Herbert Moos said that the state bank wants to equalize the dividend yield of preferred and ordinary shares. He hopes that minority shareholders will evaluate such a step positively: “I expect that this will be done by the end of 2017.”

In the case of preferred shares, their nominal value will be used to calculate dividend yield, and for ordinary shares - the market average, said a VTB representative. He did not specify for what period the average market value would be calculated.

The total par value of preferred shares is RUB 514 billion. If we assume that the weighted average cost for the year (6.11 kopecks) will be taken for ordinary shares, then at the end of 2017 their total capitalization amounted to 788 billion rubles. Thus, the share of ordinary shareholders in the dividends paid will be greater.

Who benefits?

VTB's Shareholders Advisory Council (SAC) last year raised the issue of dividend payments; the fundamental point was that no less dividends should be paid on ordinary shares than on preferred shares; various options were discussed on how to do this, says SAC member Vadim Soskov. As for the option approved by the government, the council is still studying the situation, added KSA Chairman Igor Repin.

The approach, when the yield on preferred shares and on ordinary shares equalizes, will be beneficial to minority shareholders, says BCS analyst Olga Naydenova. According to her forecasts, after paying dividends for 2017, the dividend yield on ordinary shares should have been 4%, but the new approach will significantly increase this figure. The main thing is that this principle is maintained in subsequent years, she emphasizes. At the same time, it is difficult to equalize the dividend yield on traded and non-traded securities, Naydenova continues, this is the first time she has come across this approach.

However, the state, at least this year, should not lose anything. “The proposal that we are currently discussing with the government is that the total volume of dividends that the state received on all types of shares for 2016 (common and preferred shares) should be comparable to the volume that the state will receive based on the results of 2017 - Interfax reported Moos’ words on February 26. “That is, the amount of dividends in rubles will be constant.”

First of all, it is necessary to understand the structure of the bank's authorized capital. According to the charter, VTB has 3 types of shares:

Preferred shares of the first type belong to the Ministry of Finance of the Russian Federation. Preferred shares of the second type are on the balance sheet of the Deposit Insurance Agency. Rosimushchestvo owns 60.9% of ordinary shares, and the remaining 39.1% are in free float.

Until 2018, the bank’s dividend policy assumed large payments on preferred shares, therefore, most of the profits were received by the state represented by the Ministry of Finance and the DIA. Since 2018, VTB has established payments for all three types of shares so that the dividend yield of holders of preferred and ordinary shares is equal. The state still continues to receive most of the profits, but through ordinary shares.

How were dividends calculated for 2017?

At the end of 2017, the bank calculated dividends as follows. The par value of preferred shares of the first (0.01 rub.) and second type (0.1 rub.), as well as the average price of ordinary shares for 2017, which amounted to 0.06262 rubles, were taken. Further, 61% of net profit under IFRS was allocated to payments on three types of shares so that the ratio of dividend to share price would be the same. At the end of 2017, the dividend yield for all shares was 5.51%.

* Relative to the average annual price for 2017.

This equalization of profitability between ordinary and preferred shares led to an increase in dividend payments on ordinary shares for 2017 three times compared to 2016.

What to expect at the end of 2018

First, you need to understand what financial result can be expected in 2018. In the bank’s presentation, the projected profit for 2018 is set at RUB 150 billion. However, according to the results of the first half of the year, VTB earned 98.5 billion rubles. Moreover, according to VTB Deputy Chairman of the Board, Dmitry Olyunin, the bank has revised its profit forecast for 2018 to 170 billion rubles. after the publication of half-year results.

Secondly, it is necessary to determine what share of net profit for 2018 will be allocated to dividends. Taking into account VTB’s plans to implement Government directives for companies with state participation, you can count on at least 50% of the bank’s profit as dividends for 2018. The payout ratio for 2017 was slightly higher and amounted to 61% of net profit for IFRS - we will also consider this option.

Finally, for calculations we need the average price of VTB shares for 2018, which currently is approximately 0.05 rubles.

Thus, depending on the payout ratio and the amount allocated for dividends, we have four main scenarios:

Pessimistic scenario. VTB’s profit at the end of 2018 is 150 billion rubles. and 50% of profits are allocated to dividends;

Basic scenario. VTB’s profit at the end of 2018 is 170 billion rubles. and 50% of profits are allocated to dividends;

Optimistic scenario No. 1. VTB’s profit at the end of 2018 is 150 billion rubles. and 61% of profits go to dividends;

Optimistic scenario No. 2. VTB’s profit at the end of 2018 is 170 billion rubles. and 61% of profits go to dividends.

