Kudelin Alexander, adviser to the international law firm Hogan & Hartson, PhD, LL.M.

The article analyzes issues that may arise in practice during the preparation and execution of shareholder agreements under Russian law in the light of the changes provided for by the Federal Law of June 3, 2009 N 115-FZ "On Amendments to the Federal Law" On joint-stock companies"and Article 30 of the Federal Law "On the Securities Market".

On June 8, 2009, Federal Law No. 115-FZ of June 3, 2009 "On Amending the Federal Law "On Joint-Stock Companies" and Article 30 of the Federal Law "On the Securities Market" (hereinafter - Law No. 115-FZ) came into force. FZ), among other things, he supplemented the Federal Law of December 26, 1995 "On Joint-Stock Companies" (hereinafter referred to as the JSC Law) with provisions regulating issues related to shareholder agreements. Undoubtedly, these amendments to the JSC Law can be called one of most significant and expected in Russian corporate law in recent years.

It's no secret that after some litigation, the subject of which was the agreements of shareholders<1>(first of all, the cases of MegaFon OJSC and Russian Standard Insurance CJSC), doubts arose among lawyers about the effectiveness and expediency of their conclusion between the shareholders of Russian companies due to the negative attitude of Russian courts to such agreements. At the same time, the conclusions that the latter included in the relevant judicial acts to substantiate their position, including regarding the invalidity of shareholder agreements, were criticized in the legal literature.<2>.

<1>In this article, the terms "shareholder agreement" and "shareholder agreement" have the same meaning and are used interchangeably.

<2>Fedotov I. Shareholder Agreements in Domestic Legal Practice // Corporate Lawyer. 2007. No. 5; Sergeev A. Legal nature and enforceability of shareholder agreements under Russian law // Corporate Lawyer. 2007. No. 10.

Nevertheless, if we take into account the attitude of the relevant courts to shareholder agreements (it does not matter whether or not the position of these courts was really justified and legitimate from a legal point of view), a purely pragmatic position was quickly formed among legal practitioners: in order to avoid problems with the Russian Themis, it is expedient to "take out" shareholder agreements outside the Russian legal field and regulate them according to the law of the country, where they are permissible and can be effectively applied. Thus, in practice, parties wishing to conclude an agreement of shareholders are usually invited to create intermediate (holding) companies in the relevant jurisdictions (for example, in Cyprus), transfer rights to shares in them Russian company, in respect of which the parties would like to conclude an agreement of shareholders, and regulate the relations of shareholders at the level of such an intermediate (holding) company.

It is assumed that the amendments introduced by Law No. 115-FZ will make it possible to change the situation and make it possible to conclude shareholder agreements directly at the level of a Russian company without "going" into a foreign legal field.

Parties to the shareholder agreement

Naturally, the parties to the shareholders' agreement can first of all be the company's shareholders themselves as owners of shares. At the same time, since the law does not provide otherwise, it can be concluded both between all and only between some shareholders of the company. It is equally possible for there to be several shareholder agreements between different shareholders in relation to the same company.

Finally, in addition to shareholders, there are other categories of persons whose participation in the shareholders' agreement may be appropriate (even if they were not explicitly mentioned in this article). These may include, among others:

- trustee;

- nominal holder;

- society itself;

- future shareholders (for example, persons who do not own shares of the company at the time of the conclusion of the agreement in question, but must or may acquire them in the future).

We believe that in the absence of a direct ban on the participation of these persons in the shareholders' agreement in the legislation, there is no reason to limit the composition of participants only to shareholders. A different approach would be contrary to the principles of freedom of contract and autonomy of will, expressed in Art. 1 and 421 of the Civil Code of the Russian Federation. However, it is worth paying attention to the following points.

Trustee

According to paragraph 2 of Art. 1012 of the Civil Code of the Russian Federation, when carrying out trust management of property, the trustee has the right to perform any legal and actual actions in relation to this property in accordance with the trust management agreement in the interests of the beneficiary. Also, in accordance with paragraph 2.12 of the Procedure for the implementation of activities for the management of securities, approved by the Order Federal Service on financial markets dated April 3, 2007 N 07-37 / pz-n, the rights certified by securities held in trust management are exercised by the manager at his own discretion within the limits, established by law RF and a trust management agreement. We believe that these provisions allow the trustee to enter into shareholder agreements, provided that the trust management agreement does not contain otherwise. At the same time, it should be taken into account that the trustee concludes such an agreement on his own behalf by virtue of clause 3 of Art. 1012 of the Civil Code of the Russian Federation.

Since the transfer of property for trust management does not entail the transfer of ownership of it to the trustee and there is no clear indication in the legislation of what happens to the shareholders' agreement concluded by the trustee in the event of termination of the trust management agreement, it is advisable that the shareholders' agreement be concluded simultaneously both the trustee and the owner of the shares. At the same time, it is desirable to provide in it that in the event of termination of the trust management agreement, all rights and obligations of the trustee from the agreement of shareholders in in full pass to the owner of the shares from the moment of termination of the trust management agreement. It is also advisable to provide for the obligation of the owner of shares in the shareholders' agreement to ensure that the trustee will manage the shares transferred to him without violating the provisions of the shareholders' agreement.

Nominal Holder

The participation of nominal holders in the shareholders' agreement seems to be appropriate, taking into account the functions they perform. At the same time, it would be fair to expect that a significant part of nominal holders would most likely refuse to become a party to such an agreement so as not to get into difficult situations in the event of conflicts between its participants. Nevertheless, if nominal holders receive guarantees (in the broadest sense of the word) that in the event of a corporate conflict they will not turn out to be "extreme", then, we believe, this could allow the parties to conclude shareholder agreements with their participation.

What guarantees (measures) could potentially ensure the participation of a nominal holder in the shareholder agreement? First, it is necessary to clearly enough limit the scope of responsibility of the nominal holder in case of his participation in the shareholders' agreement.

for example, the shareholder agreement could provide that if a nominal holder receives an instruction from a participant in the shareholder agreement in whose interests he exercises nominal holding (hereinafter referred to as the principal), which is clearly contrary to the provisions of the shareholder agreement (or the provisions of the shareholder agreement applicable to such instruction, may be interpreted differently), the nominee must:

option No. 1: refuse to execute such an instruction until it is confirmed by all participants in the shareholders' agreement (except for the principal) or until the decision of the competent judicial authority comes into force, ordering the nominee to execute the instruction received; or

Option #2: Suspend execution of this instruction for a while. If during this period all parties to the shareholder agreement (except for the principal) do not confirm to the nominee that this manual does not need to be executed as clearly contrary to the agreement of the shareholders or the determination of the competent judicial authority prohibiting the implementation of this instruction does not enter into force within the specified period, then the nominee holder will comply with it.

