Are you spending your paycheck before you receive it? Do you want to learn how to save and save money, get out of debt? There is no magic financial wand, but a few simple tips will help you take control of your budget and save money for vacations, a car, and even an apartment.

Why you need to save and how to save money

- Savings is a "safety cushion"

- Putting aside more money means getting an additional degree of freedom.

- Improvement of living conditions

- Savings is the future of your children

- Set aside money for leisure and luxury goods

Only 30% of Russians know how to save and save. " Money can not buy happiness”, is an old hackneyed saying that leads people into a financial dead end and a debt hole. The truth is that money can help you achieve happiness. Money is not the root of all evil, but a tool - it all depends on how you use it.

famous american actress Joan Rivers stated: "People say that money is not the key to happiness, but I always believed that having enough money, you can make this key."

And you need a key?

How to learn to save money

Can't save money? They are going away " through your fingers"and are very similar to honey, as in Winnie the Pooh's song "... if it is, then it is not immediately there." Know, you won't save a dime until you know exactly where your earnings are going.

Saving isn't as fun as spending, but nothing is impossible. The golden rules of the family budget, formulated by financial experts, will help you understand how to start saving money and not go astray. Below we will consider the secrets and ways to save money in any conditions.

Secret #1: Cost Accounting

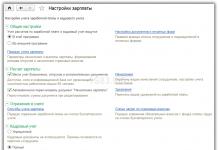

How do you decide where you can save and save money if you have no idea about your expenses? we have already written. Download an excel spreadsheet, optimize it for your needs and start recording expenses without putting off until tomorrow. Get a notepad, install if you don't like spreadsheets.

How much is spent on housing, food, taxes, debt and entertainment?

Once you have a clear picture of spending in a typical month, you can identify problem areas. How much to save money and what unnecessary, impulse purchases can be reduced, will become clearly visible in a few weeks. IMPORTANT! At first glance, it may seem silly to you to write down all your expenses, because you already know everything, but when your financial statistics lie in front of you not for a day or two, but for a month, you may be surprised at the amounts that go to certain things. This will help determine where you spend more and what you can save on, because in the conditions of one day it can be trifles, but in the conditions of a month it can be an alternative to a new refrigerator.

Money set aside for the future is a guarantee of confidence in the future.

Basic principles of the budget:

- Develop a plan: clearly define goals and set realistic deadlines for the implementation of all items. Save money just for " rainy day”is a losing strategy in a psychological sense. People are so arranged that they need " kick”, that is, a certain threat to well-being, or motivation. Saving is easier if a long-awaited and cherished dream looms ahead: an apartment, a car, or something not global, but no less important for you. Goals can range from a long-planned purchase of a new TV to a trip to a country you've wanted to see since childhood. It will be great if she can really inspire you. Your goal was as specific as possible. That is, not abstract good tv”, but a specific model. Or a trip for a certain period of time to a clearly defined country with a rough list of places to visit. Set long-term and short-term goals, calculate how much money you need to save per month and stick to your plan. Trust the experience of a successful businessman Stephen Covey: "Goals are pure fantasy unless you have a specific plan to achieve them."

- Separate needs from desires, understand the difference. Easier said than done, but make it a rule to take a break before buying. Before grabbing another stiletto or an exceptionally wonderful fifth spin, “ sleep over”with a thought for several days, especially since the pleasure of waiting for a purchase is much more than after the purchase.

- Pamper yourself sometimes! The difference between frugality and stinginess is about the same as between a fast and a healthy diet.

Secret #2: Pay Yourself First

You have probably heard this phrase more than once. Do you know why it is often repeated? This principle works. Paying yourself means putting aside a certain part of your earnings on a deposit, a separate account, or simply putting money in an envelope.

But putting money away from your paycheck at the end of the month - just what's left after all the expenses - is a huge mistake that the vast majority make.

Savings should be thought of the same way as any other account. When the receipt for electricity, cable TV or telephone arrives, what do you do? This is how you should treat your savings account. If your goal is to accumulate conditionally 10,000 rubles per month, pay for this item first.

Secret #3: Spend less than you earn

No, it's not about downshifting, do not be afraid. We are talking only about reasonable savings and planning for the future. Think for yourself: if you earn per month 50 thousand and spend 55

, the budget balance will be not minus 5 thousand rubles. Most likely, you used a credit card, and you will have to repay the debt with interest, which means that in the future you will need to shrink not by 5 thousand, but by a large amount.

No, it's not about downshifting, do not be afraid. We are talking only about reasonable savings and planning for the future. Think for yourself: if you earn per month 50 thousand and spend 55

, the budget balance will be not minus 5 thousand rubles. Most likely, you used a credit card, and you will have to repay the debt with interest, which means that in the future you will need to shrink not by 5 thousand, but by a large amount.

Zero balance is already better: you know how to plan, but you don’t know how to save money. In this case, you run the risk of being unprepared for unforeseen expenses that life regularly throws up.

What worked for Rockefeller 100 years ago, still working today. The tools change, but not the principles of economy.

How to save money and not spend it

“... It can be a fool to make money, but it takes wisdom to save and manage it for your own benefit,” - Brigham Young, the spiritual leader of the Mormons of the 19th century, had 55 wives and managed to plan and save the budget of his rather big family.

Let's face it: even if you increase your income, your financial situation will not change - you will just allow yourself to spend more. The only way out is to learn how to control expenses and save money.

When is the best time to save money?

The answer is unequivocal - immediately after receiving them. This is the basic rule of personal finance management. By saving money right away, you simply remove it from the family budget and automatically adjust yourself to the desired financial framework. Otherwise, a typical situation arises when at the beginning of the month there seems to be a lot of money, and it seems that there is nothing wrong with pampering yourself a little. By the end of the month, the wallet is empty, and you spend only on the most necessary things, and suddenly it turns out that you can’t put it off this month. Therefore, the correct solution would be to set a specific day (usually this is the date when the salary comes) and regularly replenish savings on this date. Deposit and forget is the best way to save money.

