An accountant of a company that is a tax agent can offset the amount of tax over-withheld from an employee against future payments:

When the tax period (calendar year) is still ongoing;

The employee continues to receive from the company, which excessively withheld personal income tax from his income.

Offsetting the amount of over-withheld tax when calculating personal income tax for the current month

The tax period for personal income tax is a calendar year (Article 216 of the Tax Code of the Russian Federation). Personal income tax subject to withholding is calculated on an accrual basis from the beginning of the year. When calculating the tax amount for the current month, the tax amounts withheld in previous months of the current tax period are taken into account:

That is, the offset was initially “built-in” into the procedure for calculating personal income tax.

Let’s say that from an employee’s salary accrued at the end of the past month, tax was withheld in a larger amount than prescribed by the Tax Code.

For example, the accountant did not apply the standard tax deduction for a newborn child, since the happy father of his first child brought the necessary documents only after the 5th of the next month.

The tax deduction for the first child is 1,400 rubles. (clause 4 of article 218 of the Tax Code of the Russian Federation)

The amount of personal income tax calculated without applying a tax deduction was 182 rubles more. (RUB 1,400 × 13%).

In this situation, when calculating personal income tax from wages for the current month, the accountant will determine personal income tax from the employee’s total income from the beginning of the year and will offset the amount of tax withheld up to this point (clause 3 of article 226 of the Tax Code of the Russian Federation). There is no need to inform the employee about the excessive withholding of personal income tax and require him to apply for a tax offset.

Example 1

On April 25, 2014, manager I.P. Rokotov had a son. The busy father brought a copy of the child’s birth certificate to the accounting department on May 12, 2014. Information on income subject to personal income tax and the amount of tax withheld is presented in the table below.

Table Taxable income of an employee in 2014 and the amount of personal income tax

| Month of 2014 | Amount of income | Amount of deductions | Taxable base | Personal income tax amount | |||||

| per month | cumulative total since the beginning of the year | per month | cumulative total since the beginning of the year | subject to withholding | actually withheld | ||||

| cumulative total since the beginning of the year | per month | cumulative total since the beginning of the year | per month | ||||||

| January | 22 000 | 22 000 | 0 | 0 | 22 000 | 2860 | 2860 | 2860 | 2860 |

| February | 22 000 | 44 000 | 0 | 0 | 44 000 | 5720 | 2860 | 5720 | 2860 |

Solution

Calculation of personal income tax until the submission of documents for children's deduction

For the period January - April 2014, the amount of employee income, calculated on an accrual basis from the beginning of the year, amounted to 88,000 rubles.

In the absence of documents about the birth of a child, the accountant calculated the amount of personal income tax without taking into account the child deduction.

Since the beginning of the year, the total amount of tax actually withheld was 11,440 rubles. (RUB 88,000 × 13%).

Recalculation of personal income tax after receiving documents for children's deduction

After receiving from I.P. Rokotov’s application for a child deduction and a copy of the child’s birth certificate, the accountant determined that the amount of personal income tax to be withheld from the employee’s salary for January - April 2014 should have been 11,258 rubles. [(RUB 88,000 - RUB 1,400) × 13%].

Consequently, for the period January - April 2014, the accountant withheld personal income tax from the employee’s income by 182 rubles more. (RUB 11,440 - RUB 11,258).

The tax period has not yet ended, the employee continues to work in the same company, his income will be taxed at the same rate at 13%.

No special actions with overpayment of personal income tax in the amount of 182 rubles. There is no need for an accountant to do this. It will be automatically credited when calculating personal income tax for May.

After the recalculation, the excessively withheld personal income tax amount can be seen in the debit of account 68 of the “Personal Income Tax Payments” subaccount.

Calculation of personal income tax from salary for May

Personal income tax is calculated on an accrual basis from the beginning of the year.

To calculate the amount of tax to be withheld from wages for May, the accountant will determine for the period January - May 2014:

- amount of income - 110,000 rubles;

- amount of deductions - 2800 rubles. (1400 rubles × 2 months);

- amount of taxable income - 107,200 rubles. (RUB 110,000 - RUB 2,800);

— the total amount of personal income tax subject to withholding is RUB 13,936. (RUB 107,200 × 13%).

The amount of personal income tax subject to withholding from wages for May is equal to the difference between the calculated amount of tax for the period January - May 2014 (13,936 rubles) and the amount of personal income tax actually withheld for the period January - April 2014 (11,440 rubles) (p 3 Article 226 of the Tax Code of the Russian Federation).

The amount of personal income tax subject to deduction from the salary for May will be 2,496 rubles. (RUB 13,936 - RUB 11,440).

In accounting, after the personal income tax for May is transferred, there will no longer be a debit balance in account 68 of the “Personal Income Tax Calculations” subaccount (provided that the personal income tax calculations for other employees are carried out correctly), since the excessively withheld tax amount is offset when calculating the personal income tax for May.

The amount of personal income tax from wages for May, if the employee had submitted documents on time

If the employee had submitted the application for the deduction and supporting documents on time, the accountant would have calculated personal income tax on the salary for April, taking into account the deduction.

Then personal income tax for the period January - April would be 11,258 rubles. [(RUB 88,000 - RUB 1,400) × 13%]. And the personal income tax subject to deduction from the salary for May would be equal to 2,678 rubles. (RUB 13,936 - RUB 11,258). That is, 182 rubles more. (2678 rubles - 2496 rubles).

If the documents necessary to apply the tax deduction were available, excessive personal income tax withholding would not occur.

Personal income tax credit if the employee’s tax status has changed

Let's consider this situation. At the beginning of 2014, your employee was not yet a tax resident of the Russian Federation.

When calculating personal income tax, the accountant applied a rate of 30% (clause 3 of Article 224 of the Tax Code of the Russian Federation).

After several months, the employee acquired the status of a tax resident of the Russian Federation. In this case, the amount of personal income tax withheld from his income, calculated at a rate of 30%, must be recalculated at a rate of 13% using standard tax deductions.

In such a situation, an overpayment of personal income tax is formed. It can be offset against tax withholding at a rate of 13% until the end of 2014. This is what it says:

That is, when calculating personal income tax at a rate of 13% payable for the current month, the accountant will take into account the amount of tax already withheld for previous months at a rate of 30%.

If the amount of tax withheld at a rate of 30% was not fully credited before the end of the calendar year, the employee can apply to the tax office for a refund of the remaining amount of excess personal income tax withheld. The refund will be made only by the tax inspectorate (clause 1.1 of Article 231 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated October 3, 2013 No. 03-04-05/41061, Federal Tax Service of Russia dated September 16, 2013 No. BS-2-11/615@).

