The procedure for collecting and returning personal income tax is regulated by Article 231 of the Tax Code of the Russian Federation. Taxpayers have many questions, so we will dwell on the most common cases, and also give recommendations on how to reflect actions for recalculation, collection and return of personal income tax in the programs of the 1C: Enterprise 8 system.

Additional tax assessment

The current rules for collecting personal income tax have not changed. Consequently, if for some reason the tax agent did not withhold personal income tax from the income of an individual or did not withhold the tax in full, then the missing amounts must be recovered from the taxpayer. Tax may be under withheld for the following reasons:

- by mistake if you provided an extra deduction or incorrectly indicated the income code;

- there was a recalculation for the previous period, and income increased;

- the individual has lost his tax resident status.

If the employee continues to work and receive income, then after correcting the error, recalculation or change of status, during the next personal income tax calculation in the accounting programs of the 1C: Enterprise 8 system, the missing amount will be automatically calculated and withheld.

If non-payment of tax is discovered when there is no way to withhold the tax (if the employee quits or the tax period has ended), then the organization will not be able to collect personal income tax. Paragraph 5 of Article 226 of the Tax Code of the Russian Federation states that if it is impossible to withhold from the taxpayer the calculated amount of personal income tax, the tax agent is obliged to inform the taxpayer and the tax authority at the place of his registration in writing about this and the amount of tax using a certificate of form 2-NDFL, approved by order of the Federal Tax Service of Russia dated 11/17/2010 No. ММВ-7-3/611@.

To do this, you need to generate a 2-NDFL certificate in the program in paper or electronic form and send it to the taxpayer and the tax authority at your place of registration. For 2011 cases, this must be completed no later than January 31, 2012.

Personal income tax refund

Tax may be overcharged for the same reasons as undercharged.

The general procedure for the return and offset of overpaid and collected taxes is established by 79 of the Tax Code of the Russian Federation. The new version of paragraph 1 of Article 231 of the Tax Code of the Russian Federation (came into force on January 1, 2011) clarified the rules for the return of personal income tax to an individual from whom the tax agent, for any reason, withheld excessive tax.

If the reason for over-withheld tax is a changed state of deductions or income, then from the beginning of the current year the tax agent is obliged to inform the individual from whom he previously over-withheld tax about each such fact within 10 business days from the day when the agent became aware of it. In this case, the excessively withheld amount of personal income tax is indicated. The form of the message is not regulated and can be arbitrary.

The amount of tax withheld in excess is subject to refund based on a written application from the taxpayer (paragraph 1 of Article 231 of the Tax Code of the Russian Federation). Therefore, we recommend that tax agents (employers) include a phrase in their message about the need to write such a statement. It should also be noted that the refund of the overly withheld tax amount to the taxpayer is possible only in non-cash form. Therefore, the taxpayer’s application must indicate the bank account to which the funds due to him should be transferred.

The message can be given to the taxpayer or sent by mail.

The requirement that appeared last year in the Tax Code of the Russian Federation to promptly inform the taxpayer about the existing overpayment of tax is not accompanied by regulations for recording the fact of detection of excessive withholding of personal income tax from the taxpayer’s income. The liability of the tax agent for failure to inform the taxpayer is also not provided for.

Having received an application from the taxpayer for the return of the excessively withheld amount of personal income tax, the employer decides from what funds it will be returned. The refund is possible at the expense of personal income tax amounts subject to transfer to the budget system of the Russian Federation on account of upcoming payments both for this taxpayer and for other taxpayers from whose income the agent withholds tax (paragraph 3, clause 1, article 231 of the Tax Code of the Russian Federation). The method for making a refund is selected based on the amount of tax being refunded and the deadline set for its refund. The agent must return the tax to the taxpayer within three months from the date of receipt of the relevant application from the taxpayer. Since the beginning of this year, the tax agent has been legally granted the right to refund overpaid tax at his own expense, without waiting for funds to be received from the tax authority (paragraph 9, clause 1, article 231 of the Tax Code of the Russian Federation). However, the Russian Ministry of Finance has repeatedly reminded (letters from the Russian Ministry of Finance dated May 11, 2010 No. 03-04-06/9-94, dated August 25, 2009 No. 03-04-06-01/222) that it is necessary to refund personal income tax only at the expense of tax amounts , withheld from payments of this individual.

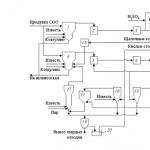

In order to return personal income tax in 1C:Enterprise 8, you need to enter a document into the database Personal income tax return: Desktop of the program “1C: ZUP 8”-> bookmark Taxes and fees -> Personal income tax refund(Fig. 1).

Rice. 1

Based on the submitted document, money should be transferred: Menu Action -> Based on -> Salary to be paid(Fig. 2).

Rice. 2

But please note that there is no liability for failure to inform about over-withheld tax. In addition, an informed employee is not obliged to insist on the return of personal income tax. That is, if the employee continues to work and has not submitted an application for a tax refund, then during the next personal income tax calculations in the 1C:Enterprise 8 programs, the excess accrued amount will automatically be taken into account when calculating personal income tax. The Tax Code of the Russian Federation does not prohibit the continuation of the offset of overly withheld tax in the next tax period. For example, an employee overpaid personal income tax was discovered in December. This situation will occur in 2011 for employees who have a third child or a disabled child. Let us recall that Federal Law No. 330-FZ of November 21, 2011 increased standard deductions for personal income tax for children retroactively, i.e., from January 1, 2011.

If employees submit applications and provide documents stating that the child is disabled or the third in the family, it will be necessary to enter information about these deductions from 01/01/2011 (Fig. 3). Take advantage Assistant for editing deductions for children, to facilitate the replacement of deductions for third and subsequent children. Commands for calling the Assistant on the Desktop of the 1C: Salaries and Personnel Management 8 program -> tab Taxes -> Editing deductions for children and in the menu Taxes and fees.

