If your organization has vehicles, then you are required to issue waybills. Enterprises involved in the transportation of people and goods use uniform forms approved by the State Statistics Committee. Other organizations may develop their own form. How to issue waybills in 1C 8.3 Accounting, read this article.

A waybill, or voucher, is a primary document that records all the data on the use of the car, namely:

- Who is the owner of the transport;

- Type, model, registration number of the vehicle;

- Odometer readings when leaving and arriving at the garage;

- Date and time of departure and arrival;

- Full name of the person responsible for dispatching the vehicle (in transport organizations this is usually a dispatcher);

- Driver's full name;

- The date and time of the medical examination signed by a health worker (large transport companies have such a position);

- Vehicle inspection records signed by a mechanic (if there are more than 100 cars in the fleet).

If you do not use a standard travel form, but your own, then all these details should be there.

In typical 1C 8.3 configurations there is no document “Waybill” and functionality for its accounting, but there are many additional programs for 1C for accounting of waybills. They are built into standard 1C configurations and help fill out waybills and monitor fuel consumption and efficiency of transport. Next, read what programs are on the market today for accounting for waybills in 1C 8.3 Accounting.

Download the program "Waybills"

Forms of waybills and a sample of filling out Form 3

Different forms of waybills have been developed for different types of transport.

- Form 3 has been developed for passenger cars. It can be used;

- For freight vehicles, three types of forms are used:

- Form 4-P. It is used when accounting for the operation of freight transport at a time tariff; on the basis of this form, salaries are calculated for drivers. Download form P4 here;

- Form 4-C. It is used for piecework payment to the driver. Download here Form 4-C;

- Form 4-M. It is used when transporting goods outside the territory of Russia. Download form 4-M here .

- For passenger transport, two main types of forms are used:

- Form 6 special. It is used for non-public buses when transporting passengers. This form is also used to calculate salaries for drivers. Download here Form 6 spec;

- Form 6. It is used for public transport (buses) when transporting passengers. This form is also used to calculate salaries for drivers. Download Form 6 here .

There are also forms of waybills for construction equipment and special vehicles.

Step 1. Issuance of funds for reporting

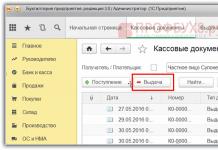

First, let's look at how to reflect the purchase of fuel and lubricants by an employee for cash in 1C 8.3. First of all, it is necessary to formalize the issuance of funds in a report. The document Cash issuance is intended for this, which can be found on the Bank and cash desk → Cash documents tab:

Go to the Cash Documents tab. To open the document, click the Issue button:

Then you need to set the transaction type: Issue to accountable person:

Next, you must indicate the organization, date, recipient's full name, amount, DDS (cash flow) item, and accounting account. All details are selected automatically from directories if you click the icon at the end of each line. Filling example:

After filling out the document, click the Post button, and a Cash Expense Order and accounting entry Dt 71.01 Kt 50.01 in the amount of 2,000 rubles are generated.

To display a printed form of cash settlement, click on the Print button, then Cash Outgoing Order and get a printed form of the document:

Step 2. Capitalization of fuel

After receiving the funds, the employee purchased fuel for cash and submitted an advance report to the accounting department. After approval of the advance report, fuel is posted. For these purposes, in 1C 8.3 you need to select the Advance report menu item on the Cash and Bank tab:

We create a new document: we indicate the accountable person, organization and warehouse. On the Advances tab, enter data about the Cash Withdrawal document:

On the Products tab, enter data on purchased fuels and lubricants, accounting account - 10.03. When posting a document, a posting is created Dt 10.03 Kt 71.01 in the amount of 2,000 rubles:

When purchasing for cash, the buyer, an individual, is given a cash receipt. In the cash receipt, VAT is not highlighted as a separate line. Depending on this, we set the appropriate settings in the Advance report: without VAT or VAT 18%.

