Accounting for costs of production of products (works, services).

Accounting for material expenses, labor costs, deductions for social events, depreciation of non-current assets, other operating expenses, other operating expenses

Production costs. Classification of expenses by economic elements. Their grouping by economic elements, costing items in planning and accounting. The task of accounting for expenses by element. Concept and nomenclature of cost elements

In accordance with the accounting regulations PBU 10/1999 “Expenses of the organization”, a decrease in economic benefits is recognized as a result of the disposal of assets (cash, other property) and (or) the occurrence of liabilities, leading to a decrease in the capital of this organization, with the exception of contributions by decision of participants (property owners).

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

The expenses of an enterprise, depending on their nature, conditions of implementation and areas of activity of the organization, are divided into:

· expenses for ordinary activities - expenses associated with the manufacture of products and their sale, acquisition and sale of goods, works, services. These are expenses that make up the cost of goods, products, works, and services.

· other expenses.

Other expenses include:

1.operating expenses are the costs associated with:

1. - provision of the organization’s assets for temporary use for a fee;

2. - provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

3. - participation in the authorized capitals of other organizations;

4. - sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products;

5. - interest paid by the organization for providing it with funds (credits, loans) for use;

6. - payment for services provided by credit institutions;

7. - contributions to valuation reserves created in accordance with the accounting rules (reserves for doubtful debts, for depreciation of investments in securities, etc.), as well as reserves created in connection with the recognition of contingent facts of economic activity;

8. - other operating expenses.

2. non-operating expenses are:

1. - fines, penalties, penalties for violation of contract terms;

2. - compensation for losses caused by the organization;

3. - losses of previous years recognized in the reporting year;

4. - amounts of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection;

5. - exchange rate differences;

6. - the amount of depreciation of assets;

7. - transfer of funds (contributions, payments, etc.) related to charitable activities, expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events;

7.8.- other non-operating expenses.

3. h extraordinary expenses – these are expenses that arise as a consequence of emergency circumstances of economic activity (natural disaster, fire, accident, nationalization of property, etc.).

The contradictions between accounting and tax accounting regarding the formation of expenses are as follows:

Some expenses in BU are accepted in full, and in NU - in a limited amount. (for example, entertainment expenses, interest on loans);

Some expenses, according to PBU, relate to operating expenses, and according to the Tax Code - to non-operating expenses (payment for bank services, interest on loans);

Some expenses according to PBU are classified as extraordinary, and according to Tax Code - as non-operating (losses from fires, natural disasters);

In accounting and accounting systems there are different rules for calculating certain expenses (depreciation, reserve amounts, etc.).

Thus, there are many contradictions and therefore, since 2002, enterprises have maintained 2 types of accounting: accounting and tax.

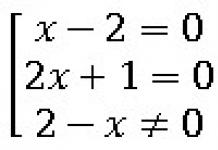

Production costs are classified according to the following criteria.

1. By cost location (productions, workshops, areas, etc.) and by the nature of production (main, auxiliary).

Primary production associated with the implementation of the process of production of products intended for sale. Auxiliary production are not directly related to the production of main products, but contribute to it.

2. By type of expense costs are grouped by cost element And costing items. The enterprise's costs for production consist of the following elements:

1) material costs (minus the cost of returnable waste);

2) labor costs;

3) contributions for social needs;

4) depreciation of fixed assets;

5) other costs (postal and telegraphic, telephone, travel expenses, etc.)

Grouping by costing items includes:

1) “raw materials and supplies”;

2) “returnable waste” (subtracted);

3) “purchased products, semi-finished products and production services of third-party enterprises and organizations”;

4) “fuel and energy for technological purposes”;

5) “wages of production workers”;

6) “contributions for social needs”;

7) “expenses for preparation and development of production”;

8) “general production expenses”;

9) “general business expenses”;

10) “losses from marriage”;

11) “other production costs”;

12) “commercial expenses”.

The total of the first eleven articles forms production cost products, and the result of all twelve articles is full cost products.

3. According to the method of inclusion in cost price of certain types of products (works, services), costs are divided into straight And indirect.

Direct costs- these are costs attributed to certain types of products, works, services based on primary documents.

Indirect- these are costs that simultaneously relate to all types of products, works, services (for example, costs for lighting, heating, etc.) They are included in the cost of products (works, services) when determining the total amount at the end of the month through distribution.

4. By economic role During the production process, costs are divided into main and invoices.

Main These are the costs directly related to the technological process of production: raw materials and basic materials and other expenses, with the exception of general production and general production and general business expenses.

Invoices expenses arise in connection with the organization, maintenance and management of production. They consist of general production and general business expenses.

5. By composition costs are divided by single-element and complex. Single element are called costs consisting of one element - wages, depreciation, etc. Comprehensive are called costs consisting of several elements, for example, shop and general plant expenses, which include wages of the relevant personnel, depreciation and other single-element expenses.

