We talked about the types of costs and gave their classification in a separate consultation. In this article, we will take a closer look at the opportunity costs of production.

What is opportunity cost

The definition of opportunity cost can be found, for example, in methodological recommendations on accounting in agricultural organizations (Order of the Ministry of Agriculture of 06.06.2003 No. 792). Based on the definition given in them, we can say that the opportunity cost of production is the loss of profit from the alternative use of capital. An example is given Agriculture: in conditions of limited factors of production, the expansion of one agricultural sector will cause a limitation of other industries that use the same factors. So there is a lost profit from the reduction of other industries or technologies. At the same time, it is considered that lost profits are also costs that are not reflected in traditional accounting. They can be calculated in the management accounting system when assessing economic efficiency production.

There are other names for opportunity cost. Opportunity costs for the production of goods are the same opportunity costs, opportunity costs or costs of rejected opportunities.

At the same time, the opportunity cost of producing a good is measured not so much by the costs that an organization would incur if alternative development of events, how much profit that would have been received in this case.

Example of opportunity cost calculation

Let's define the opportunity costs of production using an example.

In the reporting year, the organization sold its own products A for 200 million rubles. The total cost of the organization amounted to 175 million rubles. Profit from activities - 25 million rubles. (200 million rubles - 175 million rubles).

At the same time, in the reporting year, based on the forecast data, the organization could reorient itself to the production of product B. The annual sales volume for it was planned at the level of 220 million rubles, and the total amount of costs, taking into account the costs of reprofiling, was projected at 196 million rubles. rub. The profit of product manufacturer B would be 24 million rubles. In this case, 24 million rubles. and there are opportunity costs. Since the actual profit for the reporting year, minus alternative costs, is greater than 0 (25 million rubles - 24 million rubles), the chosen alternative for the production of products A is considered optimal.

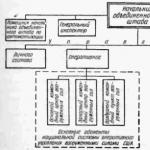

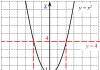

POSSIBILITY CURVE

Shows possible alternatives for the production of two goods from limited resources.

OPPORTUNITY (imputed) COSTS (cost) - the amount of one good that is sacrificed for the sake of increasing another good by one.

OS = DQ1/ DQ2, where OS is the opportunity cost,

DQ1 - decrease in the amount of the first good, DQ2 - increase in the amount of the second good.

On the production possibilities curve, the sacrificial good is shown on the y-axis, while the growing good is shown on the abscissa.

PROBLEM 1. A certain company has 84,000 rubles, for which it decided to organize the production of bread and rolls. The price of one loaf of bread is 3 rubles, and one loaf is 2 rubles. Draw the production possibilities curve for this firm.

SOLUTION: We determine the amount of bread and rolls that the company can produce for the entire money capital.

A) the amount of bread with zero production of rolls:

84000: 3= 28000 loaves;

B) the number of rolls with zero bread production:

84000: 2= 42000 rolls.

Based on the data obtained, we build the firm's production possibilities curve:

ANSWER: From available resources, a firm can produce 28,000 loaves of bread or 42,000 rolls, as well as any combination of them located on its production possibilities curve.

TASK 2. In a society, the possibilities of producing goods A and B from limited resources with their full employment are presented in the table:

Alternatives

Product A (million units) 10 9 7 4 0

Product B (million pieces) 0 2 3 4 5

Determine the opportunity cost for each option.

SOLUTION: Opportunity costs are determined by the formula:

OS = DA / DB.

Opportunity costs are determined when moving from one alternative to another, therefore:

OS 1-2 \u003d 9 - 10 / 2 - 0 \u003d -1/2,

OS 2-3 \u003d 7 - 9 / 3 - 2 \u003d -2,

OS 3-4 \u003d 4 - 7 / 4 - 3 \u003d -3,

OS 4-5 \u003d 0 - 4 / 4 - 3 \u003d -4.

The "-" sign indicates inverse relationship between the quantity of goods A and B.

To determine the dynamics of opportunity costs, we use the absolute value of the number, without a minus sign. In the problem, opportunity costs increase from ½ to 4 as you move from one alternative to another. This is due to the law of increasing opportunity costs.

