Now a few words about how publishers themselves check the circulation and number of readers of their magazines. As a rule, companies are in no hurry to place advertisements in publications that ignore the need for independent assessments of readership. In journal terminology, the concept of “reader audience” is interpreted in two ways. On the one hand, this refers to the time spent reading the magazine. On the other hand, and this is what we will talk about below, the readership is all readers (as opposed to buyers) of the publication.

Bureau of Circulation Control

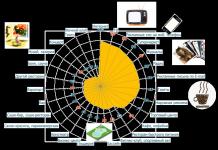

The Bureau of Circulation Control (CCB) is the largest of several watchdog organizations dedicated to determining the true circulation of American printed publications. BKT provides two services: it compiles “Publisher Reports” containing data on circulation for six months (as of June 30 and December 31), and conducts a BKT audit - an annual check of data from “Publisher Reports”. The TUC takes into account total circulation of publications, as well as circulation by state, district and issue over a six-month period. The method of distribution of circulation shares - by subscription or retail - and the discounts and bonuses provided to subscribers is also indicated. In Fig. 11.6 shows a sample "Publisher's Report".

TUC reports contain only dry figures about the primary readership. They say nothing about the products consumed, reader demographics, or the magazine's secondary audience. As we showed in the previous section, the TUC maintains its position regarding the definition of paid circulations. This aspect once again emphasizes the importance of independent ratings for publishers and advertisers.

Syndicated readership research

Advertisers, of course, are primarily interested in magazine buyers and subscribers. But, in addition, it is important for them to know what kind of people they are, what other goods they buy, and who else they give magazines to read. Currently, syndicated readership research is primarily conducted by two organizations: A&S/Simmons Magazine Metrics and Madia mark Research, Inc. (MR I).

The MRI technique is as follows. A sample of approximately 20,000 households is drawn and respondents' media use, demographic characteristics and product preferences are identified. In individual interviews, respondents are shown cards with the logos of the journals being tested. Study participants are asked how long it has been since they read a particular magazine. This approach is called the recent reading method. Its final result is an assessment of the size of the readership and a list of goods consumed by it.

A&S/Simmons is a joint venture between two research organizations: Audit and Surveys Worldwide and Kantar Media Research. The latter includes the Simmons Market Research Bureau (SMRB), which conducts mail surveys of readers and collects information about the audiences of more than 600 magazines.

Consumer magazines: summary

As we see, consumer magazines have many problems to solve and new opportunities to exploit. We are also referring to practical issues such as the control of production and distribution costs, and to the problems of integrating conventional journal practice and the Internet. The magazine market is in a state of constant change.

Rice. 11.6.

Despite the existing difficulties, magazines have a strong position in the communication environment of the 21st century. As shown in table. 11.3, magazines are read by the wealthiest Americans. Interestingly, magazines are also very popular among Internet users. Given the selective nature of most publications, there are great opportunities for effective convergence. But even if we leave aside new technologies, magazines still remain one of the main marketing and advertising tools.

Table 11.3. Portrait of the “average” magazine reader Respondents: people who read 5 or more magazines in the past month. Sum exceeds 100% due to overlapping responses

A magazine can be both the main vehicle for a national advertiser and a niche channel to reach the most likely buyers. Magazines will continue to be an important source of news, information and entertainment for millions of consumers. It is the combination of prestige and segmentation capabilities that gives magazines their main qualitative advantage over most other media. Another important fact for advertisers is that a significant part of the financial costs of magazines is offset by readers, not advertising.

A combination of factors such as affluent readership, in-depth coverage of the subject matter, broad and frequent coverage of a range of qualitative and quantitative consumer segments, and importance to advertisers will work to the benefit of magazines in the future. However, in addition to these positive characteristics, publishers will have to overcome a number of economic problems. Some of these, such as increases in postage and retail distribution costs, are beyond their direct control. In the long term, the future of magazines as a medium may depend not only on the number of readers, but also on financial elements.

Panel research is a type of research that involves a fixed sample of elements of a population whose characteristics are measured repeatedly. The sample remains unchanged over time, providing a series of pictures that, taken together, provide a vivid illustration of the situation and the changes that have occurred.

A panel is a sample of respondents who have agreed to provide information at specified intervals over an extended period of time.

Cohort analysis - Multiple profile research consisting of a series of surveys conducted over certain time periods.

Cohort is a group of respondents in whom the same events occur within the same time interval.

An omnibus study (survey) conducted by an independent research company at its own expense, in which several different interested customers can participate, paying for the inclusion of only those questions that are of direct interest to them.

The timing of the study, population, volume and sampling procedure are determined independently by the research company

Information services offered by marketing research organizations that provide information from a common database by various firms to companies that subscribe to their services.

Syndicated research. Information services offered by marketing research organizations that provide information from a common database by various firms to companies that subscribe to their services

30. Omnibus Research and Syndicated Research.

An omnibus study (survey) conducted by an independent research company at its own expense, in which several different interested customers can participate, paying for the inclusion of only those issues that are of direct interest to them. The timing of the study, population, size and sampling procedure are determined by the research company independently

Syndicated Research - Information services offered by marketing research organizations that provide information from a common database to various firms and companies that subscribe to their services.

31. Concept, types and scope of application of expert methods for obtaining and evaluating marketing information.

Expert assessment methods

The essence of the expert assessment method is that experts carry out an intuitive-logical analysis of the problem with a quantitative assessment of judgments and formal processing of the results.

The generalized expert opinion obtained as a result of processing is accepted as a solution to the problem.

Principles of conducting IEE

Scientifically based organization of all stages of the examination

Application of quantitative methods

Two classes of problems

Problems for which there is sufficient information potential

Problems for which the information potential of knowledge is insufficient to ensure confidence in the validity of these hypotheses

Areas of application of MEO

Compiling a list of possible events in various areas over a certain period of time;

Determination of the most probable time intervals for the occurrence of a set of events;

Determination of management goals and objectives, ordering them by degree of importance;

Determination of alternatives (options for solving a problem with an assessment of their preferences;

Alternative distribution of resources for solving problems with an assessment of their preference;

Alternative options for making decisions in a certain situation with an assessment of their preference.

Interview method

Conversation between a forecaster and an expert (question and answer) according to a pre-developed program.

The success of the assessment depends on the ability of the expert to give impromptu opinions on various issues.

Analytical method

Thorough independent work by an expert to analyze trends, assess the state and development paths of the predicted object.

The expert can use all the information he needs about the forecast object. He draws up his conclusions in the form of a memorandum.

Group methods

The working group appoints experts who provide answers to the questions raised regarding the prospects for the development of this facility.

Number of experts: from 10 to 150 people, depending on the complexity of the object.

The purpose of the forecast is determined, questions for experts are developed.

Peculiarities

Using a collection of ratings of relative importance made by experts in each of the areas of research being assessed.

The importance rating is expressed in points and can take values from 0 to 1, from 0 to 10, from 0 to 100, etc.

Brainstorm

First, generating ideas

Then their destructuring (destruction, criticism) with the promotion of counter-ideas and the development of a consistent point of view.

Six participants, each of whom must write down three ideas within five minutes.

The leaf goes around in a circle. In half an hour, each expert will write down 18 ideas, and all together - 108

An individual survey of experts is carried out in the form of questionnaires.

Statistical processing and formation of a collective opinion of the group, arguments in favor of various judgments are identified and summarized.

The processed information is communicated to experts, who can adjust the assessments, while explaining the reasons for their disagreement with the collective judgment. This procedure can be repeated up to 3-4 times.

As a result, the range of assessments is narrowed and a consistent judgment is developed regarding the prospects for the development of the object.

Features of the Delphi method

Anonymity of experts (members of the expert group are unknown to each other, interaction between group members when filling out questionnaires is completely excluded).

Possibility of using the results of the previous round of the survey.

Statistical characteristics of group opinion.

Commission method

Groups of experts at a round table discuss a particular problem in order to harmonize points of view and develop a common opinion.