In the case of limiting the scope of liability of a nominal holder, as described above, it is advisable for the parties to contact Special attention for the next moments.

- Criteria for the existence of a clear contradiction.

The idea of limiting the liability of a nominee is likely to be accepted by the latter only if there is a clear understanding of what actions should be considered as clearly contrary to the provisions of the shareholders' agreement. It is obvious that to a large extent the answer to this question depends on how the shareholders' agreement itself will be drawn up. Unclear or lengthy wording in the shareholder agreement will, of course, create discomfort for the nominee and make it difficult to negotiate with him regarding the conclusion of the shareholder agreement. At the same time, the parties, most likely, will also not be able to do without general formulations. In this regard, one could obviously be guided by next criterion: if it can be revealed directly from the text of the shareholder agreement that the action that the principal requires the nominee to perform does not comply with the shareholder agreement, then there is a clear contradiction and the nominee must refuse to perform such an action, as indicated above.

for example, the shareholders' agreement provides that the participants in such an agreement of shareholders vote for the conclusion by the company of a transaction for the alienation of real estate submitted to the general meeting of shareholders only if its approval is previously agreed in writing by all participants in the agreement of shareholders. If in this case the principal requires the nominee to vote for the approval of such a transaction, but cannot provide the nominee with a document confirming that all participants in the shareholder agreement have agreed to vote for the approval of such a transaction at the forthcoming general meeting shareholders, then there is a clear contradiction and the nominee holder has grounds for refusing to execute the received instruction.

At the same time, if the shareholder agreement only provides that the parties may vote for the said transaction if it does not entail significant negative consequences for the company (and no prior written approval is required), then from such a wording the nominal holder cannot understand whether or not there is a contradiction between the instruction received and the shareholder agreement (since, based on this wording of the shareholder agreement, he cannot assess whether the transaction will entail significant Negative consequences for society). As a consequence, the nominal holder has no reason to refuse to execute the instruction received by him from the principal in this case.

- Duplication in the depository agreement of the right (obligation) of the nominee holder to refuse to execute the principal's instruction.

According to paragraph 2 of Art. 8 of the Federal Law of April 22, 1996 "On the Securities Market" (hereinafter - the Law on the Securities Market), the nominal holder is obliged to carry out transactions and operations with securities exclusively on behalf of the person in whose interests he is the nominal holder of securities, and in accordance with the agreement concluded with this person, unless otherwise provided by federal law. Also, in accordance with clause 4.13 of the Regulations on depository activities in Russian Federation, approved by Resolution of the Federal Commission for the Securities Market of October 16, 1997 N 36 (hereinafter referred to as the SDA), the depository (which will actually be the nominal holder) is not entitled to determine and control the directions for using the securities of clients (depositors), establish those not provided for by law RF or a depository agreement restricting his right to dispose of securities at his own discretion. Since the legislation does not expressly provide that a nominal holder has the right (or is obliged) to refuse to execute/suspend the execution of the instruction (s) of the shareholder due to its non-compliance with the shareholders' agreement, then, taking into account the specified provisions of the Law on the Securities Market and the SDA, it is advisable that the provisions of the shareholders' agreement, providing for such a right (obligation) of the nominee holder were also duplicated in the depository agreement between the nominee holder and the relevant participant. This need is also indicated by clause 8.1.8 of the SDA. According to it, the depository is obliged to provide its client-shareholder with the exercise of the right to vote at general meetings of shareholders of the company in the manner prescribed by the depository agreement.

Secondly, the nominee holder will obviously require the other parties to the agreement (except the principal) to present obligations to compensate him for any expenses and losses that he will incur if he does not follow the principal’s instructions and will be held accountable for this. We believe that this obligation, with certain reservations,<3>said persons could take to create comfortable conditions for a nominal holder.

<3> for example, the other parties to the shareholder agreement may limit their liability only to reasonable damages or expenses and provided that they do not exceed a certain agreed limit. Certain other disclaimers and limitations of their liability may also apply.

There are a number of other points that need to be taken into account when concluding an agreement between shareholders and a nominee, but they are not considered here.

In conclusion, it should be noted that, according to paragraph 2 of Art. 8 of the Law on the Securities Market, the nominal holder of securities, at the request of the owner, is obliged to ensure that an entry is made in the registry system about their transfer to the name of the latter. It is desirable to supplement this provision with the words "unless otherwise provided by the shareholders' agreement to which the owner is a party." This wording would make it possible to avoid a situation where a participant (principal), intending to take an action that is not in accordance with the shareholders' agreement, instructs the nominal holder to re-register the shares of the company for himself. By virtue of this provision, paragraph 2 of Art. 8 of the Law on the Securities Market, the nominal holder will be required to re-register shares and will no longer be able to play the role of a "protective barrier" that prevents actions that violate the shareholders' agreement. However, if the Law on the Securities Market is supplemented with the proposed wording, the likelihood of such a development of events can be minimized.

Society

We believe that a company may be a party to a shareholder agreement, but its obligations under such an agreement to other parties to the agreement may be limited. Thus, the company could be assigned additional obligations to dispose of its shares to the extent that this does not contradict the requirements of the JSC Law. It also seems reasonable and justified to impose on the company the obligation not to register the transfer of ownership / encumbrance on shares, if this is contrary to the shareholders' agreement<4>. However, it is unlikely that a company can be forced to comply with a decision taken by the parties to an agreement of shareholders in accordance with the provisions of such an agreement, if the procedure for making such a decision, provided for by the company's charter, was not followed. This is due to the fact that it is the charter that is the constituent document of the company and decisions binding on the company must go through the adoption procedure established in the charter. If this rule is ignored, then this will mean the actual substitution of the constituent document (charter) by the shareholders' agreement, which is contrary to Russian law.

<4>We believe that for effective application In practice, such a provision of the shareholders' agreement requires the introduction of appropriate amendments to the regulations governing the procedure for maintaining the register of shareholders and depo accounts by depositories.

Future shareholders

The obligations of future shareholders from the shareholders' agreement may be conditional. This means that such obligations may come into force from the moment the shareholders' agreement is concluded with the future shareholder, but are subject to execution by the latter from the moment when he formally becomes a shareholder (i.e. when a record appears on the personal account / depo account of such a person that his shares of the company). We believe that the shareholder agreement may also include current obligations that may be subject to execution already from the moment the shareholder agreement is concluded by such a person (including the obligation to maintain confidentiality, etc.).