6. Relative to production volume costs are divided by variables And conditionally constant. TO variables include expenses, the size of which changes in proportion to changes in the volume of production (for example, wages of production workers, etc.) Amount semi-fixed expenses almost does not depend on changes in the volume of production (general business and overhead costs).

7. By frequency of occurrence costs are divided by current And one-time. TO current expenses include expenses that have a frequent frequency, for example, the consumption of raw materials and materials, and to one-time(one-time) - expenses for the preparation and development of the production of new types of products, etc.

8. By participation in the production process allocate production And commercial expenses. TO production include all costs associated with the production of commercial products and forming its production cost. Non-production (commercial) expenses are associated with the sale of products to customers. Commercial and production costs form the full cost of commercial products.

9. By efficiency costs divided by productive And unproductive. Productive the costs of producing products of established quality with rational technology and production organization are considered. Unproductive expenses are a consequence of shortcomings in technology and production organization (losses from downtime, defective products, overtime payments, etc.).

10. Depending on the nature, conditions of implementation and areas of activity organization expenses are divided into:

1) expenses for ordinary activities;

2) other expenses.

In accordance with clause 2 of PBU 10/99, the expenses of an organization are recognized as a decrease in economic benefits as a result of the disposal of assets (cash, other property) and (or) the emergence of liabilities, leading to a reduction in the capital of this organization, with the exception of contributions by decision of participants (owners of property) .

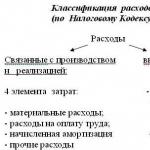

In the Tax Code The following classifications of expenses are distinguished:

1. In accordance with Article 252 NK RF expenses depending on their nature, conditions of implementation and areas of activity organizations are divided into:

· costs associated with production and sales;

· non-operating expenses.

2. In accordance with paragraph 2 of article 253 of the Tax Code of the Russian Federation expenses linked With production and (or) sales, are divided by economic content on the:

· material costs;

· labor costs;

· the amount of accrued depreciation;

· other expenses.

3. According with Article 318 of the Tax Code of the Russian Federation production and sales expenses incurred during the reporting period to determine the share of expenses associated with production and sales, related to shipped products , are divided into:

· straight (material costs determined in accordance with subparagraphs 1 and 4 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation, expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as the amount of the single social tax accrued on the specified amounts of expenses for wages, the amount of accrued depreciation on fixed assets used in the production of goods, works, services);

· indirect (all other amounts of expenses, with the exception of non-operating expenses determined in accordance with Article 265 of the Tax Code of the Russian Federation, incurred by the taxpayer during the reporting (tax) period.

4. All expenses for tax purposes can be divided into:

· expenses taken into account for tax purposes in full;

· expenses limited for tax purposes (for example, entertainment expenses, etc.)

Material costs include the cost of materials and various types of raw materials purchased from outside for the purpose of manufacturing products, performing necessary work or providing relevant services.

The purchase price of purchased materials consists of the following expenses:

Contract price;

Extra charges (surcharges);

Commission paid to intermediary organizations;

Commodity exchange services, including brokerage services;

Services of transport and other organizations for delivery and storage;

Cost of containers and packaging materials, including packaging.

From the material costs included in the cost of production, the cost of returnable waste (residues of raw materials, materials, semi-finished products generated during the production process and which have completely or partially lost the consumer properties of the original resources) is subtracted. In current accounting, returnable waste is subject to assessment according to one of two options:

1) at market prices equal to or exceeding the actual cost of their acquisition - when sold externally as a full-fledged material;

2) at a reduced cost of consumables (at the price of possible use) - when released to the main production, if they can be used to produce products with increased costs (reduced output), as well as for other internal needs or sold externally.

To labor costs relate:

Remuneration for work actually performed, issued in the form of cash or material assets;

Payment in accordance with current legislation for annual and additional leaves (or their compensation in case of non-use), preferential hours for teenagers, breaks in the work of nursing mothers;

One-time payments in the form of remuneration for length of service as an increase in salary for length of service in a specialty in a given area of the national economy;

Various payments for unworked time, subject to payment in accordance with current legislation: payment for the time an employee is on study leave, severance pay upon dismissal, in case of being sent to advanced training courses outside of work, etc.;

Payments according to regional coefficients, due to the need for regional regulation of workers' compensation (regions of the Far North, waterless and high-mountainous areas);

Payment for forced absences or less than paid work;

The difference in the employee’s salary, paid in connection with his transfer from another organization, with its preservation for a certain period (if provided for by law);

Incentive and/or compensatory payments;

Remuneration for work on a rotational basis in the amount of the tariff rate, salary for the time spent on the road from the collection point or place where the organization is located to the place of work and back according to the shift work schedule;

Wages to employees during their training in the system of advanced training and retraining of personnel with a break from their main job;

Payment to donor employees for days of examination, blood donation and rest provided after each day of blood donation;

Remuneration for students and students of universities, colleges, technical schools, lyceums and schools during the period of their internship in organizations as part of student teams, as well as during their professional orientation;

Payment of labor to workers hired from outside to perform work in accordance with civil contracts within the limits of the amounts provided for in the estimate for their implementation and payment documents;

Amounts accrued and issued or transferred for work performed to persons involved in the organization under special agreements with government organizations

Other payments that form the wage fund, except for labor costs financed from the organization’s net profit and other targeted revenues.