The disadvantage of this method is that the group of experts in their judgments is guided mainly by the logic of compromise.

Scripting method

Based on determining the logic of a process or phenomenon over time under various conditions.

Morphological analysis

Systematized consideration of the characteristics of an object using the “morphological box” method, which is built in the form of a tree of goals or a matrix in the cells of which the corresponding parameters are entered.

Connecting a parameter of the first level in series with one of the parameters of subsequent levels is a possible solution to the problem.

The total number of possible solutions is equal to the product of the number of all parameters presented in the “box”, taken by row.

Through permutations and various combinations, it is possible to develop probabilistic characteristics of objects.

32. Focus group as a tool for collecting primary data.

A focus group is an unstructured interview that a specially trained facilitator casually conducts with a small group of respondents.

The purpose of the FG is to obtain an idea of what a group of people representing a specific target market thinks about the problems of interest to the researcher

Tasks solved by the FG:

· Determination of customer preferences and their attitudes towards this product

· Obtaining opinions on new product ideas

· Presenting new ideas for existing products

· Opinions on price

· Obtaining preliminary consumer reaction to certain marketing programs

Methodological tasks of MI:

· More precise definition of the marketing research problem itself

· Development of alternative management solutions

· Developing an approach to solving the problem

· Obtaining information useful in creating questionnaires for consumer surveys

· Developing hypotheses that can be tested quantitatively

· Processing of previously obtained quantitative results

Features of focus groups

Composition: Homogeneous with pre-selection of respondents

Setting: Informal, relaxed atmosphere

Time: 1-3 hours

Recording: Audio and video recording

Requirements for the presenter

· Tolerance

· Invitation to participate

· Incomplete understanding

· Encouragement

Flexibility

Sensitivity

FG process

· Definition of the task and problem of MI

· Specifying the problem of qualitative research

· Formulation of the problem to be considered during the focus group

· Drawing up a questionnaire for selecting FG participants

· Development of a plan for conducting the FG (incl. Type of FG)

· Conducting FG

· View recording and analyze data

· Information processing and reporting

· Conducting FG

· Preliminary briefing

· Introduction of participants and information about them

Setting the discussion context

· Main discussion

· Questions from observers

Observation of the FG

· Preliminary preparation

· Observation from the very beginning

· Focus on the big picture

· Attention to the words of each participant

· Attention to comments

· No hasty conclusions

· Judgments about the personalities of participants should not influence their statements

· Avoid the opinions of dominant participants

Incentive reward

· Fee paid to the respondent for participation in the FG. Depends on the degree of complexity of respondent selection

The number of FG depends

· The nature of the object of study being discussed

· Number of market segments

· Number of new ideas proposed by groups

· Time and money

· Two-way interview

· With two leading

· With two leading opponents

· With a leading respondent

· With the customer as a participant

Mini-groups

· Remote focus group

Advantages of FG

· Synergy effect

Snowball effect

· Stimulate discussion

· Safety

· Spontaneity

· Serendipity

· Specialization

Meticulousness

· Structure

· Speed

Disadvantages of FG

· Incorrect use

· Incorrect assessment

· FG management

· Disorganization

· Non-representativeness

33. Requirements for a focus group leader.

Presenter: Observant and communicative

Requirements for the presenter

· Kindness and determination

· Tolerance

· Invitation to participate

· Incomplete understanding

· Encouragement

Flexibility

Sensitivity

34. Limitations of the focus group method.

Limitations of the Focus Group Method

The main problems of the focus group method are centered around the personality characteristics of the discussion participants. Respondents involuntarily perform many destructive roles that interfere with the effective receipt of information. This is a significant disadvantage of focus groups in comparison with a related research method - in-depth interviews. Only very experienced moderators are able to keep the discussion within the boundaries of the developed scenario and lead it to the full achievement of its goals.

During focus groups, it is quite difficult to identify deep motivations, since participants are not always ready to express relationships that characterize them from their weak points. Often, the true motivations of focus group participants are hidden behind a psychological defense mechanism. When in a focus group, participants often strive to look like experts on the issues being discussed, delving into discussions of the obvious properties of products and not reflecting their own deep motivations.

Conventional wisdom holds that high cost is an obvious disadvantage of the focus group method. We can agree with this, given that the average cost of organizing a focus group in Moscow exceeds 50,000 rubles.

35. Projection methods for collecting primary data.

Projection methods are represented by a whole group of interview techniques, including:

· associative projection methods;

· completing a sentence or drawing;

· role-playing;

· retrospective conversations.

Associative projection methods involve associative conversations (what thoughts do you have in connection with a particular event, object, etc. or associative testing of words, when the respondent is offered a set of words, and he must pronounce the association. The area of use of the method is identifying associations, arising with a specific name, event, action, invention.

Sentence or picture completion is a projection method technique in which the respondent is asked to complete a phrase or picture. The scope of use of the method is to obtain information about the feelings or reactions of potential consumers regarding a product or its brand.

Role-playing is a projection method technique in which subjects are asked to take on the role of one of the participants in the situation and describe the proposed actions. The area of use of the method is the study of hidden human reactions to the proposed role, the study of the values of potential consumers.

Retrospective interviews use a technique in which the respondent is asked to recall certain events in his life. The scope of use of the method is to identify factors that determine the behavior of potential consumers.

36. Observation as a tool for collecting primary data.

Observation

Collecting information by recording objects, events, situations or people's behavior

Observation

Used

· To determine quantitative characteristics of behavior that are inadequately recorded through self-report

· For behaviors that respondents are unable or unwilling to report

Surveillance Options 1

Situation:

Natural

· Artificially created

Natural (field) observation

Observing people, situations, objects or events without observers intervening or interacting with them

Applicable for:

Counting the number and types of people visiting a particular establishment and then recording the total number and types of orders made by them

Observations on the behavior of bank tellers

Observations of the behavior of consumers buying specific types of products, time to read instructions on packaging

Records the amount of time shoppers spend in a store looking at different display options.

Laboratory observations

Recording a target behavior or event in the context of a simulated situation

Observation Examples

· "Mystery shopper"

· Commercial tests

Mystery shopper

Information about the event:

· With opening

· Without opening

Return of goods:

· Returnable

· No return

Surveillance Options 2

Observer presence:

· Open

· Hidden

Open surveillance

The subject of the study is aware of the presence of the observer

Covert surveillance

The object is not informed of the presence of the observer

Surveillance Options 3

Data recording form:

· Structured

Unstructured

Structured form

Recording is carried out on a special form, which is possible if it is known in advance about the types of information that the researcher receives and the behavior that he observes

Unstructured form

Data recording is carried out in narrative form

Surveillance Options 4

Use of technical means:

· Using technical means

Surveillance Options 5

· Content analysis

· Trace analysis

· Retail audits

Content analysis

Objective, systematic recording of quantitatively determined characteristics of the main parameters of the communicative connection of elements of the observed object

Application

Scientific content analysis

Applied content analysis

Trace analysis

A technique in which information is collected from physical signs or evidence of past events

Q-sort

A method for selecting information about consumers’ attitudes and opinions about themselves, brand and product users, product categories, advertisers and advertising

37. Mystery shopping method. Its types and features.

Mystery shopper

A method of evaluating staff performance in which the inspector acts as a buyer, and the person being inspected does not know about it.

Information about the event:

· With opening

· Without opening

Return of goods:

· Returnable

· No return

Objects of research

The objects of the study are salespeople and consultants at retail outlets, telephone managers and consultants, online consultants on the website (using instant messaging, voice and video communication), managers processing applications by e-mail and through the order form on the website.

Evaluation criteria

compliance by employees with etiquette standards (friendliness, friendliness, etc.);

· speech of employees (literacy, politeness, clarity);

· appearance of employees in terms of neatness and compliance with the company’s corporate style;

· compliance by employees with accepted company standards;

· cleanliness and order in the premises and at employee workplaces;

· merchandising;

· speed of service;

Availability of employees for the client.