Subject of the shareholder agreement

The subject of the shareholders' agreement is defined in paragraphs 1 and 2 of Art. 32.1 of the JSC Law:

"1. A shareholder agreement is an agreement on the exercise of rights certified by shares, and (or) on the specifics of the exercise of rights to shares. Under a shareholder agreement, its parties undertake to exercise in a certain way the rights certified by shares, and (or) the rights to shares and (or) A shareholder agreement may provide for the obligation of its parties to vote in a certain way at a general meeting of shareholders, agree on a voting option with other shareholders, acquire or dispose of shares at a predetermined price and (or) under certain circumstances, refrain from alienating shares before the occurrence of certain circumstances, as well as to carry out in concert other actions related to the management of the company, with the activities, reorganization and liquidation of the company ...

- The subject of a shareholder agreement cannot be the obligation of a party to a shareholder agreement to vote in accordance with the instructions of the management bodies of the company in respect of whose shares this agreement is concluded.

When analyzing these provisions, it is advisable to pay special attention to the following.

Shares and a company in respect of which an agreement of shareholders is possible

Within the meaning of paragraph 1 of Art. 32.1 of the JSC Law, an agreement of shareholders can be concluded with respect to any shares (both ordinary and preferred) of open and closed joint-stock companies, since the said article does not contain any restrictions on this account.

According to paragraph 3 of Art. 32.1 of the JSC Law, a shareholder agreement must be concluded in respect of all shares held by a party to the shareholder agreement. It is important that in this paragraph we are talking only about the shares of a participant in the shareholders' agreement. This provision does not apply to shares of persons affiliated with him or included in his group of persons.

The paragraph also refers to shares held by a party to a shareholder agreement. Does this mean that the shareholders' agreement can only be concluded with respect to the shares held by the participant of the agreement at the time of its conclusion, and with respect to future shares (i.e. shares of the company, the owner of which the participant in the agreement will become or may become in the future) it is not applicable ? We believe that this is not the case.

First, Russian corporate law has developed a principle according to which, with the exception of cumulative voting when choosing members of the board of directors, a shareholder votes equally with all his shares (for one voting option). Since the shareholder agreement provides for the possibility of establishing a participant's obligation to vote in a certain way or in accordance with an agreed voting option (see below), by virtue of this principle, shares placed in the future are automatically subject to such an agreement. Otherwise, this principle would be violated.

Secondly, it should be taken into account that the agreement of shareholders is concluded, as a rule, for a long period and in the expectation that changes may occur during its existence, including in the number of shares owned by its participants (including the possible placement of additional shares of the company among them, as well as the acquisition by the latter of additional shares from other shareholders). Naturally, when a shareholder agreement is entered into, the parties reasonably expect that it will apply to both their current and future shares. Attempts to limit the validity of the shareholder agreement only to the shares owned by its participants at the time of its conclusion would not meet these expectations of the participants, which would be illogical and contrary to the very essence of the shareholder agreement.

At the same time, with regard to shares that a participant in the agreement may acquire in the future, there is one more point that should be taken into account when analyzing Art. 32.1. In practice, shareholder agreements often contain provisions governing the disposal of shares by their participants. In particular, the shareholder agreement may contain an obligation of one participant to sell (purchase) shares to another (from another) participant(s) in the future. Article 32.1 of the JSC Law also allows such provisions to be included in shareholder agreements.

In this regard, the question arises: will the provisions of the shareholder agreement providing for such obligations apply to the shares of the company that will be placed by the company in the future in favor of the corresponding participant in the shareholder agreement in the course of future issues? This question is caused by the fact that, according to paragraph 1 of Art. 27.6 of the Law on the Securities Market, as a general rule, the circulation of securities, the issue (additional issue) of which is subject to state registration, is prohibited until full payment and state registration of a report (submission of a notification to the registration authority) on the results of the issue (additional issue) of the said securities. At the same time, the term "circulation of securities" in Art. 2 of the Law on the Securities Market is defined as the conclusion of civil transactions involving the transfer of ownership of securities. In other words, would it be legitimate to argue that the provision of the shareholders' agreement, which establishes the participant's obligation to sell the company's shares in the future under certain conditions, by virtue of paragraph 1 of Art. 27.6 of the Law on the Securities Market is applicable only to shares placed at the time of the conclusion of the shareholders' agreement, and does not apply to those that the company will place in the future in favor of the participants in such an agreement, on the grounds that such a provision of the shareholders' agreement, in essence, entails the circulation of future shares in violation of the Securities Market Act? We believe that this broad interpretation of the Law on the Securities Market would be unlawful.

First, the obligation contained in the shareholders' agreement to sell shares in the future cannot by itself be recognized as circulation of securities in the context of the Law on the Securities Market. This is due to the fact that usually for the implementation of the specified obligation, some additional element(for example, a notice from one party to shareholder agreements to another requiring the sale of shares). Only in the presence of all such elements, it would obviously be possible to say that there is a circulation of securities in the context of the Law on the Securities Market.

Secondly, such a broad interpretation of the Law on the Securities Market would be contrary to the meaning of the shareholders' agreement. As stated above, a shareholder agreement is usually concluded for a long period and in anticipation that changes may occur during its existence, including in the authorized capital of the company (including the possible placement of additional shares of the company and among the participants in the shareholder agreement). Naturally, when concluding an agreement of shareholders, the parties reasonably expect that any provisions of such an agreement on the sale of shares in the future will apply not only to the existing shares, but also to the shares that can be acquired by the participants in such an agreement in the course of future issues of the company's shares. In this regard, the above broad interpretation of the Law on the Securities Market, in fact, would be contrary to Art. 32.1 of the JSC Law. Based on the general rule that later normative act has greater force than the earlier one, the provisions of paragraph 1 of Art. 27.6 of the Law on the Securities Market, respectively, cannot be interpreted as preventing the application of Art. 32.1 of the JSC Law, as later in time of adoption.

Thus, if the shareholders' agreement provides for the participant's obligation to sell the shares of the company in the future under certain conditions, then such a provision should be considered as applicable to all shares of this participant (both owned by him at the time of the conclusion of the agreement, and acquired by him in the future, including additional issue) and paragraph 1 of Art. 27.6 of the Securities Market Law shall not be construed as precluding the application of such provision of the shareholders' agreement to future shares.

Rights certified by shares and rights to shares

Paragraph 1 of Art. 32.1 of the JSC Law contains rather broad language as to what rights may be the subject of such an agreement. We are talking about both the rights represented by the shareholder shares, and about his rights to the shares. I would like to hope that in the course of law enforcement practice, the provisions of Art. 32.1 will be interpreted by the courts quite liberally, which will allow the parties to settle in the framework of the shareholder agreement a significant part of the issues traditionally the subject of such agreements.

However, I would like to draw attention to the following.

- Voting in a certain way.

