Reconciliation of the VAT declaration with the purchase book and sales book in 1C: Accounting 3.0

For the VAT declaration, several dozen control ratios are legally established to check the correctness of completion.

When filling out and checking a VAT return, you should always take into account the specifics of VAT accounting in each individual organization (application of different VAT rates, maintaining separate VAT accounting, etc.) and draw up algorithms for controlling VAT accounting in accordance with the existing features. In this example, we will consider an organization using OSNO, operating only with a VAT rate of 18%.

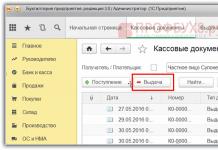

In the 1C: Enterprise Accounting 3.0 program, a special verification module is built into the regulated report “VAT Declaration”:

If there are errors in the control ratios, the form provides a list of only erroneous ratios.

Also, when filling out a VAT return, 1C users are recommended to report “Analysis of the state of tax accounting for VAT”. This report is intended to verify the correctness of registration of business activities in terms of VAT, filling out the purchase book and sales book, and filling out the tax return. The report shows current data after all regulatory operations for VAT accounting have been carried out.

The report presents the structure of the VAT tax base. Individual blocks of the scheme reflect the accrual or deduction of VAT. The yellow background shows the amounts of calculated VAT, and the gray background shows the amounts of non-calculated VAT.

How to check your VAT return before submitting it?

By clicking on each individual block, you can view its transcript.

The tax return analyzes Section 3:

- Dt 62.01×18/118 = Line code 10, Column 5 “Tax amount in rubles”;

- Dt 62.01×100/118 = Line code 10, Column 3 “Tax base in rubles”.

3. SALT Kt 62.02×18/118 = Dt 76AV (in the tax return this corresponds to line 070 of section 3, column 5 “Tax amount in rubles”);

SALT Kt 62.02 (in the tax return this corresponds to line 070 of section 3, column 3 “Tax base in rubles”).

4. In SALT account 19 there should be no balances at the end of the period (in the declaration this is line 120, section 3, column 3 “Tax amount in rubles”;

5. Dt 68.02 (forming SALT) = Section 8: information from the purchase book Line 190;

6. Kt 68.02 (we form SALT) = Section 9: information from the sales book Line 260.

If there is other income in the practical activities of the organization, then when selling goods, works and services, the proceeds of which are classified as other income, output VAT is accounted for in account 91.02 (see below for an example of RT&U entries for other income).

For further analysis of VAT calculated on other income, you can use the analysis of account 91.02 or account 68.02. When analyzing account 91.02, you need to pay attention to the revolutions according to Dt 68, and when analyzing account 68.02 - to the revolutions according to Kt 91.

In the declaration, the reflection of VAT data on accounts 91.01 and 91.02 can be tracked as follows:

- (SALT Kt 90.01.1 + SALT Kt 91.01) x 100/118 = line 10, section 3, column 3 “Tax base in rubles”;

- (SALT Kt 90.01.1 + SALT Kt 91.01) x 18/118 = line 10, section 3, column 5 “Tax amount in rubles”;

You can also analyze the data in line 10 of column 5 “Tax amount in rubles” taking into account account 91.02, which reflects VAT calculated on other income:

OSV Dt 90.03 + analysis of account 91.02 (revolutions Dt 68).

I hope this article was useful to you. If you still have questions, SITEK specialists are always ready to provide advice on working with the program.

____________________________________________________________________________

Author of the article: Specialist of the support department Anna Alexandrova. Article updated 09.26.2016

Checking the VAT return

All organizations that pay Value Added Tax are required to calculate the amount of tax and submit a declaration by the 25th of the quarter. Let us remind you that the VAT return is submitted only! in electronic form. From January 1, 2016, if the declaration is submitted in paper form, it is considered not submitted.

Any tax accountant must learn how to calculate VAT using a balance sheet (SALT).

Below we will describe how to do this.

- Use the VAT Accounting Assistant to process all invoices (including advance invoices).

- Generate SALT for the quarter.

- Pay attention to account 62.02 - these are advances received; this account must be reconciled with SALT in account 76.AB.

There are several cases when VAT is not calculated for payment of advances received; these are cases prescribed in Article 154 of the Tax Code of the Russian Federation.

If your transactions do not fall under the scope of this article, VAT on advances received should be recorded under Dt 76 of the account (see turnover by counterparties in SALT Kt 62.02).

- Create an analysis of account 19. Only the amount in correspondence with account 68 should be taken into account.

So the calculation: Turnover by Dt 90.03(sales tax) + Turnover Dt 76.AV(tax payable on advances received) + Turnover Dt 76.VA(reinstated tax on advances issued in the previous period) - Turnover by Kt 19(input VAT from the supplier: remember point 4 described above) - Turnover by Kt 76.AV(recovered VAT on advances received) - Turnover by Kt 76.VA(tax deductible on transferred advances)

As a result of these calculations, you will get the amount of your tax.

(if your organization also carried out sales through 91 accounts during this period, you must add the amount of tax that was posted through the transaction Dt 91.02 Kt 68.02)

/ "Accounting encyclopedia "Profirosta"

09.10.2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners

Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support , Providing accounting services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Organization of accounting

Look for related operations in them, next to which there is a possible error code “2”, and explain the inconsistencies. In some cases, one table may be attached to the requirement. For example, the seller declared in the declaration the deduction of advance VAT, but the declaration does not contain data on its accrual. The inspection will send such a seller a table with an extract from section 8 “Information from the purchase book...”, where the registered invoice for the advance payment with error code “2” will be indicated. Check whether you charged VAT on the advance, in what period and whether this is reflected in the VAT return. Having received an email from the Federal Tax Service Inspectorate about the provision of explanations, the payer may not send the receipt himself, but entrust this to his authorized representative Code “3”. Inconsistency of data about one transaction in parts 1 and 2 of the log of issued and received invoices.