· Audits may also assess product knowledge and sales skills. However, it is necessary to understand that this method does not replace, but is additional to, other procedures for assessing personnel performance, such as certifications, expert assessments, testing, observation, etc.

Additional options for checks

· Test purchase. During the inspection, a test purchase may be made. In this case, an additional document that allows you to control the work of the secret shopper is a cash receipt.

· Voice recording of the conversation.

· Photos and video recordings.

To organize the collection and processing of information during such research, companies often resort to specialized online reporting systems, which allow them to improve the quality of information, reducing the human factor, and automate the routine work of processing and collating a large amount of data received from field personnel. As a rule, a mystery shopper has access to such a program using the Internet and a browser - he enters the collected information and submits reports online. Managers and clients immediately see the received information and can analyze it.

The norms, standards and ethics for conducting mystery shopping research are developed and regulated by the International Mystery Shopping Providers Association (MSPA) and independent companies, and employees of the audited sites must be warned in advance that they will be periodically audited by mystery shoppers for a certain period. , and the results of mystery shopping checks should not serve as a basis for punishment or dismissal of employees.

In the Russian Federation, the activities of mystery shopping service providers are virtually unregulated. MSPA does not have effective mechanisms for monitoring the quality of services provided in the Russian Federation and the CIS, therefore, in the Russian market, users of the “mystery shopper” service have to independently check the quality of services, as a rule, focusing on the recommendations of colleagues, through holding competitions when choosing a contractor, checking whether the company -contractor member of MSPA.

38. Content analysis as an observational method.

Content analysis is an objective, systematic recording of quantitatively determined characteristics of the main parameters of the communicative connection of elements of the observed object

Application

· Scientific content analysis

· Applied content analysis

Stages of applying content analysis

· First stage

Defining the set of sources or messages being studied using a set of specified criteria that each message must meet:

Second stage

Formation of a sample set of messages. In some cases, it is possible to study the entire set of sources determined at the first stage, since the cases (messages) to be analyzed are often limited in number and are well accessible. However, sometimes content analysis must rely on a limited sample taken from a larger body of information.

· Third stage

Identifying units of analysis. They can be words or themes. The correct choice of units of analysis is an important component of the entire work. The simplest element of a message is a word. A topic is another unit that is a separate statement about a subject. There are fairly clear requirements for choosing a possible unit of analysis:

it must be large enough to convey meaning;

it should be small enough not to express many meanings;

it must be easily identifiable;

the number of units must be so large that they can be used to make

· Fourth stage

Identification of counting units, which may coincide with semantic units or be of a specific nature. In the first case, the analysis procedure comes down to counting the frequency of mention of the selected semantic unit; in the second, the researcher, based on the analyzed material and the goals of the study, himself puts forward units of counting, which can be:

physical extent of texts;

text area filled with semantic units;

number of lines (paragraphs, characters, columns of text);

duration of broadcast on radio or TV;

footage of film for audio and video recordings,

the number of drawings with a certain content, plot, etc.

· Fifth stage

Direct calculation procedure. In general, it is similar to standard methods of classification according to selected groupings. The compilation of special tables, the use of computer programs, special formulas, and statistical calculations are used.

· Sixth stage

Interpretation of the results obtained in accordance with the goals and objectives of a particular study. Usually at this stage, such characteristics of the text material are identified and evaluated that allow one to draw conclusions about what the author wanted to emphasize or hide. It is possible to identify the percentage of prevalence in society of subjective meanings of an object or phenomenon.

Quantitative Content Analysis

Quantitative content analysis (also called substantive analysis) is based on the study of words, topics, and messages, focusing the researcher's attention on the content of the message. Thus, when planning to analyze selected elements, one must be able to anticipate their meaning and determine each possible observation result in accordance with the expectations of the researcher.

What this means, in effect, is that as a first step in conducting this type of content analysis, the researcher must create a sort of dictionary in which each observation will be defined and categorized accordingly.

Qualitative content analysis

In addition to words, topics and other elements that denote the content of messages, there are other units that allow for qualitative or, as it is also called, structural content analysis. In this case, the researcher is interested not so much in what is said, but in how it is said.

For example, the task may be to find out how much time or print space is devoted to a subject of interest in a particular source, or how many words or newspaper columns were devoted to each of the candidates during a particular election campaign.

On the other hand, other, perhaps more subtle, issues related to the form of the message may be taken into account: whether a particular newspaper message is accompanied by a photograph or some kind of illustration, what the size of the headline of a given newspaper message is, whether it is printed on the front page or placed among numerous advertising messages. When answering such questions, the researcher's attention is focused not on the subtleties of the content, but on the way the message is presented. The main issue here is the presence or absence of material on the topic, the degree of its emphasis, its size, and not the nuances of its content. The result of such an analysis is often much more reliable measures than in the case of content-oriented research (since formal indicators are less inherent in ambiguity), but, as a consequence, much less meaningful.

The totality of information that will be obtained during the study

39. Questionnaire as a marketing research tool

40. In-depth interviews as a tool for collecting primary data.

There are a huge number of different research methods and techniques for collecting primary information. The main sources of obtaining marketing information are:

- Interviews and surveys; Registration (observation); Experiment; Panel; Expert assessment.

Interview (survey)- finding out people’s positions or obtaining information from them on any issue. A survey is the most common and essential form of data collection in marketing. Approximately 90% of studies use this method. The survey can be oral (personal) or written.

Personal (Face-to-face) and telephone surveys are usually called interviews. Face-to-face interviews can be formal or informal. In-depth interviews and hall tests refer to individual informal interviews. Individual informal interviews are conducted with the respondent one-on-one in the form of a dialogue, while the respondent has the opportunity to express detailed judgments on the problem under study.

In-depth interviews - are a series of individual interviews on a given topic, conducted according to a discussion guide. The interview is conducted by a specially trained, highly qualified interviewer who is well versed in the topic and masters the techniques and psychological techniques of conducting a conversation. Each interview lasts 15-30 minutes and is accompanied by the active participation of the respondent - he lays out cards, draws, writes, etc. In-depth interviews, unlike structured interviews used in quantitative surveys, allow you to penetrate deeper into the psychology of the respondent and better understand his point of view, behavior, attitudes, stereotypes, etc. In-depth interviews, despite the large time investment (compared to focus groups), turn out to be very useful in situations where the atmosphere of group discussion is undesirable. This may be necessary when studying individual problems and situations that are not usually discussed in a wide circle, or when individual points of view may differ sharply from socially approved behavior - for example, when discussing issues of gender relations, sex, certain diseases, hidden political beliefs, etc. .p. In-depth interviews are used when testing and developing initial advertising developments (creative ideas), when it is necessary to obtain direct, individual associations, reactions and perceptions - without regard to the group. In this case, the optimal combination is the method of in-depth interviews and focus groups with the same respondents. And finally, in-depth interviews are indispensable when conducting qualitative research, when the characteristics of the target group make it impossible to collect respondents for a focus group - i.e. at one time in one place for 2-3 hours. For example, when we are talking about busy businessmen, wealthy citizens, narrow professional groups, etc.

41. Online research. Comparison with traditional methods of information collection.

What is the difference between offline and online qualitative research? Everyone has

them in more detail.

Traditional qualitative research (offline)

1) During an offline focus group you can use the product (try it

taste, smell, etc.)

3) The researcher and the customer can observe and analyze non-verbal

participants' behavior

5) Face-to-face interaction allows you to experience a synergistic effect when the result of group interaction is always greater than the sum of individual efforts.

