Payers of insurance premiums, in accordance with Art. 419 of the Tax Code of the Russian Federation, are legal entities - employers that pay wages to individuals, as well as Individual entrepreneurs who are required to pay both for themselves and for employees.

Insurance premiums are paid for:

- compulsory pension insurance (OPS);

- compulsory health insurance (FOMS);

- compulsory social insurance - for temporary disability, "injuries" (FZ-125) and "motherhood".

The list of payments not subject to insurance taxation is contained in Art. 422 of the Tax Code of the Russian Federation.

Expert opinion

Andrey Leroux

More than 15 years of experience Specialization: contract law, criminal law, general theory of law, banking law, civil procedure

Enterprises and organizations that do not enjoy the right to preferential (reduced) tariffs make payments at general tariffs (Article 426 of the Tax Code of the Russian Federation).

The total amount of insurance premiums in 2019 cannot exceed 30%, of which:

- PFR - 22% on income up to the marginal base and + 10% on income above the base;

- MHIF - 5.1% without restrictions on limit values;

- OSS - 2.9% without restrictions on the upper limit.

The subjects of taxation will be citizens of the Russian Federation; foreigners legally working on the territory of Russia, but not being highly qualified workers (HQS) and citizens of the EAEU legally working on the territory of the Russian Federation.

Rates for foreign workers

Insurance premiums paid from the income of foreigners (but not citizens of the EFES) who are not HQS legally working in the Russian Federation are:

- Mandatory pension insurance - 22% + 10% over the base;

- OSS (VNiM) 1.8;

The rest of the fees are not paid.

For foreigners who are HQS:

- OPS - 22% + 10% over the base;

- OSS (VNiM) - 2.9%.

Other insurance premiums are not paid.

Table 1 - Insurance premiums for self-employed entrepreneurs in 2019

Reduced insurance premium rates in 2019

| Category of beneficiaries | Tariffs in 2019 |

| Companies implementing the results of intellectual activity | PFR - 20% FSS - 2.9% MHIF - 5.1% |

| Simplified non-profit and charitable organizations | PFR - 20% FSS - 0% MHIF - 0% |

| Skolkovo residents | PFR - 14% FSS - 0% MHIF - 0% |

| Residents of special economic zones | PFR - 6% FSS - 1.5% MHIF - 0.1% |

Contributions under GPC agreements

From the income of individuals working under a GPC agreement (of a civil law nature), contributions are paid only to the Pension Fund of the Russian Federation and the FFOMS.

In accordance with Chapter 34 of the Tax Code of the Russian Federation, contributions to the Social Insurance Fund in case of temporary disability and in connection with motherhood are not accrued, and to OSS from accidents at work and occupational diseases - only if this is provided for in the GPC agreement (Paragraph 4, clause 1, article 5 Law No. 125-FZ).

Non-contributory payments

Certain types of employee benefits are not subject to insurance premiums. For example, state benefits, compensation payments, financial assistance, tuition fees, payments in favor of foreigners, etc. (For more details, see Chapter 34 of the Tax Code of the Russian Federation).

Payment procedure

Payments are made monthly until the 15th day of the following month. If the last day of the payment period falls on a weekend or holiday, the payment is transferred to the next business day. You can pay from your current account on a payment order or in Sberbank. The tax website also has a personal account for the TIN, where the debt is reflected and you can print a receipt. Or you can get receipts from the tax office.

The question of what percentage of the salary goes to the pension fund in 2019 worries every working Russian. After all, it is these payments that make it possible to form the fund from which a citizen of the Russian Federation will receive his income upon retirement.

How does this happen?

If you are officially employed, then your employer, when paying your wages, automatically withholds a small part of it and pays it to various funds. This money that has been withheld from you is called income tax.

This fee is the main one, and it is from that that is displayed in all official documents, in particular, in the certificate in the form 2-NDFL. It is believed that the employee himself voluntarily makes part of the deductions from his income, and the employer in this situation is only a tax agent who helps him with the transfer. In fact, the role of the employee is very small, because the amount of money is charged without taking into account his opinion.

Note that not all income is taxable. The exceptions are:

- unemployment benefits,

- maternity allowance,

- severance pay upon retirement, dismissal,

- all kinds of compensation - for causing damage to health, for unused vacation days, etc.