15 ways to save and save money

1. Set aside money for essential needs in four envelopes - one for each week. Put the money for targeted savings in the fifth envelope and hide it away if you have not opened a deposit account.

2 . Put your credit/debit cards out of your wallet, take cash for the amount you planned for the week.

3 . Open a deposit. You can create separate accounts for each item of savings: for cars, vacations, the future of the child. The magic of compound interest at least compensates for inflation, if it does not multiply the deferred. You can save money on a card if you are absolutely confident in your willpower.

4 . Plan your menu for the week ahead and make a grocery list. Firstly, this will save the home cook from the heavy thoughts “what to cook tonight”, and secondly, there will be no situation when the refrigerator is full of remnants of expired products.

5 . Go to the store when you are short on time, if you have an hour left before an interesting TV show or important business. With a shopping list in hand, you literally “fly” through the retail space and avoid the temptation to buy unnecessary things.

6 . Buy in bulk whenever possible. Chain stores constantly arrange promotions and sales for some items. Rice, pasta, toothpaste, toilet paper, etc., bought at a discount, are a good start for savings next month.

7 . Pay bills on time. Automate payments if possible. Late fees are a minus of your budget. And do not wave your hand that, they say, quite a penny has run up there: a penny saves a ruble.

8 . Check the price before buying anything expensive. Go online and see if another seller is offering a better price on the item.

9 . Avoid impulse buying. Wait a day or two, consider how much you need this item, check the price with other merchants.

10

.  Review tariffs for Internet, mobile phone and satellite/cable TV. There are examples when people overpaid five times more for TV, because they did not know about the price changes. Operators will not transfer to a favorable tariff without your participation.

Review tariffs for Internet, mobile phone and satellite/cable TV. There are examples when people overpaid five times more for TV, because they did not know about the price changes. Operators will not transfer to a favorable tariff without your participation.

11 . A healthy lifestyle is the way to a healthy budget! It's not easy, but try to give up bad habits. Just multiply the cost of a pack of cigarettes by the number of days in a year. You could save this money.

12 . Allow yourself pleasant spending, psychological comfort - above all. New clothes, gatherings with friends over a glass of beer - why not? But don't get carried away. Remember the plan - you have a goal.

13 . Take a look at the cabinets. How can you save money here, you ask? Sell what you no longer wear. Take it to a thrift store or advertise on an online site. The proceeds of unplanned money are put aside in envelopes or in a bank.

14 . Plan your vacation in advance. The cost of hotels, air and train tickets is usually lower if booked six months or a year before the trip.

15 . Do not give up. " When everything seems to be against you, remember that the plane takes off against the wind...". (Henry Ford).

How to learn how to save money with a small salary

Yes, it is not at all as simple as all sorts of financial analysts and experts like to recite, but there is no other way out. You don’t have to reinvent the wheel, the basic rules on how to properly save money from your salary:

Yes, it is not at all as simple as all sorts of financial analysts and experts like to recite, but there is no other way out. You don’t have to reinvent the wheel, the basic rules on how to properly save money from your salary:

- Be sure to keep "home accounting", where you make absolutely all your income and expenses. Once you can see for yourself exactly how much money you spend on various needs (food, utility bills, entertainment, etc.), it will be much easier to analyze and determine which categories of expenses can be cut. In the future, this will help to calculate how much money you can save painlessly for the budget.

- Before going to the store, make a shopping list and do not take more than the amount needed for your list. All kinds of marketers and merchandisers do not eat their bread in vain: according to statistics, without a clear plan, the buyer spends on average 1.5 times more money in the store than planned.

- It is much more profitable to cook food on your own, without resorting to the services of cooking and semi-finished products. It is useful not only for the wallet, but also for the stomach.

- Don't buy things you don't need just because they are cheap. As practice shows, in most cases, after the purchase, such things remain gathering dust on the shelves and in wardrobes, waiting for the right opportunity that will never come.

- Control utility bills and expenses. Make sure that lighting fixtures do not work in vain in the rooms, and there must be meters for water and gas.

What to do if you can't save money at all

In this case, you can resort to radical methods, eliminating absolutely all expenses that you can do without. This method is often referred to as the "financial diet", it includes the exclusion from your expenses:

- Absolutely any entertainment;

- Products that are not categorized as essential. Roughly speaking, a list of foodstuffs for a week is compiled, which should be enough for a normal diet. Then there is a purchase according to this list, and any additional expenses are simply excluded;

- Meals in cafes, restaurants, bars, etc.;

- Spending on clothes and other things, if the old ones are in a more or less tolerable condition;

- Unnecessary trips by own and public transport;

- Any other expenses that are not necessarily required.

You need to seriously consider whether it is worth saving money in this way before resorting to this method. Because the goal for which you decide to save money in this way must be really worthwhile. Otherwise, it is unlikely to compensate for all the hardships that you have to go to. And as practice shows, it is much more difficult to start saving money with not very successful experience behind you.

How to save money for a car

Before you inhale the smell of the interior and enjoy the smoothness of the car, you must return to the point " budget". The car is now not only a means of transportation, but also a way to "splurge" and seem not what we are. 86% of those who drive expensive and prestigious cars are not millionaires. Moreover, related expenses: gasoline, winter tires, insurance and maintenance, often turn out to be an unbearable burden for the family budget. You don't want to hear this, but live within your means!

« 20% rule”, which Westerners are guided by, says that the cost of a car should not exceed twenty percent of annual income. Alas, this rule is rarely applicable in our realities, so we will focus on the cost of service and credit.

How much should a car cost

You must not spend more than 10% of your monthly household income on car maintenance. Less than 10% is even better. This should include all costs for the car:

- loan price;

- insurance;

- vehicle tax;

- Maintenance;

- summer/winter tires;

- refueling and washing;

- parking fees.

The more expensive the car, the higher the cost of maintaining it. In the event of a road incident, damage repair can ruin and land on the " starvation ration» family. Think about it.

How to save money for a car

Buying a car, new or used, is the second biggest expense for most people (after an apartment). This is a medium-term goal that you need to fix in the budget and determine how much money you need to save each month.