- Specialty of the Higher Attestation Commission of the Russian Federation08.00.10

- Number of pages 147

1. SYNDICATE LENDING AS A SOURCE OF FINANCIAL RESOURCES FOR ENTERPRISES.

1.1. Features of credit relations between enterprises and the banking sector.

1.2. The essence and specificity of syndicated lending.

1.3. The role and place of syndicated lending in the modern Russian economy.

2. WAYS AND WAYS OF SOLVING PROBLEMS OF DEVELOPMENT OF SYNDICATE LENDING.

2.1. Analysis of foreign experience in syndicated lending and the possibility of its application in Russia.

2.2. Organization of syndicated lending in Russian banks.

2.3. Syndicated lending risk management.

Recommended list of dissertations in the specialty "Finance, money circulation and credit", 08.00.10 code VAK

Entry of Russian companies into international capital markets by attracting international syndicated loans 2008, Candidate of Economic Sciences Aronov, Boris Bakhbievich

Formation and development of an effective mechanism for organizing syndicated lending in the Russian Federation 2009, Candidate of Economic Sciences Semenova, Anastasia Viktorovna

Syndicated loans and Eurobonds as forms of attracting external debt financing by Russian banks 2007, Candidate of Economic Sciences Korchminsky, Alexander Vladimirovich

New banking products and their implementation in the Russian economy 2009, Candidate of Economic Sciences Ivanov, Artem Aleksandrovich

Organization of syndicated lending in Russia 2004, Candidate of Economic Sciences Grigorieva, Olga Mikhailovna

Introduction of the dissertation (part of the abstract) on the topic “Syndicated lending to enterprises in modern conditions”

Relevance of the research topic. The problem of lack of investment remains relevant for the modern Russian economy. The depreciation of fixed assets in some industries has reached a critical threshold, which is due to the insufficient investment capabilities of enterprises. The investment needs of the real sector of the economy to expand capital investments and increase working capital require the creation of an effective credit system and its improvement. Bank lending helps revitalize the economy and make it competitive. However, the ability of banks to provide investment loans is limited by a lack of internal long-term resources and high credit risks.

Few Russian banks alone are capable of providing the large volume of loans necessary to meet the needs of enterprises. In this regard, syndicated lending to Russian enterprises as Russian ones is relevant; and foreign banks. The experience of foreign countries gives grounds to assert that it is the development and improvement of syndicated bank lending that will become one of the significant factors in the growth of investment in the fixed capital of enterprises, as well as overcoming the raw material orientation of the Russian economy through its diversification and the realization of competitive advantages. The development of syndicated loans will allow banks to expand the tools of their active operations and optimize risk management. This will strengthen, on the one hand, the functional role of banks in the Russian economy, and on the other, create conditions for strengthening their financial stability.

The problems of using a syndicated loan for lending to enterprises necessitate a scientific understanding of the most important aspects of its theory and practice. The study of the theoretical foundations of this financial instrument was quite limited. In this regard, there is a need to analyze the specifics of syndicated lending, its place and role in the theory and practice of credit, identify its inherent risks, develop measures to minimize them and create a system of state regulation.

The degree of development of the problem. Recently, scientific research has appeared on the problems of bank lending and investment, to one degree or another, affecting syndicated lending. In the domestic economic literature, general aspects of syndicated lending are considered by Dovgyallo M., Zhemchugov A., Lavrushin O., Matovnikov M., Mekhryakov V., Pivkov R., Sukhushina G. Abroad, issues of lending and investment are covered in scientific publications of such authors as Anderson A., Weaver P.M., Kingsley G.D. Among the works of foreign authors studying syndicated lending, Robert P. McDonald, Peter Gabriel, Norton J.J., Tony Rhodes, Barry Howcroft, Christine Solomon, Andrew Fight should be highlighted. The analysis of Russian literature on lending problems shows that the theoretical and practical aspects of syndicated lending have not yet been sufficiently studied.

Purpose and objectives of the study. The main goal is to justify the syndicated loan as an important source of resources for the real sector of the economy, to identify the limiting factors of its development, to develop the necessary ways to minimize them, aimed at strengthening its role in the modern Russian economy.

To achieve the goal, the following tasks were set and solved in the study: to determine the essence of a syndicated loan and to clarify the conceptual apparatus associated with it; identify the place and role of a syndicated loan in the system of credit relations and the factors of its development; propose and justify methodological approaches to assessing the creditworthiness of syndicated lending participants; justify proposals for improving the regulatory framework for syndicated lending in Russia; analyze foreign experience in syndicated lending and the possibility of its application in Russia; identify specific risks inherent in syndicated lending and develop recommendations for minimizing them.

The object of the study is a syndicated loan, which has become widespread in economically developed countries.

The subject of the study is the organization of a syndicated loan in Russia, as one of the most important sources of financial resources for business entities, and the identification of the reasons for its insignificant volumes.

Theoretical and methodological basis of the study. The theoretical basis of the study was the works of famous foreign and domestic scientists on economics, finance, credit theory, devoted to issues of banking and syndicated lending.

A step-by-step system analysis of the organization of the syndicated lending process, its patterns and cause-and-effect relationships at the micro and macro levels was used as the methodological basis for the study. Based on statistical data, the work provides a comparative analysis of the use of syndicated loans in Russia and abroad.

The information base for the study was data from the State Committee of the Russian Federation on Statistics, reference information materials and publications of the Bank of Russia, the Ministry of Economic Development and Trade of the Russian Federation, central banks of the near and far abroad, as well as rating and information agencies (AKM, Interfax, RosBusinessConsulting) and other databases . Loan and security agreements, internal correspondence and decisions of Credit Committees of banks participating in syndicated lending and materials obtained during the author’s practical work in a commercial bank were widely used.

The scientific novelty of the dissertation lies in the development of the concept of syndicated lending in the modern Russian economy.

The most significant results characterizing the scientific novelty of the study:

1. Based on identifying the specifics of lending objects and subjects, the features of a syndicated loan as a tool for the functioning of a large banking syndicate are revealed. The object of a syndicated loan, taking into account the long terms of organizing a syndicate and, accordingly, additional costs, should be a single business transaction that has a long-term and targeted nature (investment goals).

The functions of the syndicate participants are determined: creditor banks (distributing the total loan amount and associated risks among themselves), agent bank (servicing cash flows on the loan) and organizing bank (carrying out the process of organizing the loan), and the features of the relationship between them are identified. It has been proven that all payments between lenders and borrowers must be carried out through an agent bank.

2. It was revealed that the advantage of a syndicated loan compared to other forms of bank lending is the ability for borrowers to attract larger amounts of funds while reducing costs and time for processing and diversifying the risks of lenders who are able to provide a loan in an amount exceeding the credit risk limits per person borrower.

The advantages of a syndicated loan over such financial instruments as the issue of shares and bonds are shown. These advantages for the borrower consist in the possibility of obtaining a stable source of investment (resistance to changes in the capital market) and optimal use of attracted resources. For lenders, they include a higher level of control over the security of loan funds and their intended use, leading to a reduction in the risks of the syndicate.

It has been proven that a syndicated loan helps solve the problem of the most risky captive lending, because allows banks to provide their shareholders with the funds they need without violating credit risk limits.

3. The reasons that determined the development of syndicated lending in foreign countries and in Russia have been identified. The spread of syndicated loans in developed countries is largely due to the need to diversify the credit risks of banks than to the problem of their low capitalization.

The stages of syndicated lending and the structure of the syndicate are highlighted, and the features of its formation in Russia are determined:

The functions of the organizing bank, as well as the agent bank and partly the lender (usually providing a significant share of the loan), are usually performed by one bank;

The absence of some syndicate participants required abroad (for example, a syndicate manager, a loan underwriter, etc.) and organizations regulating the syndicated lending process and responsible for standardizing documentation.

To reduce risks caused by insufficient experience of syndicate participants, the use of international practice of securing syndicated loans is justified:

Limitation of the borrower’s actions by the provisions of the loan agreement (the principle of “cross-insolvency”);

Transfer of some functions to more experienced participants in the syndicated loan market;

Establishing limits on the total amount of debt of the borrower to creditors (except for debt from trade operations).