When an overpayment cannot be offset

Overpayment of personal income tax on dividends. The company paid dividends to the employee. Due to a technical glitch in the program, instead of the 9% rate (clause 4 of Article 224 of the Tax Code of the Russian Federation), the accountant applied a rate of 15% (clause 3 of Article 224 of the Tax Code of the Russian Federation).

As a result, there was an overpayment of personal income tax. It cannot be counted against personal income tax payments from wages, but can only be returned. This is explained as follows.

The amount of personal income tax on wages is determined separately from the amount of personal income tax on dividends. This follows from paragraph 1 of Article 225 of the Tax Code.

When calculating personal income tax on dividends and personal income tax on wages, different tax rates are used (9% and 13%), two different tax bases are calculated (clause 2 of article 210 of the Tax Code of the Russian Federation).

The calendar year has ended. The total amount of tax is calculated based on the results of the calendar year (clause 3 of Article 225 of the Tax Code of the Russian Federation).

If at the end of the year there is an overpayment, the accountant cannot offset it against future personal income tax deductions from the income of the next calendar year.

For example, personal income tax was excessively withheld from an employee’s salary for 2013. This overpayment cannot be taken into account when calculating tax on income accrued in 2014. Since in 2014 the accountant determines the tax base starting from January 1 (clause 3 of Article 226 of the Tax Code of the Russian Federation).

The employee quit. Since after dismissal the employee will no longer receive income from this organization, offset becomes impossible.

When it cannot be counted, it can be returned. In all cases in which the overly withheld personal income tax cannot be offset, it can be returned. Returns can be made by:

The company in which the amount of personal income tax withheld was excessive. The return procedure is described below;

Tax Inspectorate. To do this, after the end of the calendar year, the employee can submit a declaration in Form 3-NDFL. It must be accompanied by a certificate in form 2-NDFL (clause 5.6 of the certificate will reflect the excess amount of personal income tax withheld) and a tax refund application.

Procedure for the return of over-withheld personal income tax by a tax agent

The procedure for the company to return excessively withheld personal income tax is described in detail in paragraph 1 of Article 231 of the Tax Code.

Before proceeding with it, the accountant must record the fact of excessive withholding of personal income tax in the accounting certificate.

Notification to employee about overpayment

The accountant must inform the employee about the excess tax withholding within 10 days from the date of discovery of such a fact. You can do this in different ways:

Send a written notice (sample below);

Add a line to the accounting certificate indicating that the employee is aware of the fact that excessive personal income tax has been withheld.

Sample Notification of an employee about excessive withholding of personal income tax

The employee will sign the notice or certificate. His signature will mean that he is familiar with it. If the employee has already resigned, the message can be sent by mail with return receipt requested.

According to specialists from the main financial department, it is better to first agree with the taxpayer on the procedure for sending this message (letter of the Ministry of Finance of Russia dated May 16, 2011 No. 03-04-06/6-112).

An employee writes a request for a refund

The basis for the return of excessively withheld personal income tax is the employee’s application (clause 1 of Article 231 of the Tax Code of the Russian Federation). As in all documents related to the calculation of personal income tax, we advise, in order to avoid claims from inspectors, to ask the employee to indicate in the text of the application:

Passport details;

Registration address;

TIN (if available).

In the application, the employee indicates the bank account number to which the company accountant will transfer the tax.

From the date of receipt of the application from the employee, the period within which the company must return the tax will begin.

Return period and source of funds for return

The refund is made within three months from the date of receipt of an application from the employee for the return of excessively withheld personal income tax. The tax is returned by reducing the amounts of personal income tax to be transferred to the budget in the future, both from the income of this employee and from the income of other employees.

In case of delay, interest is accrued for each calendar day of violation of the deadline based on the refinancing rate of the Central Bank of the Russian Federation in effect on the days of violation (paragraph 5, clause 1, article 231 of the Tax Code of the Russian Federation).

When a company applies to the tax office

After receiving an application for a personal income tax refund from an employee, the accountant needs to assess whether the company has the opportunity to return the tax within three months at the expense of personal income tax payable to the budget from the income of other employees (clause 2 of the letter of the Ministry of Finance of Russia dated May 16, 2011 No. 03-04- 06/6-112).

If the amount of tax to be transferred to the budget is not enough to make a refund within three months, the company can apply to the tax office for a refund of the missing amount. 10 days are allotted for this from the date the employee submits the return application.

The accountant sends to the tax office:

An application on behalf of the company for the return of the excessively withheld amount;

An extract from the tax register for the corresponding tax period;

Documents confirming excessive withholding and transfer of tax amounts to the budget system of the Russian Federation.

The tax office will return the personal income tax amount in the manner prescribed by Article 78 of the Tax Code.

Before this payment is received, the accountant has the right to return the money at the expense of the company’s own funds (clause 1 of Article 231 of the Tax Code of the Russian Federation).

The tax agent is obliged to transfer the excessively withheld amount of personal income tax to the employee’s bank account.

When a personal income tax refund is carried out by a tax agent

The year has not ended, but the employment contract with the employee has been terminated. In this case, a refund of the over-withheld personal income tax can be made by a tax agent, however, subject to the following conditions:

The fact of excessive withholding of personal income tax was discovered before the end of the tax period in which it occurred and the employee was dismissed;

The refund procedure has been launched before the end of this tax period.

The absence of an employment relationship is not in this case an obstacle to the return of excessively withheld personal income tax.

If a company applies for a personal income tax refund to the tax office, the receipt of funds from the budget must be recorded as: Debit 51 Credit 68 subaccount “Personal Tax Calculations”, and the transfer of excessively withheld personal income tax to the employee - in the usual manner by posting: Debit 70 Credit 51.

E.A. answered questions. Sharonova, economist

Personal income tax: we return, withhold, transfer

Errors in calculating personal income tax are very unpleasant; there is too much hassle in correcting them. But the most annoying thing is that even if you yourself identify the error, pay additional tax and penalties and submit updated 2-NDFL certificates (new ones with correct data) to the Federal Tax Service, then, according to the regulatory authorities, this will not exempt you from the fine. And all because the rules of Art. 81 NKs do not work here. After all, an updated 2-NDFL certificate is not an updated calculation and not an updated declaration. True, there is a single court decision in which it stated the following. If the tax agent, before the start of the on-site tax audit, paid additional personal income tax and submitted the correct 2-NDFL certificate, then the conditions for exemption from the fine are met. Resolution of the FAS ZSO dated September 30, 2013 No. A27-17110/2012. But, as you yourself understand, you will most likely have to resolve this issue through the courts.

Now let’s see how organizations should act when identifying errors in personal income tax.

Salary is accrued in the month the error is discovered

A. Kiseleva, Belgorod

In April, I discovered that for February one employee’s salary was incorrectly calculated and accrued - less than necessary. And accordingly, personal income tax was underpaid. How can we now correct the situation so as not to pay fines and penalties?

