Trade originated in ancient times. With the development of humanity, practically nothing has changed, except, of course, the market for goods and services itself. If earlier production was based on a certain territory, now the purchase of land from other countries for the construction of their own plants and factories is a completely ordinary phenomenon. Not only European countries, but also the Russian Federation are doing this (and quite actively). Actually, we will talk about which country has the largest TNCs in the world.

What is a transnational corporation?

A TNK is initially a company with production branches in several countries. The role of such corporations in the process of globalization is undoubtedly enormous. TNCs can act not only as manufacturing companies, but also as telecommunications, insurance and audit companies. In addition, this includes transnational banks and pension funds.

The budget that some of the world's largest multinationals have is so large that it exceeds the financial status of some countries. For example, the net annual profit of General Electric Corporation is just over $13 billion, which is almost 34 times more than the annual budget of Andorra with a population of 85.4 thousand people or slightly less than the GDP of Iceland for 2015. Corporations also play a large role in science; TNCs account for about 80% of the financial supply of research and development work and approximately the same number of registered patents.

why internationality?

The first option represents the desire of TNCs to create a single leadership center. It must be located in the country to which the corporation belongs. Other branches operate only with the permission of the parent company.

The second option allows you to make your own decisions. Leadership centers are created in each branch. Subsidiaries, as a rule, are sufficiently independent from other branches of the corporation.

Sources of effective activity of transnational corporations

A comparative description of the world's largest TNCs, the practical benefits of which are undeniable, suggests the following: the use of raw materials from other countries, as well as its financial capabilities, makes it possible to expand, capture or retain the sales market. In addition, efficient operation is due to the proximity of foreign consumers. Awareness about the conduct of research tests, as well as about their results, has a very good effect on the development of transnational corporations.

In addition to these principles, a comparative description of the world's largest TNCs makes it clear that operating in several countries simultaneously helps to strengthen competitiveness and improve relations with partner countries.

Statistics on the value of foreign assets

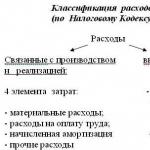

The main areas of activity of current corporations are electronics, automotive manufacturing, oil production and refining. The world's largest multinationals often invest in companies with the goal of sustainability in the global market. In the list of largest foreign assets, the first places are given to the following corporations:

- General Electric. Country - USA, occupation - electronics. The share of foreign assets is 30%.

- Royal Dutch Shell. Country - Netherlands - Great Britain, type of activity - oil industry. The share of foreign assets is 66%.

- "Ford". Country - USA, type of activity - automotive industry. The share of foreign assets is 30%.

In addition to the listed companies, there are many more TNCs that use this development method to achieve sustainability.

List of corporations

An important indicator of a company's success in the international market is the amount of sales realized in other countries. The largest TNCs in the world, the list of which is presented below, was analyzed precisely according to this principle. Also, in addition to the type of activity and the country of ownership, the items also include corporate revenue:

- Walmart (retail sector, USA) - 482,130.

- State Grid Corporation of China (electric power industry, China) - 329,601.

- China National Petroleum (oil and gas sector, China) - 299,271.

- Sinopec Groupe (petrochemical industry, China) - 294,344.

- Royal Dutch Shell (oil and gas sector, Netherlands - UK) - 272,156.

Not all TNCs are listed here. But as of 2016, these are the companies that make up the top five.

TNK in Russia

Since the end of the 19th century, Russia has been trying to join the activities of transnational corporations around the world. But the constant slowdown due to revolutions and political reshuffles did not allow this process to be carried out fully. It is for this reason that until now, the services and products of foreign companies prevail in the country. Only relatively recently did Russia begin to create its own, which are very similar to TNCs.

The comparative characteristics of the world's largest TNCs were only supplemented with a Russian representative at the end of the 20th century, namely: in 1996, the rating published by the Financial Times presented the Gazprom company.

At the moment, the development of Russian corporations is slower than that of other countries. For more successful advancement in the global market, Russia needs to combine efforts to improve its own financial and industrial groups together with friendly states.