From a financial point of view, a car is not an investment. The machine loses almost a third of its value in the first year of operation, requires investment and fixed costs.

The less you spend on a car, the more you have left for everything else.

A brief reminder on how to plan a purchase and save:

- Do the math: add insurance, installation of a security alarm and diagnostics to the cost of the transport itself (if the car is not new). Leave room for maneuver just in case: unscheduled oil changes, changes in insurance. Divide the resulting figure by the amount that you are able to save regularly from your salary. The result is the period for which the money will accumulate.

If you decide to take a car loan, determine how much you can pay each month. Try not to go beyond the budget outlined above.

- Spend a little time and take an interest in the terms of lending from car dealers. A little note of advice: in December-January, many merchants reduce prices or offer interest-free loans, monitor prices.

Generally, the higher the down payment, the lower the interest rate. Therefore, it would be optimal to find a middle ground: set aside part of the money in advance, get a loan for the remaining amount.

- Bargain! Ask in the salon about possible discounts. At the end of the reporting periods (month or quarter), the head of the sales department can meet you halfway and make some discount.

At a minimum, you will be offered rugs, protection, or some other useful little thing as a gift.

- Now that you've determined the cost, timing, and your options, let's move on to the tricky part: stick to the plan and save.

How to save money is your decision; the best way is to do it automatically. Get a separate deposit account in a bank with the possibility of replenishment and capitalization. The money in the bank will grow a little. Set a regular payment from the main account, every month the bank will transfer the agreed amount to the specified deposit.

Or, in the old fashioned way, put the signed envelope with money in the chest of drawers. Seal it! If one day you feel an irresistible desire to plunge into the “stash”, you will think “is it worth it” while you open the envelope.

How to save money for an apartment or house

Buying an apartment or house is one of the biggest financial steps in life. If you are not a rich celebrity, you will have to learn from experience how to save money from every paycheck. On the one hand, this is a difficult task. But the prize is great! Own square meters are expensive both literally and figuratively.

In fact, there are only two options for buying an apartment:

- entirely for cash;

- loans plus cash.

Mortgage or savings?

It may seem crazy to save money for an apartment or save money to buy a home without a mortgage. However, have you thought about the overpayments, which reach very impressive sizes?

For example, a large two-room apartment in the regions costs from 2 to 2.5 million rubles. Let's take the minimum. Suppose there is accumulated money or maternity capital - 500 thousand rubles, that is, you will have to borrow from the bank about one and a half million at a minimum rate of 11% per annum. A twenty-year mortgage will cost you an extra $2.2 million.

Do you want to know how much money and how long you need to save monthly to save the same amount? To make the comparison clear, let's assume that it was decided to save 15 thousand rubles for the future. Monthly capitalization, replenishment of the deposit will give the desired result after 6 years of slow savings.

Bonuses, proceeds from the sale of second-hand items, other additional income should go straight to the deposit. This will significantly speed up the accumulation and bring the long-awaited “X-hour” closer.

How to save money for an apartment

« ... ordinary people ... the housing problem only spoiled them ...- Woland looked into the water. Buying your own home in modern conditions is not an easy task, but it can be solved.

- Take note of 15 tips to save money and consistently stick to the chosen strategy.

- Enlist the support of loved ones: if you are forced to rent a house and at the same time save for an apartment, try to “compact” a little and temporarily live with your parents.

- Americans often let tenants into a spare room to cut utility and rental costs. Consider the idea, it is not as bad as it seems at first glance.

- Review your current apartment rent: maybe choose a less expensive area?

- Set up a separate savings account, but don't forget to add to the "emergency" fund. Housing savings is the last place you can get money in an emergency.

Discipline, planning, thrift, budgeting – those boring accounting terms that got the hang of it while you were reading…

Think Different: independence, freedom, impressions, your home, confidence in the future.

The ability to save money and take care of every penny will give you the key that we talked about at the beginning. The key to happiness that you can make yourself.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

In contact with

Classmates

Financial independence is the ability to live at the level at which you are accustomed to not working.

If, for example, you do not have savings or assets or a business that brings you income, and you have to work every day to get money, this is an absolute financial dependence on society, the employer and the condition of your body, because as soon as you get tired, exhausted, get sick or want to go on vacation, but you do not have such an opportunity and you are forced to work hard in order to receive money, eat it up, pay for housing, transport and everything else.

It is absolute financial dependence.

According to the philosophy of attitudes towards money, people can be divided into:

1) Hungry

2) Scoundrel

Addition

4) Honest jerk

A hungry man is a person who spends everything he earns.

The greatest secret of hunger is to eat everything you have, and no matter how much you earn, earn 5 thousand rubles - you have to spend it, earn 15 thousand rubles, you need to spend, 30 thousand - we will spend everything at zero.

Hungry people tend to spend money in their head even before they receive it, they have not yet received a scholarship, but they already know where they will spend it, they have not yet received a salary, but mentally ate it.

Sometimes they say about some unsuccessful entrepreneurs, they say that this person eats up profits, that is, he does not invest it in business development, but he spends it exclusively on living. It is these people who roll through life with some financial zero.

If you meet people who say that they have no way to postpone, because they need to get dressed and pay for the children and buy food, know that you are a beggar.

A hungry man will always find a way to buy himself a fancy cell phone, he will find a way to smoke a pack of kent a day.

Kent costs about $1, he could not smoke and save this amount and used to go to a Turkish country, to an inexpensive hotel say 3 stars for 5 days, but he says he does not have the opportunity to vacation abroad.

Smoking is a pleasure for the poor.

A scoundrel is a person who spends everything he earns.

The scoundrel is forced to sit on the tail of others, a scam, a casino, robbery, violence, murder, extortion, bribery and everything connected with these. There is no desire to produce money, to create jobs, to create work, but the desire to use it is very strong. It should be noted that the villains are formed mainly from the poor.

Most people will not achieve anything because they will spend all their energy on achieving other people's goals.

A rich man is a person who spends less than he earns.