Please note that you are entitled to a refund of part of the tax paid if you paid for your children's education, medical services or purchased real estate. We talk more about this deduction in this article.

The higher your salary, the higher the deductions will be. It is this money that will become your pension in the future. You yourself should be interested in finding a job with official employment as early as possible, as well as with a “white” salary in order to secure a comfortable old age.

Insurance premiums

In addition to tax deductions, which appear directly on your payroll and significantly affect the final amount you receive in your hands, there are also insurance deductions that your employer makes. These amounts are paid by management on their own, and they go to pension, medical and social insurance.

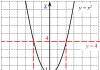

How is the calculation made? Based on the amount of salary that is indicated in your 2-NDFL certificates. What rates are used for this? They are shown in the table below:

So what percentage goes to payouts?

Today, only a 22% income tax is withheld from employees to the Pension Fund. Please note that his employer pays, in fact, the employee does not see this money, they are only in the reporting.

The contribution to the PFR, in the amount of 22% of the employee's salary, consists of:

- insurance (16%) part,

- funded parts (6%).

Six percent of the individual tariff (accumulative part) can be disposed of independently: transferred to a non-state pension fund, management company or invested.

For some industries in Russia, there are reduced percentages of deductions to the Pension Fund (in particular, for IT companies). Also, some categories of workers, on the contrary, have an increased rate, which is carried out by their employer. This applies to those categories of workers who are employed in hard work or work with harmful working conditions.

Also interesting is taxation for certain categories of citizens:

- Individual entrepreneurs who do not make payments to other individuals (self-employed, when there is only 1 person in the company), began to pay a fixed amount from 2018, which is calculated based on the result of the calendar year. Previously, the calculation was carried out according to the minimum wage.

- Employees who do not have Russian citizenship, but live in the territory of the Russian Federation, must also pay taxes. If they are highly qualified workers - 13%, if the patent is a fixed amount, specialists from the Eurasian Economic Union - 13%, and refugees also pay 13%.

Indexing

The funded pension is not indexed by the state, unlike the insurance one. In 2012, the funded part was temporarily frozen, as there were not enough funds in the Pension Fund and it was necessary to allocate money from the National Wealth Fund and the Federal budget.

Now 6% of the wage fund is directed to the payment of pensions, and not to savings. Such an operation allowed to save about 500 billion rubles in the budget for 2013-2014.

Due to the difficult economic situation, the moratorium has been extended until the end of 2018. Only citizens born before 1967 will not be able to pick up the funded part. Others are not affected by this decision.

What to choose: NPF or PFR?

Today, many people prefer to keep their money not in the state pension fund (PFR), but in a non-state one. The reasons are quite clear and understandable - they offer a larger amount of profitability.

What are the additional benefits? You are free to choose the company that will manage your funds. You will know in advance in which industries savings are invested, what percentage of income the organization has shown in recent years, you will be able to track the status of your account via the Internet, etc.

In addition, savings are inherited. And do not worry about the safety of your money - your payments from employers will be guaranteed by the state, i.е. even if the NPF loses its license for any reason, your funds will be transferred to the FIU.

What is the pension now?

It is calculated using special coefficients (points), which depend on the length of service, retirement age and the presence of a decree. Please note that only official income is taken into account!

Every person who has official employment forms his pension without fail. Currently, for each person, the total amount is divided into two equal parts, which is replenished by the employer - through the payment of taxes and contributions.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

These contributions to the pension fund must be made by each enterprise. Consider how you can track your savings, as well as the question of checking them.

What it is

Each employer must calculate and transfer contributions for workers to the FIU per month. In addition to the Pension Fund, it is also worth making contributions to the FSS and FFOMS.

The meaning of these payments is to make certain payments by the employer, and in the event of insured events in the fund where payments are made, they make a reverse withdrawal of funds in favor of the employee.

For example, when a person takes sick leave, the FSS pays an allowance, which should be transferred in case of temporary disability. The Pension Fund of Russia does the same when it is necessary to pay a pension upon reaching a certain age.

Here it is worth remembering that the employer must make pension and other types of contributions from his own funds, and he does not have the right to deduct these amounts from the employee's salary. With regard to pension contributions, they are divided into two categories: insurance pension and funded.