If the seller is a legal entity, then a check with allocated VAT and an invoice are issued. Then check the Invoice box and enter the invoice details. In our case, the purchase was made without VAT.

When posting a document in 1C 8.3, transactions are generated, which can always be viewed by clicking the icon that is in every document. Thus, we will see the generated transactions for this document:

How to properly prepare an advance report, the features of working with accountable persons in 1C 8.2 (8.3) are discussed in our video lesson:

Step 3. Write-off of gasoline using waybills

The next stage is writing off gasoline in 1C to expense accounts. The write-off takes place on the basis of the waybill. To do this, in 1C 8.3, a document is used, which is located on the Production tab:

In the document you need to enter the warehouse and organization. In the document table on the Materials tab, add a line with the fuel to be written off, enter the quantity and account (10.03):

On the Cost Account tab, enter the write-off account, cost item and department:

According to the example, when posting a document, a posting is created Dt 44.01 Kt 10.03 in the amount of 2,000 rubles. Thus, the fuel is written off.

Accounting for fuel and lubricants in 1C 8.3 using fuel cards

Step 1. Transfer of prepayment to the supplier

In case of purchasing fuel and lubricants (gasoline) using fuel cards, first of all it is necessary to make an advance payment to the supplier through a document. To do this, use the Bank statements item on the Bank and cash desk tab:

And create a new document by clicking the Write-off button:

When posting this document, posting Dt 60.02 Kt 51 is created in the amount of 100,000 rubles:

Step 2. Receipt of the fuel card

The next stage is the receipt of the fuel card, which in 1C 8.3 is formalized by the document Receipt (acts, invoices). It can be found in the Shopping section:

Create a Goods Receipt document. In the Invoice field we put the number and date of the supplier document. Use the Add button to add the Fuel Card item. We set the quantity, price and supplier:

If the transaction involves VAT, then fill in the number and date of the presented invoice in the lower left corner and click the Register button:

When finalizing the document, we run the document with the Post button and as a result we get the following transactions:

For quantitative accounting of fuel cards in 1C 8.3, cards are accounted for off-balance sheet account 006 by manual posting through the document Transactions entered manually:

Step 3. Acceptance of fuel and lubricants for accounting

At the end of the month, as a rule, the supplier submits documents on the fuel actually filled. Based on them, fuels and lubricants (fuel) are accepted for accounting using the document Receipt of goods and services to account 10.03. To do this, we will create a new document, enter the supplier, organization, warehouse, contract and add lines to the Products table. We fill in the same way as when receiving fuel cards:

We check the transactions that are generated when posting the document:

Step 4. Write-off of gasoline in 1C 8.3 using waybills

Based on the data from waybills in 1C, actually consumed fuels and lubricants are written off as expenses. In the 1C 8.3 database, this operation is carried out through the document Requirement-invoice.

When writing off fuel and lubricants for non-production needs, the write-off of fuel is carried out using the same document Request-invoice, but on the expense account tab we indicate account 91.02 and the cost item Not accepted for taxation:

When conducting, a wiring is generated:

Step 5. Monitoring the remaining fuel (gasoline) in the warehouse

To control the remaining fuel in the warehouse, in 1C 8.3 we create a turnover balance sheet (SBV) according to account 10.3. The document is located on the Reports tab:

We open the SALT for account 10.3, set the report parameters: period, selection by item, by quantity and generate the SALT. You can select by item from the directory using the Find function, entering the keyword Gasoline in the search window:

The program "Respect: Accounting for waybills and fuels and lubricants" is supplied integrated into the following standard configurations of the 1C company:

- 1C: Enterprise Accounting,

- 1C: Trade Management,

- 1C: Integrated automation,

- 1C:UPP.

Integration allows you to generate movements in accounting registers without transferring data. Based on the waybills, a fuel write-off document is generated. Programs and equipment must comply.