PROBLEM 3. Possible alternatives for the production of goods Y and X in society are as follows:

Options 1 2

Goods U (pcs.) 40 30

Product X (piece) 20 25

What is the opportunity cost of increasing the production of good X from 20 to 25?

SOLUTION: We determine the opportunity costs according to the well-known formula:

OS \u003d (30-40): (25-20) \u003d - 2.

To increase the production of good X by one unit, society has to sacrifice two units of good Y, therefore, the opportunity cost of increasing the production of good X by 5 units will be equal to 10 units of good Y: 2 x 5 \u003d 10 units. U.

TASK 4. Father and son are picking mushrooms and berries for sale. During the day, the father can collect 10 kg of mushrooms or 20 kg of berries, and the son 15 kg of mushrooms or 30 kg of berries. How to distribute work between them most effectively?

SOLUTION: We determine the opportunity costs of picking mushrooms or berries by father and son and compare them. The decision is made at the lowest opportunity cost.

Opportunity cost of mushroom picking by the father (Mushroom OS): Mushroom OS = 20 kg of berries: 10 kg of mushrooms = 2, i.e. picking mushrooms, the father refuses to pick berries. Each kg of collected mushrooms is "worth" refusing 2 kg of berries.

Opportunity cost of picking mushrooms by son:

OS of mushrooms = 30 kg of berries: 20 kg of mushrooms = 1.5 kg of berries.

For each kg of collected mushrooms, the son loses (refuses) 1.5 kg of berries.

Since the opportunity cost of picking mushrooms is higher for the father (the loss of 2 kg of berries is greater than the loss of 1.5 kg), it is therefore more efficient to pick mushrooms for the son, and berries, respectively, for the father.

One can compare similarly the opportunity costs of picking berries by father and son: OS of berries by father = 10 kg of mushrooms: 20 kg of berries = 1/2,

OS of berries by son = 20 kg of mushrooms: 30 kg of berries = 2/3.

Since the opportunity cost of picking berries is less for the father: 1/2<2/3, то отцу эффективнее собирать ягоды, что подтверждает ответ, полученный выше.

In order to calculate how much B can be produced instead of the available 66A, it is enough to recall that the internal opportunity cost of producing one good A in Russia is 0.5 of good B. That is, instead of 66A, Russia can produce 33. As a result, the leftmost point of the CPV has a coordinate of 233 (= 200 + 33). The CPV has a fracture. Note that the resulting segment of the CPV is parallel to the original CPV, since Russia ended trade at this segment and returned to the choice between producing two goods at domestic opportunity cost. Now let's build the US CPV. The USA, starting trading at point 200B, according to the proportion of exchange 1A=1.5B (which is equivalent to the proportion 1B=A), wants to exchange 200B for 133 goods A (= 200 *). Russia has the capacity to supply 133 goods A.

Problem number 142. opportunity cost calculation

At the same time, such a division will allow uniting separate industries and territorial complexes, establishing a relationship between countries. This is the essence of MRI. It is based on the economically advantageous specialization of individual countries in the manufacture of certain types of goods and their exchange in quantitative and qualitative proportions. Development factors The following factors encourage countries to participate in MRI:- Volume of the domestic market.

Large countries have more opportunities to find the necessary factors of production and less need to engage in international specialization.

opportunity cost

In order to trade effectively with another country, a given economy does not need to have a higher productivity in the exchanged good, but it is sufficient to produce it at a lower opportunity cost. This is of great practical importance. For example, the United States is more productive than Ecuador in the production of software and in the cultivation of bananas. But this does not mean that the US will not trade any goods with Ecuador.

Important

Because the opportunity cost of bananas is lower in Ecuador, he will specialize in producing and trading bananas. The US, by contrast, has lower opportunity costs of producing software, and will trade it. Thus, each country trades in the product in the production of which resources are used in the most optimal way.

Opportunity cost formula

Attention

Opportunity costs are divided into 2 types: external and internal. External costs are associated with the acquisition of a resource and correspond to the benefit that can be obtained by using the same costs of another alternative resource. Internal costs are due to the use of not attracted, but own resources, which means that the time costs of the company's resources are equal to the benefit that can be obtained from the alternative use of its resources.

