Rostrud published on its official website "Report with guidance on compliance with mandatory requirements, providing an explanation of what behavior is lawful, as well as an explanation of the new requirements of regulatory legal acts for the 3rd quarter of 2017."

The document should help employers navigate the legislative innovations and prevent violations of the requirements of the Labor Code of the Russian Federation and by-laws.

- wages, including compensation payments included in the salary, and payments that are not included in it;

- types of non-monetary form of payment of wages, in which it is prohibited to pay part of wages;

- wages in conditions that deviate from normal, and in special conditions (in particular, work with harmful or dangerous working conditions, work in the Far North and equivalent areas, work at night, overtime work, etc.) ;

- possible cases of wage reduction (failure to comply with labor standards, downtime, manufacturing of products that turned out to be defective);

- grounds and procedure for deductions from wages, types of payments from which it is prohibited to deduct (including amounts of money in compensation for harm, etc.);

- the procedure for calculating the average wage for vacation pay and payment of compensation for unused vacation.

Also, answers are given with legal justification on the following questions:

- payment for work on a day off;

— establishment of an allowance for combination, execution of an order for an allowance for combination;

- inclusion of the district coefficient in the composition of the salary;

- average earnings upon dismissal due to staff reduction.

COMPLIANCE GUIDANCE REPORT THAT CLARIFIES WHAT IS GOOD BEHAVIOR AND CLARIFICATIONS OF NEW REGULATIONS FROM Q3 2017

SALARY

Important! The salary of an employee consists of the following elements:

1) salary (official salary); tariff rate;

2) compensation payments (surcharges and allowances of a compensatory nature);

3) incentive payments.

Salary (salary)- a fixed amount of remuneration of an employee for the performance of labor (official) duties of a certain complexity for a calendar month, excluding compensation, incentives and social payments.

Tariff rate- a fixed amount of remuneration of an employee for fulfilling a labor norm of a certain complexity (qualification) per unit of time without taking into account compensatory, incentive and social payments.

Important! The salary is established in the employment contract in accordance with the current employer's remuneration system (piecework, time-based, mixed) and is not limited to a maximum amount.

Compensation payments included in salary:

For work in special climatic conditions

for work in territories subjected to radioactive contamination;

for the use by the employee of his tool, mechanism;

for work with harmful or dangerous working conditions;

for work with information constituting a state secret;

for work in conditions that deviate from normal (when performing work of various qualifications, combining professions (positions), overtime work, night work, etc.);

other payments provided by the system of remuneration.

The list of types of payments of a compensatory nature in federal budgetary, autonomous, state institutions approved. Order of the Ministry of Health and Social Development of Russia dated December 29, 2007 N 822.

Payments that are not part of wages, in particular, include payments specified in Art. 165 of the Labor Code of the Russian Federation, which are produced:

When sent on business trips;

when moving to work in another area;

in the performance of state or public duties;

when combining work with education;

in case of forced termination of work through no fault of the employee;

when granting annual paid leave;

in some cases, termination of the employment contract;

due to the delay due to the fault of the employer in issuing a work book upon dismissal of an employee.

Incentive payments:

Additional payments and allowances of a stimulating nature (for length of service, for an academic degree, etc.);

bonuses (for the performance of specific work, based on the results of the reporting period, etc.);

other incentive payments provided for by the wage system (for quitting smoking, for saving consumable materials, etc.).

Important! The terms of remuneration established by a collective agreement, an employment contract or local regulations cannot be worsened in comparison with those established by labor legislation.

The salary of an employee who has fully worked out the norm of hours and fulfilled the norms of labor cannot be less than the minimum wage.

Important! The minimum wage (SMIC) is set at the federal level. At the regional level - in the subject of the Russian Federation, the minimum wage is established.

Unlike other payments, the regional coefficient and the percentage allowance for work experience in the regions of the Far North and equivalent areas are not included in the minimum wage.

The minimum wage is established by federal law and cannot be lower than the subsistence minimum for the able-bodied population. The procedure and terms for a phased increase in the minimum wage to the subsistence minimum for the able-bodied population are established by federal law.

With regard to employees of a separate structural unit, the norm on the minimum wage established in the territory of the subject of the federation where this structural unit is located applies.

Important! The employer is obliged to index wages in connection with the growth of consumer prices for goods and services (Article 134 of the Labor Code of the Russian Federation).

At the legislative level, the procedure for such indexation is not defined. This does not release the employer from the obligation to index. The procedure for indexation of wages is determined in the collective agreement, agreement, local regulatory act.

If based on the results of the calendar year during which Rosstat recorded an increase in consumer prices, wage indexation was not carried out, the employer is subject to liability established by law, regardless of whether he adopted the corresponding local act or not. At the same time, supervisory or judicial authorities are obliged to force him to eliminate the violation of labor legislation, both in terms of indexation and in terms of adopting a local act, if there is none.

Important! When paying wages, the employee must receive a payslip in writing, which must contain information:

1) on the components of wages due to him for the relevant period

2) on the amounts of other amounts accrued to the employee

Important! Other amounts include, among other things, monetary compensation for violation by the employer of the deadline for paying wages, vacation pay, payments upon dismissal or other payments.

3) on the amount and grounds for the deductions made

Important! The amount of deductions cannot exceed 20 percent for each payment of wages, and in cases established by federal law - 50 percent (Article 138 of the Labor Code of the Russian Federation), and in exceptional cases - 70 percent.

Exceptional cases include retention

When serving corrective labor;

in the recovery of alimony for minor children;

in case of compensation for harm caused by an employee to the health of another person;

in case of compensation for harm to persons who have suffered damage in connection with the death of the breadwinner;

in compensation for damage caused by a crime.

4) on the total amount of money to be paid.

Important! The form of the pay slip is approved by the employer, taking into account the opinion of the representative body of employees.

Wages are paid to the employee at the place of work.

Important! Upon a written application of the employee, the salary is transferred to the account indicated by the employee in the bank (credit institution) on the terms determined by the collective agreement or the employment contract.

Part of the salary, but not more than 20 percent of the accrued monthly salary, may be paid in non-monetary form.

Important! In the following types of non-monetary form, it is prohibited to pay part of wages:

Bonds

coupons

debentures

receipts

alcohol

narcotic substances

toxic substances

harmful substances

other toxic substances

weapon

ammunition

other items in respect of which a ban or restriction on their free circulation is established.

Important! The place and terms of payment of wages in non-monetary form are determined by a collective agreement or an employment contract.

Important! Wages must be paid at least every half month. In practice, this means that the gap between payments does not exceed 15 days.

Important! Specific dates for the payment of wages are established by the internal labor regulations, the collective agreement, the labor contract.

For violation of the terms of payment of wages, the employer is liable in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation for each day of delay. Also (depending on the scale of the deed), he should be held administratively or criminally liable.

As a general rule, upon dismissal, all amounts due to the employee (including wages for the period worked) must be paid no later than on the last day of work (part 1 of article 140 of the Labor Code of the Russian Federation). Otherwise, it may be provided only by agreement of the parties, in accordance with which the parties terminated the employment relationship. In this case, the agreement, which includes a condition on the timing and amount of the corresponding payment, must be drawn up in writing in 2 copies.