It should be noted that since 2014, payments have not been made in favor of the formation of the funded part, since all funds go to replenish the insurance part.

When is produced

Payments, which should go to replenish the pension savings of each person, must be made on the 15th day of each month. At this time, the employer pays contributions for the previous month.

In other words, if the employer makes contributions on October 15, then these contributions are made for the month of September worked.

Be sure to remember the timing of the deductions, so that subsequently the employees at the enterprise do not have disagreements with the employees of the Pension Fund.Who pays insurance premiums

Contributions to the FIU are required to be made by the following categories of persons and enterprises:

- Organizations making payments under any agreements in favor of individuals.

- IP: for persons in whose favor money was paid for work or services under contracts of any kind, as well as for themselves.

- Notaries, lawyers and other categories of self-employed citizens.

- Individuals, in situations where they make payments under any agreements, and in those situations where they do not act as sole proprietors.

Video: How to find out?

Tariffs in 2019

Despite the fact that changes in the legislative framework are constantly being made in the pension sector, the general rate for contributions to the Pension Fund of the Russian Federation does not change. For 2019, it is the same 22% of wages, provided that payments cannot exceed the annual limit.

If it is exceeded, then deductions are 10% of earnings.

Those individuals who pay their own contributions will also pay fixed contributions to the Pension Fund, which amount to 26% of the minimum wage. In this case, this amount is multiplied by 12 months.

It turns out that based on the actual size of the minimum wage, which is 7500 rubles, the total amount of the fixed contribution for the year will be 23400 rubles.

Additional tariffs for OPS

Additional tariffs for contributions to the Pension Fund are introduced for those employers who have jobs in hazardous industries. In other words, if they make contributions in favor of those persons who are entitled to receive a preferential pension.

The tariff should be determined in accordance with the given assessment of working conditions, as well as the assigned class.

Amounts not subject to taxation

It is worth remembering that, unlike the personal income tax, which is taken into account in accordance with bonuses, salaries and the district coefficient of the employee, the amount according to insurance premiums is not included in the salary. In other words, an employee at an enterprise receives a salary minus personal income tax.

As for the situation with the payment of funds to the FIU, the payer must transfer a certain amount based on income, while not deducting this amount from the salary.

How can I find out the amount of deductions to the Pension Fund from wages

The amount of deductions should depend on the status of the payer. For those enterprises that operate under the general taxation regime, it is 22% of earnings. 10% may also be added in situations where the amount of income is more than 800,000 rubles.

This amount should be calculated on the total amount of wages for each employee.

Organizations that use the simplified system must pay 20%. Individual entrepreneurs pay the same rate for their employees.Payment details

It is important to understand that for fruitful cooperation with the Pension Fund of Russia, you should definitely have the details for which you need to pay all contributions. If an employer or self-employed citizen makes a payment using incorrect details, then in this case it will be very difficult to prove that the payment was made on time.

And these deductions will be quite difficult to credit to the required account.

That is why we give a list of details for paying various categories of insurance premiums:

- To pay for the formation of the insurance part of the labor pension.

- To pay for the formation of the funded part of the pension.

- Contributions for compulsory medical insurance, which are credited to the budget of the FFOMS.

- Contributions for CHI, which are credited to the TFOMS budget.

Budget classification codes

In the following list, we provide budget classification codes for various types of insurance premiums transferred by employers and self-employed citizens:

- For payments for the formation of the insurance part of the pension - 39210202010061000160.

- For payments for the formation of the funded part of the pension - 39210202020061000160.

- Contributions for compulsory medical insurance, which are credited to the budget of the FFOMS - 39210202100081000160.

- Contributions for compulsory medical insurance, which are credited to the budget of the TFOMS - 39210202110091000160.

The procedure for transferring funds

All contributions are accrued by accounting staff, thus, all payments in favor of the employee are multiplied by the amount at the insurance rate. This formula is the same for each enterprise - it cannot depend on the taxation regime.

Accounting for the reporting period accrues 22% of the earnings of workers in the FIU. If the salary has reached the level of more than 624,000 rubles, then the tariff should be 10%. For example, if an employee receives 20,000 rubles every month, the accounting department charges 4,400 rubles every month.

