The Regulations on the Rules for Transferring Money (Central Bank of the Russian Federation dated June 19, 2012 No. 383-P) does not contain a form of foreign currency payment order. It is not included in the All-Russian Classifier of Management Documentation (OKUD) OK 011-93 (Resolution of the State Standard of Russia dated December 30, 1993 No. 299). Therefore, each bank (commercial or state) uses its own form of payment document and the procedure for filling it out.

Features of drawing up a foreign currency payment order

The emergence of “bank clients” has replaced paper forms in the banking sector. Although paper forms are still used, for example, to print and create a backup copy.

The payment order form and the procedure for filling it out are necessary for such an area as foreign exchange transactions. Payment in foreign currency must meet the requirements:

- Russian legislation on currency regulation and control;

- international standards ISO (International Organization for Standardization);

- standards of the SWIFT (Society for World Wide Interbank Financial Telecommunications) system.

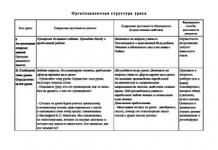

Currency payment order form

Important! The codes located on the left (for example 33B, 52a, etc.) correspond to a specific field of the SWIFT format in the international ISO system. According to SWIFT standards, such payments do not allow the use of characters like: №, %, #, $, &, “ “, =, @, \, ( ), , ;, *,!, _,< >.

The correctness of the details is important for both the payer and the bank for the purposes of:

- reducing the risk of erroneous execution of orders for payment in foreign currency;

- acceleration of currency control procedures and greater efficiency of payment;

- reducing translation costs by reducing the number of investigations into unaccepted or erroneously accepted payments;

- fulfillment of obligations to the counterparty without additional costs, including due to failure to meet payment deadlines.

Currency control

All transactions with foreign currency are under special control of the state. The main regulatory legislative act of December 10, 2003 No. 173-FZ. The regulation procedure is determined by the Central Bank of the Russian Federation and the Government (Clause 1, Article 5 No. 173-FZ).

The law primarily applies to residents and non-residents. Residents include, inter alia, legal entities created in accordance with the legislation of the Russian Federation, and non-residents include legal entities created in accordance with the legislation of foreign states and located outside the territory of the Russian Federation (Article 1 No. 173-FZ).

Currency transactions between residents and non-residents are carried out through authorized banks (Clause 1.1, Article 19. No. 173-FZ).

As part of control, residents are required to provide authorized banks with the information specified in clause 1.1. Art. 19. No. 173-FZ, including:

- the expected timing of receiving foreign currency or Russian currency from non-residents for the fulfillment of obligations under contracts;

- expected terms of fulfillment by non-residents of obligations under agreements.

Documentation of control requirements is carried out on the basis of Instruction of the Central Bank of the Russian Federation dated June 4, 2012 No. 138-I. It contains the procedure for residents to provide control documents, the forms of these documents, as well as information for filling them out, in particular, code of the type of currency transaction in the payment order.

Types and codes of currency transactions

Appendix 2 of the Central Bank of the Russian Federation Instruction No. 138-I contains a list of transactions of residents and non-residents. It is used to process transactions and related documents. Currency transaction code in the payment order indicated on the basis of the data defined in the List.

Here are some codes in general form (the code for the type of operation group is not considered):

| Operation type code | Name of the type of operation | |

|---|---|---|

| 01 | 010 | Sale by a resident of foreign currency for Russian currency |

| 01 | 030 | Purchase of foreign currency by a resident using Russian currency |

| 11 | 100 | Payments by a resident in the form of advance payment to a non-resident for goods imported into the territory of the Russian Federation, with the exception of payments specified in group 23 of the List |

| 13 | 020 | Settlements by a resident in favor of a non-resident for goods sold on the territory of the Russian Federation, with the exception of settlements under codes 23110, 23210, 23300 of the List |

| 20 | 200 | Payments by a non-resident for work performed by a resident, services provided, with the exception of payments under code 20400, and those specified in groups 22 and 58 of the List |

Thus, type of currency transaction in the payment order indicated by numbers.

As noted earlier, the absence of a unified federal form of payment order for the transfer of foreign currency has led to the appearance in each bank of some differences in the details and procedure for filling out this document.

Another feature is that currently filling out almost every banking document is carried out through the “bank-client” application interface, which also differs from the type of similar program in another bank.

With this specificity in mind, let’s look at the procedure for filling out a payment order step by step, using the form from the first section of our article.