Explanation of VAT line 130 and 90

Add to favoritesSend by email Line 090 of the VAT return in section 3 must be completed when restoring the tax, if the taxpayer-buyer uses the right to deduct “advance” VAT when transferring an advance payment to the supplier. Let's consider how to correctly generate such a tax amount and reflect it in the declaration.

Application of VAT deduction on advances to the supplier Restoration of VAT on advances to the supplier The procedure for filling out line 090 of the VAT return Results Application of VAT deduction on advances to the supplier Provisions of paragraph 12 of Art. 171 of the Tax Code of the Russian Federation provides the taxpayer with the right to apply a tax deduction for VAT amounts included in advances transferred to suppliers. The mandatory conditions for applying the deduction are the following points (clause.

9 tbsp.

Explanations for VAT returns from 2017

VAT differences upon prepayment, No. 3

- New forms of VAT accounting have appeared: when will they come into force?, No. 3

- New invoices, their accounting journal and books of purchases and sales, No. 3

- Errors in invoices? Needs to be fixed, No. 3

- Does the amount difference increase the VAT base, No. 3

- Optimization of VAT for non-trading organizations, No. 2

- Prepayment and shipment in one quarter: what to do with VAT?, No. 2

- Internet conference on VAT amendments: report, No. 1

- 2011

- October VAT amendments are transferred to the declaration, No. 24

- We calculate the VAT base and deductions when the price is in foreign currency or in yuan. e., No. 21

- Adjustment invoice form: gift from the Federal Tax Service, No. 20

- Agreement in

How to fill out line 090 of section 3 of the VAT return

- Preparation of VAT report, No. 19

- VAT upon assignment of a claim, No. 18

- YOU put in a word about VAT deductions for inseparable improvements, No. 17

- Update of VAT accounting documents, No. 17

- New rules for VAT document flow and more, No. 16

- Revelations from YOU about VAT rates and deductions, No. 16

- When to charge VAT and when to deduct: conclusions of the Supreme Court, No. 15

- What to do if you receive an adjustment invoice instead of a corrected one or vice versa, No. 13

- Main VAT document: correctly and on time, No. 11

- Fill out an invoice? Easy!, No. 8

- Near zero, or at what rate to charge VAT when working with international organizations, No. 8

- During an on-site inspection, the VAT refunded by camera was taken away: what to do?, No. 6

- Fill out an invoice? Elementary!, No. 4

- 2013

Announcement

Tax Code of the Russian Federation. Submitting an updated declaration as part of a desk audit of the primary declaration before drawing up the report is equivalent to correcting independently discovered errors. After all, since the desk inspection report has not yet been drawn up, the errors discovered by the inspectors have not been recorded. Letter of the Federal Tax Service dated November 20, 2015 No. ED-4-15/20327.

Attention

And if, for example, he considers that you have underestimated the tax base and underpaid the tax, you will be fined by the tax authority. 122 of the Tax Code of the Russian Federation. Sometimes inspectors scare organization officials with an administrative fine in the amount of 2,000 to 4,000 rubles.

Camera: we provide explanations on the VAT declaration

It is conducted for intermediary operations, as well as for operations of developers and forwarders (if they include only their remuneration in revenue). For example, an intermediary commission agent must register in part 2 of the accounting journal an invoice received from the principal.

And invoices issued to customers must be reflected in part 1 of the accounting journal. Data on invoices received and issued within the same intermediary transaction must be comparable.

If there are discrepancies, the inspection will attach to its request a table with an extract from section 10 “Information from the log of issued invoices” and/or a table with an extract from section 11 “Information from the log of received invoices” indicating information on “problematic » operations by entering the code “3” in the corresponding lines. Code "4".

In section 3 of the VAT return, the indicator in column 3, line 200 “Total amount of tax payable to the budget under section 3” must be equal to the difference between the indicator in column 5, line 110 “Total amount of tax calculated taking into account the restored tax amounts...” and the indicator in column 3 line 190 “Total amount of tax subject to deduction” RUB 80,000.00.<

VAT exempt, No. 15

- Let's continue the conversation: we solve VAT issues together, No. 15

- VAT on reimbursement of transportation costs, No. 14

- We solve VAT issues together, No. 14

- How to correct errors in VAT reporting, No. 13

- Special intermediary and invoice journal, No. 12

- Invoice for VAT from inter-price difference: attention to the amount of tax!, No. 12

- VAT deduction: immediately or later?, No. 11

- 10% or 18%? How to determine the VAT rate when selling a toy with a logo, No. 11

- Some consequences of transferring VAT deductions, No. 11

- We accept VAT for deduction in parts, No. 11

- Camera revealed a deduction for an incorrect VAT rate: what to do, No. 7

- And again about VAT, No. 6

- “Non-competitive” sale to a bankrupt: is there VAT?, No. 6

- VAT: tips and solutions on deductions and accruals, No. 5

- 2014

Explanation of VAT on pages 130 and 090

Tax Code of the Russian Federation. And if you received a request to submit documents, but did not comply with it on time, the organization may be fined 200 rubles. for each document not submitted. 1 tbsp. 126 of the Tax Code of the Russian Federation. Other articles from the magazine "MAIN BOOK" on the topic "VAT - accrual / deduction / refund": 2018