According to this paragraph, the participants in the shareholders' agreement undertake to exercise their rights, certified by shares, in a certain way. From the text of the article it is not clear what this term means. for example, if the shareholders' agreement is limited to a description of the general criteria or principles on the basis of which the management of the company will be carried out, as well as general description its business goals and objectives, would this be sufficient for the obligation to vote in a certain way on the relevant agenda item to be considered to have arisen for a participant in the shareholder agreement or, in the absence of more specific provisions in the shareholder agreement, such general provisions only create an obligation for its participants to agree on a joint position regarding voting on specific issue agenda? However, if such a position is not agreed<5>, there is no obligation to vote in a certain way, and each party to the agreement has the right to vote as it considers necessary, without taking into account the above general rules.

<5>Those. until the parties to the shareholder agreement have determined which particular option ("for", "against", "abstained") on the relevant agenda item they should vote for at the relevant meeting of shareholders.

We believe that the answer to the above question depends on whether the shareholder agreement provides for the obligation of shareholders to agree on the voting option before voting or not. If such an obligation is expressly provided for by the agreement, then in the course of agreeing (i.e., in the selection process) on the voting option for which the participants in the shareholder agreement will have to vote at the upcoming meeting of shareholders, the parties must proceed from the general principles, goals and objectives described in the agreement shareholders. Directly at the relevant meeting of shareholders, the participants in the shareholders' agreement will have to vote for the option that was ultimately approved (selected) in the course of agreeing on the voting option. At the same time, we believe that in the absence of a court decision or ruling prohibiting them from voting for the agreed version, all participants in the shareholder agreement (both those who agree and disagree with the approved (agreed) voting option) should vote for this particular voting option.

On the contrary, if the shareholder agreement does not directly provide for the obligation to agree on a voting option before voting, then during the voting itself, the parties must proceed from the general principles, goals and objectives described in the agreement. In this case, each shareholder will independently decide which voting option is more in line with the spirit and letter of the shareholders' agreement.

With practical point Of course, the more detailed the description of what actions the participants in the shareholder agreement are obliged (not) to perform, the more confident the parties will feel in the event of a dispute from such an agreement. At the same time, in practice, it is not always possible to provide for detailed regulation on each item in the shareholders' agreement. Equally, at the time of its conclusion, the parties cannot always clearly understand the whole range of tasks and issues that they will have to solve in the course of managing the company. In this regard, in the agreement of shareholders, obviously, in any case, they will be forced to combine both provisions containing general principles, tasks and goals, the achievement of which the participants in the shareholder agreement consider it necessary to ensure through the pooling of votes, as well as more specific requirements (specific rules) regarding voting.

- Concerted action.

Paragraph 1 of Art. 32.1 of the JSC Law, it is possible to establish an obligation for shareholders to "coordinate the voting option with other shareholders", as well as to "carry out in concert" actions related to the management of the company, its activities, reorganization and liquidation.

Within the meaning of paragraph 1 of Art. 32.1 The obligation to coordinate the voting/action option with other parties to the agreement exists only if it is expressly provided for in the agreement.

The legislator did not give a clear definition of what should be understood by the phrase "carry out in concert other actions related to the management of the company, with the activities, reorganization and liquidation of the company." We believe that this provision should be interpreted as broadly as possible. In particular, within the meaning of this paragraph, such actions obviously may include the exercise by shareholders of their right to demand information from the company, presenting a demand to the company for the repurchase of their shares, refusing to participate in a shareholders' meeting, etc.

In Art. 32.1 of the JSC Law does not say anything about the concerted actions of the company's participants in the event of initiation of proceedings to declare the company bankrupt. We believe that such actions could also be the subject of an agreement by the shareholders, since they are related to the activities and possible liquidation of the company.

In Art. 32.1 of the JSC Law also does not say anything about under what conditions a voting option or action should be considered agreed. In particular, it is not clear from the text of this article whether the approval of a voting option or action requires the approval of all participants in the shareholder agreement or it is sufficient that the corresponding voting option (action) be approved by only a part of such participants. We believe it would be correct to interpret this article as allowing that the voting option (action) can be considered agreed even if it is approved by only a part of the participants in the shareholder agreement, provided that the agreement procedure is defined in the shareholder agreement<6>. At the same time, one should proceed from the fact that if the voting option (action) is agreed (on) by the necessary number of participants in the shareholders' agreement, then the participants in this agreement who disagree with the decision of the rest (hereinafter - the dissenting participants), in any case, are obliged to obey and vote for this (agreed) option to vote or take the specified action<7>. This approach seems reasonable, since, in order to protect the interests of the dissenting participants, the parties could provide in the shareholder agreement that the dissenting participants have the right to demand that their shares be redeemed by the remaining participants at market price, determined until the moment of the relevant action/vote.

<6> for example, a voting option (action) is considered approved if it is approved by the participants owning shares representing the majority of votes from the total number of votes held by all participants in the shareholders' agreement at the general meeting of shareholders of the company.

<7>Naturally, except for a situation where, by a court decision or ruling, the participants are prohibited from voting / acting accordingly.

- Prohibition of the obligation to vote according to the instructions of the governing bodies.

According to paragraph 2 of Art. 32.1 of the JSC Law, the subject of a shareholder agreement cannot be the obligation of a party to a shareholder agreement to vote in accordance with the instructions of the management bodies of the company in respect of whose shares this agreement is concluded. This paragraph, obviously, should be interpreted broadly, since it is aimed at ensuring that the parties to the agreement are not controlled by the governing bodies. for example, there is a risk that the provisions of the shareholder agreement, which also provide that, when voting, participants in the shareholder agreement are required to make decisions that comply with the recommendations of the management bodies or instructions of subsidiaries, are recognized as contradicting the requirements of this paragraph, the provisions of the shareholders' agreement.

- Duty to refrain from exercising rights.

No less important is the fact that paragraph 1 of Art. 32.1 allows the parties to conclude agreements, the subject of which may also be an obligation to refrain from exercising the respective rights. It is hoped that this provision will put an end to the debate on whether or not a shareholder's consent not to take any action constitutes an invalid waiver of the right<8>.

<8>We believe that without this provision the shareholder's consent not to take any action in such an agreement would not constitute a waiver in principle. In essence, the agreement of one party in a multilateral treaty not to take some action in exchange for (not) taking any action of the other party is the exercise of the right of the first party. Only in this case the right is realized not in a positive, but in a negative way. However, taking into account the position taken by the court in the case of OJSC "MegaFon", provided for by Art. 32.1 The possibility of including in the shareholders' agreement an obligation to refrain from exercising the relevant rights should deprive supporters of a different interpretation of the provisions of this kind of reason to say that there is an illegal waiver of the right.