To assess the involvement of a company in the production of goods and services abroad, it is used transnationality index, which makes it possible to compare the size of economic activity within and across national borders. The transnationality index is based on a comparison of the size of a company's economic activities at home and abroad.

UNCTAD calculates this index as the arithmetic average of three values: the share of assets abroad in the total assets of the company; share of sales abroad in total sales; the share of personnel employed at foreign enterprises in the total number of company personnel. Global companies have a significantly higher transnationality index compared to ordinary TNCs. According to World Investment Report 2010, for the 100 leading TNCs in the world, the internationality index is currently close to the average value of 63%; for the TNCs from EU countries included in this list, it was even 67.6% in 2008.

The concentration of highly qualified personnel, scientific and technical knowledge and experience, and global management organization allow such companies to optimally locate sources of material and technical supplies, production and sales. Because of their transnational structure, they can benefit from country differences in market conditions, economic policies, levels of taxes and import duties, wage rates, technical and environmental standards, etc. Moreover, they are able to smooth out or enhance these differences to a certain extent.

The modern economic system is influenced by the processes of transnationalization of production and capital, driven by TNCs. The interdependence of countries is growing due to the increasing pace of globalization, the national sovereignty of states is decreasing, and supranational entities - global corporations - are emerging.

According to UNCTAD, in 2008 there were 82 thousand TNCs operating in the world, they controlled 810 thousand foreign branches. Among them, no more than 2–3 thousand first-class TNCs play a truly leading role in the world economy and the globalization process, including approximately 500 top-tier TNCs and 100–150 of the largest transnational banks (TNBs) and financial corporations. The largest 100 TNCs (less than 0.2% of their total number) control 12% of total foreign assets and 16% of total foreign sales. Currently, more than a third of the world's GDP and more than 75% of global trade are controlled by the five hundred largest TNCs. In 2012, about 82 thousand TNCs and 810 thousand of their foreign branches provided employment to 72 million people. Their sales volume amounted to $26 trillion, and TNC enterprises created $7 trillion of added value (about 9% of the world's gross domestic product). The top 10 TNCs earn more income than all countries on the African continent. Already about 10 years ago, TNCs controlled 80% of licenses and patents for new inventions.

Leading TNCs, especially those that occupy dominant positions in high-tech, forward-looking industries (electronics, aerospace, advanced engineering sectors, production of new materials, etc.), define the face of the modern global economy and serve as a “calling card” for countries of origin.

About 80% of existing TNCs come from advanced countries, the rest from developing and transition countries. The 500 leading TNCs today account for over 1/3 of manufacturing exports, 3/4 of trade in commodities, and 4/5 of trade in new technologies. The latter is quite natural, since the share of TNCs covered by UNCTAD statistics in global R&D expenditures reaches at least half, and in global commercial expenditures for the same purposes - at least 2/3.

The role of TNCs in global trade, production, and finance continues to grow continuously. At the same time, the main forces are concentrated in the 100 largest TNCs in the world, which have enormous economic power. The result of the dominance of these giants and their economic policies is a shift in the proportions of world production and sales. Thus, several global corporations actually have a decisive influence on the development of the main sectors of the world economy and on the nature of the international division of labor.

By involving many countries where their foreign divisions are based in production chains, changing the intra-company division of labor, they seem to impose it on traditionally existing connections between countries, transforming and often deforming them.

The following features can be identified that distinguish global TNCs from the general mass of companies operating in foreign markets:

- separation from national soil, the global nature of intra-company planning, as well as supply and sales operations, under centralized private control;

- the use of an international unit division of labor within a system of technologically interconnected enterprises in different countries of the world, exchanging unfinished products at non-commercial, transfer prices;

- division of markets between branches and their centralized technological support.

Analysis of the activities of TNCs allows us to identify several types.

- 1. Ethnocentric TNCs create branches abroad to ensure supplies of raw materials or sales markets, but foreign markets remain for them, first of all, a continuation of their domestic market.