Social contributions include accrual to the wage fund for the implementation of social expenses (payment of old-age pensions, disability, benefits for temporary disability, unemployment, etc.). Their composition contains mandatory deductions in accordance with current legislation according to established standards. The amount of deductions is determined by multiplying the current rate (norm) for the corresponding extra-budgetary fund by the accrued wages included in the cost of products (works, services) under the element “Labor costs”. In this case, those types of payment for which insurance premiums are not charged are subject to exclusion.

Depreciation of fixed assets includes:

The amount of accrued depreciation charges for the complete restoration of the organization’s own fixed assets in accordance with accepted accrual methods defined in the accounting policy;

The amount of accrued depreciation charges for the complete restoration of leased fixed assets operated under long-term lease or leasing terms;

The amount of accrued depreciation charges for the complete restoration of fixed assets provided free of charge to public catering organizations serving the personnel of their organization and employees of other organizations;

The amount of accrued depreciation charges for full recovery from the cost of premises and equipment provided by organizations to medical institutions for the organization of medical stations for the purpose of providing medical services to the workforce and located on the territory of this organization;

The amount of increase in depreciation charges for full restoration based on the results of the revaluation of fixed assets carried out in accordance with current legislation.

The amount of depreciation charges for the complete restoration of intangible assets is taken into account as part of other costs.

Other costs combine all other costs that were not included in the previous cost elements:

Payment of interest on a bank loan received for the acquisition of fixed assets and inventories, before accepting these assets for accounting;

Business travel expenses;

Payment of the cost of work on certification of products confirming their compliance with the necessary consumer qualities;

Various taxes, fees and payments (including payments for compulsory types of insurance);

Rewards for inventions and innovation proposals;

Lifting;

Payment to third parties for fire and security guards;

fees for training and retraining of personnel;

Payment of postal, telegraph and office expenses;

Costs for warranty repairs and maintenance;

Payment for rent in the situation of renting individual objects related to fixed assets or their individual parts;

Contributions to the repair fund created by the organization itself on the basis of the standards for deductions developed by it and the book value of fixed assets;

Amortization of intangible assets;

Other costs included in the cost of production, but not related to those indicated above.

Material costs They occupy the largest share in the cost of production. Therefore, correct accounting and strict control over their implementation ensure the reliability of data on product costs and contribute to its reduction.

Material costs at manufacturing enterprises are reflected in the following items as part of the cost of production:

♦ raw materials and basic materials;

♦ semi-finished products of own production;

♦ returnable waste (subtracted);

♦ auxiliary materials;

♦ fuel and energy for technological purposes.

Accounting is maintained on account 10 “Materials” for the corresponding subaccounts.

Based on the analysis of Part 1 of Article 255 of the Tax Code of the Russian Federation, as well as the list of costs provided for in this article, labor costs can be grouped on the following basis:

According to the form of payment;

For the intended purpose.

According to the form of payment, labor costs are divided into:

1) payments made in cash;

2) payments made in kind;

3) payment in favor of the employee.

Payments made in cash are the main method of remuneration, which are recorded in account 70 “Settlements with employees for wages.” According to Article 131 of the Labor Code of the Russian Federation, wages are paid in cash in the currency of the Russian Federation (in rubles). Also, in accordance with this article, remuneration can be made in non-monetary form (in kind). An independent type of labor costs is the payment by the employer in favor of employees of certain expenses. The most common case is the employer's insurance of its employees, provided for in paragraph 16 of Article 255 of the Tax Code of the Russian Federation.

According to their intended purpose, labor costs can be grouped as follows:

1) any accruals to employees made for various reasons;

2) incentives and bonuses;

3) bonuses and one-time incentive accruals;

4) compensation accruals related to the operating mode;

5) compensation charges related to working conditions;

6) costs associated with maintaining employees.

Specific types of labor costs listed in Article 255 of the Tax Code of the Russian Federation are distributed in accordance with the classification according to their intended purpose.

In accordance with the laws of the Russian Federation on pensions, on employment, on health insurance, on state social insurance, employees of the organization are subject to social insurance and security.

For this purpose, monthly deductions for social needs are made from accrued wages and other payments equivalent to it at the established rate. The size of the organization's insurance premiums to the Pension Fund. Social Insurance Fund. Compulsory health insurance funds and the State Employment Fund are established annually by Federal Law.

To determine the amount of deductions for social needs and settlements with each social fund, a special calculation is drawn up. The calculated amounts of deductions for social needs are credited to the same accounts to which accrued wages and other payments equivalent to them were allocated, with an increase in the organization's debt to each social fund.