- Deduction of VAT from the seller when returning goods by simplifier, No. 8

- The transaction was declared invalid: in what period should VAT be adjusted, No. 7

- Safe share of VAT deductions, No. 6

- How can sellers - participants in the tax-free system fill out a VAT return, No. 3

- Address in the invoice: regular clarifications from the Ministry of Finance, No. 3

- VAT amendments: what to prepare for, No. 1

2017

Cost of purchases according to the invoice, difference in cost according to the adjustment invoice (including tax), in the currency of the invoice (Page 170) Amount of tax according to the invoice, difference in the amount of tax according to the adjustment invoice accepted for deduction , in rub. and cop. (Page 180) For reference: Possible error code 1 2 3 4 13 14 18 19 20 99 01 37 08/09/2015 Data that raises doubts among tax authorities 08/19/2015 7713587777 70 800 10 800 4 Error code helps to understand what taxes are doubting iki . Code “4” indicates that an error may have been made when registering the invoice.

In parentheses it is explained which data are in doubt. The number in brackets indicates a column in the same table with a dubious indicator 185 01 181Data that raises doubts among tax authorities 09.24.2015 09.24.2015 7716777788 212 400 32 400 4The error code helps to understand what tax officials doubt.

Therefore, the specialist involved in the declaration has no right to make mistakes, although even experienced employees make them.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

General information:

If the declaration indicates the right to a tax refund, Tax Inspectorate specialists conduct a desk audit.

At the same time, they are required to submit documents that serve as confirmation of the legality of using tax deductions.

Lines 150 and 130

Let's start by looking at how to check line 130 and line 150 of the VAT return. These positions are located in section 3 of the reporting document.

If the indicators in these lines are greater than 0, then the value in line 110 must equal the number indicated in line 150.

If this rule is violated, the taxpayer most likely underestimated the amount of VAT that is subject to restoration.

The accountant is required to fill out lines 110 and 150 of section 3 if there were transactions in the reporting period when VAT on advances were accepted for deduction.

After receiving services/works/products from suppliers, specialists are required to restore these amounts of value added tax.

If this rule is not followed, then the accountant violates the requirements specified in.

On line 200

Another important ratio for checking the declaration of accounts is the value noted in line 200. This column must be equal to or less than the sum of the values in column 5 (lines 010, 020, 030,040).

If this rule is not followed, then the accounting department may have made one of two mistakes:

- the amount of spent advances is not fully included in the sale; accordingly, the total tax base is underestimated;

- A violation was committed if the organization deducted VAT from the prepayment received, but did not deliver services/work/products to the buyer. In this case, tax deductions are not justified.

Line 210

Another important ratio is the value of column 3 of line 210.

This section indicates the amount of tax transferred by the taxpayer to the budget as a buyer - tax agent, which is subject to deduction.

In order for a tax resident to exercise the right to deduction, two conditions must be met:

- services/works/products must be actually purchased or provided;

- value added tax must be transferred to the budget.

Other ratios

Using control ratios, not only the data specified in the VAT return is checked, but also the values noted in other reporting forms.

For example, in column 3 of line 210 “Revenue” of the profit and loss statement, the indicator must be equal to or less than the value calculated on the basis of section 3 of the VAT return (the amount of column 3 on lines 010, 020, 030, 040, 050 and the value adding lines 030, 040, 050 columns 5).

If this ratio is not correct, then the taxpayer may have underestimated the VAT tax base. So, we found out how to check the VAT return according to tax rules. Let's consider other methods.

Other ways

When a VAT return is received by the Tax Inspectorate, specialists first of all carry out automated control of the correctness of filling out the indicators.

If there is an arithmetic error in the document, this may result in additional tax charges.

Using the automated “Tax” program, which has various calculation algorithms built into it, specialists check the declaration indicators.

Taxpayers must check the required details included in this reporting document: TIN, KPP, tax period, name of organization, reporting year.

After tax authorities have completed automated control, they select enterprises for inclusion in the plan for conducting audits and other control activities.

Important. A professional, experienced accountant knows that the value added tax return can be verified by analyzing account 68.2. "Calculations with the budget for VAT."

Check with financial statements

The Federal Tax Service obliges tax specialists to check the VAT return with financial statements, for example, with.

Initially, the inspector monitors the fulfillment of two conditions:

- section 2.1. page 250 balance. The amount of VAT on advances, which are accepted for deduction after shipment of products/works/services, must be equal to 0;

- page 621 gr. 3 balances. At the beginning of the year, the amount of accounts payable for settlements with suppliers and contractors should also be equal to 0.

If these conditions are met, the tax inspector compares the following indicators, which must be equal to each other:

- page 621 gr. 4 of the balance sheet - the amount of accounts payable for settlements with suppliers and contractors at the end of the year;

- the amount of payment received, which is calculated on an accrual basis, against future deliveries of products/works/services, minus VAT.

If these values are equal, then there are no violations. If there is no equality, then there is an error in the document.

In any case, such a discrepancy is a reason to call an accountant to the tax office to provide clarification.

How to check a declaration with turnover (SAW)?

