In the literature on real estate valuation, 5 methods for determining depreciation are usually considered in one combination or another by different authors:

- Cost compensation method (compensation cost method);

- Chronological age method;

- Method of effective age (life span);

- Expert method;

- Breakdown method.

1. Cost compensation method. The amount of physical wear, in general terms, is equated to the cost of its elimination.

Advantage of the method:

1. An excellent substantiation of the economic essence of the amount of physical wear and tear. It is simply impossible to come up with counterarguments.

Disadvantages of the method:

1. In some cases, additional justification is required for the need to perform repairs on a particular element. For example, near the front door inside a large office, the top layer of linoleum was worn off, but throughout the rest of the area it is in excellent condition. What to do? Replace only a piece in 2-3 m 2 ? But technically it is impossible to do this in such a way that the place of repair is not conspicuous - linoleum has such qualities as shrinkage in the initial period of operation and, albeit slight, but fading of the pattern over time. It is undignified to carry out such repairs for a self-respecting company. Replace all over? Expensive.

2. The complexity of practical implementation:

a) It is necessary to accurately determine the physical volume of repairs for each item;

b) Choose a suitable calculation base (unit cost estimates, price lists of repair companies, aggregated cost indicators, etc.) and justify your choice. It should be correctly understood that the accuracy of calculations directly depends on the choice of the calculation base;

c) Directly perform the calculation.

Applicable for a small object

At first glance, nothing complicated. And if the object of assessment is an administrative building of 15 thousand square meters and with varying degrees of wear and tear of elements in different parts of the building? You will write only one defective statement indicating the composition and physical volume of work for a week. And how to take into account the loss of bearing capacity (and, accordingly, the cost), for example, the foundation? At the same time, one should not forget that each conclusion or figure should be substantiated. This is a FSO requirement. So it turns out that there is nothing complicated, but to put it into practice ... It’s better not to get involved - and you will spend a lot of time, and one description and justification will take up a significant amount of the report.

From a comparison of the advantages and disadvantages, one thing follows - the method is good, but very difficult to implement in practice, especially for large buildings. Appraisers know this very well and use this method only as a last resort and, to be honest, only when it is beneficial for the appraiser for one reason or another.

2. . Basic formula for calculation:

Ifiz = × 100% (1)

where Vx- the actual (chronological) age of the object of assessment;

Vss

Advantages of the method:

1. The whole calculation is performed in one arithmetic operation;

2. The calculation is based on only two indicators: the chronological age of the appraisal object (taken from the technical documents for the appraisal object) and the standard service life (economic life) - this indicator is taken from the regulatory documents for the operation of buildings. Thus, from the point of view of the credibility of the initial data for the calculation, the appraiser is fully insured.

Disadvantages of the method:

1. The method does not take into account the fact that during the operation of the building, individual elements can be repeatedly repaired or completely replaced. This situation is often encountered when a building built several decades ago has recently been renovated with the replacement of most of the short-lived elements.

2. It is considered that the method is not applicable for buildings with a service life close to the economic life or longer than the economic life, i.e. when it is mathematically possible to obtain a wear value of more than 100%, which, logically, simply cannot be. The situation is typical for buildings of pre-revolutionary construction, when, with the excellent quality of construction work, a safety margin was laid according to the principle “grandchildren and great-grandchildren live and be happy”. And even from this seemingly hopeless situation, Russian appraisers manage to find a worthy way out (honor and praise to their ingenuity). And the way out is very simple. There is such a regulatory document as the Decree of the State Statistics Committee of the Russian Federation No. 13 of February 7, 2001 "On approval of instructions for filling out forms of federal state statistical monitoring of the presence and movement of fixed assets." Paragraph 4 of this regulatory document contains a table of the ratio of the actually past estimated service life (i.e., in our understanding of physical wear and tear, determined by the chronological age method) and the degree of analytical wear. In this case, for example, the degree of physical wear of 1% corresponds to the degree of analytical wear of 0.02%. And the degree of physical wear of 100% - the degree of analytical wear of 91.08%. And then, i.e. for 100% what? I quote from the document: In cases where the period that has elapsed since the beginning of the operation of the facility has exceeded the duration of its estimated period of exhaustion of operational resources (i.e., amounted to more than 100% of its value), for each percentage of excess up to 200% inclusive, the degree of analytical wear indicated in the last position table (91.08%), increases by 0.05 percentage points, and after 200% - by 0.01 percentage points". And this applies to all types of fixed assets! Why not a way out? The document is normative. The calculation method is extremely simply described. So what if the normative document was created for statistical purposes, and not for evaluation. The vast majority of the normative documents that we use were not created for evaluation purposes. What to go far - the same collections of UPVS were originally intended for the revaluation of fixed assets. It is we, the appraisers, who have adapted them for ourselves. I don't know about you, but I liked this one. True, there is not enough logic, and even at the border of the degree of analytical wear of 91.08%, a sharp and inexplicable “break” of the curve occurs, if you try to draw a dependence. Yes, there is such a drawback in the calculation method. But it's still better than nothing. Especially in a situation where it is simply impossible to apply other methods of calculating physical wear, for example, when evaluating the metal pole of a power transmission line, which, according to all regulatory documents, should have “died” back in the era of stagnation, and it still stands like a sentry at the mausoleum and the eye of the operator pleases.

A comparison of the advantages and disadvantages implies a limitation on the use of this method - the method gives fairly accurate results in the first years of the chronological life of the object of assessment. With increasing age, the accuracy of calculations drops sharply. Already at the chronological age of the building in 10-15 years old this method is not recommended.