Sample of filling out a foreign currency payment order

Let's consider the conditions that:

- a transaction is completed for our payment of 10,000 US dollars to the Turkish supplier (hereinafter referred to as the beneficiary), in the form of advance payment for goods imported into the territory of the Russian Federation;

- payment is made directly from a current account in Sberbank (without purchasing currency);

- terms of payment: commissions of our bank are carried out at the expense of the payer, and commissions and expenses of other banks are at the expense of the beneficiary client (SHA details in the “Commissions and expenses” section of the order).

Step 1: details of the parties

Indicate not only the details of the beneficiary and his bank (indicating, if necessary, the clearing code), but also your own details in English: international details of your bank, foreign currency account number and more.

Below, in the filling samples, improvised details of the parties are indicated; in fact, they are determined by the foreign trade agreement.

Details are indicated in the currency order in capital letters (upper case).

Step 2: Exchange control data

At this stage, information from the transaction passport can be used.

Step 3: filling out the top part (“header”) of the order

Indicate the document number, the date of its preparation, the payment amount and the ISO code of the payment currency (in the example, the code is US dollars, USD).

Step 4: payer details

Enter the data collected in step 1 in the fields of the “Payer Client” and “Payer Bank” sections.

Step 5: recipient details

Enter the data collected in step 1 in the fields of the “Beneficiary Bank” and “Beneficiary Client” sections.

Step 6: Section “Payment Purposes” and “Commissions”

Indicate the purpose of payment (in English, not Turkish) and check the SHA option (see payment terms at the beginning of this section of the article).

Step 7: Opcode

Indicate the code of the type of operation, defining it in Appendix 2 of the Instruction of the Central Bank of the Russian Federation No. 138-I. For our case it will be:

In addition, if the transaction passport has already been issued, then its number and date are indicated. Since the example considers an advance payment for goods, the field “Customer declaration No.” is not filled in, since the goods have not yet been delivered.

The registration is completed with the signatures of authorized persons of the organization and a seal (if applicable).

The general appearance of the completed order should be like this.

The currency transaction type code is a 5-digit number that encrypts the essence of the banking transaction being carried out. These codes (or KVBO) are indicated in special certificates and payment orders. Let's consider where CVBOs are used, what is the procedure for their application, as well as the main codes of currency transactions in the material below.

Where are KVVO used?

Codes of types of currency transactions (KVVO) are used by payers when filling out payment documents in rubles in situations where one of the parties is a non-resident (whether it is the payer himself, the recipient of the money, or a non-resident bank where an account is opened for another resident person).

Codes of types of currency transactions are necessary to ensure control, monitoring and analysis of information on payment transactions carried out between residents/non-residents.

The currency transaction code is indicated in the certificate filled out by the resident:

- when crediting/debiting money (in Russian rubles) from/to a non-resident;

- when crediting foreign currency to a transit account or debiting funds in foreign currency from a current account.

KKVO are also needed to conduct foreign exchange transactions in the form of debiting Russian currency from the bank account of a resident/non-resident. In this case, a payment order is submitted to the authorized bank.

The list of codes for types of currency transactions is given in Appendix 2 to Bank of Russia Instruction No. 138-I dated June 4, 2012. From 03/01/2018, this instruction loses its force and a new instruction of similar content comes into force (dated 08/16/2017 No. 181-I). The new instructions also contain a list of codes (Appendix 1), but they are named differently: codes for types of transactions of residents and non-residents. The structure of the code directory, the principle of their formation and numbering are preserved. A group of codes numbered 59, allocated to operations under clearing agreements, was added to the new directory.

Procedure for using KVVO

The code for the type of currency transaction is entered in the same column of the payment document where the text of the payment purpose is entered, and is entered immediately before the text component. Before the 5-digit number indicating the required operation code, 2 Latin letters - V and O - must be indicated without a space.

All alphanumeric code must be enclosed in curly braces. The entry should look like this:

where xxxxx is the code corresponding to the currency transaction being carried out.

Any CBVO is conventionally divided into 2 parts, where the first 2 digits indicate the group into which similar currency transactions are combined, and the remaining 3 digits are the number that, within the specified group, specifies the operation being performed.