If an accounting register such as this is not compiled within the organization, then you should not implement the design of this document in order to check the correctness of the VAT return.

In cases of desk audit, the tax inspector may request a balance sheet along with other documentation.

However, if the accounting policy of the enterprise reflects that the turnover is not compiled, the accounting department has the right not to submit this document.

By the way, when preparing and submitting a VAT return, with the specified right to a tax refund, the enterprise should prepare for an in-depth desk audit.

Based on its results, the tax inspectorate can make the following decisions:

- reimbursement of the full amount of tax that was claimed for reimbursement upon filing;

- refusal of reimbursement;

- partial refund of value added tax.

Check with income tax return

The tax inspector will necessarily compare the VAT return with the income tax return.

So, the specialist will compare the value of sales noted in the first of these documents with the amount of proceeds from sales, which is located in the second.

If the values are not equal, then either the taxpayer committed a violation, or the enterprise took into account any revenue as part of non-operating income.

This situation is quite justified if the money comes, for example, from renting out property.

By the way, from 2019, taxpayers will be required to enter into the VAT return data and, that is, information on which the organization calculated the tax and declared deductions.

There is a lot of hassle associated with the purchase book, because large enterprises have not 10–100 lines, but several thousand.

This feature is not at all important to tax authorities; all data must be entered in a special section of the VAT return.

Filing a VAT return entails significant difficulties even for experienced accountants. If the accounting is carried out by an individual entrepreneur himself, the task becomes doubly difficult. The document form adopted since 2015 has only made the situation worse, becoming more cumbersome and complex.

Tax reporting data for VAT

Organizations and entrepreneurs who, in the course of their activities, present VAT to customers as part of the cost of services rendered or goods supplied, are required to periodically submit tax reports to the Federal Tax Service. Based on the information received, the VAT previously presented to buyers for payment to the budget is calculated.

Taxpayers have the right to reduce the accrued amount by incoming VAT, that is, received from suppliers. In addition, the calculated tax payable is reduced by VAT payments actually transferred to the budget at a rate of 0% as a result of the import of goods into the territory of the state.

| Taxpayers | Subjects of the Russian Federation that charge VAT | Tax agents |

| Tax payable | Presented to buyers, excluding deductions | Accrued tax for foreign representatives, municipal authorities and other cases |

| Delivery deadlines | 25th day after the end of the tax period | |

| Reporting format | Electronically | It is allowed to submit reports on paper if the entities are not VAT payers |

Sections of the VAT return must reflect the following data:

- Estimated tax due or refundable.

- VAT required to be remitted by the tax agent.

- Tax calculation at various rates, including 0%.

- Confirmed and unconfirmed tax deductions at a rate of 0%.

- Tax-exempt transactions.

- Data from tax registers (books of purchases, sales, invoice journals).

- Information about transactions on issued invoices in the interests of 3 parties.

In cases where contradictory information is discovered when reconciling data with counterparties, tax authorities have the right to request explanations for the discrepancies and require the submission of updated declarations. The period for detecting errors, submitting corrective information or providing clarifying information does not exceed 5 working days.

Tax accrued

Tax is calculated according to the total amount of VAT presented to customers. All information is entered based on data from tax registers, which are books of purchases and sales. Information from these documents is included in the reporting.

Filing a declaration electronically allows inspectors to quickly compare data on outgoing and incoming VAT from counterparties. In case of disagreement, the inspection has the right to request additional clarification.

Information from the sales book in section 9 of the declaration also contains information about the amounts accrued by tax agents.

Tax deductions

Taxpayers have the right to reduce the total amount of calculated tax by the amount of input VAT. If subjects declared their right to deductions during the tax period, they are required to fill out section 8 of the declaration in accordance with the data in the purchase book. The number of entries depends on the actions performed.

Deductions also include the amount of VAT actually paid during the tax period under review on imported goods imported into the country. In this case, the legality of the transferred tax must be confirmed by the Federal Tax Service.

Filling out a VAT return

Until 2014, the main condition for choosing a declaration format was the current number of employees. If an employer employed more than 100 people, reporting must be provided electronically. For other subjects, regular paper forms were also accepted.

Starting from the 1st quarter of 2014, VAT returns are provided only in electronic format. An exception is made only for a small category of subjects:

- tax agents who are not VAT payers;

- tax agents are VAT payers, but exempt from the obligation to charge it.

If this group of persons issues invoices with an allocated amount of tax in favor of third parties, then it loses the right to report using paper media.

Deadlines for submission and payment of taxes

The tax period for VAT is a quarter. After its completion, quarterly reporting is submitted to the Federal Tax Service no later than the 25th. In cases where the deadline falls on a holiday or weekend, it is moved to the next working day.

Persons who are not recognized as taxpayers, but issue invoices in favor of third parties on the basis of valid agency agreements or commission agreements, report the tax and pay it to the budget before the 20th day.

Late submission of reports is fraught with fines in the amount of 5% of accrued payments, but not less than 1000 rubles. This rule also affects tax agents.

Payers who are exempt from paying VAT for one reason or another, but who present the tax in invoices for their customers, will also have to report on time and transfer the received tax to the budget.

After filing a declaration, economic entities are given the right to transfer the tax not in full in accordance with the amount received for payment, but in equal shares within 3 months after the deadline for submission. But this does not affect tax payers when importing goods into the territory of the Russian Federation, as well as persons representing tax agents for foreign suppliers without registration in the territory of the Russian Federation.