3. Method of effective age. The basic formula for calculating has 3 spellings:

Ifiz = × 100% = ×100% = ×100% (2)

where Ve is the effective age of the object of assessment, i.e. how old the object looks;

Vost - remaining economic life;

Vss– normative service life (economic life).

Advantages of the method:

- The entire calculation is performed in one arithmetic operation;

- Index Vss is taken from the normative documents for the operation of buildings and does not need special justification.

Disadvantage of the method:

1. It is practically impossible for an appraiser to justify the value of East. Agree that not a single specialist will be able to say exactly (up to a year) how long the building will be in operation. The exception is the case when, for one reason or another, the building must be demolished in a certain period of time, but this is already a category of economic (external), and not physical wear and tear.

Comparison of the advantages and disadvantages of the method leads to the fact that in practice this method is almost never used.

4. Expert method. The method is based on the scale of expert assessments for determining the physical deterioration, set out in the Departmental regulatory document VSN 53-86r "Rules for assessing the physical deterioration of residential buildings". The amount of wear is determined by external (visible) damage to the elements. It is this method that BTI employees use when compiling technical passports for buildings. The formula for calculation looks like:

Ifiz = × 100% (3)

where II- the amount of physical wear and tear of i - that element in the building, determined according to the regulatory document;

SW i- specific gravity of i - that element in the building;

i– element number.

Advantages of the method:

1. Relative ease of performing calculations;

2. The methodology for determining physical wear and tear is established by a regulatory document and is described in sufficient detail in it. The evidence part is reinforced concrete. Especially when the opinions of the BTI employee (reflected in the technical passport of the building) and the appraiser (reflected in the act of inspection of the appraisal object or in the defective statement) suddenly miraculously completely converge.

Disadvantages of the method:

1. The methodology itself provides for an accuracy of calculations of ±5%. Depreciation for a specific element can be determined, for example, at 25% or 30% - well, such a gradation - after 5%. But even this is not scary, but the significant influence of the subjective factor (see paragraph 3).

2. The magnitude of the error is inversely proportional to the experience of the evaluator. In addition, quite often there is a situation when a simple cosmetic repair hides many visible signs of wear of the main power elements of the building, which leads to a significant underestimation of the actual wear of the building as a whole.

3. When choosing a calculation method, the advantages of the method often outweigh the disadvantages, and therefore this method is used by appraisers very actively.

Breakdown method. The method involves determining the total physical wear and tear for individual groups, taking into account the physical possibility of eliminating this wear or the economic feasibility of eliminating it:

- Correctable physical deterioration (deferred repair);

- Irreparable physical wear and tear of short-lived elements (those that can be repeatedly replaced during the operation of the building);

- Irreparable wear and tear of long-lived elements (those that form the power frame of the building and can only be restored during a major overhaul or reconstruction of the entire building).

The values of irremovable wear are determined from the cost of the elements, taking into account the removable wear. The total physical wear is determined by summing up the individual types of wear. At the same time, as part of the implementation of the breakdown method, at various stages of the calculation, the cost compensation method, the chronological age method, and the expert method can be used.

Advantage of the method:

1. The method makes it possible to take into account both visible and hidden factors that cause wear of elements (for example, natural "fatigue" of materials, which appears suddenly and leads to instantaneous destruction of the element).

Disadvantages of the method:

- Quite a large amount of calculations compared to other methods;

- The method is not applicable for conditions where there is no reliable information about the timing of repairs for short-lived elements (for example, the building was bought quite recently and the new owner simply does not have data on what and when was last repaired at the appraised object). Therefore, it becomes impossible to reasonably calculate the irremovable wear of short-lived elements using the chronological age method.

Nevertheless, this method is quite actively used.

So, we have identified the main advantages and disadvantages of the methods. For some methods, the scope was limited. It is time to find out how accurate the calculation methods are.

Chronological age method. Yes, applicable, but only at the initial stage of building operation. As the chronological age increases, subject to ongoing repairs, the magnitude of the error increases.

Effective age method. An interesting method that can eliminate the main drawback chronological age method, but we can hardly prove it. Establishing the degree of error is difficult.

As a result, the above methods are rarely used in real assessment. What is the most commonly used? Cost compensation method, expert method and breakdown method.

3. Real estate appraisal

3.5. Approaches to real estate valuation.

3.5.2. Cost approach

Cost approach- this is a set of valuation methods based on determining the costs necessary to restore or replace the object of assessment, taking into account accumulated depreciation. It is based on the assumption that the buyer will not pay more for the finished object than for the creation of an object of similar utility.

Information needed to apply the cost approach:

- wage level;

- the amount of overhead costs;

- equipment costs;

- profit margins for builders in a given region;

- market prices for building materials.

Advantages of the cost approach:

1. When evaluating new objects, the cost approach is the most reliable.

2. This approach is appropriate or the only possible one in the following cases:

§ technical and economic analysis of the cost of new construction;

§ justification of the need to update the existing facility;

§ valuation of buildings for special purposes;

§ when evaluating objects in "passive" market sectors;

§ analysis of land use efficiency;

§ solution of object insurance problems;

§ solving problems of taxation;

§ when agreeing on the value of the property obtained by other methods.

Disadvantages of the cost approach:

1. Costs are not always equivalent to market value.

2. Attempts to achieve a more accurate assessment result are accompanied by a rapid increase in labor costs.

3. The discrepancy between the costs of acquiring the property being valued and the costs of new construction of exactly the same object, because accumulated depreciation is subtracted from the construction cost during the appraisal process.