4. For the first time, the need to determine the minimum and maximum share of a bank’s participation in a syndicated loan has been identified and justified. The determination by the organizing bank of the minimum share of the lender in the provided syndicated loan is due to the need to limit the unreasonable increase in the number of lenders and, as a consequence, increase the time and organizational costs for forming a syndicate. Establishing a maximum share of a bank's participation in a syndicated loan is associated with the need to ensure equal conditions for all creditors and limit the largest of them in making unilateral decisions that are unacceptable to other participants and infringe on their rights.

5. Specific risks of syndicated lending are identified: insolvency of the borrower, agent bank, failure to fulfill obligations by the agent bank, creditors, insufficient experience of the organizing bank, and ways to minimize them are proposed:

The need for lenders to assess the creditworthiness of not only the borrower, but also the agent bank, and in some cases, other lenders, taking into account the specifics of the capital flow of syndicated lending;

Participation of the agent bank and the organizing bank in the syndicated loan as lenders (accepting lending risks together with other participants);

The independence of banks in providing their shares of the loan, since their obligations should not depend on the failure of other participants to fulfill their obligations;

Making all decisions on controversial issues within the syndicate by the banking majority;

Determining the procedure for changing the agent bank in case of improper performance of its functions.

The theoretical significance of the study lies in the fact that the main conclusions and recommendations contained in the work can be used in research works that contribute to further study of the problems of syndicated lending. The provisions of the dissertation research can be used in the preparation of textbooks and lectures in the disciplines “Money, credit, banks”, “Finance, money circulation and credit”, etc.

The practical significance of the study lies in the fact that the theoretical and practical conclusions, recommendations, proposals and results formulated in the dissertation research can be used by Russian commercial banks to carry out syndicated lending to enterprises, as well as by the Bank of Russia when developing specific measures to draw up and improve banking legislation in the field of syndicated lending.

The practical significance of the dissertation lies in the development of a methodological apparatus, preparation of proposals and recommendations for minimizing the risks of syndicated lending, which have been tested and can be used in the activities of commercial banks.

Testing and implementation of research results. The main provisions of the dissertation and the results of the research were reported and approved at the Conference “Economic Theory and Practice: Problems of Interaction” held at MESI (Moscow, 2003).

The recommendations obtained as a result of the study were partially reflected in the Credit Policy, the Regulations for a syndicated loan with the participation of JSCB BIN as an agent bank, and were also repeatedly used in loan agreements with the participation of JSCB BIN in syndicated loans as a lender .

Volume; And; dissertation structure; The dissertation is presented on 147 pages, consisting of an introduction, two chapters, a conclusion, and a list of references (148 titles). The work contains 12 tables in the text of the dissertation and 6 appendices.

Conclusion of the dissertation on the topic “Finance, money circulation and credit”, Boyarenkov, Andrey Vladimirovich

CONCLUSION

The transformations taking place in the Russian economy in recent years have necessitated the creation of an effective banking sector capable of bringing domestic production to a new level of development and increasing the competitiveness of Russian products. The analysis of international and domestic credit relations shows that one of the ways to solve this problem is to involve an increasing number of commercial banks in the investment process.

A dissertation research devoted to the analysis of syndicated lending as one of the most important sources of financial resources for business entities, its place and role in the modern Russian economy, the specifics of the organization, the development of methodological provisions to ensure the conditions for the effective functioning of this type of credit relations between banks and the real sector of the Russian economy and the formation of risk management mechanisms for syndicated lending, allows us to draw the following conclusions:

1. A comparative analysis of the definitions of syndicated lending existing in economic science, due to the need to systematize various theoretical approaches to the interpretation of this concept, showed that in scientific works the theoretical aspects of syndicated lending are not fully covered, which makes it difficult to create effective mechanisms for its practical application. Based on the analysis, a definition was developed and formulated that most fully reveals the economic essence of a syndicated loan: The results of this stage of the study made it possible to formulate the cause-and-effect relationships that led to the emergence of this financial instrument, and on their basis to develop a theoretical basis for syndicated lending, its basic principles and characteristics, taking into account the functions of its subjects, the specifics of the lending object and capital movements,

2. A systemic analysis of the organization of credit relations between banks and the real sector of the economy indicates that in the modern economy syndicated lending is widely used as. source of long-term investment. This circumstance is due to the possibility of the borrower attracting larger amounts of funds than an individual bank can afford, reducing costs and time for arranging a loan, diversifying the credit risks of lenders, etc. Syndicated loans serve as a tool for enterprises to attract significant resources and are capable of influencing the capitalization of the economy in order to increase economic growth and competitiveness of products.

3. An analysis of the practice of using syndicated lending by Russian banks made it possible to determine the further direction of research into the place and role of this financial instrument in the modern system of economic relations. In this regard, the study assessed the scale of use of syndicated loans, as a result of which it was revealed that in the modern Russian economy, syndicated loans still play a minor role as an investment tool for the real sector of the economy. The work establishes the reasons for the insignificant volume of syndicated loans provided by commercial banks to large Russian borrowers, among which the main ones are the high organizational costs of banks, long terms of organization (difficulty of finding lenders of equivalent capabilities), lack of development of legal support, etc.: This situation has a restraining effect on the development of operations syndicated lending in Russia. The study developed methodological approaches to unify the legal support for syndicated lending, which made it possible to determine the conditions for the sustainable development of the object under study and establish priority tasks, the solution of which will help increase the role of this financial instrument in the investment process.

4. Consideration of the process of organizing syndicated lending in Russia made it possible to identify possible ways to improve its economic and organizational structure, taking into account the responsibility of syndication participants, their actions in the event of dishonest performance by one of the parties of their obligations, and elaboration of legal relations. Based on a study of the mechanism of syndicated lending, as the main tool for modernization and renewal of fixed assets of Russian enterprises, methodological approaches to its organization have been developed, and the need to determine the minimum and maximum share of participation in syndication has been identified. This makes it possible to prevent an unreasonable increase in the number of creditors, an increase in the period and organizational costs of forming a syndicate, on the one hand, and to ensure equal conditions for all creditors within the syndicated loan, on the other.

5. An analysis of the foreign theory and practice of syndicated lending showed that there this financial instrument has a long history and has accumulated extensive experience in regulating the relationships of its subjects, while in Russia for many decades the syndicated loan was not covered in the published literature, and in practice it was poorly covered used. Based on a study of the practice of using syndicated lending in developing and developed countries of the world, it was determined that the main emphasis when organizing syndication is on securing loans. In this regard, the work developed a model of relationships between syndicated lending entities, identified stages and determined the structure of syndication, and formulated recommendations for the use of international experience in Russia.

6. In order to minimize possible losses associated with the lack of experience of syndicate participants, the need to expand the number of syndication participants is justified. It is proposed to apply foreign practice in securing syndicated loans, that is, to provide for a “cross-insolvency” clause in the loan agreement at the stage of organizing a syndicated loan.

7. As a result of a study of the conditions for the effective organization of syndicated lending in Russia, certain aspects of the imperfection of the legal framework regulating the relations of lending entities were identified, which made it possible to formulate recommendations for improving the legal support for syndicated lending. The necessity of regulating the syndicated lending procedure at the level of regulatory documents of the Bank of Russia has been proven, including the development of a section containing definitions of syndication participants, their functions, the legal responsibility of lenders and borrowers to each other, as well as possible risks of participants and mechanisms for minimizing them. The necessity of unifying internal legal documentation used by commercial banks during syndication is substantiated. Methodological approaches have been developed to conclude a single multilateral loan agreement between a syndicate of banks and the borrower, which should more fully and clearly reflect the rights, obligations and actions of participants in syndicated lending.

8. In order to improve the efficiency of syndicated lending, the need to identify specific risks inherent in syndicated lending and develop recommendations for minimizing them is substantiated. During the analysis of the process of organizing syndicated lending in Russia, it was revealed that the features of such risks are practically not taken into account by modern practice. The main task is to identify and prevent possible adverse events, as well as to find ways to reduce their consequences.