Rice. 3

If a deduction for a disabled child has already been established, its amount will change automatically. These employees will be overpaid in taxes. Employees may not have time or may not want to submit an application for a personal income tax refund. When submitting the 2-NDFL report to the Federal Tax Service, the tax agent will indicate the amount of the overpayment there. The taxpayer may not apply to the Federal Tax Service for a tax refund. A tax agent - an organization - can continue to count overpayment amounts when making calculations in 2012. This approach is implemented in the 1C:Enterprise 8 programs.

If an overpayment of personal income tax is detected when the employee no longer works for the organization, then the tax agent reports the overpayment of tax at the end of the tax period in the 2-NDFL report to the tax authority and notifies the taxpayer about this, and the taxpayer must receive a refund of the over-withheld amounts. contact the tax office at your place of residence.

Recalculation of taxes when acquiring Russian resident status

An excessively withheld amount of personal income tax also arises in the event of a change in the status of the taxpayer from a non-resident to a resident of the Russian Federation. A non-resident paid personal income tax at a rate of 30%. After an individual is recognized as a tax resident of the Russian Federation, the specified income in accordance with paragraph 1 of Article 224 of the Tax Code of the Russian Federation is subject to taxation at a rate of 13%.

Until 2011, such overpayments were subject to refund. Legislative changes have confused users. The prohibition on the return of overpayment of personal income tax that arose in connection with a change in the taxpayer’s status does not mean that it is not necessary to recalculate the tax at a rate of 13% and take into account the overpayment in the next assessments.

Letters from the Ministry of Finance of Russia dated 08/12/2011 No. 03-04-08/4-146 and the Federal Tax Service of Russia dated 06/09/2011 No. ED-4-3/9150 indicate that the tax agent calculates, withholds and pays personal income tax amounts to the budget system of the Russian Federation with taking into account the tax status of the taxpayer determined on each date of payment of income. Having determined at a certain date the change in the status of a non-resident to the status of a resident, when calculating personal income tax, it takes into account the amounts that were previously accrued at a rate of 30%.

Users of 1C:Enterprise 8 programs do not need to do anything in this case. It is enough to indicate only the change in taxpayer status and the recalculation will be made automatically when calculating personal income tax.

Letter of the Ministry of Finance of Russia dated November 22, 2010 No. 03-04-06/6-273 indicates two cases in which tax refunds can only be made to the Federal Tax Service: change of Russian resident status, property deduction.

If an employee applies to an employer for a property tax deduction not from the first month of the tax period, the deduction is provided starting from the month of application.

A refund of over-withheld tax can be made by the tax authority when the taxpayer submits a tax return to the inspectorate based on the results of the tax period.

The Ministry of Finance repeatedly indicates in its letters that those amounts of tax that were withheld in accordance with the established procedure before receiving the taxpayer’s application for a property tax deduction and the corresponding confirmation from the tax authority are not “excessively withheld.”

However, representatives of the Federal Tax Service of Russia in a letter dated 06/09/2011 No. ED-4-3/9150 indicate that the refund of over-withheld tax when changing the status of a resident of the Russian Federation can be carried out by the tax agent-employer during this tax period.

In a letter from the Ministry of Finance of Russia dated September 28, 2011 N 03-04-06/6-242, Deputy Director of the Department of Tax and Customs Tariff Policy S.V. Razgulin replies that the above letter from the Federal Tax Service is a request to the Ministry of Finance of Russia, to which there were appropriate explanations were given. And the letter of the Ministry of Finance dated August 12, 2011 No. 03-04-08/4-146, which was issued in response to a request from the Federal Tax Service, clearly indicates that in accordance with paragraph 1.1 of Article 231 of the Tax Code of the Russian Federation, the provisions of which came into force on January 1, 2011. , the refund of the amount of personal income tax to the taxpayer in accordance with the status of a resident of the Russian Federation acquired by him is carried out by the tax authority with which he was registered at the place of residence (place of stay). The refund is made when the taxpayer submits a tax return at the end of the specified tax period, as well as documents confirming the status of a tax resident of the Russian Federation in this tax period, in the manner established by Article 78 of the Tax Code of the Russian Federation.

Thus, if an employee of an organization acquires the status of a tax resident of the Russian Federation, the tax amount is refunded based on the results of the tax period by the tax authority.

Users of the 1C:Enterprise 8 programs only need to indicate the date of change of taxpayer status and the recalculation will be made automatically when calculating personal income tax.

In accordance with paragraph 1 of Article 231 of the Tax Code of the Russian Federation, income tax withheld from an employee in excess is returned to him within three months from the date the latter receives the application

An organization (as a tax agent) can return the overpayment of tax to an employee at the expense of the amounts of this tax to be transferred to the budget for upcoming payments, both for the specified taxpayer and for other taxpayers. If the amount of personal income tax to be transferred by the tax agent to the budget is not enough to return the overpayment to the employee, the tax agent must contact his office within 10 days from the date of receipt of the application from the employee. To do this, an application is submitted there for the return of the amount of tax that was excessively withheld from the person.

Please note: only for returns! In our opinion, the amount of personal income tax excessively withheld from taxpayers’ income and transferred to the budget by a tax agent cannot be offset against the performance of this agent’s duties (letter dated November 23, 2010 No. 03-02-07/1-543). The fact is that the tax agent is simply obliged to collect “someone else’s” tax and transfer it to the budget. Therefore, he has no right to offset “someone else’s” tax against his own obligations.

Rules for returning personal income tax to a tax agent

The rules for refunding the amount of overly withheld tax are prescribed in Article 78 of the Tax Code of the Russian Federation. Let's remind them. Overpayment amounts are returned by tax authorities at the place of registration of the tax agent, usually without charging interest on this amount.

To receive a refund of the overpayment, the tax agent must submit an application.