4. Problematic calculation of the cost of reproduction of old buildings.

5. Difficulty in determining the amount of accumulated wear and tear of old buildings and structures.

6. Separate assessment of the land plot from buildings.

7. Problematic evaluation of land plots in Russia.

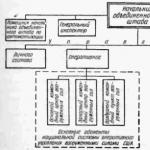

Stages of the cost approach(see fig.3.3):

- Calculation of the cost of the land plot, taking into account the most efficient use (Cz).

- Calculation of replacement cost or replacement cost (Svs or Szam).

- Calculation of accumulated depreciation (all types) (Sizn):

· physical deterioration

- wear associated with a decrease in the performance of an object as a result of natural physical aging and the influence of external adverse factors;

· functional wear

- wear and tear due to non-compliance with modern requirements for such objects;

· external wear

- depreciation as a result of changes in external economic factors.

Calculation of the cost of the object, taking into account the accumulated wear and tear: Sleep = Svs-Sizn.

Determination of the final value of real estate: Sit = Sz + Sleep.

3.5.2.1. Comparative unit method

This method involves calculating the cost of building a comparative unit of a similar building. The cost of a comparative unit of an analogue should be adjusted for existing differences in the compared objects (layout, equipment, property rights, etc.)

If 1 m 2 is selected as a comparative unit, then the calculation formula will look like this:

C o \u003d C m 2 * S o * K p * K n * K m * K in * K pz * K vat,

C o - the value of the object being assessed;

C m 2 - the cost of 1 m 2 of a typical building on the base date;

S about - the area of the estimated object (number of units of comparison);

K p - coefficient taking into account the possible discrepancy between the data on the area of the object and the construction area (1.1-1.2);

K n - coefficient taking into account the possible discrepancy between the evaluated object and the selected typical structure (for identical = 1);

K m - coefficient taking into account the location of the object;

K in - coefficient taking into account the change in the cost of construction and installation works between the base date and the date at the time of assessment;

K pz - coefficient taking into account the profit of the developer (%);

K VAT - coefficient taking into account VAT (%).

An important step is the choice of a typical object. In this case, it is necessary to take into account:

- a single functional purpose;

- proximity of physical characteristics;

- comparable chronological age of objects;

- other characteristics.

3.5.2.2. Breakdown method

This method involves breaking down the assessed object into building components - foundation, walls, ceilings, etc. The cost of each component is obtained based on the sum of direct and indirect costs required for the arrangement of a unit of volume according to the formula:

, where

, where

From zd - the cost of building the building as a whole;

V j is the volume of the j-th component;

C j is the cost per unit of volume;

n is the number of selected building components;

K n is a coefficient that takes into account the existing inconsistencies between the assessed object and the selected typical structure.

There are several options for using the component breakdown method:

- subcontract;

- breakdown according to the profile of work;

- allocation of costs.

Subcontract method based on the fact that the builder-general contractor hires subcontractors to perform part of the construction work. Then the total costs for all subcontractors are calculated.

Stake by profile method similar to the previous one and based on the calculation of the costs of hiring various specialists .

Cost Allocation Method involves the use of different units of comparison to evaluate different components of the building, after which these estimates are summed up.

Rice. 3.3. The procedure for assessing the value of real estate using the cost approach

3.5.2.3. Quantitative survey method

This method is based on the application of a detailed quantitative calculation of the costs for the installation of individual components, equipment and the construction of the building as a whole. In addition to calculating direct costs, it is necessary to take into account overheads and other costs, i.e. a complete estimate of the reconstruction of the assessed object is compiled.

Construction cost calculation

The cost of construction of buildings and structures is determined by the amount of investment required for its implementation. The cost of construction, as a rule, is determined at the stage of pre-project studies (preparation of a feasibility study for construction).

The estimated cost of construction of buildings and structures is the amount of funds required for its implementation in accordance with the project documentation.

Based on the estimated cost, the amount of capital investments, construction financing, as well as the formation of free (contractual) prices for construction products is calculated.

The estimated cost of construction includes the following elements:

construction works;

equipment installation works (assembly works);

the cost of purchasing (manufacturing) equipment, furniture and inventory;

other costs.

Cost calculation methods.

When drawing up estimates (calculations) of the investor and the contractor on an alternative basis, the following cost calculation methods can be used:

resource;

resource-index;

basic-index;

basic compensatory;

based on a data bank on the cost of previously built or designed analog objects.

Resource method - calculation in current (forecast) prices and tariffs of resources (cost elements), is carried out based on the need for materials, products, structures (including auxiliary ones used in the production process), as well as data on distances and methods of their delivery to the construction site , energy consumption for technological purposes, operating time of construction machines and their composition, labor costs of workers.

Resource-index method - this is a combination of the resource method with a system of indexes for resources used in construction.

Cost indices (prices, costs) - relative indicators determined by the ratio of current (forecast) cost indicators and basic cost indicators for resources comparable in terms of nomenclature.

Basis-index method - recalculation of costs according to the lines of the estimate from the basic price level to the current price level using indices.

Basic compensation method - summation of the cost calculated in the basic level of estimated prices and the additional costs determined by the calculations associated with changes in prices and tariffs for the resources used during the construction process.

It should be taken into account that before the stabilization of the economic situation and the formation of appropriate market structures, the most priority methods for calculating the estimated cost are the resource and resource-index methods. In the practical activities of experts, the basic-index method for calculating the estimated cost is more popular.

Determining the depreciation of a property

Depreciation is characterized by a decrease in the usefulness of a property, its consumer attractiveness from the point of view of a potential investor and is expressed in a decrease in value (depreciation) over time under the influence of various factors. Depreciation (I) is usually measured as a percentage, and depreciation is valued as depreciation (O).