Important! If the day of payment of wages coincides with a weekend or non-working holiday, payment of wages is made on the eve of this day.

PAYMENT UNDER NORMAL CONDITIONS

Remuneration for work in special conditions and other cases of performance of work in conditions deviating from normal is made at an increased rate (due to the payment of appropriate compensations).

Special working conditions include:

1) work with harmful or dangerous working conditions;

2) work in the regions of the Far North and equivalent areas.

Important! In the following cases, wages are paid taking into account compensation for work in conditions that deviate from normal:

1) work at night;

2) performance of works of various qualifications;

3) when combining a profession (positions);

4) overtime work;

5) work on weekends and non-working holidays;

6) when developing new industries (products).

1. Work with harmful or dangerous working conditions

The wages of employees working with harmful or dangerous working conditions are set at a higher rate than normal working conditions.

Important! The minimum wage increase for work in harmful or dangerous conditions is 4% of the tariff rate (salary) established for various types of work with normal working conditions.

Specific amounts of increased wages for work in harmful conditions are established by the employer, taking into account the opinion of the representative body of employees.

Important! If the employer does not have a representative body of employees, specific amounts of increased wages are established by an employment contract with an employee.

The specific amount of wage increases for workers with harmful or dangerous working conditions may be determined in the collective agreement (if any).

2. Work at night

The employer is obliged to pay for work at night in an increased amount (compared to work in normal conditions). Night time is the period from 22:00 to 06:00.

Important! The minimum amount of increased wages for night work is set by the Government of the Russian Federation for all wage systems and is 20% of the hourly wage rate for each hour of night work (or 20% of the salary calculated per hour of night work). The employer is obliged to pay for night work at least at the specified rates.

The surcharge is charged only on the hourly tariff rate or salary calculated per hour of work (without taking into account other surcharges and / or allowances received by the employee).

The specific amount of increased pay for night work is established by the employment contract with the employee.

Important! If the organization has a representative body of workers, the specific amount of the increase in wages for work at night can be established by a local act adopted taking into account the opinion of the representative body of workers.

In addition, the amount of increased wages for night work may be provided for in the collective labor agreement (if any).

3. Work in special climatic conditions

1. Work in the regions of the Far North and areas equated to them

Important! For work in special climatic conditions, remuneration is made using regional coefficients and percentage bonuses to wages.

The sizes of regional coefficients and percentage allowances are established by the Government of the Russian Federation, normative acts of the former USSR.

State authorities of the constituent entities of the Russian Federation and local self-government bodies have the right to establish higher sizes of regional coefficients than those established by the Government of the Russian Federation or the regulations of the former USSR.

Important! The procedure and conditions for calculating the interest surcharge:

an increase in the allowance for every six months of work, then for each year of work - by 10 percent (up to reaching 80-100 percent of wages - depending on the region of the Far North, up to reaching 50 percent of wages - for areas equated to the RKS).

Important! The procedure and conditions for calculating the youth percentage allowance (for employees under the age of 30):

The presence of work experience in the regions of the Far North or areas equated to them for a duration of at least six months. When calculating the length of service, it is summed up regardless of the timing of the break in work and the grounds for terminating the employment relationship;

residence in the regions of the Far North or areas equated to them - at least 1 year;

increase in the allowance for every six months of work, then for each year of work (for CSWs), for every six months of work (for MCS) (up to 80 percent of salary - CSW, 50 percent of salary - MCS).

2. Work in waterless, alpine and desert areas

Important! For work in waterless, high-mountainous and desert areas, remuneration is made using the appropriate coefficients for wages.

The procedure and conditions for applying the coefficient are established by regulatory legal acts of the federal level.

4. Performance of works of various qualifications

Qualification is the degree of professional training and readiness of an employee to perform a labor function in a particular specialty.

Important! When paying for work of various qualifications, the employer must comply with the following procedure:

1) with time wages - the work of an employee is paid for work with a higher qualification;

2) in the case of piecework wages - the work of the employee is paid at the rates of the work performed by him.

Important! When an employee is entrusted (due to the nature of production) with a piecework wage to perform work rated below the category assigned to the employee, the employer is obliged to pay the employee the difference between the categories.

5. Combination of professions (positions)

The combination of professions (positions) is carried out within the framework of one employment contract. This is its difference from internal combination. The combination of professions (positions) is carried out without exemption from the main job. This is its difference from a temporary transfer to another job.

Important! This type of increased payment includes the following types of additional work performed by an employee during the working day without being released from his main job:

Combination of professions (positions);

expansion of service areas;

increase in the scope of work;

performance of the duties (or part thereof) of a temporarily absent employee who retains his/her place of work.

Important! The amount of additional payment for the performance of the specified work is determined by agreement of the parties to the employment contract, taking into account the content and volume of additional work. The maximum amount of additional payment is not limited by law.

6. Overtime

Overtime work is work performed by an employee at the initiative of the employer outside the working hours established for the employee: daily work (shift), and in the case of summarized accounting of working time - in excess of the normal number of working hours for the accounting period.

Overtime work is paid at a higher rate. Specific amounts of increased pay may be established in a collective agreement, local regulation or employment contract.

Increased pay for work outside the normal working hours on public holidays cannot be paid twice (first as for overtime work, and then as for work on a holiday).

Important! The minimum amount of increased pay for work in excess of the normal working hours:

1. Employees receiving a monthly salary

The first two hours - in the amount of an hour and a half rate (part of the salary for a day or hour of work) in excess of the salary;

subsequent hours - in the amount of a double hourly rate (part of the salary for a day or hour of work) in excess of the salary.

2. Employees whose work is paid at daily or hourly wage rates,

In the amount of one and a half daily or hourly rate for the first two hours and double daily or hourly rate for the following hours;

3. Pieceworkers

The first two hours are paid at least one and a half piece rates, the subsequent hours at least double piece rates.

Important! At the request of the employee, overtime work, instead of increased pay, may be compensated by providing additional rest time, but not less than the time worked overtime.

7. Work on weekends and non-working holidays

Remuneration of at least double the amount is made in the following cases:

The employee worked on) the day off (days) established for him by the Rules of the VTR,

If, according to the VTR Rules, Saturday and (or) Sunday are not days off for an employee, and days off are provided to him on other days of the week, then Saturday and Sunday are ordinary working days for him and are paid in a single amount.

The employee worked on one (several) non-working holidays established by Art. 112 of the Labor Code of the Russian Federation.

Important! The minimum amount of increased wages for work on a weekend or holiday:

With piecework wages - at double piecework rates;

when paying for work at daily and hourly tariff rates - at a double daily or hourly tariff rate;

employees who receive a salary (official salary) - depending on the norm of working hours worked in the month.

Important! Employees receiving a salary (official salary) work on holidays and weekends is performed in the following order:

If work on a day off was carried out within the monthly norm of working time - in the amount of a single daily or hourly tariff rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary);

if work on a day off was carried out in excess of the monthly norm of working time - in the amount of a double daily or hourly tariff rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary).