At the same time, the question of whether it is possible to refrain only from exercising substantive rights, or whether this wording also covers procedural rights (for example, whether a shareholder can undertake an obligation to refrain from filing a claim against members of the management bodies of the company or from contesting any decisions of the governing bodies of the company). We believe that it would be correct to interpret this wording broadly, i.e. as allowing shareholders to assume obligations to refrain from exercising certain procedural rights. At the same time, the main question is what remedies can be applied to a participant in the shareholder agreement for violation of the obligation to refrain from exercising the relevant procedural rights (primarily for violation of the above obligation to refrain from filing claims). Taking into account that the legislation and the courts in general have a negative attitude towards the contractual restriction of the procedural rights of the parties to the agreements, we believe that before the relevant changes are made to the Russian procedural legislation, enforcement in kind<9>the provisions of the shareholder agreement establishing the obligation of the participants to refrain from bringing claims, most likely will not be possible (or at least unlikely). However, getting monetary compensation(first of all, in the form of a penalty) for such a violation, as well as the possibility of forcing the violator to sell the shares of the company in the event of such a violation, it seems acceptable.

<9> for example, by obtaining a judicial act prohibiting a participant in the shareholder agreement from filing relevant claims or refusing to satisfy the stated claims solely in connection with the presence in the shareholder agreement of the obligation of the participants to refrain from filing relevant claims.

- Share deals.

Paragraph 1 of Art. 32.1 of the Law on JSC provides for the possibility to include in the shareholder agreement provisions governing transactions with shares. In particular, this paragraph provides for the possibility of selling at a predetermined price and (or) under certain circumstances. It is not clear from the text itself what the terms "predetermined price" and "certain circumstance" mean. Thus, it is not clear whether a specific price should be set in the shareholder agreement or whether it is sufficient to describe the mechanism for determining it in the future. It is also not clear whether a certain circumstance means an event that is beyond the control of the parties to the shareholder agreement (for example, a change in exchange rates, a financial crisis, etc.), or whether such circumstances also include events that are fully controlled by the corresponding participant (for example, the sale of shares one of the parties to the agreement is carried out at the request of the other participant in the shareholder agreement, regardless of the validity of such a requirement). We believe that the term "predetermined price" would be correct to interpret broadly, i.e. as giving the parties the opportunity to determine in the shareholders' agreement not only a specific price, but also a mechanism for determining it in the future. Equally, the term "certain circumstance" should be interpreted as including events both beyond the control of the parties to the shareholder agreement and beyond their control.

In view of the foregoing, no less important is the question of whether paragraph 1 of Art. 32.1 include traditional deadlock resolution mechanisms in shareholder agreements, such as a provision for the buyback of shares by one of the participants using the rules of "Russian roulette", "Texas shooting", "Danish auction", and other similar mechanisms. We believe that the specified paragraph 1 of Art. 32.1 of the JSC Law allows the use of such mechanisms. All of these methods of resolving deadlock situations are based on the same principle: in the event of a conflict between shareholders, one of the company's participants must buy out the shares of another participant. These mechanisms only describe the method of determining who will be the buying/selling participant, as well as the prices and mechanics of closing a share buyback transaction. All these elements are covered by paragraph 1 of Art. 32.1 of the JSC Law, which provides for the possibility of the parties to the agreement to assume obligations to exercise rights to shares in a certain way, to acquire or alienate shares at a predetermined price and (or) under certain circumstances, refrain from alienating shares until certain circumstances occur.

The next part of this article will deal with the validity of a shareholder agreement in relation to third parties, the liability of its participants, the form of a shareholder agreement, issues related to the subordination of a shareholder agreement governing relations between shareholders of a Russian company to foreign law, as well as some other issues.

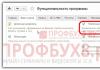

1. A shareholder agreement is an agreement on the exercise of rights certified by shares, and (or) on the specifics of the exercise of rights to shares. Under a shareholder agreement, its parties undertake to exercise in a certain way the rights certified by shares and (or) the rights to shares and (or) refrain (refuse) from exercising these rights. A shareholder agreement may provide for the obligation of its parties to vote in a certain way at a general meeting of shareholders, agree on a voting option with other shareholders, acquire or alienate shares at a predetermined price and (or) under certain circumstances, refrain (refuse) from alienating shares until certain circumstances, as well as to carry out in concert other actions related to the management of the company, with the activities, reorganization and liquidation of the company.

The shareholder agreement is concluded in writing by drawing up one document signed by the parties.

2. The subject of a shareholder agreement may not be the obligation of a party to a shareholder agreement to vote in accordance with the instructions of the management bodies of the company in respect of whose shares this agreement is concluded.

(see text in previous edition)

4. The shareholder agreement is binding only on its parties. A contract entered into by a party to a shareholder agreement in violation of the shareholder agreement may be declared invalid by a court at the suit of the interested party to the shareholder agreement only in cases where it is proved that the other party under the agreement knew or obviously should have known about the restrictions provided for by the shareholder agreement.

(see text in previous edition)

4.1. Shareholders of the company who have concluded a shareholder agreement are obliged to notify the company of the fact of its conclusion no later than 15 days from the date of its conclusion. By agreement of the parties to the shareholder agreement, a notice to the company may be sent by one of its parties. In the event of failure to fulfill this obligation, shareholders of the company who are not parties to the shareholder agreement shall have the right to demand compensation for the losses caused to them.

5. A person who, in accordance with a shareholder agreement, has acquired the right to determine the procedure for voting at a general meeting of shareholders on shares of a public company, is obliged to notify the public company of such an acquisition if, as a result of such an acquisition, this person, independently or jointly with its affiliated person or persons, directly or indirectly gets the opportunity to dispose of more than 5, 10, 15, 20, 25, 30, 50 or 75 percent of the votes on the placed ordinary shares of a public company. Such notice must contain information about:

(see text in previous edition)

the full company name of the public company;

(see text in previous edition)

your name or title;

the date of conclusion and the date of entry into force of the shareholder agreement, or the dates of adoption of decisions on amendments to the shareholder agreement and the dates of entry into force of the relevant amendments, or the date of termination of the shareholder agreement;

the duration of the shareholder agreement;

the number of shares owned by the persons who have entered into the shareholder agreement as of the date of its conclusion;

the number of ordinary shares of the company, which provide this person with the opportunity to dispose of votes at the general meeting of shareholders, as of the date the obligation to send such a notification arises;

the date on which the obligation to send such notification arises.

Such notification must be sent within five days from the date of the occurrence of the relevant obligation.

5.1. A public company discloses the information contained in the notices specified in this article in the manner prescribed by the legislation of the Russian Federation on securities.

