| 5 | Development plan development | Evaluation allows you to draw up a competent business plan |

Method 3. Estimated by industry peers

It uses data on the purchase or sale of enterprises close in profile and volume of production. The method is logical and understandable, but you need to take into account the specifics of the company being valued and specific economic realities.

The main advantage of this method is that the appraiser focuses on actual data, not abstractions, and takes into account the objective situation on the sales market.

There are also disadvantages - the comparative approach does not always affect the prospects for business development and uses average indicators of industry peers.

Method 4. Estimated cash flow forecast

The assessment is carried out taking into account the long-term prospects of the company. Specialists need to find out what profit a particular business will bring in the future, whether investments in the enterprise are profitable, when the investments will pay off, in what directions the funds will move.

4. How to assess the value of the business of an enterprise - a step-by-step instruction for beginners

So, we have already found out that only professionals can competently evaluate a business. Now consider the specific steps that business owners need to take.

Step 1. Choosing an appraisal company

The choice of an appraiser is a responsible and important stage of the procedure. The final result depends entirely on it.

Professionals are distinguished by the following features:

- solid experience in the market;

- use of up-to-date technologies and methods, modern software;

- availability of a functional and convenient Internet resource;

- a list of well-known partners who have already used the services of the company.

The specialists themselves, who will carry out the assessment, must have permits and insurance of their professional liability.

Step 2 We provide the necessary documentation

The appraisal firm will certainly explain to you in detail what documents you need to provide, but if you collect the package in advance, this will save time and immediately set the appraiser on a business wave.

Clients will need:

- title documents of the company;

- company charter;

- registration certificate;

- a list of real estate, property, securities;

- accounting and tax reports;

- list of subsidiaries, if any;

- certificates of debt on loans (if there are debts).

The package is supplemented depending on the goals and features of the procedure.

Step 3 We coordinate the business valuation model with the contractor

Usually the customer knows for what purpose he conducts the assessment, but is not always aware of which methodology is best to apply. During the preliminary conversation, the expert and the client work together to develop an action plan, determine the methods of evaluation and agree on the timing of its implementation.

Step 4 We are waiting for the results of industry market research by experts

To begin with, appraisers need to analyze the situation in the industry segment of the market, find out current prices, trends and development prospects for the area under study.

Step 5 We follow the business risk analysis

Risk analysis is a necessary stage of business assessment. The information obtained in the course of such an analysis is necessarily used in the preparation of the report.

Step 6 We control the determination of the development potential of the enterprise

Professional appraisers always take into account the prospects for business development, but it is desirable for clients to control this stage of the study and be aware of the results. It's always good to know what potential your business has.

Step 7 We receive a report on the work done

The final stage of the procedure is the preparation of the final report. The finished document is divided into separate positions and contains not only bare figures, but also analytical conclusions. The report, certified by signatures and seals, has official force in resolving property disputes and in litigation.

How to conduct an assessment as competently and safely as possible for your company? The best option is to involve independent lawyers as consultants at all stages. This can be done by using the services of the site Lawyer. The specialists of this portal work remotely and are available around the clock.

Most of the consultations on the site are free. However, if you need more in-depth assistance, the services are paid, but the amount of the fee is set by the customer.

5. Professional assistance in business valuation - an overview of the TOP-3 valuation companies

No time, desire or opportunity to look for an appraiser yourself? Don't worry, take advantage of our expert review. The top three Russian appraisers include the most reliable, competent and trusted companies. Read, compare, choose.

It doesn’t matter for what purpose you are conducting an assessment - buying and selling, lending on collateral, improving management, reorganization - KSP Group specialists will carry out the procedure professionally, promptly and in accordance with all the rules.

It doesn’t matter for what purpose you are conducting an assessment - buying and selling, lending on collateral, improving management, reorganization - KSP Group specialists will carry out the procedure professionally, promptly and in accordance with all the rules.

The company has been operating on the market for more than 20 years, has about 1,000 regular customers, is well versed in the realities of Russian business, and provides free consultations to customers. Among the permanent partners of the company are well-known companies, small and medium-sized businesses.

The organization has membership in the Self-Regulatory Organization ROO (Russian Society of Appraisers) and liability insurance for 5 million rubles.

The company was founded in 2002. The company guarantees prompt work (the term for business assessment is 5 days) and offers adequate prices (40,000 for a standard assessment procedure). In its methods, the organization adheres to the principles of "Ethical Business" - transparency, honesty, openness, compliance with the terms of the contract, responsibility.