: Despite the fact that the employee did not receive his salary in February, it is recognized as income in the month of additional accrual - in April clause 2 art. 223 Tax Code of the Russian Federation. An employee of the Ministry of Finance also agrees with this.

FROM AUTHENTIC SOURCES

Advisor to the State Civil Service of the Russian Federation, 1st class

“ Since the organization accrues additional income in the form of wages in April, that is, in the month the error was discovered, the additional accrued amount is April income. Consequently, the organization calculates personal income tax on this income in April clause 3 art. 226 Tax Code of the Russian Federation. The organization must withhold personal income tax from the April salary at the time of its payment. clause 4 art. 226 Tax Code of the Russian Federation. And transfer to the budget no later than the day you receive cash from the bank for its payments clause 6 art. 226 Tax Code of the Russian Federation.

Therefore, if within this period the organization transfers personal income tax to the budget, then it will not face any fines or penalties. After all, there will be no reason for this.

An offense for which a fine is provided under Art. 123 of the Tax Code of the Russian Federation, can be imputed to a tax agent only if he had the opportunity to withhold and transfer the appropriate amount, taking into account the fact that the withholding is carried out from funds paid to the taxpayer in clause 21 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57” .

You must return the over-withheld personal income tax even to a former employee

G. Zalukaeva, St. Petersburg

The employee's personal income tax was withheld unnecessarily and transferred to the budget. We cannot refund the tax because the employee has already quit. What to do now with the amount of overpaid tax?

: First of all, within 10 days from the day you discovered excessive personal income tax withholding, you are obliged to inform your former employee about this clause 1 art. 231 Tax Code of the Russian Federation. You can send him a registered letter with return receipt requested to the address that he indicated to you when applying for a job.

If an employee comes to you and asks you to return the over-withheld tax, you will be required to do so. clause 1 art. 231 Tax Code of the Russian Federation. As the Ministry of Finance explains, the dismissal of an employee, as well as the period in which the over-withheld tax is refunded, do not in any way affect this duty of the tax agent. Letter of the Ministry of Finance dated December 24, 2012 No. 03-04-05/6-1430.

ATTENTION

You cannot return personal income tax in cash from the cash register. At the same time, liability for the “cash” return of the Tax Code has not been established.

And this year the Constitutional Court agreed with the Ministry of Finance. He pointed out that the Tax Code of the Russian Federation provides for a special (special) procedure for the return of personal income tax over-withheld by a tax agent, which has priority over the general procedure for the return of tax overpayments Definition of the Constitutional Court dated February 17, 2015 No. 262-O. This means that a person cannot apply directly to the Federal Tax Service for a refund of the overpayment, bypassing the tax agent. A citizen can submit an application for the return of excessively withheld personal income tax along with the 3-NDFL declaration directly to the Federal Tax Service only if the tax agent is absent (for example, when it was liquidated) clause 1 art. 231 Tax Code of the Russian Federation.

So you will need to return the overly withheld tax to the employee, regardless of when he contacted you - before submitting the 2-NDFL certificate to the inspectorate or after.

When the employee comes to you, ask him to write a statement in which he must indicate the amount of personal income tax to be returned, the account number and bank details where the money should be transferred. You will have to return the tax within 3 months from the date of receipt of the application. At the same time, by the amount of tax returned to the former employee, you will reduce the amount of personal income tax to be transferred to the budget for other employees. clause 1 art. 231 Tax Code of the Russian Federation.

If the former employee does not show up by the end of the year, then at the end of the year, no later than 04/01/2016, you will submit a 2-NDFL certificate to the Federal Tax Service, where in clause 5.6 you will indicate the amount of excess tax withheld. clause 2 art. 230 Tax Code of the Russian Federation.

And if an employee comes to you after submitting a 2-NDFL certificate for him, then after the tax refund you will have to submit a new (clarifying) 2-NDFL certificate to the Federal Tax Service. In it you will reflect the correct data: on income, deductions, calculated (clause 5.3 of the certificate), withheld (clause 5.4 of the certificate) and transferred (clause 5.5 of the certificate) personal income tax. This certificate will no longer contain excessively withheld tax (clause 5.6 is not completed), and the amounts of personal income tax calculated, withheld and transferred will be equal. Keep in mind that this certificate must indicate the number of the previously submitted 2-NDFL certificate, but the date of preparation - the new one section I Recommendations, approved. By Order of the Federal Tax Service dated November 17, 2010 No. ММВ-7-3/611@ (hereinafter referred to as Order No. ММВ-7-3/611@).

You are required to withhold personal income tax from a working employee

L. Suhoveeva, Moscow

I came to the organization as chief accountant and discovered that an employee was mistakenly provided with a deduction for a child who was already over 30 years old. Probably, the previous accountant entered data taken from the air; there are no documents. When I informed the employee about this, he was indignant and refused to voluntarily return the tax, saying that if I wanted to, I could do it only through the court.

As far as I know, I cannot withhold personal income tax for past periods. Or is it still possible? Do I need to report it to the tax office?

: Actually, your employee is wrong about the court. In ch. 23 of the Tax Code directly states that tax amounts not withheld from employees or not fully withheld are collected from them by the organization itself until the debt is fully repaid and clause 2 art. 231 Tax Code of the Russian Federation. So you simply have to recalculate personal income tax and withhold it from the employee.

Another question is over what period this should be done. When conducting an on-site audit, tax officials have the right to inspect only 3 years preceding the year in which the decision to conduct audits was made and clause 4 art. 89 Tax Code of the Russian Federation. And when they will come to you is unknown.

In this situation, you can recalculate personal income tax for the 3 years preceding the year the error was discovered - 2012, 2013, 2014. As we understand, the error was discovered after submitting 2-NDFL certificates for this employee to the Federal Tax Service. Therefore you need to do this:

- recalculate the tax. If we assume that the employee was provided with an extra child deduction in the amount of 1,400 rubles every month for 3 years, then the total amount of excess deductions will be 50,400 rubles. (12 months x 3 years x 1400 rub.). And the personal income tax underwithheld from this amount will be equal to 6,552 rubles. (RUB 50,400 x 13%);

- inform the employee about the mistake made and the amount of personal income tax that must be withheld from him clause 2 art. 231 Tax Code of the Russian Federation;

- since the employee does not agree to repay the debt voluntarily, then withhold tax from the income paid to him. At the same time, the total amount of personal income tax withheld (tax for the current month + debt) should not exceed 50% of the amount given to the employee in person clause 4 art. 226 Tax Code of the Russian Federation;

- transfer the withheld tax to the budget;

- pay penalties to the budget for the period from the day following the day when personal income tax should have been transferred to the budget until the day of its actual payment, inclusive Art. 75 Tax Code of the Russian Federation;

- after you have withheld the entire personal income tax debt, submit to your Federal Tax Service newly compiled (clarifying) certificates 2-NDFL for this employee section I Recommendations, approved. By Order No. ММВ-7-3/611@. In them you will no longer have child deductions. And the amounts of calculated, withheld and transferred personal income tax will be greater. Moreover, all three personal income tax amounts in the certificates must be the same, since on the date of their submission the tax from the employee has already been withheld and transferred to the budget.