Pessimistic scenario

We draw up an equation, taking into account that the dividend yield should be the same for all types of shares. We get the following formula:

Nominal value of type 1 prefs (RUB 0.01) * Number of shares (21,404 billion) * Dividend yield (x) + Nominal value of type 2 preferred (RUB 0.1) * Number of shares (3,074 billion pcs.) * Dividend yield (x) + Average cost of ordinary shares (RUB 0.05) * Number of shares (12,961 billion pcs.) * Dividend yield (x) = Bank profit for 2018 (RUB 150 billion .) * Payout ratio (50%)

As a result, we get a dividend yield (x) equal to 6.4% for the pessimistic option or 0.003205 rubles. per share. Now let's calculate the remaining options using the same scheme.

Basic scenario

If the bank earns 170 billion rubles. and will allocate 50% of net profit to dividends, then at the end of 2018 the dividend yield to the average price for 2018 will be equal to 7.2%, which is 0.03635 rubles. per share.

In our opinion, this scenario is the most likely.

Optimistic scenario No. 1

If VTB decides to focus on last year’s ratio (61% of profit), with a profit of RUB 150 billion, the dividend per share could be RUB 0.00391, which implies a 7.8% return.

Optimistic scenario No. 2

The latter option is possible if the planned profit level exceeds RUB 170 billion. and maintaining the payout ratio at 61%. In this case, the yield is almost 9%, assuming RUB 0.004435. per share.

Taken together we get the following:

* Dividend yield is calculated based on the accepted average price of 0.05 rubles.

It is worth noting that these calculations remain relevant while maintaining the following assumptions:

VTB continues to adhere to the policy of equal dividend yield for three types of shares;

The bank's net profit reaches the target value;

The Government's directive to pay 50% of profits is being implemented;

Absence of crushing sanctions and other force majeure.

During the analysis, the following patterns were identified:

1) The dividend per share based on the results of 2018 may be less than last year, given that VTB’s forecast profit increases by 25% to RUB 150 billion. (for a pessimistic scenario). Moreover, the dividend yield in this case is 1% higher compared to 2017.

2) A decrease in the average price of an ordinary share reduces the dividends received. This means that at a lower price, the absolute amount of dividend per share can be lower to provide the same relative yield.

3) Preferred shares, for which the price is fixed, benefit from the fall of ordinary shares. It follows from paragraph 2 that when the market price falls, redistribution occurs in favor of preferred shares, and vice versa when the market price rises.

As part of the calculations, we focused on the dividend yield relative to the average annual price of 0.05 rubles. Today, August 9, quotes are at the level of 0.0442 rubles. Thus, the potential profitability is higher relative to today's values.

“To make a decision (to announce) the payment of dividends based on the results of 2016 in the amount of: 0.00117 rubles per issued ordinary registered share of VTB Bank (PJSC) with a par value of 0.01 rubles,” the message says.

In addition, the supervisory board recommended paying dividends in the amount of 0.052 kopecks per preferred registered share of the first type with a par value of 1 kopeck, as well as 0.588849 kopecks per preferred share of the second type with a par value of 10 kopecks.

The VTB shareholder register for dividend payments will close on May 10. To pay the final dividends for 2016, 15.164 billion rubles will be allocated for ordinary shares, 11.13 billion rubles for type 1 preferred shares, and 18.1 billion rubles for type 2 preferred shares. At the beginning of January of this year, VTB transferred 17.9 billion rubles in interim dividends for 2016 to the budget. Thus, the total volume of dividend payments for 2016 will be 62.294 billion rubles.

VTB for 2015 paid dividends at the level of 2014: 0.117 kopecks per ordinary share (15.17 billion rubles), 0.58 kopecks per preferred share of the second type (17.84 billion rubles), and 0.000422 kopecks per preferred share of the first type (90.3 million rubles). The total volume of payments amounted to 33.9 billion rubles, which amounted to 67.3% of net profit under RAS and 19 times higher than net profit under IFRS.

VTB’s net profit according to IFRS for 2016 increased 30 times - to 51.6 billion rubles, according to RAS - by 44%, to 70 billion rubles. VTB's authorized capital is 651.034 billion rubles. It includes 12.96 trillion ordinary shares (worth 130 billion rubles at par), of which 60.935% belong to the Federal Property Management Agency. Also, the authorized capital includes 21.404 trillion preferred shares of the first type (worth 214 billion rubles) owned by the Ministry of Finance of the Russian Federation. The DIA owns 3.074 trillion preferred shares of the second type (worth 307.4 billion rubles), or 47.2% of VTB’s authorized capital.