Example. What is the amount of tax due based on the following data? The total tax charged to buyers in the 1st quarter of 2016 was 746,548 rubles. The amount of input VAT from suppliers for the same period is 422,315 rubles. The actual tax paid on the import of imported goods is 182,315 rubles.

Based on the information received, VAT payable was 746,548 rubles - 422,315 rubles - 182,418 rubles = 141,815 rubles. The taxpayer has the right to transfer amounts no later than the following dates:

The main causes of errors when filling out a VAT return

Errors in the document appear due to elementary inattention, incorrect entry of codes, misunderstanding of the peculiarities of VAT calculation and its registration. Such violations will lead to additional time expenditure, double-checks by the Tax Inspectorate and significant penalties. If the deadline for submitting the document has expired, or the verification reveals errors, the tax authorities have the right to impose a penalty of up to 5% of the amount of taxes that the company was obliged to pay in the designated quarter.

Private entrepreneurs and companies conducting commercial activities and paying value added tax are required to file a VAT return, even if they had no VAT transactions during the quarter. Since 2004, the value added tax for the vast majority of goods has been 18%.

Control ratios - a way to check a VAT return

In order to avoid mistakes, the Federal Tax Service suggests checking the declaration using control ratios (abbreviated as KS), identifying consistency in the declaration itself and in relation to other company reports for the tax period.

These ratios are used both by representatives of the tax authorities themselves and by employees of companies filing returns to eliminate possible inaccuracies. The tax service has drawn up the new CS in the form of a table, which includes not only verification indicators, but also the classification of errors identified under the specified CS. In 2015, some of the formulas were changed in accordance with innovations in filling out the declaration itself and its form. New sections have appeared - from the eighth to the twelfth, and now the formulas help to assess the correctness of their completion in relation to the sections that have not actually undergone changes - from the first to the seventh.

The Federal Tax Service table contains 44 types of formulas that the taxpayer or tax inspector uses to verify the declaration with the primary documentation. Each type of tax payer has its own set of verification formulas.

How to check a VAT return: indicators that the tax office checks

- ratio of total sales and total revenue(this indicator is reflected in the Company's profit and loss statements). For example: combining UTII with the general tax regime, the amount of revenue according to the VAT return will be less than that reflected in the profit and loss statements.

- comparison of indicators from the VAT return with indicators from the income tax return(for example, the amount of sales revenue from these documents). Deviations in amounts are acceptable if part of the profit came from non-operating income. When comparing these documents, it is necessary to take into account the differences by period: a VAT return is prepared for each quarter, and profit reports are generated incrementally towards the end of the year.

- ratio of previously received advances and the amount of VAT on sales. First of all, attention will be drawn to the excess of the advance over the specified amount. Although this is possible if not all implementation was completed during the reporting period.

What verification formulas are used to compare data from sections 1 to 7 with data from sections 8 to 12

The following abbreviations are used in the given formulas for checking the KS: page - s, section - r.

- According to paragraph 1.27: p.060 r.2 + p.110 r.3 + p.050 and p.080 r.4 + p.050 and p.130 r.6 = p.260 + p.270 r.9 (when the VAT amount in section 9 is greater than in sections 1 to 6, the Federal Tax Service will request clarification on this fact).

- According to paragraph 1.28: p.190 r.3 + p.030 and p.040 r.4 + p.080 and p.090 r.5 + p.060, p.090, p.150 r.6 = p. 190 rub. 8 (will attract the attention of the Federal Tax Service when deductions in section 8 are less than in sections 3 to 6).

- According to clause 1.32: p.8 / p.180 = p.190 (the amount of VAT to be deducted must match the total on the last page of the section).

- According to paragraph 1.37: p.9 / p.200 = p.260; p.210 is equal to p.270 (the amount of VAT payable must match the total on the last page of the section).

- According to clause 1.25: if p.050 r.1 > 0, then p.190 r.8 – (p.260 + p.270 r.9) > 0 (when deductions exceed the total VAT payable, the amount must be paid for reimbursement in p.050 r.1; the amount of reimbursement is equal to the difference of all deductions and calculated VAT).

Changes in the VAT return from January 1, 2015

| Changes to filing a return | Until 2015 | From January 1, 2015 |

| Deadlines for submitting reports and paying VAT | Until the 20th | Extended for 5 days, until the 25th |

| Changes in the declaration form | – | Changes to sections 8 to 12 |

| Declaration submission form for VAT payers | Can be submitted in paper or electronic form | Only in electronic form |

| Declaration form for agents who do not pay VAT | In paper or electronic form | |

| More information | There was no requirement | It is necessary to enter information in the book of purchases and sales |

Other errors in the VAT return

Before filing a declaration, it is necessary to check for arithmetic errors, the correctness of filling in the taxpayer’s data and various details (individual taxpayer number, checkpoint, year and quarter for which reporting is submitted, exact name of the company). Even such mistakes will lead to additional difficulties and penalties.

Accountants of companies using the traditional tax system experience stress associated with desk audits on a quarterly basis. Tax officials now “cameralize” every declaration. Taxation and accounting expert Angelina Volkonskaya told BUKH.1S how a desk audit of VAT of Russian companies is carried out, and what surprises an accountant may encounter in the process.