WE TELL THE EMPLOYEE

If an employee was provided with deductions to which he was not entitled, then the employer has the right to independently recalculate the personal income tax and withhold the underpaid amount of tax from the salary.

However, the fact that you submit updated 2-NDFL certificates to the Federal Tax Service and correct everything yourself before the tax authorities come to you for inspection, unfortunately, will not save you from a fine for late transfer of personal income tax and penalties Articles 123, 75 of the Tax Code of the Russian Federation. After all, as the Ministry of Finance explained, exemption from a fine in this case is simply not provided for by the Tax Code Letter of the Ministry of Finance dated February 16, 2015 No. 03-02-07/1/6889. The only thing that can be done is to try to reduce the fine, citing the fact that your mitigating circumstances include correcting the error yourself and paying additional taxes and penalties. subp. 3 p. 1 art. 112 Tax Code of the Russian Federation. Maybe the inspectors will meet you halfway.

A former employee will not be able to withhold additional personal income tax

L. Kozhichkina, Bryansk

In March, when generating personal income tax reporting, I discovered an error: the amount of tax calculated turned out to be greater than the amount of tax withheld and transferred.

I started checking and discovered that for some reason the program did not calculate tax on the amount of sick leave for an employee, which we paid in October. This employee quit in September, and then gave us sick leave in October. Therefore, we cannot withhold personal income tax.

What to do now, what to reflect in the 2-NDFL certificate? What do we face - a fine or just penalties? Until when will penalties be accrued?

: Indeed, this is an unfortunate mistake. But its consequences are even sadder.

Firstly, you had the opportunity to withhold personal income tax when paying benefits, but did not do so. And accordingly, the tax was not transferred to the budget on time. Even though this was a program error, you still face a fine of 20% of the unwithheld personal income tax amount Art. 123 Tax Code of the Russian Federation.

Secondly, since after paying for sick leave, you no longer paid any amounts to the former employee until the end of the year, you no later than 02/02/2015 (January 31 is a day off, Saturday) had to inform your Federal Tax Service about the impossibility of withholding personal income tax clause 5 art. 226, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation. That is, submit a 2-NDFL certificate for it with attribute “2”, where you had to indicate only income in the form of sick leave, as well as the amount calculated (clause 5.3 of the certificate) and non-withheld personal income tax (clause 5.7 of the certificate) pp. 1-3 Orders, approved. By Order of the Federal Tax Service dated September 16, 2011 No. ММВ-7-3/576@;. If you fail to submit the certificate within the prescribed period, you will face a fine of 200 rubles. clause 1 art. 126 Tax Code of the Russian Federation But this does not negate the obligation to present it. By the way, you must send the same certificate to your former employee. Since he will now have to declare the specified income and pay tax on it subp. 4 clause 1, pp. 2-4 tbsp. 228, paragraph 1, art. 229 Tax Code of the Russian Federation.

In addition, the Ministry of Finance and tax authorities believe that you must draw up a regular 2-NDFL certificate for this employee (with the sign “1”), which you submit to the Federal Tax Service no later than 04/01/2015 clause 2 art. 230 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated December 29, 2011 No. 03-04-06/6-363; Federal Tax Service for Moscow dated 03/07/2014 No. 20-15/021334. It must reflect all calculations for the current year, namely all income received by him, all deductions provided, as well as the total amounts of personal income tax - calculated (clause 5.3 of the certificate), withheld (clause 5.4 of the certificate), transferred (clause 5.5 of the certificate) and unretained (clause 5.7 of the certificate) section II Recommendations, approved. By Order No. ММВ-7-3/611@.

Thirdly, for untimely transfer of personal income tax, you face penalties for the period from the moment when you were supposed to withhold and transfer the tax to the budget, and until the due date for its payment by an individual at the end of the tax period. clause 2 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57; Letter of the Federal Tax Service dated August 22, 2014 No. SA-4-7/16692. That is, penalties will have to be paid until July 15, 2015 inclusive clause 4 art. 228 Tax Code of the Russian Federation.

At the same time, you don’t have to pay fines and penalties, since the tax authorities themselves will collect everything from you if they come to check with you. Or maybe it will pass. In addition, when inspectors discover a violation, you can explain that personal income tax was not withheld on time not due to your fault, but due to a glitch in the program. And if the amount of the fine is large, then ask the tax authorities to reduce it, indicating that you yourself corrected the mistake subp. 3 p. 1 art. 112 Tax Code of the Russian Federation. It is possible that this will work.

Due to the transfer of personal income tax to the wrong KBK, fines and penalties are not threatened

M. Baryshnikov, Omsk

I am registered as an individual entrepreneur using the simplified procedure. And 10 months ago I registered as an employer. When registering with the Federal Tax Service, I was given a sample receipt for paying personal income tax for employees, which indicated the following BCC: 182 1 01 02030 01 1000 110. I paid the tax to it in a timely manner for 9 months, when I paid salaries to employees (residents of the Russian Federation).

In January 2015, I decided to clarify whether the BCC had changed since the new year. And I discovered that personal income tax for employees must be transferred to KBC 182 1 01 02010 01 1000 110. The same KBC was in effect in 2014.

It turns out that in 2014 I transferred personal income tax for employees using the wrong KBK. Is there any way to fix this now and what will I face (fines, penalties)?

: Indeed, you transferred personal income tax for your employees to the wrong KBK. After all, on KBK 182 1 01 020 30 01 1000 110 personal income tax must be paid in the case when individuals themselves declare their income in accordance with Art. 228 Tax Code of the Russian Federation Order of the Federal Tax Service dated December 30, 2014 No. ND-7-1/696@.

But, as a specialist from the Ministry of Finance explained, there is nothing wrong with this, everything can be fixed.

FROM AUTHENTIC SOURCES

“The Tax Code stipulates that if an error is detected in the execution of an order for the transfer of tax, which does not entail the non-transfer of this tax to the budget system of the Russian Federation to the appropriate account of the Federal Treasury, the taxpayer has the right to submit to the tax authority at the place of his registration a statement about the error with a request to clarify the basis, type and the nature of the payment, tax period or payer status. This application must be accompanied by documents confirming the payment by the taxpayer of the specified tax and its transfer to the budget system of the Russian Federation to the appropriate account of the Federal Treasury. clause 7 art. 45 Tax Code of the Russian Federation.

The procedure for clarifying the BCC can only be carried out within the same tax. In the case under consideration, this is possible, since the entrepreneur transferred personal income tax for employees to the wrong KBK, but also intended for this tax.