Decoding of digital values of groups (subject to changes coming into force from 03/01/2018):

|

Foreign exchange transactions carried out by resident persons by bank transfer |

|

|

The above operations carried out by non-residents |

|

|

RR/N when conducting foreign trade activities that involve the import of goods into the territory of the Russian Federation |

|

|

RR/N for trade operations without import of goods to Russia |

|

|

PP/N when selling goods in Russia |

|

|

RR/N when conducting foreign trade activities that are related to the fulfillment by residents of contractual obligations (work, services, transfer of information, intellectual and exclusive rights) |

|

|

RR/N when conducting foreign trade activities that are associated with the fulfillment by non-residents of contractual obligations (work, services, transfer of information, intellectual and exclusive rights) |

|

|

RR/N when transferring goods (performing work/services) by residents |

|

|

RR/N when transferring goods (performing work/services) by non-residents |

|

|

RR/N when purchasing real estate |

|

|

RR/N within the framework of agreements on the assignment of the right of claim (debt transfer) |

|

|

RR/N for other foreign trade transactions not listed above |

|

|

Calculations for the provision of cash loans by residents to non-residents |

|

|

Calculations for the provision of cash loans by non-residents to residents |

|

|

Calculations when residents fulfill loan obligations |

|

|

Calculations when non-residents fulfill loan obligations |

|

|

Investment calculations (capital investments) |

|

|

Calculations when non-residents purchase securities from residents |

|

|

Calculations when residents purchase securities from non-residents |

|

|

Calculations when fulfilling obligations under the Central Bank |

|

|

RR/N for futures transactions |

|

|

Settlements for transactions related to trust management of assets |

|

|

Settlements for brokerage operations |

|

|

Settlements under clearing agreements |

|

|

Payment transactions carried out by non-residents on their accounts in Russian rubles in cash |

|

|

Payment transactions carried out by residents in foreign currency in cash |

|

|

Operations not related to trade |

|

|

Settlements between a bank authorized to carry out foreign exchange transactions and a non-resident in Russian rubles, as well as between a bank and a resident in foreign currency |

|

|

Settlements for other currency transactions that were not mentioned above |

Features of the currency transaction code “Salary to non-residents”

If a resident pays a salary to an employee who is listed in the bank as a non-resident (has a different citizenship), then when issuing a payment order, the KVVO must be indicated. If this is not done, the bank will not accept the payment order for execution, since it violates currency legislation.

When transferring a salary to such a foreign citizen, you should indicate the code 70060. It is important not to forget to simultaneously issue a payment slip for personal income tax and insurance contributions, so as not to violate tax laws.

Read about the timing of transferring personal income tax to the budget when paying salaries in our article “When to transfer income tax from salary?” .

Currency transaction code 10100

Currency transaction code 10100 is used in settlement transactions of non-residents for prepayment to a resident for goods exported from Russia.

Currency transaction code 10200

The currency transaction type code 10200 denotes payments made by a non-resident to a resident in the event of a deferred payment for products exported from the Russian Federation.

Currency transaction code 11100

Currency transaction type code 11100 is a resident’s settlement transactions for prepayment to a non-resident for goods imported into Russia.

Currency transaction code 11200

11200 - code for the type of currency transaction indicating settlements by a resident if a non-resident has given a deferred payment for products imported into Russia.

12060 — currency transaction code

This operation is the fact of payment by a resident to a non-resident for goods sold abroad without their import into Russia.

13010 — currency transaction code

Payment from a non-resident to a resident for products sold in Russia.

Currency transaction type code 20100

20100 - currency transaction code indicating an advance payment by a non-resident for services/works provided by a resident, etc.

Currency transaction code 20200

The currency transaction type code 20200 in the payment document indicates that the non-resident is paying for work/services performed by the resident, etc.

20400 — currency transaction code

This code marks an operation to carry out settlements under commission agreements (instructions, provision of guarantees) from a non-resident (principal, principal or principal) in favor of a resident (attorney, agent, commission agent).

Currency transaction code 20500

This is how settlements are noted within the framework of the execution of commission agreements (assignments, provision of guarantees) from a resident (attorney, agent, commission agent) to a non-resident (principal, principal or principal).

Currency transaction code 21100: decryption

The currency transaction type code 21100 in the settlement document (certificate) indicates an advance payment by a resident in favor of a non-resident performer of work (services).

Currency transaction code 21200: decryption

The currency transaction type code 21200 represents a payment by a resident for services performed by a non-resident.

Currency transaction code 35030

This code is set if a payment is made from a non-resident to a resident for other foreign trade transactions.

Currency transaction code 35040

Settlements made by a resident in favor of a non-resident for other foreign trade transactions.

Currency transaction code 41030

This CCBO means that settlements are being made for the transfer of funds on credit by a non-resident in favor of a resident.