Wealth is a state of mind.

The ability to live more modestly than the level that you can afford, while if a person has the inclinations of a rich person, he already saves his scholarship in his student years, so that after graduation from the university he will manage his funds at his own discretion. Usually these people plan to create their own office, their own business.

Most of the businesses that people are starting to notice started with two graduates renting a basement room with their existing funds, putting in rented old photocopiers, providing consulting services to the population, and copying documents at the same time.

Later, they hired several workers, then another and another, they invested every penny they earned, the premises expanded, the number of jobs increased, and other workers came to these jobs and said “how bad everything is, surely the bosses have money, connections, opportunities”

Justification is the words that losers use to be right in their own eyes.

Honest moron - spends less than earns.

The state of emergency saves at the same time, not knowing what. A person does not have specific plans and goals, he, simply denying himself everything, puts money in a stocking.

Rather than saving for old age, it is better to invest in your youth.

In contact with

How to save money? Any person at least once, but asked this question. Even more often, especially this year, people are wondering why they didn’t save before? In this article, I have collected 20 tips on how to organize the process of saving money. And it doesn't matter what you save up for. Recommendations are also suitable for those who want to create an airbag. And those who aim to save money for investment purposes.

1. Realize that you need to put off

Many people now live paycheck to paycheck. And this happens to people, both low-income and high-income people. They just put it in a savings account. And, unfortunately, not money. As the crisis comes, things are bad for such people. One stress. And why do you need it? Stabilization fund, reserve fund, airbag. Call it whatever you want, but it has to be.

2. Record expenses

Sometimes, people would be happy to create a personal gold reserve. But money is not enough for a simple life. The best solution is to consider your costs. Only without fanaticism. It is enough to mark expenses with an accuracy of 10 rubles. (or even up to 100 rubles) You can fix it in a simple Excel file. Easier and more interesting - in a mobile application. A month is enough to identify inefficient spending items that can be cut.

3. Don't confuse an investment portfolio with an airbag

You will probably have to print the stabilization fund at a time when there is a crisis in the country. But here's the bad luck: in a crisis, often with investments, too, a crisis. Partners do not return debts on receipts. High-risk projects "default". There are liquidity problems. The task of withdrawing investments into cash is extremely problematic. So…

4. Money in the stabilization fund must be liquid

One of my goals for 2015 was related to savings. I decided to set aside at least 10% of my income every month and convert it to pounds. I had an idea to buy a parking space in England. At the same time, I believed that these accumulations "in which case" would serve as an airbag. Ruble-dollar slides led to the fact that "if something happens" came very quickly.

Pounds had to be sold immediately. I had no luck with the course. But most of all, unlucky with the unscrupulous spread of domestic exchange offices. Basically, because of this, I lost a third of my investment in the operation. Therefore, my advice: the money of the stabilization fund should be held in the most liquid currencies. Dollar and euro. No exotic.

5. Protect the stabilization fund from yourself

The main enemy of your savings is yourself. Are you familiar with the situation when you run out of money and you climb into an envelope with savings? You take a little and promise yourself to return everything from the first pay. Then you take a little more and more ... At one point, you find the envelope empty.

As already mentioned, a good airbag should be liquid. But at the same time, this money should be hard to come by. What does my personal experience say? I invested my savings in investment coins, securities and exotic currencies. Such assets were really difficult to squander. But it was difficult to sell them quickly without loss.

6. Remote stabilization fund

The most effective way to store savings is a deposit. Moreover, not every bank is suitable here. It is optimal to find a bank from the first hundred, but with an undeveloped branch network. The main feature is that their office is as far as possible from your home. And you would be too lazy to go there. It is important to choose a deposit with the ability to deposit and withdraw money without penalties and loss of interest.

7. Better to save a fixed amount than a percentage of income

If you live on one salary, then you can not bathe. Divide the salary by 10 and send the received amount to the deposit. If you have many sources of income and they are unstable, it is harder for you. To calculate 10%, you have to sum up all the income for the month. For professional investors, this can be a daunting task. It is easier to calculate the average monthly income for the last quarter and six months. And constantly set aside a tenth of this amount.

8. Save without fanaticism

At 20, I tried to save as much as possible. In some months, it was possible to save about 50% of income. And I did not have a mortgage - there was a motivation to save as much money as possible. Looking back, I consider such savings unnecessary. There are two other important areas for investment. This is self-education (trainings, courses) and charity. The last point is not altruism, but a pragmatic choice.

9. Automate saving money

In terms of saving money, your main assistant is automation. Program a regular transfer of money from the current account to the deposit. If you are an employee, let the money be debited from the salary of the card. If you are a freelancer, businessman or investor, automate debiting funds from your main current account.

10. Forget about savings

Automating the transfer of money to a deposit solves another important problem. Over time, information about the deposit can simply pop out of your head. So, you certainly can not spend this money. I personally do not take into account the stabilization fund at all in my accounting. It also helps to forget about this money.

11. The stabilization fund is different for the stabilization fund

Often people have only one place to save. In one egg they store money for a "rainy day", a down payment on a mortgage and for a vacation. All in one! But it's not right. Piggy banks should be different. Because, in this way, you can correctly estimate the required size of each of them.

For example, you should spread the money for health and for "maintenance of the pants." And it's not the same. The capsule for treatment should be opened as a last resort and solely for the intended use. If the money "for life" runs out, it is wiser to borrow than to spend money on health. Better to be healthy with debt than sick without debt.

12. A credit card is a bad stabilization fund

Some of my friends consider it reasonable to direct all free money into investments. And if there's a problem, they'll use a credit card. I think this strategy is wrong. When a person has an ass, the last thing he wants to do is go into debt. And don't be tempted by the grace period on your credit card. In case of force majeure, money is often needed in cash. And when withdrawing them from an ATM, the grace period is immediately canceled.

13. You need to know what you are saving for.

Don't put off 10% just because the smart books say so. Trust me, you won't last long. Five years ago, with a salary of 40 thousand rubles. I collected 200 thousand. One day I wondered why I needed this money. The motivation inspired by the authors of books with advice "you need to save" seems to be gone. As a result, I quickly lost all my savings.

