In the Russian Federation, pension provision operates under the terms of the compulsory pension insurance system (OPS), therefore it is guaranteed for all residents of the Russian Federation. From the transferred insurance payments, the budget of the country's Pension Fund is formed, from which registered citizens are paid pensions assigned depending on the funds received to the personal account of each participant.

Explanation of some basic concepts of OPS

Compulsory pension insurance is a system of measures (legal, economic) taken by the state and providing for compensation of the official income of citizens previously received by them (before retirement).

In Russia, the performance of these functions is carried out by special structures:

- Pension Fund of the Russian Federation (state).

- Non-state funds.

Insured persons are persons covered by the insurance policy. These include citizens who have citizenship of the Russian Federation, citizens of other states and persons who do not have citizenship, but permanently or temporarily living within the Russian Federation.

Personalized (individual) accounting is a procedure for concentrating and recording on a personal personal account (PAL) information for each insured person, including information about:

- his employment in the form of length of service;

- made transfers of money for the formation of a pension.

The amount of payment due to the recipient depends on the total amount of accumulated money. The account number (SNILS) of each recipient is indicated in the insurance document (certificate).

An agreement on compulsory pension insurance is a document drawn up between a citizen and a non-state fund and predetermines, upon the occurrence of the event provided for in the transaction, the payment to the recipient from the NPF of a part of the collected amount (cumulative).

Insurers are legal organizations, individual entrepreneurs who transfer insurance payments to the Pension Fund for themselves and for employees (insured).

Structure of the OPS

Pension insurance, involving all categories of residents of the Russian Federation, is divided into:

Pension insurance, involving all categories of residents of the Russian Federation, is divided into:

- Mandatory, which is assigned:

- upon reaching the age specified by law (old age);

- when establishing a group;

- At ;

- Voluntary, providing for payments formed from amounts paid by employers and independent transfers from citizens.

PFs of non-state affiliation are entitled to conduct activities in both options.

Pension benefits are paid to the recipient in the form of a set amount of money on a regular basis, when they reach a certain age, or as a benefit in certain circumstances.

The pension consists of parts:

- a fixed payment, which is transferred by the state without taking into account the income received (earnings) and the amount of contributions to those who have reached the legal age and if the applicant has work experience (at least 10 years);

- , determined depending on the amount of payments paid in the Pension Fund for the period of the citizen’s labor activity, and calculated as the ratio of the amount of capital before payment is assigned and the number of months of waiting for payments (252 months);

- , for citizens born in 1967 and younger, if a choice was made in its favor before 2015.

Subjects of the pension insurance system

The main elements of the OPS system are presented:

- the main insurer or Pension Fund of the Russian Federation;

- insurers or employers paying their own contributions and for employees;

- insured persons or registered citizens who have received a certificate of a participant in the compulsory insurance policy.

The factor determining membership in the category of insured is the transfer of insurance payments to the Pension Fund by persons with Russian Federation citizenship working in the country or abroad, stateless persons and citizens of other states present in the Russian Federation temporarily or permanently.

Attention! Insureds or organizations and persons engaged in private (individual) activities belonging to several categories are required to pay insurance premiums on all available grounds.

Additionally, the state assumes responsibility for the obligations of the insurer (PF) providing compulsory insurance. A non-state pension fund can also perform the functions of an insurer, but only in relation to the formation of the funded part.

Responsibilities and rights of system participants

The legislation of the Russian Federation defines the rights and responsibilities for participants in the compulsory pension insurance system in the implementation of functions, the rules for the formation and expenditure of budgetary funds, as well as the rules for payment of payments (Federal Law on Compulsory Pension Insurance, No. 167 of December 15, 2001).

The policyholder is obliged to register as such with the Pension Fund of the Russian Federation and pay the premiums on time and in full.

The insurer is obliged:

- account for and control incoming funds;

- ensure strictly targeted use of proceeds;

- assign and pay pensions (insurance, funded).