42015 — currency transaction code

This code marks transactions carried out by a resident in connection with the repayment of the principal debt to a non-resident as part of the fulfillment of loan obligations.

Currency transaction code 61100

This code marks currency transactions involving the movement of foreign currency from one resident’s transit account to another.

Currency transaction code 61135

This is a transfer of foreign currency from a resident’s account opened in one bank to a similar account opened in another bank.

Currency transaction code 70060

This code indicates the payment of wages by a resident to a non-resident.

Currency transaction code 70205

Other settlements carried out by a resident to a non-resident for transactions that are not trade.

99090 — currency transaction code

All other currency transactions that were not mentioned under all other codes.

Results

Codes of types of currency transactions (from 01.03.2018 acquiring the name “Codes of types of transactions of residents and non-residents”) are used when preparing payment documents for such transactions and certificates about them submitted to banks. The 5-digit code number encrypts the 2-digit number of the group into which the operations directory is divided, and the 3-digit number of the specific type of operation included in this group.

The reference book is an appendix to the instructions of the Bank of Russia. Until 03/01/2018, the instruction dated 06/04/2012 No. 138-I is in force, containing a list of codes in Appendix 2. From 03/01/2018 it is replaced by the instruction dated 08/16/2017 No. 181-I, in which the reference book is given in Appendix 1. The updated reference book no. 59 contains an additional group of codes.

Currency transactions, in accordance with the norms of current legislation, are carried out both between residents and non-residents of the Russian Federation. Each operation is entered into a payment order, each has its own code, and it is issued in a special way. In this article we will look at what the 21200 currency transaction code means, and how its correct spelling in a payment card differs from other codes.

Prohibitions and permissions

Currency transactions on the territory of our country are prohibited between Russians. But this ban does not apply to absolutely all operations and not to every individual citizen. Currency can be sold, bought, gifted, or inherited. But all this is permitted either between close relatives (donation and inheritance), or to authorized banks, which carry out such operations on their own behalf and at their own expense.

The exception is those cases when Russians are forced to “use” the currency in order to:

carry out international cargo or passenger transportation;

arrange cargo insurance, etc.

Currency transactions are also possible between an authorized bank and a resident. For example, if a citizen takes out a foreign currency mortgage from a financial institution.

Code in payment

Residents and non-residents of Russia can also enter into agreements for the provision of services or the purchase/sale of any goods. And in this case, they contact the bank so that the required amount (advance or payment itself) is transferred to the buyer or seller, depending on what operation will be carried out. These transactions will be recorded in payment orders, and here you must definitely indicate the transaction code. Let’s assume that a Russian has agreed with his acquaintance living abroad to provide some services, and he needs to pay an advance. In this case, the payment order will contain the transaction code (VO21100) (without spaces). But if you need to pay for services already provided, then the numbers will be different: 21200, the currency transaction code that is used in this case. Here, the first two-digit digit means that this operation is related to foreign trade relations between a resident and a non-resident. In the payment order it should look like this: (VO21200).

Tax on foreign exchange transactions

Currently, Russian citizens do not pay tax on the income they receive from foreign exchange transactions. However, last year, by order of the Ministry of Finance, Russians had to indicate in their income statements how much income they received as a result of transactions for the purchase and/or sale of foreign currency. Individuals had to calculate and pay for it themselves. But there was confusion. For example, it was not clear to many what the tax base would be in this case. As a result, such taxation has not yet been approved at the legislative level.

The income that an individual receives when exchanging currency is also not taxed, although two years ago the Union of Industrialists of Russia put forward an initiative to tax at a rate of 1% all currency exchange transactions, except those that are the fulfillment of obligations under international treaties. However, this initiative did not find support from legislative bodies.

So, currency transactions are possible between residents of the Russian Federation only in some individual cases, but transactions between a resident and a non-resident are limited to a lesser extent. If a resident needs to pay for services provided to him by a non-resident, he contacts the bank to transfer the required amount. To do this, you need to fill out a payment order and indicate in it the number 21200 - the currency transaction code.

The digital code of the currency transaction in the payment order is filled in when drawing up settlement documentation for payments in foreign currency. Why exactly is it necessary to indicate such information and what legislative acts are regulated by the KVVO - more on this later.

Based on sub. 3.1-3.4 Instructions of the Bank of Russia No. 138-I dated June 4, 2012, the execution of payment orders for foreign exchange payments requires the correct indication of the KVVO (code of the type of foreign exchange transaction). The five-digit indicator is entered in the line Purpose of payment at the beginning of the text sentence and has the following structure:

In this case, ***** is a designation of the type of foreign exchange transaction.