Related video Pay attention Fixed costs the company must bear in any case, to a certain extent they are practically independent of production volumes.

Educational materials

Sweden has a comparative advantage in cheese and Portugal in wine. Consequently, when establishing trade relations between these two countries, Sweden will specialize in cheese, and Portugal in wine. Sweden exchanges 3 tons of cheese for 1 ton of wine from Portugal.

In order to produce 3 tons of cheese, Sweden spends 3*20=60 hours. Therefore, to obtain 1 ton of wine from Portugal, she needs to spend 60 hours. But if she wanted to produce wine herself, she would have to spend 100 hours. Her benefit from specialization and trade was 40 hours. Portugal exchanges 1 ton of wine for 3 tons of cheese from Sweden. It takes 25 hours to produce 1 ton of wine.

Therefore, to receive 3 tons of cheese from Sweden, she needs to spend 25 hours. But if she wanted to make the cheese herself, she would have to spend 3*40=120 hours.

/ typical tasks for met-11 with solutions

Solution: Total costs TC = fixed costs FC + variable costs VC = (average fixed costs AFC + average variable costs AVC) ∙ output Q. Given: AFC = 20 den. units / piece, AVC=100 den. units / piece, Q= 2000 pieces TS = (20 +100) ∙ 2000 = 240000 den. units Answer: b) 240 thousand den. units

- The company produced 100 units in the reporting period. products and sold it at a price of 22 thousand rubles. per piece

In this period, the wages of employees amounted to 400 thousand rubles, the cost of raw materials and materials - 500 thousand rubles, the cost of used equipment - 300 thousand rubles. The salary of the owner of the company as an employee in a competitive enterprise would be 200 thousand rubles. Define: accounting costs; economic costs, accounting profit and economic profit of the enterprise.

How to Calculate Opportunity Costs

When the incremental cost of producing each additional unit of output is less than the average cost of the units already produced, the production of that next unit will lower the average total cost. If the cost of the next additional unit is higher than the average cost, its production will increase the average total cost. The foregoing refers to a short period. In the practice of Russian enterprises and in statistics, the concept of "cost" is used, which is understood as the monetary expression of the current costs of production and sales of products. The composition of the costs included in the cost price includes the cost of materials, overheads, wages, depreciation, etc.

How to Find Opportunity Costs

Typical examination (test) tasks for students of all specialties in the discipline "Economics (Economic Theory)" 2011-2012 account. year Below are typical tasks (total number - 8) and examples of solving some of them. The correct formatting of the solution is in italics.

- Figure 1 gives a graphical model of the production possibilities of the economy. Determine the opportunity cost of producing an additional unit of good X at point A2.

Figure 1 Solution: In general terms, opportunity cost is the amount of one good (for example, good A) that must be sacrificed in order to obtain another good (for example, good B).

Accordingly, the calculation of the opportunity cost of producing one additional unit of product B is carried out according to the formula: Losses in the production of product A / gain in the production of product B.

Costs. production cost formulas

This means that instead of producing 1 ton of cheese, it can produce 0.2 tons of wine. At what proportion of the exchange of cheese for wine will Sweden enter into trade relations? The answer sounds like this: Sweden will change cheese for wine when for 1 ton of cheese it can get MORE than 0.2 tons of wine. If it receives exactly 0.2 tons of wine from trade, then Sweden does not care whether to produce wine on its own or to receive it from Portugal.

If Sweden receives less than 0.2 tons of wine from trade, then it will be profitable for Sweden to produce it on its own, and trade will not take place. Similarly, Portugal will change wine for cheese when for 1 ton of wine he gets MORE than 0.625 tons of cheese. This means that Portugal wants to get LESS for 1 ton of cheese than 1.6 tons of wine.

The intersection of the interests of Sweden and Portugal is in the range 1 CHEESE ∈ (0.2;1.6)WINE.