- 2. It is characteristic of polycentric companies that the foreign market is no less, and often a more important sector of their activity compared to the domestic market. Their foreign branches produce most of their products.

- 3. Regiocentric TNCs are especially popular in integration groups. They no longer focus on the markets of individual countries, but on entire regions, for example, the whole of Western Europe, although in this case foreign branches are located in individual countries.

- 4. Geocentric companies are the most mature type of TNC; it is most characteristic of those TNCs that are, as it were, a decentralized federation of regional branches.

A significant increase in foreign production and sales of the largest TNCs has led to a high level of global transnationalization of production and capital. The main goal of creating foreign subsidiaries is to capture new markets in developed and developing countries. In general, the activities of TNCs and their economic policies are aimed at suppressing competition from other companies and occupying a dominant position in global commodity markets. From this point of view, TNCs are a destructive force for medium and small businesses that cannot compete with global giants. A special feature of TNCs in the modern era is a certain duality of their interests: on the one hand, they seek greater liberalization of trade and democratization of global economic relations, on the other, the activities of TNCs are more similar to a planned economy, where internal prices are set, dictated by the strategy of TNCs, and not free market mechanisms.

Relying on their economic power and an extensive network of foreign branches, sometimes located in dozens of countries, TNCs naturally strive to increase their political influence. History knows of cases where TNCs have allocated large funds to lobby their interests, the adoption or non-adoption of certain laws. Global companies represent a special, global power on a global scale, the sphere of which does not know state borders. Moreover, the greater the element of multinational participation in such a company, the more it strives to free itself from the limiting influence of the governments of the countries in whose territories its activities extend.

Transnational company (corporation)(TNK) - company(corporation), owning production units in several countries. And also a company whose foreign activities account for about 25-30% of its total volume and which has branches in two or more countries.

In foreign literature the following are highlighted: signs transnational corporations:

1. the company sells its products in more than one country;

2. its enterprises and branches are located in two or more countries;

On first stage Transnationalization of the activities of large industrial firms, they invested primarily in the raw materials industries of foreign countries, and also created their own distribution and sales divisions in them. The latter was caused not only by the fact that the creation of its own overseas distribution and sales divisions required significantly less investment than the creation of manufacturing enterprises abroad, but also by the possible negative impact of new production facilities on the ability to maintain an effective level of capacity utilization at the firm's home enterprises. This influence was especially strong in the production of identical or poorly differentiated products (for example, this factor restrained the growth of industrial investments by metallurgical firms, while firms in the food and other industries that produced products with certain trademarks were more willing to invest in the creation of manufacturing enterprises Abroad).

Second phase The evolution of the strategy of transnational corporations is associated with the strengthening of the role of foreign production divisions of transnational corporations and the integration of foreign production and sales operations. At the same time, foreign production branches specialized mainly in the production of products that were produced by parent companies at the previous stages of the production cycle. As demand differentiates and integration processes intensify in different regions of the world, production branches of transnational corporations are increasingly reoriented to produce products other than those produced by the parent company, and sales divisions are increasingly reoriented to serving emerging regional markets.

10. Transnationalization index and characteristics of leading TNCs based on it.

To identify transnational companies, there is a special transnationalization index. The transnationalization index is calculated using the following formula:

I T = 1/3 (A I /A + R I /R + S I /S) x 100%,

I T - transnationalization index, %; A I - foreign assets; A - total assets; R I is the volume of sales of goods and services by foreign branches; R - total sales of goods and services; S I - foreign state; S is the total number of employees of the company.