Important! Specific amounts of increased wages for work on a day off or a holiday may be established by a collective agreement, a local act (adopted taking into account the opinion of the representative body of workers), an employment contract.

At the request of the employee, instead of increased pay, work on a day off can be compensated for by providing another day of rest. In this case, payment for work on a day off is made in a single amount, and the other day of rest provided is not paid.

Important! Payment for work on weekends and holidays of creative workers specified in the list of positions, approved. Decree of the Government of the Russian Federation of April 28, 2007 No. 252, is determined by a collective agreement, a local act, an employment contract.

8. Development of new industries (products)

During the period of development of new industries (products), the employee may retain the previous salary.

Important! The possibility of maintaining the previous wages is provided for in the collective agreement (if any), the employment contract.

The term "former salary" should be understood as the average earnings of an employee, calculated according to the rules of Art. 139 of the Labor Code of the Russian Federation.

POSSIBLE WAGE REDUCTION

Changing the terms of an employment contract, including in terms of reducing wages, is allowed only by agreement of the parties to the employment contract. However, in some cases, monthly wages may be paid in a smaller amount than established in the employment contract without obtaining the consent of the employee.

Important! In the following cases, an employee's salary may be reduced:

Failure to comply with labor standards (Article 155 of the Labor Code of the Russian Federation),

Failure to comply with labor standards should be understood as the performance of a smaller amount of work, failure to fulfill the established task, failure to achieve the established quantitative result, etc.

Failure to fulfill labor (official) duties (Article 155 of the Labor Code of the Russian Federation),

Duties must be fixed in the employment contract, job description or in the local regulations of the employer, and the employee must be familiarized with them against receipt (Article 21, part 3 of Article 68 of the Labor Code of the Russian Federation).

Simple (Article 157 of the Labor Code of the Russian Federation),

manufacturing of products that turned out to be defective (Article 156 of the Labor Code of the Russian Federation).

1. Remuneration for non-fulfillment of labor standards or non-fulfillment of labor duties

Important! The amount of remuneration in case of non-fulfillment of labor standards (if labor is standardized) or non-fulfillment of labor (official) duties (if labor is not standardized) depends on the reason for non-fulfillment of the labor norm or non-fulfillment of labor (official) duties:

Causes due to the fault of the employee;

The fault of an employee can be expressed in violation of technical or technological standards, violation of internal labor regulations, refusal to perform work without good reason, etc.

Reasons due to the fault of the employer;

The fault of the employer may lie in the failure to provide work stipulated by the employment contract, in the failure to provide normal conditions for the employee to comply with labor standards, etc.

Causes beyond the control of the employee or the employer.

Reasons beyond the control of the employee and the employer can be expressed in circumstances of an emergency, unforeseen nature (natural disaster, quarantine, etc.).

Important! The presence of guilt (or lack thereof) must be established and documented.

If the employee is at fault, the normalized part is paid in accordance with the volume of work performed.

If the employer is at fault, remuneration is made in the amount not lower than the average wage of the employee, calculated in proportion to the time actually worked.

For reasons beyond the control of either the employee or the employer, remuneration is made in the amount of at least two-thirds of the tariff rate, official salary, calculated in proportion to the time actually worked.

2. Payment for labor in the manufacture of products that turned out to be defective

Under the marriage in the manufacture of products should be understood as a decrease in the quality of products as a result of deviations in the process of its manufacture from the established technical specifications and state standards, sanitary norms and rules, building codes and regulations, as well as other documents that establish mandatory requirements for the quality of goods, works, services.

Important! The amount of remuneration for the manufacture of products that turned out to be defective also depends on the presence or absence of the employee's fault in this.

If there is no fault of the employee in the production of a defect, payment for defective products is made on an equal basis with good products. The reason and percentage of rejects, as well as the degree of product suitability, do not matter.

Important! The absence of the employee's fault may consist in the presence of a marriage of raw materials (materials) from which the products are made, documented.

Partial defects due to the fault of the employee are paid at reduced rates depending on the suitability of the product.

Important! Full marriage due to the fault of the employee is not paid.

The work of an employee who has allowed a marriage, performed by him to correct products defective through his fault, is not subject to payment.

3. Payment for downtime

Important! When idle, the employee does not have the necessary amount of work. In case of non-fulfillment of labor standards, work is provided, but the conditions necessary for its implementation are not provided.

Important! Payment for downtime depends on whose fault it occurred:

employer,

worker,

in the absence of the fault of the employee and the employer.

Important! Downtime due to the fault of the employer is a temporary suspension of work due to technological, economic, technical or organizational reasons.

Downtime due to the fault of the employer is paid in the amount of at least two-thirds of the average wage of the employee. Payment is made on the basis of the average wage - hourly (with a downtime of less than one working day) and average daily (with downtime for the whole working day or more).

One of the cases of downtime due to the fault of the employer is the period during which the employee refused to perform work that directly threatened his life and health (see Article 379 of the Labor Code of the Russian Federation).

Important! A collective agreement, a local act may provide for an increased amount of payment for downtime due to the fault of the employer.

Downtime for reasons beyond the control of either the employee or the employer is paid in the amount of at least two-thirds of the tariff rate, salary, calculated in proportion to the downtime.

Important! A collective agreement or local act may provide for an increased amount of payment for downtime for reasons beyond the control of the employee and employer.

Reasons beyond the control of the employee and the employer may be equipment failure or other circumstances that make it impossible for the employee to perform work. An employee who did not participate in the strike, but in connection with it was not able to perform his work, is paid as if he was idle through no fault of the employee. However, the fault of the employer in this case is also absent.

Important! The employee is obliged to inform his immediate supervisor or other representative of the employer about the start of downtime caused by the specified reasons.

Important! Downtime due to the fault of the employee is not paid.

The fault of the employee in the occurrence of downtime can be expressed in his failure to notify the employer about the circumstances that could lead to downtime, if these circumstances were known to the employee and he could evaluate them.

4. Features of downtime for creative workers

Important! Non-participation of creative workers in the creation and (or) performance (exhibition) of works is not idle time.

The time of non-participation of creative workers in the creation and (or) performance (exhibition) of works is not idle time and can be paid if it is provided for in the collective agreement, local regulatory act, labor contract.

The amount and procedure for paying creative workers for the time of non-participation in the creative process is established by a collective agreement, a local normative act, an employment contract.

Important! Deductions from wages can only be made on the grounds established by the Labor Code of the Russian Federation or other federal laws:

Repayment of debts to the employer (Article 137 of the Labor Code of the Russian Federation);

compensation for damage caused to the employer by the guilty actions of the employee (Chapter 39 of the Labor Code of the Russian Federation);

execution of a court decision (according to executive documents) (Article 138 of the Labor Code of the Russian Federation);

as a result of the fulfillment by the employer of the duties of a tax agent for the calculation of personal income tax;

execution of the will of the employee to withhold (if such a possibility is provided for by federal law) (part 3 of article 28 of the Federal Law of 12.01.1996 No. 10-FZ).