Another quarter has ended, the VAT return has been completed and submitted to the tax office, and are you going to relax? Forget it! After all, a desk audit of the declaration still awaits, based on the results of which tax authorities may identify shortcomings, inconsistencies or errors. This is especially easy to do in light of the technical capabilities of inspections to conduct “cross-checks” in relation to invoice data reflected in section 8 of the declaration from the buyer and in section 9 from the seller.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1. Tax officials are now “cameralizing” every submitted VAT return.

2. The declaration may be checked within three months from the date of its submission. The procedure and conditions for reducing the three-month period are not provided for by the Tax Code of the Russian Federation, but there are also no restrictions on completing the inspection before the expiration of this period.

3. During the camera room, there are three possible scenarios:

- the inspection was satisfied with everything, no documents or explanations were requested;

- the inspection demanded to provide clarifications or make corrections to the declaration (to provide a “clarification”);

- the inspection demanded the submission of certain documents, reflecting a list of them in a written request.

4. For failure to provide explanations or for submitting them late, liability is provided in the form of a fine in the amount of 5,000 rubles (20,000 rubles for a repeated violation within a calendar year). There will be no fine if the accountant immediately made corrections instead of explanations and submitted an updated declaration within 5 days.

5. The organization is given 10 working days from the date of receipt of the request to prepare and submit all documents. If this time is not enough, the company can apply for an extension of the period by sending a corresponding notification to the inspectorate.

6. If, based on the results of a desk audit, the Federal Tax Service does not reveal any violations of tax legislation, then the report is not issued. And organizations will not be specifically informed about the completion of the inspection. The report based on the results of the camera meeting is sent to the company only if the outcome of the audit is unfavorable.

7. If the company does not agree with the conclusions of the inspection based on the results of the inspection, it can draw up written objections. They must be submitted within one month from the date of receipt of the inspection report. The tax office will consider the objections and make a final audit decision, which may or may not take the objections into account.

8. If you disagree with the final conclusions of the inspection, the company can appeal the decision to the regional department of the Federal Tax Service, and then to the arbitration court.

Even such a seemingly harmless action as the buyer entering into the declaration, for example, the invoice number “1” instead of “0001”, which is reflected in the received document, can be a reason for close interest on the part of the inspectors. It’s good if these shortcomings are really harmless, and the explanations provided will satisfy the tax authorities. But there are also inaccuracies that directly affect the amount of VAT payable. In this case, the consequences can be very dire for the company.

Therefore, in order to pass a desk audit of VAT without losses or with minimal losses, an accountant must know everything about its implementation.

How long does the check take?

The declaration will be checked within three months from the date of its submission (clause 2 of article 88 of the Tax Code of the Russian Federation). For example, if a company submitted a VAT return on April 18, then a desk audit of this return is generally carried out from April 19 to July 18.

At the same time, the current tax legislation does not provide for the procedure and conditions for reducing the three-month period. However, conducting a desk audit, in which VAT is claimed for refund, before the expiration of three months from the date of submission of the declarations does not contradict the tax legislation (letter of the Ministry of Finance of the Russian Federation in letter dated December 22, 2015 No. 03-07-03/75213). This means the check may complete earlier.

Test of conscience: developments

So, submitting a VAT return always entails a desk audit. In this case, three scenarios are possible:

- the most favorable option for the company: the inspection went smoothly, the inspection did not request any documents or explanations;

- During the inspection, the inspection required clarification or corrections to be made to the declaration (submit a “clarification”);

- the inspection demanded the submission of certain documents, reflecting the list in a written request.

We will not dwell on the first option, since everything is already clear here.

If events develop according to the second option, you should know that tax authorities may require explanations from the accountant in strictly defined cases (clauses 3, 6 of Article 88 of the Tax Code of the Russian Federation). Thus, inspectors can demand clarification or corrections to the declaration (by submitting a “clarification”) if they have discovered:

- errors in the declaration;

- contradictions between the information contained in the submitted documents;

- discrepancies between the information provided by the taxpayer and the information contained in the documents available to the inspectorate and received by it during tax control.

The last reason is the most popular, since such inconsistencies are often discovered when comparing the invoice data specified in the declaration of the company being inspected and in the declaration of its counterparty. Moreover, not only the buyer, but also the seller may be guilty of discrepancies in invoice information.

More often, the reason for the discrepancies is trivial - a technical error made by one of the parties to the transaction when transferring data from the invoice to the sales book or purchase book, and then to the declaration. In this case, the accountant has nothing to fear, since such shortcomings usually do not affect the amount of tax reflected in the declaration. But if the discrepancy between the data resulted in a reduction in the amount of VAT payable or an overestimation of the amount of VAT to be reimbursed, then, most likely, the tax authorities will require documents rather than explanations (the third option, which we will talk about a little later).

In addition, tax authorities can also request clarification or corrections to the declaration during a desk audit of the declaration in which preferential transactions are indicated, as well as an updated VAT declaration in which the amount of tax has decreased compared to the amount indicated in the primary declaration.

The accountant is given five working days to prepare, present his explanations in writing and submit them to the Federal Tax Service (or submit a “clarification”). The legislation does not establish the form and requirements according to which an organization is obliged to provide written explanations requested by the tax inspectorate during a desk audit. Accordingly, they can be presented in free form.

Moreover, from 01/01/2017, most VAT payers should send explanations exclusively electronically in a specially established format (with the exception of explanations regarding preferential transactions). “Paper” explanations will be considered not submitted. This is due to the amendments made to paragraph 3 of Art. 88 of the Tax Code of the Russian Federation by Federal Law of 01.05.2016 No. 130-FZ. This rule does not apply to those who have the right to report VAT on paper, in particular, these are taxpayers who are exempt from paying VAT under Art. 145 of the Tax Code of the Russian Federation.