6. The person obliged to send a notice in accordance with paragraph 5 of this article, and the persons to whom this person, in accordance with the concluded shareholder agreement, is entitled to give binding instructions on the procedure for voting at the general meeting of shareholders, until the date of sending such a notice, have the right to vote only on shares, the number of which does not exceed the number of shares owned by this person before the obligation to send such notice arose. In this case, all shares owned by this person and these persons are taken into account when determining the quorum of the general meeting of shareholders.

7. The shareholder agreement may provide for ways to ensure the fulfillment of obligations arising from the shareholder agreement, and measures of civil liability for non-fulfillment or improper fulfillment of such obligations.

The rights of the parties to the shareholder agreement based on this agreement, including the right to demand compensation for losses caused by violation of the agreement, the collection of a penalty (fine, penalties), payment of compensation (a fixed amount of money or an amount to be determined in the manner specified in the shareholder agreement) or application other measures of liability in connection with the violation of the shareholder agreement are subject to judicial protection.

The draft amendments to the Law on Joint-Stock Companies, which allows to conclude shareholder agreements under Russian law, were developed and submitted to the Government for consideration a year ago, but got bogged down in interdepartmental approvals. On April 22, 2009, the bill was finally approved. In order for the document to be adopted faster, it will be added to the amendments to Art. 68 of the JSC Law.

The need to consolidate this institution at the legislative level was dictated by a number of factors, such as the growing number of mergers and acquisitions (M&A), the need to protect companies from raider takeovers and, of course, the active attraction of foreign investment in Russian economy by concluding deals with foreign investors. So, foreign partners who are going to become participants Russian societies, are particularly interested in the possibility conclusion of a shareholder agreement, since it allows you to resolve such important issues as the procedure for voting in the company, the election of the board of directors and the formation of other management bodies, the procedure for distributing profits, the withdrawal of a participant from the company, and the procedure for resolving disputes between participants. Thus, shareholder agreement establishes an effective regime for the management of the company and control over the implementation by the participants of their obligations.

Application of foreign law to shareholder agreements in the Russian Federation

Due to the fact that relations of participants in joint-stock companies are regulated in Russian law by imperative norms, leaving no opportunity for the participants to conclude an agreement among themselves, some participants in the companies tried to find a way out of the situation by subordinating the shareholder agreement in relation to the Russian company the rules of the law of a foreign state. However, one of these attempts was called into question by the decision of the arbitration court in the so-called MegaFon case, which declared the shareholder agreement invalid due to a contradiction with the norms of public policy of the Russian Federation.

Arbitrage practice

Collapse Show

A group of minority shareholders applied to the court with a demand to invalidate the agreement of the shareholders of OJSC Megafon, who collectively own 97% of the shares. At the same time, the shareholder agreement regulated the procedure for managing the company, the procedure for selling shares and some other issues related to the legal capacity of the company. The plaintiffs referred, in particular, to the fact that this agreement violates the public policy of the Russian Federation, since the provisions of the agreement provided for the application of foreign law (Sweden) to issues of the status of the Russian legal entity and the rights and obligations of shareholders. As a result, the courts of all instances.

The specified shareholder agreement is in this moment the only one in respect of which a decision was made in a Russian arbitration court, and, without a doubt, the grounds described by the court in the reasoning part of the decision will be considered by the courts in similar cases in the future.

However, apply foreign law regarding shareholder agreement affecting the interests of participants in Russian society, without violating the imperative norms of Russian law, is possible.

One of the options is to create trust in a foreign country in relation to trust property (of a Russian company), while the activities of such a trust will be regulated by the law of a foreign jurisdiction.

Another option is an creation of a foreign holding company holding shares of a Russian company, and the conclusion within the framework of this holding shareholder agreement. In this case, the contractual relations of the participants are transferred to the jurisdiction, the legislative norms of which will apply to this shareholder agreement. At the same time, a foreign company that owns shares in a Russian company will fully manage the decisions under the shareholder agreement. Choice of applicable law in respect of this shareholder agreement is determined by the members of the holding, and this may be either the law of the country of incorporation of the holding company or some other jurisdiction. Although this scheme and avoids invalidation of the shareholder agreement Russian court, it still has obvious disadvantages associated with indirect asset management. It should also be borne in mind that if the end assets in this scheme are located on the territory of the Russian Federation, first of all it is necessary to check whether such a transaction does not require, in accordance with Art. 28 of the Law of 08.11.2008 No. 195-FZ "On Protection of Competition" prior consent of the Federal Antimonopoly Service of the Russian Federation.

For the effective use by participants of Russian societies of the institute shareholder agreement it is advisable to refer to foreign practice in this matter. Let us consider how shareholder agreements are implemented in England. Due to its discretion, English law is the most popular when choosing the applicable law by Russian and foreign companies in the process of concluding capital transactions.

Shareholder agreements in English corporate law

General issues

Shareholder agreement under English law is rare flexible tool, participants can write almost any questions in it. However, it cannot be changed without the consent of all parties to the agreement. In case of conflicts with the Articles of Association of the company, the shareholder agreement takes precedence.

The parties to the agreement may be all or individual shareholders of the company. The company itself rarely acts as a party to the agreement in order to avoid contradiction. legislative norms England, since any terms of the agreement that change the legal position of the company are null and void. However, on behalf of a company with private equity capital (Private Equity House), managers can act on the basis of an agreement with the company and ensure that the company fulfills its obligations.

typical terms of shareholder agreements are:

- Conditions related to the establishment of a company and making deposits:

- the amount and method of making shareholders' contributions;

- prospective lines of business of the company;

- Conditions related to corporate governance in the company and the procedure for voting on certain issues:

- the right of individual shareholders to nominate candidates for management bodies;

- establishing a requirement to obtain a qualified majority of votes for making decisions on certain issues (supermajority voting requirements);

- establishing the exclusive competence of the meeting of shareholders and the board of directors;

- the right of shareholders to receive information about the activities of the company (meaning information that shareholders do not have the right to receive in accordance with the constituent documents of the company and the legislation of the country of registration of the company).

Conditions relating to the disposal of shares:

- prohibition on alienation of shares and/or their transfer as security (lock-up provisions);

- pre-emptive rights in relation to the acquisition of shares (pre-emptive rights);

- the right to join (tag-along right), allowing a minority shareholder to sell his shares at the same price at which another shareholder sells shares, i.e. if the “buying” shareholder wants to buy the shares of the “selling” shareholder, he must also purchase the shares of the minority shareholder at the same price;

- the right to connect (drag-along right), allowing the majority shareholder to demand the repurchase of shares from minority shareholders;

- conditions for the protection of the rights of minority shareholders;

- options to sell or buy shares (call option, put option).

Conditions for resolution of disputes between shareholders, also referred to as "deadlocks" (deadlocks).