For some enterprises preferential tariffs for insurance premiums are provided. For example, for the field of information technology, it should be 8%. As for the income of employees, employers pay contributions according to the increased tariff - 6% more.

This applies to those citizens who are employed in heavy production.

Term

It is important to remember that each company must comply with certain deadlines in order to make contributions on time. If there is a violation of these terms, then problems may arise when recalculating the full amount on the personal account of the employee, on which the insurance part is formed.

Payments must be made by the 15th of any month. In other words, payment is made for each previous month.

How to check by SNILS

Contributions to the FIU should be reflected in the individual account of each citizen. In other words, on a personal personal account. It is important to remember that in a situation where a person decides to use his funded pension, you can find out the amount of pension savings by the SNILS number.

In order to do this, you must contact the Pension Fund staff and provide all the necessary contact information to form a request.

Through the Internet

Do not forget that the pension contributions that were formed on the personal account of each person can also be checked through the specialized information portal "Gosuslugi". In addition, it is possible to order the necessary certificate on the official website of the PFR.

In order to find out the amount of your pension contributions, you must have your passport and SNILS on hand. At the same time, it is worth remembering that another person can find out all the necessary information on the state of the personal account only if there is a power of attorney.

It turns out that every Russian citizen who is officially employed has his own personal account with the Pension Fund of the Russian Federation, to which deductions are received from the employer. Each person has the full right to find out the status of a personal account at any time.

"Your OREOL" understood what changes had occurred with the funded part of the pension.

Tatyana Belousova

Today's pensioners on average receive a pension of 10-11 thousand rubles. It is clear that you will not show off much for this amount, therefore, those who are far from retirement, at least once, but thought about it - and not save up for old age? Moreover, the pension legislation allows this to be done. In one of the previous issues of "Your AREOL" we talked about the changes in the new year with the insurance part of the pension, in this one we will talk about the funded part.

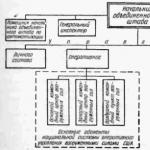

Block one

Retirement educational program (in the form of a diagram)

The employer transfers 22 percent of the employee's "white" salary to the Pension Fund.

6 percent - go to a fixed payment, which each pensioner receives as part of a pension.

10 percent are transferred to the insurance part of the pension, which has become a separate type of pension since January 1, 2015.

6 percent (for people born in 1967 and younger) is the funded part of the pension, which has now also become a separate type of pension.

For persons born older than 1967, all 16 percent go to the insurance part.

Historical digression

Since 2004, Russians born in 1967 and younger have had the right to independently manage their funded part, that is, transfer it to any non-state pension fund (NPF) or to a management company (MC). The money of those who did not want to play money games remained in the Pension Fund of the Russian Federation, and the State Management Company Vnesheconombank itself was engaged in the increment of this part of the pension savings of citizens.

What has changed?

Since January 1, 2014, future pensioners have been given the right to decide whether they want to keep the funded pension or transfer all employer contributions to insurance. The selection must be made by December 31, 2015.

If the so-called "silent people", that is, those who have never transferred money to the NPF, continue to be silent, then from 2014, contributions from their funded part will automatically be transferred to the insurance. Moreover, after 2015 they will not be able to transfer the funded part to NPFs.

At the same time, all previously formed pension savings from the “silent people” are preserved, continue to “work”, and will be paid out upon retirement.

Those who have at least once transferred money to an NPF or a management company also have a choice - to leave everything as it is, or refuse to form the funded part of the pension in favor of the insurance by writing a corresponding application. In this, the law does not limit them - such a transition can be made at any time.

Block two

There is a choice...

In the fall of 2013, the Government of the Russian Federation adopted a decision on the so-called "freeze" of the funded part of citizens. Simply put, contributions to the funded part for 2014 and 2015 of those Russians who chose NPFs and UKs were sent to the Pension Fund of the Russian Federation to form the insurance part.

Two years are allegedly given to the NPFs so that they build their work in a different way - they go through the corporatization procedure and enter the system of guaranteeing citizens' pension rights. It is very similar to a banal robbery, however, according to the manager of the Omsk branch of the Pension Fund of the Russian Federation Sergey Todorov, the government did not take such a step from a good life: did not appear. It was necessary to put things in order in this area.”

At the moment, not all NPFs have passed the corporatization procedure - according to unofficial data, only nine.