Important! As a general rule, the amount of all deductions for each payment of wages cannot exceed 20 percent of the amount of earnings. The amount of deductions under several writ of execution should not exceed 50 percent of the employee's salary (part 2 of article 138 of the Labor Code of the Russian Federation).

As an exception, for some types of deductions, the maximum amount of deductions may be increased.

1. Deductions to pay off debts to the employer

Important! Repayment of debt to the employer is made on one of the following grounds:

To compensate for the unworked advance payment issued to the employee on account of wages;

to pay off the unspent and not returned in a timely manner advance payment issued in connection with a business trip;

to pay off an unspent and not returned in a timely manner advance payment issued in connection with the transfer to another job in another locality;

to pay off unspent and not returned in a timely manner in other cases;

to return the amounts overpaid to the employee due to counting errors (repeated payment of wages for one working period, advance payment for one business trip, etc. is not recognized as a counting error);

to return the amounts overpaid to the employee in the event that the body for considering individual labor disputes recognizes the employee's guilt in failure to comply with labor standards (part three of Article 155 of the Labor Code of the Russian Federation);

for the return of amounts overpaid to the employee in the event that the body for considering individual labor disputes recognizes the guilt of the employee during downtime (part three of Article 157 of the Labor Code of the Russian Federation);

upon dismissal of an employee before the end of the working year, on account of which he has already received annual paid leave, for unworked vacation days.

Important! The employer is not entitled to deduct for unworked vacation days in the following cases:

If the employee quits due to refusal to transfer to another job, which is necessary for him in accordance with a medical report, or if the employer does not have an appropriate job (paragraph 8 of the first part of Article 77 of the Labor Code of the Russian Federation);

if the employee leaves in connection with the liquidation of the organization or the termination of the activity of an individual entrepreneur (clause 1 of the first part of article 81 of the Labor Code of the Russian Federation);

if an employee leaves due to a reduction in the number or staff of employees of an organization, an individual entrepreneur (clause 2 of part one of article 81 of the Labor Code of the Russian Federation);

if the employee leaves due to a change in the owner of the property of the organization (in relation to the head of the organization, his deputies and the chief accountant) (clause 4 of the first part of Article 81 of the Labor Code of the Russian Federation);

if the employee is dismissed in connection with the conscription of the employee for military service or sending him to an alternative civilian service that replaces it (clause 1, part 1, article 83 of the Labor Code of the Russian Federation);

if the employee is dismissed in connection with the reinstatement of an employee who previously performed this work, by decision of the state labor inspectorate or court (clause 2, part 1, article 83 of the Labor Code of the Russian Federation);

if the employee is dismissed in connection with the recognition of the employee as completely incapable of work (clause 5, part 1, article 83 of the Labor Code of the Russian Federation);

if the employee is dismissed due to death (clause 6, part 1, article 83 of the Labor Code of the Russian Federation);

if the employee leaves due to the death of the employer - an individual (clause 6, part 1, article 83 of the Labor Code of the Russian Federation);

if the employee is dismissed in connection with the recognition by the court of the employee as dead or missing (clause 6, part 1, article 83 of the Labor Code of the Russian Federation);

if the employee leaves due to the recognition of the employer - an individual as dead or missing (clause 6, part 1, article 83 of the Labor Code of the Russian Federation);

if the employee is dismissed due to the onset of emergency circumstances that prevent the continuation of labor relations (military operations, catastrophe, natural disaster, major accident, epidemic and other emergency circumstances), if this circumstance is recognized by a decision of the Government of the Russian Federation or a public authority of the corresponding subject of the Russian Federation ( clause 7, part 1, article 83 of the Labor Code of the Russian Federation).

Important! The employer is obliged to follow the procedure for withholding amounts to pay off debts to him (except for withholding amounts for unworked vacation days upon dismissal of an employee):

The decision to withhold the employer must take no later than one month from the date of expiration of the period established for the return of the advance, repayment of debt or incorrectly calculated payments

the employee does not dispute the grounds and amounts of deduction.

Important! If the employee disagrees with the basis or amount of deduction, the employer is not entitled to make it.

The deduction is made only from wages, i.e. remuneration for work, incentive and compensation payments (including upon dismissal). Other amounts overpaid to the employee may be recovered through the court.

2. Deductions for compensation for damage caused to the employer through the fault of the employee

The employee is obliged to compensate the employer for the direct actual damage caused to him. The employer cannot recover lost income (lost profit) from the employee.

Important! For the damage caused, the employee is liable within the limits of his average monthly earnings, unless otherwise provided by the Labor Code of the Russian Federation or other federal laws.

Important! In the cases established by Art. 243 of the Labor Code of the Russian Federation, an employee can be held fully liable, that is, to compensate for the direct actual damage caused to the employer in full.

3. Execution of a court decision on executive documents

The employer is obliged, and the employee is not entitled to prevent the employer from withholding from wages the amounts indicated in the executive documents issued on the basis of a court decision (verdict).

The amount of deductions from wages is calculated from the amount remaining after deducting taxes. In this case, deduction and deduction are summed up. Their amount should not exceed 20 (50, 70) percent of earnings.

Important! As an exception to the general rule, deductions can be up to 70 percent of earnings if:

Serving by an employee of correctional labor,

serving correctional labor by an employee

recovery of maintenance for minor children,

compensation for harm caused to the health of another person,

compensation for harm to persons who have suffered damage in connection with the death of the breadwinner,

compensation for the damage caused by the crime.

Important! The employer is prohibited from deducting from the following payments due to the employee (part 4 of article 138 of the Labor Code of the Russian Federation, paragraph 8 of part 1 of article 101 of the Federal Law “On Enforcement Proceedings):

Amounts of money for damages

payments in connection with a business trip, with transfer, admission or assignment to work in another locality;

payments in connection with the wear and tear of a tool belonging to an employee;

amounts of money paid by the organization in connection with the birth of a child;

amounts of money paid by the organization in connection with the registration of marriage;

sums of money paid by the organization in connection with the death of relatives.

4. Deductions from wages to fulfill the duty of a tax agent

The tax agent (employer) is obliged to withhold the accrued amount of tax directly from the income of the taxpayer (employee) when they are actually paid.

Important! The tax amount should not exceed 50 percent of the payment amount.

The total amount of tax withholding must not exceed 20 percent of wages.

5. Deductions from wages at the will of the employee

Important! The employee has the right to apply to the employer with a statement on the production of deductions from his wages. The will of the employee must be expressed in writing.

If there is an employee's application for the transfer of the amounts withheld from his salary as trade union membership dues, the employer does not have the right to refuse him this.

Important! The employer is not entitled to charge an employee a fee for the transfer of trade union membership dues.

The procedure for transferring trade union dues is determined by the collective agreement, agreement.

Important! The employer is obliged to transfer trade union membership dues on a monthly basis and in a timely manner.