Tax officials indicate that the fact of excessive personal income tax payment must be confirmed. To do this, they need to present evidence: accounting statements, explanations, payroll statements with error corrections. This was also stated in the letter dated April 3, 2009 No. 03-04-06-01/76. This requirement is also supported by judges (resolutions of the FAS Volga District dated May 24, 2010 No. A49-10662/2009, FAS Ural District dated July 22, 2008 No. F09-5055/08-S2).

If the tax agent has arrears on other taxes of the corresponding type or arrears on the corresponding penalties and fines, then the overpayment will be returned to him only after the amount of the overpaid tax is offset against the arrears.

But here the question arises: does this rule apply to the situation with the return of personal income tax? After all, you must agree, we are not talking about the tax agent’s own taxes, but about the tax that he unnecessarily withheld from individuals and must return it to them! However, for example, in the resolution of the Federal Antimonopoly Service of the Far Eastern District dated October 31, 2012 No. F03-4477/2012, the court decided that the above rule is also applicable in cases where an organization has overpaid personal income tax.

In general, an application for a refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount. In this case, the tax authorities must make a decision on the refund within 10 days from the date of receipt of the application.

Tax officials are required to inform the tax agent in writing about the decision made - positive or negative - within five days from the date of adoption of the relevant decision. This message is transmitted to the company personally against a signature or in another way confirming the fact and date of its receipt.

For violation of the deadline for the return of the overpayment, the tax agent is due interest from the refinancing rate in effect on the days of violation of the refund deadline.

Updated 2-NDFL

When recalculating tax in connection with clarification of the tax obligations of an individual, the tax agent, in accordance with Section I of the Recommendations for filling out form 2-NDFL “Certificate of income of an individual for the year 20__”, approved by order dated November 17, 2010 No. MMV-7-3/ 611@, issues a new certificate. In it, in the fields “No.___” and “from___” you should indicate the number of the previously submitted certificate and the new date of preparation of the certificate.

If in the previous period the tax agent withheld tax in excess and then returned the overpayment to the employee, an updated certificate for the specified period is required for this person, correcting paragraphs 5.3-5.5 of the updated certificate in accordance with the indicators formed after the recalculation. Clause 5.6 of the updated certificate is not completed.

Thus, the employer should submit to the tax authorities new certificates in form 2-NDFL for the past year in relation to those employees from whose income personal income tax was excessively withheld and transferred to the budget, as well as an application for a credit or refund of the overpaid tax.

Please note: the deadline for submitting a new, updated certificate in form 2-NDFL is neither the Tax Code of the Russian Federation, nor the order of the Federal Tax Service of Russia No. ММВ-7-3/611@, nor the order of the Federal Tax Service of Russia dated September 16, 2011 No. ММВ-7-3 /576@. Therefore, if the initial certificate in Form 2-NDFL was submitted to the tax authorities in a timely manner, then the employer will not face any penalties for failure to submit (late submission) of a new (updated) certificate in Form 2-NDFL.

Payment of personal income tax to an employee

Before the tax agent returns from the budget the amount of personal income tax that was excessively withheld and transferred from the taxpayer, he has the right to return the overpayment at his own expense.

Let's look at an example of which entries for personal income tax returns should be drawn up by an accountant.

Example

The employee’s taxable income erroneously included the amount of financial assistance paid to him in the amount of 4,000 rubles. As a result, he was overdeducted and transferred to the personal income tax budget in the amount of 520 rubles. (RUB 4,000 x 13%). When this fact was revealed, the employee was returned the overpayment from the travel agency's cash desk, after which she (as a tax agent) received a refund from the budget.

The transactions for the return of personal income tax will be as follows:

DEBIT 70 CREDIT 68 subaccount “Personal Tax Payments”

- 520 rub. - erroneous entry reversed;

DEBIT 51 CREDIT 68 subaccount “Personal Tax Payments”

- 520 rub. - money was returned from the budget.

DEBIT 70 CREDIT 50

- 520 rub. - money was returned to the employee.

Return from the Federal Tax Service of excessively transferred personal income tax

Do not confuse the personal income tax refund that the tax agent makes because he withheld excess from an individual’s income with the case when the withholdings were calculated correctly, but the tax agent made a mistake in the amount of the transfer. This is a completely different situation.

For example, the conflict situation was considered in the resolution of the Federal Antimonopoly Service of the Moscow District dated April 30, 2014 No. F05-3657/2014. The tax authorities refused to return the overpaid personal income tax to the tax agent due to the fact that the fact of overpayment of tax at the expense of the tax agent can only be established based on the results of an on-site audit. However, the judges did not agree with this and decided that since the company submitted to the tax office accounting certificates, payroll statements, balance sheets containing the consolidated amounts of accrued and paid personal income tax, and for the transfer of tax, this is quite sufficient to prove that the company transferred personal income tax in an amount greater than it itself withheld from employees. So the tax authorities must return this overpayment.

A. Anishchenko,

auditor

E.A. answered questions. Sharonova, economist

Personal income tax: we return, withhold, transfer

Errors in calculating personal income tax are very unpleasant; there is too much hassle in correcting them. But the most annoying thing is that even if you yourself identify the error, pay additional tax and penalties and submit updated 2-NDFL certificates (new ones with correct data) to the Federal Tax Service, then, according to the regulatory authorities, this will not exempt you from the fine. And all because the rules of Art. 81 NKs do not work here. After all, an updated 2-NDFL certificate is not an updated calculation and not an updated declaration. True, there is a single court decision in which it stated the following. If the tax agent, before the start of the on-site tax audit, paid additional personal income tax and submitted the correct 2-NDFL certificate, then the conditions for exemption from the fine are met. Resolution of the FAS ZSO dated September 30, 2013 No. A27-17110/2012. But, as you yourself understand, you will most likely have to resolve this issue through the courts.

Now let’s see how organizations should act when identifying errors in personal income tax.

Salary is accrued in the month the error is discovered

A. Kiseleva, Belgorod

In April, I discovered that for February one employee’s salary was incorrectly calculated and accrued - less than necessary. And accordingly, personal income tax was underpaid. How can we now correct the situation so as not to pay fines and penalties?