Waybills and fuels and lubricants in 1C: Accounting

Accounting module in the standard configuration "1C: Enterprise Accounting", supported by versions 2.0 and 3.0, and platforms 8.2 and 8.3, respectively.

Accounting entries for the write-off of fuel and lubricants are generated by the document "Request invoice". The invoice indicates the write-off warehouse and cost account indicating analytics. The invoice is created based on the data from waybills for the required period.

1C: Trade Management

The program is integrated into the standard configuration Trade Management, version 10. The mechanism for integrating and generating movements in accounting registers is similar to the Enterprise Accounting configuration. Based on the waybills, a fuel and lubricants write-off document is generated - “Demand invoice”.

1C: Integrated automation

The subsystem for recording waybills and fuels and lubricants is integrated into the standard configuration Integrated automation, version 1.1. The formation of movements in fuel and lubricants accounting registers is carried out by an invoice, which is created on the basis of waybills for the required period.

1C:Manufacturing enterprise management

The configuration for accounting for waybills and fuel and lubricants is integrated into the standard configuration of the UPP, version 1.2. The formation of movements in fuel and lubricants accounting registers is carried out by the document “Demand invoice”, which is created based on a sample of waybills for the period.

System Requirements

To work with the program, computers and software must meet the requirements of the 1C:Enterprise 8 platform.

The license for the program “Respect: Accounting of waybills and fuels and lubricants” provides for the user to have the main delivery of PROF version 1C: Enterprise 8 (Accounting, Trade Management, SCP or Integrated Automation).

To work in multi-user mode, you will need additional client licenses for the 1C:Enterprise 8 platform. Additional licenses for workstations for the configuration “Respect: Accounting of waybills and fuels and lubricants” are not required.

Installation and update procedure

The configuration for “Accounting for waybills and fuels and lubricants” is built into the working database by combining it by subsystem in the 1C:Enterprise 8 configurator. The configuration can also be installed autonomously if the working configuration cannot be changed or data synchronization is not required. In this case, based on the results of the working period, it is enough to transmit summary data on fuel consumption.

Update

The RespectSoft company releases regular program updates, which also contain new versions of standard configurations. This way our users can only be updated with our releases.

In this case, it is possible to update only the standard 1C configuration. Upon request, we can send detailed instructions on how to update and install the configuration.

Certification 1C: Compatible

The program is certified by 1C and already has 6 “Compatible! Software system 1C:Enterprise". The presence of a certificate is an official confirmation that the program has passed thorough testing in 1C for correct collaboration and ease of use with the 1C:Enterprise system.

- Creation and printing of waybills;

- Automatic filling of remaining fuel when leaving with data from the previous sheet;

- Automatic filling of the speedometer when leaving with data from the previous sheet;

- Automatic completion of mileage if such a route has been filled out previously;

- Accounting for fuel consumption (km, hour, engine hour, technical operations);

- Accounting for gas stations (simple and advanced: plastic cards, coupons, cash, gas station, supplier, warehouse);

- Accounting and planning of vehicle costs (tires, maintenance, compulsory motor insurance, spare parts, oil, fuel);

- Possibility of specifying consumption rates for winter/summer and setting the winter/summer period for organizations and departments;

- Salary calculation (hour, km, t.km, t, technical operations);

- Printing of waybills (including double-sided, group, without return data, without departure and return data, printing with an attachment);

- Continuous numbering;

- Reports.

- Accounting for standard fuel consumption based on waybills was implemented in accordance with the Order of the Ministry of Transport of the Russian Federation dated March 14, 2008 N AM-23-r on the introduction of methodological recommendations “Standards for the consumption of fuels and lubricants in road transport” (Buses, Flatbed trucks) , Tractors, vans, cars, Dump trucks, Special and specialized vehicles performing work while parked, Special and specialized vehicles performing work while moving);

- The ability to keep records of several types of fuel or a mixture of fuels for one vehicle. For example, a vehicle uses gasoline and gas, or 95 and 92 gasoline are filled into one tank.