Insured persons have the right:

- make additional contributions (above the mandatory amount) to the pension option:

- receive statements from your individual account.

Do you need information on this issue? and our lawyers will contact you shortly.

Obtaining an insurance certificate

Anyone can obtain an insurance document (SNILS certificate) independently or through an employer.

Anyone can obtain an insurance document (SNILS certificate) independently or through an employer.

When applying in person to the Pension Fund branch at the place of actual residence (registration), the applicant provides a questionnaire and an identification document (ID, passport). The certificate must be issued within 5 working days.

When applying for a job, the data of a citizen who has not opened a personal account in the OPS system is sent by a specialist from the employer’s personnel structure to the Pension Fund division within 17 days from the date of employment. The Pension Fund registers the applicant in the system and prepares a SNILS certificate within no more than 5 working days after receiving documents from the employer. The prepared form is issued by the policyholder to the newly registered person within 7 days.

To obtain SNILS for a minor child, one of the parents applies to the Pension Fund department with the following documents:

- your passport;

- statement;

- child's birth document;

- certificate of registration at the place of residence or place of stay.

Children from 14 to 18 years old can obtain a document from the Pension Fund on their own if they have a passport.

Contents of the pension insurance agreement

If a citizen has chosen a non-state pension fund as an insurer to form a funded pension, then an agreement on compulsory pension insurance is concluded between them.

If a citizen has chosen a non-state pension fund as an insurer to form a funded pension, then an agreement on compulsory pension insurance is concluded between them.

Under the terms of the contract, the fund is obliged to assign to the insured and pay him a cumulative share of the labor pension upon reaching a legally defined age. In the event of the death of a registered person, payments are made in favor of legal successors.

The text of the document contains a description of the personal data of the registered person, information about the insurance situation, details of the parties, as well as:

- duration of the transaction;

- obligations and rights of the participating parties (PF, insured person);

- accounting for received money and subsidizing it;

- liability of participants for improper fulfillment of contractual obligations in accordance with the legislation of the country;

- requirements for assigning and making payments from the funded portion of capital by age;

- criteria for transferring accumulated amounts to the legal successors of the deceased insured person;

- conditions for making additions and requirements for the transaction.

During the same period, only one insurance contract can be concluded between a citizen and a non-state pension fund.

Attention! The agreement is recognized as coming into force on the date of receipt of the money transferred by the insurer to the current account of the selected fund.

Formation of pension components

In the compulsory pension system, insurance and funded pensions are formed mainly from insurance contributions. Until 2014, employers paid contributions for employees for both types of pensions. However, until the end of 2015, citizens were given the right to choose: to direct the entire amount to form an insurance pension or distribute it between insurance and funded pensions.

In the compulsory pension system, insurance and funded pensions are formed mainly from insurance contributions. Until 2014, employers paid contributions for employees for both types of pensions. However, until the end of 2015, citizens were given the right to choose: to direct the entire amount to form an insurance pension or distribute it between insurance and funded pensions.

The general tariff for insurance payments (22%), taking into account the chosen method, is distributed as follows:

- in the case of the formation of the insurance part, 6% is allocated for payment of the basic share to current pensioners and 16% for the formation of future payments to the insured person;

- in the case of the formation of the insurance and funded parts of the pension, 6% is allocated for the payment of the basic share, 10% for the payment of the registered person himself, and 6% for the payment of the funded share.

The opportunity to distribute insurance premiums is still available to those who have entered into an employment relationship and for them first Contributions began to arrive after 01/01/2014.

Important! The receipt of new insurance contributions from employers for funded pensions in the mandatory pension insurance system was suspended by decision of the state for the period from 2014 to 2020.Citizens who have made a choice in favor of the formation of an insurance and funded pension have the right to refuse the formation of a funded pension at any time. To do this, you must submit an application or change the decision before the end of the year in which the application was submitted by withdrawing it.

Attention! The state does not index the funded portion of the payment. Investment of accumulated funds can be both profitable and unprofitable, which will be reflected in the amount of the pension in the future.