Of course, those who kept money in NPFs may have a question: what should I do if my company does not go through the corporatization procedure? You will have to transfer money to the one that will do this, or return to the Pension Fund.

True, there is one “but” - the Russian government is increasingly talking about the fact that the “freeze” will last at least until 2018. There is doubt that the joint-stock NPFs and MCs will survive until this year, and the entire funded system will not lose its relevance.

Favorable percentage

Today, both NPF and Vnesheconombank manage only those pension savings that they received from Russians before 2014. However, the yield leaves much to be desired.

For example, in the same VEB, the profitability in the fourth quarter of 2014 went negative, the loss amounted to 19 billion rubles. Data on NPF are not yet available. In any case, they can be found on the website of the National Association of NPFs.

Have women been hurt?

The Ministry of Labor and Social Protection of the Russian Federation has developed new rules for calculating the payment period and the amount of the funded part of the pension. They will be applied by both the Pension Fund of the Russian Federation and the NPF from 2016. Most importantly, women will receive less than men every month. This is due to the fact that the former live longer than the latter, and retire earlier. The amount of savings is divided by the time that the average man or woman lives after retirement. According to the official website of the Ministry of Labor of the Russian Federation, for men this period is 227 months, and for women - 270 months.

According to the federal press, the funded pension for Russian women will be 20 percent (or about 100 rubles) less than for men.

According to the current Russian legislation, the employer must make contributions to the Pension Fund from the wages of its employees. At the same time, many are interested in specific numbers, because often people want to keep all their income and expenses under control. In addition, the pension also depends on the amount of payments. Naturally, no one wants their income to drop significantly after a well-deserved rest. What contributions to the Pension Fund the employer pays from the salaries of employees Let's look at insurance premiums to the Pension Fund in more detail. Currently, 22 percent of their wages are withheld from employees in the FIU. Moreover, in this case, as mentioned above, the employer must pay. These are, in particular, individuals, individual entrepreneurs, enterprises and organizations. However, there is a category of citizens who must pay contributions to the Pension Fund on their own.

What percentage of our salary goes to the pension fund?

You yourself should be interested in finding a job with official employment as early as possible, as well as with a “white” salary in order to secure a comfortable old age. So what percentage goes to payouts? Today, only a 22% income tax is withheld from employees to the Pension Fund.

Please note that his employer pays, in fact, the employee does not see this money, they are only in the reporting. The contribution to the PFR, in the amount of 22% of the employee's salary, consists of:

- insurance (16%) part,

- funded parts (6%).

Six percent of the individual tariff (accumulative part) can be disposed of independently: transferred to a non-state pension fund, management company or invested.

For some industries in Russia, there are reduced percentages of deductions to the Pension Fund (in particular, for IT companies).

Payment of insurance premiums to the PFR

Home — Pension funds The question of what percentage of the salary goes to the pension fund in 2018 worries every working Russian. After all, it is these payments that make it possible to form the fund from which a citizen of the Russian Federation will receive his income upon retirement.

Attention

How does this happen? If you are officially employed, then your employer, when paying your wages, automatically withholds a small part of it and pays it to various funds. This money that has been withheld from you is called income tax.

Info

Please note that you are entitled to a refund of part of the tax paid if you paid for your children's education, medical services or purchased real estate. We talk more about this deduction in this article.

The higher your salary, the higher the deductions will be. It is this money that will become your pension in the future.

What percentage of the salary is deducted to the pension fund?

Important

Today, many people prefer to keep their money not in the state pension fund (PFR), but in a non-state one. The reasons are quite clear and understandable - they offer more yield.

What are the additional benefits? You are free to choose the company that will manage your funds. You will know in advance in which industries savings are invested, what percentage of income the organization has shown in recent years, you will be able to track the status of your account via the Internet, etc.

In addition, savings are inherited. And do not worry about the safety of your money - your payments from employers will be guaranteed by the state, i.е. even if the NPF loses its license for any reason, your funds will be transferred to the FIU.

Saving for old age is unprofitable?

If for the entire period of employment or a certain period of time the employer did not deduct funds to the FIU, you can draw up a complaint and send it to the labor inspectorate, which also accepts electronic applications, or to the tax service, which the company is servicing, by territorial attribute. How much is deducted from the salary to the Pension Fund was discussed in detail in this article.