The company was founded in 2002. The company guarantees prompt work (the term for business assessment is 5 days) and offers adequate prices (40,000 for a standard assessment procedure). In its methods, the organization adheres to the principles of "Ethical Business" - transparency, honesty, openness, compliance with the terms of the contract, responsibility.

Yurdis employs 20 professional appraisers, members of the largest Russian SROs. Each of the specialists has liability insurance in the amount of 10 million rubles, diplomas and certificates confirming high qualifications. Among the well-known clients of the company are Gazprombank, Sberbank, Svyazbank, Center for Organization of Military Mortgage.

3) Atlant Grade

The company has been doing business in the appraisal market since 2001. Works with tangible and intangible assets, develops and predicts ideal schemes for increasing income, cooperates with enterprises in all regions of the Russian Federation.

The company has been doing business in the appraisal market since 2001. Works with tangible and intangible assets, develops and predicts ideal schemes for increasing income, cooperates with enterprises in all regions of the Russian Federation.

The list of advantages includes the reference accuracy of estimates, competent legal execution of reports, a clear understanding of the goals and objectives of customers. The firm is accredited by commercial and state banks of the Russian Federation, uses an extended methodological base in its work, and applies its own technological and scientific developments.

And a few more tips on choosing a competent appraiser.

Reputable companies have a well-designed and flawlessly functioning website. Through the Internet resource of such companies, you can get free consultations, order services, talk with managers and representatives of the support service.

Conversely, one-day firms may not have a network portal at all, or it may be designed as a cheap one-page site. No additional information, analytical articles, interactive features.

Tip 2. Refuse to cooperate with broad-based companies

Organizations that position themselves as universal firms do not always have the appropriate level of competence.

The value of the current business is an objective indicator of the functioning of the enterprise and reflects the current value of the benefits in the future from its functioning. This allows you to calculate the most likely price at which it can be sold on the open market. The question of how to assess the value of a business is of a practical nature and is of great importance for every entrepreneur at various stages of the company's functioning.

How is business valuation carried out

First of all, it is necessary to determine the main goal that the business valuation process has. There are two options here.

First option- the cost is necessary for the implementation of certain legal actions. That is, you need to obtain an official opinion in the form of a “Valuation Report”, which will be prepared by an independent appraiser licensed to carry out this procedure.

Second option– an appraisal is carried out to determine how much the real value of your business is. To do this, you no longer need the "Valuation Report", in accordance with the requirements of Law No. 135-FZ.

These options have a fundamental difference not in the quality of the work that the appraiser performs, but in relation to the results obtained. Valuation activity is a licensed type of activity. For this reason, it is subject to certain requirements from the current legislation. The fulfillment of these requirements in the process of compiling the Assessment Report, as a rule, causes an increase in the cost of the specialist's work.

If the results of the work are drawn up not in the form of an official Report, but as a Conclusion, during the negotiations, a detailed development and agreement of a clearly formulated task for the assessment takes place. According to this task, the appraisers will perform only the procedures you specify, which are required to resolve certain issues.

Business valuation is a procedure in which it is required to calculate the value of a business as a property complex, which provides its owner with a profit.

The assessment takes into account the value of all assets of the company: machinery, real estate, equipment, financial investments, stocks, intangible assets. It is also necessary to take into account past and future income, possible prospects for the further development of the company, the competitive environment and the state of the market as a whole. Based on a comprehensive analysis, the company is compared with peer companies. After that, information about the real value of the business is already formed.

Methodology

Three methods are used to calculate the value of an enterprise.: costly, profitable and comparative. In practice, there are different situations, and for each class of situations, their recommended methods and approaches are used.

For an adequate choice of method, it is necessary to classify situations in advance, determining the type of transaction, the features of the moment for which the assessment is carried out, and so on.

Certain types of enterprises are most often evaluated on the basis of commercial potential. For example, for a hotel, guests are the source of income. This source is subsequently compared with the cost of operating expenses to determine the profitability of the business. This approach is called profitable.. This method is based on discounting the profit received from the rental of property. The valuation results under this method include both the land value and the building value.

If a business is not bought or sold, there is no developed business market in this direction, for example, a hospital or a government building is considered, then assessment can be carried out on the basis of the cost method, that is, it will take into account the cost of building a building, taking into account depreciation and depreciation costs.

If there is a market for a business that is similar to the one being valued, the market or comparative method can be used to determine the market price of the enterprise. This method is based on the selection of comparable properties that have already been sold on the market.