9. Based on the results of the study, specific risks of syndicated lending are formulated: insolvency of the borrower, agent bank, failure to fulfill obligations by the agent bank and lenders, insufficient experience of the organizing bank.

By exploring the possible consequences of an incorrect or insufficiently developed assessment of the creditworthiness of syndication entities, the need for a more detailed analysis of these risks has been established. During the study, a methodology was developed for managing the risks of syndicated lending and recommendations for minimizing possible damage were proposed for each individual risk. In particular, taking into account the specifics of capital flows during syndicated lending, lenders are asked to assess the creditworthiness of not only the borrower, but also the agent bank, and in some cases, other lenders, in order to minimize risks.

List of references for dissertation research Candidate of Economic Sciences Boyarenkov, Andrey Vladimirovich, 2004

1. Civil Code of the Russian Federation (part two) dated January 26, 1996. No. 14-FZ as amended. from 12/23/03 Chapter 42.

2. Federal Law of the Russian Federation "On Banks and Banking Activities" dated December 2, 1990. No. 395-1 harm, dated 12/23/03.

3. Federal Law of the Russian Federation "On the Central Bank of the Russian Federation (Bank of Russia)" dated July 10, 2002. No. 86-FZ c. ed. from 12/23/03

4. Instruction of the Central Bank of the Russian Federation "On mandatory standards for banks" dated January 16, 2004. No. 110-I.

5. Instruction of the Bank of Russia "On the procedure for regulating the activities of banks" dated 10/01/97. No. 1 in ed. from 05/06/02 (lost force).

6. Instruction of the Central Bank of the Russian Federation dated June 30, 1997. No. 62a in ed. dated 18.08.03 “On the procedure for the formation and use of reserves for possible loan losses.”

7. Regulations on the procedure for the provision (placement) of funds by credit institutions and their return (repayment) dated 08/31/98. No. 54-P as amended. from 07/27/01

8. Statement of the Government of the Russian Federation, the Central Bank of the Russian Federation "On the strategy for the development of the banking sector of the Russian Federation" dated December 30, 2001.

9. Program of socio-economic development of the Russian Federation for the medium term (2003-2005) dated 08/15/03.

10. Concept for the development of the banking system of the Republic of Belarus for 2001-2010. (www.nbrb.by).

11. Bulletin of Banking Statistics, 2004, No. 2.

12. Investment market: market conditions in 2002 // Investments in Russia, 2003, No. 5. With. 23-31.

13. Investment market: conditions in the 1st quarter of 2003. //Investments in Russia, 2003, No. 9. With. 27-30.

14. Issues of modernization of the Russian banking system //Bulletin of the Bank of Russia, 2002, No. 37. With. 3-9.

15. Main directions of the unified state monetary policy for 2004 //Money and Credit, 2003, No. 12. With. 3-25.

16. The state of the banking sector of the Russian Federation in 2002 //Bulletin of the Bank of Russia, 2003, No. 30. With. 1-55.

17. Socio-economic situation in Russia in 2002 // Bulletin of the Bank of Russia, 2003, No. 14. With. 4-21.

18. Socio-economic situation in Russia in the first half of 2003 // Bulletin of the Bank of Russia, 2003, No. 51. With. 5-21.

19. Socio-economic situation in Russia in 2003. //Bulletin of the Bank of Russia, March 11, 2004, No. 17. With. 6-23.

20. I) Books, monographs, textbooks, reference literature:

21. Abramov S.I. Management of investments in fixed assets. M.: Exam, 2002. - 543 p.

22. Agafonova M.Yu., Azriliyan A.N., Azriliyan O.M. Large economic dictionary. M.: Legal Culture Foundation, Institute of New Economics, 1998. -859 pp.

23. Alpatova E.S. Development of credit relations and the role of the banking sector in their improvement. Kazan: Taglimat, 2003. - 91" p.

24. Ametistova L.M., Polishchuk A.I. The role of the banking system in the economy: a textbook. M.: MPEI, 1999. - 39 s.

25. Antonov N.G., Pessel M.A. Money circulation, credit and banks. M.: Finstatinform, 1995. - 272 s.

26. Belyaeva I.Yu., Eskindarov M.A. Capital of financial and industrial corporate structures: theory and practice. M.: Infra-M, 2001. - 399 p.

27. Large economic dictionary / Ed. Azriliyan A.N. M.: Institute of New Economics, 1994. - 528 p.

28. Borisov A.B. Large economic dictionary. M.: Book World, 2001. -895 s.

29. Bykova N.I. Credit system and its structure. St. Petersburg: Preprint, 2000. - 16 s.

30. Money, credit, banks: textbook. /Ed. Lavrushina O.I. M.: Finance and Statistics, 2003. - 460 s.

31. Dovgyallo M.V. Syndicated lending. M.: Financing of commercial real estate / Institute of Urban Economics Foundation, issue 7, 2000 - 86 p.

32. Druzhinin A.B. Debt capital as a special type of universal capital. M.: MAKS Press, 2001. - 57 s.

33. Zolotarenko S.G., Tarasova G.M. Credit systems of Russia and Germany. -Novosibirsk: NGAEiU, 2000. 148 p.

34. Kiselev V.V. Credit system of Russia: problems and ways to solve them. -M.: Finstatinform, 1999. 397 pp.

35. Kleshchev A.G. Shumakova O.D., Bragina Z.V. Investment resources of industrial production. Kostroma: 2000 - 167 p.

36. Kogogina M.I., Khalilova M.Kh. Bank loan. Kazan: Kazan University, 2001. - 196 p.

37. Kolesnikov V.I., Chernenko V.A., Malkova S.A., Ivanova L.M. Credit and its main forms: textbook. St. Petersburg: SPUEiF, 2001. - 74 s.

38. Kosterina T.M. Banking: textbook. M.: Market DS Corporation, 2003 - 237 p.

39. Kurakov V.L. Financial and economic dictionary. Cheboksary: Chuvash State. University, 1999 - 416 s.

40. Kurakov L.P., Timiryasov V.G., Kurakov V.L. Modern banking systems: Textbook. M.: Helios ARV, 2000. 287 p.

41. Lavrushin O.I., Mamonova I.D., Valentseva N.I. Banking: textbook. M.: Finance and Statistics, 2003. - 667 p.

42. Maslennikov V.V. Foreign banking systems. M.: Elit-2000, 2001 - 390 p.

43. Mishkin F.S. Economic theory of money, banking and financial markets: textbook. Translation from English. M.: Aspect Press, 1999. -820 s.

44. Moskvin V.A. Lending for investment projects: recommendations for enterprises and banks. M.: Finance and Statistics, 2001. - 238 p.

45. Olshany A.I. Bank lending: Russian and foreign experience. -M.: RDL, 1998 - 351 p.

46. Patrusheva E.G. Management of investment attraction by Russian industrial enterprises. Yaroslavl: YSU, 2002. - 186 p.

47. Peshchanskaya I.V. Short-term loan: theory and practice. M.: Exam, 2003 - 318 p.

48. Pivarchuk S.B. Bank lending to enterprises. M.: MSHA, 1996. -58 s.

49. Popova E.M. Credit and banking system: textbook. St. Petersburg: SPbGUEiF, 2002. - 108 s.

50. Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B. Modern economic dictionary. M.: Infra-M, 2003. - 480 s.

51. Rudy K.V. Financial and credit systems of foreign countries. M:: New knowledge, 2003. - 300 s.

52. Sadvakasov K., Sagdiev A. Long-term investments of banks. Analysis. Structure. Practice. -M.: Os-89, 1998. -112 s.

53. Semenyuta O.G., Ivanenko E.V., Malofeev G.D. Fundamentals of banking in the Russian Federation: textbook. /Under. ed. Semenyuty O.G. Rostov-on-Don: Phoenix, 2001 - 448 p.

54. Smulov A.M. Problems of interaction between industrial enterprises and banks. M.: Finance and Statistics, 2002. - 303 s.