Based on the entrepreneur’s application, the tax authority will make a decision to clarify the payment, and will also recalculate (add) penalties automatically accrued to the tax amount Letters of the Ministry of Finance dated July 17, 2013 No. 03-02-07/2/27977; Federal Tax Service dated December 22, 2011 No. ZN-4-1/21889.

Now regarding the application of responsibility. Since personal income tax was withheld by the entrepreneur and transferred in a timely manner and in full, the tax authority has no grounds for bringing him to tax liability under Art. 123 Tax Code of the Russian Federation.”

Advisor to the State Civil Service of the Russian Federation, 1st class

When an employee receives income, the organization, as a tax agent, is obliged to calculate personal income tax on the employee’s taxable income, withhold it and transfer the withheld amount to the budget (clause 1 of article 226 of the Tax Code of the Russian Federation).

Excessively withheld personal income tax occurs in the following situations:

- Deductions are provided retroactively.

- When changing status from non-resident to resident.

- Perform any recalculations. For example, when an employee’s salary was calculated for the month, and it later turned out that he had been granted leave without pay.

Deductions provided retroactively

Let's look at how excess is taken into account using an example when an employee wrote an application for a retroactive deduction. In other cases, you need to act in the same way.

For example, an employee submitted an application for a deduction not in January, but in March. Salaries for January and February have already been calculated and personal income tax has been calculated.

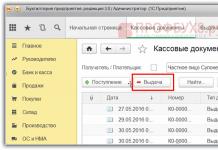

How to register the right to a standard tax deduction for personal income tax in 1C ZUP 3.0 (2.5), see our video:

The first event option: when the total personal income tax amount for the current month is positive

In 1C 8.3 ZUP 3.0 This is what the salary calculation for January 2016 looks like: taxable income will be 16,500 rubles. and the tax on it is 2,145 rubles. A similar calculation will be for February 2016:

In March 2016, an employee writes an application to provide her with a deduction for one child:

When calculating your salary for March 2016, let’s pay attention to the personal income tax tab. On the Accruals tab, the calculation will be the same as in January and February:

Firstly, we see that a deduction of 1,400 rubles was applied. (the Applied deductions column is filled in). Secondly, in addition to the line for March 2016, lines for previous months appear. Tax in the amount of -182 rubles. corresponds to the amount of tax that must be recalculated taking into account the deduction, i.e. 1,400 * 13% = 182 rub. Thus, in March, personal income tax will be recalculated and tax amounts for January and February will be taken into account. When paying salary for March, tax will be withheld taking into account this recalculation:

In 1C 8.2 ZUP 2.5 the calculation will be similar. The only difference is how the information on deductions will be entered.

In 1C for salary accounting ed. 2.5 in order to assign deductions to an employee, you need to open the individual’s card (Desktop – Personnel records – See also – Individuals or go from the employee’s card to the link “More details about the individual..”), execute the “Personal Income Tax” command in top command bar:

In the Data Entry for Personal Income Tax window, enter information on deductions:

When calculating salary for March 2016, we will also see the recalculation of personal income tax for January and February 2016:

We pay the salary for March, post the document and look at the personal income tax accumulation register and settlements with the budget. In this register, with the type of movement “Expense” (“minus”), the personal income tax withheld is recorded:

You can view the records that were created in the Personal Income Tax Accounts with the Budget register by clicking the Go to – Personal Income Tax Accounts with the Budget button in the open document Salaries to be paid by organizations:

The second version of the event: when the total personal income tax amount for the current month is negative

In the examples under consideration, the tax amount for March 2016 was enough for the total tax amount to be positive for three months. But there are situations when the tax amount for the current month may not be enough and the tax will end up being negative.

IN ZUP 3.0 for example, employee A.I. Sokorina worked only one day in March; the rest of the time she took leave without pay.

Then, when calculating her salary for March 2016, she will have the following calculation:

Taxable income will be 750 rubles, personal income tax on this amount will be 98 rubles. But since the employee is entitled to a deduction, it will not be applied in full, but only for 98 rubles. The remaining amount is 182 – 98 = 84 rubles. will be counted towards the next billing month. Amounts for January and February will also be credited next month. Amounts that cannot be taken into account in the current calculation appear in the Tax for credit or refund column.

If this column is not visible in 1C ZUP 8.3, you can enable its display using the More – Change form button. This column must always be monitored, since it records excessively withheld personal income tax. Program 1C 8.3 ZUP 3.0 keeps records of such amounts separately and does not offer them for payment:

Let's pay the salary for March and see that the amount payable has not been increased by the amount of excess tax withheld and is equal to 750 rubles:

We will generate a payslip for March. The amount of over-withheld tax is taken into account as a debt owed by the enterprise at the end of the month:

Let's look at the salary summary for March 2016, we will be interested in the personal income tax line:

As you can see, in the total amount of personal income tax (6,545 rubles) there is an amount with excessively withheld personal income tax (-448 rubles), which should not affect the withheld tax. According to the law, the amount of withheld personal income tax must be transferred to the budget, but in the summary we see the amount of calculated personal income tax. Thus, the amount that needs to be transferred to the budget for March should be 448 rubles. more than in the vault.

In the salary payment statement, personal income tax for transfer is recorded in the amount of 6,993 rubles, which is 448 rubles. more than in the vault (6,545 + 448 = 6,993 rubles):

Let's calculate the salary for April 2016 and look at the personal income tax tab:

For employee A.I. Sokorina, the over-withheld personal income tax in the amount of 448 rubles is offset. Now the amount is in the column Tax to be credited, refunded stands with a plus sign:

In the payslip for April, the debt is the amount that does not include excessively withheld personal income tax. Thus, the amount is 448 rubles. was credited. The information displayed in “For reference” tells us this:

We will pay employees salaries for April 2016:

The personal income tax amount according to the code was 8,708 rubles, and it is necessary to transfer the amount of 8,260 rubles, which is 448 rubles. less. The amount of tax withheld differs from that calculated exactly for the credited amount of excess personal income tax withheld.

If the personal income tax amount in the summary contains negative values, then when transferring personal income tax to the budget, these amounts should not be taken into account. Accordingly, the amount in the summary and the amount when paying personal income tax will never be equal. Also, if negative amounts are offset in the next month, then the amount in the personal income tax summary will not be equal to the amount for personal income tax transfer to the budget.

In addition, the amount of personal income tax withheld in excess can be included in the calculation of the next month. The employee can write a statement and the over-withheld tax will be returned to him.

Changing status from non-resident to resident

If excessively withheld personal income tax arose as a result of a change in status from non-resident to resident, then the tax is not refundable, but can only be offset in the calculation of subsequent months. If at the end of the tax period not the entire amount has been credited, then the organization submits information about the excessively withheld personal income tax to the tax office and the tax office itself returns this amount to the employee after his application.