Payment and tariffs of insurance premiums

Contributions to compulsory pension insurance are calculated taking into account the maximum amount of earnings ( 865,000 rubles in 2019). If income exceeds the specified value, an additional tariff (10%) is provided.

Contributions to compulsory pension insurance are calculated taking into account the maximum amount of earnings ( 865,000 rubles in 2019). If income exceeds the specified value, an additional tariff (10%) is provided.

Payments must be paid to the Pension Fund by the employer no later than the 15th of each month, and are also reflected in mandatory reporting in a single form submitted to regulatory authorities in paper and electronic form. Violations of the terms of payment of contributions and their volume cause the imposition of a fine on the policyholder.

The rate for transferring contributions this year is 22%. The policyholder pays for himself 26% of the annual minimum wage, which in 2019 amounted to 11,280 rubles. For self-employed individuals and entrepreneurs who do not have hired employees, the fixed payment will be 26,545 rubles with the addition of 1% of the amount exceeding 300,000 rubles.

Important! The money from the country's Pension Fund is not an integral part of the federal budget and is intended only for the fulfillment of target obligations.

Pension Fund expenses in some periods may exceed the amount of accumulated funds if employers, for various reasons, do not pay accrued contributions. The resource deficit is covered through subsidies from the state budget of the Russian Federation.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers of our site.

Last changes

The current moratorium on the full use and disposal of pension savings has been extended until 2020 inclusive.

Our experts monitor all changes in legislation to provide you with reliable information.

Since insurance premiums are calculated from the payroll, the first change you should pay attention to is the increase. It reached the level of 11,280 rubles. and, thus, equaled the subsistence minimum (according to the Ministry of Labor, the subsistence minimum in Russia in the second quarter of 2018 for the working population is exactly 11,280 rubles).

Ideally, from January 1, companies should not have a single employee with an employment contract whose salary is less than the new established minimum wage. This will avoid problems with both the tax office regarding the calculation of insurance premiums and the labor inspectorate.

The second change is associated with an increase in the maximum wages from which insurance contributions to extra-budgetary funds are calculated and paid (in accordance with).

In the Pension Fund of the Russian Federation, from January 1, 2019, the maximum amount of the total income of each individual, calculated on an accrual basis from January 1, 2019, is 1,150,000 rubles. That is, for each employee, the employer keeps records of accruals of all income that it pays to this individual. Until the total income reaches RUB 1,150,000. Insurance premiums to the Pension Fund of the Russian Federation are calculated at a rate of 22%. As soon as the amount of total income, calculated on an accrual basis, exceeds 1,150,000 rubles, contributions to the Pension Fund begin to be charged at a rate of 10%.

Previously, in 2018, the maximum base for compulsory pension insurance was RUB 1,021,000.

As for the Social Insurance Fund, the maximum base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity has also been indexed since January 1, 2019. The amount of total income in 2019 increased to RUB 865,000. In 2018 it was 815,000 rubles.

Contributions to the Compulsory Medical Insurance Fund, as in previous years, are still not limited, that is, there is no restrictive limit in this case.

Since data for 2018 is important for the reporting campaign, companies need, in particular, to check whether any of the employees exceeded the limit of 1,021,000 rubles. total income at the end of 2018 and, if possible, adjust tax and accounting registers.

Insurance premium rates in 2019

Insurance premiums in 2019 include maternity and sickness premiums, medical premiums, pension contributions and personal injury contributions. Their total rate is 30% plus an accident insurance premium rate, which depends on the hazard of the operation.

Contributions to compulsory pension insurance: if the amount of payments to an individual employee does not exceed 1,150,000 rubles, then the rate is 22%; if the amount of payments to an individual employee exceeds RUB 1,150,000, then the rate is +10% on payments above the base.

Contributions for compulsory health insurance: rate 5.1%.