Note! Spaces in data inside curly braces are prohibited. The full list of approved QUOs is contained in Appendix 2 to the Instructions.

What monetary payments are recognized as foreign exchange according to the provisions of Law No. 173-FZ of December 10, 2003:

- Write-off of ruble funds or their receipt in favor of/from a non-resident of the Russian Federation.

- Write-off of foreign currency funds or their receipt from/to the corresponding foreign currency bank accounts of residents, as well as non-residents.

- Write-off of any funds or their receipt from accounts (accounts) in banking institutions recognized by non-residents.

Code of the type of currency transaction in a payment order - mechanism of action

Each of the existing digital VBOs is theoretically divided into 2 interdependent subparts. The first consists of two digits and implies the group of the currency transaction being performed; the second includes three numbers explaining the type of VO.

For example, KVVO 01030 is used to indicate the acquisition by a Russian enterprise of foreign currency for rubles by writing off finances from the account:

- 01 – non-cash monetary transactions between participants who are residents of the Russian Federation.

- 030 – purchase of any foreign currency for rubles.

Code of the type of currency transaction in a payment order - basic values

To better understand the essence of the topic, let’s consider the commonly used values of KVBO. One of the most popular indicators is the code of the currency transaction for the salary of a non-resident. The specified coding is applied when an employer who is a resident of the Russian Federation transfers wages and other charges (with the exception of those attributable to code 70125) for the performance of labor duties to employees recognized as non-residents of our country.

- Currency transaction code 10100 - valid for mutual settlements between non-residents and residents as part of the transfer of prepayment for foreign economic activity when exporting products/goods abroad, incl. on agency transactions, on the execution of orders/commissions. In addition to gr. 22.

- Currency transaction code 10800 - used in mutual settlements between residents and Russian non-residents as part of the transfer of previously received cash surplus for the export of products outside the Russian Federation. Except KVVO 22800.

- Currency transaction code 11200 - denotes such payments by residents, the implementation of which takes into account the deferment provided by the non-resident party, including payment for intermediary relations. In addition to gr. 23.

- Currency transaction code 13010 – is valid for mutual settlements between non-residents and Russian residents for products sold in their home country. Except KVVO 22300, 22210, 22110.

- Currency transaction code 20200 – is valid for mutual settlements between non-residents and Russian residents for various types of work performed by the resident party, including information provided and products of intellectual activity. In addition to KVVO 20400, gr. 22, gr. 58.

- Currency transaction code 21100 - decoding implies the transfer of an advance by a resident to a non-resident. In addition to KVVO 21400, gr. 23, gr. 58.

- Currency transaction type code 21200 – valid for mutual settlements for non-resident services by a Russian resident. In addition to KVVO 21400, gr. 23, gr. 58.

- Currency transaction code 61100 – shows the transit movement (transfer) of foreign currency between the resident’s foreign currency bank accounts.

- Currency transaction code 70060 - used for non-trading settlements, or more precisely when a resident company pays a salary to a non-resident specialist. This also includes the issuance of other similar amounts. Except code 70125.

- Currency transaction code 99020 – used when returning funds to a non-resident in the event of an erroneous debit or credit.

Note! The full index of KVVO is located in Appendix No. 2 No. 138-I.

The procedure for preparing settlement documents is determined by the Bank of Russia. If we are talking about transferring funds in favor of non-residents, then in the “Purpose of payment” field you must indicate the currency transaction code. How not to make a mistake, read this article.

Codes of types of currency transactions (KVVO) are contained in Appendix 2 to Instructions of the Bank of Russia dated June 4, 2012 No. 138-I. They must be indicated in settlement documents in certain strictly defined cases:

- When filling out a certificate of currency transactions.

- When filling out a payment order for a transfer in Russian currency, as well as in any foreign currency, if the transaction is foreign currency, when:

- the payer is a Russian organization, and the recipient of funds is a foreign company or citizen;

- the payer is a resident - when making transfers to his own accounts or to the accounts of another resident opened in a bank outside of Russia;

- the payer is a foreign organization or citizen;

- the payer is a financial agent (factor), the recipient is also a Russian company (and vice versa), in the case of settlements within the framework of a financing agreement concluded between them for the assignment of a monetary claim (factoring) and (or) an agreement on the subsequent assignment of a monetary claim.

What is a currency transaction type code?