Accounting for deductions for social needs and settlements with social insurance and security authorities is carried out on passive account 69 “Settlements for social insurance and security”. Accounting for settlements with each fund is carried out on the corresponding subaccounts of account 69 on the basis of the accountant's calculations, statements from the current account and payment orders for the transfer of funds to the corresponding funds.

Account 02 “Depreciation of fixed assets” is intended to summarize information on depreciation accumulated during the operation of fixed assets.

The accrued amount of depreciation of fixed assets is reflected in accounting under the credit of account 02 “Depreciation of fixed assets” in correspondence with the accounts of production costs (sales expenses). The lessor organization reflects the accrued amount of depreciation on leased fixed assets as a credit to account 02 “Depreciation of fixed assets” and a debit to account 91 “Other income and expenses” (if rent forms operating income).

Upon disposal (sale, write-off, partial liquidation, transfer free of charge, etc.) of fixed assets, the amount of depreciation accrued on them is written off from account 02 “Depreciation of fixed assets” to the credit of account 01 “Fixed assets” (sub-account “Disposal of fixed assets”). A similar entry is made when writing off the amount of accrued depreciation for missing or completely damaged fixed assets.

Account 05 "Depreciation of intangible assets" is intended to summarize information on depreciation accumulated during the use of the organization's intangible assets (with the exception of objects for which depreciation charges are written off directly to the credit of account 04 "Intangible assets").

The accrued amount of depreciation of intangible assets is reflected in accounting under the credit of account 05 “Amortization of intangible assets” in correspondence with the accounts of production costs (selling expenses).

Upon disposal (sale, write-off, transfer free of charge, etc.) of intangible assets, the amount of depreciation accrued on them is written off from account 05 “Amortization of intangible assets” to the credit of account 04 “Intangible assets”.

The following accounts are intended to account for production costs (performance of work, provision of services):

20 “Main production”;

21 “Semi-finished products of own production”;

23 “Auxiliary production”;

25 “General production expenses”;

26 “General business expenses”;

28 “Defects in production”;

29 “Service industries and farms”;

96 “Reserves for future expenses”;

97 “Deferred expenses”.

In the general case, the organization’s accounting policies regarding cost accounting should reflect the following points:

1) the method of writing off general business and general production expenses (they can be written off as conditionally fixed expenses directly to the debit of account 90 (method of forming partial cost of production) or included in the cost of production under account 20, 23, 29 (method of forming full cost);

2) the method of distributing indirect costs between cost calculation objects. Indirect expenses (general business expenses, if they are written off to accounts 20, 23, 29, general production expenses) are distributed among the objects of calculation in proportion to the distribution base, which can be used:

Amount of direct materials costs,

Amount of salary expenses

The amount of direct costs of materials and wages,

The sum of all direct expenses.

3) a method of grouping expenses by cost items to generate information for management purposes and cost calculations. For example, the main costing items may be: raw materials and supplies; returnable waste (subtracted); purchased products and semi-finished products; fuel and energy for technological purposes; basic and additional wages of production workers; mandatory deductions from wages; expenses for the maintenance and operation of machinery and equipment; general production expenses; general running costs; losses from marriage; business expenses; other production costs.

All of the above cost accounting accounts (except for account 96) are active in relation to the balance sheet. Expenses are taken into account in the debit of these accounts, and their write-off in credit. At the end of the month, the costs recorded in the collection and distribution accounts (25, 26, 28, 97) are written off to the accounts of the main and auxiliary production, as well as service production and farms.

From the credit of accounts 20 “Main production”, 23 “Auxiliary production” and 29 “Service production and facilities”, the actual cost of manufactured products (work, services) is written off. The balance of these accounts characterizes the amount of costs for work in progress.

In small organizations, to account for production costs, as a rule, they use accounts 20 “Main production”, 26 “General business expenses”, 97 “Deferred expenses” or only account 20.

The determining one among cost accounting accounts is calculation account 20 “Main production”. It summarizes information on production costs, the products (works, services) of which determine the content of the organization’s statutory activities.

To account for the availability and movement of semi-finished products in organizations, account 21 “Semi-finished products of own production” is used. Semi-finished products of our own production can be used later in the production of products or sold. The debit of account 21 “Semi-finished products of own production” in correspondence with account 20 “Main production” reflects the costs associated with the production of semi-finished products. From the credit of account 21, semi-finished products are written off depending on the direction of their use, either to the debit of account 20 “Main production” when spent in their own production, or to the debit of account 90 “Sales” when sold to other organizations and individuals.

Accounting for semi-finished products is carried out, as a rule, at production costs (actual, standard or planned) with the addition of commercial expenses upon sale. The costs of transporting semi-finished products of own production between production units within the organization are included in their cost.