55. Modern financial and credit dictionary. /Under general ed. M.G. Lapusta, P.S. Nikolsky. M.: Infra-M, 2002. - 567 p.

56. Tikhomirova E.V. Development of a short-term bank lending system. St. Petersburg: Nestor, 2002. - 147 p.

57. Financial and credit dictionary (volume 3) / Main. editor Garetovsky N.V. -M.: Finance and Statistics, 1994. 512 pp.

58. Financial and credit encyclopedic dictionary. /Ed. Gryaznova A.G. M.: Finance and Statistics, 2002. - 1168 p.

59. Shcherbakova G.N. Banking systems of developed countries. M.: Exam, 2002 - 224 p.

60. Economics: textbook. /Ed. Bulatova A.S. M.: Jurist, 2002. - 896 s.

61. Entov R., Radygin A., May V. et al. Development of the Russian financial market and new tools for attracting investments. M.: RAS, ANKh under the Government of the Russian Federation, Institute for the Economy in Transition, 1998 - 283 p.

62. I) Publications in periodicals:

63. Alymov Yu. Current issues of monetary policy //Banking Bulletin, 2003, December, No. 34. With. 4-14.

64. Amosov A. Long-term strategy for compensation of disposal and renewal of fixed assets // Economist, 2003, No. 9. With. 3-12.

65. Astakhov D. The shortage of investment ideas threatens Russia with a financial crisis // Izvestia, 2004, February 19, No. 30. With. 12.

66. Bezrukov V:, Safronov B., Melnikov B. Socio-economic development of the Russian Federation in 2003 and forecast for 2004 // Economist, 2004, No. 1. With. 319.

67. Berezanskaya E. Easy money is over //Vedomosti (Appendix Banks and Finance), 2004, March 10, No. 39. p. 1.

68. Bulatov A. Russia in the global investment process // Issues of Economics, 2004, No. 1. With. 74-84.

69. Vorontsov I. Russian banking system at the stage of economic growth // Banking, 2002, No. 11. With. 14-19.

70. Vyugin O.V. Economics and monetary policy //Money and Credit, 2003, No. 11. With. 3-7.

71. Gosteva E. Banks will soon have no one to lend to //Izvestia, 2004, January 22, No. 10. With. 6

72. Gritsyna V., Kurnysheva I. Features of the investment process // Economist, 2000, No. 3. With. 8-19.

73. Gromkovsky V. Syndicated loans: know how and know what // Securities Market, 2000, No. 8. With. 93-99.

74. Gryadunova M. Exotic type of loan capital // Banking in Moscow, 2002, No. 9. With. 48-49.

75. Guseva K.N. Long-term lending as a method of integrating banking and industrial capital // Money and Credit, 2000, No. 7. With. 16-23.

76. Danilina Yu., Syndication market: formation, development, current state // Banking in Moscow, 2004, No. 1. With. 28-31.

77. Edronova V.N., Khasyanova S.Yu. Analysis of the borrower’s creditworthiness //Finance and Credit, 2001, No. 18. With. 3-9.

78. Edronova V.N., Khasyanova S.Yu. Classification of bank loans and lending methods //Finance and Credit, 2002, No. 1. p.2-6.

79. Edronova V.N., Khasyanova S.Yu. Ways to improve credit policy //Finance and Credit, 2002, No. 4. With. 2-8.

80. Ermasova N.B. Credit risk management in the banking sector //Finance and Credit, 2004, No. 4. With. 16-20.

81. Zhemchugov A. Syndicated lending as a tool for mobilizing credit resources // Securities Market, 2000, No. 20. With. 76-80.

82. Zaika I., Kryukov A. National economy and investments // Economist, 2003, No. 7.-p. 21-26.

83. Zamuruev A.S. Credit and loan: terminological analysis, classification and definition of form // Money and Credit, 1999, No. 4; With. 32-35.

84. Ivanov E. Quantity will increase in quality // Banking in Moscow, 2004, No. 1. - With. 25-28.

85. Kalin A.A., Narozhnykh H.B. Models for attracting capital by large Russian corporations //Finance and Credit, 2001, No. 4. With. 38-46.

86. Kozlov A.A. Issues of modernization of the Russian banking system //Money and Credit, 2002, No. 6. With. 4-12.

87. Kozlov A.A. On the development of the resource base of banks and increasing their role in ensuring economic growth in Russia // Bulletin of the Bank of Russia, 2003, No. 60.-p. 3-5.

88. Kozlov A.A. Banking sector "Motor No. 2" of economic growth // Banking in Moscow, 2003, No. 11. - With. 4-6.

89. Kozlov A.A. Ultimately, everything is decided by the market // Expert, 2003, No. 27-28. -With. 42-46.

90. Kozlov A.A. Some current issues in the development of the Russian banking sector // Money and Credit, 2004, No. 2.

92. Lavrushin O.I. Features of the use of credit in a market economy //Banking, 2002, No. 6. With. 2-8.

93. Lepetikov D. When lenders want, but borrowers can // Expert, 2002, No. 46.-p. 92-96.

94. Loginov V. Renewal of fixed capital // Economist, 2002, No. 3. With. 310.

95. Loginov E.L., Shevchenko I.V. Investment dominant of the transformation of the Russian economy: problems of the influence of foreign investments //Finance and Credit, 2002, No. 13. With. 10-16.

96. Mazurenok O., Tsvetkov A. Regulatory regulation of consortial lending in the Republic of Belarus //Banking Bulletin, 2002, No. 4. With. 15-18.

97. Matovnikov M.Yu. Lending to related borrowers by Russian banks // Financier, 2001, No. 11. With. 24-28.

98. Matovnikov M. Syndicated lending in Russia // Financier, 2001, No. 8-9.-p. 28-30.

99. Matovnikov M. Syndicated lending: still exotic // Banking in Moscow, 2001, No. 10. With. 26-28.

100. Mekhryakov V.D. On the issue of syndicated lending // Banking, 2002, No. 12. With. 12-14:

101. Ostapenko V.V., Meshkova V.M. Bank lending to enterprises: needs, opportunities, interests // Finance, 1999, No. 8. With. 22-25.

102. Pashtova L.G. Sustainable economic growth is determined by investment policy //Finance, 2003, No. 7. With. 11-13.

103. Pessel M.A. Loan, credit, loan // Money and Credit, 1999, No. 4: p. 27-29.

104. Pessel M.A., Kosterina T.M. The problem of objective and subjective in modern credit relations // Banking, 2001, No. 2. With. 25-32.

105. Pivkov R. Objective and subjective obstacles to syndication // Banking in Moscow, 2001, No. 10. With. 29-30.

106. Pivkov R. Syndicated loan as a reasonable alternative to a bond loan // Securities Market, 2001, No. 24. With. 22-24.

107. Pisarenko P. Mergers and acquisitions of banks as a factor in maintaining competitiveness in the financial services market // Analytical Banking Journal, 2002, No. 3, pp. 32-34.

108. The President announced the program of action for the second term // Izvestia, 2003, December 19, No. 232. With. 1.3.

109. Redko N. Banks are the main suppliers of investment resources in the Russian economy // Analytical banking journal, 2003, No. 7. - With. 14-21.

110. Reznikov M. Syndicated lending: regional banks, unite! //Analytical bulletin "VIP-consultant" 2001, June 2.

111. Semenov S. On the role of banks in the economy // Financial business, 2000, No. 11-12.-p. 29-32.

112. Sergienko Y. Finance and the real sector in a transition economy // Economist, 2002, No. 3. With. 58-62.

113. Slipenchuk M.B. Economic reforms in Russia and the investment process // Financial business, 2002, No. 5. With. 3-9.

114. Sukhushina G. Syndicated lending: problems and prospects // Banking in Moscow, 2001, No. 4. - With. 23-24.

115. Tarasova O. Syndicated lending is the way to implement large investment projects //Banking Bulletin, 2003, No. 13. -With. 17-18.