The code for the type of currency transaction in the payment order must be indicated before the text part in the “Purpose of payment” detail. There is even a special format for this important prop:

(VO<код вида валютных операций>}

It must be specified exactly this way, without indentations or spaces inside the curly braces. Its place is before the text part of the payment purpose. The VO designation is large Latin letters that do not change; they must be followed by the digital code itself. In a payment order it always has five characters. Each KVVO is conventionally divided into two parts:

- the first two digits indicate the group into which similar transfers are combined;

- the last three digits indicate a number that specifies the transfer being made in accordance with currency legislation.

How to decipher KVVO

There is a table with which you can easily decipher the first two digits of any KVVO.

|

Currency conversion payments made by individuals or Russian companies by bank transfer |

|

|

Foreign currency conversion non-cash transfers carried out by foreign citizens or companies |

|

|

Code for settlements between companies from the Russian Federation and foreign companies when conducting foreign trade activities related to the export of goods from the territory of Russia |

|

|

Currency code when transferring companies from the Russian Federation to foreign companies or individuals when conducting foreign trade activities related to the import of goods into Russia |

|

|

Transfers of domestic organizations for trade transactions without import of goods to Russia |

|

|

Payment by foreigners to domestic companies when selling goods directly in Russia |

|

|

Currency code indicated when paying residents to non-residents when conducting foreign trade activities related to the fulfillment by domestic firms of contractual obligations (work, services, transfer of information, intellectual and exclusive rights) |

|

|

Payment by organizations from the Russian Federation to foreign companies when carrying out foreign trade activities related to the fulfillment by foreigners of contractual obligations (work, services, transfer of information, intellectual and exclusive rights) |

|

|

Mutual settlements between residents and non-residents when transferring goods (performing work/services) by domestic firms or individual entrepreneurs |

|

|

Payment by residents to non-residents when transferring goods (performing work/services) by foreign firms or citizens |

|

|

Transfers from Russian companies and individual entrepreneurs to foreigners for purchased real estate |

|

|

Payment by residents to foreigners within the framework of agreements on the assignment of claims (debt transfer) |

|

|

Code of transfers between residents and non-residents for other foreign trade transactions |

|

|

Payments for the provision of a cash loan by a Russian company to a foreigner or foreign company |

|

|

Payment code for the provision of a cash loan by a foreign company from the Russian Federation |

|

|

Payments when Russian companies fulfill loan obligations |

|

|

Calculations when foreign companies fulfill loan obligations |

|

|

Payments upon investment (capital investments) |

|

|

Transfers when foreigners purchase securities from residents of the Russian Federation |

|

|

Transfers when Russian companies purchase securities from non-residents |

|

|

Payments upon fulfillment of obligations under securities |

|

|

Mutual settlements between Russians and foreigners on derivatives transactions |

|

|

Payment for transactions related to trust management of assets |

|

|

Payments for brokerage operations |

|

|

Payment transactions carried out by foreign companies and citizens on their accounts in Russian rubles in cash |

|

|

Payments made by Russian companies in foreign currency in cash |

|

|

Non-trading transactions |

|

|

Settlements between a bank authorized to carry out foreign exchange transactions and a non-resident in Russian rubles, as well as between a bank and a resident in foreign currency |

|

|

Settlements for other currency transactions that were not mentioned above |

Let's try to decipher the operation code 10100.

From the table above we immediately see that it is associated with the export of goods. This code usually denotes an advance payment to a resident for goods exported from Russia. The numbers “100” at the end will tell us this. In a similar way, you can decipher any type of currency transaction in a payment order. But in order to simplify the work, the Central Bank has developed a special table that contains all the necessary values. You can download it at the end of this article.

Sample of filling out a payment order for a non-resident (in Russian rubles)

The payment order is filled out for the transfer of Russian rubles, so its usual filling procedure is maintained in accordance with the documents and details of the counterparty, except for the currency transaction code, which must be indicated in the final field of the payment order. To do this, before the text in the “Purpose of payment” field, you need to write VO in capital Latin letters, and then the five-digit transaction code from the table below. The code must be enclosed in curly braces.

Let’s assume that the Russian organization VESNA LLC needs to pay wages to its employee who works remotely from Kazakhstan and is not a resident of the Russian Federation. In this case, you need to fill out the payment form as usual, and in the appropriate field write:

(VO70060) Salary of Abdurakhmanov Ilyas Karimovich for July 2017.

This entry on the payment slip will look something like this.