5.3 examples of solving some problems

In a narrower sense, sunk costs include the costs of resources that cannot be used in alternative ways, such as the purchase of specialized equipment. This category of expenses does not apply to economic costs and does not affect the current state of the company. Costs and price If the organization's average cost equals the market price, then the firm earns zero profit.

If favorable market conditions increase the price, then the organization makes a profit. If the price corresponds to the minimum average cost, then the question arises about the feasibility of production. If the price does not cover even the minimum of variable costs, then the losses from the liquidation of the firm will be less than from its operation.

International distribution of labor (MRT) At the heart of the world economy is MRI - the specialization of countries in the manufacture of certain types of goods.

The theory of comparative advantage was developed in the middle of the last century. In a simplified form, opportunity costs are characterized as missed opportunities. Opportunity costs are mainly considered in the framework of management accounting. In the traditional perception of accounting, the concept of missed opportunities is absent due to the reflection of transactions at the time of their completion. In the article we will talk about the opportunity costs of production, give examples of the calculation.

The emergence of opportunity costs

In the process of conducting management accounting in production, several types of costs are determined.

What is opportunity cost

The main characteristic of opportunity costs is the limited resource. The costs incurred in the production of one type of product must be redirected to the production of products of another type. Opportunity cost refers to the resources that must be diverted from the production of another product.

At the same time, there are costs that have no other use case. When planning costs, it is taken into account that the predominant number of costs cannot be considered as alternative ones. As an example, we can cite the conditions when organizations are limited in determining the alternative use of funds allocated for costs in the form of payments for the rental of real estate, the purchase of equipment and office equipment, and current repairs.

Sources of formation of opportunity costs

Opportunity costs cannot be determined by assignment to cost elements. The indicator is a design determined by calculation. The enterprise determines the value of lost opportunities based on its own understanding of the desired profitability of the business. From the point of view of economic theory, costs are subject to division into explicit and implicit types according to the source of formation.

Explicit costs are formed from external sources, have clear documentary evidence and are recognized as accounting costs.

The explicit types include:

- Labor costs for production workers.

- Expenses for the acquisition of inventories for the production of products - raw materials, materials, semi-finished products.

- Fare.

- Payment for utilities.

- Payment for the provision of services of companies providing insurance and lending activities.

Along with explicit costs, there are implicit costs. Implicit (imputed) costs include resources identified at the enterprise itself.

Estimating Opportunity Costs

The definition of opportunity costs is made as the costs of producing one product, estimated through the costs of creating another type of product. The indicator characterizes the costs that will not be incurred, since resources have already been diverted to the production of another type of product. When evaluating an alternative option, the following conditions are taken into account:

- An important component in the assessment of production costs is the time factor. The benefits from the production of products can be revealed in different periods.

- The amount of opportunity costs as a result of changing activities is determined by the profit received by the enterprise when choosing another option.

- One of the indicators requiring additional consideration is the amount of funds diverted to the project.

- The indicators during the assessment should be reflected in the same units of account.

The definition of missed opportunities is especially important for industries with unused resources.

Calculating the opportunity cost

The calculation takes into account only the costs that are subject to change in connection with the introduction of a new project. Indirect costs will be constant, which does not require the use of their values in determining the effectiveness of an alternative. In the detailed calculation of opportunity costs, itemized costing is determined with the subsequent elimination of fixed costs.

Only future cash flows are considered. A more general definition defines the profit obtained by using the available and alternative options.

Simplified Example of Opportunity Cost Calculation

The enterprise during the year produced product A with a sales value of 50 million rubles, while incurring costs in the amount of 45 million rubles. The resulting profit amounted to 5 million rubles. At the same time, the enterprise was considering production option B, the planned cost of products would be 75 million rubles, with production costs of 73 million rubles, including the costs of reprofiling. As a result, the profit of the alternative option would be 2 million rubles, which is lower than the actual production. The company chose the release of products A as more profitable than the alternative.

Rubric “Questions and answers”

Question number 1. Are there opportunity costs that may have external or internal sources of formation, depending on changing conditions?

Question number 2. Is it possible to reflect lost opportunities in accounting costs?

Accounting costs do not contain information about missed opportunities.