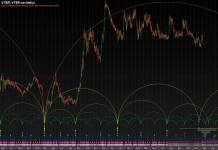

VTB shares have been consolidating in a triangle since mid-2015. A few weeks ago, quotes broke through support, but quickly returned higher. We managed to close above the 262 moving average. Currently resistance is provided by the 21 EMA. Medium-term growth will be considered only if it consolidates above the triangle. The overall picture remains bearish.

Like any joint-stock company, VTB Bank pays remuneration to holders of its securities. At the same time, shareholders can earn money not only by receiving VTB dividends, but also due to exchange rate differences. The company's securities are traded on the Moscow Exchange in the form of ordinary (non-preferred) shares and on the London Stock Exchange in the form of depositary receipts.

VTB dividend policy

VTB Bank shares are traded on the stock market. Their price changes under the influence of various factors - profit margins, positive and negative news, liquidity of securities, investor sentiment, and the general state of the economy.

To a large extent, the attractiveness of this security is determined by the size of VTB24 dividends. The higher the investor's compensation in relation to the average annual price of the stock, the greater the interest in it and the higher the demand for it (which in turn leads to higher prices).

Despite the fact that the company’s profit level and capitalization are growing annually, and its securities are classified as “blue chips,” VTB’s dividends for 2015 amounted to only 1.9% of the issuer’s average annual value.

Regarding VTB's dividend policy, investors should consider several factors:

- The decision on exactly how much and when dividends will be paid is made by the general meeting of shareholders; it is held annually and usually in the summer;

- Funds are accrued to the nominee holder 10 days after payment of dividends through a broker or trustee, to other shareholders - after 25 days;

- Since 2014, dividends from VTB shares have not been paid in cash; money can be received in a brokerage or bank account or by transfer by mail (in the form of a check).

The bank issues two types of shares:

- Ordinary shares with the ticker VTBR, which are traded on the Moscow Exchange;

- Privileged ones that cannot be found in free circulation. They were issued twice in favor of certain acquirers: in 2014 - in favor of the Ministry of Finance; in 2015 – in favor of the Deposit Insurance Agency.

Receiving dividends on VTB shares in 2015 was no exception. Consequently, investors can more likely count on receiving stable income in the future.

Despite some nuances, VTB Bank shares are one of the most stable financial instruments on the Russian stock market, and the company itself is the largest in its segment and is actively supported by the state. Therefore, we can talk about a special attitude of investors towards these securities.

Amount of dividends by year

It should be noted that dividends are distributed by the company for the past year. So, if we say that payments were made in 2015, then we mean that the profit received in 2014 was distributed.

Expectations for 2017

It is not yet known what the size of VTB's dividends per share for 2017 will be; this will be decided at the annual meeting of shareholders, which will approximately take place in the summer of 2017. However, given the previous statistics, you can expect the same reward.

Payments 2015

For example, for VTB dividends in 2015, the register was closed on June 24, 2017. All payments were made to persons holding VTB securities at the time the register was closed on July 4, 2017.

For preferred shares, dividends amounted to 0.000004 and 0.005 rubles per share, depending on the type. VTB dividends for 2015 per share with a par value of 0.01 rubles were fixed at 0.00117 rubles. Investors have the opportunity to look at the results of 2014 and compare profitability.

Profitability 2014

In 2014, more than 15.1 billion rubles were paid to the holders of ordinary shares, and 2.8 billion rubles – to the owners of preferred shares. VTB dividend profit for 2014 per ordinary share with a par value of 0.01 rubles is fixed at 0.00117 rubles, per preferred share – 0.00013. When calculating the amount, rounding is done to the nearest kopeck.

As you can see, in both 2014 and 2015 the amount of dividend profit was equal. At the end of 2013, investors received 0.00116 rubles per share, and at the end of 2012 – 0.00143 rubles. Minimum payments were recorded in 2009 based on the results of 2008 - only 0.000447 rubles per share.

How to buy VTB shares

Access to the stock market is prohibited for ordinary individuals. In order to be able to purchase bank shares and count on the payment of VTB dividends, you must have an account with any broker that provides access to the Moscow Stock Exchange.

Records of ownership of shares by a private individual are kept in a special depository. Therefore, after changing the broker, nothing bad will happen to the securities - the new company will simply request information about the owner from the depository. If the investor does not have a brokerage account during the period of receiving dividends, he will be able to receive dividends from VTB Bank and any other companies whose securities he owns at a later date.

Upon receipt of dividends, they will be credited to the trader’s account within 10 days. The recipient will be able to dispose of the funds at his own discretion: purchase another lot of shares with them, cash them out or transfer them to a bank account.