Contributions for insurance in case of temporary disability and maternity: if the amount of payments to an individual employee did not exceed 865,000 rubles, then the rate is 2.9%; if it exceeds 865,000 rubles. — 0%, that is, there are no payments over the limit.

Reports to extra-budgetary funds for 2018

The updated form must be submitted by March 1, 2019. No changes have been made to completing this form. However, in section 3 in column 14, the title was expanded with the following wording: “information about the periods counted in the insurance period of the unemployed.”

The form includes all employees who received monetary rewards from which insurance premiums were paid. That is, employment contracts, civil contracts, and copyright contracts are taken into account.

If one employee in the reporting year was registered as a full-time employee, was also on leave without pay, took sick leave, etc., then all these periods, in accordance with personnel orders, must be reflected in the SZV-STAZH form, since this affects for calculating the employee's pension.

This form is presented for periods that expired before January 1, 2017, and actually serves to correct errors of previous periods. A form is also filled out for it.

It is worth noting some changes that have occurred in correcting errors in the SZV-M form.

On October 1, 2018, it came into force, which introduced changes to the Instructions on the procedure for maintaining personal accounting and clearly regulated the algorithm for correcting errors in the SZV-M form. It lies in the fact that the Pension Fund, having discovered an error, is obliged to notify the payer of insurance premiums within five days that an authorized person has identified false information. The company, in turn, undertakes to correct the error within five calendar days for the insured person for whom it was identified. If the payer manages to do this within five days, then no fines are applied to him.

That is, the Instructions now clearly indicate that updated information is provided only for those insured persons in respect of whom an error warning was received.

There is another significant innovation, which is associated with the application of sanctions in the event of self-identification and correction of errors. Previously, if the company itself identified an error and eliminated it before it came to the attention of the Pension Fund, there were no grounds for a fine. Now sanctions are not applied if two conditions are simultaneously met: the policyholder independently discovered an error in the previously submitted information and corrected it before the Pension Fund found out about it, and the erroneous information was accepted by the Pension Fund.

Calculation of insurance premiums in 2019

From January 1, 2019, several important innovations related to the calculation of insurance premiums are in effect. They shouldn't be ignored either.

Firstly, the grace period for applying reduced rates for an entire category of policyholders has ended. Enterprises on the simplified tax system engaged in industrial production, agriculture, transport, and construction lost their benefits. Previously, according to , they had preferences if several conditions were met at once.

The same benefit, in accordance with and, was lost:

- enterprises on the simplified tax system;

- pharmacies on UTII;

- entrepreneurs with patents.

From 2019, they must pay insurance premiums on a general basis.

Who does the reduced insurance premium rate apply to:

- for non-profit and charitable organizations under the simplified tax system (extended until 2024). Such policyholders will continue to pay only pension contributions at a rate of 20%.

- for companies working in information technology, for residents of the Skolkovo project, free economic zones, etc.

In connection with current changes, you should pay attention to. It explains how to fill out insurance premium calculations due to the fact that from January 1, 2019, some insurance premium payers will no longer be eligible for reduced rates.

So, in particular, when filling out the calculation for the first quarter of 2019, such payers need to indicate the payer’s tariff code “01” and the corresponding category code of the insured person (“NR”, “VZHNR”, “VPNR”).

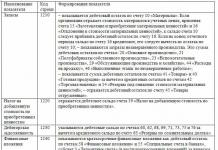

BCC for insurance contributions for compulsory pension insurance, which are credited to the Pension Fund (fixed payment):

- contributions - 182 1 02 02140 06 1110 160

- penalties - 182 1 02 02140 06 2110 160;

- fines - 182 1 02 02140 06 3010 160.

BCC for insurance premiums for compulsory health insurance, which are credited to the Compulsory Medical Insurance Fund:

- contributions - 182 1 02 02103 08 1013 160;

- penalties - 182 1 02 02103 08 2013 160;

- fines - 182 1 02 02103 08 3013 160.

What to do with professional income tax payers?