The transnationalization index of the world's 100 leading companies in 2008 averaged 57%. For some companies, especially from small and medium-sized countries, this figure was significantly higher. Thus, for the Swiss Nestle it was 93.5%

|

General Motors |

|

|

Type |

Public company |

|

Year of foundation | |

|

Location |

USA: Detroit(state Michigan) |

|

Key figures |

Daniel Ackerson (Chairman and CEO) |

|

Industry |

Automotive industry |

|

Products |

Passenger cars and commercial vehicles |

|

Turnover |

▲ $135.6 billion (2010) |

|

Operating profit |

▲ $5.7 billion (2010) |

|

Net profit |

▲ $6.5 billion (2010) |

|

Number of employees |

202 thousand people (2010) |

TNC leaders in terms of the volume of foreign assets and their transnationalization index, 2008.

|

A country |

Industry |

Assets abroad, billion dollars |

Sales abroad, billion dollars |

Personnel at foreign companies, thousand people. |

Transnationalization index, %* |

|

|

General Electric |

electrical equipment | |||||

|

Royal Dutch/Shell Group |

British |

oil | ||||

|

Vodafone Group |

British |

telecommunications | ||||

|

British Petroleum |

British |

oil | ||||

|

Toyota Motor Corporation | ||||||

|

Exxon Mobil |

oil | |||||

|

oil | ||||||

|

Germany |

electricity, gas, water supply. | |||||

|

Electricity de France |

electricity, gas, water supply. | |||||

|

Ford Motor |

* The “transnationalization index” (or transnationality) characterizes the degree of foreign (external) business activity of a particular corporation and is calculated as the arithmetic average of three indicators (in%): a) the ratio of foreign assets to the amount of assets; b) the ratio of foreign sales to total sales; c) the ratio of those employed abroad to the total number of employed. UNCTAD experts also proposed calculating a “comprehensive indicator of transnationalization”, combining five main criteria (sales, production, employment, assets and investments).

Compiled By World Investment Report, 2009: Transnational Corporations, Agricultural Production and Development. UN. N.-Y. and Geneva, 2009.

For TNCs, the growing scale of transnationalization means expanding the scope of activity and accelerating the turnover of capital, and with this its accumulation, the greatest freedom of competitive maneuver within the boundaries of the world market compared to national companies, etc. Employment at foreign branches of TNCs is growing. In general, more jobs are created in developing countries and countries with economies in transition than in developed countries.

Among the largest TNCs in terms of the volume of foreign assets, we should note General Electric, Vodafone, Royal Dutch/Shell, Exxon Mobil, etc. (Table 16).

For many TNCs, foreign assets constitute a very significant share of all company assets (Vodafone - 90%; Exxon Mobil - 70%; Nestlé - 70%, etc.). The most significant share of sales abroad in the total volume of product sales is typical for British Petroleum, Total, Exxon Mobil, Vodafone, Toyota, etc. In terms of the number of employees at foreign enterprises, the American Wal is the leader among non-financial TNCs March Stories" (wholesale trade), German "Siemens" (electrical equipment), Swiss "Nestlé" (food industry), American "IBM" (software), etc.

The highest transnationalization index is distinguished by the activities of chemical and pharmaceutical TNCs, as well as companies in the food and electronics industries. Often the most “transnationalized” are corporations from countries with a fairly narrow domestic market, which are looking for competitive advantages abroad. Such companies, for example, include the Swiss Roche and Nestlé (index 86–90%). But in recent years, the transnationalization index of corporations has increased to 80%: British Petroleum (oil industry), Vodafone Group (telecommunications), ArcelorMittal (metallurgy), Ford Motor (automotive industry), etc.

Despite the observed increase in transnationalization, attention should be paid to the fact that the influence of TNC activities continues to increase not only on the economic life of developing countries, but also on the economy of developed countries. For example, the share of foreign firms in production and employment in most OECD countries is constantly increasing. A kind of record holder is Ireland, where the share of foreign firms in the early 2000s. accounted for 2/3 of its industrial production and employed almost 50% of the total population employed in the country's economy.

Volumes of foreign investments by TNCs. Multinational companies expand their international activities by acquiring other companies or establishing subsidiaries in other countries, organizing joint ventures or entering into other types of associations. For such operations it is not necessary to resort to the export of capital and reinvestment of profits earned abroad. It is possible to absorb another company by receiving a loan at the place where the acquisition transaction took place. Other methods are also used, incl. appropriation of local fixed capital to pay off debt, etc. In other words, data on international capital movements (foreign investment flows) essentially do not provide a complete picture of how TNCs are expanding their activities. Yet foreign direct investment (FDI) is the most reliable information about the pace of this process, as well as the areas where capital is directed.