Excessively withheld personal income tax - what to do?

Let's study how to return excessively withheld personal income tax in the 1C 8.3 (8.2) program for personnel.

How to return excessively withheld personal income tax in 1C ZUP 8.3 (rev. 3.0)

- We generate a tax refund document: section Taxes and contributions – Personal income tax refund:

- A document for payment of salary, in which we already see that the amount is paid in the amount of 1,198 rubles (750 rubles (salary) + 448 rubles (returned personal income tax):

In the payslip we see that an amount of over-withheld personal income tax was generated and in the same month it was offset, that is, returned and paid together in the salary for March 2016:

In the case of a personal income tax refund, you must manually make an entry in the register Calculations of tax agents with the personal income tax budget in order to correctly display personal income tax information for transfer. To do this, we will create a Data Transfers document. In setting up the composition of registers, we will select the accumulation register Calculations of tax agents with the personal income tax budget. Let’s fill it in as an “expense” with the amount “-448.00”:

Thus, we adjusted the information on the personal income tax transferred to the budget by the amount of the refund.

About possible errors when withholding personal income tax in 1C ZUP 3.0, see our video lesson:

How to return excessively withheld personal income tax in 1C ZUP 8.2 (rev. 2.5)

Let’s say an employee takes leave without saving from 03/01/16 to 03/30/16.

Thus, in March he worked only 1 day:

Let's calculate his salary for March 2016 and see that a personal income tax amount with a minus sign has been formed, that is, an excessively withheld personal income tax has arisen:

This amount does not increase the amount payable and is stored in a separate personal income tax register for offset. You can view it by clicking on the Go button in the posted Payroll document:

If over-withheld personal income tax occurs, an entry with a “+” sign is placed in the register. In the payslip for March, the debt at the end of the month is 909.45 rubles, of which 364.00 rubles is the amount of excessively withheld personal income tax:

The amount of personal income tax withheld in excess should not increase the amount payable. This is what we see, having generated a document for payment of salary for March 2016. The amount to be paid is 545.45 = 909.45 -364.00 rubles:

When posting a payment document, a zero amount of withheld tax is recorded, and thus a difference arises between the calculated and withheld personal income tax. We can look at the calculated tax in the salary summary or in employee pay slips:

In the summary for March 2016, the amount of personal income tax calculated was 1,716.00 rubles. there is a negative tax amount. You need to transfer to the budget the amount withheld, that is, for March 2016. an amount of 364 rubles must be transferred. more than we see from the vault.

See the amount that must be transferred for March 2016. You can use the report Analysis of accrued taxes and contributions on the date when the salary for March was paid. In our example, this is 04/05/2016. The personal income tax withheld column will indicate the amount to be transferred to the budget:

There are two possible scenarios for working with such personal income tax:

- or read out in the following months;

- or it is returned at the request of the employee.

The amount of excessively withheld personal income tax is credited in the following months

Let's calculate the salary for April 2016. Employee New S.S. taxable income is 12,000 rubles - 1,400 rubles. (deduction) = 10,600 rub. Personal income tax on this income is 10,600 * 13% = 1,378 rubles. – we see this on the personal income tax tab:

When carrying out this document, an entry is created in the personal income tax accumulation register for offset, but with a “-” sign, that is, the amount that was previously recorded in this register with a “+” sign in March 2016 was written off by this document:

When paying salary for April, the amount “To be paid” will be more by 364 rubles:

Let's generate a report Analysis of personal income tax on the date of payment of salary for April 2016 (as of 05/04/2016) and see how much needs to be transferred to the personal income tax budget for April 2016. And as can be seen from the report, this amount is 3,094.00 rubles. less than the amount according to the set of 3,458.00 rubles. for 364.00 rub:

If an employee has written an application for a personal income tax refund

We create a document for personal income tax return: Desktop – Taxes – Personal income tax return. When carrying out this document, records are generated in registers.

To be credited to the personal income tax register in an amount equal to the tax refund amount with a “-“ sign. Thus, the excess withheld tax is considered written off:

The monthly salary register for organizations records the amount that will be paid to the employee:

In the personal income tax register, settlements with the budget create an entry with a “-“ sign, which reduces the amount of withheld tax by 364 rubles:

We pay registered personal income tax refund:

When a document is entered into the personal income tax register for offset, the amount of calculated tax when calculating the salary for April 2016 will already be different, since the amount was written off earlier using the personal income tax return document:

Forming the payment for April 2016, the amount paid is 364 rubles. less than in the previous example:

Let's return to the Analysis of accrued taxes and contributions report and generate it on the payment date. The amount of withheld tax to be transferred to the budget has not changed compared to the previous example:

In ZUP 2.5, as well as in ZUP 3.0, when returning personal income tax, there is no reduction in the amount of transferred personal income tax in the register Calculations of tax agents with the budget for personal income tax, so you have to manually adjust this amount.

The discrepancy in the amount of personal income tax withheld and personal income tax to be transferred can be seen if you generate a report Analysis of accrued taxes and contributions for the period from April to the date of salary payment:

In order to adjust the amount to be transferred, use the Data Transfer document. We create an entry in the accumulation register Calculations of tax agents with the budget for personal income tax with the type of movement incoming, for the amount of the returned personal income tax with a minus sign, thereby reducing the amount to be transferred:

Let’s generate a report again with the same parameters and see that the amount of personal income tax withheld has become equal to the amount of personal income tax to be transferred:

Let's summarize. If for some reason you have an overly withheld personal income tax in your calculations, then now you know how to return the overly withheld personal income tax for its correct accounting in 1C programs.

The moment of registration of withheld personal income tax in 1C ZUP 2.5 depends on the checkbox “When calculating personal income tax, take the calculated tax into account as withheld.” Each option, depending on whether the checkbox is checked or not, has its own nuances that require increased attention. See our video for more details:

To bring to you all the latest information on the formation of form 6-NDFL, to understand all the intricacies and nuances of filling out calculations in 1C, the Profbukh8 team ( 1

ratings, average: 5,00

out of 5)

These materials are available

for viewing by registered users only

subscribers of the Profbukh8.ru project

In practice, accountants periodically encounter situations where personal income tax has been excessively withheld from employees. In this regard, in Letter dated August 13, 2014 No. PA-4-11/15988, the Federal Tax Service considered the issue of the procedure for returning personal income tax, excessively withheld and transferred to the budget by the tax agent from the employee’s income. We described in the presented article what recommendations the tax department specialists presented on this issue.

According to the rules clause 1 art. 231 Tax Code of the Russian Federation the refund to the taxpayer of the excessively withheld amount of tax is made by the tax agent at the expense of the amounts of this tax subject to transfer to the budget system of the Russian Federation on account of upcoming payments both for the specified taxpayer and for other taxpayers, from whose income the tax agent withholds the said tax, within three months from the day the tax agent receives the corresponding application from the taxpayer.