You need to ask yourself: why do you need savings? What is the purpose of your stabilization fund? For example, it is reasonable to have a health fund. At the same time, you can have reserves for your business. Their size should cover the cost of servicing debts for at least three months.

14. Consider the planning horizon

If you are saving for a comfortable old age, you have a wide choice. In addition to the dollar and the euro, you can keep some of your savings in pounds, and some in gold. I have already written about the disadvantages of investing in these assets. But if you buy for many years, the question of liquidity disappears. I note that in this case, consistency is important. Before you save for a long-term goal, you need to save for unforeseen needs.

15. Save monthly

If you want to set aside money from a quarterly bonus or windfall, that's commendable. But often this trick fails. When paid, good intentions can disappear. You will want to spend money on vacation or the latest iPhone. That's not the point. We need a systematic approach. It is optimal to replenish savings regularly - once a month.

16. Pay yourself first

Often people do not save a percentage of income, but what remains before payday. 3% of revenues left - good, 10% - great! I lived that way too. And if in the last days before the salary I had extra money, I increased expenses. Sometimes so much that there was nothing left. Therefore, it is necessary to replenish savings not in the last place, but in the first place. And not just anything, but a specific amount or percentage.

17. Be disciplined

It was like this for me: I put the first month in an envelope on the 1st. In the second month - 3 numbers, in the third - already 5. You understand what I'm getting at. Having allowed the element of optionality only once, then degradation follows. You need to set a specific number when you will manually or automatically save money. It is important that the monthly payment date is realistic.

18. Remember the promise you made to yourself to save money.

You read an article about how to save money. They said to themselves: "Yes, damn it, I'll save money!" And for the third month they forgot about it (if not earlier). Or you have supposedly good reasons not to save anything.

We know that any habit is developed within 21 days. But this rule applies to regular processes. There are other chips at work here. What do I use? I put the task of converting 10% into savings into the list of goals for the year. And I hang it wherever I can. On the wall at the computer, the lock screen on the iPhone, on the "home page" in the browser. The main thing is that the goals are always in front of your eyes.

19. Keep savings in foreign currency

Recent years have shown us in which currency it is better to save money. Accumulations with a horizon of more than a year must be kept in foreign currency. But if you save up for something small, then do it in rubles. Knowing the cost of your goal, divide it by the nth number of months. Set aside the resulting figure regularly. This will make it easier to control the accumulation process and you can quickly check how much is left to the goal.

20. Maintain privacy

If you systematically save money, regardless of income, in a couple of years you will accumulate a good amount. Remember that most Russians don't like the rich. Even if their superiority is small. Therefore, do not tell anyone about your financial achievements. Otherwise, the relationship may deteriorate. Or they will start to climb to you with a request to lend. Better to keep your mouth shut. And to dedicate the narrowest circle of people to personal finance.

Liked the article?Bodo Schaeffer

The ability to save money is characteristic of few people, because it is directly related to the ability of a person to organize his life, for which it is necessary to adhere to certain rules and strict self-discipline. But if a person has a desire to learn this skill, he will definitely learn it. And so that you, dear readers, have this desire, and at the same time the knowledge of how to save money correctly - carefully read this article! In it, I will tell you about how and why to save money in order not only to have a strategic reserve of funds, but also to be able to control yourself and your desires, not allowing all the money you earn to seep through your fingers.

Well, we will learn with you how to save money and thus effectively manage it. I have already learned how to do this, now I will share with you all the knowledge that I myself have. You know how to earn money - this is very good, and you know how to increase your income - this is commendable. But it is also necessary not to let the earned money spread in all directions. Still, you earned them with your own work, and your work must be valued and respected - taking care of your money.

The task before us is solved with the help of two things: motivation and knowledge. Moreover, motivation is much more important than knowledge. There is not much to know here in order to save money - you just need to save it, that is, set aside a certain part of your income and not spend the money you save. But to do this on a regular basis, you need to have good motivation. Therefore, I will focus on it.

So, before you start saving money, a person must answer two questions for himself. The first question sounds like this: why and why do you need to save money, that is, what is the point in this, what is the interest, what is the benefit from this? And the second question: how to save money correctly so as not to limit yourself in anything and at the same time get a tangible result from your actions in the form of solid savings? Here, I will answer these two questions, explaining to you the meaning of accumulating money and talking about ways to accumulate it.

Question one: why save money?

It is necessary to save money not only in order to have savings, that is, not only for economic reasons, but also for psychological ones. The very process of accumulating money is financial management, which requires a disciplined and competent approach. And this means that a person who saves money develops self-discipline, as well as the attentiveness and responsibility necessary for success in this business. After all, in order to add penny to penny and always know how much money you have accumulated and where it is, you need to be an attentive and responsible person who tightly controls your finances. Thus, it turns out that by saving money, a person gains power over them. He does not allow money to excite his emotions and induce himself to thoughtless and uncontrolled spending of money - he manages them rationally, strictly setting aside a certain part of the earned funds to create savings. And gaining power over money - a person gains power over himself, controlling money - he controls himself. Therefore, we can say this - you need to save money, including in order to become a wiser, more perfect person.

I will even say this - having savings is about the same as having a child who needs to be looked after, who needs to be taken care of, who needs to be fed, taught and educated so that he grows up as a normal person. Money should be treated the same way - they also need care and guidance, they also need to be monitored so that they bring a lot of good and little harm. The child requires a lot of attention and money also requires no less attention. The child requires a caring attitude and money requires a caring attitude. No normal parent will leave their child to the mercy of fate, and in the same way, a serious and responsible person will not throw money left and right, because money is his strength, it is his vital juices, his mind, his time - expressed in money . Therefore, when a person saves money, he is engaged in a very important and responsible business, which is directly related to his life. After all, if necessary, savings can allow a person to retire for a while, relax, and possibly switch to some other activity that takes time to master. The accumulated money provides a person with a very valuable resource for this life - time. After all, if it suddenly happens that the source of money dries up, then savings will help a person live for some time without working. They can also be used to solve some serious problems, such as health problems. And with their help, you can start some new business, you can create a new business without getting into any loans. Money is a tool, and savings are a toolbox that can be used anytime you need it.