Deadlock is understood as such a situation when none of the shareholders or none of the groups of shareholders has enough votes to make a decision on any key issue of the company's activities (taking into account the fact that the rest of the shareholders object to such a decision). The procedure for determining which situation is a deadlock is provided for in the shareholder agreement. For example, a shareholder agreement may identify several key issues for the company on which such an impasse may arise. In English corporate practice deadlocks are resolved different ways, each of which has its own idiomatic name.

"Conversation at the Fireplace" (fire-side chat). When it is necessary for the directors to be present to resolve a dispute, but they cannot be present, such a meeting takes place between representatives of the shareholders at an informal level.

"Russian roulette" (Russian roulette). A very radical solution; its essence lies in the fact that in the event of a “deadlock”, one or both shareholders send an offer to the other shareholder to buy out half of the share capital, indicating the price. A shareholder who has received such a notification has a choice: to sell his stake to another shareholder at the specified price, or, conversely, to buy another shareholder's stake at the same price.

"Texas/Mexican Shootout" (Texas/Mexican shootout). Each of the parties to the shareholder agreement participating in the “deadlock” sends an independent mediator a sealed offer of the price at which it is ready to purchase the share of the other party. The envelopes are opened at the same time, and the bid with the highest price wins, i.e. the person submitting such an application must buy and the other party must sell his share at the specified price.

Means of protecting the rights of shareholders and liability for non-fulfillment of obligations

The means of protecting the rights of shareholders in case of violation of the provisions of the shareholder agreement are:

- Recovery of compensation for losses (liquidated damages).

Damages in English contract law are not punitive, but compensatory, i.e. they are not punitive. In private equity, the shareholders have the discretion to choose the form in which damages will be collected from the party that violated the agreement. - Performance in kind (specific performance) - the requirement to fulfill obligations under the agreement.

- Determination of the court on the prohibition of certain actions (injunction).

At the same time, it should be noted that separate provisions agreements (warranties) give shareholders the right only to indemnification, while others (conditions and representations) give the right to recover damages and terminate the entire agreement.

Mechanisms for Ensuring the Obligations of Shareholder Agreements in the Russian Federation

If the mechanisms for securing the obligations of the parties in shareholder agreements under English law are of a property nature, then Russian obligations are non-property, i.e. do not provide in court the right to demand from a shareholder who has violated his obligation to fulfill the obligation in kind. At the same time, such a mechanism for ensuring obligations, popular among shareholders, as a penalty, often does not bring the expected result, because. courts actively use their right to reduce the size of the penalty (Article 333 of the Civil Code of the Russian Federation), explaining this by the fact that the penalty is disproportionate to the consequences of the breach of obligations. The criterion of proportionality was significantly blurred by the position of the highest judicial authorities that “when assessing such consequences, the court may take into account, among other things, circumstances that are not directly related to the consequences of the breach of an obligation (the price of goods, works, services; the amount of the contract, etc.). p.)” (p. 42 of the joint resolution of the Plenums of the Supreme Arbitration Court of the Russian Federation and the Supreme Court of the Russian Federation No. 6/8).

Arbitrage practice

Collapse Show

JSC "Russian Railways" filed a lawsuit against JSC "Severstal" to recover a fine for demurrage during loading and unloading of cars belonging to the plaintiff. The Arbitration Court and the Court of Appeal satisfied the claims in part, applying Art. 333 of the Civil Code of the Russian Federation. After that, the plaintiff filed a cassation appeal demanding that the previous judgment and satisfy the claim in full. The FAS SZO left the decisions of the courts unchanged and did not satisfy the cassation appeal, pointing out the obvious disproportion of the penalty to the consequences of the breach of obligation, since the amount of the fine exceeds not only the cost of services under the operation agreement concluded between the parties railway tracks, but also the amount of the contract itself, and the delay occurred for an insignificant period.

As a result, many participants conclusion of shareholder agreements go for alternative commitment measures. Such a measure is primarily a mutual pledge of shares in fulfillment of the obligations of the parties to the shareholder agreement. It is also possible to conclude preliminary contract with a suspensive condition in the form of certain obligations of the parties, after the fulfillment of which the parties go to conclude a shareholder agreement.

Thus, the legislative consolidation of the right of shareholders to enter into shareholder agreements will be a significant step in the development of corporate legislation in the Russian Federation. This right, according to the author, provides shareholders with guarantees for the diversification of risks associated with the implementation economic activity companies, which should confirm the effectiveness of shareholder agreements in future practice.

Footnotes

Collapse Show

The shareholder agreement represents documentation type drawn up between the shareholders and the company. By means of paper regulation of the main issues of the enterprise. Traditionally they are associated with practical aspects:

- management of the Company and regulation of basic issues;

- distribution of profits, assets;

- creation of a procedure for the alienation of shares;

- event financing;

- elimination of conflicts.

The document gets a special role, because it contributes to the regulation of relations between the parties and their stabilization. Consider its features, compilation, use in the course of maintaining relations between members of the Societies.

Features and content

The document is subject to conclusion both between all and between elected persons. The shareholder agreement (hereinafter referred to as AC) as an independent document is inherent several characteristic features:

- independent regulation of relations between shareholders;

- "non-public" character;

- the inability to change the conditions without obtaining the appropriate consent from the participants;

- optional for shareholders who do not act as principal parties to the transaction.

Part by part JSC management the document ensures the obligatory attendance of shareholders at the general meeting, voting on certain issues, the formation of a special procedure for determining candidacies and electing members of the supervisory board.

Part by part JSC management the document ensures the obligatory attendance of shareholders at the general meeting, voting on certain issues, the formation of a special procedure for determining candidacies and electing members of the supervisory board.

If we talk about alienation of shares, the document helps to determine the pre-emptive right of shareholders who have entered into an agreement to acquire shares, as well as to prohibit their alienation.

The content of the agreement is classic and includes the rights, obligations of the parties, dispute resolution procedures, the level of responsibility, personal data and signatures. Regulation of the basic conditions of JSC is carried out through the law No. 14-FZ, however, this is only partially done. For example, within the framework of the paper, it is possible to establish a certain voting procedure or an agreement on the subsequent sale of shares and private conditions.

Normative base

On the basis of the study, it can be noted that the effectiveness of the use of AO in order to increase the effectiveness of work is recognized not only among specialists in the field of jurisprudence, but also among economic employees.

AT international law agreement means civil contract, which lies between a number of sides. The status of JSC is determined on the basis of Art. 1210 of the Civil Code of the Russian Federation, as well as in relation to Art. 1211 of the Civil Code of the Russian Federation. The principle of the will of the parties implies some restrictions, they are provided for in the framework of paragraph 5 of Art. 1210 .