Depending on the reasons causing the depreciation of the property, the following types of depreciation are distinguished: physical, functional and external.

Physical and functional wear is divided into removable and irreparable.

Removable wear - this is wear, the elimination of which is physically possible and economically feasible, i.e. the costs incurred to eliminate one or another type of wear contribute to an increase in the value of the object as a whole.

Identification of all possible types of depreciation is the accumulated depreciation of the property. In value terms, cumulative depreciation is the difference between the replacement cost and the market price of the property being valued.

The cumulative accumulated depreciation is a function of the lifetime of the object. Consider the main evaluative concepts that characterize this indicator.

Physical life of the building (FZh) - the period of operation of the building, during which the state of the load-bearing structural elements of the building meets certain criteria (structural reliability, physical durability, etc.). The term of the physical life of the object is laid down during construction and depends on the capital group of buildings. Physical life ends when the object is demolished.

Chronological age (XV) - the period of time that has passed from the date of commissioning of the object to the date of assessment.

Economic Life (EJ) is determined by the operating time during which the object generates income. During this period, ongoing improvements contribute to the value of the property. The economic life of the object ends when the operation of the object cannot generate income, indicated by the corresponding rate for comparable objects in this segment of the real estate market. At the same time, the ongoing improvements no longer contribute to the value of the object due to its general wear and tear.

Effective age (EV) is calculated on the basis of the chronological age of the building, taking into account its technical condition and the economic factors prevailing on the date of assessment that affect the value of the property being assessed. Depending on the characteristics of the operation of the building, the effective age may differ from the chronological age up or down. In the case of normal (typical) use of the building, the effective age is usually equal to the chronological one.

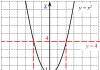

Remaining economic life (OSE) buildings - the period of time from the date of assessment to the end of its economic life (Fig. 3.4).

Rice. 3.4. Periods of building life and indicators characterizing them

Depreciation in valuation practice must be distinguished in meaning from a similar term used in accounting (depreciation). Estimated depreciation is one of the main parameters that allow you to calculate the current value of the appraised object on a specific date.

Physical wear and tear is the gradual loss of the technical and operational qualities of an object that were originally laid down during the construction under the influence of natural and climatic factors, as well as human life.

The methods for calculating the physical deterioration of buildings are as follows:

Normative (for residential buildings);

cost;

life time method.

Normative method the calculation of physical wear and tear involves the use of various regulatory instructions of the intersectoral or departmental level.

In these rules, a description of the physical wear and tear of various structural elements of buildings and their assessment are given.

The physical deterioration of the building should be determined by the formula:

, where

, where

And f - physical deterioration of the building,%;

And i - physical wear of the i-th structural element,%;

L i - coefficient corresponding to the share of the replacement cost of the i-th structural element in the total replacement cost of the building;

P- the number of structural elements in the building.

The shares of the replacement cost of individual structures, elements and systems in the total replacement cost of the building (as a percentage) are usually taken according to the aggregate indicators of the replacement cost of residential buildings approved in the prescribed manner, and for structures, elements and systems that do not have approved indicators, at their estimated cost .

This technique is used exclusively in domestic practice. For all its clarity and persuasiveness, it has the following disadvantages:

- due to its "normativity", it initially cannot take into account the atypical operating conditions of the facility;

- the complexity of the application due to the necessary detailing of the structural elements of the building;

- the impossibility of measuring functional and external wear;

- subjectivity of specific weighing of structural elements.

At the core cost method The definition of physical wear is physical wear, expressed at the time of its assessment by the ratio of the cost of objectively necessary repair measures that eliminate damage to structures, an element, a system or a building as a whole, and their replacement cost.

The essence of the cost method for determining physical wear and tear is to determine the cost of recreating building elements.

This method allows you to immediately calculate the wear of the elements and the building as a whole in terms of value. Since the impairment calculation is based on a reasonable actual cost to bring worn items to “like new condition”, the result under this approach can be considered fairly accurate. The disadvantages of the method are the obligatory detailing and accuracy of calculating the costs of repairing worn-out building elements.

Determination of the physical deterioration of buildings lifetime method . Indicators of physical depreciation, effective age and economic life are in a certain ratio, which can be expressed by the formula:

I - wear;

EV - effective age;

VF - typical period of physical life;

OSFZh - the remaining period of physical life.

![]() .

.

The use of this formula is also relevant when calculating percentage adjustments for depreciation in compared objects (comparative sales method), when it is not possible for the appraiser to inspect the selected analogues. The percentage of depreciation of elements or the building as a whole calculated in this way can be translated into value terms (depreciation):

![]() .

.

In practice, building elements that have removable and irremovable physical wear are divided into "long-lived" and "short-lived".

"Short-lived elements"- elements that have a shorter life than the building as a whole (roofing, sanitary equipment, etc.).

"Long-lived elements"- elements whose expected life is comparable to the life of the building (foundation, load-bearing walls, etc.).

Removable physical wear and tear of "short-lived elements" occurs due to the natural wear and tear of building elements over time, as well as careless operation. In this case, the selling price of the building is reduced by the corresponding impairment, as the future owner will need to make “previously deferred repairs” in order to restore the normal operating characteristics of the structure (current interior repairs, restoration of leaking roof areas, etc.). This assumes that the items are restored to "practically new" condition. Removable physical depreciation in monetary terms is defined as the "cost of deferred repairs", i.e. the cost of bringing the object to a state "equivalent" to the original.

Fatal physical wear of components with a short life is the cost of restoring high-wear components, determined by the difference between the replacement cost and the amount of removable wear, multiplied by the ratio of the chronological age and the physical life of these elements.