In production organizations, payments for semi-finished products between production units allocated to a separate balance sheet are reflected in account 79 “On-farm settlements”. In those organizations where semi-finished products of own production are not taken into account on account 21, they are reflected as part of work in progress on account 20 “Main production”.

Semi-finished products can be sold externally. If this is done systematically, then account 43 “Finished products” is used, and not account 21 “Semi-finished products of own production”. But if this is an occasional fact, then semi-finished products are written off at their cost to the debit of account 90 from the credit of account 21.

In the journal-order form, accounting for production costs is carried out in journal-order No. 10, which is compiled on the basis of the final data of the cost accounting sheets of workshops (form No. 12), accounting for the costs of service industries and farms (form No. 13), accounting for losses in production (form No. 14), accounting for general business expenses, deferred expenses and commercial expenses (form No. 15), etc.

Journal-order No. 10 reflects all production costs for cost elements from the credit of the corresponding material and settlement accounts, as well as internal turnover in production cost accounts (writing off general production and general business expenses, services and work of auxiliary production). Data from the order journal is used to calculate costs by element and calculate the cost of production.

In the production process, when recording transactions in accounting, some costs can be directly and directly attributed to a specific type of product or cost object. Such costs are called direct. Other costs cannot be directly attributed to a specific product; they are called indirect or indirect.

The division of costs into direct and indirect depends largely on the specific situation. If the organization produces one type of product (product), then all costs can be classified as direct. If the organization produces several types of products, then the consumption of materials is distributed among each type of product. Such distribution can be carried out in proportion to the consumption of material assets according to the standards established per unit of production; established flow coefficient; quantity or weight of manufactured products, etc.

To direct costs, as a rule, include material costs and costs of paying key production personnel. Direct material costs include raw materials and basic materials that become part of the finished product, and their cost is directly and directly transferred to a specific product. Direct labor costs include labor costs that can be directly attributed to a specific type of finished product. This is the wages of workers involved in the production of products.

To indirect expenses include general production overhead costs, which represent a collection of various costs associated with production, but which cannot be directly attributed to a specific type of finished product (products). These costs are difficult to track during the manufacture of the product. At the same time, the production cost of a product must, of course, include general production costs. They are included in the cost of production using the cost allocation method (in proportion to the basic wages of production workers, direct costs, etc.).

Overheads arise in connection with the organization and maintenance of the production process and its management and include general production and general business expenses. General production (shop) expenses are associated with maintenance and production management in the organization’s workshops.

The main groups that make up general production costs include:

Auxiliary products and components;

Indirect labor costs (wages of workers not directly involved in the production of one product, but associated with the production process within the organization as a whole: craftsmen, repairmen, support workers, as well as payment for vacations and overtime);

Other indirect general production expenses (costs of maintaining workshop buildings, maintenance and current repairs of equipment, property insurance, rent, depreciation of equipment, etc.).

The composition and size of general production expenses are determined by estimates for the maintenance and operation of equipment, administrative and business expenses of the workshop. Estimates are prepared for each workshop separately. The purpose of planning expenses and highlighting independent costing items in the actual cost of production is constant monitoring of compliance with estimates.

Planning and accounting of general production expenses are carried out according to the following nomenclature of items:

Depreciation of production equipment and vehicles;

Contributions to the repair fund or costs of repairing production equipment and vehicles;

Equipment operating costs;

Wages and social contributions for workers servicing equipment;

Costs of testing, experiments and research;

Labor protection of workshop workers;

Losses from defects, from downtime due to internal production reasons, etc.

Synthetic accounting of general production expenses is maintained on the active collection and distribution account 25 “General production expenses”.

Based on primary documents confirming the fact and amount of general production expenses incurred, the following entries are made in the accounting accounts:

At the end of the month, the amount of general production expenses recorded in the debit of account 25 “General production expenses” is written off by distributing it to the cost of individual types of products in proportion to the amount of the basic wages of production workers (direct costs of materials, etc.).

5. Accounting for administrative expenses. Accounting for other operating expenses. Other ordinary business expenses. Extraordinary expenses. PBU 10/1999 “Organization expenses”

General running costs(administrative and management costs) are also classified as overhead costs. They are related to the management and maintenance of the organization as a whole. The composition and size of these expenses are determined by the estimate.

Synthetic accounting of general business expenses is carried out on the active collection and distribution account 26 “General business expenses”, and analytical accounting - on account 26 “General business expenses” according to budget items in a separate statement.

Planning and accounting of general business expenses is carried out according to the following nomenclature of items:

Expenses for business trips of the management staff;

Representation expenses related to the activities of the organization;

Office and postal expenses;

Depreciation of fixed assets for general purposes;

Contributions to the repair fund or costs for current repairs of buildings, structures and equipment for general purposes;

Expenses for the maintenance of buildings, structures and equipment for general purposes;

Costs of testing, experiments, research, maintenance of general economic laboratories;

Expenses for labor protection of the organization's employees;

Training and retraining of personnel;

Mandatory deductions, taxes and fees;

Unproductive general business expenses, etc.