Thus, during the period from 1967 to 1976, the volume of foreign investments by TNCs increased less than three times (from 105 billion to 287 billion dollars). But just 20 years later, in 1996, the total accumulated volume of foreign direct investment (FDI) in the world increased to $2.7 trillion, and in 2000, the $6 trillion mark was exceeded, in 2004. – $9 trillion. If in the mid-1990s. Approximately 39 thousand foreign investors, including the world's largest TNCs and 270 thousand foreign branches controlled by them, were involved in placing capital abroad in the late 1990s. investments were already made by about 65 thousand TNCs and their branches, and in 2008 - already more than 82 thousand TNCs and about 810 thousand their branches. As noted above, currently only the foreign activities of TNCs approximately correspond to 10% of world GDP and account for about 1/3 of world exports. And the volume of foreign direct investment by companies in 2008 amounted to $1.7 trillion. A record level was noted in 2007 – $1.98 trillion (Table 17).

Table 17

Transnationalization Index

When analyzing TNCs, the concept of “transnationalization index” is used, which comes in two types.

The company transnationalization index reflects the degree of involvement of a particular TNC in the production of goods and services abroad. It is calculated as the sum of three values: the share of assets abroad in the total assets of a TNC, the share of sales abroad in the total sales of this corporation, the share of personnel abroad in the total number of personnel of this TNC. In 2003 The transnationalization index of the world's 100 leading TNCs averaged 56%, although for many TNCs it was much higher, especially for TNCs from small and medium-sized countries.

The country transnationalization index assesses the importance of foreign multinationals for a particular country. It is calculated as the sum of four values: the share of foreign direct investment in all capital investments of the country, the ratio of foreign direct investment accumulated in the country to the country's GDP, the share of branches of foreign corporations in the production of the country's GDP, the share of those employed in these branches in the total number of employees in the country. Small developed countries and territories are the most transnationalized. In 2002 these were Hong Kong (82%), Belgium and Luxembourg (77%), Ireland (69%), Singapore (60%). The remaining countries were less transnationalized - Estonia (39%), Hungary (30%), Canada and Spain (21% each), Russia (19%), USA (18%), Japan (1%).

Geoeconomic factors of international economic relations

The emerging world order has recently acquired more and more characteristics of an economic order. And if previously the world economy was a field in which sovereign states acted...

Big Mac Index

Big Mac Index

Big Mac Index

Big Mac Index

The Australian Commonwealth Bank assessed the ratio of real exchange rates based on the dollar cost of an iPod MP3 player in different countries of the world. The iPod index is built on the same principle as the famous "Big Mac index"...

Business competitiveness of the BRIC countries (Brazil, Russia, India, China)

3. Stage of development of the state; 4. Factors hindering business development; 5. Detailed Global Competitiveness Index. Below is a comparative analysis of the competitiveness of the BRIC countries for all profile elements except 5...

United Nations Development Program (UNDP) Human Development Concept

Almost simultaneously with the emergence of the concept of human development, the problem of quantifying achievements in improving the lives of people around the world arose...

World Economy and System of National Accounts

The Growth Competitiveness Index (GrowthCI) measures an economy's ability to achieve sustainable growth over the medium term...

Development of a strategy for the transnationalization of Russian enterprises

The current stage of development of the world economy, the dominant trend of which is the globalization of economic processes, is also characterized by significant changes in the structure and directions of world economic relations. On the one side...

Development of a strategy for the transnationalization of Russian enterprises

Today in the world, more than 80% of global commodity turnover, over 50% of global industrial production are controlled by world-famous corporations. They also own more than 60% of the patents, licenses for new equipment, technologies...

Economy of South Korea

The index of involvement in the world economy (globalization, information space, international affairs) is measured annually by Foreign Policy magazine for 62 countries, home to 85 percent of the world's population...