: Despite the fact that the employee did not receive his salary in February, it is recognized as income in the month of additional accrual - in April clause 2 art. 223 Tax Code of the Russian Federation. An employee of the Ministry of Finance also agrees with this.

FROM AUTHENTIC SOURCES

Advisor to the State Civil Service of the Russian Federation, 1st class

“ Since the organization accrues additional income in the form of wages in April, that is, in the month the error was discovered, the additional accrued amount is April income. Consequently, the organization calculates personal income tax on this income in April clause 3 art. 226 Tax Code of the Russian Federation. The organization must withhold personal income tax from the April salary at the time of its payment. clause 4 art. 226 Tax Code of the Russian Federation. And transfer to the budget no later than the day you receive cash from the bank for its payments clause 6 art. 226 Tax Code of the Russian Federation.

Therefore, if an organization transfers personal income tax to the budget within this period, it will not face any fines or penalties. After all, there will be no reason for this.

An offense for which a fine is provided under Art. 123 of the Tax Code of the Russian Federation, can be imputed to a tax agent only if he had the opportunity to withhold and transfer the appropriate amount, taking into account the fact that the withholding is carried out from funds paid to the taxpayer in clause 21 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57” .

You must return the over-withheld personal income tax even to a former employee

G. Zalukaeva, St. Petersburg

The employee's personal income tax was withheld unnecessarily and transferred to the budget. We cannot refund the tax because the employee has already quit. What to do now with the amount of overpaid tax?

: First of all, within 10 days from the day you discovered excessive personal income tax withholding, you are obliged to inform your former employee about this clause 1 art. 231 Tax Code of the Russian Federation. You can send him a registered letter with return receipt requested to the address that he indicated to you when applying for a job.

If an employee comes to you and asks you to return over-withheld tax, you will be required to do so. clause 1 art. 231 Tax Code of the Russian Federation. As the Ministry of Finance explains, the dismissal of an employee, as well as the period in which the over-withheld tax is refunded, do not in any way affect this duty of the tax agent. Letter of the Ministry of Finance dated December 24, 2012 No. 03-04-05/6-1430.

ATTENTION

You cannot return personal income tax in cash from the cash register. At the same time, liability for the “cash” return of the Tax Code has not been established.

And this year the Constitutional Court agreed with the Ministry of Finance. He pointed out that the Tax Code of the Russian Federation provides for a special (special) procedure for the return of personal income tax over-withheld by a tax agent, which has priority over the general procedure for the return of tax overpayments Determination of the Constitutional Court dated February 17, 2015 No. 262-O. This means that a person cannot apply directly to the Federal Tax Service for a refund of the overpayment, bypassing the tax agent. A citizen can submit an application for the return of excessively withheld personal income tax along with the 3-NDFL declaration directly to the Federal Tax Service only if the tax agent is absent (for example, when it was liquidated) clause 1 art. 231 Tax Code of the Russian Federation.

So you will need to return the overly withheld tax to the employee, regardless of when he contacted you - before submitting the 2-NDFL certificate to the inspectorate or after.

When the employee comes to you, ask him to write a statement in which he must indicate the amount of personal income tax to be returned, the account number and bank details where the money should be transferred. You will have to return the tax within 3 months from the date of receipt of the application. At the same time, by the amount of tax returned to the former employee, you will reduce the amount of personal income tax to be transferred to the budget for other employees. clause 1 art. 231 Tax Code of the Russian Federation.

If the former employee does not show up by the end of the year, then at the end of the year, no later than 04/01/2016, you will submit a 2-NDFL certificate to the Federal Tax Service, where in clause 5.6 you will indicate the amount of excess tax withheld. clause 2 art. 230 Tax Code of the Russian Federation.

And if an employee comes to you after submitting a 2-NDFL certificate for him, then after the tax refund you will have to submit a new (clarifying) 2-NDFL certificate to the Federal Tax Service. In it you will reflect the correct data: on income, deductions, calculated (clause 5.3 of the certificate), withheld (clause 5.4 of the certificate) and transferred (clause 5.5 of the certificate) personal income tax. This certificate will no longer contain excessively withheld tax (clause 5.6 is not completed), and the amounts of personal income tax calculated, withheld and transferred will be equal. Keep in mind that this certificate must indicate the number of the previously submitted 2-NDFL certificate, but the date of preparation - the new one section I Recommendations, approved. By Order of the Federal Tax Service dated November 17, 2010 No. ММВ-7-3/611@ (hereinafter referred to as Order No. ММВ-7-3/611@).

You are required to withhold personal income tax from a working employee

L. Suhoveeva, Moscow

I came to the organization as chief accountant and discovered that an employee was mistakenly provided with a deduction for a child who was already over 30 years old. Probably, the previous accountant entered data taken from the air; there are no documents. When I informed the employee about this, he was indignant and refused to voluntarily return the tax, saying that if I wanted to, I could do it only through the court.

As far as I know, I cannot withhold personal income tax for past periods. Or is it still possible? Do I need to report it to the tax office?

: Actually, your employee is wrong about the court. In ch. 23 of the Tax Code directly states that tax amounts not withheld from employees or not fully withheld are collected from them by the organization itself until the debt is fully repaid and clause 2 art. 231 Tax Code of the Russian Federation. So you simply have to recalculate personal income tax and withhold it from the employee.

Another question is over what period this should be done. When conducting an on-site audit, tax officials have the right to inspect only 3 years preceding the year in which the decision to conduct audits was made and clause 4 art. 89 Tax Code of the Russian Federation. And when they will come to you is unknown.