The removable physical wear of elements with a long life is determined by a reasonable cost of its elimination, similarly to the removable physical wear of elements with a short life.

The irreparable physical wear and tear of elements with a long life is calculated as the difference between the replacement cost of the entire building and the sum of removable and irremovable wear, multiplied by the ratio of the chronological age and the physical life of the building.

functional wear. Signs of functional wear in the assessed building - non-compliance of the space-planning and/or constructive solution with modern standards, including various equipment necessary for the normal operation of the structure in accordance with its current or intended use.

Functional wear is divided into removable and irreparable.

The cost expression of functional wear is the difference between the cost of reproduction and the cost of replacement, which excludes functional wear from consideration.

Removable functional wear is determined by the costs of the necessary reconstruction, contributing to a more efficient operation of the property.

Causes of functional wear:

deficiencies requiring the addition of elements;

deficiencies requiring replacement or modernization of elements;

superimprovements.

Weaknesses that require the addition of elements are building and equipment elements that are not present in the existing environment and without which it cannot meet modern performance standards. Wear due to these positions is measured by the cost of adding these elements, including their installation.

Deficiencies requiring replacement or modernization of elements - items that still perform their functions, but no longer meet modern standards (water and gas meters and fire fighting equipment). Depreciation for these positions is measured as the cost of existing elements, taking into account their physical wear and tear, minus the cost of returning materials, plus the cost of dismantling existing ones, and plus the cost of installing new elements. The cost of returning materials is calculated as the cost of dismantled materials and equipment when used at other facilities (finalized residual value).

Super-improvements - positions and elements of the structure, the presence of which is currently inadequate to the modern requirements of market standards. Removable functional depreciation in this case is measured as the current replacement cost of the “superimprovement” items minus physical depreciation, plus the cost of dismantling, and minus the salvage value of the dismantled elements.

Unrecoverable functional wear is caused by outdated space-planning and/or structural characteristics of the assessed buildings in relation to modern construction standards. A sign of irreparable functional wear is the economic inexpediency of incurring costs to eliminate these shortcomings. In addition, it is necessary to take into account the market conditions prevailing at the date of the assessment for adequate architectural compliance of the building with its purpose.

Depending on the specific situation, the cost of irremovable functional wear can be determined in two ways:

1) capitalization of losses in rent;

2) capitalization of excess operating costs necessary to maintain the building in proper order.

To determine the required calculated indicators (rent rates, capitalization rates, etc.), adjusted data on comparable analogues are used. At the same time, the selected analogues should not have signs of irremovable functional wear identified in the object of assessment.

Impairment caused by irreparable functional depreciation due to an outdated space-planning solution (specific area, cubic capacity) is determined by capitalization of losses in rent.

Calculation of unrecoverable functional wear by capitalizing the excess operating costs required to maintain the building in good condition can be done in a similar way. This approach is preferable for assessing the irremovable functional depreciation of buildings that differ in non-standard architectural solutions and in which, nevertheless, the amount of rent is comparable to the rent for modern analogues, in contrast to the amount of operating costs.

External (economic) depreciation - depreciation of the object due to the negative influence of the external environment in relation to the object of assessment: the market situation, easements imposed on certain use of real estate, changes in the surrounding infrastructure and legislative decisions in the field of taxation, etc. External depreciation of real estate, depending on the reasons that caused it, in most cases is unremovable due to the invariability of the location, but in some cases it can “remove itself” due to positive changes in the surrounding market environment.

The following methods can be used to assess external wear:

capitalization of losses in rent;

comparative sales (paired sales);

the economic life span.

| Previous |

Effective duration is the duration calculation for bonds with built-in options. This duration measure takes into account the fact that expected cash flows will fluctuate as interest rates change. The effective duration can be estimated using the modified duration if the bond with embedded options behaves like a bond without an option.

OFF "Effective duration"

An embedded option bond behaves like a bond without an option when exercising the embedded option will offer the investor no benefit. Thus, the safety cash flows cannot change given the change in returns. For example, if existing interest rates were 10% and the redeemable bond paid a coupon of 6%, the redeemable bond would behave like a bond with no option because it would not be optimal for the company to call the bonds and reissue them with higher interest rate.

Effective duration calculates the expected decline in the price of a bond when interest rates rise by 1%. All others are equal, the longer the maturity of the bond, the longer its effective duration. However, the effective duration will always be lower than the maturity of the bond.

Example of effective duration calculation

The formula for effective duration contains four variables. It:

P(0) = original price of $100 face value bond

P(1) = price of the bond if the yield were to decrease by Y percent

P(2) = price of the bond if the yield should increase by Y%

Y = estimated return change used to calculate P(1) and P(2)

Full formula for effective duration: Effective duration = (P(1) - P(2)) / (2 x P(0) x Y)

As an example, let's say an investor buys a bond at 100% and that the bond is currently yielding 6%. Using a 10 percent change in yield (0.1%), it is calculated that if the yield falls by this amount, the bond is valued at $101. It also found that with a 10 basis point increase in yield, the price of the bond is expected to be $99. 25. Given this information, the effective duration will be calculated as:

Effective Duration = ($101 - $99.25) / (2 x $100 x 0.001) = $1.75 / $0.2 = 8.75

This effective duration of 8.75 means that if there is a change in yield of 100 basis points or 1%, then the price of the bond is expected to change by 8.75%. This is an approximation. The estimate can be refined by factorizing the effective convexity of the bond.

- changes in technology;

Over time, there is a decrease in the relative cost of buildings and structures for a number of reasons:

- wear of structures during operation;

- adverse environmental impact;

- changes in technology;

- impact of various external factors.