Under ideal conditions, all three methods used should give the same value. But in practice, markets are imperfect, producers may operate inefficiently, and users may have imperfect information.

These approaches involve the use of various evaluation methods.

The income approach includes:

- cash flow discounting method, focused on the assessment of the existing business, which will continue to operate. It is more often used to evaluate young companies that have a promising product, but have not yet earned enough income for capitalization.

- the capitalization method is used for those enterprises that, during capitalization, accumulated assets in previous periods.

The cost approach includes:

- salvage value method;

- the net asset method, applicable in cases where the investor plans to significantly reduce the volume of output or even close the enterprise.

Comparative approach includes:

- the method of industry coefficients, focused on the assessment of existing companies, which will continue to operate in the post-reporting periods.

- a method of transactions applicable in cases where it is planned to reduce output or close an enterprise.

- capital market method, also focused on operating enterprises.

Methods of the comparative approach are applicable only when choosing a company-analogue, which must be of the same type as the company being valued. Below we will briefly review the use of the main methods for calculating the cost of a business.

Brief instruction

To calculate the value of your business in the forecast period, you must use the discounted cash flow method. A discount rate is used to bring future income to present value.

Then, according to the forecast, the value of the business is calculated using the following formula:

P = CFt/(1+I)^t,

where I- discount rate, CFt denotes cash flow, and t is the number of the period for which the assessment is made.

At the same time, it is important to understand that your enterprise will continue to function in the post-forecast period. Depending on the further prospects for business development, various options are possible from complete bankruptcy to rapid growth. For calculations, the Gordon model can be used, which assumes stable growth rates of profits and sales and the equality of depreciation and capital investments.

In this case, the following formula is used:

P \u003d CF (t + 1) / (I-g),

where CF (t+1) reflects the cash flow for the first year of the post-forecast period, g– flow growth rate, I- discount rate.

This model is most appropriate when calculating indicators for businesses with a significant market capacity, stable supplies of materials, raw materials, as well as free access to financial resources and a generally favorable market situation.

If the bankruptcy of the enterprise and the further sale of property are predicted, then, To calculate the value of a business, you must use the following formula:

P \u003d (1-Lav) x (A-O) - Pliq,

where P liq- expenses for the liquidation of the enterprise, L cf– discount for urgent liquidation, O– amount of liabilities, BUT- the value of the company's assets, taking into account the revaluation.

Costs include insurance costs, taxation, appraiser's fees, management costs, and personnel payments. The liquidation value also depends on the location of the company, the quality of the assets, the overall market situation and other factors.

In the course of the assessment of domestic enterprises, the date of the assessment is of great importance. The binding of settlements to the date is especially important in a market that is oversaturated with property that is in a pre-bankrupt state and lacks investment resources.

The Russian economy is characterized by an excess of asset supply over demand. This imbalance affects the value of the property offered for sale. The price of property in a balanced market will not match the value in a depression. But investors and business owners will be primarily interested in the real value in a particular market under certain conditions. And buyers are focused on reducing the likelihood of losing money, so they require guarantees. When assessing the value of a business, it is required to take into account all risk factors, including bankruptcy and inflation.

In inflationary conditions, at first glance, it is best to use the discounted cash flow method for calculations. This is true only if the rate of inflation is predictable. However, it is quite difficult to predict the flow of income in the conditions of instability for several years ahead.

2. Romanov V.S."The problem of managing the company's value: a discrete case" // Management problems. - 2007. - No. 1.

3. Romanov V.S."The task of managing the company's value - a discrete case" // Management of large systems: Sat. Art. / IPU RAN - M., 2006. - C. 142-152. http://www.mtas.ru/Library/uploads/1151995448.pdf

4. Romanov V.S."Influence of information transparency of the company on the discount rate" // Financial management - 2006. - No. 3. - P. 30-38.

5. Romanov V.S."Success with investors" // Journal of Company Management. - 2006. - No. 8. - S. 51-57.

6. Romanov V.S., Luguev O.S."Estimation of the fundamental value of the company" // "Securities Market". - 2006. - No. 19 (322). - S. 15-18.

7. Dranko O.I., Romanov V.S."Choosing a company's growth strategy based on its value maximization criterion: a continuous case". Electronic journal "Investigated in Russia", 117, pp. 1107-1117, 2006 http://zhurnal.ape.relarn.ru/articles/2006/117.pdf

8. Copeland T., Kohler T., Murin D."Company Value: Valuation and Management". - Second edition, stereotypical - M .: "Olimp-Business", 2000.