In this situation, you can recalculate personal income tax for the 3 years preceding the year the error was discovered - 2012, 2013, 2014. As we understand, the error was discovered after submitting 2-NDFL certificates for this employee to the Federal Tax Service. Therefore you need to do this:

- recalculate the tax. If we assume that the employee was provided with an extra child deduction in the amount of 1,400 rubles every month for 3 years, then the total amount of excess deductions will be 50,400 rubles. (12 months x 3 years x 1400 rub.). And the personal income tax underwithheld from this amount will be equal to 6,552 rubles. (RUB 50,400 x 13%);

- inform the employee about the mistake made and the amount of personal income tax that must be withheld from him clause 2 art. 231 Tax Code of the Russian Federation;

- since the employee does not agree to repay the debt voluntarily, then withhold tax from the income paid to him. At the same time, the total amount of personal income tax withheld (tax for the current month + debt) should not exceed 50% of the amount given to the employee in person clause 4 art. 226 Tax Code of the Russian Federation;

- transfer the withheld tax to the budget;

- pay penalties to the budget for the period from the day following the day when personal income tax should have been transferred to the budget until the day of its actual payment, inclusive Art. 75 Tax Code of the Russian Federation;

- after you have withheld the entire personal income tax debt, submit to your Federal Tax Service newly compiled (clarifying) certificates 2-NDFL for this employee section I Recommendations, approved. By Order No. ММВ-7-3/611@. In them you will no longer have child deductions. And the amounts of calculated, withheld and transferred personal income tax will be greater. Moreover, all three personal income tax amounts in the certificates must be the same, since on the date of their submission the tax from the employee has already been withheld and transferred to the budget.

WE TELL THE EMPLOYEE

If an employee was provided with deductions to which he was not entitled, then the employer has the right to independently recalculate the personal income tax and withhold the underpaid amount of tax from the salary.

However, the fact that you submit updated 2-NDFL certificates to the Federal Tax Service and correct everything yourself before the tax authorities come to check you, unfortunately, will not save you from a fine for late transfer of personal income tax and penalties Articles 123, 75 of the Tax Code of the Russian Federation. After all, as the Ministry of Finance explained, exemption from a fine in this case is simply not provided for by the Tax Code Letter of the Ministry of Finance dated February 16, 2015 No. 03-02-07/1/6889. The only thing that can be done is to try to reduce the fine, citing the fact that your mitigating circumstances include correcting the error yourself and paying additional taxes and penalties. subp. 3 p. 1 art. 112 Tax Code of the Russian Federation. Maybe the inspectors will meet you halfway.

A former employee will not be able to withhold additional personal income tax

L. Kozhichkina, Bryansk

In March, when generating personal income tax reporting, I discovered an error: the amount of tax calculated turned out to be greater than the amount of tax withheld and transferred.

I started checking and discovered that for some reason the program did not calculate tax on the amount of sick leave for an employee, which we paid in October. This employee quit in September, and then gave us sick leave in October. Therefore, we cannot withhold personal income tax.

What to do now, what to reflect in the 2-NDFL certificate? What do we face - a fine or just penalties? Until when will penalties be accrued?

: Indeed, this is an unfortunate mistake. But its consequences are even sadder.

Firstly, you had the opportunity to withhold personal income tax when paying benefits, but did not do so. And accordingly, the tax was not transferred to the budget on time. Even though this was a program error, you still face a fine of 20% of the unwithheld personal income tax amount Art. 123 Tax Code of the Russian Federation.

Secondly, since after paying for sick leave, you no longer paid any amounts to the former employee until the end of the year, no later than 02/02/2015 (January 31 is a day off, Saturday) you had to inform your Federal Tax Service about the impossibility of withholding personal income tax clause 5 art. 226, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation. That is, submit a 2-NDFL certificate for it with attribute “2”, where you had to indicate only income in the form of sick leave, as well as the amount calculated (clause 5.3 of the certificate) and non-withheld personal income tax (clause 5.7 of the certificate) pp. 1-3 Orders, approved. By Order of the Federal Tax Service dated September 16, 2011 No. ММВ-7-3/576@;. If you fail to submit the certificate within the prescribed period, you will face a fine of 200 rubles. clause 1 art. 126 Tax Code of the Russian Federation But this does not negate the obligation to present it. By the way, you must send the same certificate to your former employee. Since he will now have to declare the specified income and pay tax on it subp. 4 clause 1, pp. 2-4 tbsp. 228, paragraph 1, art. 229 Tax Code of the Russian Federation.

In addition, the Ministry of Finance and tax authorities believe that you must draw up a regular 2-NDFL certificate for this employee (with the sign “1”), which you submit to the Federal Tax Service no later than 04/01/2015 clause 2 art. 230 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated December 29, 2011 No. 03-04-06/6-363; Federal Tax Service for Moscow dated 03/07/2014 No. 20-15/021334. It must reflect all calculations for the current year, namely all income received by him, all deductions provided, as well as the total amounts of personal income tax - calculated (clause 5.3 of the certificate), withheld (clause 5.4 of the certificate), transferred (clause 5.5 of the certificate) and unretained (clause 5.7 of the certificate) section II Recommendations, approved. By Order No. ММВ-7-3/611@.

Thirdly, for untimely transfer of personal income tax, you face penalties for the period from the moment when you were supposed to withhold and transfer the tax to the budget, and until the due date for its payment by an individual at the end of the tax period. clause 2 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57; Letter of the Federal Tax Service dated August 22, 2014 No. SA-4-7/16692. That is, penalties will have to be paid until July 15, 2015 inclusive clause 4 art. 228 Tax Code of the Russian Federation.

At the same time, you don’t have to pay fines and penalties, since the tax authorities themselves will collect everything from you if they come to check with you. Or maybe it will pass. In addition, when inspectors discover a violation, you can explain that personal income tax was not withheld on time not due to your fault, but due to a glitch in the program. And if the amount of the fine is large, then ask the tax authorities to reduce it, indicating that you yourself corrected the mistake subp. 3 p. 1 art. 112 Tax Code of the Russian Federation. It is possible that this will work.