Before considering the methods for calculating various types of depreciation and obsolescence inherent in real estate, you should become more familiar with the basic concepts and their properties.

The concept of "wear" has a different content in different branches of knowledge and activities. There are significant differences in the meaning given to the meaning of the term "wear and tear" by professional valuers 11 accounting professionals. In an accounting context, depreciation (like depreciation) is a means of recovering costs over the life of a property. Obviously, the calculation of depreciation is not an appraisal procedure. The appraiser-practitioner is not interested in the accounting of assets (in the way that he is interested in the accountant), he tries to justify the conclusion about one or another value of the object of assessment. The purpose of the appraiser, when it comes to depreciation in the valuation, is to determine the value of a specific property on a specific date under the cost approach, considering depreciation (estimated) as the difference between the values \u200b\u200bof restoration (replacement) and the market value of improvements.

On the other hand, in the methodological literature on assessment there are definitions of depreciation from the technical and operational sphere of real estate or used in engineering technology (For example, in one of the well-known textbooks on the assessment of machinery and equipment there is the following definition: “Physical wear and tear of machinery and equipment is a change in size , shape, mass or surface condition due to wear due to permanent loads or due to the destruction of the surface layer during friction ... The amount of wear is characterized by the established units of length, volume, mass, etc. ". Here, the definition of wear as" dimensional change "is the definition is technological, machine science, but not evaluative), that is, not evaluative.

No one argues that special knowledge is useful, but it is additional, not defining, and cannot serve as definitions of this concept within a specific discipline - the theory of valuation and the valuation profession associated with economic measurements.

Since value is created by utility, the decrease in the cost of improvements to the appraised object during operation and under the influence of various other factors of obsolescence is a consequence of depreciation, i.e. loss of its value (utility).

Depreciation (estimated), or impairment, - is the actual loss in the value of improvements to the property as a result of a number of factors (increase in age, degree of intensity of operation, the emergence of new building materials and new developments in the design of buildings (structures), legislative restrictions, etc.) that have different sources of origin.

Accumulated depreciation is characterized by the loss of value of improvements for all possible reasons.

Classical valuation theory distinguishes three types of impairment:

- physical deterioration;

- functional obsolescence;

- external (economic) obsolescence.

Physical wear (deterioration)- loss of the cost of improvements associated with the partial or complete loss of the initial properties of the serviceability of building elements as a result of natural aging as a result of their operation and under the influence of natural forces, as well as design errors or violations of construction rules (Fig. 11.1).

This type of impairment occurs due to the deterioration of the physical and technical condition (strength, rigidity, attractiveness, etc.) of individual structural elements or the entire building as a whole. A decrease in the cost of a building can also be associated with the quality of construction, the building materials used, the operating conditions of the facility, climatic conditions, the regularity of current repairs, etc. Usually the market thinks that the new building is better than the old one.

Functional obsolescence (functional obsolescence) - the loss of value of improvements due to the discrepancy between their functional characteristics and market requirements at the date of assessment.

This may be obsolescence of a constructive or space-planning solution, building materials and engineering equipment of a building (structure), outdated infrastructure and interior, non-compliance of the quality of construction work with modern market standards for this type of building (structure), the presence of excesses, etc. Functional Obsolescence can apply to both long-lived and short-lived features.

Curve reflecting the process of accumulation of physical wear

I - the period of intensive accumulation of wear associated with the start of operation of the object, the period of running-in;

II - the period of stabilization, the period of normal operation and slow wear, during which irreversible deformations accumulate;

III - a period of intensive accumulation of fatigue (technically unrecoverable) deformations, and when the amount of wear reaches a critical value (80%), the question arises of the need to dismantle the building

The value of functional obsolescence characterizes the degree of functional discrepancy between its individual elements or the entire building as a whole and the main parameters of its performance, which determine the living conditions of people, the volume and quality of services provided, with modern market requirements.

External (economic) obsolescence (external obsolescence)- loss of value due to the negative impact of factors external to the assessed object.

These factors can be of a different nature:

- physical (there is an airport, a high-speed highway, a factory, etc. near the residential area);

- economic (there may be a change in the ratio of supply and demand, prices for raw materials and (or) energy carriers, the level of competition, the external economic situation, the impact of macroeconomic, sectoral, regional economic factors that have a negative impact);

- political (legislative restrictions and changes in political, financial and other conditions in the real estate market).

This type of obsolescence is inherent in improvements due to their fixed position and, unlike physical obsolescence and functional obsolescence, does not appear in the object itself. It is associated with an unfavorable change in the external economic environment of the object (aging environment). Therefore, external obsolescence is considered in relation to the object as a whole and applies both to the land plot and to improvements in certain proportions. At the same time, external depreciation is often measured by the capitalized value of rent losses, estimated using the gross rent multiplier.

The fact that the sources are separated (do not intersect) and cover the full range of values of possible causes allows us to assert that a system of depreciation and obsolescence has been introduced in the theory of assessment, which does not allow double counting, in contrast to a certain “set” of types of depreciation (obsolescence) that is deficient in this sense , introduced in the ESS (see paragraph 3.3.3 of the textbook). Thus, for example, depreciation is defined as the loss in value resulting from the consumption of assets through their use. Here, the sources are considered in the immediate environment, which determines the quality of operation of the object of assessment. Functional obsolescence is associated with changes in the industry that produces the object of assessment, and external obsolescence, as the name implies, is determined by changes in the macroeconomic conditions for the functioning of the object.

Almost all types of wear and tear can be observed on newly built buildings, even those that meet the most efficient use of land. This is due to the fact that certain miscalculations and deviations from the original project may be made during the construction work. In addition, due to the length of the design period and the long construction time, even the most modern projects by the time the facility is put into operation may have a functional discrepancy.