The employee has the right to apply to the employer with an application for deduction from wages and the subsequent direction of the withheld funds for other purposes - repaying a loan, paying for studies, etc. Unlike trade union dues, the employer is not obliged to impose any additional obligations on its accounting department in this regard, however, it can do this on the basis of an agreement with the employee

PROCEDURE FOR CALCULATION OF THE AVERAGE WAGE FOR PAYING VACATION AND PAYING COMPENSATION FOR UNUSED VACATION

To calculate the average wage, all types of payments provided for by the wage system applied by the relevant employer are taken into account, regardless of the sources of these payments.

To calculate the average earnings, social payments and other payments not related to wages (material assistance, payment of the cost of food, travel, education, utilities, recreation, and others) are not taken into account.

When calculating average earnings for vacations, calendar days are taken into account, not working days.

Important! When calculating the average wage for vacation pay and compensation for unused vacation, the average daily wage is used. The average earnings of an employee is determined by multiplying the average daily earnings by the number of calendar days in the payable period.

The number of calendar days in the accounting period is derived on the basis of the Production calendar for a particular year.

Important! The average daily earnings for vacation pay and compensation for unused vacation are calculated for the last 12 calendar months (billing period).

In this case, the calendar month is the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

The specified period does not include time and amounts accrued during this time if:

a) the employee retained the average salary in accordance with the legislation of the Russian Federation, with the exception of breaks for feeding the child;

b) the employee received temporary disability benefits or maternity benefits;

c) the employee did not work due to downtime through no fault of his own;

d) the employee did not participate in the strike, but due to this strike he was unable to perform his work;

e) the employee was provided with additional paid days off to care for disabled children and those disabled since childhood;

f) the employee was otherwise released from work with full or partial retention of wages or without pay.0

IN important! The monthly premium accrued in the billing period is included in the calculation one by one for each bonus indicator for each month of the billing period.

Premiums for a period of more than a month, but not more than the billing period, accrued in the billing period, are included in the calculation one for each indicator.

The premium for a period greater than the calculated one, accrued in the billing period, is included in the calculation in the amount of the monthly part for each indicator for each month of the billing period.

The bonus at the end of the year is included in the calculation if it is accrued for the year preceding the period for which the average earnings are maintained. It does not matter whether this premium was accrued in the billing period or after it.

If the billing period has not been fully worked out, then bonuses accrued taking into account the time actually worked in the billing period are included in the calculation in full. At the same time, bonuses accrued without taking into account the hours actually worked are taken into account in an amount proportional to the time worked in the billing period.

Important! Average daily earnings (payments involved in the calculation of average earnings) are subject to indexation if salaries have been increased for all employees of the organization or structural unit (branch, department, workshop, etc.) in which the employee works.

At the same time, premiums and other additional payments established by:

In the range of values (for example, from 10% to 30% of salary);

in absolute terms (for example, 10,000 rubles);

not to salaries (for example, 2 percent of sales).

Payments are indexed by a coefficient, which is calculated according to the following formula: Coefficient = (Salary after indexation) / (Salary before indexation)

Important! If in the last 12 calendar months the employee did not have actually accrued wages or actually worked days, or this period consisted of time excluded from the billing period, the wages accrued for the previous 12 calendar months are used to calculate the average earnings.

If the employee goes on vacation in the first month of work, then the average daily earnings are calculated for the period from the first day of work to the start of the vacation.

If the employee did not have actually accrued wages or actually worked days for the 12 calendar months preceding the billing period, the average earnings are determined based on the tariff rate, salary (official salary) established for him.

Average earnings for vacation pay and compensation for unused vacation are calculated using the following formula:

SZ \u003d SDZ × DO,

Where:

SZ - average earnings;

SDZ - average daily earnings;

TO - the number of vacation days, incl. unused.

The average daily earnings to pay for vacation provided in calendar days is calculated according to the following formula (including when working on a part-time basis):

Average daily earnings \u003d (Salary for the billing period) / (Number of days in the billing period)

The formula for calculating the number of days in a fully worked billing period is as follows:

Number of days worked = 12 × 29.3

The formula for calculating the number of days in an incomplete month of the billing period is as follows:

OD \u003d DOV / (KD × 29.3),

Where:

OD - the number of days worked;

DOV - the number of calendar days falling on the hours worked in a given month *;

CD - the number of calendar days in a month.

* Calendar days are not included when the employee:

I was on vacation;

was on sick leave or on a business trip;

for other reasons, he was released from work while maintaining average earnings (for example, he was provided with additional days off to care for a disabled child).

The average daily earnings to pay for the vacation provided in working days is calculated according to the following formula (including when working on a part-time basis):

Average daily earnings =(Salary for the billing period)/(〖Number of days worked〗^*)

* The number of days worked is calculated according to the 6-day working week calendar.

Compensation for unused vacation is calculated according to the following formula:

Compensation=((KM×O)/12-IDO)×SDZ,

Where:

KM - the number of months of work included in the length of service, giving the right to leave *;

О - the duration of the leave established for the employee in accordance with labor legislation and local acts of the employer (or "established for the employee by the employment contract");

IDO - the number of vacation days used by the employee from the moment of employment;

SDZ - average daily earnings.

* The length of service giving the right to the annual basic paid leave includes:

Actual work time;

the time when the employee did not actually work, but the place of work (position) was retained for him, including the time of annual paid leave, non-working holidays, weekends and other days of rest;

time of forced absenteeism in case of illegal dismissal or removal from work and subsequent reinstatement at the previous job;

the period of suspension from work of an employee who has not passed a mandatory medical examination through no fault of his own;

time of unpaid leave granted at the request of the employee, not exceeding 14 calendar days during the working year.

The length of service giving the right to annual additional paid leave for work with harmful and (or) dangerous working conditions includes only the time actually worked in the relevant conditions.

Important! The collective agreement, local normative act may also provide for other periods for calculating the average wage, if this does not worsen the position of employees.

Compensation for unused vacation and vacation pay are treated equally. A difference in the amount may arise if the period for granting leave and the period for which compensation is calculated are different. For example, leave is granted in February and compensation is paid in November. Since earnings during the year may vary, the average daily earnings in February and November of the same year may be different.

EXPLANATORY WORK

Pay for work on a day off

Question:

How should work on weekends and holidays be paid in accordance with the amendments made by Federal Law No. 125-FZ of June 18, 2017 “On Amendments to the Labor Code of the Russian Federation” to Article 153 of the Labor Code of the Russian Federation? Is it possible for an employee to choose a single daily rate and an additional day of rest instead of paying double for his work when working on weekends and holidays?

Answer:

As a general rule, work on weekends and holidays is still paid at least double the amount.

Work on a weekend or non-working holiday may still be compensated by providing another day of rest with the consent of the employee. In this case, work on a weekend or non-working holiday is paid in a single amount, and the day of rest is not subject to payment.

Legal rationale:

In accordance with Art. 153 of the Labor Code of the Russian Federation, work on a weekend or a non-working holiday is paid at least twice the amount:

Pieceworkers - not less than double piecework rates;

employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) per day or hour of work) in excess of the salary (official salary), if work on a weekend or non-working holiday was carried out within monthly norm of working hours, and in the amount of at least double the daily or hourly rate (part of the salary (official salary) per day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly norm of working hours.