By the way, from this year, for failure to provide explanations or for submitting them late, liability has arisen in the form of a fine in the amount of 5,000 rubles (20,000 rubles for a repeated violation within a calendar year) under Art. 129.1 Tax Code of the Russian Federation. There will be no fine if the accountant immediately made corrections instead of explanations and submitted an updated declaration within 5 days.

Cheat sheet from the Federal Tax Service

The Federal Tax Service does not hide what actions and what behavior it expects from companies during desk audits. On the contrary, it tells and “pushes” organizations in the right direction.

A couple of years ago, the Federal Tax Service of Russia, in its letter dated November 6, 2015 No. ED-4-15/19395, told how to act for companies that received a requirement to provide explanations in connection with the identification of inconsistencies during the camera room.

But first, officials reminded that each operation for which a discrepancy is established will be “coded.” For example, if the error code is “1”, then this means that:

- there is no entry about the transaction in the counterparty’s declaration;

- the counterparty did not submit a VAT return for the same reporting period;

- the counterparty submitted a declaration with zero indicators;

- errors made do not allow us to identify the invoice record and, accordingly, compare it with the counterparty.

So, she needs:

- within six days, send to the Federal Tax Service Inspectorate an electronic receipt of the request (if this is not done, then 10 days from the date of expiration the Federal Tax Service Inspectorate may block the company’s current account);

- check the correctness of filling out the declaration, check the entry reflected in the declaration with the invoice, pay attention to the correctness of filling in the details of the entries for which discrepancies have been established (dates, numbers, amounts, correctness of calculation of the amount of VAT depending on the rate and cost of purchases (sales) ). If an invoice was accepted for deduction in parts (several times), it is also necessary to check the total amount of VAT accepted for deduction for all entries in such an invoice, including taking into account previous tax periods;

- submit an updated declaration if, in the process of fulfilling the previous paragraph, an error was identified that led to an underestimation of the amount of tax payable;

- provide explanations indicating correct data (if the error did not lead to an underestimation of the tax payable). True, here officials also recommend submitting a “clarification”, although this is not at all necessary.

If the accountant, after the audit, does not identify errors, then he must still inform the tax office about this, as is also stated in the above letter.

In addition to the explanations, the accountant can attach extracts from tax and (or) accounting registers, as well as documents confirming the accuracy of the data included in the declaration (clause 4 of Article 88 of the Tax Code of the Russian Federation).

What documents may be requested?

The third option - when inspectors request documents - is the most unfavorable. It is clear that with the submission of documents, the risks increase that the tax authorities will find something else.

Let us explain in what cases documents may be required from a company during a desk VAT audit. The list of such cases is limited:

- The company submitted a declaration with the amount of tax to be reimbursed from the budget. In this case, the tax inspectorate has the right to request documents that confirm the right to deduct VAT in accordance with Art. 172 of the Tax Code of the Russian Federation (clause 8 of Article 88 of the Tax Code of the Russian Federation). Therefore, in practice, accountants try to avoid such situations, in which they are helped by the legally established possibility of transferring deductions to a later date.

- The information specified by the organization in the declaration does not coincide with the information in the declaration submitted to the Federal Tax Service by the organization's counterparty. To attract the attention of tax authorities, discrepancies must indicate an understatement of the VAT payable. In this case, you will be required to provide invoices, primary and other documents related to the relevant transactions (clause 8.1 of Article 88 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated September 16, 2015 No. SD-4-15/16337). In addition, inspectors may also require copies of the sales book, purchase book, and journal of invoices received and issued (letter of the Federal Tax Service of Russia dated August 10, 2015 No. SD-4-15/13914).

- The company applies VAT relief. Such organizations should be prepared for the fact that, as part of a desk audit, they will be asked for documents confirming their right to apply benefits. In this case, benefits are not transactions that are not recognized as an object of taxation or are exempt from it without providing an advantage to a certain category of persons. Therefore, tax authorities do not have the right to demand documents confirming the legality of excluding such transactions from the tax base (letter of the Federal Tax Service of Russia dated December 22, 2016 No. ED-4-15/24737).

- The organization submitted an updated VAT return after two years from the date established for filing primary reports for the corresponding period (clause 8.3 of Article 88 of the Tax Code of the Russian Federation). In this case, tax authorities may require not only primary and other documents confirming changes in information in the relevant declaration indicators. You will also have to present the analytical tax accounting registers on the basis of which the indicated indicators were formed before and after their adjustment.

Lots of documents? Deadlines can be extended

The organization is given 10 working days from the date of receipt of the request to prepare and submit all the documents requested by the tax authorities (clause 3 of Article 93 of the Tax Code of the Russian Federation).

If this time is not enough (for example, due to a larger volume of documents or because the accountant is on vacation), then the company can apply for an extension of the period by sending a notice to the Federal Tax Service Inspectorate in which:

- the reasons for the impossibility of submitting documents are explained;

- the deadline within which documents can be submitted is indicated.

But this must be done quickly enough - within one business day following the day the request for documents is received. True, filing such a notification does not guarantee a positive outcome of the case, but usually tax authorities meet companies halfway, agreeing to extend the deadline.

The Federal Tax Service Inspectorate informs the company about the decision made within two days from the date of receipt of the notification.