Effective from January 1, 2019, which introduces an experiment to establish a special tax regime for. The so-called professional income tax is valid in Moscow, the Moscow region, the Kaluga region and the Republic of Tatarstan.

It is important for companies to know that they can sign civil agreements with a person registered as a professional income tax payer, but as with an individual who is a professional income tax payer. Having received confirmation through the tax service website that a given entity is using the new special regime, companies do not need to withhold or accrue any amounts from its income to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund.

Re-registration in social insurance for “injuries” for 2019

Fixed the rates of insurance premiums for injuries for 2019, 2020 and 2021. That is, they are not subject to promotion. The current preferential rates of insurance premiums (in the amount of 60% of the established amount) for individual entrepreneurs in relation to payments to employees who are disabled people of groups I, II and III are also preserved.

The deadline for submitting a certificate of confirmation of the main area of activity and an application for confirmation of the insurance tariff remains until April 15.

Therefore, when companies prepare reports for the first quarter of 2019, in particular, the 4-FSS statement for 2019, they need to take into account the new tariffs that were established based on the results of 2018. To the FSS department where they are registered as payers of insurance premiums for injuries, they must submit:

- certificate confirming the main activity

- application for setting a tariff in accordance with the main type of activity

These documents can be submitted personally to the Social Insurance Fund employee by the head or his authorized representative, sent by post or courier, or transmitted in electronic format using the government services website.

If a company ignores this obligation and does not submit the necessary documents, the tariff will be assigned to it by default (the FSS will select the OKVED register of legal entities with the maximum injury rate and set a coefficient and percentages for it).

Since 2015 installed two base limits to calculate insurance premiums:To the employee of Svetly Put LLC from the beginning 2015 year, a salary was accrued in the amount of 680,000 rubles.

1) for the Pension Fund of Russia - 711,000 rubles.

2) for the Social Insurance Fund - 670,000 rubles.

At the same time, he also performed work under a contract, the remuneration amount for which was 70,000 rubles.

Let us determine the basis for calculating contributions to each fund and the amount of contributions itself. Pension Fund.

Contributions to the Pension Fund of the Russian Federation at a rate of 30 percent are assessed on employee income not exceeding 711,000 rubles.

From the excess, that is, from an amount equal to 39,000 rubles. (680,000 + 70,000 – 711,000), you must pay contributions at a rate of 10 percent.

In total, pension contributions will be accrued in the amount of 217,200 rubles. (RUB 711,000 x 30% + RUB 39,000 x 10%). FFOMS.

Contributions are assessed on all payments made to employees.

That is, the base for this employee will be 750,000 rubles. (680,000 + 70,000).

The amount of contributions will be equal to 38,250 rubles. (RUB 750,000 x 5.1%). FSS.

Payments under a civil law agreement are not included in the contribution base to the Social Insurance Fund.

That is, 70,000 rubles. are not subject to contributions.

Exceeding the salary limit in the amount of 10,000 rubles is also not subject to contributions. (680,000 – 670,000).

The accrued amount of contributions will be 19,430 rubles. (RUB 670,000 x 2.9%). Trauma.

Limit for Social Insurance Fund = 670 thousand rubles. NOT applies to injury contributions

(these contributions are paid on all payments, as before, there is no limit for them).

Contributions for compulsory insurance to state extra-budgetary funds are the second largest financial burden after taxes, which every entrepreneur or organization bears. There are many nuances in the calculation and payment of insurance premiums, and for violations in the order of their calculation you can receive serious fines. What happened to social contributions in 2015 and how they may change in 2016 can be found in this material.