9. Damodaran A. Investment Valuation (Second Edition) - Wiley, 2002. http://pages.stern.nyu.edu/~adamodar/

10. Damodaran A. Estimating Risk free Rates // Working Paper / Stern School of Business. http://www.stern.nyu.edu/~adamodar/pdfiles/papers/riskfree.pdf

11. Fernandez P. company evaluation methods. The most common errors in valuations // Research Paper no. 449/University of Navarra. — 2002. http://ssrn.com/abstract=274973

12. Fernandez P. Equivalence of ten different discounted cash flow valuation methods // Research Paper no. 549 / University of Navarra. - 2004. http://ssrn.com/abstract=367161

13. Fernandez P. Equivalence of the APV, WACC and Flows to Equity Approaches to Firm Valuation // Research Paper / University of Navarra. — August 1997. http://ssrn.com/abstract=5737

14. Fernandez P. Valuation Using Multiples: How Do Analysts Reach Their Conclusions? // Research Paper / University of Navarra. — June 2001. http://ssrn.com/abstract=274972

15. 2006 Uniform Standards of Professional Appraisal Practice // The Appraisal Foundation. — 2006. http://www.appraisalfoundation.org/s_appraisal/sec.asp?CID=3&DID=3

16. International Valuation Standards 2005 // International Valuation Standards Committee. http://ivsc.org/standards/download.html

17. Business Valuation Standards // American Society of Appraisers. — November 2005. http://www.bvappraisers.org/glossary/

18. "Appraisal Standards Mandatory for Application by Subjects of Appraisal Activities", approved by Decree of the Government of the Russian Federation of July 6, 2001 No. 519

19. Pavlovets V.V."Introduction to Business Valuation". — 2000.

21. Kislitsyna Yu.Yu. Some methods of modeling the financial development of an enterprise: Dis. cand. those. Sciences. - M., 2002.

22. Dranko O.I., Kislitsyna Yu.Yu."Multilevel model of financial forecasting of the enterprise" // "Management of socio-economic systems: Collection of works of young scientists" / IPU RAS. - M .: Fund "Problems of Management", 2000. - C. 209-221.

23. Kovalev V.V."Introduction to financial management" - M .: "Finance and statistics", 1999.

24. Modigliani F., Miller M. How much does a firm cost?: Collection of articles. - M .: "Delo", 1999.

25. Leifer L. A., Dubovkin A. V. "Using the CAPM Model to Calculate the Discount Rate in the Russian Investment Market". http://www.pcfko.ru/research5.html

26. Kukoleva E., Zakharova M."Risk-Free Rate: Possible Calculation Tools in Russian Conditions" // "Questions of Assessment". - 2002. - No. 2.

27. Sinadsky V."Calculation of the discount rate", Journal "Financial Director". - 2003. - No. 4.

28. Rachkov I.V."Calculating the cost of equity using the Goldman Sachs model".

29. Shipov V., "Some Features of Estimating the Cost of Domestic Enterprises in a Transitional Economy" // "Securities Market". - 2000. - No. 18. http://www.iteam.ru/publications/article_175/

30. Rozhnov K.V."A variant of calculating the discount rate in business valuation based on the method of cumulative construction" // "Questions of assessment - 2000". - No. 4. http://oot.nm.ru/files/1.pdf

31. Jennergren L.P. A Tutorial on the McKinsey Model for Valuation of Companies - Fourth revision // Stockholm School of Economics - August 26, 2002.

32. Brailey R., Myers C."Principles of corporate finance" - M., "Olimp-Business", 2004.

33. Goriaev A. Risk factors in the Russian stock market // New Economic School - Moscow: 2004. http://www.nes.ru/~agoriaev/Goriaev%20risk%20factors.pdf

34. Humphreys D. Nickel: An Industry in Transition1 http://www.nornik.ru/_upload/presentation/Humphreys-Dusseldorf.pdf

35. Speech by T. Morgan, Deputy General Director, Member of the Management Board of OJSC MMC Norilsk Nickel, at the BMO Capital Markets 2007 Global Resources Conference. Tampa, Florida (USA), February 26, 2007 http://www.nornik.ru/_upload/presentation/2007%2002%2026%20BMO%20February%202007%20Norilsk%20Nickel_final.pdf

36. Speech by Deputy General Director of OJSC MMC Norilsk Nickel D.S. Morozov at the UBS conference. Moscow, September 13-15, 2006.