It should be noted that previously the regulatory authorities drew attention to the need for the taxpayer to provide a written application for the return of the overly withheld tax amount ( Letters of the Ministry of Finance of the Russian Federation dated July 21, 2014 No. 03‑04‑05/35552 , dated 05/26/2014 No. 03‑04‑06/24982 ).

IN Letter dated May 16, 2011 No. 03‑04‑06/6-112 The Ministry of Finance noted that clause 1 art. 231 Tax Code of the Russian Federation a maximum period of three months has been established for the tax agent to return to the taxpayer the amounts of tax withheld in excess from the moment he submits the application. The tax agent makes a decision to independently return the tax amounts or to apply to the tax authority for the return of the tax amounts to the tax agent immediately after receiving the taxpayer’s application for the return of the amounts of overly withheld tax. In this case, a repeated application by the taxpayer for the return of excessively withheld tax amounts is not required.

FYI

Based on para. 2 p. 1 art. 231 Tax Code of the Russian Federation The tax agent is obliged to inform the taxpayer about each fact of excessive withholding of tax that has become known to him and the amount of excess withheld tax within 10 days from the date of discovery of such a fact. IN Letter from the Ministry of Finance of the Russian Federationdated 10/18/2013 No. 03‑04‑06/43608 contains a clarification that the Tax Code does not provide for notification of the tax authority about the refund of the overly withheld amount of tax.

If the amount of tax to be transferred by the tax agent to the budget system of the Russian Federation is not enough to return the amount of tax that was excessively withheld and transferred to the budget system of the Russian Federation to the taxpayer within the period established clause 1 art. 231 Tax Code of the Russian Federation, the tax agent, within 10 days from the date the taxpayer submits the corresponding application to him, sends to the tax authority at the place of his registration an application for a refund to the tax agent of the amount of tax withheld in excess.

The return of the tax amount transferred to the budget system of the Russian Federation to the tax agent is made by the tax authority in the manner established Art. 78 Tax Code of the Russian Federation. The tax office must notify the tax agent in writing of its decision to refund the overpayment (refusal to make a refund) within five business days from the date of the decision ( clause 6 art. 6.1, clause 9 art. 78 Tax Code of the Russian Federation). If a positive decision is made, the personal income tax inspectorate must return the overpayment to the tax agent within a month after receiving the corresponding application from him ( clause 6 art. 78 Tax Code of the Russian Federation).

If the specified period is violated, interest is charged on the amount to be returned for each calendar day of delay ( clause 10 art. 78 Tax Code of the Russian Federation).

The tax department explained how interest is calculated in Letterdated 02/08/2013 No. ND-4-8/1968@ “On the accrual of interest for violation of the deadline for the return of amounts of overpaid (collected) tax”. Department specialists noted that the interest rate is assumed to be equal to the refinancing rate of the Central Bank of the Russian Federation, which was in effect on the days when the repayment deadline was violated.

According to the rules clause 5 art. 79 Tax Code of the Russian Federation the amount of excessively collected tax is subject to refund with interest accrued on it within one month from the date of receipt of a written application (application submitted in electronic form with an enhanced qualified electronic signature via telecommunication channels) of the taxpayer for the return of the amount of excessively collected tax. Interest on the amount of excessively collected tax is accrued from the day following the day of collection until the day of the actual refund.

Please note that the current edition Art. 78 And 79 Tax Code of the Russian Federation does not indicate on what number of days - 360, 365 or 366 - the corresponding interest is calculated.

At the same time, in clause 2 of the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 13, Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 of October 8, 1998 “On the practice of applying the provisions of the Civil Code of the Russian Federation on interest for the use of other people’s funds” (hereinafter - Resolution No. 13/14 ) it is clarified that when calculating the annual interest payable at the refinancing rate of the Central Bank of the Russian Federation, the number of days in a year (month) is taken equal to 360 (30) days, unless otherwise established by agreement of the parties, rules binding on the parties, as well as business customs.

Judicial practice indicates that courts find it possible to calculate interest in the amount of 1/360 of the refinancing rate in accordance with clause 2 of Resolution No. 13/14 .

Taking into account judicial practice, the Federal Tax Service also believes it is appropriate to calculate interest in the amount of 1/360 of the refinancing rate for each calendar day of violation of the deadline for returning the amount of overpaid (collected) tax.

FYI

IN Letter of the Federal Tax Service of the Russian Federation dated September 20, 2013 No. BS-4-11/17025 The issue of the procedure for returning overpaid amounts of personal income tax from income in the form of dividends from equity participation in the organization was considered. Tax department officials explained that when making a personal income tax refund, the type of income paid to other persons and the applied tax rate do not matter. It turns out that in order to return personal income tax, it is not necessary to reflect in payment documents additional information about the payment of personal income tax on income received in the form of dividends from equity participation in the activities of the organization.

According to section IRecommendations for filling out form 2-NDFL “Certificate of income of an individual for the year 20__”, approved By Order of the Federal Tax Service of the Russian Federation dated November 17, 2010 No. ММВ-7-3/611@, when recalculating personal income tax in connection with clarification of the tax obligations of an individual, the tax agent issues a new certificate. When drawing up a new certificate to replace the previously submitted one, in the fields “No.___” and “from ___” you need to enter the number of the previously submitted certificate and the new date of preparation of the certificate.

If, as a result of the recalculation, it was established that the tax agent had excessively withheld personal income tax from the employee’s income in the previous period and the refund of the amount of excessively withheld tax was made by the tax agent, then in relation to this taxpayer an updated certificate should be issued for the specified period, correcting clauses 5.3 - 5.5 of the updated certificates in accordance with the indicators formed after recalculation. Clause 5.6 of the updated certificate is not completed.

Thus, if in 2014 it is discovered that tax was excessively withheld from employees in 2013, the organization must submit to the tax authority new certificates in form 2-NDFL for 2013 in relation to those employees from whose income it was excessively withheld and transferred to the personal income tax budget, and application for credit or refund of overpaid tax.

Along with an application for the return of the amount of tax that was excessively withheld and transferred to the budget system of the Russian Federation, the tax agent submits to the tax authority:

- an extract from the tax register for the corresponding tax period;

- documents confirming excessive withholding and transfer of tax amounts to the budget system of the Russian Federation (accounting certificates, explanations, payroll statements with error correction).

FYI

Until 2011, that is, before amendments were made Federal Law of July 27, 2010 No. 229-FZ V clause 1 art. 231 Tax Code of the Russian Federation, the provisions of this paragraph did not provide for the possibility of the tax agent returning the overpayment at his own expense. However, the Ministry of Finance allowed the possibility of such a return. The corresponding clarifications from the financial department are presented in Letter dated 04/03/2009 No. 03‑04‑06‑01/76 . In addition, the Tax Code of the Russian Federation did not contain provisions allowing for the return of excessively withheld personal income tax at the expense of taxes withheld from the income of other individuals ( Letters of the Ministry of Finance of the Russian Federation dated June 28, 2010 No. 03‑04‑06/6-136 , dated 04/12/2010 No. 03‑04‑06/9-72 , dated 06/09/2009 No. 03‑04‑06‑01/130 ).