Insurance premium rates for 2015 were approved by Federal Law No. 212-FZ of July 24, 2009 and Federal Law No. 167-FZ of December 15, 2001. These rates will not change in 2016. The size of insurance premiums traditionally depends on the fund into which they are accrued, the size of the wage base that is accrued for each employee of the organization, as well as the category of the employee to whom certain payments were made. In addition, the composition and size of contributions differs for individual entrepreneurs and legal entities using different taxation regimes. Let's try to figure out how insurance premiums should be calculated and paid in 2016.Insurance premium rates

Insurance contributions to extra-budgetary funds in 2015 must be calculated from all payments accrued to the organization’s employees within the framework of labor relations. At the same time, contributions to the pension fund must also be paid from payments made within the framework of civil relations with individuals. In 2016, insurance premiums will need to be paid from a higher base. By virtue of Article 11 of the Federal Law of July 24, 2009 No. 212-FZ, the calculation of insurance premiums in 2015 was carried out on the day of accrual of payments in favor of employees. The date of payment of social benefits is also determined in this way. Therefore, employers reduce the contributions accrued to the Social Insurance Fund on a monthly basis by the amount of employee benefits accrued in the same month. In this case, the date of actual payment of such benefits does not matter. This procedure will not change in 2016. The employer is obliged to independently determine the base for calculating insurance premiums for each employed person on an accrual basis from the beginning of the year. All organizations that were required to pay insurance premiums at general rates in 2015 applied the following approved procedure:- Contributions to the Russian Pension Fund were calculated at a rate of 22% for payments that do not exceed 711 thousand rubles, and at a rate of 10% for all payments that exceed this amount.

- Contributions to the Russian Social Insurance Fund were calculated at a rate of 2.9% for payments that do not exceed 670 thousand rubles, and at a rate of 0% for all payments that exceed this amount.

- Contributions to the FFOMS were calculated at a rate of 5.1% of any payment amount.

- 718 thousand rubles for contributions to the Social Insurance Fund (instead of 670 thousand rubles in 2015);

- 796 thousand rubles for contributions to the Pension Fund (instead of 711 thousand rubles in 2015).

The salary of the chief engineer of the plant is 300 thousand rubles. In January 2016, he was awarded a bonus based on the results of 2015 in the amount of 450,000 rubles. The employee's income for January 2016 amounted to 750,000 rubles (300,000 + 450,000). We calculate contributions:

- to the Pension Fund for the amount of 750 thousand rubles at a rate of 22% = 165,000 rubles

- in the Social Insurance Fund in the amount of 718 thousand rubles at a rate of 2.9% and in the amount of 32 thousand rubles at a rate of 0% = 20,822 rubles

- to the Federal Compulsory Medical Insurance Fund in the amount of 750 thousand rubles at a rate of 5.1% = 38,250 rubles

Reduced rates

Some insurance premium payers have the right to apply reduced insurance premium rates. The right to apply reduced insurance premiums must be confirmed during verification from the Social Insurance Fund or Pension Fund. There is no need to write applications or provide any documents to the territorial departments of the funds before this. Such payers can be divided into three large groups:- Developers of innovative technologies and those organizations that implement them;

- Representatives of small businesses;

- Non-profit and charitable organizations.

- all agricultural producers, including Unified Agricultural Tax payers;

- tribal communities and organizations that are engaged in traditional farming and works of folk art;

- public organizations of disabled people;

- mass media.

Important changes for 2016

1. Monthly reporting to the Pension Fund of Russia

From April 1, 2016, employing organizations will have a new obligation - they will have to report monthly to the Pension Fund on the personal data of employees. In such a report, the deadline for submission of which is set before the 10th day of each month, it is necessary to indicate information about the last name, first name and patronymic, identification number and SNILS of all citizens officially employed and receiving income in the organization. Employers will have to submit such a report for the first time on May 10, 2016. It should be noted that this report is additional and does not in any way affect the regular report to the Pension Fund in the RSV-1 form. The law has already been adopted by the State Duma and approved by the Federation Council, but has not yet been signed by the President of Russia. In accordance with it, insurers are also required to provide data of those citizens with whom they have concluded civil contracts for the provision of services and performance of work. The report does not need to indicate the amounts of income received and assessed contributions; it is simply a list of citizens. However, if the organization does not provide such information to the Pension Fund or is late, it will have to pay a fine of 500 rubles for each employee on the list.2. Increase in contributions for individual entrepreneurs

The minimum wage (SMW) will increase from 5,965 rubles in 2015 to 6,204 rubles in 2016. Consequently, individual entrepreneurs who pay a fixed insurance premium “for themselves” will have to pay more in 2016. Not 22,261.38 rubles, but 23,153.33 rubles. Of them:- To the Pension Fund 6204*26%*12 = 19,356.48 rubles;

- In FFOMS 6204*5.1%*12 = 3796.85 rubles.