All actual costs are collected and reflected in accounting records

At the end of each month, general business expenses are written off to the credit of account 26. General business expenses are distributed between finished products and work in progress remaining at the end of the reporting month. Then the costs attributable to finished products are distributed among their individual types in proportion to the selected base or write-off method. These expenses can be written off in two ways:

1) inclusion in the production costs of specific types of products through distribution similar to the distribution of overhead costs;

2) writing off general business expenses as semi-fixed ones to the “Sales” account by distributing them between types of products sold.

When writing off general business expenses to account 90 “Sales”, they are distributed by type of products, works or services sold in proportion to sales revenue, production cost of products or other indicator.

The choice of one or another method of writing off general business expenses should be reflected in the accounting policy of the organization. Of course, the second method greatly simplifies the write-off of general business expenses. However, it is applicable provided that all products to which general business expenses relate are sold or the share of these expenses in the cost of production is insignificant.

The actual data, after accounting and distribution of overhead costs, are entered into the summary accounting sheet for the costs of production of products (works, services).

The company incurs various types of expenses to ensure its own functioning. Not all of them have a direct connection with the main activity. However, they also need to be taken into account and recognized. Since 2006, the gradation of expenses has been simplified: in addition to expenses for core activities, other expenses are allocated. Operating rooms also fall into this category.

What costs can be attributed to this article, how to correctly calculate and take into account operating expenses, as well as evaluate the success of their management, read in this article.

What are operating expenses?

All indirect costs of the enterprise are classified as operating expenses. Previously, there was a division of costs into the following:

- emergency;

- operating rooms.

Since 2006, according to Order 116n of September 18, this division has ceased to be mandatory, but for the convenience of the enterprise it can continue to be applied. Now it is customary to divide all expenses into two large groups.

If we imagine the entire complex of expenses of an enterprise, then at one pole there will be funds intended directly for the production of products, and at the other - other expenses, which include operating costs, that is, additional expenses for providing capital.

FOR EXAMPLE. The company purchased a beverage production apparatus - this is a capital expenditure. Operating funds derived from it will be funds for the purchase of tea and coffee for refilling, sugar, cups, payment for electricity and equipment maintenance, as well as, if the device was purchased on credit, money for paying bank interest.

So, operating expenses(in English literature “operating expenses”, abbreviation “NUT”) are the costs of daily maintaining the functioning of the enterprise.

Composition of operating expenses

The current accounting plan 10/99 in paragraph 11 of Chapter 3 provides a complete list of the enterprise’s expenses classified as operating. These include:

- assets provided for rent or other form of temporary use or ownership for a fee;

- intellectual property rights leased out for temporary use;

- contributions to the authorized capital of other LLCs;

- all forms of alienation of one’s property, including products (sale, lease, write-off);

- created monetary reserve funds;

- commissions and interest paid to banking organizations.

NOTE! These expenses will be recognized as operating expenses only if they do not relate to the main activities of the organization, in which case they should be considered ordinary.

Operating expenses classified as other

These include expenses not included in the previous list:

- payment of fines for violation of the conditions specified in the contract;

- compensation for losses caused by the fault of the company;

- losses from financial obligations that can no longer be recovered;

- the size of the difference in exchange rates;

- amounts from the write-off of discounted assets.

Accounting for operating expenses

Operating expenses, as they relate to others, are reflected in accounting account 91 (on debit). To account for expenses, a first-order subaccount 91.2 is opened.

For this sub-account, the accountant keeps records throughout the reporting period on a cumulative basis. At the end of the month, the total is summed up: the difference between other income and expenses is displayed on account 91.9.

FOR YOUR INFORMATION! An accountant must keep records in such a way that a specific result can be tracked for each financial transaction.

Accounting entries for accounting for operating expenses

Let's look at operating expenses using a specific example.

Rafflesia LLC sold a machine that had been in use for 3 years (a fixed asset) for 40,000 rubles, including VAT of 6,153 rubles. The initial cost of the fixed asset was 100,000 rubles. According to the documents, the useful life of such a machine is 6 years. For three years of use, a depreciation amount of 55,000 rubles was accrued. The machine was delivered to the buyer at the expense of Rafflesia LLC, which hired transport from a third-party company for this purpose, the costs for this amounted to 15,000 rubles, including VAT of 2,307 rubles.