117. Titov D. Syndicated loans for industry // Banking in Moscow, 2000, No. 3. With. 20-21.

118. Tikhomirova E.V. Credit operations of commercial banks //Money and Credit, 2003, No. 9. With. 39-46.

119. Tushunov D. Credit activity of Russian enterprises // Issues of Economics, 2003, No. 7. With. 78-88.

120. Fedorov V. Investments and production // Economist, 2000, No. 10. With. 1730.

121. Khmelev M. American banks were struck by gigantomania // Izvestia, 2004, January 16, No. 6. With. 5.

122. Khorovsky V. Syndicated lending. Technologies and the legal field // Banking in Moscow, 2000, No. 12. With. 60-62.

125. Yampolsky M.M. On the interpretation of credit //Money and Credit, 1999, No. 4. With. 30-32.1.) Sources in foreign languages:

127. Bank lending law & practice by Chatterjee A. Publisher: Skylark Publications, 1994.

128. Booth C. D. Report On Hong Kong. Asian Development Bank. Regional Technical Assistance Project. Insolvency Law Reforms. University of Hong Kong China.

130. Crews Lott W., Makel Larry A., and Evans Walter E., Structuring Multiple Lender Transactions, 1995.

131. International finance law, von Holger Langer, LL.M., Dokumente und Ubersichten zum Internationalen Finanzrecht.

132. International syndicated loans by Robert P. McDonald. Publisher: Intl Pubn Service, 1983, December.

133. Legal aspects of syndicated loans by Peter Gabriel. Publisher: Butterworths. -276p.

134. Norton J.J. International syndicated lending and economic development in Latin America: the legal context. Essays in international financial & economic law No. 9, 1997.-80p.

135. Rabindra Nathan. Report On Malaysia. Asian Development Bank. Regional Technical Assistance Project. Insolvency Law Reforms, Shearn Delamore & Co.

136. Rowan McR. Russell, Impact of Recent Corporate Collapses on Negotiating and Drafting Syndicated Loans, 1993.

137. Syndicated loans Barometer of Commercial Credit Risk //American Banker, 2000, January 10.

138. Syndicated lending by Tony Rhodes (Editor). Publisher: Euromoney Publications PLC, December, 1996. 520p.

139. Syndicated lending by Banks by Barry Howcroft, Christine Solomon. Publisher: Books Britain, March, 1985. 92p.

140. Syndicated lending (Self Study Workbook) by Andrew Fight. Publisher: Euromoney Publications PLC, 2001,1 March.

141. Syndicated lending for Borrowers in Emerging Markets Publisher: Euromoney Publications PLC, 1999, January. 200p.

142. The Euromoney Syndicated Lending Handbook. Publisher: Euromoney Institutional Investor, 2002, November.

143. Weaver P. M., Kingsley C. D. Banking & lending practice, Lawbook Co, 2001.-379p.

145. V) Internet resources and computer databases143. http://www.akm.ru144. http://www.cbonds.ru145. http://www.cbr.ru146. http://www.expert.ru147. http://www.interfax.ru148. http://www.rbc.ru Consultant plus

146. Main indicators of the 30 largest banks as of 01/01/04, billion rubles.

147. Bank Assets Capital Loans NBS-net as a percentage of assets

148. Sberbank of the Russian Federation 1453.90 149.02 812.24 55.9

149. Vneshtorgbank 257.70 52.72 119.78 46.5

150. Gazprombank 212.43 30.41 106.68 50.2

151. Alfa Bank 176.24 24.70 107.69 61.1

152. MPB 125.68 28.23 84.39 67.1

153. Rosbank 113.50 12.02 71.87 63.3

154. Bank of Moscow 110.07 11.31 71.25 64.78; MDM-Bank 99.62 11.81 53.01 53.2.9. IMB 83.49 6.67 36.16 43.310. PSB 65.92 5.82 40.57 61.5

155. Uralsib 64.79 10.15 39.25 60.6

156. Raiffeisenbank 61.21 5.54 30.01 49.0

157. Citibank 60.76 8.59 30.57 50.3

158. Petrokommerts 43.50 7.26 19.93 45.8

159. Promsvyazbank 37.33 4.26 21.16 56.7

160. Menatep St. Petersburg 36.53 3.76 16.40 44.9

161. Trust 33.90 5.37 8.70 25.7

162. NIKoil 33.64 6.49 20.76 61.7

163. Nomos Bank 30.63 5.01 16.10 52.6

164. Zenit 30.21 4.13 18.50 61.2

165. Avtobank-Nikoil 30.04 6.54 11.07 36.9

166. Guta-bank 29.51 3.65 20.33 68.9

167. Transcreditbank 28.91 3.85 17.15 59.324; Globex 27.85 10.46 19.87 71.3

168. Eurofinance-Mosnarbank 26.67 5.31 11.18 41.9

169. Commerzbank (Eurasia) 26.48 1.17 12.25 46.3

170. Revival 26.48 3.04 17.33 65.4

171. Impexbank 22.51 3.24 11.86 52.7

172. AkBars 22.15 3.41 12.60 56.9

173. Ingosstrakh-Soyuz 21.29 4.10 11.08 52.1

Syndicate research is an analysis of a specific market initiated by a research company for the benefit of many client companies. The results belong to the research company and are free for publication. Syndicate research can also have other names - regular or initiative.

Several companies can use the results of syndicated research at the same time. This makes it possible to significantly reduce the financial costs of conducting research and at the same time obtain the necessary information about the market under study. What marketing decisions can be made based on syndicated research? Here are some of them:

- Description of the target market consumer

- Specifics of consumption in the market

- Constructing a competitor map based on key parameters

- Cannibalization within a brand portfolio

- Analysis of partners for cross-promotion

In fact, the application of the results of proactive research is almost limitless, as they have great potential. The advantages of syndicative research can be determined by the following points:

1. Large sample

Typically, research of this nature uses a large sample of respondents across many dimensions. In this case, you can look at the market under study from different angles. The result is multidimensional and claims to be universal.

2. Deep analysis

Possibility of segmentation and in-depth analysis of each segment. Given the regional differences and lifestyles of respondents grouped together, there is the potential for in-depth market research.

3. Savings

One of the most important reasons is the opportunity to share costs with other market participants interested in the research.

The main groups by which respondents are segmented:

- By social status (from A to E, where A is the highest class: top managers and E is the lower class: unskilled workers with secondary education)

- By property ownership (by possession of certain durable items)

- For expenses on food and utilities (mandatory expenses)

- By consumer activity (how often and to what extent consumption occurs)

- By purchasing behavior

- By lifestyle

- Psychographic scaling

- Family and presence of children

For in-depth analysis of segments, value judgments and situational statements are often used based on:

- Attitude towards family and children

- Attitude to work, career

- Attitude towards leisure time

- Attitude to advertising and media

- Attitude to finance

- Attitude to nutrition and health

- Attitude to fashion

- Attitude to new technologies

Sometimes regular research can reveal interesting facts. For example, the statement “I like it when others think that my financial affairs are going well” was confirmed by 56% of the Russian population in December 2014. For comparison, in 2010 this data was 53%. (Base: population 16-75 years old, cities 100 thousand+

Source: Russian Target Group Index 2010 – 2014-12)

As mentioned above, the result of syndication analysis can be an analysis of competitors or the study of cannibalization within a brand portfolio. What data can we analyze? Let's look at an example:

Let's look at the X1 and X2 brands - they have the smallest indicators, while X10 has proportional, good indicators both in terms of knowledge and use. If the ratio is below average, as in the case of the X6 or X5 brand, this may indicate deficiencies in distribution or advertising policy.

In addition to knowledge, consumption and preference of brands, the ratio of these three indicators is important, revealing “brand strength” using two basic formulas:

Conversion= % of consumers ever / % aware * 100

Retention= % loyal / % ever consumers * 100

Shows how well a brand retains consumers, how actively consumers become loyal to this brand.