Due to the transfer of personal income tax to the wrong KBK, fines and penalties are not threatened

M. Baryshnikov, Omsk

I am registered as an individual entrepreneur using the simplified procedure. And 10 months ago I registered as an employer. When registering with the Federal Tax Service, I was given a sample receipt for paying personal income tax for employees, which indicated the following BCC: 182 1 01 02030 01 1000 110. I paid the tax to it in a timely manner for 9 months, when I paid salaries to employees (residents of the Russian Federation).

In January 2015, I decided to clarify whether the BCC had changed since the new year. And I discovered that personal income tax for employees must be transferred to KBC 182 1 01 02010 01 1000 110. The same KBC was in effect in 2014.

It turns out that in 2014 I transferred personal income tax for employees using the wrong BCC. Is there any way to fix this now and what will I face (fines, penalties)?

: Indeed, you transferred personal income tax for your employees to the wrong KBK. After all, on KBK 182 1 01 020 30 01 1000 110 personal income tax must be paid in the case when individuals themselves declare their income in accordance with Art. 228 Tax Code of the Russian Federation Order of the Federal Tax Service dated December 30, 2014 No. ND-7-1/696@.

But, as a specialist from the Ministry of Finance explained, there is nothing wrong with this, everything can be fixed.

FROM AUTHENTIC SOURCES

“The Tax Code provides that if an error is detected in the execution of an order for the transfer of a tax, which does not entail the non-transfer of this tax to the budget system of the Russian Federation to the appropriate account of the Federal Treasury, the taxpayer has the right to submit to the tax authority at the place of his registration a statement of the error with a request to clarify the basis, type and the nature of the payment, tax period or payer status. This application must be accompanied by documents confirming the payment by the taxpayer of the specified tax and its transfer to the budget system of the Russian Federation to the appropriate account of the Federal Treasury. clause 7 art. 45 Tax Code of the Russian Federation.

The procedure for clarifying the BCC can only be carried out within the same tax. In the case under consideration, this is possible, since the entrepreneur transferred personal income tax for employees to the wrong KBK, but also intended for this tax.

Based on the entrepreneur’s application, the tax authority will make a decision to clarify the payment, and will also recalculate (add) penalties automatically accrued to the tax amount Letters of the Ministry of Finance dated July 17, 2013 No. 03-02-07/2/27977; Federal Tax Service dated December 22, 2011 No. ZN-4-1/21889.

Now regarding the application of responsibility. Since the personal income tax was withheld by the entrepreneur and transferred in a timely manner and in full, the tax authority has no grounds for bringing him to tax liability under Art. 123 Tax Code of the Russian Federation.”

Advisor to the State Civil Service of the Russian Federation, 1st class

Article 231 of the Tax Code of the Russian Federation, the personal income tax withheld from an employee in excess is returned to him by the tax agent within three months from the date the latter receives the taxpayer’s application.

An organization (as a tax agent) can return the overpayment of tax to an employee at the expense of the amounts of this tax to be transferred to the budget for upcoming payments, both for the specified taxpayer and for other taxpayers. If the amount of personal income tax to be transferred by the tax agent to the budget is not enough to return the overpayment to the employee, the tax agent must contact his tax office within 10 days from the date of receipt of the application from the employee. To do this, an application is submitted there for a refund of the amount of tax that was excessively withheld from a person.

Please note: only for returns! According to financiers, the amount of personal income tax excessively withheld from taxpayers’ income and transferred to the budget by a tax agent cannot be offset against the fulfillment by this agent of his obligation to pay taxes (letter dated November 23, 2010 No. 03-02-07/1- 543). The fact is that the tax agent is simply obliged to collect “someone else’s” tax and transfer it to the budget. Therefore, he has no right to offset “someone else’s” tax against his own obligations.

Rules for returning personal income tax to a tax agent

The rules for refunding the amount of overly withheld tax are prescribed in Article 78 of the Tax Code of the Russian Federation. Let's remind them. Overpayment amounts are returned by tax authorities at the place of registration of the tax agent, usually without charging interest on this amount.

To receive a refund of the overpayment, the tax agent must submit an application.

Tax officials indicate that the fact of excessive personal income tax payment must be confirmed. To do this, they need to present evidence: accounting statements, explanations, payroll statements with error corrections. This is also stated in the letter of the Ministry of Finance of Russia dated April 3, 2009 No. 03-04-06-01/76. This requirement is also supported by judges (resolutions of the FAS Volga District dated May 24, 2010 No. A49-10662/2009, FAS Ural District dated July 22, 2008 No. F09-5055/08-S2).

If the tax agent has arrears on other taxes of the corresponding type or arrears on the corresponding penalties and fines, then the overpayment will be returned to him only after the amount of the overpaid tax is offset against the arrears.

But here the question arises: does this rule apply to the situation with the return of personal income tax? After all, you must agree, we are not talking about the tax agent’s own taxes, but about the tax that he unnecessarily withheld from individuals and must return it to them! However, for example, in the resolution of the Federal Antimonopoly Service of the Far Eastern District dated October 31, 2012 No. F03-4477/2012, the court decided that the above rule is also applicable in cases where an organization has overpaid personal income tax.

In general, an application for a refund of the amount of overpaid tax can be submitted within three years from the date of payment of the specified amount. In this case, the tax authorities must make a decision on the refund within 10 days from the date of receipt of the application.

Tax officials are required to inform the tax agent in writing about the decision made - positive or negative - within five days from the date of adoption of the relevant decision. This message is transmitted to the head of the company personally against a signature or in another way confirming the fact and date of its receipt.

For violation of the deadline for the return of an overpayment, the tax agent is due interest based on the refinancing rate of the Bank of Russia in effect on the days of violation of the refund deadline.

Updated 2-NDFL

When recalculating tax in connection with clarification of the tax obligations of an individual, the tax agent, in accordance with Section I of the Recommendations for filling out form 2-NDFL “Certificate of income of an individual for the year 20__”, approved by order of the Federal Tax Service of Russia dated November 17, 2010 No. MMV-7- 3/611@, issues a new certificate. In it, in the fields “No.___” and “from___” you should indicate the number of the previously submitted certificate and the new date of preparation of the certificate.