Let's consider the reflection of this operation in accounting:

- debit 76 “Settlements with various debtors and creditors”, credit 91.1 – 40,000 rubles. – reflection of the buyer’s debt for the sold machine (fixed asset item);

- debit 91.2, credit 01.1 “Fixed assets” – 6,153 rubles. – accrual of VAT on the sale of an object from fixed assets;

- debit 01.2 “Disposal of fixed assets”, credit 01.1 – 100,000 rubles. – reflection of the disposal of fixed assets;

- debit 02 “Depreciation of fixed assets”, credit 01.2 – 55,000 rubles. – write-off of depreciation of fixed assets;

- debit 91.2, credit 01.2 – 45,000 rub. (100 thousand – 55 thousand) – write-off of the residual value of the sold fixed asset item;

- debit 91.2, credit 60 “settlements with suppliers and contractors” – 15,000 rubles. – write-off of transportation costs for delivery of purchased fixed assets to the buyer;

- debit 19 “VAT”, credit 60 – 2307 rub. – reflection of VAT for payment of the organization that carried out the delivery;

- debit 51 “Cash accounts”, credit 76 “Settlements with various debtors and creditors” - 100,000 rubles. – repayment of the buyer’s debt for the purchased fixed asset.

Analysis of the effectiveness of operating expenses

In addition to the purposes of recording monetary transactions, accounting for operating expenses helps to solve additional tasks to improve the efficiency of business activities. This type of cost, along with capital costs, makes up a significant part of the financial costs of any organization.

What can you learn from operating expense metrics?

By comparing these costs with revenue from sales of products, we can draw a conclusion about how expensive it is for the enterprise to produce these types of goods. This relationship is called operating expense ratio.

It allows you to understand how much percent of the income received goes to support the current activities (operations) of the organization, that is, how effective it is.

If you study this coefficient over time, you can track the potential to increase production and/or sales without unnecessary costs. A decreasing ratio indicates a decrease in operating expenses with a constant or even increasing sales volume. This indicates an increase in revenue, and therefore a net increase in the profit of the enterprise.

What factors influence the operating expense ratio?

The reasons that influence the increase or decrease in operating costs can be either external (independent of the organization itself) or internal.

External factors impact on operating costs:

- the level of inflation in the state: the more intense the inflationary processes, the greater will be the operating costs associated with the recalculation of wages, loan payments, costs for contractors’ services, etc.;

- changes in mandatory payments, as well as tax rates - the higher the taxes, the higher the operating costs.

Internal factors(those that can be changed through the efforts of the company itself):

- volume of production of products and their sales - even if, as a result of an increase in volumes, operating expenses increase, the cost per unit of production will significantly decrease, since operating expenses in their constant part will not change;

- duration of the production cycle - the shorter it is, the faster the assets will turn over, as a result of which operating costs will be reduced due to, for example, storage of goods, its natural loss, management costs, etc.;

- labor productivity - the more products each worker produces per unit of time, the lower the operating costs for settlements with personnel will be;

- state of production assets - less worn-out equipment requires less money for maintenance and repairs;

- the number of current assets owned by the organization - a company that owns more property will spend less on rent, leasing and contracts, which will also reduce operating costs.

RESULT. Operating expenses—the day-to-day expenses to keep the business running—are classified as “other expenses.” Reducing these costs leads to increased profits for the organization.

One of the types of accounting is expenses and income. Depending on their nature, they can be divided into other, as well as income and expenses from other activities. Read about what exactly is included in operating expenses and income in the next article.

Operating income is recognized as such if it is not received from the main activity of the company. In the opposite situation, they need to be accounted for in account No. 90, as profit from standard activities.

Other operating income includes income from:

- From OS objects received free of charge;

- From providing assets for rental use;

- From implementation;

- Income of previous periods;

- Accounts payable for which the statute of limitations has expired;

- Interest received from loans provided;

- Compensation for damage caused to the company;

- Amounts of profit from additional valuation of fixed assets;

- From participation in the capital of simple partnerships;

- Other.

Composition of expenses

Operating expenses are the opposite of capital expenses and the direct costs of making goods.

Operating expenses include costs that are aimed at:

other expenses

Other operating expenses include:

- Fin. sanctions;

- Cost of services provided by third party companies;

- Losses from negative exchange rate differences;

- Losses from asset depreciation;

- Taxes and fees.

They are accounted for in account No. 91.

Net operating income

As you can see from these lists, there is a lot of overlap between expenses and income. In this regard, their ratio is used when calculating the amount of profit for other economic factors. activities. Thanks to their separate accounting, it is possible to determine the NER.

The formula for operating income will be:

NOR = the amount of gross income - the amount of operating costs (minus depreciation).

This indicator determines the amount of net profit from the use of property, contributions to the management company and securities, as well as other types of income.

Postings for accounting income and expenses

The entries for accounting for operating income and expenses will be as follows:

- D10 - K91-1 - capitalization of surplus valuables that were identified during the inventory.

- D62-1 – K91-1 – calculation of rent for a month.

- D76 – K91-1 – accrual of profit from the transfer of intellectual property rights.

- D50 – K91-1 – receipt of income from the sale of fixed assets.

- D60 – K91-1 – writing off an unrealistic debt to be collected on income.

- D91-2 – K01 – reflection of the residual price of the sold asset.

- D91-2 – K50 – writing off negative exchange rate differences as expenses.

- D91-2 – K60 – RKO accounting.