VAT will be charged, but deductions will not be noticed

It's no secret that the inspector's task is to identify errors that led to a reduction in the amount of VAT payable.

That is, tax authorities, first of all, will look for transactions that are not included in the tax base, and deductions confirmed by defective documents (or not at all confirmed by relevant documents). And they are unlikely to pay attention to the fact that any invoice was not registered in the purchase book and, accordingly, its indicators were not included in the “tax deductions”. But even if they pay attention to this, they certainly won’t reflect it in the inspection report, so as not to underestimate their “merits” in the form of additionally assessed taxes and sanctions.

But will they be right? As judicial practice shows, this issue is controversial.

On the one hand, applying a VAT deduction is a right, not an obligation. And companies declare their right by reflecting deductions in the declaration. And if the deduction was not reflected in the “primary” declaration, then they have the opportunity to reflect it in the updated declaration. Consequently, the company cannot oblige the inspectorate to include in the act deductions that it did not reflect. This conclusion was made, for example, in the decisions of the Arbitration Court of the Volga District dated 04.29.15 No. F06-23365/2015, FAS Far Eastern District dated 06.03.2014 No. F03-1817/2014, FAS Northwestern District dated 02.26.2013 in case No. A56 -49359/2011.

At the same time, there are court decisions with the opposite conclusion. For example, the Arbitration Court of the North-Western District in its resolution dated 07/09/2015 No. Ф07-4290/2015 noted that the taxpayer’s right to independently apply deductions by declaring them does not relieve the Federal Tax Service from the obligation to determine, as part of the audit, the amount of the tax liability actually payable to the budget.

Thus, you should not count on the fact that unaccounted deductions will be included in the audit report, because even the courts do not have a consensus on this matter.

Based on the results of the inspection - an act. But not always

If, based on the results of a desk audit, the Federal Tax Service does not reveal any violations of tax legislation, then the report is not issued. And the organization is not specifically notified about the completion of the audit (if we are not talking about a VAT return using the declarative tax refund procedure under Article 176.1 of the Tax Code of the Russian Federation), since such an obligation is not contained in the Tax Code of the Russian Federation (letter from the Federal Tax Service of Russia for Moscow dated 21.05. 2009 No. 20-14/4/051403).

Therefore, if three months have passed since the date of filing the declaration, and no demands or an act have been received from the inspection, then we can consider that it has “gone through”.

Thus, the report will be sent to the company only if the outcome of the audit is unfavorable.

If the accountant does not agree with the conclusions of the report, he can draw up written objections.

They must be submitted within one month from the date of receipt of the inspection report (clause 6 of Article 100 of the Tax Code of the Russian Federation). The tax inspectorate considers objections and makes a final decision on the audit, in which the objections may or may not be taken into account.

If you disagree with the final conclusions of the inspection, the company can appeal the decision to the regional department of the Federal Tax Service, and then to the arbitration court.

Before submission, it is very important for the accountant to double-check its completion in detail, and in particular, the correct calculation of VAT payable to the state budget. This will help the company avoid possible mistakes and legal costs.

Step-by-step algorithm:

- First of all, check the data from the general ledger. It is necessary to check the correspondence of the numbers and dates of the primary accompanying documentation that you use when filling out accounting records, check the amounts of payments and taxes on them. Correct all discrepancies and contradictions before the declaration falls into the hands of the tax inspector, otherwise you risk paying a penalty after a desk audit.

- Analyze the balance sheet. Now it is important to divide the data from accounts 60 and 62 into subaccounts, where 60.2 and 62.1 are always exclusively in debit, and 60.1 and 62.2 are in credit, respectively. If there is a contradiction, reconcile the balance at the end of the tax period according to accounts and amounts from.

- Next, you need to create a statement for account 41 “Goods”. The remaining goods must be in debit and not highlighted in red in accounting. Otherwise, if an error was made, check all issued and received invoices for mis-grading.

- In this order, you need to create a statement of account 19 “VAT on acquired values”, where the debit balance should be .

- If there were advances during the reporting period of the declaration, you should open the balance sheet of subaccount 76 “Advances”. Multiply the credit of subaccount 62.2 by the VAT rate - the value should coincide with the credit at the end of the period.

- In the 1C program, you need to create a subaccount for counterparties, check all invoices, accompanying documents, amounts paid and received - they should not freeze. If you have signed multiple agreements with the same supplier or customer, break them down separately in your accounting. This will help you avoid getting lost in payments and VAT calculations.

- Be sure to check the data on the purchase and sales books for issued and received invoices: their numbers, dates, product names, amounts and costs - do not allow continuous numbering. The manager or chief accountant of the enterprise must approve the signatures and seals in the documentation if corrections have been made to them.

- Check the invoice journal: data on numbers and dates, VAT amounts, total cost, name of the buyer, TIN number and final amounts using the balance sheet. If the transfer of products was free of charge, invoices are not recorded in the journal. The invoice for the advance payment, if there was one, is also not registered.

- Next, it would be advisable to number the sales book, stitch it, certify the information with the seal and signature of the head of the organization, and indicate the number of pages on the last page on the reverse side.

- After checking the details of the purchase book, check the data with the specified statements. Tax documents must be registered in the period when the right to VAT deduction arose.

- If you missed an invoice for the previous one, or made a mistake in it, cancel it. In this case, you need to fill out an additional sheet, draw up and submit an updated VAT return.