Specific amounts of remuneration for work on a weekend or non-working holiday may be established by a collective agreement, a local normative act adopted taking into account the opinion of the representative body of workers, and an employment contract.

An increased amount of payment is made to all employees for the hours actually worked on a weekend or non-working holiday. If part of the working day (shift) falls on a weekend or non-working holiday, the hours actually worked on the weekend or non-working holiday (from 0 hours to 24 hours) are paid at an increased rate.

According to part 4 of Art. 153 of the Labor Code of the Russian Federation, at the request of an employee who worked on a weekend or non-working holiday, he may be given another day of rest. In this case, work on a weekend or non-working holiday is paid in a single amount, and the day of rest is not subject to payment.

Establishment of an allowance for combination

Question:

Employee A is accepted as an auxiliary worker, receives a salary of 10,000 rubles. Employee B is accepted as a digger, receives a salary of 9000. Both employee A and employee B combine the profession of a slinger, the content and amount of work in the combined profession are the same for employees. For the performance of additional work, employees are given an additional payment of 10% of the official salary for the main job; that is, for combining the profession of a slinger, employee A receives 1000 rubles, and employee B - 9000. Art. 151 of the Labor Code of the Russian Federation establishes that the amount of the additional payment is established by agreement of the parties to the employment contract, taking into account the content and (or) volume of additional work. Should the size of the additional payment for employee A and employee B be the same with the same content and volume of additional work, is this a violation?

Answer:

Yes, it should, in the described situation, the amount of additional payment for performing additional work in the profession of a slinger should be the same for workers, since they perform the same amount of work.

Legal rationale:

According to Part 1 of Art. 60.2 of the Labor Code of the Russian Federation, with the written consent of the employee, he may be entrusted with the performance during the established duration of the working day (shift), along with the work determined by the employment contract, additional work in another or the same profession (position) for additional payment (Article 151 of the Labor Code of the Russian Federation).

Additional work entrusted to an employee in another profession (position) can be carried out by combining professions (positions) (part 2 of article 60.2 of the Labor Code of the Russian Federation).

In accordance with Art. 151 of the Labor Code of the Russian Federation, when combining professions (positions), an additional payment is made to the employee.

The amount of the additional payment is established by agreement of the parties to the employment contract, taking into account the content and (or) volume of additional work (Article 60.2 of the Labor Code of the Russian Federation).

According to part 2 of Art. 132 of the Labor Code of the Russian Federation prohibits any kind of discrimination when establishing and changing the conditions of remuneration.

Issuing an order for a combination allowance

Question:

An employment contract has been concluded with the employee, which immediately states that, along with the main job, the employee combines work in a second position. For combining an employee with an employment contract, an additional payment of 10% of the salary for the main position is established. The organization uses a unified form of employment order. Is it necessary in this case to indicate the additional payment for the combined position in the line “surcharge”? And how to indicate it if the form involves indicating the amount in numbers, and the employment contract indicates the payment as a percentage?

Answer:

The employer should issue a separate combination order, which will indicate the nature of the additional work, the period and amount of payment.

In the order for employment, it is not necessary to indicate the additional payment for the combined position.

Legal rationale:

According to Art. 60.2 of the Labor Code of the Russian Federation, with the written consent of the employee, he may be entrusted with the performance during the established duration of the working day (shift), along with the work determined by the employment contract, additional work in another or the same profession (position) for additional payment (Article 151 of the Code).

Additional work assigned to an employee in another profession (position) may be carried out by combining professions (positions). Additional work assigned to an employee in the same profession (position) can be carried out by expanding service areas, increasing the volume of work. In order to perform the duties of a temporarily absent employee without being released from work specified in the employment contract, the employee may be entrusted with additional work both in another profession and in the same profession (position).

The period during which the employee will perform additional work, its content and volume are established by the employer with the written consent of the employee.

The employee has the right to early refuse to perform additional work, and the employer - to cancel the order to perform it ahead of schedule, notifying the other party in writing no later than three working days.

In accordance with Art. 151 of the Labor Code of the Russian Federation when combining professions (positions), expanding service areas, increasing the volume of work or performing the duties of a temporarily absent employee without exemption from work specified in the employment contract, the employee is paid an additional payment.

The amount of additional payment is established by agreement of the parties to the employment contract, taking into account the content and (or) volume of additional work (Article 60.2 of the Code).

Inclusion of the district coefficient in the composition of the salary

Question:

Is the wording in the concluded employment contract correct that the established salary of 40,000 includes the district coefficient? After all, the salary is a fixed amount of wages for an employee without taking into account compensatory, incentive and social payments, that is, the district coefficient is not a component that forms the salary of an employee? In the issued payslip in the payroll there is no district coefficient line, only the above salary and bonus, so it is not charged?

Answer:

1. No, illegal. If a salary system is established for an employee with the application of a regional coefficient to wages, then the amount of salary and the regional coefficient in the employment contract must be indicated separately.

2. The regional coefficient should not be included in the employee's salary.

3. If the organization applies a regional coefficient to wages, then the payslip must have a separate line indicating the size of the coefficient.

Legal rationale:

According to par. 5 hours 2 tbsp. 57 of the Labor Code of the Russian Federation, the terms of remuneration (including the size of the tariff rate or salary (official salary) of an employee, additional payments, allowances and incentive payments) are mandatory conditions for inclusion in an employment contract.

In accordance with Part 1 of Art. 135 of the Labor Code of the Russian Federation, the salary for an employee is established by an employment contract in accordance with the remuneration systems in force for this employer.

According to Part 1 of Art. 129 of the Labor Code of the Russian Federation wages (remuneration of an employee) - remuneration for work depending on the qualifications of the employee, the complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions that deviate from normal, work in special climatic conditions and in territories exposed to radioactive contamination, and other payments of a compensatory nature) and incentive payments (additional payments and allowances of a stimulating nature, bonuses and other incentive payments).

Salary (official salary) - a fixed amount of remuneration of an employee for the performance of labor (official) duties of a certain complexity for a calendar month, excluding compensation, incentives and social payments (part 4 of article 129 of the Labor Code of the Russian Federation).

In accordance with Part 1 of Art. 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to notify in writing each employee:

1) on the components of wages due to him for the relevant period;

2) on the amount of other amounts accrued to the employee, including monetary compensation for violation by the employer of the established deadline, respectively, payment of wages, vacation pay, payments upon dismissal and (or) other payments due to the employee;

3) on the amount and grounds for the deductions made;

4) on the total amount of money to be paid.

Average earnings upon dismissal due to staff reduction

Question:

The employee was laid off on June 07, 2017. On September 12, 2017, he applied to the organization for the payment of earnings for the third month. Documents confirming the right to pay wages for the third month (work book and passport) were provided to the accounting department, and a certificate from the Employment Center on employment was transferred to the chief accountant, but the employee has not received the money so far. How long does it take for the organization to pay?