In conclusion, we note that according to para. 4 paragraphs 1 art. 231 Tax Code of the Russian Federation the tax agent must return the over-withheld personal income tax in non-cash form by transferring funds to the individual’s bank account. The taxpayer's account details should be specified in the application. In accounting, for the specified personal income tax amount, a reversal entry is made to the debit of account 70 “Settlements with personnel for wages” and the credit of account 68 “Calculations for taxes and fees”, personal income tax subaccount. Payment of this tax amount is reflected in the debit of account 70 and the credit of account 51 “Current accounts”.

When calculating income tax, errors often occur, as a result of which personal income tax is excessively withheld. There may be several reasons: an arithmetic error by the accounting service, ignoring supporting documents for deductions during calculations, changing the status of an employee from non-resident to resident.

What should an accountant do if he discovers excessive deductions from an employee’s income? Our article will tell you about the procedure and legislative norms regulating tax refunds to employees.

What does the legislator say?

The procedure for returning personal income tax withheld excessively from income is contained in the Tax Code of the Russian Federation, Art. 231-1. The return of amounts to the employer that he excessively transferred for the employee to the Federal Tax Service is regulated by the Tax Code of the Russian Federation, Art. 78. Article 231 does not exclude the possibility of paying a citizen personal income tax amounts from the employer’s funds until the moment when the Federal Tax Service Inspectorate returns this money to the employer’s account.

The same article talks about the need for a tax refund if the payer wrote an application addressed to the employer with a request to provide him with a property deduction, but the right to deduction was not taken into account in the calculation.

Property deduction in connection with the purchase (construction) of housing has its own nuances when it comes to income tax refunds.

According to the law, an individual has the opportunity to receive a deduction (according to the Tax Code of the Russian Federation, Article 220, paragraphs 7-8):

- at the tax office at the end of the year;

- in the place where he works, in the middle of the year.

When applying for a deduction at the place of work, the taxpayer must keep in mind that the accounting department will begin to reduce personal income tax in calculations from the month in which he wrote an application requesting a deduction. This raises the question of whether the employer should recalculate the tax downward from the beginning of the year and then return it.

The Ministry of Finance says that the employer should not return personal income tax withheld before receiving the taxpayer’s application (with confirmation from the tax office that he has the right to do so) (document No. 03-04-06/6-46 dated 21/03/11 . and a number of others).

Return algorithm

Having discovered the fact of excessive deduction, the company’s management is obliged to follow the return procedure prescribed in the Tax Code of the Russian Federation:

- Inform the employee about excessive personal income tax withholding. The form of such a message can be arbitrary, and the notification procedure is agreed upon with the employee in advance (Ministry of Finance, document No. 03/04/06/6-112 dated 05/16/11). A ten-day period has been established from the moment the violation is discovered for sending such a message to an employee of the company. The notification must indicate the amount to be returned (Tax Code of the Russian Federation, Article 231-1, Article 6.1-1).

- Wait until the employee writes an application requesting a personal income tax refund (Article 231-1 of the Tax Code and letters from the Ministry of Finance). The application can be submitted within a period of up to 3 years from the moment the tax was paid (Article 78-7 of the Tax Code). The money is returned to the employee only to his account, in non-cash form. The account number must be indicated in the application.

- Return the overpayment to the employee within 3 months after receiving the application from the employee. If this deadline is ignored, then for each subsequent calendar day the employer is obliged to accrue interest and pay it along with the returned amount. The interest rate is equal to the Central Bank refinancing rate that was current at the time of the violation.

The resulting tax overpayment can be repaid using current personal income tax payments, i.e. reduce the amount of personal income tax due to amounts accrued from the income of this employee or other employees, regardless of the tax rate that was used in the calculations and the types of income.

If for some reason a company is unable to return to an employee the tax withheld in excess, it is necessary to contact the Federal Tax Service, submitting an application for the need to return personal income tax to an individual within the time limits established by law. The application is accompanied by documents that reflect the fact of overpayment, and tax documents-calculations for personal income tax withholding (extracts from the NU registers for the corresponding period).

Note! If the tax agent paid personal income tax “for future use”, i.e. against future payments, and has made an overpayment, the Federal Tax Service does not recognize it as an overpayment of income tax, since payment of this tax at the expense of a tax agent is unacceptable. In this case, the company should apply to the Federal Tax Service for a refund of “non-personal income tax” that was paid by mistake. It is also possible to offset this amount against other taxes (letter No. GD-4-8/2085@ dated 02/06/17).

An employee can return personal income tax by contacting the Federal Tax Service:

- if the company where he worked was liquidated;

- if the employee acquired the status of a resident of the Russian Federation in the current calendar year.

In the latter case, the overpayment arises due to the difference in personal income tax rates for residents and non-residents (13 and 30% of income, respectively). When applying, the taxpayer provides an income tax return and an application indicating the account to which the excess tax withheld will be transferred. It is also necessary to confirm the status of a resident of the Russian Federation with documents available to the employee (copies of registration documents at the place of residence, migration card, etc.).

It may happen that the employee has already been fired, and the accounting department has discovered an overpayment of tax on his income. In this case, the company is obliged to return the excessively withheld personal income tax to the employee.

The refund is processed in the same order and according to the same algorithm as given above: notification, application from the employee, transfer of funds to him.

If by the end of the year the employee has not responded to the notification and has not written a statement, a 2-NDFL certificate is generated based on it, which indicates the fact and amount of the overpayment. It is advisable to send a copy of such a certificate to the employee along with the notification.

If the information has already been sent to the tax office, and the employee has declared his right to a refund, the amount must be returned.

After this, a corrective certificate 2-NDFL is submitted to the Federal Tax Service, in which the excessively withheld tax will not be reflected. In addition, Form 6-NDFL must indicate the amount transferred to the employee into the account of over-withheld personal income tax in the reporting period in which the transfer took place.

Accounting entries for personal income tax return transactions are adjustment entries - reversal Dt 70 Kt 68/NDFL.

Briefly

The return of personal income tax to the employee is made after he is notified of the amount excessively withheld from income. Refunds are made based on the employee’s application, only by bank transfer to the individual’s bank account.

If it is impossible to transfer the tax, the management of the company is obliged to contact the Federal Tax Service with a statement about this, attaching the relevant information on personal income tax from the NU registers. Ignoring the tax agent's obligations to return personal income tax leads to the need for him to pay additional interest for each day of delay.