3. Changes in contributions to the Social Insurance Fund

From 2016, the payment deadlines for standard contributions to the Social Insurance Fund and “injury” contributions for employers will become uniform. In 2015, contributions for injuries had to be transferred to the Social Insurance Fund no later than the day on which the organization established the payment of wages to employees. However, from 2016, these contributions will no longer be tied to the date of payment of wages and they must be paid no later than the 15th day of the month following the reporting month. That is, these contributions will have to be paid at the same time as regular ones. The bill has already been approved by State Duma deputies and should come into force on January 1, 2016.4. Criminal liability for non-payment of insurance premiums

Until now, the Criminal Code of the Russian Federation has not provided for the liability of employers for non-payment of mandatory insurance contributions. A bill is currently being considered in the State Duma, which proposes to amend the and. The author of the initiative is the Government of the Russian Federation and if deputies support it, then in 2016 employers will face criminal liability for evading mandatory contributions to the Russian Pension Fund and the Social Insurance Fund.5. New report form 4-FSS

Organizations must report for 2015 using Form 4-FSS, which was approved by Order No. 59 of the FSS of the Russian Federation dated February 26, 2015. Although minor technical amendments were made to this form in July, in general it remained the same. However, from the 1st quarter of 2016, a new reporting form 4-FSS will be in effect. So far it is known that a new field “district” will be added to its title page, and a separate section on contributions from foreign citizens from EAEU countries will be added to the form itself.6. Contributions for injuries in 2016

Although the injury rates themselves remained the same in 2016, approved by Federal Law No. 362-FZ of December 14, 2015, each organization must annually go through the procedure of assigning one of 32 tariffs. This determines what rate it will apply to calculate contributions for injuries - from 0.2% to 8.5%. This depends on the type of activity of the organization, as well as on how it passed the special assessment of the working conditions of employees. There is no limit on employee income to determine the base subject to contributions for injuries. From the editor: detailed information on the calculation and payment of insurance premiums, as well as reporting on them, can be found in.In 2016, many changes were made to the legislation regarding insurance contributions to the Pension Fund and pension payments. Here's a quick overview of these changes.

The insurance premium rate for compulsory pension insurance in 2016 remains the same – 22%. The maximum base for calculating insurance contributions to the Pension Fund has changed. Now the limit for contributions to the Pension Fund is 796 thousand rubles. In 2015, the maximum base for calculating pension contributions was 711 thousand rubles. (plus 10% above this amount). Salary amounts upon reaching the limit are subject to contributions at a rate of 10%. At the same time, the maximum base for contributions to the Federal Compulsory Medical Insurance Fund has been abolished; contributions for compulsory health insurance are paid at a general rate of 5.1%.

All rates of insurance contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund in 2016

|

Payers of insurance premiums who are on the general taxation system and apply the basic tariff of insurance premiums |

||

|

Individual entrepreneurs applying the patent taxation system and making payments to individuals |

||

|

Pharmacy organizations and individual entrepreneurs with a license for pharmaceutical activities; non-profit organizations that apply the simplified tax system and carry out activities in the field of social services, scientific research and development, education, healthcare, culture and art and mass sports; Charitable organizations using the simplified tax system |

||

|

Organizations making payments to ship crew members, with the exception of ships used for oil storage and transshipment |

||

|

Economic societies and economic partnerships created by budgetary scientific institutions and autonomous scientific institutions |