You can indirectly purchase shares of VTB Bank and receive dividends on them by investing in the VTB Global Dividend Fund. Mutual Fund managers work with Russian and foreign issuers; the strategy is based on receiving dividends on the global stock market. The number of issuers of a mutual fund necessarily includes shares of VTB itself.

Conclusion

Thus, you can invest in VTB shares in two ways: earning from exchange rate differences or receiving dividends. In recent years, the bank’s policy has been aimed at maintaining the size of remunerations, but investors will only find out what exactly VTB’s dividends for 2017 will be next year. To purchase shares, you must use the services of brokers. You can invest indirectly in the stock market by purchasing shares of the Global Dividend Fund and entrusting trading on the stock exchange to professional traders.

Becoming a shareholder and receiving dividends means significantly increasing your level of well-being.

Current dividend table for 9 months of 2017

Last week, the cutoff for dividends for 6 months of 2017 ended. During December 2017, there will be cutoffs for dividends for 9 months of 2017 and will continue in January 2018

In the last review, I already noted that a number of companies are in a hurry to pay increased dividends before the presidential elections.

But the reasons for paying dividends urgently now may not only be elections. So, for example, Mostotrest is paying interim dividends for the first time due to the need to improve the performance of pension funds that own shares of PJSC Mostotrest.

The urgent request for the payment of these dividends to NPFs is related to the losses that a number of NPFs suffered in connection with the situation in Otkritie and Binbank banks. I quote a statement from a top manager of one of the non-state pension funds:

“By the end of the year, the funds expect to come up with “market average indicators.” “At the end of 2017 (when the profitability from the placement of savings and reserves is posted to clients’ accounts. - Kommersant’s note), the NPF plans to provide its clients with a positive result in all areas of activity.”

Of course, Mostotrest's dividends will not be superfluous for this.

Last week there was some interesting dividend news:

Ekaterinburg. November 15. INTERFAX - Board of Directors of OJSC Kamensk-Ural Non-Ferrous Metals Processing Plant ( KUZOTSM, Sverdlovsk region, part of the Renova Group of Companies) recommended that shareholders decide to pay dividends for 9 months of 2017 in the amount of 2.03 rubles per share, the company said in a statement.

Dividends totaling 102 million 162.231 thousand rubles are proposed to be paid from retained earnings."

KUZOTSM is available in Kwik, but there were no trades on it, and I didn’t even see the quotes. That is, there is no way to calculate the yield and buy at the cut-off price too.

Another thing is interesting in this news: now Renova demands payment of dividends in all shares traded on the Moscow Exchange (Rusal, Khimprom, KUZOTsM). The only exception is OMPC. So far, no dividends have been paid there. Although the company has a significant NPE.

Renova owns OMPK on a parity basis with the company's management.

The fall in VTB quotes is the hit of this week

I have read many explanations of the reasons for this fall.

And since I myself am a shareholder of VTB24, which is now being merged into VTB, it goes without saying that I came up with an explanation for such a fall.

I considered the situation by analogy with the merger of Bank of Moscow into VTB. I was also a shareholder of BM at the time of joining.

VTB, under an offer, bought over 10% of BM shares, exceeded the 95% ownership limit, and in November 2015 launched a procedure for the forced purchase of Bank of Moscow shares from minority shareholders. The squeeze out price is 589.89 rubles per share.

The last additional capitalization of the Bank of Moscow took place at the end of 2011 - beginning of 2012, then the bank placed additional shares worth 102 billion rubles in favor of the VTB Group. The placement price was 1,111.77 rubles per security

Let's see how Bank of Moscow quotes reacted to corporate procedures for joining VTB

Now VTB is joining again. This time from VTB24 bank.

And again, the offer price for those who disagree is 3 rubles per 1 share of VTB24.

For those who go for conversion, a coefficient of 1/79 is offered.

We calculate the valuation: 3 rubles divided by 79 shares = 0.038 rubles.

After such estimates, it was difficult to expect an increase in VTB quotes, which is what we see on the chart of recent days.

It is also necessary to take into account that in mid-January 2018, when VTB24 shares will be converted into VTB shares, and this array of shares will arrive at the owners’ depot, an additional supply of VTB shares will be created, i.e. to those who held VTB24 shares in order to receive dividends at a normal rate profitability, it is unlikely to be tempted to hold VTB shares with its meager DD.

It turns out that at least until the end of January 2018, VTB share prices will be under supply pressure.

In one of the posts on the smart lab I saw a rhetorical question: Has Gref ever mentioned increasing dividends in Sberbank

Yes, I specifically mentioned it. I compiled the Government’s proposals and Gref’s proposal into a table and calculated the expected dividends

Good luck with your dividend hunt!