In general, I believe that the desire and ability to save money is a sign of elitism. Not all these expensive toys that people seek to buy in order to emphasize their significance make a person better, and the ability to do difficult, complex things, the ability to adhere to strict discipline, the ability to plan for years to come, the ability to control one’s desires, one’s nature are signs highly developed person. By saving money, a person complicates his behavior - making himself a part of the civilized world. After all, what is a civilization in which we all live so comfortably - this is a complicated artificial model of the world that a person created in order to live in comfort and prosperity. And what is a civilized, highly developed person - this is a person with complex thinking and behavior, this is not such a primitive creature as nature made him, this is a highly organized system with a practical mind and complex behavior. Not only the ability and desire to save money affect the quality of a person, but it is a very important element of a person's behavior that characterizes him as a highly organized person. After all, the constant saving of money, in order to save and accumulate it, is a ritual that requires a high organization of the mind, discipline, and order. It is quite obvious that some gouging will not be able to save money, for him this is an impossible task. But even if he begins to save them, he will not be able to accumulate serious capital, because he will not be able to save it, he will not be able to restrain himself from not touching this money. In addition, you need to be able to protect your money from encroachments by other people, including from the state, which likes to get into the pockets of its citizens. So the accumulation of money is not just a job, it is an art, it is a whole culture that requires high qualities from a person, with the help of which he will act as he should, and not as he wants.

From the foregoing, it follows that the main incentive for the accumulation of money for a person should be the desire to make himself a more serious and financially responsible person. Put money aside - take a look at yourself and tell yourself that you can save money, you can be disciplined by saving a portion of your income every month, and you can control yourself so that you don't spend the accumulated money. It's all about pride and self-respect - you don't need to refer to the need to save money, you don't need to do it under duress, it's better to awaken the desire to save in yourself in order to do it with joy and interest, with the understanding that you are doing it for yourself and not because it is necessary. After all, you will actually do this for yourself - after all, all the money that you accumulate will not go anywhere - they will remain yours as they were. They just start working for you in a new way. Firstly, they will become a reliable support for you in solving many important tasks, and secondly, they will contribute to your personal development. After all, you want to become even smarter, stronger, more experienced, more confident in yourself, right? Saving money will help you with this.

Question two: how to save money?

As for the ability to save money, there is nothing complicated in this matter - you just need to systematically set aside part of the income you earn and not spend this money. Below I will explain the best way to do this. But first you need to tune in to this task. Actually, it was for this reason that I began to explain the principle of accumulating money from the motivation for this activity. After all, the most difficult thing in saving money is to start saving it. That is, it is difficult for some people to take money and put it, say, in a safe, and then do it again next month, and so every month. At the same time, you cannot touch this money, that is, you cannot spend it.

The main barrier that prevents you from saving money in this way is, of course, psychological. After all, what is required of a person who wants to start saving money? It is necessary, as I said above, to simply take a certain amount of your income and save it, either by putting this money in a safe or in a bank account. Everything is very simple. But the psychological barrier I’m talking about is based on the idea that by saving money, we limit ourselves in some way, and also switch our attention from the desire to constantly increase our income to the desire to save, shrink. Say, the desire to save money prevents them from earning, as it deprives a person of an incentive to increase his income. Let's deal with both of these points in order to remove the psychological barrier that prevents you from starting to save money.

So, the first thing to deal with is the thought of a person limiting himself in something because of the need to save money. The fallacy of this thought is easy to prove if you think about what a person understands by limiting oneself in something. After all, this is a very relative concept - a limitation. Compared to what, or with whom, do we limit ourselves when we save money? A person can save money with a salary of twenty thousand conventional units, and in the same way he can save money with millions in income. And what happens that in each of these cases he limits himself in some way? If so, then following this logic, we can say that without having even higher incomes, a person also limits himself in some way. And if so, then how does the restriction that becomes a consequence of saving money by a person differ from those restrictions that he is forced to adhere to - without having super-high incomes? The difference is only in a person's perception of his actions, in his attitude to what he does. You need to change your attitude towards savings from negative to positive, and then you can easily start saving money without thinking about any self-restraints. Therefore, understand that by saving at least a tenth, at least a twentieth of your income, depending on your current capabilities, you do not limit yourself in anything. Just like you don't limit yourself to anything by not having a higher income than your current income. In general, the rejection of one thing always means a choice in favor of something else. Therefore, if you decide to give up something, for example, from some kind of purchase, in order to put aside the saved money, then you have not lost anything - you have gained one at the expense of the other. You have made a choice, the correctness of which depends on what you gave up for the sake of savings. If from some insignificant nonsense - your choice is one hundred percent correct.

So all you have to do is decide how much you want, not how much you can, set aside money each month so that you never touch a certain part of it again. It is clear that never means that you can touch them only in the most exceptional cases, otherwise the very meaning of accumulating money is lost. We save money not in order to break loose and spend it all on satisfying some of our next desires, but in order to have the foundation of our material well-being. And just as we do not disassemble the foundation of the house in which we live, so that it does not collapse, we should not destroy the foundation of our capital in the form of accumulations, so as not to deprive ourselves of the strength and confidence that it gives us.