||

|

Organizations and individual entrepreneurs with resident status of a technology-innovative special economic zone, organizations and individual entrepreneurs that have entered into agreements on the implementation of tourism and recreational activities |

||

|

Organizations operating in the field of information technology |

||

|

Organizations and individual entrepreneurs using a simplified taxation system in certain types of activities |

||

|

Organizations that have received the status of participants in the Skolkovo Innovation Center project |

||

|

Payers of insurance premiums who received the status of a SEZ participant in the territories of the Republic of Crimea and Sevastopol |

||

|

Payers of insurance premiums who have received the status of resident of territories of rapid socio-economic development |

||

|

Payers of insurance premiums who have received resident status of the free port of Vladivostok |

||

As in 2015, if the number of employees exceeds 25 people, reporting must be submitted electronically. The reporting deadlines did not change in 2016: in paper form it must be submitted on February 15, May 16, August 15, November 15, and in electronic form - on February 20, May 20, August 22, November 21.

From the second quarter of 2016, additional monthly simplified reporting was introduced for employers. Employers will be required to provide information for each employee, which includes the employee’s full name, INN and SNILS. If you fail to submit monthly simplified reporting, the employer faces a fine of 500 rubles. for each employee for whom information has not been submitted.

In 2016, the minimum wage increased, which is 6,204 rubles. Accordingly, the size of the fixed payment for individual entrepreneurs has increased. In 2016, the fixed contribution will be 19,356.48 rubles. with income within 300 thousand rubles. per year plus 1% of the amount over 300 thousand rubles, but not more than 154,851.84 rubles.

Let us remind you that since 2015, payment of insurance premiums is made without rounding - in rubles and kopecks.

In 2016, some BCCs for payment of contributions changed. For the purpose of separate accounting of insurance premiums, changes have been made to the codes of subtypes of budget income for KBK, used for the payment of insurance premiums in a fixed amount, calculated from the amount of income of the payer, not exceeding the maximum amount of income and calculated from the amount of income received in excess of the maximum amount (1%) . New BCCs have been introduced for the payment of insurance premiums for compulsory health insurance in a fixed amount. In addition, the codes of subtypes of KBK income have been changed to separately account for penalties and interest on the corresponding payment. All BCCs for the payment of pension contributions can be viewed in the table.

About pensions

Insurance pensions will be indexed only for non-working pensioners. Pensions for this category of pensioners will be increased by 4%. Working pensioners will receive pensions without indexation. Let us remind you that the indexation of insurance pensions will apply to citizens who retired before September 30, 2015. Those who became pensioners after this date will have to notify the Pension Fund of their status as a non-working pensioner. If a pensioner belonged to the category of self-employed people, he will be considered working if he was registered with the Pension Fund as an insurer as of December 31, 2015.

Also, state pension benefits will be indexed by 4%. This type of pension is indexed by 4% regardless of whether the citizen receiving the pension works or not (from April 1, 2016).

The size of the fixed payment after indexation will be 4558.93 rubles. per month, the cost of a pension point is 74.27 rubles. To obtain the right to an insurance pension in 2016, you must have at least 7 years of experience and 9 pension points. The expected pension payment period when calculating the funded pension in 2016 is 234 months.

The average annual old-age insurance pension in 2016 will be 13,132 rubles, social pension – 8,562 rubles. All non-working pensioners will receive a social supplement to their pension up to the level of the pensioner’s subsistence level in their region of residence.

About pension savings

The moratorium on the formation of pension savings has been extended for 2016. 6% of the funded pension will be used to form an insurance pension.

About maternity capital

The maternity capital program has been extended for two years, that is, a child must be born before December 31, 2018 to receive a maternity capital certificate. From 2016, maternity capital funds can be used, among other things, to purchase goods and pay for services for the social adaptation of disabled children.

Those who did not receive a one-time payment of 20 thousand rubles. from maternity capital funds, they will be able to do this in 2016. The amount of maternity capital is not indexed. Like last year, it is 453,026 rubles.