- D91-2 – K63 – formation of a reserve for doubtful debts.

- D91-2 – K66, 67 – write-off of interest on the loan.

- D91-9 – K99 – closing income on account No. 91.

- D99 – K91-9 – closing the loss on account No. 91.

Operating costs or operating expenses(English) OPEX, abbr. from operating expense, operating expenditure, operational expense, operational expenditure) - the company’s daily expenses for doing business, producing products and services.

Amount of operating expensesOPEX) and capital expenditures (eng.CAPEX) constitute company expenses that are not included in the direct cost of products or services that the company offers to the market. For example, the purchase of a copier is a capital expense, while the purchase of paper, toner, electricity, and payment for repairs and maintenance of this device are operating expenses.. In general, for a business, operating expenses include staff salaries, rental costs, utility bills, etc.

Operating costs (the company's daily expenses for organizing sales, administration, R&D, etc.) are contrasted with direct costs - the company's expenses for the direct creation of goods and services. In other words, direct costs are the amount of money a company spends to turn raw materials or components into finished products.

In the income statement, operating expenses are indicated in relation to the time period in which they were incurred - month, quarter or year.

Transaction costs- costs associated with concluding transactions and reflecting costs:

- to choose a partner;

- signing agreements and monitoring execution;

- to adapt to ongoing changes;

- to improve the qualifications of individual employees;

- to prevent fraud;

- in case of unexpected shocks.

Transaction costs(OVERHEAD) - (indirect costs; operating costs; overhead costs) production goods and services that are not direct costs, that is expenses expenses incurred in addition to the costs of raw materials and labor used in the production of these goods and services. Indirect costs are divided into fixed costs and variable costs. The first ones include: magnitude which does not change when the scale of production changes, for example, rental payments for company , depreciation charges for building and equipment. The second includes those whose magnitude depends on changes in the scale of production, for example, expenses for fuel and electricity.

oncosts The cost of a product or service in excess of direct costs.

Operating losses- the difference between income from the main activities of the company and the corresponding expenses and expenses, with the exception of income received not from the main activities of the enterprise, and calculated before deductions from income; synonyms - net operating profit (or loss), operating income (costs). (operating income (or loss)) and net operating income (costs) (net operating income (or loss)). Income deductions are a group of items that make up the final portion of a company's income statement that are required in the normal course of business and are typically deducted to calculate net income. Essentially, they are expenses that are independent of the company's day-to-day operations rather than expenses that are dependent on it. Includes payment of interest; depreciation deductions; bond expenses; income tax; losses resulting from the sale of production facilities, divisions, and main assets; adjustment of the results of the past year; reserves allocated for probable expenses; bonuses and other periodic distributions of profits among managers and employees; write-off of intangible assets; adjustments resulting from major changes in accounting practices, such as the basis for valuing inventory; expenses resulting from fire, flood and other extraordinary expenses; losses incurred on foreign exchanges; other material and one-time expenses.

They represent a set of everyday expenses directly related to running a business, but not of a capital nature, that is, not due to the acquisition of new fixed assets.

What are operating expenses

Until 2006, the company’s expenses were divided into two groups:- Direct - directly related to the main activity of an economic entity and included in the cost of goods produced (services provided). This is a set of expenses through which the final product that goes on sale is obtained from raw materials and supplies.

- Indirect - other expenses associated with maintaining the functioning of the business and not directly included in the cost of finished products.

- non-operating - i.e. related to the acquisition of fixed assets;

- operational - aimed at maintaining the daily functioning of the company;

- emergency - caused by the occurrence of emergency situations (accidents, natural or man-made disasters).

Composition of the company's operating expenses

In 2006, Order No. 116n of the Ministry of Finance was adopted, which canceled the effect of PBU 10/99 in the previous edition. Since the publication of the administrative document, the term “operating expenses” has ceased to exist at the official level. All expenses of the organization were divided into two large groups: those related to the usual line of business and others.Despite changes in regulations, the term “operating expenses” is widely used in accounting parlance. Today it is used as a synonym for the concept of “other costs”. According to the text of the regulation, this category includes:

- expenses associated with leasing the organization's fixed assets (for example, residential or commercial premises);

- expenses associated with the provision of intellectual property objects (licenses, patents) for use;

- interest paid by the company for the use of borrowed funds (loan products received);

- expenses associated with the write-off of fixed assets, disposal of warehouse stocks;

- commissions paid for banking services;

- expenses associated with organizing participation in other legal entities (for example, associated with the purchase of shares, interests);

- contributions sent to funds that are created in accordance with the provisions of accounting legislation;

- compensation for losses that the company’s activities caused to third parties;

- payment of monetary sanctions for non-compliance with the terms of contracts with counterparties;

- exchange rate differences (the rate of currency sales was lower than the purchase rate);

- payments made by the company as part of charity (assistance to non-state foundations, contributions to cultural or sporting events);

- losses from previous periods recognized in the current year.