The second thing that needs to be dealt with in order to destroy the psychological barrier that prevents saving money is the thought that our, or rather your attention, during the accumulation of money, switches from the desire to increase income to the desire to save and save. It is important to understand here that one thing does not interfere with the other at all - you do not deprive yourself of an incentive to increase income, you supplement it with an incentive to keep the money you have already earned. You cannot be constantly focused solely on income, because such a position is contrary to the very essence of the economy. Not only do we live in a world with limited resources, in which constant growth is impossible in principle, it will inevitably be, because it must be replaced by a recession, before a new leap upwards, which means that we need to be prepared for such recessions, even if there are more. did not exist in your life. So also the very efficiency of your life directly depends on how well you control your finances. Here you can draw an analogy with a bucket of water - into which you can pour more and more water, but if it is full of holes, then this water will flow out and the ever-increasing pressure will only contribute to this. Also, in real life, rising incomes often go hand in hand with even higher spending, which, for the example above, would mean that the holes in our bucket of water get bigger as more water is poured into it. Therefore, there is no need to oppose the ability to increase income, the ability to competently manage your money, adhering to reasonable savings and regularly setting aside a certain amount of money to create savings. Don't let wrong mindsets build up barriers in your head on the way to achieving the goals that are important to you.

Take a look at your income now and decide how much of it you will save every month. There are recommendations according to which you need to save at least a tenth of your earnings, but I believe that this figure should not be constant - you can save five or twenty-five percent of your earnings, depending on your current need for money. The main thing in this case is not the amount of deferred funds, but the regularity of the procedure for their postponement. You can build a whole house by brick, and very quickly, if everyone, I emphasize, lays a brick every day. The main thing is the regularity of actions. And the vast majority of people have the ability to save money - you just need to save a certain amount every month, doing it as if you were paying someone for something that you should pay for. And you really pay - you pay yourself. You pay yourself for the opportunity to be a highly organized person who has the right to have savings.

A person who accumulates money lengthens his mind and complicates his thinking. After all, what does it mean to save money - it means to think about tomorrow, that is, to launch your thought into the future, and not proceed from the situation that exists here and now. At the same time, thinking becomes more complicated due to the fact that a person not only calculates what kind of savings he will have in the future, but also thinks about how to protect and protect his savings. This is also a very important point in the process of accumulating money. Money must be able to protect, how one must be able to protect oneself and one's loved ones, one's property, one's rights, one's values. And in this case, you need to take into account the fact that not in any currency you can store money. You and I know that the currencies of some countries are so weak at a fundamental level that they can depreciate by more than half in a year. Therefore, you need to save money - in the right currency and keep it in the right place. The correct currency is the world's reserve currency. The right place to keep money is one where the right to private property is protected by law. Also, a safe place to store money in the correct currency is a safe, from which they will not go anywhere without your knowledge. Well, not very large amounts can be stored in our banks - in state-owned banks. In general, if we talk about keeping money, then I recommend laying your eggs in different, most reliable baskets, the main one of which will be your personal safe and reliable banks in the developed countries of the world, where money is best protected. But it makes sense to keep large savings in such banks. It is better to keep small savings in your own safe, in a safe currency, if you do not plan to spend this money for a very long time. And also a certain amount of savings can be stored in our banks in domestic currency, based on the medium term. Perhaps more competent financial advisers in this matter can offer better options, but personally I adhere to just such a strategy for storing and accumulating money.

Now let's talk more specifically about the process of accumulating money. Suppose your income is one thousand conventional units, some of which you are going to set aside, thanks to my instructions, so that you have savings. How to start doing it? I advise you, at a minimum, not to deviate from the classic recommendations and set aside at least a tenth of your income, except for special cases when your need for money is especially acute, for example, you need it for treatment, to save a business, to solve problems. with the law and the like are very important matters. In this case, you can set aside less, for example, five percent of income. But you absolutely must do it, in any case, because it is important for your very attitude towards the accumulation process. Whatever your financial situation is, save money, at least five percent of the money you earn, but save it. And as a maximum, you can set aside exactly as much as you can afford to put aside, without denying yourself what you really need, but at the same time saving on all sorts of unimportant things for you. There’s some logic here - you don’t cut your expenses, putting aside, say, twenty percent of your income, by saving on what you don’t really need, for example, on expensive and meaningless entertainment, on alcohol and the like. - you redirect your funds from ineffective, and even frankly harmful areas of your life for you, to a more promising direction. Why, say, spend the money you earn on paying off a loan that you don’t have to take, because it’s much more interesting to create a personal fund for targeted savings, in which you will have funds for various long-term and short-term tasks. This is a more responsible, but at the same time more interesting way of life, in which you control money to a greater extent than they control you.

Then, those funds that you will set aside every month must be divided into two parts. One part - let it be sixty percent of the funds you save, you need to keep in the bank, or if you want, then at home, for medium-term tasks. That is, these will be savings that you plan to use in the medium term to solve various problems. But the remaining forty percent should become your emergency reserve, designed for the long term, that is, for solving the most serious, most complex problems and tasks. That is, it will be the same airbag that will allow you to become a more confident person in the future. Of course, at first, such money must be kept in a safe currency at home, in a safe, and when there is a lot of it, it will be possible to open an account in a reliable foreign bank, in which they will be reliably protected. This is how I recommend you save money. Basically, the whole difficulty lies in getting addicted to this business, while the accumulation technique itself is quite simple, much easier to manage a profitable business or work performed by some specialists.

Mistakes

What mistakes can you make when saving money? There are several. First of all, again, these are psychological mistakes that arise because of a person’s desire to do one thing and unwillingness to do another. For example, some people adhere to such a strategy - to save only the money that they have left after all the supposedly mandatory spending. This should not be! You don’t have to wait until you have some money left to save it - immediately save a certain part, ten or more percent, at worst, save five percent of your income if you really need money, but do it right away. After all, what does it mean to put aside what remains. Stay after what? After what-such spending? What does a person put above his own savings? Very little can be put above this, agree. After all, the money that we save - they do not go anywhere - this is our money, we do not lose it, we own it - they are our property. Therefore, our, your savings should not live according to the residual principle. Respect your savings. Save money before you start spending your income, not after.

The next mistake is a waste of accumulated money. As some people say - they break down when they save money and spend everything they have accumulated, allowing their weakness to destroy everything. The fault here is not the weakness itself, but its justification. If you broke loose and spent the accumulated money, then there can be no excuse for this, unless your spending was related to a matter of life and death. But as a rule, spending in such cases turns out to be unreasonable. Consequently, any waste of accumulated money should be condemned, first of all by the owner of this money, and if this does not help, then you need to somehow punish yourself in order not to allow yourself such actions in the future.