Answer:

The average salary retained by the employee for the second and third months after the dismissal due to the reduction in the number or staff of the organization is paid to the employee after the corresponding month on the next day after his application, set in the organization for payment of wages.

Legal rationale:

In accordance with Part 1 of Art. 178 of the Labor Code of the Russian Federation upon termination of an employment contract due to a reduction in the number or staff of employees of the organization, the dismissed employee is paid a severance pay in the amount of the average monthly salary, and he also retains the average monthly salary for the period of employment, but not more than two months from the date of dismissal (with offset severance pay).

In exceptional cases, the average monthly salary is retained by the dismissed employee for the third month from the date of dismissal by decision of the public employment service agency, provided that the employee applied to this agency within two weeks after the dismissal and was not employed by him (part 2 of article 178 of the Labor Code RF).

According to clause 12 of the Regulations on the procedure for the release, employment of workers and employees and the provision of benefits and compensation to them, approved by the Decree of the USSR State Labor Committee, the Secretariat of the All-Union Central Council of Trade Unions dated 02.03.1988 N 113 / 6-64, payment of the retained average earnings for the period of employment is made after the dismissal of the employee as before place of work on the days of issuance of wages at this enterprise upon presentation of a passport and work book, and for the third month from the date of dismissal - and a certificate from the employment authority (except for persons dismissed in connection with the reorganization or liquidation of the enterprise).

Until laws and other regulatory legal acts in force on the territory of the Russian Federation are brought into line with the Labor Code of the Russian Federation, laws and other legal acts of the Russian Federation, as well as legislative and other regulatory legal acts of the former USSR, in force on the territory of the Russian Federation within the limits and in the manner , which are provided for by the Constitution of the Russian Federation, Resolution of the Supreme Council of the RSFSR of December 12, 1991 N 2014-1 "On ratification of the Agreement on the establishment of the Commonwealth of Independent States", are applied insofar as they do not contradict the Labor Code of the Russian Federation (part 1 of article 423 of the Labor Code of the Russian Federation) .

What are night hours?

In order to answer this question, one must refer to Article 96 of the Labor Code, which deals with night work. Part one talks about what hour the night time starts and when it ends. Time frames are formed from 22:00 to 6:00 in the morning. In this case, the duration of the shift should be reduced by 1 hour. Working off and debts to the employer are excluded. The duration of the shift should not be reduced if this is established by the contract, if the shift is already reduced, or if the employee is hired for night work, that is, all his shifts are night shifts without going to work during the day.

Positives and negatives for the employee

Such a phenomenon as working at night has its drawbacks and advantages in comparison with the general order. The advantages, of course, include an increased rate and an increase in wages, a free day during which you can devote yourself to children, family, other things, it is possible to combine it with another job. At night, contact with the management is reduced to a minimum, it is unlikely that the boss will go at night in order to check the quality of the work being done.

However, there are significant disadvantages that the employee must also take into account. Firstly, this is a violation of the sleep schedule, which means problems with health and condition. A different work schedule for members of the same family creates problems in communication, communication and joint household management. And of course, unproductiveness after a night shift during the day. This provision especially applies to those situations where the employee performs hard physical labor. The forces of the body will run out, the mood will deteriorate, and productivity during the day will be reduced to zero.

Who is not allowed to work at night?

To answer the question of how night hours are paid, you need to understand in detail what it is and what are the exceptions. If we have decided on the concept, then we did not mention exceptions earlier. There are categories of people who under no circumstances can be involved in work at night:

Women who are expecting a baby - pregnant women are strictly forbidden to work at night, regardless of how long they are.

Underage workers - for normal development, children need a full and healthy sleep, which is why they are also prohibited from working at night at the legislative level.

These categories may be involved in night work hours only if they are involved in the development or staging of works of art. In this case, the consent of the employee is considered a prerequisite.

Night work with consent

In addition to these categories of workers, there are those who can be involved in labor only with consent. It must be recorded in writing, this is a requirement of the law, the violation of which is unacceptable. These categories include the following groups of people:

Women who have children under the age of 3 in their care.

People with disabilities are people with disabilities.

Employees with children with disabilities. This is not only about women, but also about men.

Employees who have certain family obligations - caring for sick or infirm relatives.

Employees who raise children under 5 years of age on their own, that is, there is no spouse. Here again we are talking about both men and women.

People who have children under the age of 5 in their care. The emphasis is on guardianship, that is, persons must be guardians.

When employing representatives of such categories of the population, the employer must take into account the health and capabilities of people. If there are contraindications or restrictions on work, it is not advisable to involve such people.

Right of withdrawal

An important nuance is the right of the employee to refuse to perform this type of work. The employer is obliged to explain to the ward why he can refuse to go to work between 22:00 and 06:00. As a result, the employee draws a conclusion and makes a decision. In writing, he must confirm that he agrees to work and does not use the right of refusal.

The Supreme Court has repeatedly pointed out in its rulings that refusing to work at night is not a misdemeanor, it is a legitimate choice of a person. That is why the employer is not entitled to bring to disciplinary responsibility, impose a fine, deprive bonuses, reprimand or do anything else.

General rule of wages

How are night hours paid? Due to the fact that night work is more difficult than day work, and also that it affects the health of citizens, the legislator has established additional payments for those who go to work at night. In general, the surcharge for night time is regulated by a collective agreement, a local act that is valid in a certain area, or taking into account the opinion of the employee. Article 154 only indicates the minimum threshold for additional payments, showing that the employer cannot establish payments below this threshold. The minimum wage increase is 20% of the hourly wage for each hour. That is, the amount of wages in the daytime per hour is taken, 20% is calculated and added to the original wage.

Increasing the amount of surcharges

We have established how night hours are paid according to the general rule, but is it valid on the territory of the Russian Federation or is the norm higher? Analyzing modern statements, we can say that there is a practice of raising the threshold for additional payments from 20 to 40%. Most employers pay extra for night shifts at exactly this rate, but we recall that this is not established by the Labor Code. Specialists and scientists emphasize that the payment for night hours according to the Labor Code is minimal, while the maximum sizes are not set. That is, the legislator gives this right to local, local levels. Often this issue is discussed at the conclusion of an employment contract, a collective agreement.

On the territory of the USSR, there was a decree that established, on the contrary, the maximum amount of extra pay for night shifts. In the modern world, the legislator has taken a different path and sets only limits on the minimum size, while the maximum can reach 100%, it all depends on the agreement between the employer and the employee or on a local act.

The practice of national football associations, subsidiaries of FIFA, the federal football union is interesting. All the labor activity of these enterprises was concentrated on holding the Confederations Cup, which was held in 2017, and the World Cup in 2018. In this area, the specific amount of wages for night shifts was established by the collective agreement. This is primarily due to the fact that this area of activity has its own details and nuances that simply cannot be reflected in the Code or other law. To this end, in many areas and areas of work, their local acts are actively operating.

Shift work

In practice, there are often such working conditions as a shift schedule with night hours. How to calculate the amount of payment in this case? As we noted earlier, surcharges are calculated separately for each hour, and then summed up. This system is not so convenient when it comes to professions in which the employee regularly or constantly works at night. For example, night watchmen are paid using a shift rate that already takes into account night work and fixes the amount of pay.