Views and sides

Based on the nature of the participants, AS in a JSC can traditionally be divided into varieties:

- agreement between minority shareholders- the transaction can be completed before the formation of a real opportunity to influence the management process;

- an agreement concluded between investors-partners, its compilation is carried out in order to prevent unfriendly parties and protect the organization;

- majority share agreement, its compilation takes place in order to form a controlling shareholding between the participants who have come to an agreement in the methodology and management strategy.

Both all persons owning shares, and a certain part can act as parties. All rights and obligations specified in the contract relate exclusively to the parties to the transaction, the law does not provide for any other restrictions in this regard.

There are no strict requirements and nuances regarding filling out the paper. There is only list of required items which are regulated:

There is unified form, implying the inclusion of all features and details. The AC assumes the extension to it of all existing norms of the Civil Code of the Russian Federation regarding the protection of the legitimate rights and interests of the parties. Therefore, for failure to fulfill a number of obligations, certain responsibilities.

Mandatory conditions

If the shareholder agreement provides for a liability factor, appropriate measures will be taken in the event of a breach of obligations. For example, if the agreement provides for the fact that a shareholder does not have the right to sell a share to a competing company, the other participants have the right to demand the transfer of rights to securities to themselves.

The order in which the conclusion of the document takes place is extended basic rules and regulations associated with contracts.

Signing must be carried out by persons who have the appropriate authority to do so. Finding them out is not difficult. documentation checks. Otherwise, in the trial, the AU will not be considered as a serious evidentiary paper.

The AU categorically cannot be concluded by the final beneficiaries and other persons. This right is reserved exclusively to the shareholders. Information that a person is a shareholder, confirming his current status, must also be included in the text part of the agreement or attached in a photocopied version.

- When determining the terms of the AS, it is necessary to check for compliance with the charter, since the parties do not have the right to refer to the invalidity of the agreement.

- Art. 32.1 of the Civil Code of the Russian Federation testifies to the obligation of the parties to notify the JSC of the conclusion of the AS. They seek to regulate the issue related to the imposition of obligations on a certain shareholder.

- As with any other treaty, there are options and measures to ensure liability for deviations from the norms. It is recommended to describe all mechanisms related to liability in detail, otherwise it will be difficult to implement the idea.

Thus, the shareholder agreement is arrangement concluded between the shareholders. Its execution is carried out as a single document to be signed by all participants.

The legislation establishes forms of shareholder behavior that may or may not be specified in the documentation.

Additional information on the shareholder agreement is presented in the video below.

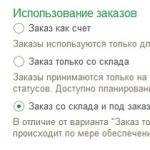

Due to the insufficient development of the structure of shareholder agreements by domestic civil lawyers, the legislator took the path of least "resistance", fixing in Article 32.1 of the Law on Joint Stock Companies an indicative list options the subject of the contract. Namely: 1) the obligation of its parties to vote in a certain way at the general meeting of shareholders; 2) coordinate the voting option with other shareholders; 3) acquire or alienate shares at a predetermined price and (or) upon the occurrence of certain circumstances; 4) refrain from alienating shares until certain circumstances occur; 5) carry out in concert other actions related to: management, activities, reorganization and liquidation of the company.

At the same time, a fair concern is expressed in the legal literature that the question of the legal force of conditions that are not directly named in the Law on joint-stock companies is currently open (I. Kornev, V. Arutyunyan. Shareholder agreement: conclusion, content and execution // Corporate Lawyer , No. 1. 2010). In my opinion, any provision of a shareholder agreement, the meaning of which is related to determining the procedure for the exercise of rights certified by shares, or rights to shares, falls under the control of the company, unless the inclusion of such a provision in the shareholder agreement is directly contrary to the mandatory norms of the law. One of these norms contains a ban on obliging the parties to a shareholder agreement to vote in accordance with the instructions of the management bodies of the company in respect of whose shares this agreement is concluded (Part 2 of Article 32.1 of the Law on Joint Stock Companies).

Cause of a shareholder agreement as the defining purpose of the agreement

If we summarize the provisions of the law, then the subject of a shareholder agreement can be defined as a legal action (inaction) to manage the company or exercise the rights to shares . In this case, as a rule, all parties to the agreement pursue a common goal.

The unity of purpose of the parties to the shareholder agreement allows us to speak about the presence his cause. Since the law regulates shareholder agreements rather poorly, the allocation of a cause allows, firstly, to speak of the independence of this agreement, and, secondly, to apply provisions on agreements to shareholder agreements, the cause of which is similar to the cause of shareholder agreements.

You can draw a parallel with the simple partnership agreement. In accordance with Article 1041 of the Civil Code of the Russian Federation, two or more persons (partners) undertake to combine their contributions and act jointly without forming a legal entity to make a profit or achieve another goal that does not contradict the law. The similarity of the treaties on the basis of unity of purpose seems to be more than obvious. However, this ratio does not seem to be convincing for all authors.

I will dwell on the work of V. Kononov “Problems of the subject and content of the agreement of participants in economic companies under Russian law. Part 1” (Corporate Lawyer, No. 10, 2010). He points to the following differences. First, there are no property relations between the parties to the shareholder agreement related to making contributions to joint activities. Secondly, the shareholder agreement does not focus on the emergence of legal relations with the participation of third parties, which is confirmed by the absence of the elements necessary for representation.

In my opinion, neither the first nor the second argument of the author are correct. First, part 3 of Article 32.1 of the Law on Joint Stock Companies states that the agreement is concluded in respect of all shares owned by the parties. In a shareholder agreement, the block of shares of each party entering into a contractual relationship is essential, since the amount of rights that the parties to the shareholder agreement will receive when carrying out joint activities depends on the number of shares. Secondly, the shareholder agreement, one way or another, extends not only and not so much to its parties, but to the company within which the shareholder agreement is concluded, as well as to other shareholders who are not parties to this agreement. For implementation joint activities not necessarily the participation of all shareholders. For example, in a general meeting, it is permissible to issue a power of attorney.

Alternative subject of the shareholder agreement or legislative inaccuracy?

Article 32.1 of the Law on Joint Stock Companies indicates that the subject of a shareholders' agreement may be the exercise of the rights certified by shares and/or right for shares. It seems to me that the assumption of an alternative subject of the contract in this case is a mistake.

In a shareholder agreement, issues of mutually beneficial exercise of corporate rights are of paramount importance, and not the procedure and grounds for the sale of shares. Thus, the obligation to exercise rights to shares cannot be the only condition of the shareholders' agreement, since without the conditions for exercising corporate rights in the shareholder agreement, this agreement turns into a sale and purchase agreement (or other agreement for the sale) of shares under the condition . At the same time, there is real opportunity recognition of such an agreement under a potestative condition (the problems of implementing transactions under a potestative condition were considered by me in another post:).