And of course, you should not go to extremes and save most of the money you earn, turning the accumulation process into an end in itself. Then you will definitely shift the focus from increasing income to saving money, thereby worsening your financial situation. Stick to the golden mean - just save every month from five to, say, twenty percent of your income, distributing these funds in such a way that some of them are set aside for the medium term, and some, forty or thirty percent, become an untouchable strategic reserve. Then very quickly you will accumulate a solid capital, which you can rightfully be proud of, because it will symbolize your high organization and discipline, as well as the maturity of your mind.

Accumulating money is a very interesting process that allows a person to feel like the owner of his funds, and even more - the owner of his life. Not many people save money, and even fewer people know how to do it right. Therefore, if you join the club of those who have certain savings for various purposes, you will immediately feel exclusive, and this feeling will positively affect your self-confidence. After all, taking a loan for one purpose or another is easy, very easy, for this, you see, you don’t need a lot of mind - just know that you pay the monthly amount due and don’t think about anything. And it is quite another thing to save money, when every month you pay not to the bank, being indebted to him, but to yourself. You yourself force yourself to pay, but not to someone, but to yourself. This requires a person's willpower and understanding of the importance of the process of accumulating money. Saving money is much more difficult than borrowing it.

As for all the tricks associated with the accumulation of money that exist so that a person deceives himself with their help, I am categorically against them. For example, according to some recommendations, money should be stored in a place where it is difficult to take it so that there is no temptation to do so. Or you do not need to carry money with you so as not to spend it. Or, money can be trusted to someone who can save it better than you, without trusting them to themselves. All this is nonsense that goes against the very idea of accumulating money. By saving money, we bring up a serious, responsible person with sufficient self-discipline not to allow ourselves to spend our savings. If this cannot be done, you need to accustom yourself to self-discipline, and not shift the responsibility for accumulating money to other people. It is not necessary to save money just for the sake of accumulating a certain amount by any means - it is necessary, through this process, to cultivate a disciplined person who is able to control himself. Otherwise, the accumulation of money will become for a person the eternal game of a child with matches. I don't recommend you play this game. There should be no tricks - you need to learn to resist temptations and weaknesses - saying “no” to yourself when you really want to, and not trying to outwit them, deceiving yourself. Otherwise, the human mind will never become mature.

And here is what I would like to say to you in the end on this issue. You do not need to tell other people that you are saving money - they do not need to know about it. Silently do your job - save money and do not tell anyone about anything, and even more so do not show off your savings to anyone. So you save yourself from many problems and all sorts of misunderstandings. Only you should know about your savings. At worst, only your closest people can be privy to this secret. And even then, they can only be told about the money box that you have designed for medium-term goals, while your strategic reserve should become your secret. So as you can see, the process of accumulating money also contributes to such an important skill for life as the ability to keep your mouth shut.

If you have already started saving money, congratulations - this is a smart step towards a secure future. Ideally, your financial "airbag" should be enough for six months of life without financial income. But even if every month you make a profit and increase your savings, this does not mean that your strategy is perfect.

David Blaylock, a financial planner, analyzed the common ones and gave some tips for improving them.

Strategy #1: Save What's Left

So you pay your monthly bills, maybe spend some on entertainment, and then whatever's left goes into a bank account. Knowing that you, in principle, have money, you can spend more than you should, and then spend the funds intended for accumulation. Also, it's hard to set a specific savings goal for yourself, because you can never be sure how much you'll have left after spending all your money. Instead, you can try another method.

So how should it be?

The very first bill you need to pay after your paycheck is your savings account.

Make it your rule and treat it as a mandatory and most important part of payments (of course, if you have enough money to pay all other bills).

Create an automatic transfer of money from your bank card to your savings account at the beginning of the month or from each cash receipt. If you just set up such an automatic money transfer and forget about it, after a while the amount of accumulated funds will surprise you greatly.

Strategy number 2. I transfer money to a savings account

So, you are regular - that's great. Yes, and a savings account with a plastic card is very convenient. But here, too, there are downsides.

If you run out of money, you run the risk of withdrawing your savings or even spending them on an unexpected but very welcome purchase. And, most likely, you will, because withdrawing money is very easy: it is always within reach, you don’t even have to go to the bank, just use an ATM.

So how should it be?

Open a bank deposit for 6 months or a year. This way you will definitely not spend money intended for storage. Just don't invest everything. Leave some in a regular savings account for emergencies.

Strategy number 3. All my savings are in one account

When you have only one savings account, it seems that the money in it accumulates quickly and there is enough for everything. If you're only saving for one thing, like an apartment or a vacation, then you're fine. But if you have several goals, one bank account makes it difficult to calculate and you do not see concrete progress. It is more difficult for you to understand what is enough money for, and what will have to wait.

As a result, it turns out that, having spent savings, for example, on a vacation, you leave nothing for a new car.

So how should it be?

It is better to have several accounts, each of which will be dedicated to a specific purpose, for example: “for home”, “for vacation”, “for education for a child”. This will make it much easier to calculate your finances and see real progress.

Strategy #4: I save big when I can.

Some people do not save money on a permanent basis, but save large amounts at once when a lucky opportunity occurs. In this way of accumulation, feelings of abundance and guilt alternate. The last one is when you have to take money from your savings. The frustration of doing so can even discourage you from ever saving money again.

So how should it be?

The best thing to do is to set yourself savings goals and work towards them. Decide on a specific amount of money to set aside each month. If it seems to you that it can be increased without compromising the quality of life, do it. But! Contributions must remain consistent and equal.

Strategy #5: I save everything I can

Despite the need to have savings, you should not get too hung up on this and deny yourself the pleasures. They help us stay happy and maintain mental health.

So how should it be?

If you haven't had a month in which you could contribute money to an "emergency fund", put off all other payments and pleasures until you can.

When your six-month "emergency fund" is replenished, Blaylock advises changing strategy. Since small cash savings bring little money, it is worth considering longer-term savings with good interest.