If in the previous period the tax agent withheld tax in excess and then returned the overpayment to the employee, an updated certificate must be issued for this person for the specified period, correcting paragraphs 5.3-5.5 of the updated certificate in accordance with the indicators formed after the recalculation. Clause 5.6 of the updated certificate is not completed.

Thus, the employer should submit to the tax authorities new certificates in form 2-NDFL for the past year in relation to those employees from whose income personal income tax was excessively withheld and transferred to the budget, as well as an application for a credit or refund of the overpaid tax.

Please note: the deadline for submitting a new, updated certificate in form 2-NDFL is not established either by the Tax Code of the Russian Federation, or by order of the Federal Tax Service of Russia No. MMV-7-3/611@, or by order of the Federal Tax Service of Russia dated September 16, 2011 No. MMV-7- 3/576@. Therefore, if the initial certificate in Form 2-NDFL was submitted to the tax authorities on time, then the employer does not face liability for failure to submit (late submission) of a new (updated) certificate in Form 2-NDFL.

Payment of personal income tax to an employee

Before the tax agent returns from the budget the amount of personal income tax that was excessively withheld and transferred from the taxpayer, he has the right to return the overpayment at his own expense.

Let's look at an example of which entries for personal income tax returns should be drawn up by an accountant.

Example

The employee’s taxable income erroneously included the amount of financial assistance paid to him in the amount of 4,000 rubles. As a result, he was overdeducted and transferred to the personal income tax budget in the amount of 520 rubles. (RUB 4,000 x 13%). When this fact was revealed, the employee was returned the overpayment from the travel agency's cash desk, after which she (as a tax agent) received a refund from the budget.

The transactions for the return of personal income tax will be as follows:

DEBIT 70 CREDIT 68 subaccount “Personal Tax Payments”

- 520 rub. - erroneous entry reversed;

DEBIT 51 CREDIT 68 subaccount “Personal Tax Payments”

- 520 rub. - money was returned from the budget.

DEBIT 70 CREDIT 50

- 520 rub. - money was returned to the employee.

Return from the Federal Tax Service of excessively transferred personal income tax

Do not confuse the personal income tax refund that the tax agent makes because he withheld excess from an individual’s income with the case when the withholdings were calculated correctly, but the tax agent made a mistake in the amount of the transfer. This is a completely different situation.

For example, the conflict situation was considered in the resolution of the Federal Antimonopoly Service of the Moscow District dated April 30, 2014 No. F05-3657/2014. The tax authorities refused to return the overpaid personal income tax to the tax agent due to the fact that the fact of overpayment of tax at the expense of the tax agent can only be established based on the results of an on-site audit. However, the judges did not agree with this and decided that since the company submitted to the tax inspectorate accounting certificates, pay slips, balance sheets containing the consolidated amounts of accrued and paid personal income tax, and payment orders for the transfer of tax, then this is quite enough to prove that that the company transferred personal income tax in an amount greater than it itself withheld from employees. So the tax authorities must return this overpayment.

A. Anishchenko,

auditor

A wide variety of errors can occur in the accounting process, and in some cases they result in an employer withholding excessive amounts of taxes from its employees.

Current legislation provides for certain rules for such situations, allowing individuals to return the tax that was excessively withheld from them, but in order to do this, several operations will have to be performed.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

That is why it will be useful for all individuals, including entrepreneurs, to learn about how to return excessively withheld personal income tax.

Legal grounds

In accordance with paragraph 1 of Article 231 of the Tax Code, any individual can contact his company, which has withheld an excessive amount as a tax agent. To do this, fill out an application addressed to the head of the company in any form.

The tax refund is made exclusively to the taxpayer himself, and other persons cannot apply for the specified amount, since this is not provided for by the current tax legislation. Such clarifications are indicated in the letter of the Ministry of Finance No. 03-04-06/7028, published on 03/07/13.

An application for a tax refund by an individual must be submitted within three years from the date of withholding the specified amount, which is stated in paragraph 7 of Article 78 of the Tax Code. It is worth noting that the right to apply for a tax refund can in no way depend on the existence of any employment relationship between the citizen and the company at the time of filing the application.

Thus, you can apply for a refund even after dismissal, but this must be done before the expiration of the period provided for a refund in accordance with current legislation.

If an overpayment is discovered by the company, then, in accordance with paragraph 6 of Article 6.1 of the Tax Code, it must submit a corresponding notification to the taxpayer within ten working days, and the current legislation does not establish exactly how this message should be sent.

Controversial issues

Individuals quite often ask various questions about the practice of returning over-withheld taxes, and many of the situations mentioned are themselves quite controversial.

Is it possible without recourse?

To return the overpayment, the taxpayer must submit a corresponding request to the tax agent, completing the application in writing. The deadline for filing such an application in accordance with paragraph 7 of Article 78 of the Tax Code is three years from the date of assessment of taxes.

It is worth noting the fact that during the application process, the employee will have to indicate a complete list of details of his personal or current account, to which the employer will need to transfer funds, since the overpayment is returned in non-cash form.

In addition, do not forget that the deadline for transferring the overpayment is set at three months, which begins with the submission of the corresponding application.

Upon dismissal

First of all, after discovering an error in the calculation of withheld tax, you need to inform your former employee about the error. For example, you can do this by issuing a registered letter with return receipt requested at the address that was indicated as registration by the citizen during employment.

If a former employee himself comes to the company and asks for a refund of the overly withheld tax amount, the company will also have to do this without fail. As the Ministry of Finance points out, the dismissal of an employee and the period in which the over-withheld tax amount is returned do not in any way affect the specified duty of the authorized agent.

This opinion was also supported by representatives of the Constitutional Court. He pointed out that the Tax Code provides for a specialized procedure for the return of the amount of tax that is excessively withheld by tax agents.