- 04.12.2017

Read also

- How to fill out section 2 of 6-personal income tax? Rules for filling out the form 6-NDFL

- VAT on marketing services.

The cost of marketing services

- Tax period in the VAT return.

How contributions are made to the pension fund of the Russian Federation from salaries and their percentage

See also: How much is the minimum and average salary in Crimea How can you check the deductions to the Pension Fund Now let's talk about whether it is possible to make sure that the employer really fulfills his obligations in terms of insurance premiums in good faith. It is quite simple to do this - through the website of the State Service. Here you will first need to go through a simple registration procedure and fill in all the fields. After that, you will have access to all the features of this resource.

Next, we go to the Personal Account and type in the search bar “Checking the pension account”. You will be redirected to the official website of the FIU. Now you need to enter the login and password under which you were authorized on the State Services portal.

Going to the Personal Account already on the website of the Pension Fund, select the section "About pension rights". You can also take a different, more difficult path.

Percentage and rates of contributions to the PFR in 2017

The main news since the beginning of 2017 in the accounting field was the information that the management and regulation of all insurance premiums, namely pension, social and medical insurance, were transferred from the relevant authorities to the Federal Tax Service. This decision of the government is due to the reduction and streamlining of reporting.

How much is deducted from the salary to the Pension Fund? This is a common question. Let's figure it out. Since January 1, 2017, the Federal Tax Service (FTS) has been monitoring the deductions to the treasury for all contributions, processing and analyzing this information, as well as debt collection processes.

How much is deducted from the salary to the pension fund? percentage of deductions in the Pension Fund of the Russian Federation

Through the Internet Do not forget that the pension contributions that were formed on the personal account of each person can also be checked through the specialized information portal "Gosuslugi". In addition, it is possible to order the necessary certificate on the official website of the PFR. In order to find out the amount of your pension contributions, you must have your passport and SNILS on hand. At the same time, it is worth remembering that another person can find out all the necessary information on the state of the personal account only if there is a power of attorney.

It turns out that every Russian citizen who is officially employed has his own personal account with the Pension Fund of the Russian Federation, to which deductions are received from the employer. Each person has the full right to find out the status of a personal account at any time.

Contributions to the pension fund

What needs to be submitted this year? Thus, from January 2017, it is only necessary to provide: - a report is submitted to the Social Insurance Fund on injuries at work and on the issue of special attestation of workplaces; - in the Pension Fund of the Russian Federation - the old type of reporting on SZV-M and the new reporting on the form of SEV-experience. Deadlines: — ESSC — before the 30th of the month following the reporting period; - FSS - up to the 20th in paper format and up to the 25th on electronic media following the reporting month; - SZV-M - until the 15th; - CMEA experience - by March 1, 2018. Reason for refusal of contributions There are situations when an employer may not pay contributions for an employee:

- The organization is obliged to pay for the employee only in the case of official employment, that is, when an employment contract is concluded and signed.

Pension fund 22 percent

The deduction from the salary is 13%, and in this example - 910 rubles. Why does an ordinary employee need to know about deductions? The category of citizens that controls the timely enrollment in the Pension Fund of the Russian Federation can be sure that their future pension will not suffer. Such a check can be carried out every three months, requiring the accounting department to provide information on the payment of contributions in writing. Sometimes employees feel embarrassed in front of their superiors, therefore they do not require such confirmation from the accounting department and do not use their legal right, in accordance with Art. fourteen

Federal Law "On Individual Accounting for Compulsory Pension Insurance". Rates, which include mandatory and additional As we have already found out, the 22 percent rate of transfers from salaries to the Pension Fund is mandatory for everyone, except for beneficiaries.

Every person who has official employment forms his pension without fail. Currently, for each person, the total amount is divided into two equal parts, which is replenished by the employer - through the payment of taxes and contributions. These contributions to the pension fund must be made by each enterprise. Consider how you can track your savings, as well as the question of checking them. What it is Each employer must calculate and transfer contributions for workers to the FIU per month. In addition to the Pension Fund, it is also worth making contributions to the FSS and FFOMS. The meaning of these payments is to make certain payments by the employer, and in the event of insured events in the fund where payments are made, they make a reverse withdrawal of funds in favor of the employee.