What is a table?

In planning the duration and remuneration of an employee, the employer is obliged to keep special records. This obligation is imposed on him by the law in article 91. There are several forms of time sheets, the most common of which are those that record the length of the working day and the amount of wages. Such time sheets must be maintained by individual entrepreneurs, government organizations or any other enterprises. The report card separately notes each day when the employee worked, and at the end of the month everything is summed up and wages are paid.

Data entry

Night hours in the report card differ in their characteristics. The duration of work in a given period of time is marked in the timesheet with the code "H", otherwise it can be indicated by the numbers "02". The line is marked with these pointers, and below the number of hours that the employee works on a particular day is fixed. In this case, not only hours, but also minutes are indicated. There are cases when a person has processed the daily norm and "enters" the night one for 1.5 hours, then they should be noted in the report card. At the end of the month, the calculation takes place and the amount of the surcharge is calculated.

Night shifts and holidays, weekends

The amounts of payment for night working hours and weekends, holidays have some difference, so let's figure out what to do if these categories match. The key word in holidays and weekends is the day, that is, at such a rate, the daytime from 6 am to 00 pm is paid. Time from 00:00 to 06:00 in the morning is paid at the night rate. These calculations are very important, because for going to work on a day off, the rate rises from 20% to 100% plus the original cost.

Night hours in 24-hour businesses

In the modern world, 24-hour convenience stores are opening more and more often, which work 24 hours 7 days a week. At the same time, an employer who arranges an employee to work in such a store must know how night hours are paid. In this case, it is advisable to apply the tariff rule, that is, to set a separate fee for the night shift in advance. This is convenient, first of all, because the duration of the shifts is always fixed, there will be no need to constantly calculate the number of hours and the rate. It is necessary to set the tariff in advance and include all the data in the time sheet, which we mentioned earlier. This is the peculiarity of wages in a convenience store. This applies not only to the latter, but also to any enterprise that operates both at night and during the day.

It is necessary to distinguish between multi-shift and non-shift mode. The latter includes situations where an employee has a divided working day into evening and daytime, one-time daily duty, episodic going to work, regardless of the time of day. The first type includes constant work on the night shift.

Calculation examples

In order to understand in practice how night shifts are paid according to the Labor Code, we will give one example.

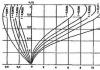

The salary of an employee for a month of work is exactly 75,000 rubles. At the same time, he works 5 days a week, every day at work he spends no more than 8 hours. First of all, we calculate how many hours an employee works per week. We multiply 8 and 5, we get 40 hours a week.

The following situation occurs. In September, the employee began working at night at the request of the supervisor. He worked until 00 hours once a month. According to the production calendar, the normal duration of work per month is 176 hours. We divide the salary by the number of hours and get the amount of payment per hour - 426.14 rubles. We calculate a surcharge of 20% and get 85.22 rubles. Let's summarize - it turns out 511.4 rubles. We multiply by 2 and get the amount of the allowance to the monthly salary - 1,022.73 rubles.

When performing work of various qualifications, the labor of workers - modern workers, as well as employees, is paid for work of a higher qualification

The labor of trade workers is usually paid according to the rates of the work performed. In the case when trade workers are entrusted with the performance of work rated below the grades assigned to the workers, workers performing such work may be paid an inter-class difference. The amount of the inter-class difference and conditions its payments are established by collective agreements (Art. 104 of the Labor Code of the Ukrainian SSR; Art. 86 of the Labor Code of the RSFSR)

How is temporary work paid? Temporary replacement is the performance of duties in the position of a temporarily absent employee, caused by production necessity

The substitute employee is paid the difference between his actual salary (official, personal) and the official salary of the replaced employee (without personal allowance).

Payment of the difference in salaries can be made under the simultaneous presence of the following conditions:

1 If the replacement employee is not a full-time deputy or assistant to the absent employee (in the absence of a deputy position). If the head has several assistants, then the first, senior assistant is considered to be a full-time deputy.

2. If the replacement lasted more than 12 working days in a row (due to the transition to a 5-day working week, this period is determined by the calendar, not the schedule).

The chief engineer of an enterprise, institution or organization does not have the right to receive a difference in salaries during the period of temporary replacement of an absent head

Temporary deputies are rewarded under the conditions and in the amount established for the position of the replaced employee, while the bonus is accrued on the official salary of the deputy. No bonus is accrued for the difference in salaries

The appointment of an employee, including a full-time assistant, deputy or chief engineer, as acting in a vacant position is considered a transfer to another job with the consent of the employee, with all the ensuing legal consequences

When a worker is temporarily assigned the duties of a foreman, technician, accountant or other employee, remuneration is made according to work of the highest qualification. In this case, the worker receives a salary and a bonus based on the work actually performed. If the payment for this work is lower than the average earnings for the main work of the worker, then he is paid an additional payment up to the average earnings (clarification of the State Committee of the Council of Ministers of the USSR on labor and wages and the All-Union Central Council of Trade Unions of December 29, 1965 "On the procedure for paying for temporary replacement." Byul State Committee, 1966, No. 3).

The legislation does not establish a deadline for replacing One employee with another, if the replaced employee retains his position.

How is work paid during a temporary transfer to another job? Temporary transfer of an employee to another job, regardless of his consent, is allowed in such cases: in case of production necessity; when idle; as a disciplinary action. The transfer order shall indicate the reason and term for the transfer.

In case of production necessity, the administration has the right to transfer workers and employees for a period of up to 1 month to work not stipulated by an employment contract at the same enterprise, institution, organization or at another enterprise, institution, organization, but in the same area with remuneration for work performed , but not lower than the average earnings in the previous job.

Such a transfer is allowed to prevent or eliminate a natural disaster, industrial accident or immediately eliminate their consequences in order to prevent accidents, downtime, death or damage to public property and in other exceptional cases, as well as to replace an absent employee.

When transferred to a lower-paid job due to downtime, workers and employees who meet production standards retain their average earnings from their previous jobs, and workers and employees who do not comply with the norms, or transferred to time-paid work, retain their tariff rate (salary) (Art. 14 Fundamentals of Labor Legislation; Articles 33, 34 of the Labor Code of the Ukrainian SSR; Articles 26, 27 of the Labor Code of the RSFSR).

Transfer to another temporary job may take place at the initiative of the employee in connection with the state of health. In this case, the law establishes appropriate guarantees that do not allow the deterioration of the financial situation of workers.

In accordance with Art. 66 of the Fundamentals of Labor Legislation for workers and employees who, for health reasons, need to be provided with easier work, the administration is obliged to transfer, with their consent, to such work in accordance with a medical report temporarily or without a time limit

When transferring for health reasons to an easier lower-paid job, workers and employees retain their previous average earnings for 2 weeks from the date of transfer, and in cases provided for by the legislation of the USSR and Union republics, the former average earnings are retained for the entire period of performance of lower-paid work or payment of state social insurance benefits