Question number 3. How does the company organize the control of opportunity costs?

Management accounting aims to group data by cost center. The collection of data with subsequent reflection in the reports is carried out by the responsible manager. Data analysis is carried out by an official from the management level.

Production costs include all kinds of expenses and cash expenditures that will need to be made to create a product. For any company, they act as payment for purchased factors of production, that is, they cover the payment of materials, salaries of employees, depreciation, as well as expenses that relate to production management.

After the sale of the goods, the entrepreneur receives cash proceeds, part of which must fully compensate for the above costs, while the other gives the profit for which this production was organized.

Opportunity cost - what is it?

The predominant part of production costs includes the use of various production resources. At the same time, if certain production resources can be used in one place, they cannot be used in another, because they differ in such properties as scarcity and rarity. For example, the money that is needed to purchase a blast furnace for making cast iron cannot be simultaneously spent on making bricks. Thus, if a resource begins to be used in one area or another, the opportunity to use it in another way is lost.

Thus, any decision to manufacture a certain product involves the complete abandonment of the use of the same resources in order to produce some other type of product. It is this type of cost that is called "opportunity cost". And it is they that should be taken into account in the process of keeping records of the work of any enterprise.

Opportunity costs are the costs of manufacturing a particular product, which are estimated in terms of the lost opportunity to use these resources for another purpose.

How to evaluate them?

In order to figure out how to evaluate them, we can take Robinson, who lived on a desert island, as an example. Oddly enough, but even in this case there are opportunity costs.

For example, near his hut, he began to grow corn and potatoes. The land plot is limited on one side by the ocean, on the other - by the jungle, and on the third there are rocks. Under these conditions, Robinson decides to expand the production of corn, but he has only one option to realize this - to increase the area that will be occupied by corn, by reducing the area that is currently occupied by potatoes. In this case, the opportunity cost of producing each next cob of corn in this case can already be expressed in potato tubers, which he did not receive when using the potato land resource for growing corn.

What to do with mass production?

This example only covers two products, but what if there are hundreds or even thousands of them? It is in this case that opportunity costs are measured in money, with the help of which the comparison of all other products is ensured. To determine and calculate them, a qualified specialist is hired who will be able to calculate them, as well as note any changes and their consequences.

Peculiarities

Opportunity cost can be called the difference between the profit that a company could receive in the case of the most profitable among all real alternative uses of resources, and the real profit received. However, there are several features here as well.

Not all entrepreneurial costs can be called opportunity costs. With any method of using resources, the costs that the manufacturing company bears in an unconditional manner can hardly be called alternative. Such non-opportunity costs do not take any part in the process of economic choice.

What is the difference between implicit and explicit costs?

If we consider the issue from an economic point of view, the concept of opportunity costs provides for their distribution into two groups: implicit and explicit.

Explicit costs are presented in the form of cash payments towards suppliers of various factors of production, as well as necessary intermediate products. In particular, there are several clear costs:

- Opportunity costs in the form of workers' wages.

- Cash costs for the purchase or rental of all kinds of equipment, machines, buildings, structures.

- Making payments for various transportation costs.

- Payment of utility bills.

- Payment for various services of banks and insurance.

- Payment for the services of suppliers of material resources.

What are implicit costs?

The implicit costs of alternative choice are all possible costs of using resources that belong to a given company, that is, they are unpaid costs.

They can be represented as follows:

- Payments that a company could receive if it used its resources more profitably. In particular, this can also include the salary that the entrepreneur could regularly receive if he worked elsewhere, lost profits, interest on capital that was invested in various valuable documents, as well as rent payments on the land used.

- Normal profit as the minimum reward for an entrepreneur that keeps him in a particular industry. For example, if a person is engaged in the production of fountain pens, and considers it quite acceptable to receive a normal profit in the amount of 15% of the capital that he has invested. Moreover, if the production of fountain pens will provide the entrepreneur with less than this profit, then in this case he will have to transfer his capital to other industries that will provide him with at least a normal profit.