Expansion of functionality

Additionally, it is possible to expand the functionality of the program through the implementation of modules developed by Sintez:

|

|

Expansion modules are supplied separately from the main program; the cost is indicated in the “Prices” tab.

Delivery options and licensing

You choose the level of integration yourself:

1. Waybills for 1C (Subsystem) are built into a standard configuration:

- Enterprise accounting 3.0 (BP 3.0)

- Accounting for a construction organization 3.1 (BSO 3.1)

- Trade Management 11.1 (UT 11.1)

- Management of a small company 1.4, 1.6 (UNF 1.4, 1.6)

- ERP Enterprise Management 2.0, 2.1 (UPP ERP UP 2.0, 2.1)

As a result, you get the "Waysheets" subsystem within its standard configuration. No need to jump from one program to another. There is no need to fill in contractors and employees. There is no need to enter entries for fuel write-off into the Request-invoice document. The standard configuration is updated in a standard way, a standard update.

2. Waybills for 1C (Configuration)

As in the first case, there is no need to fill in contractors and employees. There is no need to enter entries for fuel write-off into the Request-invoice document. Data exchange with standard configurations occurs via a COM connection.

For the configuration to work, the 1C:Enterprise 8.3 platform is required (purchased separately). Pay attention! - the basic version of the standard 1C configuration, supplied with a software license, allows you to run only the basic version of the configuration. For example, if you purchase "1C: Accounting 8. Basic version", then you will only be able to run the "1C: Accounting 8. Basic version" configuration. Therefore, for the Waybills for 1C configuration to work, a “non-basic” license for the 1C platform is required. This license comes with PRO versions of standard 1C configurations (for example, “1C: Accounting 8 PROF”, “1C: Accounting 8. Set for 5 users”, etc.) or with the delivery of the “1C: Enterprise 8. Technological supply” platform. The number of users of the software product is limited only by the number of 1C user licenses. There is no need to purchase additional licenses.

A waybill is a document on the basis of which the costs of fuels and lubricants (fuels and lubricants) are taken into account. The printed form (form according to OKUD No. 0345001) is not mandatory for all organizations except transport companies. In typical 1C 8.3 configurations there is no printed waybill form (you can add it as an external one), but several methods are implemented:

- According to advance reports

- By coupons

- By fuel cards

Let's look at step-by-step instructions and some features of each of them.

The accounting scheme looks like this:

- Issuing cash to an accountant

- Preparation of an advance report

- Cash back to the cashier

- Write-off of costs for fuel and lubricants using fuel cards

Figure 1 shows an advance report, which reflects several operations at once: a report on the advance payment issued, the receipt of gasoline to the warehouse, invoice data (if there is one).

In Fig. 2 you can see the document postings. In order for accounting accounts for the “AI-92 Gasoline” product to be filled out automatically, you need to add a line for the “fuels and lubricants” group in the information register “” (see Fig. 3)

The printed form of the waybill can be connected as an external report or processing to the “Additional reports and processing” directory (see Fig. 4). The report itself will have to be ordered from specialists or purchased from Infostart.

The return of money on the advance report (in our example it is 8 rubles) is drawn up in the document “”, which is filled out automatically in the “Enter based on” mode from the document “”.

Write-off of fuel and lubricants using fuel cards

Unlike coupons, fuel cards are accounted not as, but as strict reporting forms in off-balance sheet account 006.

In general, the accounting scheme consists of the following points:

- Posting a fuel card

- Posting of gasoline received using a fuel card

- Write-off of expenses.

The capitalization of the cost of a fuel card can be recorded as a receipt of service - see Fig. 11 and Fig. 12. And the card itself is accounted for in account 006 by manual operation (Fig. 13)

The receipt of fuel is documented with the document “ ” (see Fig. 14, Fig. 15).