Accrued depreciation- loss of value due to all impairment factors

Impairment system in real estate valuation

The impairment may be recoverable or irrecoverable.

Recoverable impairment is depreciation or obsolescence, the elimination of the causes of which is technically feasible and economically justified (expedient).

An action is considered economically justified, as a result of which the increase in the value of the object of assessment after the elimination of the cause is not less than the cost of its implementation.

Fatal impairment- deterioration or obsolescence, for which the elimination of the causes that cause it cannot be physically or technically realized, or the elimination of which is not economically justified.

Physical deterioration and functional obsolescence may or may not be recoverable at the assessment date.

External (economic) depreciation in real estate appraisal is always considered fatal. It is directly related to the location of the object being assessed. The reasons causing it are external to the property and cannot be eliminated by the owner of the property being valued.

The depreciation of buildings is directly related to their age and the service life of both the entire building and its individual structural elements. Theoretically, over the course of its useful life, a building or a component of a building should lose all its value, therefore, in calculating impairment, the age and useful life reached at the date of assessment are used to calculate the general depreciation of buildings or components. In this case, the appraiser must have an idea about the life cycle of the property.

Since real estate objects are subject to physical, economic and legal changes during the entire period of their existence, each immovable thing (except land) goes through the following enlarged life cycle stages:

- formation - construction, creation of a new enterprise, acquisition (purchase, allocation, etc.) of a land plot;

- operation - functioning and development (expansion, reconstruction, reorganization, etc.);

- termination of existence - demolition, liquidation, natural destruction.

At the same time, during the life cycle of real estate as a physical object, there is a change, possibly repeated, of the owner, owner or user of this property as an object of law.

Life cycle of a property obeys certain patterns and includes, by definition, G. Harrison (Harison G. Real Estate Appraisal: translated from English M .: ROO, 1994), such concepts as the term of physical life, the term of economic life, the term of the remaining economic life, as well as chronological and effective age.

When calculating accumulated depreciation (cumulative impairment), appraisers use the following concepts.

Normative service life (Tm)- the service life of buildings and structures determined by regulatory enactments, subject to the rules and terms of maintenance and repair.

The standard service life of buildings and structures (their structural elements) is established (calculated) taking into account the implementation of measures for their technical operation (taking into account the repair and construction measures). This is the estimated period of time during which the object and its structural elements, depending on the type of material of the main structures (foundations, walls and ceilings), can be used for their intended purpose, taking into account current and major repairs periodically carried out in it. Depending on the durability, which determines the capital group of buildings (structures) and their main structural elements, the standard service life can range from 10 to 175 years.

The term of the physical life of improvements (Gr) (actual life) - the period from the completion of the construction of improvements to their demolition. This is the period of time during which the building exists. The economic feasibility or inexpediency of use is not taken into account. The term of physical life can be standard, actual, calculated (forecasted) and increased due to modernization and improvement of conditions.

The term of the economic life of the object (G c) (effective life)- the period of time during which improvements to the land plot contribute to the value of the property; the time during which the object can be used, making a profit.

Depending on the durability (capitality group) of buildings (structures) and their structural elements, the economic life can be from 5 to 50 years until the moment associated with the emergence of an urgent need for major repairs.

The timing of physical and economic life can be very different - usually the expected physical life exceeds the economic one. Current and major repairs, as well as reconstruction, lengthen both physical and economic life.

Chronological age of improvements (T) (chronological or actual age)- the period elapsed from the date of commissioning of the object to the date of assessment. This is the actual (according to the technical data sheet) age of the object.

The effective age is established on the basis of visual inspection and is based on the experience and judgment of the assessor or evaluator. It is determined by assessing the appearance, technical condition, economic factors of operation and other reasons affecting) the value of the object, takes into account the consumer characteristics (commodity properties) of the object as of the date of assessment for its possible sale. The actual age, in order to determine which the condition of the object being assessed must be correlated with the corresponding object among the actual age, as if it were operated under typical conditions and normal intensity of operation.

This is the estimated period of time during which the building will continue to bring profit to its owner, determined by the difference (Tf - Tef) (The often incorrect definition should be avoided: "the remaining economic life is the period from the date of the assessment to the end of the economic life of the object" On the date of appraisal, the appraiser determines two indicators - the chronological age and the effective age of the building, and it is the latter that appears in the calculations). This period is usually used by the appraiser to estimate future earnings. Refurbishment and modernization of the facility extends the remaining economic life.

Estimation of the remaining economic life of the object

Effective Age of Improvement (TEF) (effective age)- age, expertly determined on the date of assessment by the physical condition and degree of usefulness of the object (according to economic factors affecting the value of the object being evaluated).

The effective age may be less than the chronological age if the building has been operated at a high level or has been reconstructed. Conversely, if a building has been poorly maintained, its effective age may be greater than its chronological age.

The effective age is established on the basis of visual inspection and is based on the experience and judgment of the assessor or evaluator. It is determined by assessing the appearance, technical condition, economic factors of operation and other reasons affecting) the value of the object, takes into account the consumer characteristics (commodity properties) of the object as of the date of assessment for its possible sale. E is the actual age, in order to determine which the condition of the assessed object must be correlated with the corresponding object among the actual age, as if it were operated under typical conditions and normal intensity of operation.

The effective age can be determined based on the chronological age, taking into account the accumulated depreciation and the listed economic factors. It can be defined in the same way as the difference between the terms of the economic life and the remaining economic life of the object. Depending on how the building has been maintained, whether repairs, upgrades or refurbishments have been carried out or not, the effective age of the building may be more or less than its chronological age.