- The implicit opportunity cost law provides that for the owner of capital, the implicit cost is the profit that he could have received if he had invested his own capital not in this, but in some other business. For example, for a peasant, who is the owner of the land, one can single out as such implicit costs the rent that he could receive if this land were leased to him.

Thus, the opportunity cost of production, in accordance with Western economic theory, includes the income of the entrepreneur, and it is considered as a payment for risk, which the entrepreneur is rewarded with, and is also stimulated to retain their own financial assets in this enterprise, without diverting them to the implementation of any or other purposes.

What is the difference between economic and accounting costs?

Production costs, which include average or normal profit, are various economic costs. Economic, or various time costs, in modern theory, are the costs of the company, which are carried out in the conditions of making the best economic decisions regarding the use of resources. This is the ideal to which the company should strive as much as possible. Of course, the actual picture of building total costs is slightly different, because any ideal will be difficult to achieve.

It is worth noting that economic costs are not equivalent to those that accounting operates. Accounting costs do not include the profit of the entrepreneur, which is reflected in such an indicator as the production possibilities curve. Opportunity costs of production, which operates in economic theory, in comparison with accounting differ in the assessment of internal costs. The latter, in turn, are associated with costs incurred through the use of own products in the production process. For example, a certain part of the grown grain crop is used to sow the company's land areas. The company will use such grain for internal needs, as a result of which it does not pay for it.

In accounting, internal costs should be accounted for in accordance with the cost price. However, from the point of view of the pricing of the produced goods, such opportunity costs must be estimated at the market price of the resource expended.

External and internal costs

Internal costs are associated with the use of some of our own products, which will later be processed into a resource for subsequent production.

External costs include the costs of funds that are required to purchase resources owned by people who do not own the company. It is these costs that will subsequently become the income of resource providers.

Production costs that are incurred in the process of manufacturing a product can be divided into categories not only depending on what kind of resources were used - the company itself or those that had to be paid for. There are also other opportunity costs. Production capabilities should be considered from all points of view in order to thoroughly calculate and establish the ideal efficiency of the entire system.

Average cost

In order to determine as clearly as possible the possible volumes of production at which the company will be able to protect itself from a significant increase in costs, a study of the dynamics of average costs is carried out.

It is worth noting the fact that Marx, based on this type of cost, completely constructed the concept of production prices, as well as the average rate of profit that falls on capital. This type of cost also exists in the accounting department of the company, however, its arsenal is an order of magnitude more voluminous, and the leading role in it is given to general and marginal costs. A thorough analysis of their structure and dynamics is needed in order to determine the optimal volume of production and establish possible boundaries for the movement of costs, under which production will still remain profitable.

For the manufacturer, not only gross, but also average costs are important, which are used for comparison with the cost that is mandatory indicated per unit of production.

The opportunity cost curve includes the average cost of deciding whether or not to produce a given product at all. In particular, if the cost, which is the average revenue per unit of output, is less than the average variable cost, then the company will be able to minimize its losses by shutting down its operations in the short term. If the price is below the level of average total costs, then in this situation the company begins to earn a negative economic profit, as a result of which, in principle, it should consider the prospect of final closing.

Time costs

A person does not have the opportunity to have everything that he would like, as a result of which he has to choose based on the amount of income. In the overwhelming majority of cases, people prefer to choose those products that can ultimately bring them maximum satisfaction.

To acquire a certain product, a person will need to give up something, because his capabilities are limited. What you have to give up when acquiring the chosen thing is usually called time costs. When purchasing a product, money is usually given in return, but in fact, in this case, it will be necessary to give up the desired thing that is next in value and which could be purchased for the same money.

Companies, like every person, also need to make a choice where it is best to spend the money that they have at the moment. For example, if for a certain product the opportunity costs are equal to the current profit, then it is clearly not worth developing this area. But at the same time, it is possible to build new facilities or reconstruct existing ones, or, perhaps, pay dividends to shareholders. In this case, the primary task of management is to correctly identify the most important problem, after which it will be necessary to direct all efforts to solve it.

But at the same time, it is worth remembering that the value of the cost of a missed opportunity represents the cash proceeds from the most profitable among all possible ways of using certain resources, and this should be the starting point.