Separately, it is worth noting that after dismissal, citizens cannot apply directly to the Tax Service office for a refund of overpayments, bypassing the company. It is possible to submit an application along with a tax return only after the complete elimination of the tax code, therefore, if the company continues to operate, tax refund continues to be included in the list of its responsibilities for three years from the date of excessive withholding.

If the employee himself comes and points out the amount of tax withheld in excess, you need to ask him to write a statement indicating the amount of tax to be refunded. The application must also contain the current account number and exact details of the banking institution to which the funds will be transferred.

The tax refund must be made within three months from the date of receipt of the application, and the amount of personal income tax that will be transferred to the budget for current employees can be reduced by the specified amount of tax.

Special attention should be paid to the fact that if an employee comes to request a refund of overly withheld tax after a 2-NDFL certificate has been submitted for it, then in this case, after returning the specified amount, you will have to draw up updated reporting, which will already reflect the correct data.

For foreigners

An employer does not have the right to require any documents from its employees in order to exempt them from paying personal income tax or to exempt from taxation the profits accrued to individuals who are not tax residents of Russia.

In accordance with the rules specified in Article 232 of the Tax Code, the taxpayer has no obligation to provide his employer with any documentation confirming the fact of paying taxes in the territory of another state in order to be freed from the need to withhold it directly at the place of employment.

In order to avoid having to pay personal income tax in Russia, the payer will need to submit to the tax authorities official confirmation that he is a resident of a state with which Russia has a double tax treaty.

In addition, you will also need to provide a document confirming the amount of income received, as well as the fact of paying tax outside of Russia, to the Tax Service office. This document must be confirmed by employees of the tax authority of the specified state.

Confirmation of the accuracy of the provided paper can be submitted both before the tax is calculated or any advance payments, and throughout the year from the end of the tax period, as a result of which the taxpayer intends to claim exemption from paying tax, as well as offset and receipt of any or tax deductions.

Details on ZUP in 1C

In order to return the excessively withheld tax amount through 1C, the documents must be prepared as follows:

- A specialized document intended for return is generated. To create it, you need to go to the “Taxes and Contributions” category, and then select the “Personal Tax Return” function.

- A document for salary payment is drawn up, in which you can already see that the amount is paid in the amount of the salary itself, as well as the returned tax added to it. In the payslip you can see that there was an amount of overcharged tax that was offset against the same month, that is, the return and payment was made within one month along with the salary.

- If it is necessary to return personal income tax to the register, the corresponding entries are made manually in order to correctly display the necessary information for the transfer. To do this, create a document “Data transfer”, after which in setting up the composition of registers, select the corresponding item “Calculations of tax agents for personal income tax”. This document must be completed as an expense, the amount of which is the amount of overpaid tax.

Calculation and transfer of the amount

The tax amount is calculated quite simply - the amount of the accepted tax rate is multiplied by the total amount of the base from which the tax will be withheld. The latter is established in accordance with current legislation separately for each specific type of profit of individuals.

As mentioned above, after discovering an error, the employer must inform his employee about the presence of such an oversight within ten days, as a result of which the payer issues a corresponding free-form refund application in writing. After submitting the document, the money is returned within three months or offset against subsequent tax withholdings.

The tax agent, in turn, must transfer the excess tax amount to the bank account of his employee himself or contact the Tax Service for this purpose. The total period of claims that can be made for overpaid taxes is three years.

If an employer with a tax agent duty does not have the means to recoup over-withheld amounts by reducing withholding of future taxes from that employee and other payers, as well as its own funds, then it will need to file an appropriate tax filing with the Internal Revenue Service. application for a refund in accordance with Article 78 of the Tax Code.

Decisions on such applications are made within ten banking days, and it may happen that the applicant will not receive his funds back if he has any debt on penalties, fines or taxes. In such a situation, the tax authorities will use the excess transferred amount to pay off the debt, and the employer, in turn, will have to pay its employees independently.

How can an employee return excessively withheld personal income tax?

In accordance with paragraph 1 of Article 231 of the Tax Code, personal income tax, which is excessively withheld from wages and other types of payments in favor of the taxpayer, must be returned by his employer. The employee must receive notification of the overpayment within ten days from the moment such an error is discovered, and this message can be received in any form, since the current legislation does not indicate any restrictions. It is worth noting that the procedure for sending this message must be agreed upon in advance with the addressee.

When the application is received, the employer transfers the amount of tax withheld in excess, and this will need to be done within three months. If the deadlines are missed, then in this case, in addition to the tax amount itself, it will also be necessary to withhold additional interest accrued for the violation.

Interest is calculated for each calendar day of delay, while the interest rate must be equal to the refinancing rate of the Central Bank, which was in effect at the time the penalty was calculated. Refunds of overpayments for personal income tax are carried out in exactly the same way, only instead of the accepted refinancing rate, the key rate must be used when calculating additional charges.

Detailed algorithm

Refunds from the employer are carried out as follows:

- The employee receives information about the amount being overdeducted. After discovering an error, the employer reports in any form about the discovered fact of excessive withholding. In some cases, the employee himself can file an application if he sees the fact of obvious excessive tax withholding.

- An application for refund is submitted to the employer. As mentioned above, an application can be submitted both upon receipt of a notification of excessively withheld personal income tax, and upon independent discovery of an error. In the application, it is necessary to indicate the bank account to which all specified amounts of funds will need to be transferred, since the overpayment is returned exclusively in non-cash form.

- The amount is transferred to the specified account. The amount of personal income tax that was excessively withheld is sent to the specified bank account.

The refund is carried out through the tax authority as follows:

- All necessary documents are prepared. In particular, in addition to the standard application, you need to prepare a special tax return, as well as documents confirming the presence of an overpayment and the status of the payer as a tax resident of Russia.

- Documents are submitted to the Tax Service office, that is, to the institution in which the specified person is registered. They can be submitted in person, with the help of an authorized representative, as well as by mail and electronically.

- The tax authority makes a decision and returns the funds to the bank account.

Regardless of who exactly will handle the refund, this operation must be carried out within three months from the date of receipt of the relevant notification.