The term of the remaining economic life of the object (T) (the rest of the effective life or remaining economic life)- this is the estimated period of time during which the building will continue to bring profit to its owner, determined by the difference (Tf - Tef) "". At the date of assessment, the appraiser determines two indicators - the chronological age and the effective age of the building, and it is the latter that appears in the calculations). This period is usually used by the appraiser to estimate future earnings. Repair and modernization of the facility increase the period of the remaining economic life (Fig. 11.3).

The life cycle of a particular commercial real estate object as property, from the point of view of its current owner, who makes his own subjective path with the real estate object from purchase to sale or exchange, can be repeated many times, each time with a new owner, until the end of the economic or physical life object. For objects - historical monuments - the indicator of the physical life span is more important, and not the fact of the change of owner, owner and user.

All stages of the life cycle of a real estate object and indicators of its age are interconnected, and when one of them changes, the others change accordingly. The presence of real estate at one or another stage of the life cycle should be taken into account by the owner in order to implement adequate measures to ensure the preservation and increase in the profitability of the property.

Step 6. Calculation of the effective age of comparable properties (EV).

Step 7. Divide the amount of wear by the effective age and obtain the average annual wear.

The effective age (EV) at the date of assessment is 25 years.

The effective age is the age that reflects the condition and usefulness of the appraised object. It shows how an object looks regardless of its actual age. The effective age can be less than the actual age of a building if it has been reasonably well maintained, has been repaired in a timely manner, has excellent design quality, and is in high demand in the market. However, if the building has been misused, its effective age may be less than its actual age.

I \u003d EV / EZh Sob, where EV is the effective age of the object

This method is quite simple and logical, but its significant drawback is the subjectivity of determining the effective age and the period of economic life.

Effective age of the structure (years) 19

The effective age (expert estimated) is based on an assessment of the appearance of the object, taking into account its condition. This is the age that corresponds to his physical condition.

lifetime method. The percentage of physical depreciation when applying this method is calculated as the ratio of effective age to the period of economic life.

The effective age is determined by assessing the appearance of the building, taking into account its condition.

The depreciation coefficient of a building is defined as the ratio of the effective age to the normative

The effective age of each object is determined by the method of expert estimates.

If the tasks of each employee of the unit are specialized, then it follows that the purpose and purpose of each unit must also be specialized. The principle of unity of leadership states that administrative and organizational efficiency increases if each unit has one job (or a homogeneous set of jobs) that is (are) planned and directed by the leader,

As social production grows and its efficiency increases, so does the role of the service sector. This is explained by the fact that, firstly, a highly developed and efficient social production is able to release an increasing number of workers from the sphere of direct material production (due to the growth in the productivity of social labor in it) and send them to the public service sector, and secondly, that at the present stage the role of the services themselves in meeting the needs of the population is increasing.

Such a procedure for changing prices, bringing them into line with the conditions of production and sale of products does not correspond to the new economic mechanism, and in particular to the principles of full cost accounting. Under the new conditions, the economic framework of the enterprise's economic activity is expanding. If earlier self-financing was limited to the fulfillment of planned indicators for profit and cost reduction, now all material incentives are made dependent on the final results, the economic measure of which is profit. The role of profit as the main indicator of efficiency is growing. In contrast to the old, truncated, full cost accounting is aimed at increasing the efficiency of production not only by reducing the cost of manufactured products, but also by means of new highly efficient products, where the main reserves are located.

As we know, efficiency (maximizing total surplus) implies equality between price and marginal cost. Thus, the optimal two-part tariff assumes that p = c. The optimal fixed part of the tariff will then correspond to consumer surplus, with p = c, i.e. / = S(p) = S() = A + + B + C. Note that when using a two-part tariff ( 1) profit rises from A to A + B + C (the difference between price and cost is such that the seller does not receive a variable profit, but bails out a huge amount through a fixed rate) (2) the total surplus rises from A + Bg.oA + B + C (more sold, as efficiency would dictate) and (3) total consumer surplus rises from B to A + B + C (marginal price falls from monopoly price pm to marginal cost), but (4) decreases net consumer surplus (total surplus minus fixed tariff) from B to zero (total consumer surplus is at the disposal of the monopolist due to the fixed tariff). In other words, as a result of non-linear pricing, aggregate efficiency increases and consumer welfare deteriorates. In Section 10.5, which discusses various aspects of government policy on price discrimination, we can see that the trade-off between social efficiency and consumer welfare is one of the most difficult issues.

The consumer selects the sets of characteristics suitable for him from the available set. Note that the efficiency values increase - this is a radical departure from the traditional theory - since for any set of characteristics obtained by combinations of A to B, a larger set can be achieved with the same proportions - C, or combinations of A and C, or B and C. Rational consumer will choose combinations on the effective frontier of characteristics AB . Which point he chooses will depend entirely on his preferences. If a consumer has well-distributed preferences and behaves rationally, we can assume that all three goods are sold, but no consumer buys A and B at the same time.

At each specific enterprise, depending on the nature of the products manufactured, the availability of certain technological processes, the level of organization of production and labor, one or another form of remuneration is used. For example, piecework wages may be inefficient if only the piece-bonus or piece-progressive option is used, but if the piece system is used, then efficiency increases. At the same enterprise, depending on the production of a particular type of product by workshop, the options for applying wages may also be different.

Efficiency is effectiveness, fruitfulness is measured by the ratio of results to costs. Efficiency increases if results increase at constant costs. Even greater efficiency is achieved by combining increased results with reduced costs.

Thus, at a constant average